TIDMASY

RNS Number : 0517P

Andrews Sykes Group PLC

28 September 2011

Andrews Sykes Group plc

28 September 2011

Interim Financial Statements for the six months to 30 June

2011

6 months ended 6 months ended

30 June 2011 30 June 2010

Andrews Sykes Group plc (unaudited) (unaudited)

Summary of Results GBP'000 GBP'000

Revenue from continuing operations 27,717 27,573

Normalised EBITDA* from continuing

operations 7,784 8,851

Normalised operating profit ** 5,930 6,816

Profit for the financial period 4,116 5,225

Basic earnings per share (pence) 9.58p 11.83p

Net funds 7,920 2,762

* Earnings Before Interest, Taxation, Depreciation, profit on

the sale of property, plant and equipment, Amortisation and

non-recurring items.

** Operating profit before non-recurring items as reconciled on

the consolidated income statement.

Andrews Sykes Group plc

Chairman's Statement

Overview

The group's revenue for the six months ended 30 June 2011 was

GBP27.7 million which was almost the same as last year's figure of

GBP27.6 million. The group's normalised operating profit* fell by

GBP0.9 million from GBP6.8 million in the first half of 2010 to

GBP5.9 million in the current period.

The group continues to generate strong cash flows. As at 30 June

2011 the group has net funds of GBP7.9 million, an increase of

GBP3.0 million compared with 31 December 2010 and an increase of

GBP5.2 million compared with the position as at 30 June 2010. This

clearly demonstrates the group's strong positive cash flow and is

after share buyback payments of GBP1.1 million.

Management has been mindful of the need to maintain the

operational structure of the business and to ensure that this is

not damaged by unnecessary cuts in expenditure. Our hire fleet

continues to be well maintained and the group has spent GBP3.0

million on new plant and equipment in the six months under review.

This is necessary to ensure that we remain in a strong position

ready to take advantage of any business opportunities whenever they

arise.

Operations review

Our main hire and sales business in the UK and Northern Europe

has been adversely affected by the mild weather at the end of 2010

/ 11 winter which resulted in an early end to the heating season.

Whilst May and June saw some dry and warm weather it was never hot

enough to significantly stimulate our air conditioning business

which remained flat.

During the period we opened our fourth Dutch depot in the North

East of the country. This has strengthened our market leading

position in the Netherlands and will provide a platform for future

expansion in the area.

Our Belgian subsidiary, which was opened as a low cost based

operation in 2007, traded well and provided a significantly

improved contribution to operating profit in the period. The

business continues to develop and become more self-sufficient and

further opportunities are seen as the market continues to grow.

In June we opened a new low cost based operation in Italy

following the business model that we successfully implemented in

Belgium. Although at a very early stage, management are confident

that this will provide good opportunities for the years ahead.

Overall, our UK installation business performed in line with

last year albeit at relatively modest levels compared with the rest

of the group.

Our business in the Middle East continues to suffer from the

economic downturn in the region although we have recently seen some

improvements in trading, particularly in Abu Dhabi. Debt collection

remains a concern and it has once again been necessary to increase

the level of bad debt provision to ensure that adequate reserves

are held at the end of the period. This area remains a priority for

management and we are currently making more improvements in this

area.

Profit for the financial period and earnings per share

The above GBP0.9 million decrease in operating profit together

with an adverse movement in the euro sterling exchange rate, which

resulted in an inter company foreign exchange loss of GBP0.2

million compared with a profit of GBP0.4 million last period, were

the main reasons for the decrease in the profit for the financial

period which, after tax, fell by GBP1.1 million from GBP5.2 million

in the first half of 2010 to GBP4.1 million in the current period.

Basic earnings per share fell by 19% to a still creditable 9.83

pence for the six month period.

Dividends

No interim dividends have been declared in the period under

review. The Board continues to adopt the policy of returning value

to shareholders whenever possible and accordingly the decision

regarding an interim dividend will be taken later in the year in

the light of profitability and cash resources.

Share buyback programme

The Board continues to believe that shareholder value will be

optimised by the purchase by the company, when appropriate, of its

own shares.

During the six months ended 30 June 2011 a total of 431,216

ordinary shares were purchased for cancellation for a total

consideration of GBP0.9 million. Total cash outflow for share

buybacks was GBP1.1 million as this includes the payment of GBP0.2

million in respect of share purchases made at the end of last year.

