|

|

UNITED STATES |

|

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

|

Washington, D.C. 20549 |

|

|

|

|

|

|

|

SCHEDULE 13D/A |

|

Under the Securities Exchange Act of 1934

(Amendment No. 9)

(Name of Issuer)

Ordinary Shares without par value

(Title of Class of Securities)

(CUSIP Number)

Amedeo Nodari

Financial Shareholdings’ Department

Intesa Sanpaolo S.p.A.

Via Monte di Pietà 12

20121 Milan, Italy

(+39) 02 879 62552

With a copy to:

Jeffrey H. Lawlis, Esq.

Latham & Watkins

Corso Matteotti, 22

Milan 20121

Italy

(+39) 02 3046 2039

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. o

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

(Continued on following pages)

|

CUSIP No. 87927W10 |

|

|

|

|

1. |

Names of Reporting Persons.

I.R.S. Identification Nos. of above persons (entities only).

Intesa Sanpaolo S.p.A. |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

x |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

WC, BK |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

Republic of Italy |

|

|

|

Number of

Shares

Beneficially by

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

29,059,811 |

|

|

|

8. |

Shared Voting Power

3,003,586,907 (See Item 5) |

|

|

|

9. |

Sole Dispositive Power

2,759,000 |

|

|

|

10. |

Shared Dispositive Power

3,003,586,907 (See Item 5) |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,032,646,718 (See Item 5) |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

22.5% (See Item 5) |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

CO, BK |

|

|

|

|

|

|

2

This Amendment No. 9 (this “Amendment”) amends the Statement on Schedule 13D (the “Schedule 13D”) filed on November 1, 2007 and as subsequently amended by Intesa Sanpaolo S.p.A., a company incorporated under the laws of the Republic of Italy (“Intesa Sanpaolo”), with respect to the ordinary shares without par value (“Telecom Shares”), of Telecom Italia S.p.A., a company incorporated under the laws of the Republic of Italy (“Telecom Italia”). Capitalized terms used in this Amendment without definition have the meanings ascribed to them in the Schedule 13D, as amended.

Introduction

As previously described in Amendments No. 2 and No. 3 to Schedule 13D (filed on December 1, 2009, and December 23, 2009, respectively, by Intesa Sanpaolo), the terms of SI’s exit from Telco were approved on November 26, 2009 and the SI Exit Transaction was concluded on December 22, 2009. In connection with SI’s exit from Telco, Intesa Sanpaolo, Mediobanca, Generali and Telefónica (collectively, the “Existing Shareholders”) concluded the New Shareholders Agreement, amending and renewing the original Shareholders Agreement. In addition, as previously described in Amendment No. 4 to Schedule 13D (filed on January 22, 2010, by Intesa Sanpaolo), Telco refinanced its existing financial indebtedness maturing in January 2010 through the New Refinancing Facility dated as of January 11, 2010 with the Senior Lenders.

As previously described in Amendment No. 5 to Schedule 13D (filed on March 12, 2012 by Intesa Sanpaolo), on February 29, 2012, the Existing Shareholders undertook to ensure the refinancing of Telco’s financial indebtedness through the most appropriate financing instruments in proportion to their respective shareholdings of Telco. A copy of the related Telco press release, dated February 29, 2012, was previously filed on Schedule 13D as Exhibit 27. On May 31, 2012, the Existing Shareholders announced the completion of the refinancing transactions for Telco’s financial indebtedness maturing in 2012, as approved by Telco’s board of directors on May 3, 2012 (the “2012 Refinancing”).

As previously described in Amendment No. 6 to Schedule 13D (filed on June 14, 2012 by Intesa Sanpaolo), as part of the 2012 Refinancing, Telco (i) executed a capital increase of euro 600 million, entirely subscribed by all the Existing Shareholders on a pro rata basis (the “Capital Increase”), (ii) issued a euro 1.750 billion bond (the “2012 Bond”), entirely subscribed by all the Existing Shareholders on a pro rata basis, and (iii) entered into a euro 1.050 billion loan agreement (the “2012 Refinancing Facility”) with Société Générale, UniCredit Corporate Banking S.p.A., HSBC Bank plc, Intesa Sanpaolo and Mediobanca, as lenders (collectively, the “2012 Lenders”). The 2012 Refinancing Facility matured on November 27, 2013 and was secured by a pledge (the “2012 Pledge”) in favor of the 2012 Lenders over 1,730,000,000 Telecom Shares held by Telco (the “2012 Pledged Shares”).

The funds received by Telco in connection with the 2012 Refinancing were used to repay the January 2010 New Refinancing Facility, a euro 1.3 billion bond previously issued by Telco and subscribed for by the Existing Shareholders and were used to repay Telco’s remaining banking debt of euro 860 million which matured between June and October 2012.

In connection with the Capital Increase, the Existing Shareholders amended article 5 of Telco’s by-laws, previously filed on Schedule 13D as Exhibit 13. An unofficial translation of the amendments to article 5 was previously filed on Schedule 13D as Exhibit 28.

Pursuant to the terms of the 2012 Refinancing Facility, on May 31, 2012, the Existing Shareholders and the 2012 Lenders entered into an option agreement (the “2012 Pledged Shares Option Agreement”) pursuant to which the parties (i) terminated the prior Option Agreement entered into on January 11, 2010 and previously filed on Schedule 13D as Exhibit 22 and (ii) established the terms and conditions that would govern the Existing Shareholders’ option to acquire the 2012 Pledged Shares from the 2012 Lenders (the “2012 Call Option”) in the event that the 2012 Lenders acquire any of the 2012 Pledged Shares by enforcing the 2012 Pledge. Copies of the 2012 Pledged Shares Option Agreement and the Telco press releases announcing the events described above, dated May 3, 2012 and May 31, 2012, were previously filed on Schedule 13D as Exhibit 29, Exhibit 30 and Exhibit 31, respectively.

