TIDMASY

RNS Number : 5268C

Andrews Sykes Group PLC

02 May 2012

Andrews Sykes Group plc

Summary of results

For the 12 months ended 31 December 2011

12 months 12 months

ended ended

31 December 31 December

2011 2010

GBP'000 GBP'000

Revenue from continuing operations 53,838 55,951

Normalised EBITDA* from continuing operations 15,387 17,721

Normalised operating profit** 11,882 13,942

Profit on the sale of property 3,113 164

Profit after tax for the financial period 11,566 10,562

Basic earnings per share from total operations

(pence) 27.05p 24.19p

Dividend paid per equity share (pence) 6.60p 11.10p

Net cash inflow from operating activities 11,606 13,863

Total dividends paid 2,818 4,800

Net funds 10,365 4,905

*Earnings Before Interest, Taxation, Depreciation, profit on

sale of property, plant and equipment, Amortisation and non-

recurringitems as reconciled on the consolidated income

statement.

** Normalised operating profit, being operating profit before

non-recurring items as reconciled on the consolidated income

statement.

For further information, please contact:

Andrews Sykes Group plc

KE Ford 01902 328700

N+1 Brewin

Sandy Fraser/ Joe Stroud 0845 213 4730

Andrews Sykes Group plc

Chairman's Statement

For the 12 months ended 31 December 2011

Overview and financial highlights

The group's revenue for the year ended 31 December 2011 was

GBP53.8 million, a decrease of GBP2.1 million, or 3.8%, compared

with the same period last year. This decrease had a virtually

direct impact on normalised operating profit* which fell by GBP2.0

million from GBP13.9 million last year to GBP11.9 million in the

year under review. This decline in trading was, however, more than

offset by the non-recurring profit of GBP3.1 million on the sale of

our freehold property in Gallions Road, London. Consequently the

basic earnings per share increased by 11.8% from 24.19p last year

to 27.05p this year.

The group continues to generate strong cash flows. Net cash

inflow from operating activities was GBP11.6 million which, mainly

due to the decline in normalised operating profit*, was down by

GBP2.3 million compared with last year. Nevertheless, net funds

increased from GBP4.9 million last year to GBP10.4 million at 31

December 2011 despite shareholder related cash outflows of GBP3.9

million on dividends and the purchase of own shares. External bank

borrowings have been reduced by GBP6 million from GBP20 million at

the start of the year to GBP14 million by the year-end.

Cost control, cash and working capital management continue to be

priorities for the group. In total working capital has been reduced

for the third year running, this time by GBP0.5 million. Capital

expenditure on the hire fleet has been increased from GBP2.2

million in 2010 to GBP4.1 million this year and the group purchased

a freehold property for GBP2.7 million to replace the property sold

during the year. These actions will ensure that the group's

infrastructure and revenue generating assets are sufficient to

support future growth and profitability. Hire fleet utilisation,

condition and availability continue to be the subjects of

management focus.

Operating performance

The second half year is normally significantly more profitable

than the first but 2011 proved to be an exception. The following

table splits the results between the first and second half

years:

Turnover NormalisedOperating

profit*

--------------- --------- --------------------

GBP'000 GBP'000

--------------- --------- --------------------

1st half 2011 27,717 5,930

--------------- --------- --------------------

1st half 2010 27,573 6,816

--------------- --------- --------------------

2nd half 2011 26,121 5,952

--------------- --------- --------------------

2nd half 2010 28,378 7,126

--------------- --------- --------------------

Total 2011 53,838 11,882

--------------- --------- --------------------

Total 2010 55,951 13,942

--------------- --------- --------------------

Our main hire and sales business in the UK and Northern Europe

has faced challenging trading conditions throughout 2011 mainly as

a result of unhelpful weather conditions but also due to the

current economic conditions.

Trading in the first half remained flat and profit was adversely

affected by the temperate weather at the end of the 2010/11 winter

which resulted in an early end to the heating season. This was

followed by another mild summer that failed to stimulate demand for

our all important air conditioning products. Unlike last year, the

start of the 2011/12 winter was also mild which did not allow our

heating division to compensate for the under-performance of the air

conditioning business. The last 18 months have also been unusually

dry resulting in the drought conditions recently announced for some

parts of the UK. Overall the operating profit, excluding profit on

the sale of property, of this business segment fell from GBP13.8

million last year to GBP12.0 million this year, this being the main

reason for the decline in the group's normalised operating profit*

in the current period.