These purchases enhanced earnings per share and were for the

benefit of all shareholders.

The directors confirm that they intend to continue to actively

pursue this policy and any shareholder who is considering taking

advantage of the share buyback programme is invited to contact

their broker, bank manager, solicitor, accountant or other

independent financial advisor authorised under the Financial

Services and Markets Act 2000, in order to contact Brewin Dolphin

Limited who are operating the buyback programme on behalf of the

company.

Outlook

Trading conditions in the third quarter to date have been

challenging for our main UK hire and sales business. The summer has

not been hot enough to stimulate demand for our all important air

conditioning business. Trading conditions in the Middle East remain

challenging and will continue to do so for the remainder of

2011.

Nevertheless our business remains strong and cash generative.

Our specialist hire divisions continue to perform well and we will

continue to follow our policies of investing in both these and our

traditional core products as well as developing our non-seasonal

businesses.

Overall the Board is cautiously anticipating a reasonable

performance for the rest of 2011.

JG Murray

Chairman

27 September 2011

* Operating profit before non-recurring items as reconciled on

the consolidated income statement.

Andrews Sykes Group plc

Consolidated Income Statement

For the 6 months ended 30 June 2011 (unaudited)

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 27,717 27,573 55,951

Cost of Sales (12,533) (11,883) (24,015)

--------- --------- -------------

Gross Profit 15,184 15,690 31,936

Distribution Costs (4,642) (4,518) (9,219)

Administrative expenses: - Recurring (4,612) (4,356) (8,775)

-

Non-recurring - 164 164

--------- --------- -------------

- Total (4,612) (4,192) (8,611)

--------- --------- -------------

Operating Profit 5,930 6,980 14,106

----------------------------------------------------- --------- --------- -------------

Normalised EBITDA*

Depreciation and impairment losses 7,784 8,851 17,721

Profit on the sale of plant and (2,092) (2,281) (4,239)

equipment 238 246 460

--------- --------- -------------

Normalised operating profit 5,930 6,816 13,942

Profit on the sale of property - 164 164

--------- --------- -------------

Operating profit 5,930 6,980 14,106

--------- --------- -------------

Income from other participating

interests

Finance income - - 400

Finance costs 888 843 1,844

Inter company foreign exchange (974) (1,103) (2,144)

gains and losses (197) 395 168

--------- --------- -------------

Profit before taxation 5,647 7,115 14,374

Taxation (1,531) (1,890) (3,812)

Profit for the financial period 4,116 5,225 10,562

--------- --------- -------------

There were no discontinued operations in any of the

above periods.

Earnings per share from continuing

operations

Basic (pence) 9.58p 11.83p 24.19p

Diluted (pence) 9.58p 11.83p 24.18p

Dividends paid per equity share 0.00p 0.00p 11.10p

(pence)

*Earnings Before Interest, Taxation, Depreciation, profit on

the sale of property, plant and equipment, Amortisation and

non-recurring items.

Andrews Sykes Group plc

Consolidated Balance Sheet

As at 30 June 2011 (unaudited)

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment

Lease prepayments 13,154 12,543 11,817

Trade investments 57 58 58

Deferred tax asset 164 164 164

Retirement benefit pension 717 1,238 721

surplus 2,411 - 1,990

--------- ---------- ------------

16,503 14,003 14,750

--------- ---------- ------------

Current assets

Stocks 3,919 4,117 4,032

Trade and other receivables 13,640 13,723 15,917

Cash and cash equivalents 22,632 23,716 25,709

--------- ---------- ------------

40,191 41,556 45,658

--------- ---------- ------------

Current liabilities

Trade and other payables

Current tax liabilities (9,206) (7,521) (10,143)

Bank loans (1,689) (1,980) (2,274)

Obligations under finance (6,000) (6,000) (6,000)

leases (203) (261) (203)

Provisions (13) (13) (13)

Derivative financial instruments - - (7)

--------- ---------- ------------

(17,111) (15,775) (18,640)

--------- ---------- ------------

Net current assets 23,080 25,781 27,018

--------- ---------- ------------

Total assets less current

liabilities 39,583 39,784 41,768

Non-current liabilities

Bank loans

Obligations under finance (8,000) (14,000) (14,000)

leases (475) (628) (553)

Provisions (41) (53) (47)

Derivative financial instruments (34) (65) (41)

