TIDMENOG

RNS Number : 1925N

Energean PLC

19 January 2023

Energean plc

("Energean" or the "Company")

Trading Statement & Operational Update

London, 19 January 2023 - Energean plc (LSE: ENOG TASE: ) is

pleased to provide an update on recent operations and the Group's

trading performance in the 12-months to 31 December 2022 together

with guidance for 2023. This information is unaudited and subject

to further review. Energean will release its 2022 full year results

on 23 March 2023.

Mathios Rigas, Chief Executive of Energean, commented:

"2022 was a landmark year for Energean. We commenced production

from the only FPSO in the strategically vital Eastern Mediterranean

region; commenced payment of dividends to our shareholders; and we

successfully discovered and de -risked new natural gas resource s

adjacent to our infrastructure, providing significant potential

upside and export optionality. We are proud to have helped to

underwrite Israeli and regional energy security and promote

prosperity.

"Our focus for 2023 is on continued operational growth. We will

continue to ramp up production from Karish and finalise the

development concept for the strategically significant, 67 bcm

Olympus Area. Production will also start from Karish North in

Israel and N EA/NI in Egypt. 2023 is the year that we will make a

significant step towards delivering our medium -term production

target of 200 kboed.

"If we have learned anything in 2022, it is that the world needs

additional secure supplies of energy, and that natural gas remains

the catalyst for, and foundation of, a just energy transition and

vital sustainable development. Our recent CDP rating upgrade

demonstrates our commitment to being the best version of Energean

that we can be. We are and remain an ESG leader in the sector . We

will continue to deliver on our promises.

"We are committed to investing in projects where we can create

value for all relevant stakeholders. In an uncertain world, we hope

governments understand the value of enhanced domestic and regional

energy production, value that is unlocked through long-term

investment. We hope that the intelligent policy we have seen in

Israel and Egypt can be replicated across the region , continuing

the investment that will unlock the strategic value in the

subsurface."

Operational Highlights

-- Karish project brought onstream on 26 October 2022 and

excellent reservoir deliverability confirmed

-- Successfully identified and implemented solutions to resolve

a range of typical above-ground commissioning issues at Karish,

with no further impact to production levels anticipated following

the FPSO commissioning process, expected February 2023

-- Key development projects (Karish North, NEA/NI, Cassiopea) on

track to deliver 200 kboed mid-term production target

-- Successful completion of the 2022 growth drilling programme

in Israel which discovered and de-risked approximately 75 bcm

(approximately 480 mmboe) of new gas resource

o Including 67 bcm (approximately 430 mmboe) of additional gas

resource in the Olympus Area, for which the development concept is

now being finalised

Corporate and Financial Highlights

-- Strong financial performance for the year to 31 December 2022

o Revenues were $736.7 million, a 48% increase versus 2021

comparable period ($497.0 million)

o EBITDAX of $418.5 million, an increase of 97% versus 2021

comparable period ($212.1 million)

o On track to deliver mid-term annualised targets of $2.5bn of

revenues and $1.75bn of EBITDAX

o Group cash as of 31 December 2022 was $498.0 million

(including restricted amounts of $75 million) and total liquidity

was $719.0 million

-- Q3 2022 dividend of 30 US$cents/share paid on 30 December

2022; total of 60 US$cents/shares, representing two-quarters of

dividend payments, returned to shareholders in 2022

-- Carbon Disclosure Project ("CDP") rating increased A- (from

B) and outperforming the global average for E&Ps of C

FY 2022 FY 2021 % Change

Average working interest

production kboed 41.1 41.0 0.2%

----------- -------- -------- ---------

Sales and other revenue $ million 736.7 497.0 48.2%

----------- -------- -------- ---------

Cash Cost of Production $ million 284.4 261.6 8.7%

----------- -------- -------- ---------

Adjusted EBITDAX [1] $ million 418.5 212.1 97.3%

----------- -------- -------- ---------

Capital expenditure $ million 699.8 403.5 73.4%

----------- -------- -------- ---------

Exploration expenditure $ million 135.7 48.7 178.6%

----------- -------- -------- ---------

Decommissioning expenditure $ million 7.6 2.7 181.5%

----------- -------- -------- ---------

Cash (including restricted

amounts) $ million 498.0 930.5 (46.5%)