In the light of the above factors I consider that management's

performance has been creditable ensuring that the group produced

another satisfactory trading performance. This clearly demonstrates

our ability to return acceptable profit levels even in times of

unfavourable external influence and is due, in part, to the

continuing development of non-weather dependent niche markets which

continue to benefit the performance of our specialist hire

divisions. We will continue to invest in and develop these

businesses as well as our traditional core products and

services.

Our hire and sales business in the Middle East returned an

operating profit of GBP0.6 million this year compared with GBP0.7

million in 2010 on similar turnover levels. Although the profit is

lower than last year there are now some initial signs of improved

trading conditions in Abu Dhabi although the economic conditions in

Dubai remain challenging.

The UK fixed installation business continued to improve its

trading performance, the segment profit increased by GBP0.1 million

to GBP0.3 million this year and we look forward to further

improvements again next year.

A more detailed review of this year's operating performance is

given in the Operations Review within the Directors' report in the

2011 Annual Report and Financial Statements.

Profit on the sale of property

During the year the group sold the freehold of one of its main

UK depots, based in Gallions Road, London, to a property developer.

Gross proceeds were GBP3.7 million resulting in a profit on

disposal of GBP3.1 million and this has been disclosed as a

separate non-recurring item on the face of the income

statement.

Although the group was not actively looking for a sale,

management took advantage of a unique opportunity to realise a

significant profit and cash flow advantage for the benefit of

shareholders. The group purchased a replacement freehold property

locally in Peninsular Way for GBP2.7 million and expect the

relocation to the new premises to be completed by the end of the

first half of 2012. Part of the net cash inflow of GBP1 million

will be spent on capital improvements in 2012 following which the

group will have a much improved and enlarged operating base from

which to serve its customers in London and the South East of

England.

Profit for the financial year and earnings per share (EPS)

Profit after tax increased by GBP1 million from GBP10.6 million

last year to GBP11.6 million this year and basic EPS increased by

11.8% from 24.19p last year to 27.05p this year. However this was

significantly influenced by the above profit on sale of property of

GBP3.1 million. The adjusted basic EPS, excluding the profit on the

sale of property, would have been 20.24p in 2011, a decrease of 15%

compared with the equivalent figure last year of 23.81p.

A more detailed review of the profit for the financial year is

given in the Operations and Financial Review within the Directors'

Report in the 2011 Annual Report and Financial Statements. Defined

benefit pension scheme

During March 2012 the December 2010 funding valuation was agreed

by management with the pension scheme trustees and accordingly

revised "Schedule of Contributions" and "Recovery plan" have now

been put into place. These provide that the group will make

additional contributions, including an expense allowance, to the

pension scheme of GBP840,000 in 2012, GBP960,000 in 2013,

GBP1,080,000 in 2014 and GBP840,000 per annum thereafter until 31

December 2018, or until the funding shortfall has been eliminated

if sooner, subject to review at the next actuarial funding

valuation due as at 31 December 2013.

Net funds

At 31 December 2011 the group had net funds of GBP10.4 million

compared with GBP4.9 million last year, an increase of GBP5.5

million despite a dividend of GBP2.8 million and cash outflows on

share buybacks of GBP1.1 million.

Equity dividends paid

The company declared an interim dividend of GBP2.8 million on 8

November 2011 and this was paid on 1 December 2011. The Board

continues the policy of returning value to shareholders whenever

possible and accordingly the decision regarding an interim dividend

for 2012 will be taken later in the year in the light of

profitability and available cash resources.

Share buyback programme

During the current year the company purchased 442,216 ordinary

shares for cancellation for a total consideration of GBP945,000 of

which GBP11,000 (2010: GBP187,000) remained unpaid at the year-end.

So far during 2012 the company has purchased a further 426,506

ordinary shares for cancellation for a total consideration of

GBP815,000. These purchases enhanced earnings per share and were

for the benefit of all shareholders.

