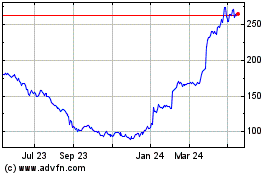

TIDMCMCX

RNS Number : 6069S

CMC Markets Plc

17 November 2021

17 November 2021

CMC MARKETS PLC

Interim results for the half year ended 30 September 2021

Reiterating FY guidance; core underlying business trending well

above pre-pandemic levels

30 September 30 September 30 September

For the half year ended 2021 2020 Change 2019 Change

Net operating income (GBP million) 126.7 230.9 (45%) 102.3 24%

Leveraged net trading revenue

(GBP million) 101.0 200.4 (50%) 85.1 19%

Non-leveraged net trading

revenue (GBP million) 24.2 26.3 (8%) 14.5 67%

Other income (GBP million) 1.5 4.2 (63%) 2.7 (43%)

Profit before tax (GBP million) 36.0 141.1 (74%) 30.1 20%

Basic earnings per share (pence) 9.6 38.3 (75%) 9.5 1%

Dividend per share (pence) 3.50 9.20 (62%) 2.85 23%

==================================== ============= ============= ======= ============= =======

Leveraged gross client income

(GBP million) 127.0 173.6 (27%) 103.5 23%

Leveraged client income retention 80% 115% (35%) 82% (2%)

Leveraged active clients (numbers) 53,834 59,082 (9%) 41,603 29%

Leveraged revenue per active

client (GBP) 1,877 3,392 (45%) 2,047 (8%)

------------------------------------ ------------- ------------- ------- ------------- -------

Non-leveraged active clients

(numbers) 185,847 168,270 10% 118,468 57%

------------------------------------ ------------- ------------- ------- ------------- -------

Notes:

- Net operating income represents total revenue net of

introducing partner commissions and levies

- Leveraged net trading revenue represents contracts for

difference ("CFD") and spread bet gross client income net of

rebates, levies and risk management gains or losses

- Non-leveraged net trading revenue represents stockbroking

revenue net of rebates

- Leveraged gross client income represents spreads, financing

and commissions charged to clients (client transaction costs)

- Leveraged active clients represent those individual clients

who have traded with or held a CFD or spread bet position with CMC

Markets on at least one occasion during the six-month period

- Leveraged revenue per active client represents total trading

revenue from leveraged active clients after deducting rebates and

levies

Key highlights

-- H1 2022 leveraged net trading revenue at GBP101.0 million (H1

2021: GBP200.4 million) down 50% as a result of a decrease in

market volatility resulting in lower client trading activity and

client income retention reverting towards guided levels.

-- Leveraged client income retention for the period at 80% with

53,834 active clients, down 9% versus H1 2021, and up 29% versus

pre-pandemic H1 2020 levels. Total client money ("AUM") in the

leveraged business stood at GBP557 million, a new period-end record

high.

-- H1 2022 non-leveraged net trading revenue was GBP24.2 million

(H1 2021: GBP26.3 million) representing 19% of Group net operating

income versus 11% in H1 2021. Underlying client numbers increased

10% versus H1 2021, now standing at 185,847 actives.

-- H1 2022 net operating income was GBP126.7 million. FY 2022

net operating income guidance reiterated at GBP250-280 million.

-- Operating costs for H1 2022, excluding variable remuneration,

were GBP83.7 million (H1 2021: GBP79.1 million). The increase is

primarily a result of the Group's continued investment in

technology staff. Variable remuneration costs decreased to GBP6.0

million (H1 2021: GBP9.8 million).

-- Announced the acquisition of approximately 500,000 Share

Investing clients currently trading with CMC through our white

label arrangement with Australia and New Zealand Banking Group

Limited ("ANZ"). The clients bring total assets in excess of AUD$45

billion and the transaction is due to complete in the next 12-18

months.

-- Regulatory total capital ratio of 20.0% and net available liquidity of GBP182.7 million.

-- Interim dividend of 3.50 pence (H1 2021: 9.20 pence) with a

total dividend for the year expected to be in line with policy at

50% of profit after tax.

-- As announced on 15 November 2021, the Board intends to

undertake an exploratory review to consider the viability of a

managed separation of the Group's non-leveraged and leveraged

businesses in the interests of maximising shareholder value.

Lord Cruddas, Chief Executive Officer, commented:

"I'm very pleased to see the business is operating well above

pre-pandemic levels across all our business lines. This is

testament to the resilience and quality of our platform and

offering.

Encouragingly for the future, we closed our first half with

client money ("AUM") in our leveraged business being maintained

close to record highs. It was also encouraging to see active client

numbers increase by 10% in our non-leveraged business in support of

our diversification strategy. Our non-leveraged business continues

to offer the greatest growth potential and now represents

approximately 50% of our trading revenue in Australia and nearly

20% of Group net operating income. In line with our aim to

diversify and grow our non-leveraged earnings we announced the

acquisition of the ANZ Share Investing clients that, when completed

over a 12-18 month period, will boost our non-leveraged business

with approximately 500,000 clients with total assets in excess of

AUD$45bn. We are on a fast track to diversification, using our

existing platform technology to win B2B and B2C non-leveraged

business. This will be further boosted with the launch of our new

UK investment platform planned in the early part of the next

financial year, which will offer both B2C and B2B potential.

In line with this strategy, we believe it is right for us to

evaluate the viability of separating the businesses in order to

unlock the significant value within the current Group structure.

The Board is expected to start this review before year end and

complete it by June 2022. We will update on progress in due

course."

Analyst and Investor Presentation

A presentation will be held for equity analysts and investors

today, 17 November 2021, at 10:30 a.m. (GMT).

A live webcast of the presentation will be available via the

following link:

https://webcasts.cmcmarkets.com/results/2022halfyear

Should you wish to ask a question, please dial into the

presentation on +44 (0)20 3059 5869, and quote "CMC Markets plc H1

2022 Results Conference" when prompted.

Forthcoming announcement dates

20 January 2022 Q3 2022 trading update

8 April 2022 FY 2022 pre-close update

Forward looking statements

This trading update may include statements that are forward

looking in nature. Forward looking statements involve known and

unknown risks, assumptions, uncertainties and other factors which

may cause the actual results, performance or achievements of the

Group to be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements. Except as required by the Listing Rules and

applicable law, the Group undertakes no obligation to update,

revise or change any forward-looking statements to reflect events

or developments occurring after the date such statements are

published.

Enquiries

CMC Markets Plc

James Cartwright, Investor Relations

Euan Marshall, Chief Financial Officer

investor.relations@cmcmarkets.com

Camarco +44 (0) 20 3757 4980

Geoffrey Pelham-Lane

Jennifer Renwick

Notes to Editors

CMC Markets Plc ("CMC"), whose shares are listed on the London

Stock Exchange under the ticker CMCX (LEI: 213800VB75KAZBFH5U07),

was established in 1989 and is now one of the world's leading

online financial trading businesses. The company serves retail and

institutional clients through regulated offices and branches in 12

countries, with a significant presence in the UK, Australia,

Germany and Singapore. CMC Markets offers an award-winning, online

and mobile trading platform, enabling clients to trade over 10,000

financial instruments across shares, indices, foreign currencies,

commodities and treasuries through contracts for difference

("CFDs"), financial spread bets (in the UK and Ireland only) and,

in Australia, access stockbroking services. More information is

available at http://www.cmcmarketsplc.com

CHIEF EXECUTIVE'S REVIEW

Leveraged business

H1 2022 leveraged net trading revenue was GBP101.0 million (H1

2021: GBP200.4 million). The reduction is a result of a decrease in

market volatility resulting in lower client trading activity

throughout the period and lower client income retention. Client

income retention for the period stood at 80%, broadly in line with

target and is expected to continue to recover through the rest of

the year. H1 2022 leveraged active clients are 9% lower compared to

H1 2021, but monthly trading client numbers continue to remain

close to record highs and importantly are still up 29% versus

pre-pandemic H1 2020 levels.