----------- -------- -------- ---------

Net debt - consolidated $ million 2,522.9 2,016.6 25.1%

----------- -------- -------- ---------

Net debt - plc excluding

Israel $ million 146.9 102.6 43.2%

----------- -------- -------- ---------

Net debt - Israel $ million 2,376.0 1,914.0 24.1%

----------- -------- -------- ---------

Outlook

-- Continued ramp-up of Karish to initial capacity of 6.5 bcm/yr

o Final stages of FPSO commissioning process now underway with

completion expected February 2023

o Total sales gas in 2023 is expected to be between 4.5 and 5.5

bcm. The top end of this range is driven by the Annual Contract

Quantity ("ACQ") under the gas sales agreements, whilst the bottom

end of the range represents the Take Or Pay ("TOP") volumes; TOP is

viewed by Energean as a highly conservative case. No spot market

sales [2] have been assumed in this range.

o First cargo of hydrocarbon liquids lifted under the contract

with Vitol expected in February 2023

-- Practical completion under the EPCIC contract with TechnipFMC and Technip Energies

-- Delivery of development projects that are key to achieving

Energean's mid-term production target of 200 kboed

o Installation of the second oil train and gas export riser, and

first gas from Karish North expected by year-end 2023,

debottlenecking FPSO capacity to 8 bcm/yr

o First gas from NEA/NI, Egypt expected in 1H 2023

o First gas from Cassiopea, Italy, expected in 1H 2024

-- Israel expansion: development concept for the 67 bcm Olympus

area to be communicated in 1H 2023

o Various commercial and technical solutions under consideration

to identify development concept that will deliver the most value to

shareholders

o Publication of Competent Persons Report ("CPR") to certify

volumes, expected in 1Q 2023 and expected to include approximately

30 Bcm of 2P reserves and 37 bcm of volumes in nearby de-risked

structures.

-- Quarterly dividend payments to be declared in line with

previously communicated dividend policy

Conference call

A webcast will be held today at 08:30 GMT / 10:30 Israel

Time.

Webcast: https://edge.media-server.com/mmc/p/hrhvh72z

Conference call registration link:

https://register.vevent.com/register/BI0c90f15b4cf7495c84ea3e2cb8abc962

After completing your conference call registration you will

receive dial-in details on screen and via email. Please note the

dial-in pin number is unique and cannot be shared.

The presentation slides will be made available on the website

shortly at www.energean.com .

Enquiries

For capital markets: ir@energean.com

Kate Sloan, Head of IR and ECM

Tel: +44 7917 608 645

For media: pblewer@energean.com

Paddy Blewer, Head of Corporate Communications Tel: +44 7765 250

857

Energean Operational Review

Production

Production excluding Israel was 35.7 kboed, in the middle of the

guidance range of 34.0 - 37.0 kboed. In 2023, underlying production

(excluding Israel) is expected to increase by approximately 12% at

the mid-point of the guidance range (2023: 37.0 - 43.0 kboed),

benefitting from contribution by the NEA/NI development, offshore

Egypt.

Israel 2022 production was lower than forecast due to the

project being in the commissioning phase. In 2023, Energean expects

to produce between 4.5 and 5.5 bcm of sales gas plus 15 and 18

kboed of hydrocarbon liquids. The top end of this range is driven

by the ACQ under the gas sales agreements, whilst the bottom end of

the range represents the TOP volumes, and is viewed by Energean as

a highly conservative case. No spot market sales [3] have been

assumed within this range.

Portfolio-wide production in 2023 is expected to be between 131

and 158 kboed, a major step towards Energean's mid-term production

target of 200 kboed.

FY 2022 FY 2023 guidance

Kboed Kboed

Israel 5.3 94 - 115

(including 0.28 (including 4.5 - 5.5

bcm of sales gas) bcm of sales gas)

--------------------- ----------------------

Egypt 25.1 (87% gas) 28 - 32

--------------------- ----------------------

Rest of portfolio 10.6 (39% gas) 9 - 11

--------------------- ----------------------

Total production (including

Israel) 41.0 (75% gas) 131 - 158

--------------------- ----------------------

Total production (excluding

Israel) 35.7 (73% gas) 37 - 43

--------------------- ----------------------

Israel

Karish Main Development

Karish came onstream on 26 October 2022 and all three wells has

been opened before year end. Data collected from the wells has

demonstrated the reservoir's ability to produce in line with

expectations.