3

As previously described in Amendment No. 7 to Schedule 13D (filed on October 7, 2013 by Intesa Sanpaolo), on September 24, 2013, Telefónica, Generali (which term now also includes Generali Italia S.p.A., formerly known as INA Assitalia S.p.A.), Intesa Sanpaolo and Mediobanca entered into an agreement to amend the 2012 Shareholders Agreement for, among other things, the recapitalization and the refinancing of Telco (the “Shareholders Agreement Amendment”).

Pursuant to the Shareholders Agreement Amendment, the Existing Shareholders agreed to recapitalize Telco and refinance certain indebtedness thereof, as more specifically described in Amendment No. 7 to Schedule 13D. In connection with this refinancing, Telco entered into a euro 700 million loan agreement on October 4, 2013 (the “2013 Refinancing Facility”) with Intesa Sanpaolo and Mediobanca, as lenders (collectively, the “2013 Lenders”) and Banca IMI Sp.A., as agent (the “2013 Facility Agent”), which matured on February 16, 2015. The 2013 Refinancing Facility was secured by a pledge (the “2013 Pledge”) in favor of the 2013 Lenders over 1,900,000,000 Telecom Shares held by Telco (including the former 2012 Pledged Shares that had secured the 2012 Refinancing Facility) (such shares subject to the 2013 Pledge, the “2013 Pledged Shares”). To facilitate this transaction, on November 27, 2013, the Existing Shareholders and the 2012 Lenders entered into contractual arrangements pursuant to which the 2012 Pledge was released and the 2012 Pledged Shares Option Agreement was terminated (the “Deed of Termination”). Concurrently, on November 27, 2013, and as described in Amendment No. 8 to Schedule 13D (filed on December 18, 2013 by Intesa Sanpaolo), a new pledged shares option agreement (the “2013 Pledged Shares Option Agreement”) was entered into between, inter alios, the Existing Shareholders and the 2013 Lenders to establish the terms and conditions which would govern the Existing Shareholders’ call option (the “2013 Call Option”) to acquire from the 2013 Lenders at the terms and conditions referred to therein, any 2013 Pledged Shares acquired by the 2013 Lenders pursuant to an enforcement of the 2013 Pledge. Except as described in Amendment No. 8 to Schedule 13D, the terms of the 2013 Pledged Shares Option Agreement and the 2013 Call Option are substantially consistent with the terms of the 2012 Pledged Shares Option Agreement and the 2012 Call Option, respectively.

On June 16, 2014, Generali (also on behalf of its subsidiaries), Intesa Sanpaolo and Mediobanca requested the initiation of a “demerger” process (spin off) of Telco, as provided in the 2012 Shareholders Agreement (the “Demerger”). Execution of the Demerger, which was approved by the extraordinary shareholders’ meeting of Telco held on July 9, 2014, remains subject to obtaining certain required anti-trust and telecommunications approvals (including those in Brazil and Argentina). Once all necessary approvals are obtained, the Demerger will be executed by transferring the current stake of Telco in Telecom Italia to four newly-created companies, one for each Existing Shareholder (the “Newcos”). The share capital of each of these Newcos will be owned in its entirety by the respective Existing Shareholders, each of which will receive into its respective Newco a number of shares of Telecom Italia in proportion to their respective economic stakes in Telco at the time of the execution of the Demerger.

On February 26, 2015, Telco and the Existing Shareholders amended and restated their respective shareholder loan agreements originally executed on July 9, 2014 (the “2015 Amended Shareholder Loan Agreements”). Pursuant to the 2015 Amended Shareholder Loan Agreements, the Existing Shareholders loaned a total of approximately €2.6 billion to Telco, with each Existing Shareholder loaning in proportion to their respective shareholdings in Telco. Telco used the proceeds received pursuant to the 2015 Amended Shareholder Loan Agreements to repay the 2013 Refinancing Facility and redeem subordinated notes issued by Telco and held by each of Intesa Sanpaolo, Mediobanca and Telefónica.

On February 27, 2015, upon the repayment of the 2013 Refinancing Facility, and according to a deed of termination between the Existing Shareholders and the 2013 Lenders (the “2015 Deed of Termination”), the 2013 Pledged Shares Option Agreement was released and the 2013 Call Option was terminated. The 2015 Deed of Termination is filed hereto as Exhibit 37.

On February 27, 2015, in order to ensure that the 2012 Shareholders Agreement remains effective until the completion of the Demerger, the 2012 Shareholders Agreement was amended to extend its term until the earlier of (i) June 30, 2015 and (ii) the date of effectiveness of the Demerger (the “2015 Shareholders Agreement Amendment”). The 2015 Shareholders Agreement Amendment is filed hereto as Exhibit 38.

4

In addition, the Option Agreement expired on February 28, 2015 as a result of the three-year duration having ended.

Items 2, 5, 6 and 7 of Schedule 13D are hereby amended and supplemented to add the following:

Item 2. Identity and Background

The names, citizenship, business addresses and principal occupations or employments of the executive officers and directors of Intesa Sanpaolo are set forth in Annex A, which is incorporated herein by reference.

During the last five years, neither Intesa Sanpaolo nor, to the best of Intesa Sanpaolo’s knowledge, any of the persons listed in Annex A, have been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors), or was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 5. Interest in Securities of the Issuer

Intesa Sanpaolo, through its interest in Telco, may be deemed to beneficially own 3,003,586,907 Telecom Shares, representing approximately 22.3% of the outstanding Telecom Shares. Intesa Sanpaolo may be deemed to have shared power to vote, or direct the vote, and shared power to dispose, or direct the dispositions, of such Telecom Shares.