Total AUM in the leveraged business stood at GBP557 million, a

new period-end record high. The Group's strategic initiatives

across the leveraged business remain unchanged. We continue to look

at ways to grow the business through an increased product offering

as well as investing in our institutional business.

Non-leveraged business

The Group's non-leveraged net trading revenue was GBP24.2

million for H1 2022 (H1 2021: GBP26.3 million). Underlying active

client numbers are up 10% versus H1 2021, now standing at 185,847.

Client non-leveraged Assets Under Administration ("AUA") reached a

new record high at AU$74.8bn, up 30% versus H1 2021 and up 67%

versus pre-pandemic H1 2020 levels. Our Australian business

recently won the Finder award for best overall Share Trading

Platform 2021 as well as winning the Canstar best platform for the

11th year running.

H1 2022 non-leveraged net trading revenue represented some 19%

of total Group net operating income. As previously highlighted,

this diversification of our earnings is core to our strategic

vision to bring enhanced growth, longer client partnerships and

reduced volatility in future earnings.

ANZ Bank client acquisition

During September 2021 CMC announced the acquisition of Australia

and New Zealand Banking Group Limited's ("ANZ") Share Investing

client base for a sum of AUD$25 m illion . The transaction involves

the acquisition of approximately 500,000 ANZ Share Investing

clients, with total assets in excess of AUD$45 billion. The AUD$25

m illion consideration will be funded from the Group's existing

cash resources.

With this acquisition, the existing white label technology

partnership, which has seen CMC's trading technology power ANZ's

share investing business since 2018, will come to an end. The

existing white label partnership generated GBP39.5 million in net

trading revenue for CMC in FY 2021 and GBP16.7 million in H1 2022.

The CMC platform will offer clients a wide range of additional

benefits currently unavailable with ANZ. These include access to

enhanced, market-leading mobile apps and complementary education

tools and resources. Following transition, the legacy ANZ Share

Investing clients will benefit from lower brokerage charges across

four major international markets and the local Australian market,

and will give CMC the opportunity to drive greater value from its

enlarged client base.

The transaction further establishes CMC as a financial

technology leader in the Australian market and removes the

uncertainty around the finite term of the existing ANZ white label

partnership. The transaction is expected to take 12 to 18 months to

fully transition clients and is another significant step in the

ongoing diversification of the Group's global business. These

clients will continue to support multi-year growth in the region

and remains core to our non-leveraged growth strategy.

Operating expenses

Operating costs for H1 2022, excluding variable remuneration,

were GBP83.7 million (H1 2021: GBP79.1 million). As previously

highlighted, this increase is primarily a result of the Group's

continued investment in technology which has resulted in higher

personnel costs. Offsetting this, marketing spend was lower over

the period although is expected to increase in H2. Given the

reduced performance of the Group, variable remuneration decreased

to GBP6.0 million (H1 2021: GBP9.8 million).

Marketing and client acquisition

Reduced market volatility in the period resulted in lower client

demand for our leveraged and non-leveraged products. This

translated into fewer opportunities to acquire high value clients

and, as a result, marketing spend during the period was 10% lower

than H1 2021 alongside a reduction in the number of client

applications.

Marketing spend for H2 2022 is expected to increase to similar levels as spent in FY 2021.

Regulatory change

The Australian Securities and Investments Commission ("ASIC")

announced new regulatory measures relating to CFDs in October 2020

that came into effect on 29 March 2021. We are supportive of the

regulatory change, as we have always operated to the highest

standards, and our experience with the European Securities and

Markets Authority ("ESMA") measures show that they are, in the

medium to long term, positive for CMC and our clients.

After the introduction of these new measures, regulatory

conditions are now more harmonised globally and we can continue to

focus on growing our business in an industry where regulatory

arbitrage is reduced. These regulatory changes reduced the notional

value of retail client trading in Australia. This, combined with

lower market volatility, resulted in less active client trading

than in the prior period, in line with our expectations and with

that seen in the ESMA region in FY 2019.

Strategic initiatives

In June we announced our intention to launch a UK non-leveraged

platform. This is an opportunity for CMC to use its industry

leading platform and brand to build a significant new business

line. It is becoming increasingly apparent that mobile digital

delivery will dominate the next generation of investment platforms.

For CMC, diversifying our business from a primarily leveraged CFD

provider to also include provision of non-leveraged wealth

management platforms is a natural evolution. Our 30-year history

has already allowed us to build a world class technology-based

trading platform. We already own the core building blocks to

facilitate this transition through our prime broking relationships

and strong relationships with regulators and other stakeholders and

are proud to already offer our clients a resilient and dependable

platform with first-class user experience. The UK has already seen

dramatic growth in direct to customer ("D2C") investment platform

AUA over recent years, with data suggesting that the UK's D2C

platform AUA currently stands at just below GBP300 billion and has

been growing at 16 % p.a. since 2008.

Institutional ("B2B")

Looking at the growth of our Australian non-leveraged business

over the past decade, i t has been built on B2B partnerships. We

now have some 160 B2B partners across the region. We ultimately see

a similar opportunity for us to utilise the same strategy in the UK

non-leveraged business. On the leveraged side, we continue to

pursue leveraged institutional and B2C opportunities and our

institutional offering continues to provide great growth potential

for both business lines.

Dividend

The Group is maintaining its dividend policy at 50% of profit

after tax. The Board has declared an interim dividend of 3.50 pence

per share (2021: 9.20 pence per share), with a view to paying a

final dividend in line with the Group's policy. The interim

dividend will be paid on 20 December 2021 to those members on the

register at the close of business on 26 November 2021.

Outlook

CMC reiterates its prior guidance and expects FY 2022 net

operating income to be between GBP250-280 million. We continue to

expect 2022 operating expenses excluding variable remuneration to

be moderately higher year-on-year, with H2 2022 operating expenses

excluding variable remuneration to be circa 6% higher than H1 2022

due to an expected pickup in marketing spend.

The Group continues to invest in technology and people in both

the leveraged and non-leveraged businesses that present significant

opportunities to deliver long-term value for shareholders.

OPERATING review

Summary

Net operating income decreased by GBP104.2 million (45%) to

GBP126.7 million, with a decrease in market volatility resulting in

lower client trading activity and lower client income retention

throughout the period. This lower volatility and trading activity

impacted both the leveraged and non-leveraged businesses.

Leveraged net trading revenue decreased by GBP99.4 million (50%)

driven by decreases in both gross client income and client income

retention. The decrease in gross client income was a result of the

significant volatility in the market in H1 2021 resulting in

exceptionally high client trading activity, with H1 2022 returning

to more normalised levels. Client income retention was lower during

the period at 80% (H1 2021: 115%) as a result of a change in the

mix of asset classes traded by clients and lower natural hedging of

flow within indices. This resulted in revenue per active client

("RPC") decreasing by GBP1,515 (45%) to GBP1,877.

