TIDMATY

RNS Number : 8733E

Athelney Trust PLC

16 February 2018

ATHELNEY TRUST plc

FINAL RESULTS

Legal Entity Identifier:

213800ON67TJC7F4DL05

Athelney Trust plc, the investor in small companies and junior

markets announces its final results for the 12 months ended 31

December 2017.

Chairman's Statement and Business Review

I announce the results for the year ended 31 December 2017. The

salient points are as follows:

-- The total return, which is the increase in NAV plus the

dividend, is 16.8 per cent (31 December 2016: 5.7 per cent)

-- Audited Net Asset Value ("NAV") was 284.8p per share (31

December 2016: 251.1p) an increase of 13.4 per cent.

-- Revenue return per ordinary share was 9.6p (31 December 2016: 10p).

-- Recommended final dividend of 8.9p per share (2016: 8.6p), an increase of 3.5 per cent.

Review of 2017

The Treasury predicted I would become the most unpopular man in

Britain. This was the only correct forecast that the Treasury made

in the several years that I was chancellor. Former Chancellor of

the Exchequer Norman, now Lord, Lamont.

Get your facts right, then you can distort them as you please.

Mark Twain.

If you put the...government in charge of the Sahara Desert, in

five years there would be a shortage of sand. Professor Milton

Friedman.

If 2016 was the year of shock and surprise, then 2017 was the

year of disruption. A blizzard of tweets followed President Trump's

inauguration (my nuclear button is bigger than yours - all grown-up

stuff, of course), answered by bots from the likes of Russia, China

and North Korea. Prime Minister (strong and stable leadership) May

turned a cast-iron majority into something much more precarious

depending on the goodwill of the DUP and the Scottish

Conservatives. The general election campaign was a superb example

of ineptitude. As far as Brexit was concerned, Britain gave way

completely on the Irish border, the rights of EU workers and the

divorce settlement so was allowed to prepare for trade talks this

year. Let us see how easy they turn out to be! Syria spent its

sixth year in civil war and Yemen was not far behind in terms of

danger to life. The rise of the populist parties continued in

Europe and brought with it an exceptionally unwelcome increase in

anti-Semitism, particularly in Hungary and Poland. President Maduro

of Venezuela continued with his quest to destroy what at one time

had been the strongest economy in Latin America. Tanks rolling down

the streets of Harare eventually persuaded autocratic President

Mugabe to resign while, at the same time, the Generals were

claiming no, there is no coup.

For the most part, though, global markets continued their serene

progress and thus improved on my hope that we could hang on to our

gains of the first half. Major markets did very well with New York,

Tokyo, Shanghai and London improving by 26.1, 19.1, 8.6 and 7.4 per

cent respectively. Turkey, Hong Kong and Austria did particularly

well in smaller markets with rises of 48.5, 38.9 and 33.2 per cent

respectively whereas Saudi Arabia, with a fall of 0.2 per cent, and

Russia and Sweden underperformed with small rises of 2.7 and 4.6

per cent. Russia is often touted as a recovery situation but four

sets of sanctions have always put me off, resulting from: the

arrest and murder of Sergei Magnitsy, the invasion of eastern

Ukraine and the Crimea, the shooting down by pro-Moscow fighters of

Malaysian Airlines flight number 17 and interference in the U.S.

general election. A better recovery proposition might be battered

and bashed retailers and shopping malls. Westfield is being bought

by Unibail-Rodamco, Hammerson has bid for Intu and Brookfield is

trying to buy out GGP. Hedge funds are heavily short and therefore

vulnerable. The same comment applies, in my opinion, to underrated

brewery groups such as Greene King and Marston's.

For the record, the Athelney Trust total return for 2017 was

16.8 per cent whereas the FTSE Small Cap., Fledgling and AIM

All-share indices rose by 14.9, 23 and 24.1 per cent respectively,

which just goes to underline the point that 2017 was about growth

strategies while those based on value and income did well enough

without matching the strong performance of Fledgling and AIM.

Ryanair boss Michael O'Leary only proposed getting rid of the

co-pilot. But now Airbus has gone one better: pilotless 'planes.

Soon, everyone will be baffled by flight attendant Elaine Dickinson

of the Airplane! film, who memorably said There's no reason to

become alarmed and we hope that you enjoy the rest of your flight.

By the way, is there anyone on board who can fly a 'plane?

Let me start this paragraph with a quote: The single greatest

edge an investor can have is a long-term orientation. So said the

shrewd Seth Klarman in his book (Margin of Safety, Risk Averse

Investing Strategies for the Thoughtful Investor) written over 25

years ago and still a great read. Private investors think

themselves at a great disadvantage compared with the professional

fund manager, who has access to considerable resources as well as

by-the-second information about companies and markets. But many

fund managers are incapable of thinking beyond a year and some not

even beyond a quarter. This hands a great advantage to the

thoughtful investor who, ideally, should do as little as possible

whereas the majority of fund managers are incentivised to do things

to show their bosses and clients that they are doing their job and

deserve to keep it. There is a saying that time in the market,

rather than timing the market, leads to a satisfactory end result.

The less you chop and change your investments, the fewer mistakes

you are likely to make. By following the simple rule of doing as

little as possible, the private investor will tend, over the long

term, to avoid many pitfalls that damage those unable to sit still.