In addition, Intesa Sanpaolo may be deemed to have sole power to vote or direct the vote of 29,059,811 Telecom Shares and sole power to dispose or direct the disposition of 2,759,000 Telecom Shares through its direct holdings and the holdings of various subsidiaries, representing approximately 0.2% and 0.02% of the outstanding Telecom Shares, respectively. These shares are not currently expected to be contributed to Telco.

The beneficial ownership of Telecom Shares by the persons listed in Annex A to Schedule 13D, to the extent currently available and to the best of Intesa Sanpaolo’s knowledge, is indicated next to such person’s name in such Annex A. To the best of Intesa Sanpaolo’s knowledge, such persons have sole voting and dispositive power over the Telecom Shares that they beneficially own. Except as described in Annex B, Intesa Sanpaolo has not effected any transaction in the Telecom Shares during the 60 days prior to the date of the event which required a filing on Schedule 13D. To the best of Intesa Sanpaolo’s knowledge, the persons listed in Annex A have not effected any transactions in Telecom Shares during the 60 days prior to the date of the event which required a filing on Schedule 13D, except as detailed in Annex A.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

In addition to the descriptions contained herein, the descriptions of the 2015 Deed of Termination and the 2015 Shareholders Agreement Amendment in the Introduction to this Amendment No. 9 are incorporated herein by reference. The summaries of the 2015 Deed of Termination and 2015 Shareholders Agreement Amendment do not purport to be full and complete descriptions of such documents and are entirely qualified by reference to the full text of such documents attached hereto as Exhibits 37 and 38, respectively.

5

THE 2015 DEED OF TERMINATION

On February 27, 2015, the Existing Shareholders and the 2013 Lenders entered into a deed of termination pursuant to which the 2013 Pledged Shares Option Agreement was terminated and the parties thereto released from their obligations thereunder, including the 2013 Call Option.

Full text of such document is attached as Exhibit 37 hereto.

THE 2015 SHAREHOLDERS AGREEMENT AMENDMENT

On February 27, 2015, to extend the effectiveness of the 2012 Shareholders Agreement until the completion of the Demerger, the 2012 Shareholders Agreement was amended to extend its term until the earlier of (i) June 30, 2015 and (ii) the date of effectiveness of the Demerger.

Full text of such document is attached as Exhibit 38 hereto.

Item 7. Materials to Be Filed as Exhibits

|

Exhibit 37: |

|

Deed of termination of the 2013 Pledged Shares Option Agreement, dated February 27, 2015, by and among Telefónica S.A., Assicurazioni Generali S.p.A. (on its own behalf and on behalf of its subsidiaries Generali Vie S.A., Alleanza Assicurazioni S.p.A., Generali Italia S.p.A. and Generali Lebensversicherung AG), Intesa Sanpaolo S.p.A. (in its capacity as shareholder) and Mediobanca — Banca di Credito Finanziario S.p.A. (in its capacity as shareholder) and Intesa Sanpaolo S.p.A. (in its capacity as lender), Mediobanca — Banca di Credito Finanziario S.p.A. (in its capacity as lender) and Société Générale and Banca IMI S.p.A. (as facility agent). |

|

|

|

|

|

Exhibit 38: |

|

Shareholders Agreement Amendment, dated February 27, 2015, between Telefónica, S.A., Assicurazioni Generali S.p.A., (on its own account and in the name of and on behalf of the following Generali’s subsidiaries Generali Vie, S.A., Alleanza Assicurazioni S.p.A., Generali Italia, S.p.A. Generali Lebensversicherung AG), Intesa Sanpaolo and S.p.A., Mediobanca — Banca di Credito Finanziario, S.p.A. |

6

SIGNATURE

After reasonable inquiry and to the best knowledge and belief of the undersigned, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: March 25, 2015

|

|

INTESA SANPAOLO S.p.A. |

|

|

|

|

|

|

|

|

By: |

/s/ Amedeo Nodari |

|

|

|

Name: |

Amedeo Nodari |

|

|

|

Title: |

Head of Financial Shareholdings’ Department |

7

ANNEX A

DIRECTORS AND EXECUTIVE OFFICERS OF INTESA SANPAOLO

The name, title, present principal occupation or employment of each of the directors and executive officers of Intesa Sanpaolo are set forth below. The business address of each director and executive officer is Intesa Sanpaolo’s address. Unless otherwise indicated, each occupation set forth opposite an individual’s name refers to Intesa Sanpaolo. All of the persons listed below are citizens of the Republic of Italy, except Jean-Paul Fitoussi who is a French citizen.