Leveraged active client numbers decreased by 9% in comparison to

H1 2021, however monthly active clients remain significantly above

pre-COVID-19 levels, demonstrating the structural shift in the

Group's client base.

Non-leveraged net trading revenue was 8% lower at GBP24.2

million (H1 2021: GBP26.3 million), with decreased client trading

activity during the less volatile market environment offset by an

active client base which was 10% larger than H1 2021 and 57% higher

than H1 2020.

Statutory profit before tax decreased by GBP105.1 million (74%)

to GBP36.0 million as a result of the decrease in net operating

income, combined with increased operating expenses as the Group

continues to invest in technology. Profit before tax margin(1)

decreased by 32.7% from 61.1% to 28.4%.

Net operating income overview

For the half year ended 30 September 2021 30 September 2020 Change Change %

GBP million

Leveraged net trading revenue 101.0 200.4 (99.4) (50%)

Non-leveraged net trading revenue 24.2 26.3 (2.1) (8%)

----------------------------------- ------------------ ------------------ -------- ---------

Net trading revenue(2) 125.2 226.7 (101.5) (45%)

Interest income 0.3 0.5 (0.2) (27%)

Other operating income 1.2 3.7 (2.5) (67%)

=================================== ================== ================== ======== =========

Net operating income 126.7 230.9 (104.2) (45%)

=================================== ================== ================== ======== =========

B2B and B2C net trading revenue

For the half

year ended 30 September 2021 30 September 2020 Change

-------------------------------------------------------

GBP million B2C(3) B2B(4) Total B2C B2B Total B2C B2B Total

-------------------------- ------------------ ------------------ ----------------- ---------------- ----------------- ----------------- ----------------- -----------------

Leveraged net

trading

revenue 85.0 16.0 101.0 183.0 17.4 200.4 (54%) (8%) (50%)

Non-leveraged

net trading

revenue 4.9 19.3 24.2 4.8 21.5 26.3 1% (10%) (8%)

Net trading

revenue 89.9 35.3 125.2 187.8 38.9 226.7 (52%) (9%) (45%)

========================== ================== ================== ================= ================= ================ ================= ================= ================= =================

(1) Statutory profit before tax as a percentage of net operating

income

(2) CFD and spread bet gross client income net of rebates,

levies and risk management gains or losses and stockbroking revenue

net of rebates

(3) Business to Consumer ("B2C") - revenue from retail and

professional clients

(4) Business to Business ("B2B") - revenue from institutional

clients

Regional performance overview: Leveraged

For the

half

year 30 September 30 September

ended 2021 2020 Change

------------------- ----------------------------------------------------------------------------------- ----------------------------------------------------------------------------------- ----------------------------------------------------------------------------------

Net Gross Net Gross

trading client trading client Net Gross

revenue income(1) Active RPC revenue income(1) Active RPC trading client Active

(GBPm) (GBPm) Clients (GBP) (GBPm) (GBPm) Clients (GBP) revenue income(1) Clients RPC

------------------- ------------------- --------------------- ------------------- ------------------ ------------------- --------------------- ------------------- ------------------ ------------------- --------------------- ------------------- -----------------

UK 34.5 47.6 13,590 2,543 66.4 63.3 14,871 4,468 (48%) (25%) (9%) (43%)

Europe 18.6 20.6 13,664 1,359 38.7 28.3 17,191 2,252 (52%) (27%) (21%) (40%)

------------------- ------------------- --------------------- ------------------- ------------------ ------------------- --------------------- ------------------- ------------------ ------------------- --------------------- ------------------- -----------------

UK &

Europe 53.1 68.2 27,254 1,946 105.1 91.6 32,062 3,280 (50%) (26%) (15%) (41%)

APAC &

Canada 47.9 58.8 26,580 1,802 95.3 82.0 27,020 3,525 (50%) (28%) (2%) (49%)

=================== =================== ===================== =================== ================== =================== ===================== =================== ================== =================== ===================== =================== =================

Total 101.0 127.0 53,834 1,877 200.4 173.6 59,082 3,392 (50%) (27%) (9%) (45%)

=================== =================== ===================== =================== ================== =================== ===================== =================== ================== =================== ===================== =================== =================

(1) Spreads, financing and commissions on CFD client trades.

Given the exceptional volatility in the prior period, all

regions saw decreases in revenue per active client, driven by lower

gross client income in all regions and reduced client income

retention across the Group. Active client figures also reduced in

all regions, primarily a result of the lower volatility presenting

fewer opportunities for clients to trade.

UK

Active clients decreased by 9% to 13,590 (H1 2021: 14,871), as a

result of a reduction in market volatility, however they remained

significantly above pre-COVID-19 levels (H1 2020: 9,259). Gross

client income decreased by 25% to GBP47.6 million (H1 2021: GBP63.3

million) driven by lower active clients in addition to a reduction

in trading activity compared to prior year.

Revenue per active client decreased by 43% to GBP2,543 (H1 2021:

GBP4,468) due to lower gross client income and a reduction in

client income retention leading to lower net trading revenue.

Europe

Europe comprises offices in Austria, Germany, Norway, Poland and

Spain. Active client numbers were 21% lower than prior year, with

gross client income decreasing by 27% to GBP20.6 million as a

result.

Revenue per active client also decreased by 40% to GBP1,359 (H1

2021: GBP2,252) due to lower gross client income and a reduction in

client income retention leading to lower net trading revenue.

APAC and Canada

Our APAC and Canada business services clients from our Sydney,

Auckland, Singapore, Toronto and Shanghai offices along with other

regions where we have no physical presence.

Active client numbers decreased by 2% to 26,580 (H1 2021:

27,020), driven by the Australia office, which was impacted both by

new regulation and lower market volatility. Gross client income

decreased by 28% to GBP58.8 million (H1 2021: GBP82.0 million),

with regulatory changes implemented by the Australian Securities

and Investments Commission ("ASIC") reducing the notional value of

retail client trading, combined with lower market volatility,

resulting in less active client trading than in the prior

period.

Non-leveraged

Net trading revenue

For the half year ended 30 September 2021 30 September 2020 Change Change %

GBP million

B2B net trading revenue 19.3 21.5 (2.2) (10%)

B2C net trading revenue 4.9 4.8 0.1 1%

------------------------- ------------------ ------------------ ------- ---------

Net trading revenue 24.2 26.3 (2.1) (8%)

------------------------- ------------------ ------------------ ------- ---------

Active clients

For the half year ended 30 September 2021 30 September 2020

Change %

B2C active clients 41,590 32,225 29%

B2B active clients 144,257 136,045 6%

Total non-leveraged active clients 185,847 168,270 10%

==================================== ================== ================== ===========

The non-leveraged business continued to display growth in active

clients, with a 10% increase compared to H1 2021. Despite the

increase in active clients, net trading revenue decreased 8% to

GBP24.2 million, driven by subdued market volatility resulting in

fewer opportunities for clients to trade.

