Watch Makers Feel Pain -- WSJ

September 15 2016 - 3:03AM

Dow Jones News

Richemont posts lower sales and issues profit warning; rivals

also see global slowdown

By Brian Blackstone in Geneva and Manuela Mesco in Milan

Switzerland's high-end watch industry on Wednesday showed more

signs of buckling under the weight of weaker global growth,

volatile currencies and sluggish tourism in Europe, as the sector

saw its second major profit warning in as many months.

Cie. Financière Richemont SA, the maker of Cartier jewelry and

watches, issued a profit warning as it posted a tumble in sales. In

July, Swatch Group AG -- owner of expensive brands such as Omega,

Blancpain and Breguet in addition to its cheaper plastic watch line

-- reported a 52% plunge in first-half profit.

Luxury brands across Europe have struggled in recent months,

with the trend particularly pronounced in Switzerland, where

companies face the added difficulty of the strong Swiss franc.

Watch exports have plunged in recent months, government and

industry data show.

Reflecting divergence within Europe, Richemont's announcement

came as French luxury rival Hermès International SCA posted a 13%

rise in net profit during the first half of the year, though

management abandoned a 8% annual sales growth target. Hermès watch

sales grew slightly, but were weaker than other product lines,

underscoring the challenges facing sellers of pricey timepieces

when negative interest rates have increased uncertainty about

incomes and the economic outlook.

Shares in Hermès dropped around 7% following the change in sales

outlook, while those in Richemont fell 4%.

Geneva-based Richemont said sales fell 14% for the five months

through August from the same period the previous year. It also said

it expects operating profit for the six months through September to

fall around 45%.

"We are of the view that the current negative environment as a

whole is unlikely to reverse in the short term," the company

said.

Longer term, Richemont is more bullish. Speaking at the

company's annual general meeting at a luxury hotel in Geneva,

Richemont Chairman Johann Rupert said, "We remain convinced of the

long-term prospects for luxury goods globally." The world economy

faces a problem of oversupply in other sectors such as automobiles

in addition to luxury goods, though Richemont is well positioned

with a strong balance sheet and premium brands, Mr. Rupert

said.

Some analysts backed that view, saying sales should reach a

trough later in the year and start to pick up, partly a reflection

of more favorable comparisons with the company's performance in

2015. The watch industry has seen soft patches before only to

bounce back as it did after the global financial crisis.

Others see deeper forces at work that could weigh on the

industry for years.

"We don't expect a V-shaped recovery seen in 2009-2010; instead

we expect a mild growth with Swiss watch exports in absolute value

to record a new high only in [seven] years, after 2020," analysts

at Macquarie Research wrote in a research note last month. "This is

similar to what was seen in the '70s during the Quartz Crisis,"

they said, referring to competition from U.S. and Asian quartz

watches like Seiko four decades ago.

Watchmakers have been hit by a series of shocks in recent years.

Weaker global growth that depresses incomes, an anticorruption

drive in China, terror attacks in shopping hubs such as Paris that

have hurt tourism, and new competitors, particularly makers

smartwatches, have all weighed on demand.

Richemont said sales were down in much of Europe, "particularly

in France, due to a significantly lower level of tourist

activity."

In Asia, sales growth in mainland China and Korea "was more than

offset by the continuing weakness of the Hong Kong and Macau

markets," where the company is buying back inventory, Richemont

said. Sales in Japan declined sharply, in part due to the strong

yen that hurt tourism.

Sales also fell in the Americas, but at a slower rate than in

other regions. They grew in the U.K. after the referendum to leave

the European Union, which weakened the pound.

Hermès sounded a cautious note about its prospects. "There's a

lot of uncertainty," said Chief Executive Axel Dumas, who specified

that the company wanted to remain flexible in terms of forecasts

for the year.

Luca Solca, an analyst at Exane BNP Paribas, said that

abandoning the 8% target for sales growth this year that the

company had given previously was a sign that Hermès's growth would

normalize.

Write to Brian Blackstone at brian.blackstone@wsj.com and

Manuela Mesco at manuela.mesco@wsj.com

(END) Dow Jones Newswires

September 15, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

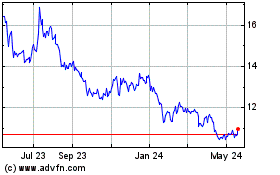

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From May 2024 to Jun 2024

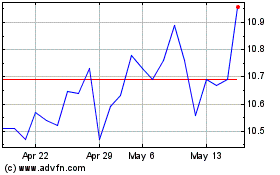

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jun 2023 to Jun 2024