Remember, while you may be doing nothing with your money, that does

not mean that your money is not doing anything for you.

The world's central banks now own a fifth of their respective

countries' national debt after years of quantitative easing. The

central banks are owned by the states whose paper they are holding

so the ultimate owners of all the government debt are the

governments themselves. If you owe something to yourself, in what

sense do you owe it? Answers on a postcard to Mark Carney, c/o Bank

of England, EC2R 8AH.

With all the problems that face us as a country, it would be

good to report that the underlying economy was doing well -

unfortunately, that is not the case; in fact, the short-term

economic performance is already disappointing. Consensus forecasts

cluster around GDP growth of around 1.5 per cent for 2018, lower

than just about anything in the developed world except for Japan

and Italy. So what is going wrong? The aftermath of the financial

crisis has been devastating, the recovery from which has been the

weakest since the war. Real household incomes are just five per

cent higher than in 2007. Between 2007 and 2016, real wages grew by

10.6 in Germany and 6.4 per cent on average in Organisation for

Economic Co-operation and Development members. Those of us aged

22-39 experienced a 10 per cent fall in real earnings between 2007

and 2017 and were particularly hard hit by the jump in house prices

from 3.6 times average annual earnings 20 years ago to 7.6 times

today.

The UK economy remains the most regionally divided: inner London

is the richest in Europe but there are some areas of high

deprivation. Part-time employment is relatively high and zero-hours

work has increased from 0.7 per cent in 2007 to 2.8 per cent today.

Productivity is poor and very close to that of Italy. This dire

record partly reflects the long (and growing) tail of poor

performers. Last, but not least, UK investment on capital

equipment, research and development is exceptionally weak. Some

argue that perverse incentives reward management for an increase in

share prices rather than any improvement in the long-term

performance of companies. This is not a description of a healthy

economy well able to withstand the severe shock of worse access to

its most important market - it is absurd to claim otherwise. The

Brexit shock, coupled with the UK's underlying weaknesses, is

likely to make the rising disappointment for the many who voted to

Leave all the more severe. The collective sigh of relief which

greeted the agreement on a two-year period of transition was wholly

misplaced - all we have succeeded in doing is moving the cliff-edge

from 2019 to 2021.

Some 47 per cent of Sports Direct's independent shareholders

voted to remove chairman Keith Hellawell at September's AGM,

believing him unable to impose corporate governance discipline on

chief executive and majority shareholder Mike Ashley. So it was

good of Mr. Ashley to show how seriously he now takes such matters.

He didn't turn up.

The average Briton must find nearly eight times his or her

salary to buy the average British house. Not in the Persimmon

boardroom. The GBP232m notional profit on share options split

between three executive Directors would be enough to purchase 300

such homes. Startling arithmetic like this comes with a few

caveats. The three men in question, the CEO, FD and MD, could sell

only 40 per cent of their options at the end of 2017. Obviously,

the remainder could produce less or more when ultimately sold and

the profits are likely to be taxed at rates approaching 50 per

cent. The irony is that the long-term investment plan aimed to

recognise good performance over a decade rather than just three or

five years. It was also spread amongst 140 senior managers, though

the top three received a third of the total awards. What the

remuneration committee did not anticipate was the soaring share

price. When shareholders approved the plan in 2012 (with some

dissent), the shares were priced at 657p but were 2738p five years

later. Ministers, trying

to sound tough on inequality, will be embarrassed. So they

should be. The main factor driving the increase in house-building

shares has been the government's own interventions in the housing

market which have fuelled demand without increasing supply. Quite

rightly, the Chairman of the board and the Chair of the

remuneration committee have now gone.

More proof of the railways' insatiable demand for money. One

rail operator has come up with its third cash-call in three years.

Anyone would think that Hornby operated real trains.........

The border between accounting scandal and fraud is marked by the

bars of a jail. Steinhoff, a South African-based, Dutch-registered,

Frankfurt-listed retail group (containing Poundland) is under

investigation by prosecutors in Germany over suspected inflated

revenue numbers [which] made their way into the accounts and in

December the Company said that it was considering the validity and

recoverability of EUR60 billion of assets. Further back, the year

2002 was a classic of its type. Multibillion-dollar frauds at

WorldCom and Tyco landed executives in jail but only three years

later. Global Crossing filed for bankruptcy protection after it

said that profits were inflated. Xerox admitted to over-stating

revenues. Six years passed from 2009 before the chairman of Indian

software group Satyam was sentenced. Let's Gowex of Spain collapsed

in 2014: its CEO said that the accounts were untrustworthy and that

he was responsible. The case continues. London-listed Globo failed

in 2015: the CEO and CFO resigned, telling the board about

falsification of data and misrepresentation of the Company's

financial situation. Investigations continue. Justice should be as

swift and as painful as possible - surely the authorities can do

better than this!

Maybe Stephen Haddrill's 25-page speech on Lessons from the

Financial Crisis was meant to be satire. The head of the Financial

Reporting Council (FRC) opened up with the news that the business

had cost us GBP11 trillion in financial support for UK banks

without mentioning that the FRC had cleared all accountancy firms

of inadequate audits. He did admit, though, that one of the big

four firms only produced a 'satisfactory' FTSE-350 audit 65 per

cent of the time. KPMG, as it happens.