Sales gas between 26 October 2022 and 31 December 2022 totaled

0.28 bcm. Nothwithstanding the excellent reservoir deliverability,

this was lower than projected as a result of the project being in

the commissioning phase, during which variability in production is

higher than in the post-commissioning phase.

A number of minor issues, which are typical of new

infrastructure and systems, have been experienced with the topside

processing infrastructure. Energean has successfully identified and

implemented solutions to resolve these issues, with no further

impact to production levels anticipated post the FPSO commissioning

process. Energean is now undertaking the final steps of this

process, which it expects to complete in February 2023.

Karish Growth Projects

Construction of the second gas export riser and second oil train

are progressing in line with expectations. Both pieces of

infrastructure are required to debottleneck the FPSO capacity to

8.0 bcm/yr, with this increase expected to be delivered by year-end

2023.

-- Installation of the second gas export riser on the FPSO is expected in 1H 2023

-- The second oil train is scheduled to be lifted and installed

on the FPSO in 2H 2023, ahead of the completion of commissioning by

year-end 2023

The Karish North development well was successfully drilled as

part of the 2022 growth drilling campaign. The well is expected to

be hooked-up to the Karish Main manifold using a spare slot in 2Q

2023 and will be ready to deliver first gas in 2H 2023. Due to the

high liquids content of the field, Karish North will not have a

material impact on production rates until the infrastructure

discussed above has been installed and commissioned in late

2023.

Israel Expansion

The Olympus Area, the discovery of which is discussed below,

will be the focus of near-term development plans. Energean is

currently finalising the development concept and commercial

solution for this strategically significant project and will

communicate its plan to the market at the appropriate time

(expected 1H 2023). A number of solutions have been considered,

providing optionality around further debottlenecking of

infrastructure above the current 8 bcm/yr nameplate capacity of the

Energean Power FPSO, and also access to gas export markets.

In 2022, Energean's growth drilling programme discovered and

de-risked approximately 75 bcm (approximately 480 mmboe) of natural

gas through its growth drilling programme.

-- The Zeus and Athena wells, block 12, discovered 25 bcm

(approximately 160 mmboe) of natural gas resources. This, in turn,

substantially de-risked a further 42 bcm (approximately 269 mmboe)

of prospective resources across the Olympus Area in nearby

prospects that have equivalent geological properties and seismic

attributes.

DeGolyer & MacNaughton, is producing a CPR to certify

resource volumes across the Olympus Area, with results expected to

be announced to the market in 1Q 2023. Energean expects

approximately 30 Bcm - Zeus, Athena and Hera - to be classified as

2P reserves, with a further 37 bcm of prospective volumes contained

within the de-risked prospects.

-- Following post-well studies, recoverable resources in the

Hermes discovery, block 31, are now estimated to be approximately 7

bcm (45 mmboe). The results from this well have provided important

additional information about Orpheus and Poseidon, nearby

prospects, that may be future targets of appraisal activity to firm

up resource volumes within this area, which Energean has named the

"Arcadia Area"

-- Energean is preparing notices of commerciality for both the

Olympus Area and Arcadia Area, required for the conversion of those

exploration licences into development leases

-- In December 2022, the Hercules well, block 23, made a

discovery in the Miocene. The C and D sands are estimated to

contain mean Gas Initially In Place ("GIIP") of approximately 3

bcm. This excludes discovered volumes in the A and B sands (which

were the subject of the upgrade to discovered Athena resource

volumes in November 2022), which are currently being evaluated, and

volumes will be communicated once available, along with Energean's

assessment of commerciality of the discovery. The large, deeper,

liquids target in the Hercules prospect was not considered

drill-ready and remains a potential target of future

exploration.

Rest of Portfolio - Development

Egypt

The NEA/NI development project is on track to deliver first gas

in 1H 2023. Gas will initially be produced from one well, NEA#6,

drilling of which completed in January 2023, with the remaining

three wells expected to be brought onstream over the course of

2023.

Italy

First gas from Cassiopea remains on track for H1 2024.

Rest of Portfolio - Exploration and Appraisal

Egypt - North East Hap'y Offshore

Energean expects to participate in an exploration well targeting

the Orion prospect (W.I. 30%) along with its partner IEOC (ENI;

70%; operator) on the North East Hap'y block, offshore Egypt, in

2023. Energean expects to farm down 12% of its interest in the

North East Hap'y block ahead of spudding the well.

