RNS Number:5954J

Andrews Sykes Group PLC

28 September 2006

Andrews Sykes Group plc (the "Company")

28 September 2006

Interim Results for the 26 weeks to 1 July 2006

Chairman's Statement

Overview and financial highlights

I am pleased to report an increase of 60% in the basic earnings per share from

continuing operations due to improved trading performance throughout the first

half of 2006.

The financial highlights of this period compared with the first half of 2005 are

as follows:

- Basic earnings per share from continuing operations increased by 2.8

pence (60%) to 7.46 pence.

- Turnover from Continuing Operations increased by #4.5m (20%) to

#27.6m.

- EBITDA (as reconciled on the face of the profit and loss account)

derived from continuing operations increased by #1.6m (29%) to #7.1m.

- Operating profit increased by #1.4m (35%) to #5.4m.

- Net cash inflow from operating activities increased by #1.0m (24%) to

#5.3m.

The Group's businesses performed well and overall were in line with our

expectations. The hire of heating and portable air conditioning equipment

benefited from the colder winter and warm early summer respectively.

Our continuing endeavours to improve our processes and strategies have

considerably enhanced our business performance during the period and will have a

positive impact on growth going forward. This, together with the measures

introduced to stimulate demand for our product in previous periods, has improved

revenues compared with 2005.

Prospects

Our performance continued well into the second half and I am optimistic for the

result for the full year. I remain confident that the Group is well prepared for

future trading and ready to take advantage of market opportunities as they

arise.

JG Murray

Chairman

27 September 2006

Andrews Sykes Group plc

Consolidated Profit and Loss Account

For the 26 weeks ended 1 July 2006

26 weeks 26 weeks to 52 weeks to

to 1 July 2 July 2005 31 December

2006 2005

Total Continuing Discontinued Total Continuing Discontinued Total

activities activities activities activities activities

#'000 #'000 #'000 #'000 #'000 #'000 #'000

Turnover 27,609 23,077 3,681 26,758 50,673 4,415 55,088

Cost of sales (13,441) (11,597) (2,064) (13,661) (23,675) (2,414) (26,089)

Gross profit 14,168 11,480 1,617 13,097 26,998 2,001 28,999

Distribution costs (4,433) (3,800) (599) (4,399) (8,038) (699) (8,737)

Administrative expenses (4,372) (4,007) (729) (4,736) (7,898) (960) (8,858)

Operating profit 5,363 3,673 289 3,962 11,062 342 11,404

EBITDA * 7,090 5,506 552 6,058 14,747 615 15,362

Depreciation and asset disposals (1,720) (1,826) (263) (2,089) (3,671) (273) (3,944)

Operating profit before goodwill 5,370 3,680 289 3,969 11,076 342 11,418

amortisation

Goodwill amortisation (7) (7) - (7) (14) - (14)

Operating profit 5,363 3,673 289 3,962 11,062 342 11,404

Exceptional profit on the disposal - 6,797 6,404

of a business - discontinued

Profit on ordinary activities 5,363 10,759 17,808

before interest and taxation

Net interest payable (598) (211) (738)

Profit on ordinary activities 4,765 10,548 17,070

before taxation

Tax on profit on ordinary activities (1,440) (868) (2,943)

Profit on ordinary activities after 3,325 9,680 14,127

taxation being profit for the

financial period

Earnings per share from continuing operations:

Basic (pence) 7.46p 4.66p 15.24p

Diluted (pence) 7.46p 4.65p 15.24p

Earnings per share from total operating

results:

Basic (pence) 7.46p 16.70p 28.16p

Diluted (pence) 7.46p 16.69p 28.16p

Dividends paid per equity share 0.0p 14.0p 14.0p

(pence)

All results for the current period derive from continuing operations. There were no material acquisitions in any period.

* Earnings Before Interest, Taxation, Depreciation and Amortisation.

Consolidated Balance Sheet

As at 1 July 2006 1 July 2 July 31 December

2006 2005 2005

#'000 #'000 #'000

Fixed assets

Intangible assets: Goodwill 24 38 31

Tangible assets 12,741 11,940 12,011

Investments 164 164 164

12,929 12,142 12,206

Current assets

Stocks 4,475 4,801 4,532

Debtors 15,886 14,002 13,929

Cash at bank and in hand 11,435 12,308 10,342

31,796 31,111 28,803

Creditors falling due within one year

Loans and overdrafts (5,000) (2,000) (5,000)

Other creditors (8,560) (7,738) (8,627)

Corporation and overseas tax (2,133) (1,267) (1,060)

(15,693) (11,005) (14,687)

Net current assets 16,103 20,106 14,116

Total assets less current liabilities 29,032 32,248 26,322

Creditors falling due after more than one year

Loans (25,000) (9,000) (25,000)

Provisions for liabilities (495) (339) (469)