|

Name and surname |

|

Position with Intesa

Sanpaolo |

|

Present Principal

Occupation

(if different from Position

with Intesa Sanpaolo) |

|

Telecom Shares

Beneficially Owned |

|

Gian Maria Gros-Pietro |

|

Chairman |

|

— |

|

— |

|

Marcello Sala |

|

Senior Deputy Chairman of Management Board |

|

— |

|

— |

|

Giovanni Costa |

|

Deputy Chairman of Management Board |

|

— |

|

— |

|

Carlo Messina |

|

Managing Director and CEO |

|

— |

|

— |

|

Carla Patrizia Ferrari |

|

Member of Management Board |

|

— |

|

— |

|

Piera Filippi |

|

Member of Management Board |

|

Attorney |

|

— |

|

Gaetano Miccichè |

|

Member of Management Board |

|

— |

|

— |

|

Stefano Del Punta |

|

Member of Management Board |

|

— |

|

— |

|

Giuseppe Morbidelli |

|

Member of Management Board |

|

Professor |

|

— |

|

Bruno Picca |

|

Member of Management Board |

|

— |

|

— |

|

Giovanni Bazoli* |

|

Chairman of Supervisory Board |

|

Professor |

|

22,634 (owned by spouse) |

|

Mario Bertolissi |

|

Deputy Chairman of Supervisory Board |

|

Professor |

|

— |

|

Gianfranco Carbonato |

|

Deputy Chairman of Supervisory Board |

|

Entrepreneur |

|

— |

|

Gianluigi Baccolini |

|

Member of Supervisory Board |

|

Entrepreneur |

|

— |

|

Francesco Bianchi |

|

Member of Supervisory Board |

|

Consultant |

|

— |

|

Rosalba Casiraghi |

|

Member of Supervisory Board |

|

Consultant |

|

— |

|

Carlo Corradini |

|

Member of Supervisory Board |

|

Consultant |

|

320,000 (personally owned) |

|

Franco Dalla Sega |

|

Member of Supervisory Board |

|

Professor |

|

— |

|

Piergiuseppe Dolcini |

|

Member of Supervisory Board |

|

Lawyer |

|

— |

|

Jean-Paul Fitoussi |

|

Member of Supervisory Board |

|

Professor |

|

— |

|

Edoardo Gaffeo |

|

Member of Supervisory Board |

|

Professor |

|

— |

|

Pietro Garibaldi |

|

Member of Supervisory Board |

|

Professor |

|

— |

|

Rossella Locatelli |

|

Member of Supervisory Board |

|

Professor |

|

— |

|

Giulio Stefano Lubatti |

|

Member of Supervisory Board |

|

Consultant |

|

— |

|

Marco Mangiagalli |

|

Member of Supervisory Board |

|

Consultant |

|

— |

|

Iacopo Mazzei |

|

Member of Supervisory Board |

|

Entrepreneur |

|

— |

|

Beatrice Ramasco |

|

Member of Supervisory Board |

|

Chartered Accountant |

|

— |

|

Marcella Sarale |

|

Member of Supervisory Board |

|

Professor |

|

— |

|

Monica Schiraldi |

|

Member of Supervisory Board |

|

Consultant |

|

— |

* Mr. Bazoli sold 38,300 shares beneficially owned personally by him during the 60 days preceeding February 27, 2015.

8

ANNEX B

TRANSACTIONS IN TELECOM ITALIA ORDINARY SHARES

The following describes transactions during the 60 days prior to the date of the event which required a filing on Schedule 13D by Intesa Sanpaolo or its affiliates in Telecom Shares. These transactions were all ordinary course broker-dealer activities engaged in by Intesa Sanpaolo or its affiliates consistent with its usual practices and unrelated to the Telco transaction. Substantially all of these transactions consisted of index arbitrage; index rebalance trading; program trading relating to baskets of securities; creation, redemption and balancing of exchange traded funds; facilitation of customer trades; model-driven trading and error correction.

|

Name of Intesa

Sanpaolo entity

or affiliate |

|

Number of

Buys |

|

Buy Volume |

|

High/Low Buy

Prices

(in €) |

|

Number of

Sells |

|

Sell Volume |

|

High/Low Sell

Prices

(in €) |

|

|

Banca IMI S.p.A. |

|

594 |

|

13,031,522 |

|

1.072 / 0.8465 |

|

16,612 |

|

94,853,466 |

|

1.068 / 0.8455 |

|

9

EXHIBIT INDEX

|

Exhibit No. |

|

|

|

|

|

|

|

99.1 |

|

Co-Investment Agreement, dated as of April 28, 2007, by and among Generali, Intesa Sanpaolo, Mediobanca, Sintonia S.A. and Telefónica.* |

|

|

|

|

|

99.2 |

|

Amendment to the Co-Investment Agreement and the Shareholders’ Agreement, dated October 25, 2007, by and among Generali, Intesa Sanpaolo, Mediobanca, Sintonia S.A. and Telefónica.* |

|

|

|

|

|

99.3 |

|

Shareholders’ Agreement, dated as of April 28, 2007, by and among Generali, Intesa Sanpaolo, Mediobanca, Sintonia S.A. and Telefónica.* |

|

|

|

|

|

99.4 |

|

By-laws of Olimpia S.p.A. (unofficial English translation).* |

|

|

|

|

|

99.5 |

|

Share Purchase Agreement, dated May 4, 2007, by and among the Investors, Pirelli and Sintonia.* |

|

|

|

|

|

99.6 |

|

The Announcement of the Board of Commissioners of the Brazilian National Telecommunications Agency (Anatel) related to the Transaction, dated October 23, 2007 (unofficial English translation).* |

|

|

|

|

|

99.10 |

|

By-laws of Telco S.p.A. (unofficial English translation).* |

|

|

|

|

|

99.11 |

|

Call Option Agreement, dated November 6, 2007, between Telefónica and Telco.* |

|

|

|

|

|

99.12 |

|

Amendment to Shareholders Agreement and to Bylaws, dated November 19, 2007, by and among Generali, Intesa Sanpaolo, Mediobanca, Sintonia S.A. and Telefónica.* |

|

|

|

|

|

99.13 |

|

Amended and Restated By-laws of Telco (unofficial English translation).* |

|

|

|

|

|

99.14 |

|

Letter of Adherence to the Call Option Agreement by Olimpia S.p.A., dated November 15, 2007.* |

|

|

|

|

|

99.15 |

|

Renewal Agreement, dated October 28, 2009, by and among Telefónica S.A., Assicurazioni Generali S.p.A. (on its own behalf and on behalf of its subsidiaries Generali Vie S.A., Alleanza Toro S.p.A., INA Assitalia S.p.A. and Generali Lebensversicherung AG), Intesa Sanpaolo S.p.A. and Mediobanca S.p.A. * |

|

|

|

|

|

99.16 |

|

Amendment Deed to the Call Option, dated October 28, 2009, by and between Telefónica S.A. and Telco S.p.A. * |

|

|

|

|

|

99.17 |

|

Joint press release, dated October 28, 2009, issued by Telefónica S.A., Assicurazioni Generali S.p.A, Intesa Sanpaolo S.p.A. and Mediobanca S.p.A. * |

