AEW UK REIT PLC VALUATION OF HOLDING IN AEW UK CORE PROPERTY FUND (6063M)

October 14 2016 - 9:13AM

UK Regulatory

TIDMAEWU

RNS Number : 6063M

AEW UK REIT PLC

14 October 2016

AEW UK REIT plc

SWING TO OFFER PRICING AND REMOVAL OF DILUTION ADJUSTMENT OF AEW

UK CORE PROPERTY FUND

AEW UK REIT plc (LSE: AEWU) ("the Company") announces that the

AEW UK Core Property Fund (the "Core Fund"), in which it currently

has an investment representing c.8% of its portfolio, has moved its

single price mechanism from a bid basis back to an offer basis and

removed its dilution adjustment of 5%. Both the move to offer

pricing basis and the introduction of the dilution adjustment were

put in place as a result of market uncertainty in the UK following

the June EU referendum result.

These changes will apply to transactions in the Core Fund with

effect from 3 October 2016.

This decision has been taken following the revised assessment by

the Fund's Independent Pricing Sub-Committee of emerging evidence

from independent valuers. The Core Fund's property portfolio

valuation rose 0.2% on a like for like basis during the month of

September and the Fund's independent valuers will remove their

valuation uncertainty clause in their September valuation

reports.

The decision to move the Core Fund pricing from offer to bid and

to apply the dilution levy in July, following the referendum

result, led to a revaluation of the Company's Core Fund holding as

at 31 July 2016 to GBP8.65 million, from GBP10.11 million as at 30

April 2016 (being 1.25p per share). The value of the Company's

holding in the Core Fund as at 31 July 2016 was 6.4% below the NAV

of the Core Fund at that time.

Alex Short, Portfolio Manager, AEW UK REIT, commented:

"We have been pleased with the resilient performance of the AEW

UK REIT portfolio in the weeks since the referendum, with tenant

demand remaining robust across most sectors and locations. Support

for the recent tap issue was encouraging and we anticipate making

further announcements over the coming weeks as we invest the new

capital in what look to be a range of very interesting and fruitful

opportunities in the UK regions."

Enquiries

AEW UK

Laura Elkin laura.elkin@aeweurope.com

+44(0) 20 7016 4880

Nicki Gladstone nicki.gladstone-ext@aeweurope.com

+44(0) 20 7016 4880

Company Secretary

Benjamin Hanley, Benjamin.hanley@capita.co.uk

Capita Company Secretarial

Services

T: 01392 477 563

FTI Consulting

Richard Sunderland, Claire aewuk@fticonsulting.com

Turvey, Richard Gotla

T: 020 3727 1000

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total

return to shareholders by investing predominantly in smaller

commercial properties (typically less than GBP10 million), on

shorter occupational leases, in strong commercial locations across

the United Kingdom.

Since its IPO in May 2015, the Company has invested just over

GBP123 million in 27 properties, including GBP9.75 million in AEW

UK's Core Property Fund, is currently invested in office, retail,

industrial and leisure assets, with a focus on active asset

management, repositioning the properties and improving the quality

of the income stream. Whilst occupational demand in strategic

locations remains, securing tenants on shorter leases allows the

Company to crystallise value through rent reviews and lease

re--gears.

The Company is currently paying a dividend of 8p per share p.a.

and targets a total annual return, over the medium term, in excess

of 12% on the IPO issue price, net of all fees.

Real estate investment specialist AEW UK Investment Management

LLP is a joint venture between the management team, which together

has an average of 25 years of real estate experience, and AEW

Europe, which has EUR48.1 billion of real estate assets under

management. AEW UK Investment Management LLP has a strong and

expert asset management team, with a proven record of identifying

and delivering value from real estate assets across all

sectors.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLLFIVITLSLIR

(END) Dow Jones Newswires

October 14, 2016 09:13 ET (13:13 GMT)

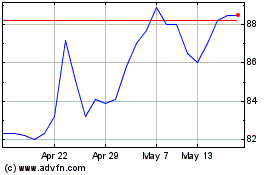

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Apr 2024 to May 2024

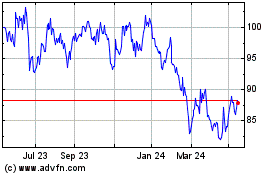

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From May 2023 to May 2024