Operating expenses

For the half year ended 30 September 30 September Change %

GBPm 2021 2020

---------------------------------------- ------------ ------------ --------

Net staff costs - fixed (excluding

variable remuneration) 34.1 28.8 (18%)

IT costs 14.2 12.7 (12%)

Marketing costs 10.8 12.0 10%

Sales-related costs 0.9 2.8 68%

Premises costs 1.8 1.7 (2%)

Legal and professional fees 4.7 3.3 (40%)

Regulatory fees 3.2 2.6 (23%)

Depreciation and amortisation 6.4 5.5 (17%)

Irrecoverable sales tax 1.0 3.3 71%

Other 6.6 6.4 (7%)

======================================== ============ ============ ========

Operating expenses excluding variable

remuneration 83.7 79.1 (6%)

Variable remuneration 6.0 9.8 39%

======================================== ============ ============ ========

Operating expenses including variable

remuneration 89.7 88.9 (1%)

Interest 1.0 0.9 (11%)

======================================== ============ ============ ========

Total costs 90.7 89.8 (1%)

======================================== ============ ============ ========

Operating expenses excluding variable remuneration increased by

GBP4.6 million (6%) to GBP83.7 million. This was driven by an

increase in staff costs (GBP5.3 million) driven by significant

investment in technology, trading and product staff over the period

and increased IT costs (GBP1.5 million) as a result of higher

market data charges and investments in strategic projects.

Irrecoverable sales taxes decreased by GBP2.3 million (71%) due

to a one-off recovery and ongoing lower irrecoverable VAT in the

UK. Sales-related costs decreased by GBP1.9m (68%) driven primarily

by release of provisions in H1 2022 that initially arose in H1

2021, and marketing costs decreased by GBP1.2m (10%) as there were

fewer opportunities for targeted marketing in the period due to the

lower market volatility.

Variable remuneration decreased to GBP6.0 million (H1 2021:

GBP9.8 million), due to the strong operating performance in H1

2022, with costs returning to more normalised levels in line with

company performance.

Taxation

The effective tax rate for H1 2022 was 22.7%, up from the H1

2021 effective tax rate, which was 21.5%. The effective tax rate

has increased in the period due to a higher proportion of Group PBT

being generated in Australia, where the corporation tax rate is

higher, and the prior period benefiting from the utilisation of

deferred tax credits.

Balance sheet and own funds

Intangible assets increased by GBP15.6 million to GBP25.9

million (31 March 2021: GBP10.3 million) as a result of the

transaction with Australia and New Zealand Banking Group Limited

("ANZ") to transition approximately 500,000 of ANZ's Share

Investing clients to CMC (AUD$25m) and the capitalisation of staff

costs related to technology projects.

Amounts due from brokers decreased by GBP73.0 million to

GBP180.9 million due to a decrease in initial margin at brokers.

Other assets increased due to cryptocurrency holdings being

reported under this new category. The Group held an immaterial

balance of cryptocurrencies as at FY 2021, which were reported

within amounts due from brokers.

Cash and cash equivalents increased during the period, with a

cash outflow for the prior year final dividend of GBP62.4m being

offset by lower IM at brokers in the period, along with cash

inflows from the Group's operating performance, resulting in a

GBP12.7 million increase.

Title transfer funds increased by GBP11.2m, reflecting the

ongoing high levels of account funding by a small population of

mainly institutional clients.

Own funds decreased by GBP36.2 million to GBP334.2 million (31

March 2021: GBP370.4 million) during the six month period with the

decrease largely due to the payment of the final FY21 dividend.

Principal risks and uncertainties

Details of the Group's approach to risk management and its

principal risks and uncertainties were set out on pages 37 to 45 of

the 2021 Group Annual Report and Financial Statements (available on

the Group website https://www.cmcmarketsplc.com ). During the six

months to 30 September 2021 and up to the date of approval of the

interim financial statements, there have been no significant

changes to the Group's risk management framework. The Group

categorises its principal risks into three categories: business and

strategic risks; financial risks; and operational risks. The

Group's top and emerging risks, which form either a subset of one

or multiple principal risks within the three principal risk

categories, and continue to be at the forefront of Group

discussions, are regulatory change across the Group, the Group's

approach to the UK's exit from the European Union and the

development and release of a UK non-leveraged platform.

RESPONSIBILITY STATEMENT

The directors listed below (being all the directors of CMC

Markets plc) confirm that to the best of our knowledge, these

condensed consolidated interim financial statements have been

prepared in accordance with UK adopted International Accounting

Standard 34, 'Interim Financial Reporting' and the Disclosure

Guidance and Transparency Rules sourcebook of the United Kingdom's

Financial Conduct Authority and that the interim management report

includes a fair review of information required by DTR 4.2.7R and

DTR 4.2.8R, namely:

-- the interim management report includes a fair review of the

important events that have occurred during the first six months of

the financial year and their impact on the consolidated interim

financial statements, together with a description of the principal

risks and uncertainties for the remaining six months of the

financial year; and

-- material related party transactions in the first six months

of the financial year and any material changes in the related-party

transactions described in the last annual report.

Neither the Group nor the directors accept any liability to any

person in relation to the interim results for the half year ended

30 September 2021, except to the extent that such liability could

arise under English law. Accordingly, any liability to a person who

has demonstrated reliance on any untrue or misleading statement or

omission shall be determined in accordance with Section 90A and

Schedule 10A of the Financial Services and Markets Act 2000.

By order of the board of directors

Lord Cruddas

Chief Executive Officer

17 November 2021

CMC Markets plc Board of Directors

Executive Directors

Lord Peter Cruddas (Chief Executive Officer)

David Fineberg (Deputy Chief Executive Officer)

Matthew Lewis (Head of Asia Pacific and Canada)

Euan Marshall (Chief Financial Officer)

Non-Executive Directors

James Richards (Chairman)

Sarah Ing

Clare Salmon

Paul Wainscott

CONSOLIDATED INTERIM INCOME STATEMENT

For the half year ended 30 September 2021

GBP '000 Note 30 September 2021 30 September 2020

===== ==================

Revenue 3 148,767 255,622

Interest income 348 478

============================================================ ===== ================== ==================

Total revenue 149,115 256,100

Introducing partner commissions and betting levies (22,377) (25,235)

============================================================ ===== ================== ==================

Net operating income 2 126,738 230,865

Operating expenses 4 (89,667) (88,859)

Net impairment losses on financial assets (21) -

============================================================ ===== ================== ==================

Operating profit 37,050 142,006

Finance costs (1,002) (900)

============================================================ ===== ================== ==================

Profit before taxation 36,048 141,106

Taxation 5 (8,173) (30,315)

============================================================ ===== ================== ==================

Profit for the period attributable to owners of the parent 27,875 110,791

============================================================ ===== ================== ==================

Earnings per share

Basic earnings per share (p) 6 9.6p 38.3p

============================================================ ===== ================== ==================

Diluted earnings per share (p) 6 9.6p 38.1p

============================================================ ===== ================== ==================

CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE INCOME

For the half year ended 30 September 2021

GBP '000 30 September 2021 30 September 2020

==================

Profit for the period 27,875 110,791

Other comprehensive income/(expense):

Items that may be subsequently reclassified to income statement

Gain/(loss) on net investment hedges 1,179 (2,572)

Currency translation differences (1,810) 6,777

Changes in the fair value of debt instruments at fair value through other

comprehensive income (5) (32)

============================================================================== ================== ==================

Other comprehensive (expense)/income for the period (636) 4,173

============================================================================== ================== ==================

Total comprehensive income for the period 27,239 114,964

============================================================================== ================== ==================