|

|

|

|

|

99.18 |

|

Telco S.p.A. press release, dated November 26, 2009.* |

|

|

|

|

|

99.19 |

|

Purchase and Sale Agreement, dated December 22, 2009 by and between Telco S.p.A. and Sintonia S.A. (unofficial English translation) * |

|

|

|

|

|

99.20 |

|

Telco S.p.A. press release, dated December 22, 2009. * |

|

|

|

|

|

99.21 |

|

Amendment Agreement, dated January 11, 2010, by and among Telefónica S.A., Assicurazioni Generali S.p.A. (on its own behalf and on behalf of its subsidiaries Generali Vie S.A., Alleanza Toro S.p.A., INA Assitalia S.p.A. and Generali Lebensversicherung AG), Intesa Sanpaolo S.p.A. and Mediobanca S.p.A. * |

|

|

|

|

|

99.22 |

|

Option Agreement, dated January 11, 2010, by and among Intesa Sanpaolo S.p.A., Mediobanca - |

10

|

|

|

Banca di Credito Finanziario S.p.A., Unicredit Corporate Banking S.p.A., Société Générale, as lenders, and Telefónica S.A., Assicurazioni Generali S.p.A. (on its own behalf and on behalf of its subsidiaries Generali Vie S.A., Alleanza Toro S.p.A., INA Assitalia S.p.A. and Generali Lebensversicherung AG), Intesa Sanpaolo S.p.A. and Mediobanca - Banca di Credito Finanziario S.p.A. as shareholders. * |

|

|

|

|

|

99.23 |

|

Telco S.p.A. press release, dated January 11, 2010 * |

|

|

|

|

|

99.24 |

|

Amendment Agreement, dated December 10, 2010, by and among Telefónica S.A., Assicurazioni Generali S.p.A. (on its own behalf and on behalf of its subsidiaries Generali Vie S.A., Alleanza Toro S.p.A., INA Assitalia S.p.A. and Generali Lebensversicherung AG), Intesa Sanpaolo S.p.A. and Mediobanca S.p.A. * |

|

|

|

|

|

99.25 |

|

Second Renewal Agreement, dated February 29, 2012, by and among Telefónica S.A., Assicurazioni Generali S.p.A. (on its own behalf and on behalf of its subsidiaries Generali Vie S.A., Alleanza Toro S.p.A., INA Assitalia S.p.A. and Generali Lebensversicherung AG), Intesa Sanpaolo S.p.A. and Mediobanca S.p.A. * |

|

|

|

|

|

99.26 |

|

Amendment Deed to the Telefónica Option Agreement, dated February 29, 2012, between Telefónica and Telco * |

|

|

|

|

|

99.27 |

|

Telco S.p.A. press release, dated February 12, 2012 * |

|

|

|

|

|

99.28 |

|

Amendments to By-Laws of Telco (unofficial English translation) * |

|

|

|

|

|

99.29 |

|

Option Agreement, dated May 31, 2012, by and among Telefónica S.A., Assicurazioni Generali S.p.A. (on its own behalf and on behalf of its subsidiaries Generali Vie S.A., Alleanza Toro S.p.A., INA Assitalia S.p.A. and Generali Lebensversicherung AG), Intesa Sanpaolo S.p.A. (in its capacity as shareholder) and Mediobanca — Banca di Credito Finanziario S.p.A. (in its capacity as shareholder) and UniCredit S.p.A., Société Générale, Milan Branch, HSBC Bank plc, ), Intesa Sanpaolo S.p.A. (in its capacity as lender) and Mediobanca — Banca di Credito Finanziario S.p.A. (in its capacity as lender). * |

|

|

|

|

|

99.30 |

|

Telco S.p.A. press release, dated May 3, 2012 * |

|

|

|

|

|

99.31 |

|

Telco S.p.A. press release, dated May 31, 2012 * |

|

|

|

|

|

99.32 |

|

Amended by-laws of Telco (unofficial English translation) * |

|

|

|

|

|

99.33 |

|

Agreement dated September 24, 2013, by and among Telefónica S.A., Assicurazioni Generali S.p.A. (on its own behalf and on behalf of its subsidiaries Generali Vie S.A., Alleanza Toro S.p.A., Generali Italia S.p.A. and Generali Lebensversicherung AG), Intesa Sanpaolo S.p.A. and Mediobanca — Banca di Credito Finanziario S.p.A. * |

|

|

|

|

|

99.34 |

|

Joint press release, dated September 24, 2013 * |

|

|

|

|

|

99.35 |

|

Deed of termination of the 2012 Pledged Shares Option Agreement dated November 27, 2013 by and among Telefónica S.A., Assicurazioni Generali S.p.A. (on its own behalf and on behalf of its subsidiaries Generali Vie S.A., Alleanza Toro S.p.A., INA Assitalia S.p.A. and Generali Lebensversicherung AG), Intesa Sanpaolo S.p.A. (in its capacity as shareholder) and Mediobanca — Banca di Credito Finanziario S.p.A. (in its capacity as shareholder) and UniCredit S.p.A., Société Générale, Milan Branch, HSBC Bank plc, ), Intesa Sanpaolo S.p.A. (in its capacity as lender) and Mediobanca — Banca di Credito Finanziario S.p.A. (in its capacity as lender) * |

|

|

|

|

|

99.36 |

|

2013 Pledged Shares Option Agreement dated November 27, 2013 between Telefónica, S.A., Assicurazioni Generali S.p.A., (on its own account and in the name of and on behalf of the |