--------- ---------- ------------

(8,550) (14,746) (14,641)

--------- ---------- ------------

Net assets 31,033 25,038 27,127

--------- ---------- ------------

Equity

Called-up share capital 427 431

Share premium 13 434 -

Retained earnings 27,082 - 21,988 23,607

Translation reserve 3,260 2,585 2,842

Other reserves 241 234 237

Surplus attributable to equity

holders of the parent 31,023 25,241 27,117

Minority interest 10 10 10

Total Equity 31,033 25,251 27,127

--------- ---------- ------------

6 months 6 months 12 months

Andrews Sykes Group plc ended ended ended

Consolidated Cash Flow Statement 30 June 30 June 31 December

For the 6 months ended 30 June 2011 2011 2010 2010

(unaudited) GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 8,783 8,856 17,763

Interest paid (218) (292) (503)

Net UK corporation tax paid (1,886) (843) (2,113)

Net withholding tax paid - - (119)

Overseas tax paid (313) (862) (1,165)

-------- -------- ------------

Net cash inflow from operating activities 6,366 6,859 13,863

-------- -------- ------------

Investing activities

Dividends received from participating

interests (trade investments)

Movements in ring fenced bank deposit - - 400

accounts - 9,000 9,000

Sale of assets held for sale - 390 390

Sale of plant and equipment 330 344 643

Purchase of property, plant & equipment (2,977) (1,014) (1,745)

Interest received 201 73 168

-------- -------- ------------

Net cash (outflow) / inflow from investing

activities (2,446) 8,793 8,856

-------- -------- ------------

Financing activities

Loan repayments (6,000) (9,000) (9,000)

Finance lease capital repayments (78) (130) (263)

Equity dividends paid - - (4,800)

Purchase of own shares (1,113) (1,053) (1,184)

Issue of new shares 13 - -

-------- -------- ------------

Net cash outflow from financing activities (7,178) (10,183) (15,247)

-------- -------- ------------

Net (decrease) / increase in cash

and cash equivalents (3,258) 5,469 7,472

Cash and cash equivalents at beginning

of period 25,709 18,150 18,150

Effect of foreign exchange rate changes 181 97 87

-------- -------- ------------

Cash and cash equivalents at end of

period 22,632 23,716 25,709

-------- -------- ------------

Reconciliation of net cash flow to movement in net funds in the

period

Net (decrease) / increase in cash

and cash equivalents (3,258) 5,469 7,472

Cash outflow from decrease in debt 6,078 9,130 9,263

Movements in ring fenced bank deposit

accounts - (9,000) (9,000)

Non cash movements re finance leases - (116) (116)

Non cash movements in the fair value

of derivative instruments 14 (10) 7

Movement in net funds during the period 2,834 5,473 7,626

Opening net funds / (debt) at the

beginning of period 4,905 (2,808) (2,808)

Effect of foreign exchange rate changes 181 97 87

Closing net funds at the end of period 7,920 2,762 4,905

------- ------- -------

Andrews Sykes Group plc

Consolidated Statement Of Comprehensive Total Income

(CSOCTI)

For the 6 months ended 30 June 2011 (unaudited)

6

months 6 months 12 months

ended ended ended 31

30 June 30 June December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Profit for the financial period 4,116 5,225 10,562

------- -------- ---------

Other comprehensive income: Currency

translation differences on foreign

currency net investments Defined benefit 417 (306) (99)

plan actuarial gains and losses Deferred 359 (14) 1,964

tax on other comprehensive income (73) 4 (530)

------- -------- ---------

Other comprehensive income for the period

net of tax 703 (316) 1,335

------- -------- ---------

Total comprehensive income for the period 4,819 4,909 11,897

------- -------- ---------

Andrews Sykes Group plc

Notes to the consolidated interim financial statements

For the 6 months ended 30 June 2011 (unaudited)

1. General information

Basis of preparation

These interim financial statements have been prepared in

accordance with International Accounting Standards (IAS) and

International Financial Reporting Standards (IFRS) as adopted by

the European Union and with the Companies Act 2006.

The information for the 12 months ended 31 December 2010 does

not constitute the group's statutory accounts for 2010 as defined

in Section 434 of the Companies Act 2006. Statutory accounts for

2010 have been delivered to the Registrar of Companies. The

Auditor's report on those accounts was unqualified and did not

contain statements under Section 498(2) or (3) of the Companies Act

2006. These interim financial statements, which were approved by

the Board of Directors on 27 September 2011, have not been audited

or reviewed by the auditors.