In October, John McDonnell, the shadow chancellor, reaffirmed

the commitments in the Labour manifesto to bring Royal Mail, rail,

water and the energy sector into public ownership. This raises not

a few questions, of which possibly the least interesting is how

much it will all cost. After all, if I borrow GBP200,000 to buy a

house worth GBP200,000 then I do not become GBP200,000 worse off at

the point of purchase. Similarly, to the extent that the government

pays what the assets are worth, then overall the public sector

would be no better or no worse off. Nevertheless, the printed media

seems determined to concentrate on this area. The second question,

in my view more important, is how much to pay for these assets.

Forcibly buying assets at below market value smacks of

expropriation and it would be crucial to the stability of the

British economy that any compensation payment is seen to be

reasonable. What is certain is that, if investors believe that they

are at risk of being expropriated in the future, they will not

invest, to the detriment of the whole country: that would be a

disaster. The third and most important question is what benefit, if

any, we might gain from spending an enormous amount of time, effort

and disruption on renationalising these industries. It is important

to remember that sectors of the economy such as energy and water

are already highly regulated in terms of prices that can be charged

and the amount of capital investment which must be undertaken.

Broadly speaking, the regulatory framework is trying to ensure that

these companies act in the public interest while the profit motive

pushes them to be as efficient as possible. Labour government

ministers should not be allowed a free hand to run these utilities

any more than should private shareholders. It is not at all clear

that from the inglorious past that such ministers are likely to be

either more competent or more trustworthy than our present system

of regulatory bodies.

Ah, those far-off days when trains, gas, electricity and water

were all in public hands and there were no fat-cat oligarchs

gouging deep profits out of our services - or so the young plus Jez

Corbyn appear to believe. Those with longer memories might remember

terrible trains, trying to get a telephone (and then sharing the

line with one's next-door neighbour), sewage in the river and at

sea, with state-owned industries run for the benefit of their

employees. Estimated losses from 1948 to 1970 - GBP105 billion in

today's money. Of course, it will be different next time.....

The price of Bitcoin rose from about $1,000 at the beginning of

the year to $14,129 at the end but, for the life of me, I cannot

see that there is any point to the thing apart from representing a

mad, wild speculation. In The Hitchhiker's Guide to the Galaxy,

Douglas Adams wrote about similarly useless money. The exchange

rate of eight Ningis to one Pu is simple enough but since the Ningi

is a triangular rubber coin 6,800 miles along each side, no-one has

ever collected enough to own one Pu. Ningis are not negotiable

currency because Galactibanks refuses to deal in fiddling small

change. Back to Bitcoin, where a chap on the staff of the Wall

Street Journal set out to buy lunch in December, paid $76.16 for a

$10 pizza and ended up lunching on an ice cream instead. Apart from

the $9.47 in fees, the problem was that the seller had not up-dated

the pizza price to reflect price changes in the Bitcoin. The buyer

gave up after waiting 30 minutes for the order to be confirmed and

settled for a $5 ice cream sandwich (?) instead, for which he paid

$17.50 including $9.62 in fees. He finally got his pizza four hours

later but, alas, by which time he had lost his appetite.

I am often asked, Gentle Reader, is Britcoin a real currency and

can I lose money if I hold onto it? The answer is, of course, that

the pound, or Britcoin as it is sometimes referred to in the media,

is an unstable and unpredictable currency often used by speculators

in shady deals or in money-laundering operations and is not

advisable for use by ordinary consumers. In recent years, Britcoin

has been talked up but then crashed spectacularly with huge losses

to investors. At present, the Britcoin remains fragile and ordinary

punters are advised to stick to better regulated and more reliable

currencies such as the Venezuelan Maduro or Zimbabwean

Bling-bling.

Sensible taxes transfer money to the government in a

straightforward way but stupid taxes are the ones which encourage

stupid behaviour in the population. Stamp duty, for example,

discourages older couples from downsizing and so forces them to

live on in a house which is too big for them. Inheritance tax falls

mainly on the less well off since the rich can gift their assets

before they die, whereas the moderately off have only their house

to bequeath. Mind you, the wallpaper tax of 1712 was not much

better: the rich simply bought plain, untaxed wallpaper, then had

it stencilled by hand. The idea of the window tax of 1696 was that

the more windows you had the richer you were likely to be. You can

still see the result in buildings of the period: surplus windows

were merely bricked up. Hat and wig taxes were introduced in the

late 18(th) Century: result, endless bickering about exactly what

was a hat and the terminal decline of the wig industry. A tax on

gin was introduced on the craze that peaked in 1742: result, the

rise of the bootleggers who often mixed the rough product with

turpentine and sulphuric acid. Blindness was a common side effect

of this particularly stupid tax.

How to claim compensation from Tesco for its accounting scandal:

submit claim to KPMG via web portal with evidence of share deals;

wait for assessment at 24.5p per share plus 4 per cent interest;

download Notice of Acceptance and Release form, sign and upload to

portal; wait 35 days for payment. How to claim a refund on a dodgy

packet of sprouts: return to store; show receipt; receive cash.

Should do better!