11

|

|

|

following Generali’s subsidiaries Generali Vie, S.A., Alleanza Toro, S.p.A. Generali Italia, S.p.A. Generali Lebensversicherung AG ), Intesa Sanpaolo, S.p.A. (as shareholder), Mediobanca — Banca di Credito Finanziario, S.p.A. (as shareholder) and Intesasanpaolo, S.p.A. (as lender), Mediobanca- Banca di Credito Finanziario S.p.A. (as lender), Banca IMI S.p.A. (as facility agent) * |

|

|

|

|

|

99.37 |

|

Deed of termination of the 2013 Pledged Shares Option Agreement, dated February 27, 2015, by and among Telefónica S.A., Assicurazioni Generali S.p.A. (on its own behalf and on behalf of its subsidiaries Generali Vie S.A., Alleanza Assicurazioni S.p.A., Generali Italia S.p.A. and Generali Lebensversicherung AG), Intesa Sanpaolo S.p.A. (in its capacity as shareholder) and Mediobanca — Banca di Credito Finanziario S.p.A. (in its capacity as shareholder) and Intesa Sanpaolo S.p.A. (in its capacity as lender), Mediobanca — Banca di Credito Finanziario S.p.A. (in its capacity as lender) and Société Générale and Banca IMI S.p.A. (as facility agent). |

|

|

|

|

|

99.38 |

|

Shareholders Agreement Amendment dated February 27, 2015, between Telefónica, S.A., Assicurazioni Generali S.p.A., (on its own account and in the name of and on behalf of the following Generali’s subsidiaries Generali Vie, S.A., Alleanza Assicurazioni S.p.A., Generali Italia, S.p.A. Generali Lebensversicherung AG), Intesa Sanpaolo, S.p.A. and Mediobanca — Banca di Credito Finanziario, S.p.A. |

* Previously filed.

12

Exhibit 99.37

To the kind attention of:

Intesa Sanpaolo S.p.A., in its capacity as Lender (as defined below)

Piazza San Carlo n. 156

Torino, Italy

Mediobanca - Banca di Credito Finanziario S.p.A., in its capacity as Lender (as defined below)

Piazzetta Cuccia n. 1

Milan, Italy

Société Générale, Milan branch

Via Olona n. 2

Milan, Italy

Banca IMI S.p.A.

Largo Mattioli n. 3

Milan, Italy

Milan, 27 February 2015

Reference is made to your letter dated 27 February 2015, with which you propose to us the execution of a deed for the termination of the option agreement entered into between us on 27 November 2013, the contents of which we reproduce in full below:

<<

To the kind attention of:

Assicurazioni Generali S.p.A. (for its own account and in the name and on behalf of the Generali Subsidiaries as defined below)

Piazza Duca degli Abruzzi n. 2

Trieste, Italy

Intesa Sanpaolo S.p.A. (in its capacity as Shareholder as defined below)

Direzione Gestione Partecipazioni

Via Monte di Pietà 12

20121 Milano

Mediobanca - Banca di Credito Finanziario S.p.a. (in its capacity as Shareholder as defined below)

Piazzetta Cuccia n. 1

Milan, Italy

Telefonica S.A.

Gran Via n. 28

28013 Madrid, Spain

Milan, 27 February 2015

Dear Sirs,

Following to our conversations, please find attached herebelow our agreement and understanding in relation to the following:

This deed of termination (the “Deed”) is entered into

BY AND BETWEEN

(1) INTESA SANPAOLO S.P.A., a bank incorporated under the laws of the Republic of Italy, whose registered office is at Piazza San Carlo No. 156, Torino, Italy, registered with the Companies’ Registry of Turin under No. 00799960158, in its capacity as lender under the facility agreement entered into on 4th October 2013 with Telco S.p.A. (“Intesa Sanpaolo”),

(2) MEDIOBANCA - BANCA DI CREDITO FINANZIARIO S.P.A., a bank incorporated under the laws of the Republic of Italy, whose registered office is at Piazzetta Cuccia No. 1, Milano, Italy, registered with the Companies’ Registry of Milan under No. 00714490158, in its capacity as lender under the facility agreement entered into 4th October 2013 with Telco S.p.A. (“Mediobanca”);

(3) SOCIÉTÉ GÉNÉRALE, a bank incorporated under the laws of France, with registered office in Paris, Boulevard Haussmann 29, acting through its Milan branch, with its offices at Via Olona 2, Milan, registered with the Companies’ Registry of Milan under number 8011215158, Milan REA number 748666, registered with the Banks Registry of the Bank of Italy under number 4858 (“SG”, and together with Intesa Sanpaolo and Mediobanca hereinafter collectively referred to as the “Lenders”);

(4) BANCA IMI S.P.A., a bank incorporated under the laws of the Republic of Italy, whose registered office is at Largo Mattioli No. 3, Milan, Italy, registered with the Companies’ Registry of Milan under No. 04377700150 (“IMI” or the “Facility Agent”);

AND

(5) TELEFÓNICA, S.A., a Spanish company with registered office at 28013, Madrid, Gran Via n. 28, Spain (“TE”);

(6) ASSICURAZIONI GENERALI S.p.A. (hereinafter “Generali”), an Italian company with registered office at Piazza Duca degli Abruzzi n. 2, Trieste, Italy for its own account and in the name and on behalf of the following Generali’s subsidiaries:

(i) ALLEANZA ASSICURAZIONI S.p.A., an Italian company with registered office at Piazza Fidia n. 1, Milano, Italy;

(ii) GENERALI ITALIA S.p.A., an Italian company with registered office at via Marocchesa n. 14, Mogliano Veneto (TV), Italy;

(iii) GENERALI LEBENSVERSICHERUNG AG, a German company with registered office at Adenauerring 7, 81737 München,Germany;

(iv) GENERALI VIE S.A., a French company with registered office at Paris, Boulevard Hausmann 11, France (hereinafter the entities (i) to (iv) the “Generali Subsidiaries” and together with Generali collectively “AG”);

(7) INTESA SANPAOLO S.p.A, an Italian company with registered office at Piazza San Carlo n. 156, Torino, Italy, in its capacity as shareholder of Telco S.p.A. (“IS”);

(8) MEDIOBANCA S.p.A., an Italian company with registered office at Piazzetta Cuccia n. 1, Milano, Italy, in its capacity as shareholder of Telco S.p.A (“MB”);

- (TE, AG, IS and MB hereinafter collectively referred to as the “Shareholders”);

(the “Parties).