Net assets excluding pension liability 3,537 22,909 853

Pension Liability (3,902) (6,050) (4,434)

Net (liabilities) / assets including pension liability (365) 16,859 (3,581)

Capital and reserves

Called-up share capital 446 11,598 446

Share premium account - 10,678 -

Revaluation reserve 738 743 741

Other reserves 217 7,395 222

Profit and loss account (1,776) (13,559) (4,994)

ESOP reserve - (6) (6)

(Deficit) / surplus attributable to equity shareholders (375) 16,849 (3,591)

Minority interests 10 10 10

Total capital employed (365) 16,859 (3,581)

Andrews Sykes Group plc

Consolidated Cash Flow Statement

For the 26 weeks ended 1 July 2006 26 weeks to 26 weeks to 52 weeks to

1 July 2 July 31 December

2006 2005 2005

#'000 #'000 #'000

Net cash inflow from operating activities as reconciled in note 4 5,292 4,258 10,196

Returns on investments and servicing of finance

Interest received 164 245 484

Interest paid (877) (353) (946)

Net cash outflow for returns on investments and servicing of finance (713) (108) (462)

Cash outflow for taxation (788) (642) (1,984)

Capital expenditure

Purchase of tangible fixed assets (2,804) (1,856) (4,056)

Sale of tangible fixed assets 342 395 608

Net cash outflow for capital expenditure (2,462) (1,461) (3,448)

Acquisitions and disposals

Cash received on the disposal of subsidiary undertakings - 9,614 10,204

Disposal costs paid less consideration received on prior year disposals (138) - -

Net cash balances disposed of with subsidiary - (439) (214)

Net cash (outflow) / inflow for acquisitions and disposals (138) 9,175 9,990

Equity dividends paid - (8,119) (8,119)

Cash inflow before the use of liquid resources and financing 1,191 3,103 6,173

Management of liquid resources

Movement in bank deposits - (87) 477

Financing

Sale of shares held in ESOP 4 9 9

New loans drawn down - - 30,000

Loan repayments - - (11,000)

Purchase of own shares (16) - (24,168)

Net cash (outflow) / inflow from financing (12) 9 (5,159)

Increase in cash in the period 1,179 3,025 1,491

Analysis of net (debt) / funds

Bank current and deposit accounts and cash in hand 11,435 12,308 10,342

Total loans and overdrafts (30,000) (11,000) (30,000)

Net (debt) / funds as reconciled in note 5 (18,565) 1,308 (19,658)

Andrews Sykes Group plc

Other Consolidated Statements

For the 26 weeks ended 1 July 2006

Consolidated statement of total recognised gains and losses

26 weeks to 26 weeks to 52 weeks to

1 July 2 July 31 December

2006 2005 2005

#'000 #'000 #'000

Profit for the financial period 3,325 9,680 14,127

Currency translation differences on (97) (88) 48

foreign currency net investments

Actual return less expected return on - 419 2,702

pension scheme assets

Experience gains and losses arising on - (38) (4)

the pension scheme liabilities

Changes in assumptions underlying the - - (3,538)

present value of the scheme liabilities

UK deferred tax attributable to the pension scheme - (114) 252

asset and liability adjustments

Total recognised gains and losses 3,228 9,859 13,587

relating to the period

Reconciliation of movement in Group shareholders' funds

26 weeks to 26 weeks to 52 weeks to

1 July 2 July 31 December

2006 2005 2005

#'000 #'000 #'000

Profit for the financial period 3,325 9,680 14,127

Dividends paid - (8,119) (8,119)

Consideration for the purchase of own shares (16) - (24,168)

Sale of own shares by the ESOP trust 4 9 9

Currency translation differences on (97) (88) 48

foreign currency net investments

Actual return less expected return on - 419 2,702

pension scheme assets

Experience gains and losses arising on - (38) (4)

the pension scheme liabilities

Changes in assumptions underlying the - - (3,538)

present value of the scheme liabilities

UK deferred tax attributable to the pension scheme - (114) 252

asset and liability adjustments

Net increase /(decrease) in shareholders' funds 3,216 1,749 (18,691)

Shareholders' (deficit) / funds at the

beginning of the period (3,591) 15,100 15,100

Shareholders' (deficit)/ funds at the end of the period (375) 16,849 (3,591)

Andrews Sykes Group plc

Notes to the accounts

For the 26 weeks ended 1 July 2006

1. Basis of preparation

The interim report for the 26 weeks ended 1 July 2006 was approved by the Board on 27

September 2006. The financial information contained in this interim report does not

constitute statutory accounts for the Group for the relevant periods.

The interim report is neither audited nor reviewed. The results for the 52 weeks

ended 31 December 2005 have been extracted from the audited financial statements that

have been filed with the Registrar of Companies. The report of the auditors was

unqualified and did not contain a statement under section 237(2) or (3) of the

Companies Act 1985.