CONSOLIDATED INTERIM STATEMENT OF FINANCIAL POSITION

At 30 September 2021

30 September 31 March

GBP '000 Note 2021 2021

===== =============

ASSETS

Non-current assets

Intangible assets 8 25,903 10,330

Property, plant and equipment 9 26,560 26,105

Deferred tax assets 5,318 6,370

Trade and other receivables 10 1,775 1,800

====================================== ===== ============= =========

Total non-current assets 59,556 44,605

====================================== ===== ============= =========

Current assets

Trade and other receivables 10 128,567 127,119

Derivative financial instruments 2,820 3,241

Current tax recoverable 2,242 1,749

Other assets 11 35,544 -

Financial investments 12 28,103 28,104

Amounts due from brokers 180,919 253,895

Cash and cash equivalents 13 131,619 118,921

====================================== ===== ============= =========

Total current assets 509,814 533,029

====================================== ===== ============= =========

TOTAL ASSETS 569,370 577,634

====================================== ===== ============= =========

LIABILITIES

Current liabilities

Trade and other payables 14 181,647 152,253

Derivative financial instruments 2,919 3,077

Borrowings 194 945

Lease liabilities 15 4,869 4,599

Provisions 885 1,889

====================================== ===== ============= =========

Total current liabilities 190,514 162,763

====================================== ===== ============= =========

Non-current liabilities

Borrowings - 194

Lease liabilities 15 10,653 10,727

Deferred tax liabilities 1,446 1,622

Provisions 1,627 1,811

====================================== ===== ============= =========

Total non-current liabilities 13,726 14,354

====================================== ===== ============= =========

TOTAL LIABILITIES 204,240 177,117

====================================== ===== ============= =========

EQUITY

Equity attributable to owners of the

Company

Share capital 73,474 73,299

Share premium 46,236 46,236

Own shares held in trust (441) (382)

Other reserves (49,970) (49,334)

Retained earnings 295,831 330,698

====================================== ===== ============= =========

Total equity 365,130 400,517

====================================== ===== ============= =========

TOTAL EQUITY AND LIABILITIES 569,370 577,634

====================================== ===== ============= =========

CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

For the half year ended 30 September 2021

Own shares Retained

GBP '000 Note Share capital Share premium held in trust Other reserves earnings Total Equity

===== ============== ============== ============== =============== ==============

At 31 March

2020 72,899 46,236 (433) (51,836) 216,013 282,879

New shares

issued 400 - - - - 400

Profit for the

period - - - - 110,791 110,791

Other

comprehensive

income for

the period - - - 4,173 - 4,173

Acquisition of

own shares

held in

trusts - - (319) - - (319)

Utilisation of

own shares

held in trust - - 370 - - 370

Share-based

payments - - - - (3,114) (3,114)

Tax on

share-based

payments 5 - - - - 790 790

Dividends 7 - - - - (35,393) (35,393)

=============== ===== ============== ============== ============== =============== ============== =============

At 30

September

2020 73,299 46,236 (382) (47,663) 289,087 360,577

=============== ===== ============== ============== ============== =============== ============== =============

At 31 March

2021 73,299 46,236 (382) (49,334) 330,698 400,517

New shares

issued 175 - - - - 175

Profit for the

period - - - - 27,875 27,875

Other

comprehensive

expense for

the period - - - (636) - (636)

Acquisition of

own shares

held in

trusts - - (277) - - (277)

Utilisation of

own shares

held in trust - - 218 - - 218

Share-based

payments - - - - (1,107) (1,107)

Tax on

share-based

payments 5 - - - - 779 779

Dividends 7 - - - - (62,414) (62,414)

=============== ===== ============== ============== ============== =============== ============== =============

At 30

September

2021 73,474 46,236 (441) (49,970) 295,831 365,130

=============== ===== ============== ============== ============== =============== ============== =============

CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS

For the half year ended 30 September 2021

30 September 30 September

GBP '000 Note 2021 2020

===== =============

Cash flows from operating activities

Cash generated from operations 16 105,515 123,236

Interest income 875 921

Tax paid (7,051) (13,640)

============================================== ===== ============= =============

Net cash generated from operating activities 99,339 110,517

============================================== ===== ============= =============

Cash flows from investing activities

Purchase of property, plant and equipment (2,340) (2,041)

Investment in intangible assets (16,910) (4,389)

Purchase of financial investments (14,805) (14,873)

Proceeds from maturity of financial

investments 14,255 14,345

Inflow/(Outflow) on net investment

hedges 1,361 (1,817)

============================================== ===== ============= =============

Net cash used in investing activities (18,439) (8,775)

============================================== ===== ============= =============

Cash flows from financing activities

Proceeds from borrowings 9,999 -

Repayment of borrowings (10,944) (1,108)

Principal elements of lease payments (3,038) (3,093)

Proceeds from issue of Ordinary Shares - 81

Acquisition of own shares (102) -

Dividends paid (62,414) (35,393)

Finance costs (985) (898)

============================================== ===== ============= =============

Net cash used in financing activities (67,484) (40,411)

============================================== ===== ============= =============

Net increase in cash and cash equivalents 13,416 61,331

Cash and cash equivalents at the beginning

of the period 118,921 84,307

Effect of foreign exchange rate changes (718) 4,454

============================================== ===== ============= =============

Cash and cash equivalents at the end

of the period 131,619 150,092

============================================== ===== ============= =============

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

For the half year ended 30 September 2021

1. Basis of preparation

Basis of accounting and accounting policies

The condensed consolidated interim financial statements have

been prepared in accordance with UK adopted International

Accounting Standard 34, 'Interim Financial Reporting' and the

Disclosure Guidance and Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority. The condensed consolidated

interim financial statements do not constitute statutory accounts

within the meaning of Section 434 of the Companies Act 2006. Within

the notes to the condensed consolidated interim financial

statements, all current and comparative data covering periods to

(or as at) 30 September is unaudited.

The Group's statutory financial statements for the year ended 31

March 2021 have been prepared in accordance with international

accounting standards in conformity with the requirements of the

Companies Act 2006 ('IFRS') and the applicable legal requirements

of the Companies Act 2006. In addition to complying with

international accounting standards in conformity with the

requirements of the Companies Act 2006, the consolidated financial

statements also comply with international financial reporting

standards adopted pursuant to Regulation (EC) No 1606/2002 as it

applies in the European Union. These financial statements have been

delivered to the Registrar of Companies. The auditors' opinion on

those financial statements was unqualified and did not contain a

statement made under Section 498 of the Companies Act 2006. The 31

March 2021 balances presented in these condensed consolidated

interim financial statements are from those financial statements

and are audited.

The accounting policies applied in these condensed consolidated

interim financial statements are consistent with those applied in

the Group's statutory financial statements for the year ended 31

March 2021, except for the change in accounting policy related to

cryptocurrency assets explained below. The condensed consolidated

interim financial statements should be read in conjunction with the

statutory financial statements for the year ended 31 March 2021. In

the year ending 31 March 2022 the consolidated financial statements

of the Group will be prepared in accordance with IFRS as adopted by

the UK Endorsement Board. This change in basis of preparation is

required by UK company law for the purpose of financial reporting

as a result of the UK's exit from the EU on 31 January 2020 and the

cessation of the transition period on 31 December 2020. This change

does not constitute a change in accounting policy but rather a

change in accounting framework. There is no impact on recognition,

measurement or disclosure between the two frameworks in the period

reported.

The condensed consolidated interim financial statements have

been prepared under the historical cost convention, except in the

case of "Financial instruments at fair value through profit or loss

(FVPL)" and "Financial instruments at fair value through other

comprehensive income (FVOCI)". The financial information is rounded

to the nearest thousand, except where otherwise indicated.