As previously reported, the directors intend to continue to

actively pursue the buyback programme provided the necessary funds

are available. Shares will only be bought back for cancellation

provided they enhance earnings per share. Any shareholder who is

considering taking advantage of the share buyback programme is

invited, after taking the appropriate independent financial advice,

to contact their stockbroker, bank manager, solicitor, accountant

or other independent financial advisor authorised under the

Financial Services and Markets Act 2000, in order to contact N+1

Brewin who are operating the buyback programme on behalf of the

company. Accordingly at the next Annual General Meeting

shareholders will be asked to vote in favour of a resolution to

renew the general authority to make market purchases of up to 12.5%

of the ordinary share capital in issue. Outlook

The group's policy of reducing its reliance on its traditional

core products and services together with the increase in

non-seasonal business and investment in new technically advanced

and environmentally friendly products will be continued into

2012.

The group continues to face challenges in all of its

geographical markets but our business remains strong, cash

generative and well developed with positive net funds. The Board is

therefore optimistic for further success in 2012.

JG Murray

Chairman

1 May 2012

* Operating profit before non-recurring items as reconciled on

the Consolidated Income Statement

Andrews Sykes Group plc

Consolidated Income Statement

For the 12 months ended 31 December 2011

12 months 12 months

ended ended

31 December 31 December

2011 2010

GBP'000 GBP'000

Continuing operations

Revenue 53,838 55,951

Cost of sales (23,873) (24,015)

Gross profit 29,965 31,936

Distribution costs (9,317) (9,219)

Administration expenses - Recurring (8,766) (8,775)

- Non-recurring 3,113 164

---------------------------------------------- ---------------------- -------------

Total administrative expenses (5,653) (8,611)

Operating profit 14,995 14,106

Normalised EBITDA* 15,387 17,721

Depreciation and impairment losses (3,911) (4,239)

Profit on the sale of plant and equipment 406 460

---------------------------------------------- ---------------------- -------------

Normalised operating profit 11,882 13,942

Profit on the sale of property 3,113 164

---------------------------------------------- ---------------------- -------------

Operating profit 14,995 14,106

---------------------------------------------- ---------------------- -------------

Income from participating interests - 400

Finance income 1,850 2,012

Finance costs (1,942) (2,144)

Profit before taxation 14,903 14,374

Taxation (3,337) (3,812)

Profit for the financial period attributable

to equity holders of the parent 11,566 10,562

---------------------------------------------- ---------------------- -------------

There were no discontinued operations

in either of the above periods

Earnings per share from continuing and

total operations

Basic (pence) 27.05p 24.19p

Diluted (pence) 27.05p 24.18p

Dividends paid per equity share (pence) 6.60p 11.10p

*Earnings Before interest, Taxation, Depreciation, profit on the

sale of property, plant and equipment, Amortisation and non-

recurringitems.

Andrews Sykes Group plc

Consolidated Statement of Comprehensive Total Income

For the 12 months ended 31 December 2011

12 months 12 months

ended ended

31 December 31 December

2011 2010

GBP'000 GBP'000

Profit for the financial period 11,566 10,562

---------------------------------------- -------------------------------- ------------------------------

Other comprehensive income:

Currency translation differences on

foreign currency net investments (184) (99)

Defined benefit plan actuarial gains

and losses (559) 1,964

Deferred tax on other comprehensive

income 184 (530)

Other comprehensive (charges) / income

for the period net of tax (559) 1,335

---------------------------------------- -------------------------------- ------------------------------

Total comprehensive income for the

period 11,007 11,897

---------------------------------------- -------------------------------- ------------------------------

Andrews Sykes Group plc

Consolidated Balance Sheet

As at 31 December 2011

31 December 2011 31 December 2010

-------------------------------------- -------------------------------------

GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 14,486 11,817

Lease prepayments 57 58

Trade investments 164 164

Deferred tax asset 760 721

Retirement benefit pension

surplus 1,629 1,990

------------------------------- ------------------- ----------------- ------------------- ----------------

17,096 14,750

Current assets

Stocks 3,561 4,032

Trade and other receivables 14,775 15,917

Overseas tax (denominated 19 -

in Euros)

Cash and cash equivalents 24,986 25,709

------------------------------- ------------------- ----------------- ------------------- ----------------

43,341 45,658

------------------------------- ------------------- ----------------- ------------------- ----------------

Current liabilities

Trade and other payables (9,696) (10,143)

Current tax liabilities (1,689) (2,274)

Bank loans (6,000) (6,000)

Obligations under finance

leases (203) (203)

Provisions (13) (13)