The interim financial statement has been prepared using the

historical cost basis of accounting except for:

i) Properties held at the date of transition to IFRS which are

stated at deemed cost;

ii) Assets held for sale which are stated at the lower of fair

value less anticipated disposal costs and carrying value and

iii) Derivative financial instruments (including embedded

derivatives) which are valued at fair value.

Functional and presentational currency

The financial statements are presented in pounds Sterling

because that is the functional currency of the primary economic

environment in which the group operates.

2. Accounting policies

These interim financial statements have been prepared on a

consistent basis and in accordance with the accounting policies set

out in the group's Annual Report and Financial Statements 2010.

Andrews Sykes Group plc Notes to the

consolidated interim financial statements

For the 6 months ended 30 June 2011

(unaudited)

Revenue

An analysis of the group's revenue

3 is as follows:

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Continuing operations

Hire 21,699 22,566 45,155

Sales 3,909 3,048 6,654

Installations 2,109 1,959 4,142

Group consolidated revenue from the

sale of goods and provision of services 27,717 27,573 55,951

-------- -------- ------------

4 Taxation

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Current tax UK corporation tax

Adjustments in respect of prior 1,348 1,691 3,261

periods - 2 (49)

-------- -------- ------------

Overseas tax 1,348 1,693 3,212

Adjustments to overseas tax in respect 290 320 671

of prior periods - 68 19

Withholding tax - - 119

-------- -------- ------------

Total current tax charge 1,638 2,081 4,021

-------- -------- ------------

Deferred tax Deferred tax on the

origination and reversal of temporary

differences Adjustments in respect of (107) (191) (213)

prior periods - - 4

-------- -------- ------------

Total deferred tax credit (107) (191) (209)

-------- -------- ------------

Total tax charge for the financial

period attributable to continuing

operations 1,531 1,890 3,812

-------- -------- ------------

Andrews Sykes Group plc

Notes to the consolidated interim financial statements

For the 6 months ended 30 June 2011 (unaudited)

Taxation (continued)

The tax charge for the financial period can be reconciled to

the profit before tax per the income statement multiplied by

the standard effective annualised corporation tax rate in the

4 UK of 26.5% (June 2010 and December 2010: 28%) as follows:

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Profit before taxation from continuing

and total operations 5,647 7,115 14,374

--------- --------- -------------

Tax at the UK effective annualised

corporation tax rate of 26.5% (June

2010 and December 2010: 28%)

Effects of: Expenses not deductible

for tax purposes Capital gain

sheltered by capital losses and

indexation allowance Utilisation of

trading losses brought forward 1,496 4,025

Effects of different tax rates of 65 1,992 130

subsidiaries operating abroad - 44 (115)

Withholding tax Non-taxable income (15) (25) -

from other participating interests (65) - (256)

Effect of change in rate of - (191) 119

corporation tax Adjustments to tax - - (112)

charge in respect of previous 50 - 47

periods - - 70 (26)

--------- --------- -------------

Total tax charge for the financial

period 1,531 1,890 3,812

--------- --------- -------------

The total effective tax charge for the financial period

represents the best estimate of the weighted average annual

effective tax rate expected for the full financial year applying

tax rates that have been substantively enacted by the balance sheet

date. Accordingly UK corporation tax has been provided at 26.5%;

the reduction to 26% for the tax year ending 31 March 2012 having

been substantially enacted on 29 March 2011; and UK deferred tax

has been provided at 26% being the rate substantially enacted at

the balance sheet date at which the timing differences are expected

to reverse.

In accordance with IAS 12 no account has been taken in these

interim financial statements of the 2011 Finance Act that was

substantively enacted on 5 July 2011 as this was after the balance

sheet date. This Act provided for the further reduction in the rate

of UK corporation tax from 26% to 25% for the tax year commencing 1

April 2012. It is estimated that if the rate change from 26% to 25%

had been substantively enacted on or before the balance sheet date

it would have had the effect of reducing the deferred tax asset

recognised at that date by approximately GBP28,000 and it will

reduce the group's future corporation tax charge accordingly.

Andrews Sykes Group plc

Notes to the consolidated interim financial statements

For the 6 months ended 30 June 2011 (unaudited)

5 Earnings per share

Basic earnings per share

The basic figures have been calculated by reference to the

weighted average number of ordinary shares

in issue and the earnings as set out below. There are no discontinued

operations in any period.