Accounting policy - Other assets

Other assets represent cryptocurrencies controlled by the Group.

The Group offers various cryptocurrency-related products that can

be traded on its platform. The Group purchases and sells

cryptocurrencies as part of its hedging activity.

The Group holds cryptocurrency assets for trading in the

ordinary course of its business, effectively acting as a commodity

broker-dealer in respect of the underlying cryptocurrency assets.

In the prior period cryptocurrency assets were disclosed within

Amount due from brokers (31 March 2021: GBP1,520,000). The assets

will continue to be measured at fair value less cost to sell with

changes in valuation being recorded within revenue in the income

statement in the period in which they arise. Cryptocurrency assets

are not financial instruments, and they are categorised as

non-financial assets.

Cryptocurrency assets continue to be held at fair value through

profit and loss therefore this accounting policy impacts

classification only. Other assets amount to GBP35,544,000 and are

presented as a separate line in the consolidated statement of

financial position.

There is no further impact for the half year ended 30 September

2021 and for the year ended 31 March 2021.

Future accounting developments

The Group did not implement the requirements of any Standards or

Interpretations that were in issue but were not required to be

adopted by the Group at the half year. No other Standards or

Interpretations have been issued that are expected to have an

impact on the Group's financial statements.

There is no material impact expected of reference rate reform

for the half year ended 30 September 2021 and will not lead to a

remeasurement gain or loss.

Significant accounting judgements and estimates

The preparation of condensed consolidated interim financial

statements in conformity with IFRS requires the use of certain

significant accounting judgements. It also requires management to

exercise its judgement in the process of applying the Group's

accounting policies. The areas involving a higher degree of

judgement or complexity, or where assumptions and estimates are

significant to the condensed consolidated interim financial

statements are:

Deferred taxes

The carrying amounts of deferred tax assets are reviewed at each

balance sheet date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered.

Contingent liabilities

Judgement has been applied in evaluating the accounting

treatment of the specific matters described in Note 20 (Contingent

Liabilities), notably the probability of any obligation or future

payments arising.

Accounting for cryptocurrencies

The Group has recognised GBP35,544,000 (31 March 2021:

GBP1,520,000 in "Amounts due from brokers") of cryptocurrency

assets and rights to cryptocurrency assets on its Statement of

Financial Position as at 30 September 2021. These assets are used

for hedging purposes and held for sale in the ordinary course of

business. A judgement has been made to apply the measurement

principles of IFRS 13 Fair value measurement in accounting for

these assets. The assets are presented as 'other assets' on the

Consolidated Statement of Financial Position. The measurement and

disclosure of cryptocurrency assets is considered to be a

significant accounting judgement.

Intangible assets

The Group has recognised GBP13,317,000 of intangible assets

under development on its Statement of Financial Position as at 30

September 2021. These assets relate to the transaction with

Australia and New Zealand Banking Group Limited ("ANZ") to

transition its portfolio of Share Investing clients to CMC for

AUD$25m. A judgement has been made to apply the measurement

principles of IAS 38 Intangibles in accounting for these

assets.

No significant estimates were used in the preparation of the

condensed consolidated interim financial statements.

Going concern

The Group has considerable financial resources, a broad range of

products and a geographically diversified business. Consequently,

the Directors believe that the Group is well placed to manage its

business risks in the context of the current economic outlook.

Accordingly, the Directors have a reasonable expectation that the

Group has adequate resources to continue in operational existence

for the foreseeable future, a period of not less than 12 months

from the date of this report. They therefore continue to adopt the

going concern basis in preparing these condensed consolidated

interim financial statements.

Seasonality of operations

The Directors consider that, given the impact of market

volatility, and the growth in overseas business, there is no

predictable seasonality to the Group's operations.

2. Segmental reporting

The Group's principal business is providing leveraged online

retail financial services and providing its clients with the

ability to trade contracts for difference (CFD) and financial

spread betting on a range of underlying shares, indices, foreign

currencies, commodities and treasuries. The Group also makes these

services available to institutional partners through white label

and introducing broker arrangements. The Group's CFDs are traded

worldwide; spread bets only in the UK and Ireland and the Group

provides stockbroking services only in Australia. The Group's

business is generally managed on a geographical basis and for

management purposes, the Group is organised into four segments:

-- Leveraged - CFD and Spreadbet - UK and Ireland ("UK & IE");

-- Leveraged - CFD - Europe;

-- Leveraged - CFD - Australia, New Zealand and Singapore ("APAC") and Canada; and

-- Non-leveraged - Stockbroking - Australia

These segments are in line with the management information

received by the Chief Operating Decision Maker (CODM).

Revenues and costs are allocated to the segments that originated

the transaction. Costs generated centrally are allocated to

segments on an equitable basis, mainly based on revenue, headcount

or active client levels, or where central costs are directly

attributed to specific segments.

Leveraged Non-leveraged

==============

30 September 2021 APAC &

GBP '000 UK & IE Europe Canada Australia Central Total

================================== ========= ========= ============== ========== =========

Segment revenue net of

Introducing partner commissions

and betting levies 35,117 18,622 48,393 24,258 - 126,390

Interest income/(expense) (253) (1) 156 446 - 348

================================== ========= ========= ========= ============== ========== =========

Net operating income 34,864 18,621 48,549 24,704 - 126,738

Segment operating expenses (8,680) (2,957) (11,939) (5,756) (60,356) (89,688)

================================== ========= ========= ========= ============== ========== =========

Segment contribution 26,184 15,664 36,610 18,948 (60,356) 37,050

Allocation of central

operating expenses (17,328) (14,737) (18,397) (9,894) 60,356 -

================================== ========= ========= ========= ============== ========== =========

Operating profit 8,856 927 18,213 9,054 - 37,050

Finance costs (250) (14) (103) (87) (548) (1,002)

Allocation of central

finance costs (237) (106) (205) - 548 -

================================== ========= ========= ========= ============== ========== =========

Profit before taxation 8,369 807 17,905 8,967 - 36,048

================================== ========= ========= ========= ============== ========== =========

Leveraged Non-leveraged

=========================

30 September

2020 APAC &

GBP '000 UK & IE Europe Canada Australia Central Total

========================= ==================== ==================== ========================= ==================== ====================

Segment

revenue net

of

Introducing

partner

commissions

and betting

levies 69,506 38,796 95,733 26,352 - 230,387

Interest

income 89 - 320 69 - 478

========================= ==================== ==================== ==================== ========================= ==================== ====================

Net operating

income 69,595 38,796 96,053 26,421 - 230,865

Segment

operating

expenses (9,970) (2,924) (9,565) (5,253) (61,147) (88,859)

========================= ==================== ==================== ==================== ========================= ==================== ====================

Segment

contribution 59,625 35,872 86,488 21,168 (61,147) 142,006

Allocation of

central

operating

expenses (17,907) (15,732) (17,483) (10,025) 61,147 -

========================= ==================== ==================== ==================== ========================= ==================== ====================

Operating

profit 41,718 20,140 69,005 11,143 - 142,006

Finance costs (261) (17) (119) (111) (392) (900)

Allocation of

central

finance

costs (153) (67) (172) - 392 -

========================= ==================== ==================== ==================== ========================= ==================== ====================

Profit before

taxation 41,304 20,056 68,714 11,032 - 141,106

========================= ==================== ==================== ==================== ========================= ==================== ====================

The measurement of net operating income for segmental analysis

is consistent with that in the income statement.