WHEREAS

(A) On 27 November 2013 the Parties have entered into an option agreement (the “Option Agreement”) to which SG subsequently acceded on 31 March 2014 providing, inter alia, for the right of the Shareholders to call and acquire from the Lenders, at the terms and conditions referred to therein, any Telecom Italia S.p.A. ordinary shares that would have been appropriated by the Lenders in case of enforcement of the pledge (the “Share Pledge”) created under and pursuant to the share pledge agreement originally entered into on 27 November 2013 between Telco S.p.A., as pledgor, and the Lenders, as secured creditors (the “Share Pledge Agreement”).

(B) On the date hereof, Telco and the Lenders have entered into a deed of release pursuant to which the Share Pledge has been released and the Share Pledge Agreement terminated.

(C) By virtue of the above, the Parties hereby intend to terminate the Option Agreement and release each other from all their respective obligations thereunder.

NOW, THEREFORE

1. The Parties hereby agree and acknowledge that:

(a) the Option Agreement is terminated and no longer in force between themselves as of the date of execution of this Deed;

(b) as a result of the termination of the Option Agreement each Party is irrevocably and unconditionally discharged and released from any of its obligations thereunder.

2. The Parties agree that this Deed may be disclosed and made public in accordance to applicable laws.

3. This Deed constitutes the entire agreement among the Parties and supersede in full any prior understandings, agreements or representations by or among the Parties, written or oral, with respect to the subject matter hereof.

4. This Deed shall be governed by, and interpreted in accordance with, the laws of the Republic of Italy. Any disputes arising out of or in connection with this Deed shall be submitted by the Parties to the Courts of Milan.

* * * * *

Should you agree with foregoing, please transmit to us a letter containing the above text, duly signed for acceptance.

Best regards,

|

|

|

|

Intesa Sanpaolo S.p.A (in its capacity as Lender) |

|

|

|

|

|

|

|

|

|

|

|

Mediobanca - Banca di Credito Finanziario S.p.A (in its capacity as Lender) |

|

|

|

|

|

|

|

|

|

|

|

Société Générale, Milan Branch |

|

>>

* * *

We hereby notify you of our acceptance of the agreement set out above.

Yours faithfully,

|

|

|

|

Intesa Sanpaolo S.p.A (in its capacity as Shareholder) |

|

|

|

|

|

|

|

|

|

|

|

Mediobanca - Banca di Credito Finanziario S.p.A (in its capacity as Shareholder) |

|

|

|

|

|

|

|

|

|

|

|

Assicurazioni Generali S.p.A. (for its own account and in the name and on behalf of the Generali Subsidiaries) |

|

|

|

|

|

|

|

|

|

|

|

Telefonica S.A. |

|

Exhibit 99.38

AGREEMENT

This agreement (the “Agreement”) is entered into

BY AND BETWEEN

· TELEFÓNICA S.A., a Spanish company with registered office at 28013, Madrid, Gran Via no. 28, Spain, tax code A-28/015865, enrolled with the Registro Mercantil of Madrid, tomo 152 de Sociedades, folio 122, hoja número 5.083, inscripción 1ª (“TE”);

· ASSICURAZIONI GENERALI S.p.A., an Italian company with registered office at Trieste, Piazza Duca degli Abruzzi no. 2, Italy, tax code 00079760328, enrolled with the Register of Italian Insurance and Reinsurance Companies under No. 1.00003 and parent company of the Generali Insurance Group enrolled with the IVASS Register of Groups with the number 026 (“Generali”), on its own behalf and in the name and on behalf of its subsidiaries ALLEANZA ASSICURAZIONI S.p.A., GENERALI ITALIA S.p.A., GENERALI LEBENVERSICHERUNG A.G. and GENERALI VIE S.A. (“Generali Subsidiaries” and, together with Generali, collectively referred to as “AG”);

· INTESA SANPAOLO S.p.A., an Italian company with registered office at Torino, Piazza San Carlo no. 156, Italy, tax code 00799960158, enrolled with the Register of Italian Banks under No. 5361 and parent company of the INTESA SANPAOLO Banking Group, enrolled with the Register of Italian Banking Groups; ABI Code No. 3069.2 (“IS”); and

· MEDIOBANCA S.p.A., an Italian company with registered office at Milan, Piazzetta Cuccia no. 1, Italy, tax code 00714490158, enrolled with the Register of Italian Banks and parent company of the MEDIOBANCA Banking Group, enrolled with the Register of Italian Banking Groups under No. 10631; ABI Code No. 10631.0 (“MB”);

(hereinafter collectively referred to as the “Parties” and, individually, a “Party”)

