Tencent Buys 10% Stake in Record Label of Billie Eilish, Drake

December 31 2019 - 7:21AM

Dow Jones News

By Shan Li and Mauro Orrù

Tencent Holdings Ltd. is buying a 10% stake in the music giant

behind Ariana Grande, Drake and Billie Eilish for EUR3 billion

($3.36 billion) in a deal that bolsters the Chinese internet

giant's growing presence in the record industry.

The company said Tuesday it was leading a consortium that has

agreed to acquire a stake in Universal Music Group from Vivendi SA,

valuing the world's largest music company at EUR30 billion. The

investment also gives Tencent the option to double its stake in the

Los Angeles-based company.

The deal hands Tencent exposure to some of the biggest names in

music -- Universal's stable also includes classic acts like Queen

and the Beatles -- and will strengthen the tech company's dominance

of the growing Chinese market.

Chinese consumers have quickly adopted to streaming-music

services, showing a willingness to pay for the likes of Spotify

Technology SA. Tencent Music Entertainment Group, the tech giant's

streaming business, went public in December 2018 in one of the

biggest U.S. listings in recent years.

Tencent said a separate deal would follow soon allowing its

streaming business to buy a minority stake in Universal's Chinese

operations.

Beyond China, Tencent is trying to defend its music-streaming

business from the rising threat of blockbuster short-video app

TikTok, which has increasing influence over the music industry by

turning little-known musicians into viral sensations, said Shawn

Yang, managing director of research firm Blue Lotus Capital

Advisors. "Old Town Road," by rapper Lil Nas X, became a global hit

after it caught on among TikTok users.

Tencent will likely try to influence future licensing

negotiations between Universal and TikTok owner Bytedance Inc., Mr.

Yang said. TikTok and its Chinese version, Douyin, allow users to

add snippets of music to their videos -- a process that depends on

licenses from Universal and other major music companies.

"Tencent Music is more and more challenged by TikTok," he said,

adding that such video services were growing in importance as a

distribution platform for music.

For Vivendi, the stake sale allows the French company to cash in

on a resurgent music industry and enables Universal to further

develop in Asia.

The music industry is turning the page on an era of

technological disruption that once bedeviled it. Universal, along

with rivals such as Warner Music Group Corp. and Sony Corp.'s Sony

Music Entertainment, now benefits from streaming services like

Spotify and Apple Inc.'s Apple Music, which have emerged as revenue

growth drivers.

Against that backdrop, Universal has become a bright spot for

Vivendi, which also said Tuesday it was in talks with other

investors about selling an additional minority stake in its music

arm at a price that "would at least be identical."

Details of the negotiations with Tencent emerged in August, a

year after Vivendi said it would embark on a search for strategic

buyers to sell up to 50% of its music subsidiary.

The purchase by the Tencent consortium, which also includes the

Chinese company's streaming arm and other undisclosed investors, is

expected to close by the end of the first half of 2020, subject to

regulatory approvals. Given trade tensions between the U.S. and

China, the transaction could face added scrutiny, although analysts

expect the deal to ultimately prevail because it doesn't involve

innovative technology or sensitive user data.

Write to Shan Li at shan.li@wsj.com

(END) Dow Jones Newswires

December 31, 2019 07:06 ET (12:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

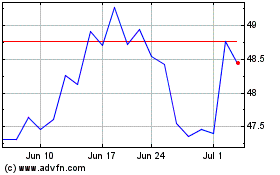

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Oct 2024 to Nov 2024

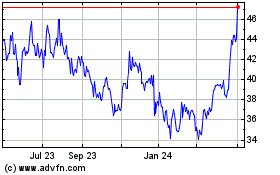

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Nov 2023 to Nov 2024