The Group uses 'Segment contribution' to assess the financial

performance of each segment. Segment contribution comprises

operating profit for the period before finance costs, taxation and

an allocation of central operating expenses.

The measurement of segment assets for segmental analysis is

consistent with that in the balance sheet. The total non-current

assets other than deferred tax assets, broken down by location of

the assets, is shown below.

31 March

GBP '000 30 September 2021 2021

==================

UK 26,638 22,662

Australia 24,953 12,693

Other countries 2,647 2,880

========================== ================== =========

Total non-current assets 54,238 38,235

========================== ================== =========

3. Revenue

GBP '000 30 September 2021 30 September 2020

==================

Leveraged 110,035 211,791

Non-leveraged 37,540 40,195

Other 1,192 3,636

=============== ================== ==================

Revenue 148,767 255,622

=============== ================== ==================

Leveraged revenue represents CFD and Spread bet revenue. Non

leveraged revenue represents Stockbroking revenue.

4. Operating Expenses

GBP '000 30 September 2021 30 September 2020

==================

Net staff costs 40,081 38,559

IT costs 14,156 12,676

Sales and marketing 11,653 14,799

Premises 1,754 1,727

Legal and Professional fees 4,654 3,325

Regulatory fees 3,240 2,645

Depreciation and amortisation 6,429 5,493

Irrecoverable sales tax 970 3,337

Other 6,730 6,298

=============================== ================== ==================

Operating expenses 89,667 88,859

=============================== ================== ==================

5. Taxation

30 September 30 September

GBP '000 2021 2020

=============

Analysis of charge for the period:

Current tax

Current tax on profit for the period 7,462 21,122

Adjustments in respect of previous periods - (116)

=================================================== ============= =============

Total current tax 7,462 21,006

=================================================== ============= =============

Deferred tax

Origination and reversal of temporary differences 1,049 9,311

Adjustments in respect of prior periods (338) (2)

Impact of change in tax rate - -

=================================================== ============= =============

Total deferred tax 711 9,309

=================================================== ============= =============

Total tax 8,173 30,315

=================================================== ============= =============

The standard rate of UK corporation tax was 19% with effect from

1 April 2017. Taxation outside the UK is calculated at the rates

prevailing in the respective jurisdictions. The effective tax rate

for the half year ended 30 September 2021 was 22.67% (H alf year

ended 30 September 2020: 21.48%), differs from the standard rate of

UK corporation tax rate of 19% (H alf year ended 30 September 2020:

19%). The differences are explained below:

GBP '000 30 September 2021 30 September 2020

==================

Profit before taxation 36,048 141,106

============================================================================== ================== ==================

Profit multiplied by the standard rate of corporation tax in the UK of 19%

(30 September 2020:

19%) 6,849 26,810

Adjustment in respect of foreign tax rates 1,334 3,266

Adjustments in respect of prior periods (338) (118)

Impact of change in tax rate 126 -

Expenses not deductible for tax purposes 142 116

Income not subject to tax (42) 11

Share awards 87 -

Other differences 15 230

============================================================================== ================== ==================

Total tax 8,173 30,315

============================================================================== ================== ==================

GBP '000 30 September 2021 30 September 2020

==================

Tax on items recognised directly in Equity

Tax on share-based payments (779) (790)

============================================ ================== ==================

6. Earnings per share ( EPS )

Basic EPS is calculated by dividing the earnings attributable to

the equity owners of the Company by the weighted average number of

ordinary shares in issue during each period excluding those held in

employee share trusts which are treated as cancelled.

For diluted earnings per share, the weighted average number of

ordinary shares in issue, excluding those held in employee share

trusts, is adjusted to assume conversion of all dilutive potential

weighted average ordinary shares, which consists of share options

granted to employees and shares issuable to client investors at

IPO.

GBP '000 30 September 2021 30 September 2020

==================

Earnings attributable to ordinary shareholders

(GBP '000) 27,875 110,791

================================================ ================== ==================

Weighted average number of shares used in the

calculation of basic earnings per share ('000) 290,669 288,985

Dilutive effect of share options ('000) 1,016 1,833

================================================ ================== ==================

Weighted average number of shares used in the

calculation of diluted earnings per share

('000) 291,685 290,818

================================================ ================== ==================

Basic earnings per share (p) 9.6p 38.3p

================================================ ================== ==================

Diluted earnings per share (p) 9.6p 38.1p

================================================ ================== ==================

For the half year ended 30 September 2021, 1,016,000 (H alf year

ended 30 September 2020: 1,833,000) potentially dilutive weighted

average ordinary shares in respect of share options in issue were

included in the calculation of diluted EPS.

7. Dividends

GBP '000 30 September 2021 30 September 2020

==================

Prior year final dividend of 21.43p per share (30 September 2020: 12.18p) 62,414 35,393

=========================================================================== ================== ==================

An interim dividend for 2022 of 3.50p per share, amounting to

GBP10,200,000 has been approved by the board but has not been

included as a liability at 30 September 2021. The dividend will be

paid on 20 December 2021 to those members on the register at the

close of business on 26 November 2021.

8. Intangible assets

Trademarks

Computer and trading Assets under

GBP '000 Goodwill software licences Client relationships development Total

========= ========== ============= ===================== =============

At 31 March 2021

Cost 11,500 125,995 1,397 2,995 6,148 148,035

Accumulated amortisation (11,500) (122,075) (1,135) (2,995) - (137,705)

========================== ========= ========== ============= ===================== ============= ==========

Carrying amount - 3,920 262 - 6,148 10,330

========================== ========= ========== ============= ===================== ============= ==========

Half year ended 30 September 2021

Carrying amount

at the beginning

of the period - 3,920 262 - 6,148 10,330

Additions - 44 - - 16,866 16,910

Transfers - 5,210 - - (5,210) -

Amortisation charge - (1,322) (24) - - (1,346)

Foreign currency

translation - (41) (1) - 51 9

========================== ========= ========== ============= ===================== ============= ==========

Carrying amount

at the end of the

period - 7,811 237 - 17,855 25,903

========================== ========= ========== ============= ===================== ============= ==========

At 30 September

2021

Cost 11,500 130,611 1,385 2,915 17,855 164,266

Accumulated amortisation (11,500) (122,800) (1,148) (2,915) - (138,363)

========================== ========= ========== ============= ===================== ============= ==========

Carrying amount - 7,811 237 - 17,855 25,903

========================== ========= ========== ============= ===================== ============= ==========

Additions of GBP16,866,000 in Assets under development are

primarily due to the transaction with Australia and New Zealand

Banking Group Limited ("ANZ") to transition ANZ's portfolio of

Share Investing clients to CMC for AUD$25m.