6 months ended 30 June 2011

------------------------------

Continuing

earnings Number

GBP'000 of shares

Basic earnings/weighted average

number of shares 4,116 42,962,764

--------------

Basic earnings per ordinary share

(pence) 9.58p

6 months ended 30 June 2010

------------------------------

Continuing

earnings Number

GBP'000 of shares

Basic earnings/weighted average

number of shares 5,225 44,156,707

--------------

Basic earnings per ordinary share

(pence) 11.83p

12 months ended 31 December

2010

------------------------------

Continuing

earnings Number

GBP'000 of shares

Basic earnings/weighted average

number of shares 10,562 43,670,777

--------------

Basic earnings per ordinary share

(pence) 24.19p

Diluted earnings per share

The calculation of the diluted earnings per ordinary share

in the previous periods is based on the profits and shares

as set out in the tables below. There are no dilutive instruments

outstanding as at 30 June 2011 and there are no discontinued

operations in any period.

6 months ended 30 June 2010

------------------------------

Continuing

earnings Number

GBP'000 of shares

Basic earnings/weighted average

number of shares

Weighted average number of shares

under option

Number of shares that would have 44,156,707

been issued at fair value to satisfy 15,000

the above options 5,225 (12,853)

-------------- --------------

Earnings / diluted weighted average

number of shares 5,225 44,158,854

-------------- --------------

Diluted earnings per ordinary share

(pence) 11.83p

Andrews Sykes Group plc

Notes to the consolidated interim financial statements

For the 6 months ended 30 June 2011 (unaudited)

5 Earnings per share (continued)

Diluted earnings per share (continued)

12 months ended 31 December

2010

------------------------------

Basic earnings/weighted average

number of shares

Weighted average number of shares Number

under option Continuing of shares

Number of shares that would have earnings 43,670,777

been issued at fair value to satisfy GBP'000 15,000

the above options 10,562 (11,952)

-------------- --------------

Earnings/diluted weighted average

number of shares 10,562 43,673,825

-------------- --------------

Diluted earnings per ordinary share 24.18p

(pence)

6 Dividend payments

The directors have not declared any interim dividends in respect

of either the period under review or the 6 month period ended

30 June 2010. On 9 November 2010 the directors declared an

interim dividend of 11.1 pence per ordinary share and the

total amount of GBP4,800,000 was paid to shareholders on the

register as at 19 November 2010 on 10 December 2010.

Andrews Sykes Group plc

Notes to the consolidated interim financial statements

For the 6 months ended 30 June 2011 (unaudited)

Retirement benefit obligations - Defined benefit pension

7 scheme

The group closed the UK group defined benefit pension scheme

to future accrual as at 29 December 2002. The assets of the

defined benefit pension scheme continue to be held in a separate

trustee administered fund.

As at 30 June 2011 the group had a net defined benefit pension

scheme surplus, calculated in accordance with IAS 19 using

the assumptions as set out below, of GBP2,411,000 (June 2010:

GBP22,000; 31 December 2010: GBP1,990,000). The asset has

been recognised in the financial statements as at 30 June

2011 and 31 December 2010 as the directors are satisfied

that it is recoverable in accordance with IFRIC14. The asset

was not recognised as at 30 June 2010 on the grounds of materiality.

The pension scheme trustees are currently carrying out a

full actuarial funding valuation, the results of which have

not yet been finalised and agreed with the company. The trustees

normally have until 31 March 2012 to complete this process.

In the meantime the group continues to make contributions

in accordance with the previously agreed schedule of contributions

of GBP10,000 per month to cover expenses of the scheme.

Assumptions used to calculate the scheme surplus

The last full actuarial valuation was carried out as at 31

December 2007. A qualified independent actuary has updated

the results of this valuation to calculate the position as

disclosed below.