Derivative financial

instruments - (7)

------------------------------- ------------------- ----------------- ------------------- ----------------

(17,601) (18,640)

------------------------------- ------------------- ----------------- ------------------- ----------------

Net current assets 25,740 27,018

------------------------------- ------------------- ----------------- ------------------- ----------------

Total assets less current

liabilities 42,836 41,768

Non-current liabilities

Bank loans (8,000) (14,000)

Obligations under finance

leases (395) (553)

Provisions (34) (47)

Derivative financial

instruments (23) (41)

------------------------------- ------------------- ----------------- ------------------- ----------------

(8,452) (14,641)

Net assets 34,384 27,127

------------------------------- ------------------- ----------------- ------------------- ----------------

Equity

Called-up share capital 427 431

Share premium 13 -

Retained earnings 31,035 23,607

Translation reserve 2,658 2,842

Other reserves 241 237

Surplus attributable

to equity holders of

the parent 34,374 27,117

Minority interest 10 10

Total equity 34,384 27,127

------------------------------- ------------------- ----------------- ------------------- ----------------

Andrews Sykes Group plc

Consolidated Cash Flow Statement

For the 12 months ended 31 December 2011

12 months 12 months

ended ended

31 December 31 December

2011 2010

GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 15,766 17,763

Interest paid (385) (503)

Net UK corporation tax paid (3,191) (2,113)

Withholding tax paid - (119)

Overseas tax paid (584) (1,165)

Net cash flow from operating activities 11,606 13,863

-------------------------------------------- ------------------------- ----------------------------------

Investing activities

Dividends received from participating

interests (trade investments) - 400

Movements in ring fenced bank deposit

accounts - 9,000

Sales of assets held for sale - 390

Sale of plant and equipment 4,221 643

Purchase of property, plant and equipment (6,582) (1,745)

Interest received 311 168

Net cash flow from investing activities (2,050) 8,856

-------------------------------------------- ------------------------- ----------------------------------

Financing activities

Loan repayments (6,000) (9,000)

Finance lease capital repayments (158) (263)

Equity dividends paid (2,818) (4,800)

Purchase of own shares (1,121) (1,184)

Issue of new shares 13 -

Net cash flow from financing activities (10,084) (15,247)

-------------------------------------------- ------------------------- ----------------------------------

Net (decrease) / increase in cash

and cash equivalents (528) 7,472

Cash and cash equivalents at the beginning

of the period 25,709 18,150

Effect of foreign exchange rate changes (195) 87

Cash and cash equivalents at end of

the period 24,986 25,709

-------------------------------------------- ------------------------- ----------------------------------

Reconciliation of net cash flow to movement

in net funds in the period

Net (decrease) / increase in cash

and cash equivalents (528) 7,472

Cash outflow from the decrease in

debt 6,158 9,263

Movements in ring fenced bank deposit

accounts - (9,000)

Non-cash movements in respect of new

finance leases - (116)

Non-cash movements in the fair value

of derivative instruments 25 7

-------------------------------------------- ------------------------- ----------------------------------

Movement in net funds / (debt) during

the period 5,655 7,626

Opening net funds / (debt) at the

beginning of the period 4,905 (2,808)

Effect of foreign exchange rate changes (195) 87

-------------------------------------------- ------------------------- ----------------------------------

Closing net funds at the end of the

period 10,365 4,905

-------------------------------------------- ------------------------- ----------------------------------

Andrews Sykes Group plc

Consolidated Statement of Changes in Equity

For the 12 months ended 31 December 2011

Attributable to equity holders of the Minority Total

parent company interest equity

-----------------------------------------------------------------------------------

Share Share Retained Translation Other Total

capital premium earnings reserve reserves

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 December

2009 443 - 17,828 2,895 225 21,391 10 21,401

Profit for the

financial

period - - 10,562 - - 10,562 - 10,562

Other

comprehensive

income

/ (charges):

Transfer on

closure of

overseas

subsidiary - - (46) 46 - - - -

Currency

translation

differences

on foreign

currency net

investments - - - (99) - (99) - (99)

Defined

benefit plan

actuarial

gains and

losses net of

tax - - 1,434 - - 1,434 - 1,434

Total other

comprehensive

income /

(charges) - - 1,388 (53) - 1,335 - 1,335

------------ --------------- --------- -------------- -------------- --------- ------------- ---------