9. Property, plant and equipment

Furniture,

Leasehold fixtures Computer Right-of-use

GBP '000 improvements and equipment hardware assets Total

============== =============== ========== =============

At 31 March 2021

Cost 19,273 9,656 36,249 19,146 84,324

Accumulated depreciation (14,393) (8,795) (27,235) (7,796) (58,219)

============================== ============== =============== ========== ============= =========

Carrying amount 4,880 861 9,014 11,350 26,105

============================== ============== =============== ========== ============= =========

Half year ended 30 September 2021

Carrying amount at

the beginning of the

period 4,880 861 9,014 11,350 26,105

Additions 106 44 2,190 3,381 5,721

Disposals - - (14) - (14)

Depreciation charge (849) (215) (1,546) (2,473) (5,083)

Foreign currency translation (33) (9) (35) (92) (169)

============================== ============== =============== ========== ============= =========

Carrying amount at

the end of the period 4,104 681 9,609 12,166 26,560

============================== ============== =============== ========== ============= =========

At 30 September 2021

Cost 19,205 9,657 38,289 22,344 89,495

Accumulated depreciation (15,101) (8,976) (28,680) (10,178) (62,935)

============================== ============== =============== ========== ============= =========

Carrying amount 4,104 681 9,609 12,166 26,560

============================== ============== =============== ========== ============= =========

10. Trade and other receivables

GBP '000 30 September 2021 31 March 2021

==================

Current

Gross trade receivables 8,799 9,103

Less: provision for impairment of trade receivables (7,626) (7,762)

====================================================== ================== ==============

Trade receivables 1,173 1,341

Prepayments and accrued income 11,407 9,799

Stockbroking debtors 114,105 99,035

Other debtors 1,882 16,944

====================================================== ================== ==============

128,567 127,119

===================================================== ================== ==============

Non-current

Other debtors 1,775 1,800

====================================================== ================== ==============

Total 130,342 128,919

====================================================== ================== ==============

Stockbroking debtors represent the amount receivable in respect

of equity security transactions executed on behalf of clients with

a corresponding balance included within trade and other payables

(note 14).

11. Other assets

Other assets are cryptocurrencies, which are owned and

controlled by the Group for the purpose of hedging the Group's

exposure to clients' cryptocurrency trading positions. The Group

holds cryptocurrencies on exchange and in vault as follows:

GBP '000 30 September 2021 31 March 2021

==================

Exchange 21,087 -

Vaults 14,457 -

========= ================== ==============

35,544 -

========= ================== ==============

12. Financial investments

GBP '000 30 September 2021 31 March 2021

==================

UK Government securities:

At the beginning of the period / year 28,037 25,385

Purchase of securities 14,805 28,933

Maturity of securities and Coupon receipts (14,782) (26,256)

Accrued interest (17) 29

Changes in the fair value of debt instruments at fair value through other

comprehensive income (5) (54)

================================================================================ ================== ==============

At the end of the period / year 28,038 28,037

================================================================================ ================== ==============

Equity securities:

At the beginning of the period / year 67 60

Foreign currency translation (2) 7

================================================================================ ================== ==============

At the end of the period / year 65 67

================================================================================ ================== ==============

Total 28,103 28,104

================================================================================ ================== ==============

GBP '000 30 September 2021 31 March 2021

==================

Analysis of financial investments

Non-current - -

Current 28,103 28,104

==================================== ================== ==============

Total 28,103 28,104

==================================== ================== ==============

Financial investments are shown as current assets when they have

a maturity of less than one year and as non-current when they have

a maturity of more than one year.

13. Cash and cash equivalents

GBP '000 30 September 2021 31 March 2021

==================

Gross cash and cash equivalents 688,685 668,304

Less: Client monies (557,066) (549,383)

================================== ================== ==============

Cash and cash equivalents 131,619 118,921

================================== ================== ==============

Analysed as:

Cash at bank 131,619 118,921

---------------------------------- ------------------ --------------

Cash and cash equivalents are short-term, highly liquid

investments that are readily convertible to known amounts of cash

and which are subject to an insignificant risk of changes in

value.

14. Trade and other payables

GBP '000 30 September 2021 31 March 2021

==================

Current

Gross trade payables 598,971 580,062

Less: Client monies (557,066) (549,383)

================================================ ================== ==============

Trade payables 41,905 30,679

Tax and social security 904 236

Stockbroking creditors 102,177 89,091

Other creditors, accruals and deferred income 36,661 32,247

================================================ ================== ==============

181,647 152,253

=============================================== ================== ==============

Stockbroking creditors represent the amount payable in respect

of equity and securities transactions executed on behalf of clients

with a corresponding balance included within trade and other

receivables (note 10).

15. Lease liabilities

GBP '000 30 September 2021 31 March 2021

==================

At the beginning of the period / year 15,326 19,273

Additions / Modifications of new leases during the period / year 3,399 1,181

Interest expense 372 818

Lease payments made during the year (3,410) (6,875)

Foreign currency translation (165) 929

=================================================================== ================== ==============

At the end of the period / year 15,522 15,326

=================================================================== ================== ==============

GBP '000 30 September 2021 31 March 2021

==================

Analysis of lease liabilities

Non-current 10,653 10,727

Current 4,869 4,599

================================ ================== ==============

Total 15,522 15,326

================================ ================== ==============

16. Cash generated from operations

GBP '000 30 September 2021 30 September 2020

==================

Cash flows from operating activities

Profit before taxation 36,048 141,106

Adjustments for:

Interest income (348) (478)

Finance costs 1,002 900

Depreciation 5,083 4,583

Amortisation of intangible assets 1,346 910

Research and development tax credit - (97)

Profit on disposal of property, plant and equipment - (109)

Share-based payment (886) (2,746)

Other non-cash movements including exchange rate movements (1,101) 800

Changes in working capital:

(Increase)/decrease in trade and other receivables and other assets (1,391) 41,740

Decrease/(increase) in amounts due from brokers 71,456 (26,688)

Increase in other assets (34,024) (1,024)

Increase/(decrease) in trade and other payables 29,394 (37,721)

Increase in net derivative financial instruments liabilities 81 1,846

(Decrease)/increase in provisions (1,145) 214

===================================================================== ================== ==================

Cash generated from operations 105,515 123,236

===================================================================== ================== ==================

17. Liquidity

The Group has access to the following liquidity resources that

make up total available liquidity:

-- Own funds. The primary source of liquidity for the Group. It

represents the funds that the business has generated historically,

including any unrealised gains / losses on open hedging positions.

All cash held on behalf of segregated clients is excluded. Own

funds consists mainly of cash and cash equivalents and also

includes investments in UK government securities which are held to

meet the Group's liquid asset buffer (LAB - as agreed with FCA).

These UK government securities are BIPRU 12.7 eligible securities

and are available to meet liabilities which fall due in periods of

stress.

-- Title Transfer Funds (TTFs). This represents funds received

from professional clients and eligible counterparties (as defined

in the FCA Handbook) that are held under a Title Transfer

Collateral Agreement (TTCA); a means by which a professional client

or eligible counterparty may agree that full ownership of such

funds is unconditionally transferred to the Group. The Group

considers these funds as an ancillary source of liquidity and

places no reliance on its stability.

-- Available committed facility (off-balance sheet liquidity).

The Group has access to a syndicated revolving credit facility of

up to GBP55.0 million (31 March 2021: GBP55.0 million) in order to

fund any potential fluctuations in margins required to be posted at

brokers to support our risk management strategy. The maximum amount

of the facility available at any one time is dependent upon the

initial margin requirements at brokers and margin received from

clients. The facility consists of a one year term facility of

GBP27.5 million and a three year term facility of GBP27.5 million,

both of which were renewed in March 2021.

The Group's use of total available liquidity resources consist

of:

-- Blocked cash. Amounts held to meet the requirements of local

market regulators and amounts held at overseas subsidiaries in

excess of local segregated client requirements to meet potential

future client requirements.

-- Initial margin requirement at broker. The total GBP

equivalent initial margin required by prime brokers to cover the