Extension of option agreements

July 13 2007 - 3:30AM

UK Regulatory

Cubus Lux plc

Extension of options to acquire certain development land known as the Olive

Island Resort

On 13 March 2007, Cubus Lux plc (the "Company") announced that it had entered

into two option agreements to acquire certain development land known as the

"Olive Island Resort" on the coast of Dalmatia in Croatia. These options were

originally for a four month term, expiring on 12 July 2007.

The Company entered into agreements on 12 July 2007 to extend these options for

a further two months, expiring on 12 September 2007.

The Olive Island Resort development land is intended to be developed into a

village resort comprising 126 villas and 305 apartments as well as accompanying

facilities, such as restaurants, shops, offices and a marina (the "Villas

Development"); and a four-star hotel containing 500 beds (the "Hotel

Development").

Both option agreements are conditional upon a number of factors, including

completion of due diligence by the Company, finalisation of the terms of

acquisition and the raising of debt or equity financing by the Company for at

least Euro10 million. The exercise of the options is subject to appropriate

consents having been granted by the government of Croatia.

Highlights, as announced on 13 March 2007:

* Option to acquire the Villas Development for Euro10 million in cash and the

issue of 33 million ordinary shares in the Company.

* Option to acquire the Hotel Development for Euro5 million in ordinary shares of

the Company.

* Independent valuation by UK based surveyors Kings Sturge of the Villas

Development at Euro39 million and the Hotel Development at Euro5 million.

In the event that the Company proceeds with the acquisition of the Villas

Development and the Hotel Development, the transaction is expected to

constitute a reverse takeover for the purposes of the AIM Rules, and will

therefore require the issue of an admission document and shareholder approval.

In addition, the transaction would be considered to be a related party

transaction for the purposes of the AIM Rules due to the connection between

Gerhard Huber, Michael Janssen and Christian Kaiser (directors of the Company)

and the counterparties to the option agreements.

For further information please contact:

Leon Nahon +44 (0)7920 834 156

Cubus Lux plc

Ross Andrews/Simon Sacerdoti +44 (0)20 7090 7800

City Financial Associates Limited

Graham Herring/Josh Royston +44 (0)20 7936 9605

Threadneedle Communications Limited

END

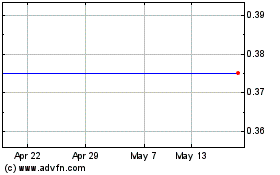

Cellular Goods (LSE:CBX)

Historical Stock Chart

From May 2024 to Jun 2024

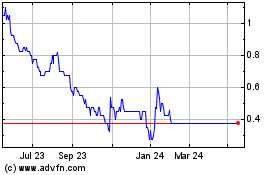

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Jun 2023 to Jun 2024