TIDMDPEU

RNS Number : 3199H

DP Eurasia N.V

27 July 2023

27 July 2023

DP Eurasia N.V.

("DP Eurasia" or the "Company", and together with its

subsidiaries, the " Group ")

Trading Update for the six months ended 30 June 2023 (the

"Period") (1) (2)

(millions of TRY, unless otherwise indicated)

For the period ended

30 June

-----------------------

Number of stores 2023 2022 Change

Turkey (Domino's) 675* 628 47

Turkey (COFFY) 51 15 36

Azerbaijan 10 10 -

Georgia 6 5 1

Total continuing operations 742 658 84

Russia 142 184 -42

Grand Total 884 842 42

Change

Group system sales (after (pre-IAS

IAS 29) (3) 2023 2022 Change 29)

Turkey 2,424.0 1,864.6 30.0% 91.7%

Azerbaijan 42.7 44.8 -4.6% 40.7%

Georgia 30.6 22.4 36.2% 99.9%

COFFY 95.3 21.7 339.5% 529.5%

Total continuing operations 2,592.6 1,953.5 32.7% 95.6%

Russia (discontinued operations) 422.2 492.7 -14.3% -14.3%

Grand Total 3,014.8 2,446.2 23.2% 64.7%

---------------------------------- ----------- ---------- ------- ----------

System sales LfL growth(4) (after IAS 29) (pre-IAS 29)

2023 2022 2023 2022

Turkey 26.5% -8.4% 86.2% 51.0%

Azerbaijan (based on AZN) 5.2% 3.7% 5.2% 3.7%

Georgia (based on GEL) 4.3% 32.2% 4.3% 32.2%

Total continuing operations 25.9% -7.9% 84.1% 50.1%

Russia (discontinued operations,

based on RUB) -24.8% -2.6% -24.8% -2.6%

* Including nine temporarily closed stores as a result of the

earthquake in early 2023.

Highlights

-- Strong overall performance with Group system sales for

continuing operations up 32.7% (pre-IAS 29: 95.6%) or 25.9% on a

LfL basis, leading to upgraded full year LfL growth guidance.

-- Delivered excellent LfL growth in Turkey of 26.5% amid a

sustained inflationary environment, reflecting our ongoing focus on

network expansion, strategic pricing, product and service

innovation.

-- Azerbaijan and Georgian operations delivered LfL growth of

5.2% and 4.3% respectively (in local currencies).

-- Online delivery system sales in Turkey increased to 83.9%

(2022: 81.2%) as a share of delivery system sales(6) , reflecting

our robust positioning for the online ordering channel. Strong

Turkish online system sales growth of 30.7% (pre-IAS 29:

93.0%).

-- Following a swift response to the devasting earthquake in

Turkey in February, which resulted in the temporary closure of 12

Domino's Pizza stores, three have now been reopened.

-- Net new store opening momentum has been maintained:

o 47 Domino's Pizza openings in Turkey year-on-year, reflecting

the strong demand profile.

o The COFFY network has now exceeded the 50-store milestone,

having increased by 22 in the current financial year (or by 36

year-on-year) to 51. We are on track with our guidance of 50-60 net

COFFY openings in FY23.

o Georgia now has six Domino's Pizza stores, an increase of

one.

-- The growth opportunity for COFFY remains significant, with

excellent market dynamics in Turkey for the coffee sub-segment.

COFFY delivered TRY 95.3 million to Group system sales, up

339.5%.

-- The Group continues to evaluate its presence in Russia and,

as previously announced, is considering various options which may

include a divestment of its Russian operations, although a sale

process is increasingly challenging. In the meantime, the Group

continues to limit investment in Russia and remains focused on

optimising the existing store coverage. At Period end, the total

number of stores in Russia stood at 142, compared to 184 at 30 June

2022.

-- Liquidity position as of 30 June 2023: TRY 370.6 million cash

and an undrawn bank facility of TRY 515 million.

-- While we remain mindful of sustained macro-economic

volatility and inflation, our first half performance was better

than the Board's expectations thanks to solid volume generation and

customer acquisition. The Board is therefore confident that LfL

inflation adjusted growth will be in the low teens for the full

year 2023, better than the previously expected high single digit

figure. Guidance for store openings and capital expenditure has

been maintained. 2023 guidance is now as follows:

2023 guidance* Previous Revised

------------------------- --------------------- ---------------------

LfL growth rate High single digit Low teens

(pre IAS 29: 60-70%) (pre IAS 29: 70-80%)

Domino's Pizza net store

openings 35 - 40 35 - 40

COFFY net store openings 50 - 60 50 - 60

Capital expenditure TRY 160 millon TRY 160 millon

------------------------- --------------------- ---------------------

*Russia excluded

Commenting on the update, Chief Executive Officer, Aslan Saranga

said:

"It has been a strong first half performance as we continue to

successfully implement our targeted action plan to mitigate the

ongoing macro challenges that management has deep experience in

navigating. As a result, we are reporting excellent and sustained

LfL growth, enabling us to upgrade full year guidance, and

continued network expansion.