UK - Isabella appraisal well

In December 2022, the Isabella appraisal well encountered

hydrocarbons in the targeted reservoir. The operator has completed

the gathering of data and has plugged and abandoned the well. The

operator intends to evaluate the drilling results to establish the

commerciality of the reservoir.

Energean Corporate Review

Dividend

In September 2022, Energean declared its maiden quarterly

dividend, aligned with its commitment to return an initial $50

million to shareholders per quarter no later than the end of

2022.

In total, Energean returned US$0.60/share to shareholders

(approximately $106 million) in 2022, representing two-quarters of

dividend payments.

In 2023, Energean intends to continue to pay quarterly dividends

to its shareholders in line with its previously communicated

dividend policy.

Windfall taxes

Energean notes the imposition of windfall taxes across the

European Union and United Kingdom. Cash taxes borne by the

contractor are not part of the Egypt fiscal regime and Israel has

already implemented its Sheshinsky Levy. Energean's exposure in the

United Kingdom is de minimis. As such, Energean's main exposure to

windfall taxes primarily relates to Italy and recently introduced

legislation.

In November 2022, Italy introduced a new windfall tax that

imposed a 50% one-off tax, calculated on 2022 taxable profits that

are 10% higher than the average taxable profits between 2018-2021.

This amount has a ceiling equal to 25% of the value of the net

assets at end-2021. Based on this, Energean estimates that it would

be required to pay an additional one-off tax of EUR 87 million in

June 2023. Energean expects to challenge this tax through the

Italian and/or EU courts.

ESG

In December 2022, the Carbon Disclosure Project updated its

rating for Energean to A-, up from B in the previous year, and

outperforming the global average for E&Ps of C.

2023 guidance

FY 2023

Consolidated net debt ($ million) 2,600 - 2,800

--------------

Cash Cost of Production (operating

costs plus royalties)

--------------

Israel ($ million) 350 - 400

--------------

Egypt ($ million) 50 - 60

--------------

Rest of portfolio ($ million) 200 - 240

--------------

Total Cash Cost of Production ($ million) 600 - 700

--------------

Development and production capital

expenditure

--------------

Israel ($ million) 140 - 160

--------------

Egypt ($ million) 140 - 150

--------------

Rest of portfolio ($ million) 300 - 330

--------------

Total development & production capital

expenditure ($ million) 580 - 640

--------------

Exploration expenditure ($ million) 40 - 60

--------------

Decommissioning expenditure ($ million) 30 - 40

--------------

Forward looking statements

This announcement contains statements that are, or are deemed to

be, forward-looking statements. In some instances, forward-looking

statements can be identified by the use of terms such as

"projects", "forecasts", "on track", "anticipates", "expects",

"believes", "intends", "may", "will", or "should" or, in each case,

their negative or other variations or comparable terminology.

Forward-looking statements are subject to a number of known and

unknown risks and uncertainties that may cause actual results and

events to differ materially from those expressed in or implied by

such forward-looking statements, including, but not limited to:

general economic and business conditions; demand for the Company's

products and services; competitive factors in the industries in

which the Company operates; exchange rate fluctuations;

legislative, fiscal and regulatory developments; political risks;

terrorism, acts of war and pandemics; changes in law and legal

interpretations; and the impact of technological change.

Forward-looking statements speak only as of the date of such

statements and, except as required by applicable law, the Company

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise. The information contained in this

announcement is subject to change without notice.

[1] Adjusted EBITDAX is calculated as profit or loss for the

period, adjusted for discontinued operations, taxation,

depreciation and amortisation, share-based payment charge,

impairment of property, plant and equipment, other income and

expenses, net finance costs and exploration and evaluation

expenses.

[2] Post commencement of obligations under the gas sales

agreements

[3] Post commencement of obligations under the gas sales

agreements

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBPMMTMTMBTFJ

(END) Dow Jones Newswires

January 19, 2023 02:00 ET (07:00 GMT)

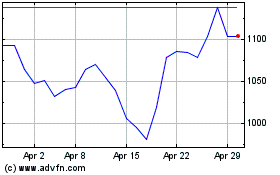

Energean (LSE:ENOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energean (LSE:ENOG)

Historical Stock Chart

From Apr 2023 to Apr 2024