Transactions with owners

recorded

directly in equity:

Purchase of

own shares (12) - (1,371) - 12 (1,371) - (1,371)

Dividends paid - - (4,800) - - (4,800) - (4,800)

Total

transactions

with

owners (12) - (6,171) - 12 (6,171) - (6,171)

------------ --------------- --------- -------------- -------------- --------- ------------- ---------

At 31 December

2010 431 - 23,607 2,842 237 27,117 10 27,127

Profit for the

financial

period - - 11,566 - - 11,566 - 11,566

Other

comprehensive

charges:

Currency

translation

differences

on foreign

currency net

investments - - - (184) - (184) - (184)

Defined

benefit plan

actuarial

gains and

losses net of

tax - - (375) - - (375) - (375)

Total other

comprehensive

charges - - (375) (184) - (559) - (559)

------------ --------------- --------- -------------- -------------- --------- ------------- ---------

Transactions with owners

recorded

directly in equity:

Purchase of

own shares (4) - (945) - 4 (945) - (945)

Issue of

shares - 13 - - - 13 - 13

Dividends paid - - (2,818) - - (2,818) - (2,818)

Total

transactions

with

owners (4) 13 (3,763) - 4 (3,750) - (3,750)

------------ --------------- --------- -------------- -------------- --------- ------------- ---------

At 31 December

2011 427 13 31,035 2,658 241 34,374 10 34,384

------------ --------------- --------- -------------- -------------- --------- ------------- ---------

Notes

1. Basis of preparation

Whilst the information included in this preliminary announcement

has been prepared in accordance with the recognition and

measurement criteria of International Financial Reporting Standards

(IFRSs), this announcement does not itself contain sufficient

information to comply with IFRSs. Therefore the financial

information set out above does not constitute the company's

financial statements for the 12 months ended 31 December 2011 or 31

December 2010 but it is derived from those financial

statements.

2. Going concern

The Board remains satisfied with the group's funding and

liquidity position. The group has external bank loans of GBP14

million and has operated both throughout the period under review

and subsequently within its financial covenants. Consequently the

loans have been analysed between current and non-current

liabilities in accordance with the agreed repayment profile.

The group has substantial cash resources which at 31 December

2011 amounted to GBP25.0 million. Net funds at 31 December 2011

were GBP10.4 million. Profit and cash flow projections for 2012 and

2013, which have been prepared on a conservative basis taking into

account reasonably possible changes in trading performance,

indicate that the group will be profitable and generate positive

cash flows after loan repayments. These forecasts and projections

indicate that the group should be able to operate within the

current bank facility and associated covenants.

The Board considers that the group has considerable financial

resources and a wide operational base. As a consequence, the Board

believes that the group is well placed to manage its business risks

successfully, as demonstrated by the current year's result, despite

the current uncertain economic outlook.

After making enquiries, the Board has a reasonable expectation

that the group have adequate resources to continue in operational

existence for the foreseeable future. Accordingly, the Board

continues to adopt the going concern basis when preparing this

Annual Report and Financial Statements and this preliminary

announcement.

3. Distribution of Annual Report and Financial Statements

The group expects to distribute copies of the full Annual Report

and Financial Statements that comply with IFRSs by 16 May 2012

following which copies will be available either from the registered

office of the company; Premier House, Darlington Street,

Wolverhampton, WV1 4JJ; or from the company's website;

www.andrews-sykes.com. The Annual Report and Financial Statements

for the 12 months ended 31 December 2010 have been delivered to the

Registrar of Companies and those for the 12 months ended 31

December 2011 will be filed at Companies House following the

company's Annual General Meeting. The auditors have reported on

those financial statements; their report was unqualified, did not

draw attention to any matters by way of emphasis without qualifying

their report and did not contain details of any matters on which

they are required to report by exception.

4. Date of Annual General Meeting

The group's Annual General Meeting will be held at 10.30 a.m. on

Tuesday 12(th) June 2012 at Floor 5, 10 Bruton Street, London, W1J

6PX.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UGUMGAUPPGQG

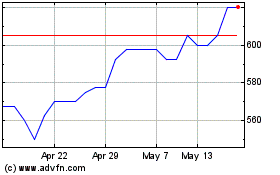

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From May 2024 to Jun 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2023 to Jun 2024