The interim statement has been prepared on a consistent basis and in accordance with

the accounting policies set out in the Group's 2005 Annual Report and Financial

Statements.

2. Segmental analysis

The Group's turnover may be analysed between the following principal activities:

26 weeks to 26 weeks to 52 weeks to

1 July 2 July 31 December

2006 2005 2005

Activity: #'000 #'000 #'000

Hire 19,151 17,169 36,389

Sales 4,539 5,331 9,509

Installation 3,919 4,258 9,190

Total 27,609 26,758 55,088

The geographical analysis of the roup's turnover was as follows:

26 weeks to 26 weeks to 52 weeks to

1 July 2 July 31 December

2006 2005 2005

By origination: #'000 #'000 #'000

United Kingdom 22,487 23,574 48,041

Rest of Europe 3,131 1,529 3,674

Middle East and 1,991 1,655 3,373

Africa

27,609 26,758 55,088

26 weeks to 26 weeks to 52 weeks to

1 July 2 July 31 December

2006 2005 2005

By destination: #'000 #'000 #'000

United Kingdom 22,137 23,190 47,612

Rest of Europe 3,180 1,561 3,737

Middle East and 2,027 1,665 3,478

Africa

Rest of World 265 342 261

27,609 26,758 55,088

The analysis of profit before interest and tax and net assets by geographical origin was as follows:

Profit before interest and tax Net assets including pension liability

26 weeks to 26 weeks to 52 weeks to As at As at As at

1 July 2 July 31 December 1 July 2 July 31 December

2006 2005 2005 2006 2005 2005

#'000 #'000 #'000 #'000 #'000 #'000

United Kingdom 4,006 10,146 16,141 20,174 20,262 17,642

Rest of Europe 1,129 387 1,155 2,051 813 1,785

Middle East and Africa 228 226 512 2,010 1,793 2,144

5,363 10,759 17,808 24,235 22,868 21,571

Net (debt) / cash (18,565) 1,308 (19,658)

Taxation (2,133) (1,267) (1,060)

Pension liability (3,902) (6,050) (4,434)

(365) 16,859 (3,581)

3. Earnings per share

The basic figures have been calculated by reference to the weighted average

number of ordinary shares in issue, excluding those in the ESOP reserve,

during the period of 44,562,701 (26 weeks ended 2 July 2005: 57,976,672).

The calculation of the diluted earnings per ordinary share is based on the

profits as set out in the table below and on 44,565,526 (26 weeks ended 2 July

2005: 57,992,597) ordinary shares. The share options have a dilutive effect

for the period calculated as follows:

26 weeks to 1 July 2006 26 weeks to 2 July 2005

Continuing Total No. of shares Continuing Total No. of

earnings earnings earnings earnings shares

#'000 #'000 #'000 #'000

Basic earnings/weighted 3,325 3,325 44,562,701 2,699 9,680 57,976,672

average number of shares

Weighted average number 16,194 30,000

of shares under option

Number of shares that

would have been issued

at fair value (13,369) (14,075)

Earnings/ diluted 3,325 3,325 44,565,526 2,699 9,680 57,992,597

weighted average number

of shares

Diluted earnings 7.46p 7.46p 4.65p 16.69p

per ordinary share (pence)

Andrews Sykes Group plc

Notes to the accounts

For the 26 weeks ended 1 July 2006

4. Reconciliation of operating profit to net cash inflow from operating activities

26 weeks to 26 weeks to 52 weeks to

1 July 2 July 31 December

2006 2005 2005

#'000 #'000 #'000

Operating profit 5,363 3,962 11,404

Goodwill amortisation 7 7 14

Depreciation 1,963 2,286 4,280

Profit on sale of fixed assets (243) (197) (336)

Decrease in stocks 57 141 37

(Increase) / decrease in debtors (1,252) 20 (591)

Decrease in creditors and provisions (603) (1,961) (4,612)

Net cash inflow from operating activities 5,292 4,258 10,196

5. Analysis of net debt

As at Cash Other non As at

1 July flow cash 31 December

2006 movements 2005

#'000 #'000 #'000 #'000

Cash at bank and in hand 11,435 1,179 (86) 10,342

Debt due in one year (5,000) - - (5,000)

Debt due after one year (25,000) - - (25,000)

Gross debt (30,000) - - (30,000)

Net debt (18,565) 1,179 (86) (19,658)

6. Distribution of interim statement

A copy of this statement will be posted to all shareholders and is available

from the Company's registered office at Premier House, Darlington Street,

Wolverhampton, WV1 4JJ.

END

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFLTAFIDFIR

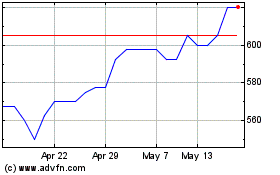

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From May 2024 to Jun 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2023 to Jun 2024