When was the last time that the UK exported more goods than it

imported for a decent period - say five years or so? The short

answer is never. Over the past 200 years, this great trading nation

has had a surplus in manufactured goods for fewer years than you,

Gentle Reader, has fingers. Even during the Empire in all its pomp

and the industrial revolution, the UK invariably sucked in more

goods than it pumped out. It's not that we don't make anything - in

fact the UK remains one of the world's biggest manufacturers. But

we have never been truly self-sufficient in such goods: indeed, the

only thing preventing Britain's balance of payments looking truly

horrendous is the services we have sold abroad - financial, legal,

consultancy, administration, retail and so on. In all but two

peacetime years over the past two centuries, the UK exported far

more services than it imported. How to square this with the

political debate about Brexit? Listening to strong and stable

leader Theresa May banging on about securing tariff-free access to

European markets, you might be forgiven for believing that all we

need is a replacement for the customs union, a quick trade deal

and, hey presto, British lorries and containers will still be able

to cross the Channel. Unfortunately, this catastrophically misses

the point. As it happens, those lorries already face the lowest

tariffs in history: these days the problems come from non-tariff

barriers such as product standards (does the product conform to our

rules), rules on immigration (no consulting work in the EU without

permission) and qualifications (a legal degree or medical

qualifications may not work in the EU). Which brings us to the

single market, which is everything to do with non-tariff barriers

policed by the Tories hate figure, the European Court of

Justice.

It works very well in goods but not so in services: architects

can work well throughout Europe but it is much harder for

accountants to do so.

What we need is a series of deep, complex deals with Europe and

the world that harmonise regulation. Such deals are fiendishly

difficult to negotiate: for instance I would expect the UK

government to protect the NHS from overseas competition and farmers

from those with lower standards on the use of hormones in meat and

GM food. Striking such complex deals would invariably involve a

loss of sovereignty - will the government explain to Leave voters

that, having taken back control, Britain will have to give it up

again?

An historic moment. One of the world's largest companies has

changed its name. Wal-Mart Stores has found a way of better

reflecting our company's path to win the future of retail. Yes,

from now on it's to be called, er, Walmart.

Capital Gains

During the year the Company realised capital profits before

expenses arising on the sale of investments in the sum of

GBP296,629 (31 December 2016: GBP294,251).

Portfolio Review

Holdings of Biffa, Countrywide, Crest Nicholson, Debenhams,

Greene King, Hostelworld, Ibstock, Marstons, Murgitroyds, NWF, The

PRS REIT and Safecharge were all purchased for the first time.

Additional holdings of Air Partner, M&C Saatchi and Record were

also acquired. Beasley, Hiscox, Lancashire Holdings and Novae were

sold. In addition, eleven holdings were top-sliced to provide

capital for the new purchases.

Corporate Activity

The holdings of Lavendon and Cape were taken over at a capital

profit of 99.1 and 19.8 percent respectively.

Dividend

The Board is pleased to recommend an increased annual dividend

of 8.9p per ordinary share (2016: 8.6p). This represents an

increase of 3.5 per cent over the previous year. Subject to

shareholder approval at the Annual General Meeting on 21 March

2018, the dividend will be paid on 6 April 2018 to shareholders on

the register on 2 March 2018.

For those patient investors who subscribed for Athelney Trust

shares in the IPO of 1994, the annual return has now risen to 17.8

per cent net of basic rate tax on the capital originally

invested.

Update

The unaudited NAV at 31 January 2018 was 279.4p whereas the

share price on the same day stood at 262p. Further updates can be

found on www.athelneytrust.co.uk

Prospects

The Federal Reserve has raised rates three times since the end

of 2016 and, in September 2017, announced a reduction in its $4.5

trillion balance sheet. Despite the Fed's gradual removal of

monetary accommodation, monetary conditions have not tightened: I

would argue that they have in fact become looser. Long-term

interest rates have hardly changed, markets keep going up and the

dollar has not appreciated markedly. The most plausible reason for

this apparent paradox is that the European Central Bank, the Bank

of Japan and the Bank of England are still pursuing policies of

extreme monetary accommodation. So, in theory at least, global

markets may have a decent-enough year. As I said at this time last

year, much could go wrong (geopolitical risks, trade protectionism,

higher oil prices for instance) but monetary policy is unlikely to

be unhelpful and so I would hope for a modest 5-7 per cent rise in

net asset value in 2018 plus a further 3 per cent from dividends,

all being well.

Dr. E C Pohl

Chairman

14 February 2018

Income Statement

For the Year Ended 31

For the Year Ended December

31 December 2017 2016

Note Revenue Capital Total Revenue Capital Total

GBP GBP GBP GBP GBP GBP

Gains on

investments

held at fair

value 8 - 835,709 835,709 - 236,357 236,357

Income from

investments 2 238,832 - 238,832 242,157 - 242,157

Investment

Management

expenses 3 (6,128) (56,042) (62,170) (5,210) (46,933) (52,143)

Other expenses 3 (26,527) (73,817) (100,344) (25,519) (63,393) (88,912)

Net return on

ordinary 206,177 705,850 912,027 211,428 126,031 337,459

activities before

taxation

Taxation 5 - - - - - -

Net return on

ordinary

activities after

taxation 6 206,177 705,850 912,027 211,428 126,031 337,459

Net return per

ordinary

share 6 9.6p 32.7p 42.3p 10p 6p 16p

Dividend per

ordinary

share paid during

the year 7 8.6p 7.9p

The total column of this statement is the profit and loss

account for the Company.

