Loss for the period (16,066,657) (4,837,919) (11,489,788)

Adjustments:

Amortisation expense - intangible

assets 29,599 14,273 53,372

Depreciation expense - property,

plant and equipment 647,360 379,853 902,531

(Profit)/loss on disposal

of property, plant and equipment 7,259 (364,097) (359,991)

Finance income (110,315) (347,275) (730,086)

Share based payments 338,383 275,583 588,514

Foreign exchange (gains)/losses (551,330) 16,751 (229,581)

(Increase)/Decrease in inventories 446,533 36,417 (1,454,957)

(Increase)/Decrease in accounts

receivable 902,907 3,269 4,920,850

(Decrease)/Increase in accounts

payable (406,212) (567,799) 299,059

Net cash flow used in operations (14,762,473) (5,390,944) (7,500,077)

-------------------------------------------------------- ---------- ------------- ----------------- ---------------

Investing activities

Purchase of computer software (28,582) (138,138) (138,354)

Purchase of mine assets,

property, plant and equipment (1,844,136) (2,719,417) (17,060,389)

Acquisition of subsidiary - - -

(net of cash acquired)

Proceeds from sale of equipment - - -

Loans repaid - - -

Interest received 110,315 347,275 730,086

-------------------------------------------------------- ---------- ------------- ----------------- ---------------

Net cash used in investing

activities (1,762,403) (2,510,280) (16,468,657)

-------------------------------------------------------- ---------- ------------- ----------------- ---------------

Financing activities

Proceeds from issue of share - - -

capital

Issue costs - - -

-------------------------------------------------------- ---------- ------------- ----------------- ---------------

Net cash from financing - - -

activities

-------------------------------------------------------- ---------- ------------- ----------------- ---------------

Net change in cash and cash

equivalents (16,524,876) (7,901,224) (23,968,734)

Cash and cash equivalents

at beginning of the period 36,944,060 61,184,915 61,184,915

Effect of changes in foreign

exchange rates 308,475 (672,437) (272,121)

-------------------------------------------------------- ---------- ------------- ----------------- ---------------

Cash and cash equivalents

at end of the period 20,727,659 52,611,254 36,944,060

-------------------------------------------------------- ---------- ------------- ----------------- ---------------

Notes to the financial statements

1 Loss per share

The loss per share is calculated by reference to the loss of

USD16, 066,657 for the six months ended 30 June 2013 and the

weighted average number of shares in issue of 250,477,868 during

the period. There is no dilutive effect of share options.

2 Basis of preparation of financial statements

The unaudited results have been prepared on a going concern

basis and on the basis of the accounting policies adopted in the

audited accounts for the year ended 31 December 2012. The results

for the period are derived from continuing activities.

The financial information set out in this half-yearly report

does not constitute statutory accounts. The figures for the period

ended 31 December 2012 have been extracted from the statutory

financial statements, prepared under IFRS, which are available on

the Group's website www.chaarat.com. The auditor's report on those

financial statements was unqualified.

3 Intangible assets - acquired mining exploration assets

Mining exploration assets acquired on the acquisition of

subsidiaries are carried in the balance sheet at their fair value

at the date of acquisition less any impairment losses, pending

determination of technical feasibility and commercial viability of

those projects.

When such a project is deemed to no longer have technical or

commercially viable prospects to the Group, acquired mining

exploration costs in respect of that project are deemed to be

impaired and written off to the statement of total comprehensive

income.

Subsequent mining exploration costs incurred on those projects

are expensed in accordance with the Group's accounting policy

below.

4 Mining exploration and development costs

During the exploration phase of operations, all costs are

expensed in the Income Statement as incurred.

A subsequent decision to develop a mine property within an area

of interest is based on the exploration results, an assessment of

the commercial viability of the property, the availability of

financing and the existence of markets for the product. Once the

decision to proceed to development is made, exploration,

development and other expenditures relating to the project are

capitalised and carried at cost with the intention that these will

be depreciated by charges against earnings from future mining

operations over the relevant life of mine on a units of production

basis.

Expenditure is only capitalised provided it meets the following

recognition requirements:

-- completion of the project is technically feasible and the

Company has the ability to and intends to complete it;

-- the project is expected to generate future economic benefits;

-- there are adequate technical, financial and other resources to complete the project; and

-- the expenditure attributable to the development can be measured reliably.

No depreciation is charged against the property until commercial

production commences. After a mine property has been brought into

commercial production, costs of any additional work on that

property are expensed as incurred, except for large development

programmes, which will be deferred and depreciated over the

remaining life of the related assets.

The carrying values of exploration and development expenditures

in respect of each area of interest which has not yet reached

commercial production are periodically assessed by management and

where it is determined that such expenditures cannot be recovered

through successful development of the area of interest, or by sale,

the expenditures are written off to the income statement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR FVLFLXKFLBBF

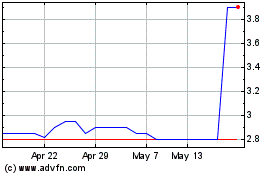

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jul 2023 to Jul 2024