"The Board is proud of the Group's reaction to support

colleagues impacted by February's devastating earthquake. We are

restoring impacted operations and continue to stand in solidarity

with our employees, business partners and the wider community.

"Our targeted strategy focuses on three areas - strategic

pricing and product innovation, continued digital innovation, and

operational efficiencies to generate sustainable profitability.

This approach has enabled us to combat the high levels of

volatility in the regions in which we operate.

"Our focus on product innovation remains integral. We continue

to broaden our entry price product range and launched a new

mushroom pizza in January which has reached good volumes. Following

the successful Pizzetta launch last year, we added new varieties to

further enhance the potential of this product line. In addition,

our new 'snacks from the oven' range was launched in February

presenting a broad choice of attractively priced products to

customers who increasingly seek value and affordability. The latest

addition to our product range, Pizza XL, has contributed well in

its early stages and in line with our internal expectations. With a

Turkish nationwide advertising campaign being rolled out in July,

we expect the contribution from Pizza XL to continue to

improve.

"We continue to improve the online proportion of our sales, and

digital innovation remains an important enabler for us to enhance

the customer experience and further solidify our robust positioning

for the online ordering channel.

"We retain a fundamental commitment to ensuring franchisees

remain profitable. As a result, franchisee demand for both Domino's

Pizza and COFFY continues to be very healthy. We have a strong

pipeline of new sites and are confident that 2023 will be another

solid year for network expansion.

"Consumer demand for COFFY stands very strong owing to its

already proven sales performance. This demand, alongside our

ambitious targets for 2023, will enable us to add further scale to

the business.

"Overall, we are pleased with the strong first half performance

with strong customer acquisition and elevated volumes. We will

continue to deliver on our targeted strategy to make the most of

what continues to be a significant growth opportunity. Whilst the

Board is conscious of the ongoing uncertainty, current trends

suggest that adjusted EBITDA for 2023 is likely to be above the

current market expectations."

Enquiries

DP Eurasia N.V.

İlknur Kocaer, CFA - Investor Relations

Director +90 212 280 9636

Buchanan (Financial Communications)

Richard Oldworth / Toto Berger / Verity +44 20 7466 5000

Parker dp@buchanan.uk.com

A conference call for investors and analysts will be held at

9.30am this morning, which will be accessible using the following

details:

Conference call dial-in: 08006522435

For further details, please contact Buchanan on +44 20 7466 5000

/ dp@buchanan.uk.com .

Notes to Editors

DP Eurasia N.V. is the exclusive master franchisee of the

Domino's Pizza brand in Turkey, Russia, Azerbaijan, and Georgia.

The Company was admitted to the premium listing segment of the

Official List of the Financial Conduct Authority and to trading on

the main market for listed securities of the London Stock Exchange

plc on 3 July 2017. The Company (together with its subsidiaries,

the " Group " ) is the largest pizza delivery company in Turkey and

the third largest in Russia. The Group offers pizza delivery and

takeaway/ eat-in facilities at its 833 stores (675 in Turkey, 142

in Russia, 10 in Azerbaijan and 6 in Georgia) as of 30 June 2023

and operates through its owned corporate stores (10%) and

franchised stores (90%). In addition to its pizza delivery

business, the Group also has its own coffee brand, COFFY, which

trades from 51 stores at period-end, 38 of which are franchised.

The Group maintains a strategic balance between corporate and

franchised stores, establishing networks of corporate stores in its

most densely populated areas to provide a development platform upon

which to promote best practice and maximise profitability.

Performance Review

Store count As of 30 June

--------------------------------------------------------

2023 2022

Corporate Franchised Total Corporate Franchised Total

Turkey (Domino's) 82 593 675 94 534 628

Azerbaijan - 10 10 - 10 10

Georgia - 6 6 - 5 5

COFFY 13 38 51 5 10 15

Total 95 647 742 99 559 658

Russia 0 142 142 92 92 184

Grand Total 95 789 884 191 651 842

Delivery channel mix and online LfL growth

The following table shows the Group's delivery system sales (7)

, broken down by ordering channel and by the Group's two largest

countries in which it operates, as a percentage of delivery system

sales for the periods ended 30 June 2023 and 2022:

For the period ended 30 June

--------------------------------------------------

2023 2022

------------------------ ------------------------

Turkey Russia Total Turkey Russia Total

15.5 5.7 15.8 18.3 17.6

Store % % % % 6.5 % %

Group's online 22.0 72.0 28.5 25.1 72.2 34.4

Online platform % % % % % %

61.8 22.3 55.2 56.1 21.3 47.7

Aggregator % % % % % %

83.9 94.3 83.7 81.2 93.5 82.0

Total online % % % % % %

0.5

Call centre 0.6 % - % 0.5 % - 0.4 %

Total 100% 100% 100% 100% 100% 100%

The following table shows the Group's online LfL growth (4) ,

broken down by the Group's two largest countries in which it

operates, for the periods ended 30 June 2023 and 2022:

Group online system sales (after IAS 29) (pre-IAS 29)

LfL growth

2023 2022 2023 2022

Group(5) 17.2% -2.9% 65.4% 45.2%

Turkey 28.0% -3.0% 88.6% 59.7%

Russia (based on RUB) -23.8% -2.5% -23.8% -2.5%

--------------------------- ------------ ---------- ------- ------

Notes

(1) COFFY numbers are included in all Turkey and Group figures,

unless presented separately. Like-for-like figures exclude COFFY.

These numbers are not audited.

(2) IAS 29 'Financial Reporting in Hyperinflationary Economies'

is currently applicable in Turkey. Company's preliminary results

for the year ended 31 December 2022, published on 12 April, was

adjusted accordingly.

(3) System sales are sales generated by the Group's corporate

and franchised stores to external customers and do not represent

revenue of the Group.

(4) Like-for-like growth is a comparison of sales between two

periods that compares system sales of existing system stores. The

Group's system stores that are included in like-for-like system

sales comparisons are those the Group considers to be mature

operations. The Group considers mature stores to be those stores

that have operated for at least 52 weeks preceding the beginning of

the first month of the period used in the like-for-like comparisons

for a certain reporting period, assuming the relevant system store

has not subsequently closed or been "split" (which involves the

Group opening an additional store within the same map of an

existing store or in an overlapping area). This is a non-IFRS

measure and non-IFRS measures are not audited.

(5) Group like-for-like growth is a weighted average of the

country like-for-like growths based on store numbers as described

in Note (4). This is a non-IFRS measure and non-IFRS measures are

not audited.

(6) Online system sales are system sales of the Group generated

through its online ordering channel.

(7) Delivery system sales are system sales of the Group

generated through the Group's delivery distribution channel.

(8) EBITDA, adjusted EBITDA and non-recurring and non-trade

income/expenses are not defined by IFRS. These items are determined

by the principles defined by the Group management and comprise

income/expenses which are assumed by the Group management to not be

part of the normal course of business and are non-trading items.

These items which are not defined by IFRS are disclosed by the

Group management separately for a better understanding and

measurement of the sustainable performance of the Group.

Appendices

Exchange Rates

For the period ended 30 June

----------------------------------------------------------

2023 2022

---------------------------- ----------------------------

Currency Period End Period Average Period End Period Average

----------- --------------- ----------- ---------------

EUR/TRY 28.154 21.407 17.522 16.196

RUB/TRY 0.303 0.256 0.321 0.200

EUR/RUB 95.105 83.651 53.858 83.520

Delivery - Take away / Eat in mix

For the period ended 30 June

--------------------------------------------------

2023 2022

------------------------ ------------------------

Turkey Russia Total Turkey Russia Total

Delivery 73.1% 72.6% 72.7% 75.7% 75.9% 75.4%

Take away / Eat in 26.9% 27.4% 27.3% 24.3% 24.1% 24.6%

Total 100% 100% 100% 100% 100% 100%

Forward looking statements

This press release includes forward-looking statements which

involve known and unknown risks and uncertainties, many of which

are beyond the Group's control and all of which are based on the

Directors' current beliefs and expectations about future events.

They appear in a number of places throughout this press release and

include all matters that are not historical facts and include

predictions, statements regarding the intentions, beliefs or

current expectations of the Directors or the Group concerning,

among other things, the results of operations, financial condition,

prospects, growth and strategies of the Group and the industry in

which it operates.

No assurance can be given that such future results will be

achieved; actual events or results may differ materially as a

result of risks and uncertainties facing the Group. Such risks and

uncertainties could cause actual results to vary materially from

the future results indicated, expressed, or implied in such

forward-looking statements.

Forward-looking statements contained in this press release speak

only as of the date of this press release. The Company and the

Directors expressly disclaim any obligation or undertaking to

update these forward-looking statements contained in this press

release to reflect any change in their expectations or any change

in events, conditions, or circumstances on which such statements

are based.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAKXKALDDEFA

(END) Dow Jones Newswires

July 27, 2023 02:00 ET (06:00 GMT)

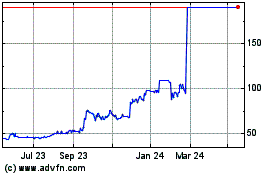

Dp Eurasia N.v (LSE:DPEU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dp Eurasia N.v (LSE:DPEU)

Historical Stock Chart

From Jul 2023 to Jul 2024