All revenue and capital items in the above statement derive from

continuing operations.

No operations were acquired or discontinued during the above

financial years.

A statement of movements of reserves is given overleaf.

A Statement of Comprehensive Income is not required as all gains

and losses of the Company have been reflected in the above

Statement.

Statement of Changes in Equity for the Year Ended

31 December 2017

Called-up Capital Capital Total

Share Share reserve reserve Revenue Shareholders'

Capital Premium realised unrealised reserve Funds

GBP GBP GBP GBP GBP GBP

Balance brought

forward at 1 January

2016 495,770 545,281 1,563,158 1,910,653 343,369 4,858,231

Net profits on

realisation

of investments - - 294,251 - - 294,251

Decrease in unrealised

Appreciation - - - (57,894) - (57,894)

Expenses allocated

to

Capital - (28,127) (110,326) - - (138,453)

Profit for the

year - - - - 211,428 211,428

Dividend paid

in year - - - - (156,663) (156,663)

Shares issued

in the year 43,700 363,933 - - - 407,633

Shareholders'

Funds at 31 December

2016 539,470 881,087 1,747,083 1,852,759 398,134 5,418,533

========== ========= ========== =========== ========== ==============

Balance brought

forward at 1 January

2017 539,470 881,087 1,747,083 1,852,759 398,134 5,418,533

Net profits on

realisation

of investments - - 296,629 - - 296,629

Increase in unrealised

Appreciation - - - 539,080 - 539,080

Expenses allocated

to

Capital - - (129,859) - - (129,859)

Profit for the

year - - - - 206,177 206,177

Dividend paid

in year - - - - (185,036) (185,036)

Shareholders'

Funds at 31 December

2017 539,470 881,087 1,913,853 2,391,839 419,275 6,145,524

======== ======== ========== ========== ========== ==========

Statement of the Financial Position as at

31 December 2017

Company Number: 02933559

Note 2017 2016

GBP GBP

Fixed assets

Investments held at fair

value through profit and

loss 8 5,966,679 5,117,268

---------- ----------

Current assets

Debtors 9 156,798 256,964

Cash at bank and in hand 45,289 59,133

202,087 316,097

Creditors: amounts falling

due within one year 10 (23,242) (14,832)

---------- ----------

Net current assets 178,845 301,265

---------- ----------

Total assets less current liabilities 6,145,524 5,418,533

Provisions for liabilities

and charges - -

Net assets 6,145,524 5,418,533

========== ==========

Capital and reserves

Called up share capital 11 539,470 539,470

Share premium account 881,087 881,087

Other reserves (non distributable)

Capital reserve - realised 1,913,853 1,747,083

Capital reserve - unrealised 2,391,839 1,852,759

Revenue reserve (distributable) 419,275 398,134

Shareholders' funds - all

equity 6,145,524 5,418,533

========== ==========

Net Asset Value per share 13 284.8 p 251.1p

Statement of Cash flows for the Year Ended

31 December 2017

2017 2016

GBP GBP

Cash flows from operating

activities

Net revenue return 206,177 211,428

Adjustment for:

Expenses charged to capital (129,859) (110,326)

Increase/(decrease) in creditors 8,410 (547)

Decrease/(increase) in debtors 100,166 (132,596)

Cash from/(used) operations 184,894 (32,041)

---------- ----------

Cash flows from investing

activities

Purchase of investments (674,520) (741,319)

Proceeds from sales of investments 660,818 570,157

---------- ----------

Net cash used in investing

activities (13,702) (171,162)

---------- ----------

Financing activities

Share issue - 379,506

---------- ----------

Net cash used in financing

activities - 379,506

---------- ----------

Equity dividends paid (185,036) (156,663)

Net (decrease)/increase in

cash (13,844) 19,640

Cash at the beginning of the

year 59,133 39,493

---------- ----------

Cash at the end of the year 45,289 59,133

========== ==========

Notes to the Financial Statements

For the Year Ended 31 December 2017

1. Accounting Policies

1.1 Statement of Compliance and Basis of Preparation of Financial Statements

The financial statements are prepared in accordance with

applicable United Kingdom accounting standards, including Financial

Reporting Standard 102 ("FRS 102"), the Companies Act 2006 and with

the AIC Statement of Recommended Practice ("SORP") issued in

November 2014 (amended January 2017), regarding the Financial

Statements of Investment Trust Companies and Venture Capital

Trusts. All the Company's activities are continuing.

1.2 Income

Income from investments including taxes deducted at source is

recognised when the right to the return is established (normally

the ex-dividend date). UK dividend income is reported net of tax

credits in accordance with FRS 102 "Income Tax". Interest is dealt

with on an accruals basis.

1.3 Investment Management Expenses

All three Directors are involved in investment management, 10%

of their salaries or fees have been charged to revenue and the

other 90% to capital. All other investment management expenses have

been charged to capital. The Board propose continuing this basis

for future years.

1.4 Other Expenses

Expenses (including VAT) and interest payable are dealt with on

an accruals basis and charged through the Revenue and Capital

Accounts in an allocation that the Board consider to be a fair

distribution of the costs incurred.

