TIDMCLCO

RNS Number : 2575E

Cloudcoco Group PLC

27 October 2022

The information contained within this announcement is deemed by

CloudCoCo to constitute inside information pursuant to Article 7 of

EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

27 October 2022

CloudCoCo Group plc

("CloudCoCo" or the "Group")

Year End Trading Update

Strong strategic and commercial progress and positive

outlook

CloudCoCo (AIM: CLCO), a leading UK provider of Managed IT

services and communications solutions to private and public sector

organisations, is pleased to provide an update on its progress for

the year ended 30 September 2022 ("FY22").

Highlights:

-- Step change in sales, with revenue expected to be no less

than GBP24.0m (FY21: GBP8.0m) as a result of the previously

announced acquisitions, now successfully integrated

-- Trading EBITDA(1) expected to be in the region of GBP1.0m

(FY21: GBP745k)

-- Launch of 'Project IGNITE' investment programme to enhance

sales capabilities

-- Opening of new, more modern headquarters in Leeds and office

locations in Warrington and Bournemouth

-- Confident of continued strong sales growth and improved

profitability in FY23

The Group delivered a strong revenue performance in the period,

with positive trading momentum from the first half continuing

through to the second. We continued to make good progress in

signing new business on multi-year terms, hardware sales were ahead

of expectations, and there were encouraging early signs of

cross-selling success between the acquired companies with our first

managed services customers taking data centre solutions and vice

versa. This performance, alongside the action taken to put the

Group on a sound footing in the first half, led to trading EBITDA

being up significantly on the prior year.

Operationally, we made excellent progress, successfully

completing the integration of the four acquired businesses.

Pleasingly, we continued to see further improvements in the

performance of the loss-making Connect business acquired in October

2021, as the year progressed further to it reaching monthly

breakeven in March 2022 as announced in the Group's interim

results.

To support the next phase of the Group's growth, we launched a

new programme of investment in the second half which has continued

into the new financial year. Known internally as 'Project IGNITE',

the programme comprises the implementation of additional sales

systems and the introduction of new talent in our new business,

mobile, alliances, sales academy, retention, and ecommerce

teams.

In line with this initiative, CloudCoCo's primary focus in the

new financial year will be on driving organic growth. At the same

time, the Board will continue to actively seek opportunities to

enhance capabilities and accelerate growth through selective

acquisitions.

While remaining cognisant of the inflationary environment in the

near term, we continue to work with our customers to help them

navigate rising third-party vendor costs and new business pipelines

across the Group are growing at a healthy rate. We are confident of

delivering continued strong sales growth and improved profitability

in FY23, weighted towards the second half in view of the

investments we are making in the first.

Mark Halpin , CEO of CloudCoCo, commented:

"The period under review has been another successful one,

characterised by a focus on integrating and optimising the four

acquisitions made in late 2021, while taking steps to ensure the

Group moves forward as a single, cohesive unit. To have delivered

such a positive financial performance in such a short space of time

while making such major leaps forward operationally is testament to

the quality of our expanded proposition and the hard work of

everyone at the business.

"Looking ahead, we are confident FY23 will be another year of

material strategic and commercial progress. Our organic growth

prospects are strong, with growing demand, all parts of the

business now fully embedded and operating profitably, and a

programme of investment underway to further bolster our sales

efforts. Alongside this, in pursuit of the next stage in our 'Get

Bigger' strategy, we are actively exploring complementary

acquisitions with the potential to enhance our one stop shop

capabilities and accelerate value creation for shareholders."

(1) earnings before net finance costs, tax, depreciation,

amortisation, plc costs, exceptional costs and share-based

payments.

Contacts:

CloudCoCo Group plc Via Alma PR

Mark Halpin (CEO)

Darron Giddens (CFO)

Allenby Capital Limited - (Nominated Tel: +44 (0)20 3328

Adviser & Broker) 5656

Jeremy Porter / Freddie Wooding - Corporate

Finance

Tony Quirke / Amrit Nahal - Equity

Sales

Alma PR - (Financial PR) Tel: +44 (0)20 3405

David Ison 0205

Josh Royston cloudcoco@almapr.co.uk

Kieran Breheny

About CloudCoCo

Supported by a team of industry experts and harnessing a diverse

ecosystem of partnerships with blue-chip technology vendors,

CloudCoCo makes it easy for private and public sector organisations

to work smarter, faster and more securely by providing a single

point of purchase for their connectivity, telephony, cyber

security, cloud, IT hardware and support needs.

CloudCoCo has headquarters in Leeds and regional offices in

Warrington, Sheffield and Bournemouth

www.cloudcoco.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFEAEFMEESEFS

(END) Dow Jones Newswires

October 27, 2022 02:00 ET (06:00 GMT)

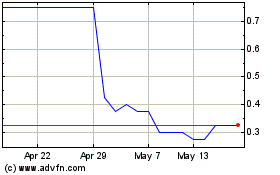

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

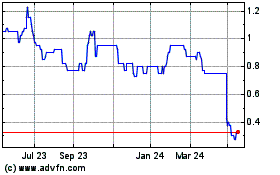

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Dec 2023 to Dec 2024