Planning permission

February 13 2008 - 4:20AM

UK Regulatory

RNS Number:8873N

Derwent London PLC

13 February 2008

PRESS RELEASE

PRESS RELEASE

13 February 2008

Derwent London plc ("Derwent London"/ "Company")

DERWENT london SECURES PLANNING FOR MAJOR 255,000 SQ FT REFURBISHMENT OF ANGEL

CENTRE, EC1

Derwent London, one of London's most dynamic and innovative property investors

and developers, has secured planning permission from Islington Borough Council

for the 255,000 sq ft net (23,690 sq m) office refurbishment of the Angel

Centre, London, EC1. The property is the first building from the London Merchant

Securities' ("LMS") portfolio to be refurbished by Derwent London after its

merger in February 2007.

Situated on the corner of Pentonville Road and St. John Street and immediately

south of Angel Tube station, the building is just a short walk from Kings Cross

and the newly opened St Pancras Eurostar terminal. This major refurbishment will

bring stylish office accommodation to this rapidly expanding and vibrant part of

London.

The new scheme will add c. 93,000 sq ft net (8,640 sq m) to the original

building, which was developed by LMS in 1984, by infilling the large external

courtyard with a spectacular atrium and expanding the skin of the building with

a new steel and glass facade. A newly landscaped public space will be created on

St. John Street with restaurants and retail space, bringing additional vitality

at street level.

Allford Hall Monaghan Morris ("AHMM"), the architects who transformed Derwent

London's Johnson Building in Hatton Garden, has been appointed on the scheme.

Similar green energy features used there will also feature at Angel, with

displacement air conditioning and smart lighting. AHMM have created a design

which will drive significant natural light into the building through three metre

windows and galleried floors which look out onto the central atrium. The six

storey building has floorplates of c. 50,000 sq ft (4,650 sq m) which will offer

flexibility for either single or multiple tenants.

Enabling works on the building are expected to begin in spring 2008 with

completion planned for early 2010. Whilst Derwent London has possession of the

building, it will continue to generate an income of �4.2 million per annum until

March 2010.

Simon Silver, Head of Development at Derwent London, commented:

"We are very excited to have gained this planning consent on the anniversary of

completing our merger with London Merchant Securities and are encouraged by the

speed at which this project is progressing.

"Derwent London has built an extremely strong track record in terms of creating

well designed schemes in London's villages that excite occupiers. In 2007, we

successfully let both the refurbished Johnson Building in Hatton Garden and the

soon to be completed Horseferry House in Victoria which is to become Burberry's

new headquarters. The Angel Centre fits into the model of these two assets and

we are confident that we can deliver an exceptional building which will be

attractively priced for future occupiers."

-ends-

For further information please contact:

Dido Laurimore/Nicole Marino, Tel: 020 7831 3113

Financial Dynamics (for Derwent London)

Simon Silver, Head of Development, Derwent London Tel: 020 7659 3000

Notes to editors

Derwent London plc

Derwent London plc was formed on 1 February 2007 following the merger of Derwent

Valley Holdings and London Merchant Securities and converted to REIT status on 1

July 2007. The group is one of London's most innovative office specialist

property developers and investors and is well known for its established

design-led philosophy and creative management approach to development. Derwent

London won the RIBA Client of the Year Award 2007.

Derwent London's core strategy is to acquire and own a portfolio of Central

London property that has reversionary rents and significant opportunities to

enhance and extract value through refurbishment and redevelopment. The group

owns and manages an investment portfolio of over �2.8 billion, of which �2.5

billion or 93% is located in Central London, with a specific focus on the West

End and the areas bordering the City of London. Landmark schemes by Derwent

London include: Qube W1, Johnson Building EC1, Davidson Building WC2 and

Broadwick House W1.

Approximately 50% of the London portfolio is identified as having the

opportunity, through development, to achieve significant gains in floor area

and, thereby, increases in value. The existing pipeline of development and

refurbishment projects is extensive, totalling 3.3 million sq ft (306,500 sq m).

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCMGGMZLFNGRZG

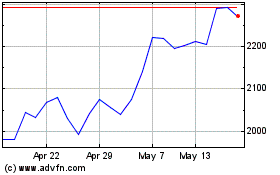

Derwent London (LSE:DLN)

Historical Stock Chart

From Jul 2024 to Aug 2024

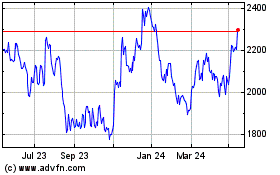

Derwent London (LSE:DLN)

Historical Stock Chart

From Aug 2023 to Aug 2024