WHEREAS

A. The Parties jointly own the whole share capital of Telco S.p.A., with registered office at Milan, via Filodrammatici no. 3, Italy, subscribed and paid-in share capital of Euro 295,858,332.00, tax code and registration number with the Companies’ Register of Milan: 05277610969, registration number at R.E.A. of Milan 1809302 (“Telco”) that, at the date hereof, owns 3,003,586,907 ordinary shares of Telecom Italia S.p.A., with registered office at Milan, Piazza degli Affari no. 2, Italy, fiscal code no. 00488410010 (“TI”), equal to approximately 22.3% of the ordinary share capital of TI, according to the proportion represented in the following schedule:

|

Shareholders |

|

no. class A

shares |

|

no° class B

shares |

|

no. class C

shares |

|

no° total

shares |

|

% voting

share capital |

|

% overall

share

capital |

|

|

Telefonica S.A. |

|

|

|

1,234,128,374 |

|

1,557,781,083 |

|

2,791,909,457 |

|

46.2 |

% |

66.0 |

% |

|

Generali Group [composed by Assicurazioni Generali S.p.A., Alleanza Assicurazioni S.p.A., Generali Italia S.p.A., Generali Lebensvericherung A.G. and Generali Vie S. A.] |

|

817,214,961 |

|

|

|

|

|

817,214,961 |

|

30.6 |

% |

19.3 |

% |

|

Intesa Sanpaolo S.p.A. |

|

310,520,713 |

|

|

|

|

|

310,520,713 |

|

11.6 |

% |

7.3 |

% |

|

Mediobanca S.p.A. |

|

310,520,713 |

|

|

|

|

|

310,520,713 |

|

11.6 |

% |

7.3 |

% |

|

Total |

|

1,438,256,387 |

|

1,234,128,374 |

|

1,557,781,083 |

|

4,230,165,844 |

|

100 |

% |

100 |

% |

1

B. Pursuant to art. 11 of the shareholders’ agreement entered into on April 28, 2007, as subsequently renewed, updated and amended (the “Shareholders Agreement”), Generali (also in the name and on behalf of the Generali Subsidiaries), IS and MB delivered a de-merger notice on 16 June 2014, i.e. within the First De-merger Window, requiring the other parties to cause the Final De-merger.

C. Following the de-merger notices under whereas B, the Final De-merger was approved by the Board of Directors of Telco on June 26, 2014 and by the extraordinary shareholders’ meeting of Telco on July 9, 2014.

D. Pursuant to art. 11 of the Shareholders Agreement and in light of the de-merger notices under whereas B, the Shareholders Agreement expires on February 28, 2015, or, if earlier, on the date of effectiveness of the Final De-merger of Telco approved by the Board of Directors of Telco on June 26, 2014 and by the extraordinary shareholders’ meeting of Telco on July 9, 2014.

E. At the date hereof, the completion of the Final De-merger is still subject to the obtainment of the authorizations mentioned in the Final De-merger plan, which have to be achieved prior to the completion of the Final De-merger.

F. In order to align the duration of the Shareholders Agreement to the date of effectiveness of the Final De-merger, the Parties now wish to renew and amend the Shareholders Agreement to extend its duration until the earliest of (i) June 30th, 2015 and (ii) the date of effectiveness of the Final De-merger.

G. At the date hereof, the Parties, Telco and its lenders have entered into certain agreements (i) to reimburse the outstanding indebtedness of Telco through shareholders’ loans and, therefore, (ii) to release the existing pledge over the TI’s shares and (iii) to terminate the option agreement concerning the pledged shares (the “Financing Transactions”).

H. Unless differently provided herein, the terms and expressions used with initials in capital letter in this Agreement shall have the same meaning attributed to them in the Shareholders Agreement as subsequently renewed, updated and amended.

Now, therefore, in consideration of the foregoing premises which are an essential part hereof, the Parties hereby

2

AGREE AND COVENANT

to renew the Shareholders Agreement, providing that it will expire at the earliest of the following dates: (i) June 30th, 2015 or (ii) the date of effectiveness of the Final De-merger.

As a result of the Financing Transactions, all the provisions of the Shareholders Agreement which make reference to the agreements mentioned in whereas G are automatically terminated.

Except as provided for in this Agreement, all other provisions, terms and conditions set forth in the Shareholders’ Agreement shall remain unchanged and are expressly hereby ratified and confirmed by the Parties.

This Agreement will become effective on February 27, 2015.

The Parties shall timely agree upon the content of all the public announcements to be made by each Party upon execution of this Agreement and shall cooperate for the timely performance of all the applicable disclosure requirements in relation thereto, provided that the Parties will remain bound by, and committed to, the confidentiality provisions set forth in Article 10 of the Shareholders Agreement.

No variation of this Agreement shall be valid unless it is in writing and signed by or on behalf of each of the Parties. The expression “variation” shall include any variation, amendment, supplement, deletion or replacement however effected.

The waiver of any right under this Agreement by any Party shall not be construed as a waiver of the same right at a future time or as a waiver of any other right under this Agreement.

This Agreement shall be governed by, and interpreted in accordance with, the laws of the Italian Republic. Any disputes arising out of or in connection with this Agreement shall be submitted by the Parties to arbitration. The venue of the arbitration shall be Milan. The arbitration shall be conducted in English and in accordance with ICC Rules.

* * * * *

|

February 27, 2015 |

|

|

|

|

|

|

|

ASSICURAZIONI GENERALI S.p.A. |

|

MEDIOBANCA S.p.A. |

|

(also in name and on behalf of |

|

|

|

the Generali Subsidiaries) |

|

|

|

Name: |

|

|

Name: |

|

Title: |

|

|

Title: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTESA SANPAOLO S.p.A. |

|

TELEFÓNICA S.A |

|

|

|

|

|

Name: |

|

|

Name: |

|

Title: |

|

|

Title: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

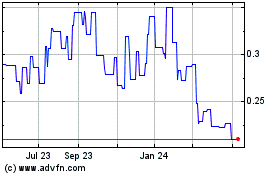

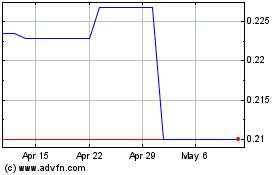

Telcom Italia (PK) (USOTC:TIAOF)

Historical Stock Chart

From May 2024 to Jun 2024

Telcom Italia (PK) (USOTC:TIAOF)

Historical Stock Chart

From Jun 2023 to Jun 2024