1.5 Investments

Listed investments comprise those listed on the Official List of

the London Stock Exchange. Unlisted investments are traded on AIM.

Profits or losses on sales of investments are taken to realised

capital reserve. Any unrealised appreciation or depreciation is

taken to unrealised capital reserve.

Investments have been classified as "fair value through profit

and loss" upon initial recognition.

Subsequent to initial recognition, investments are measured at

fair value with changes in fair value recognised in the Income

Statement.

Securities of companies quoted on a recognised stock exchange

are valued by reference to their quoted bid prices at the close of

the year, similarly, AIM-traded investments are valued using the

closing bid price on 31 December.

1.6 Taxation

The tax effect of different items of income and expenses is

allocated between capital and revenue on the same basis as the

particular item to which it relates, using the Company's effective

rate of tax for the year.

1.7 Judgements

The Directors confirm that no judgements have been made in the

process of applying the Company's accounting policies.

1. Accounting Policies (continued)

1.8 Deferred Taxation

Deferred tax is recognised in respect of all timing differences

that have originated but not reversed by the balance sheet date.

Deferred tax liabilities are recognised for all taxable timing

differences but deferred tax assets are only recognised if it is

considered more likely than not that there will be suitable profits

from which the future reversal of the underlying timing differences

can be deducted. Deferred tax assets and liabilities are calculated

at the tax rates expected to be effective at the time the timing

differences are expected to reverse. Deferred tax assets and

liabilities are not discounted.

1.9 Capital Reserves

Capital Reserve - Realised

Gains and losses on realisation of fixed asset investments are

dealt with in this reserve.

Capital Reserve - Unrealised

Increases and decreases in the valuations of fixed asset

investments are dealt with in this reserve. Unrealised capital

reserves cannot be distributed by way of dividends or similar.

1.10 Dividends

In accordance with FRS 102 "Events after the end of the

Reporting Period", dividends are included in the financial

statements in the year in which they go ex-div.

1.11 Share Issue Expenses

The costs associated with issuing shares are written off against

any premium arising on the issue of Share Capital.

1.12 Financial Instruments

Short term debtors and creditors are held at cost.

2. Income

Income from investments

2017 2016

GBP GBP

UK dividend income 154,547 175,503

Foreign dividend income 43,876 46,439

UK Property REITs 40,334 20,210

Bank interest 75 5

Total income 238,832 242,157

======== ========

UK dividend income

2017 2016

GBP GBP

UK Main Market listed investments 101,879 115,086

UK AIM-traded shares 52,668 60,417

154,547 175,503

======== ========

3. Return on Ordinary Activities before Taxation

2017 2016

GBP GBP

The following amounts (inclusive of

VAT) are included

within investment management and other

expenses:

Directors' remuneration:

- Services as a director 21,000 21,000

- Otherwise in connection with management 57,474 49,401

Auditors' remuneration:

- Audit Services - Statutory audit 10,500 10,500

Miscellaneous expenses:

- Other wages and salaries 4,134 10,300

- Management services 30,996 22,140

- PR and communications 3,891 9,662

- Stock exchange subscription 7,920 6,420

- Sundry investment management and

other expenses 26,599 11,632

162,514 141,055

======== ========

On 1 April 2016 the Company entered into a contract with J

Girdlestone to provide management services at an annual cost of

GBP24,600 plus VAT. An increase of 10% was agreed in July 2017

making the annual fee GBP27,060 plus VAT.

4. Employees and Directors' Remuneration

2017 2016

GBP GBP

Costs in respect of Directors:

Non-executive directors' fees 21,000 21,000

Wages and salaries 57,474 49,401

Social security costs 4,134 2,971

82,608 73,372

======= =======

Costs in respect of administrator:

Wages and salaries - 6,687

Social security costs - 642

- 7,329

==== ======

Total:

Non-executive directors' fees 21,000 21,000

Wages and salaries 57,474 49,401

Social security costs 4,134 3,613

82,608 80,701

----------------- -------

Average number of employees:

Chairman - -

Investment 1 1

Administration - -

1 1

================= ===========

5. Taxation

(i) On the basis of these financial statements no provision has

been made for corporation tax (2016: Nil).

(ii) Factors affecting the tax charge for the year.

The tax charge for the period is lower than (2016: lower than)

the average small company rate of corporation tax in the UK of 19

per cent. The differences are explained below:

2017 2016

GBP GBP

Total return on ordinary activities

before tax 912,027 337,459

---------- -----------------

Total return on ordinary activities

multiplied by the average small company

rate of corporation tax 19.25% (2016:

20%) 175,565 67,492

Effects of:

UK dividend income not

taxable (29,750) (34,430)

Revaluation of shares

not taxable (103,773) 11,578

Capital gains not taxable (57,101) (58,850)

Unrelieved management

expenses 15,059 14,210

Current tax charge for

the year - -

========== =================

The Company has unrelieved excess revenue management expenses of

GBP127,919 at 31 December 2017 (2016: GBP92,354) and GBP102,597

(2016: GBP102,597) of capital losses for Corporation Tax purposes

and which are available to be carried forward to future years. It

is unlikely that the Company will generate sufficient taxable

profits in the future to utilise these expenses and therefore no

deferred tax asset has been recognised.