The major assumptions used in this valuation to determine

the present value of the scheme's defined benefit obligation

were as follows:

30 June 30 June 31 December

2011 2010 2010

Rate of increase in

pensionable salaries Rate of

increase in pensions in

payment Discount rate applied

to scheme liabilities N/A N/A N/A

Inflation assumption - RPI 3.40% 3.05% 3.30%

Inflation assumption - CPI 5.50% 5.35% 5.50%

for the first 6 years 3.60% 3.15% 3.50%

Inflation assumption - CPI 2.40% N/A 2.50%

after the first 6 years 2.40% N/A 3.00%

From 1 January 2011, the government amended the basis for

statutory increases to deferred pensions and pensions in

payment. Such increases are now based on inflation measured

by the Consumer Price Index (CPI) rather than the Retail

Price Index (RPI). Having reviewed the scheme rules and considered

the impact of the change on this pension scheme, the directors

consider that future increases to (i) all deferred pensions

and (ii) Guaranteed Minimum Pensions accrued between 6 April

1988 and 5 April 1997 and currently in payment will be based

on CPI rather than RPI. Accordingly, this assumption was

adopted as at 31 December 2010; in prior periods it was assumed

that such pension increases would be linked to RPI. It has

been assumed in all periods that all other pension increases

will be linked to RPI.

Assumptions regarding future mortality experience are set

based on advice in accordance with published statistics.

The current mortality table used is PA92YOBMC+2 at all the

above ends.

The assumed average life expectancy in years of a pensioner

retiring at the age of 65 given by the above tables is as

follows:

30 June 30 June 31 December

2011 2010 2010

21.3

years

Male, current age 45 21.4 years 24.1 21.3 years

Female, current age 45 24.1 years years 24.1 years

Andrews Sykes Group plc

Notes to the consolidated interim financial

statements

For the 6 months ended 30 June 2011 (unaudited)

Retirement benefit obligations - Defined benefit pension

scheme (continued)

Valuations

The fair value of the scheme's assets, which are not intended

to be realised in the short term and may be subject to significant

change before they are realised, and the present value of

the scheme's liabilities which are derived from cash flow

projections over long periods and are inherently uncertain,

7 were as follows:

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Total fair value of plan assets

Present value of defined benefit

funded obligation calculated in 31,149 28,926 30,733

accordance with stated assumptions (28,738) (28,904) (28,743)

--------- --------- ------------

Surplus in the scheme calculated in

accordance with stated assumptions 2,411 22 1,990

Net pension asset not recognised - (22) -

--------- --------- ------------

Pension asset recognised in the

balance sheet 2,411 - 1,990

--------- --------- ------------

Andrews Sykes Group plc

Notes to the consolidated interim financial statements

For the 6 months ended 30 June 2011 (unaudited)

Retirement benefit obligations - Defined benefit pension

scheme (continued)

The movement in the fair value of the scheme's assets over

7 the reporting period was as follows:

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Fair value of plan assets at the

start of the period Expected

return on plan assets Actuarial 30,733 28,936 28,936

gains / (losses) recognised in 774 770 1,546

the CSOCTI Employer 157 (221) 1,309

contributions - normal Benefits 60 60 120

paid (575) (619) (1,178)

---------- --------- -------------

Fair value of plan assets at

the end of the period 31,149 28,926 30,733

---------- --------- -------------

The movement in the present value of the defined benefit

obligation during the period was as follows:

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Opening present value of defined

benefit funded obligation

calculated in accordance with

stated assumptions Interest on

defined benefit obligation

Actuarial gain / (loss) (28,743) (28,862) (28,862)

recognised in the CSOCTI (772) (816) (1,640)

calculated in accordance with 202 155 581

stated assumptions Benefits paid 575 619 1,178

--------- --------- -------------

Closing present value of defined

benefit funded obligation

calculated in accordance with

stated assumptions Net pension (28,738) (28,904) (28,743)

asset not recognised - (22) -

--------- --------- -------------

Present value of defined benefit

funded obligation at the end of

the period (28,738) (28,926) (28,743)

--------- --------- -------------

Amounts recognised in the income

statement

The amounts credited / (charged)

in the income statement were:

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Expected return on pension scheme

assets credited within finance

income Interest on pension scheme

liabilities charged within 774 770 1,546

finance costs (772) (816) (1,640)

--------- --------- -------------

Net pension interest credit /

(charge) Settlements and 2 (46) (94)

curtailments - - -

--------- --------- -------------

Net pension credit / (charge) in

the income statement 2 (46) (94)

--------- --------- -------------

Andrews Sykes Group plc

Notes to the consolidated interim financial statements

For the 6 months ended 30 June 2011 (unaudited)

Retirement benefit obligations - Defined benefit pension

scheme (continued)

Actuarial gains and losses recognised in the consolidated

statement of comprehensive total

income (CSOCTI)