For the year ended 31 December 2016, the Company received

approval from HM Revenue and Customs under Section 1158 of the

Corporation Tax Act 2010, therefore the Company was not liable to

Corporation Tax on any realised investment gains for 2016. The

Directors intend to continue to meet the conditions required to

obtain approval and therefore no deferred tax has been provided on

any capital gains or losses arising on the revaluation or disposal

of investments.

6. Return per Ordinary Share

The calculation of earnings per share has been performed in

accordance with FRS 102.

2017 2016

GBP GBP GBP GBP GBP GBP

Revenue Capital Total Revenue Capital Total

Attributable return

on

ordinary activities

after taxation 206,177 705,850 912,027 211,428 126,031 337,459

Weighted average

number of shares 2,157,881 2,104,868

Return per ordinary

share 9.6p 32.7p 42.3p 10p 6p 16p

7. Dividend

2017 2016

GBP GBP

Final dividend in respect of 2016

of 8.6p (2016: a final dividend

of 7.9p was paid in respect of

2015) per share 185,036 156,663

======== ========

Set out below is the total dividend payable in respect of the

financial year, which is the basis on which the requirements of

Section 1158 of the Corporation Tax Act 2010 are considered.

It is recommended that a final dividend of 8.9p (2016: 8.6p) per

ordinary share be paid out of revenue profits amounting to a total

of GBP192,051. For the year 2016, a final dividend of 8.6p was paid

on 6 April 2017 amounting to a total of GBP185,036.

2017 2016

GBP GBP

Revenue available for distribution 206,177 211,428

Final dividend in respect of

financial year ended

31 December 2017 (192,051) (185,036)

Undistributed Revenue Reserve 14,126 26,392

========== ==========

8. Investments

2017 2016

GBP GBP

Movements in year

Valuation at beginning

of year 5,117,268 4,709,749

Purchases at cost 674,520 741,319

Sales - proceeds (660,818) (570,157)

- realised gains on

sales 296,629 294,251

Increase/(decrease) in unrealised

appreciation 539,080 (57,894)

Valuation at end

of year 5,966,679 5,117,268

========== ==========

Book cost at end

of year 3,574,834 3,264,509

Unrealised appreciation at the end

of the year 2,391,845 1,852,759

5,966,679 5,117,268

========== ==========

UK Main Market listed

investments 4,618,263 4,109,077

UK AIM-traded shares 1,348,416 1,008,191

5,966,679 5,117,268

========== ==========

8. Investments (continued)

Gains on investments

2017 2016

GBP GBP

Realised gains on

sales 296,629 294,251

Increase/(decrease) in unrealised

appreciation 539,080 (57,894)

835,709 236,357

======== =========

The purchase costs and sales proceeds above include transaction

costs of GBP5,711 (2016: GBP3,695) and GBP2,401 (2016: GBP1,344)

respectively.

9. Debtors

2017 2016

GBP GBP

Investment transaction

debtors 148,483 249,295

Other debtors 8,315 7,669

156,798 256,964

======== ========

10. Creditors: amounts falling due within one year

2017 2016

GBP GBP

Social security and

other taxes 2,959 2,623

Other creditors 8,628 172

Accruals and deferred

income 11,655 12,037

23,242 14,832

======= =======

11. Called Up Share Capital

2017 2016

GBP GBP

Authorised

10,000,000 Ordinary Shares of 25p 2,500,000 2,500,000

========== ==========

Allotted, called up and fully paid

2,157,881 Ordinary Shares of 25p 539,470 539,470

========== ==========

(2016: 2,157,881 Ordinary Shares of

25p)

12. Financial Instruments

The Company's financial instruments comprise equity investments,

cash balances and debtors and creditors that arise directly from

its operations, for example, in respect of sales and purchases

awaiting settlement.

The major risks associated with the Company are market, credit

and liquidity risk. The Company has established a framework for

managing these risks. The Directors have guidelines for the

management of investments and financial instruments.

Market Risk

Market price risk arises mainly from uncertainty about future

prices of financial investments used in the Company's business. It

represents the potential loss the Company might suffer through

holding market positions by way of price movements other than

movements in exchange rates and interest rates.

The Company's investment portfolio is exposed to market price

fluctuations which are monitored by the Fund Manager who gives

timely reports of relevant information to the Directors.

Adherence to the investment objectives and the internal controls

on investments set by the Company mitigates the risk of excessive

exposure to any one particular type of security or issuer.

The Company's exposure to other changes in market prices at 31

December on its investments is as follows:

A 20% decrease in the market value of investments at 31 December

2017 would have decreased net assets attributable to shareholders

by 55.3 pence per share (2016: 47.4 pence per share). An increase

of the same percentage would have an equal but opposite effect on

net assets available to shareholders.

2017 2016

GBP GBP

Fair value through profit or loss investments 5,966,679 5,117,268

Market risk also arises from changes in interest rates and

exchange risk. All of the Company's assets are in sterling and

accordingly the Company has limited currency exposure. The majority

of the Company's financial assets are non-interest bearing, as a

result the Company's financial assets are not subject to

significant risk due to fluctuations in the prevailing levels of

market interest rates.

The carrying amounts of financial assets best represent the

maximum credit risk exposure at the balance sheet date. Bankruptcy

or insolvency of the custodian may cause the Company's rights with

respect to securities held with the custodian to be delayed.