7 The amounts credited / (charged) in the CSOCTI were:

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Actual return less expected return

on scheme assets

Experience gains and losses arising

on plan obligation

Changes in demographic and financial 157 (221) 1,309

assumptions underlying the present (65) 772 498

value of plan obligations 267 ( 617) 83

------------- -------- -------------

Actuarial gain / (loss) calculated

in accordance with stated assumptions 359 (66) 1,890

Pension asset not recognised

Reverse provision re non-recognition - (22) -

of pension scheme asset - 74 74

------------- -------- -------------

Actuarial gain /(loss) recognised

in the CSOCTI 359 (14) 1,964

------------- -------- -------------

Cumulative actuarial loss recognised

in the CSOCTI (2,127) (4,464) (2,486)

------------- -------- -------------

8 Called-up share capital

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Issued and fully paid:

42,699,588 ordinary shares of one

pence each

(June 2010 43,358,435; December

2010 43,115,804 ordinary shares

of one pence each) 427 434 431

------------- -------- -------------

During the period the company bought back 431,216 shares

for cancellation for a total consideration of GBP925,748

(June 2010 909,930 shares for a total consideration of GBP1,052,976;

December 2010 1,152,561 shares for a total consideration

of GBP1,371,354). The company issued 15,000 shares (June

2010 and December 2010 Nil) to satisfy the exercise of share

options as set out below.

The company has one class of ordinary shares which carry

no right to fixed income.

At 30 June 2011 cash options to subscribe for ordinary shares

under the executive share option scheme were held as follows:

Number of one pence

ordinary shares

---------------------------------

Subscription

Date of Date normally price per 30 June 30 June 31 December

Grant exercisable share 2011 2010 2010

---------- ----------------- ---------------- -------- -------- -------------

November November 2004 to

2001 October 2011 89.5 pence - 15,000 15,000

-------- -------- -------------

During the period 15,000 share options were exercised at a price

of 89.5 pence per share (June 2010 and December 2010: Nil options).

Accordingly 15,000 one pence ordinary shares were issued to satisfy

these options at a premium of 88.5 pence per share. No share

options were granted, forfeited or expired during either the

current or previous financial periods.

Andrews Sykes Group plc

Notes to the consolidated interim financial statements

For the 6 months ended 30 June 2011 (unaudited)

9 Cash generated from operations

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Profit for the period

attributable to equity

shareholders Adjustments for:

Taxation charge Finance costs

Finance income Inter company 4,116 5,225 10,562

foreign exchange gains and 1,531 1,890 3,812

losses Income from other 974 1,103 2,144

participating interests (888) (843) (1,844)

Profit on the sale of 197 (395) (168)

property, plant and equipment - - (400)

Depreciation Excess of normal (238) (410) (624)

pension contributions 2,092 2,281 4,239

compared with service cost (60) (60) (120)

------------ ---------- -------------

Cash generated from operations

before movements in working

capital 7,724 8,791 17,601

(Increase) / decrease in

stocks Decrease / (increase)

in trade and other

receivables (Decrease) / (377) 374 126

increase in trade and other 2,148 (428) (2,468)

payables Decrease in (705) 126 2,517

provisions (7) (7) (13)

------------ ---------- -------------

Cash generated from operations 8,783 8,856 17,763

------------ ---------- -------------

10 Analysis of net funds

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Cash and cash equivalents per cash

flow statement 22,632 23,716 25,709

--------- --------- -------------

Bank loans (14,000) (20,000) (20,000)

Obligations under finance leases (678) (889) (756)

Derivative financial instruments (34) (65) (48)

--------- --------- -------------

Gross debt (14,712) (20,954) (20,804)

--------- --------- -------------

Net funds 7,920 2,762 4,905

--------- --------- -------------

11 Distribution of interim financial statements Following a change in

regulations in 2008, the company is no longer required to circulate

this half year report to shareholders. This enables us to reduce

costs associated with printing and mailing and to minimise the impact

of these activities on the environment. A copy of the interim

financial statements is available on the company's website,

www.andrews-sykes.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KMGZLVNDGMZM

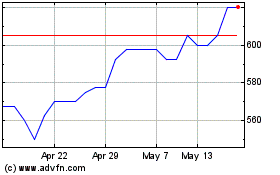

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From May 2024 to Jun 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2023 to Jun 2024