Liquidity Risk

Liquidity Risk is the risk that the Company may have difficulty

in meeting obligations associated with financial liabilities. The

Company is able to reposition its investment portfolio when

required so as to accommodate liquidity needs. However it may be

difficult to realise its investment portfolio in adverse market

conditions.

Maturity Analysis of Financial Liabilities

The Company's financial liabilities consist of creditors as

disclosed in note 10. All items are due within one year.

12. Financial Instruments (continued)

Capital management policies and procedures

The Company's capital management objectives are:

-- to ensure the Company's ability to continue as a going concern;

-- to provide an adequate return to shareholders;

-- to support the Company's stability and growth;

-- to provide capital for the purpose of further investments.

The Company actively and regularly reviews and manages its

capital structure to ensure an optimal capital structure, taking

into consideration the future capital requirements of the Company

and capital efficiency, projected operating cash flows and

projected strategic investment opportunities. The management

regards capital as total equity and reserves, for capital

management purposes.

Fair values of financial assets and financial liabilities

Fixed asset investments (see note 8) are valued at market bid

price where available which equates to their fair values. The fair

values of all other assets and liabilities are represented by their

carrying values in the balance sheet.

Financial instruments by category

The financial instruments of the Company fall into the following

categories

31 December 2017 Assets at

fair value

At Amortised through profit

Cost or loss Total

GBP GBP GBP

Assets as per the

balance

sheet

Investments - 5,966,679 5,966,679

Debtors 156,798 - 156,798

Cash at bank 45,289 - 45,289

------------------------- ---------------------------- -----------------------

Total 202,087 5,966,679 6,168,766

========================= ============================ =======================

Liabilities as per

the balance

sheet

Creditors 23,242 - 23,242

------------------------- ---------------------------- -----------------------

Total 23,242 - 23,242

========================= ============================ =======================

31 December 2016 Assets at fair

At Amortised value through

Cost profit or loss Total

GBP GBP GBP

Assets as per the

balance

sheet

Investments - 5,117,268 5,117,268

Debtors 256,964 - 256,964

Cash at bank 59,133 - 59,133

------------------------- ---------------------------- -------------------------

Total 316,097 5,117,268 5,433,365

========================= ============================ =========================

Liabilities as per

the balance

sheet

Creditors 14,832 - 14,832

------------------------- ---------------------------- -------------------------

Total 14,832 - 14,832

========================= ============================ =========================

12. Financial Instruments (continued)

Fair value hierarchy

In accordance with FRS 102, the Company must disclose the fair

value hierarchy of financial instruments.

The fair value hierarchy consists of the following three

classifications:

Classification A - Quoted prices in active markets for identical

assets or liabilities.

Quoted in an active market in this context means quoted prices

are readily and regularly available and those prices represent

actual and regularly occurring market transactions on an arm's

length basis.

Classification B - The price of a recent transaction for an

identical asset, where quoted prices are unavailable.

The price of a recent transaction for an identical asset

provides evidence of fair value as long as there has not been a

significant change in economic circumstances or a significant lapse

of time since the transaction took place. If it can be demonstrated

that the last transaction price is not a good estimate of fair

value (e.g. because it reflects the amount that an entity would

receive or pay in a forced transaction, involuntary liquidation or

distress sale), that price is adjusted.

Classification C - Inputs for the asset or liability that are

based on observable market data and unobservable market data, to

estimate what the transaction price would have been on the

measurement data in an arm's length exchange motivated by normal

business considerations.

The Company only holds classification A investments (2016:

classification A investments only).

13. Net Asset Value per Share

The net asset value per share is based on net assets of

GBP6,145,524 (2016: GBP5,418,533) divided by 2,157,881 (2016:

2,157,881) ordinary shares in issue at the year end.

2017 2016

Net asset value per

share 284.8p 251.1p

======= =======

14. Dividends paid to Directors

During the year the following dividends were paid to the

Directors of the Company as a result of their total

shareholding:

Mr Robin Boyle GBP38,619(2)

Dr. Manny Pohl GBP25,573(1)

Mr Simon Moore GBP2,752

Notes:

1. Dr Manny Pohl's relationship with Global Masters Fund Limited

is described in Note 1 to the table of Directors' interests on page

31. During the year a dividend of GBP25,573 was paid to Global

Masters Fund Limited.

2. This figure includes GBP33,678 paid to Trehellas House

Limited. Mr Robin Boyle's interest in Trehellas House Limited is

described in Note 2 to the table of Directors' interests on page

31.

For further information:

Robin Boyle, Managing Director

Athelney Trust plc

020 7628 7937

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR USORRWOAUAAR

(END) Dow Jones Newswires

February 16, 2018 02:00 ET (07:00 GMT)

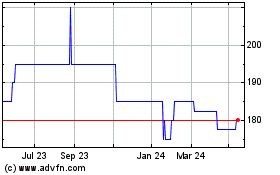

Athelney (LSE:ATY)

Historical Stock Chart

From Oct 2024 to Nov 2024

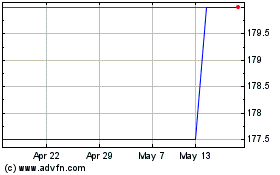

Athelney (LSE:ATY)

Historical Stock Chart

From Nov 2023 to Nov 2024