(b) Income Taxes

The cost of investments for federal income tax purposes and related gross unrealized appreciation/(depreciation) and net unrealized

appreciation (depreciation) at July 31, 2013, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Portfolio

|

|

Cost of

Investments

|

|

|

Gross

Unrealized

Appreciation

|

|

|

Gross

Unrealized

Depreciation

|

|

|

Net

Unrealized

Appreciation/

(Depreciation)

|

|

|

Macro Allocation Fund

|

|

$

|

183,084,941

|

|

|

$

|

4,243,119

|

|

|

$

|

2,204,195

|

|

|

$

|

2,038,924

|

|

|

Commodity Strategy Long-Short Fund

|

|

|

15,425,000

|

|

|

|

17,602

|

|

|

|

146,037

|

|

|

|

(128,435

|

)

|

(c) Repurchase Agreements

In a repurchase agreement, a Fund buys a security at one price and at the time of sale, the seller agrees to repurchase the obligation at

a mutually agreed upon time and price (usually within seven days). The repurchase agreement thereby determines the yield during the purchaser’s holding period, while the seller’s obligation to repurchase is secured by the value of the

underlying security. The Advisor will monitor, on an ongoing basis, the value of the underlying securities to ensure that the value always equals or exceeds the repurchase price plus accrued interest. Repurchase agreements could involve certain

risks in the event of a default or insolvency of the other party to the agreement, including possible delays or restrictions upon a Fund’s ability to dispose of the underlying securities. The risk to a Fund is limited to the ability of the

seller to pay the agreed upon sum on the delivery date. In the event of default, a repurchase agreement provides that a Fund is entitled to sell the underlying collateral. The loss, if any, to a Fund will be the difference between the proceeds from

the sale and the repurchase price. However, if bankruptcy proceedings are commenced with respect to the seller of the security, disposition of the collateral by the Fund may be delayed or limited. Although no definitive creditworthiness criteria are

used, the Advisor reviews the creditworthiness of the banks and non-bank dealers with which a Fund enters into repurchase agreements to evaluate those risks. A Fund may, for tax purposes, deem repurchase agreements collateralized by U.S. Government

securities to be investments in U.S. Government securities.

(3) Valuation

(a) Investment Valuation

The market value of domestic equity securities, including exchange-traded funds, is

determined by valuing securities traded on national securities markets or in the over-the-counter markets at the last sale price or, if applicable, the official closing price or, in the absence of a recent sale on the date of determination, the mean between the last reported bid and ask prices.

Investments in mutual funds which are not traded on an exchange are valued at their

respective net asset value per share.

The value of

foreign equity securities is generally determined based upon the last sale price on the foreign exchange or market on which

it is primarily traded and in the currency of that market as of the close of the appropriate exchange or, if there have been

no sales during that day, at the mean between the latest bid and ask prices. The Board of Trustees has determined that the

passage of time between when the foreign exchanges or markets close and when the Funds compute their net asset values could

cause the value of foreign equity securities to no longer be representative or accurate, and as a result, may necessitate that

such securities be fair valued. Accordingly, for foreign equity securities, the Funds may use an independent pricing service to

fair value price the security as of the close of regular trading on the New York Stock Exchange. As a result, a Fund’s value for

a security may be different from the last sale price (or the mean between the latest bid and ask prices).

Fixed-income

securities are generally valued using evaluated prices provided by an independent pricing service. The evaluated prices are

formed using various market inputs that the pricing service believes accurately represent the market value of a security at

a particular point in time. The pricing service determines evaluated prices for fixed-income securities using inputs including,

but not limited to, recent transaction prices, dealer quotes, transaction prices for securities with similar characteristics,

collateral characteristics, credit quality, payment history, liquidity and market conditions.

Option contracts

on securities, currencies and other financial instruments traded on one or more exchanges are valued at their most recent sale

price on the exchange on which they are traded most extensively. Futures contracts (and options and swaps thereon) are valued

at the most recent settlement price on the exchange on which they are traded most extensively. Forward foreign currency contracts

are valued on the basis of the value of the underlying currencies at the prevailing currency exchange rate as supplied by an

independent pricing service.

The total

return swaps in the Macro Allocation Fund are valued by an independent pricing service using simulation

pricing models. These models will value the underlying basket of exchange-traded equity securities within the total

return swap based on readily observable market prices.

CLS’

shares of the Subsidiary are valued at the net asset value per share of the Subsidiary, which is calculated using the same valuation

procedures as CLS. For CLS, the Subsidiary’s investment in the Swap is fair valued based on the calculation of the Index

by the counterparty. The counterparty calculates the Index each index business day at the close of business in London,

which is typically 11:00 AM Eastern Time. The Advisor performs certain daily tests of the Swap value in order to test the

reasonableness of the counterparty’s valuation. In determining the fair value of the Swap, the Advisor, under procedures

approved by the Board of Trustees, will consider whether there have been significant events that have occurred from the close

of business in London when the Swap is valued and the time that the Fund calculates its NAV.

Securities,

and other assets, for which a market price is not available or is deemed unreliable (e.g., securities affected by unusual

or extraordinary events, such as natural disasters or securities affected by market or economic events, such as bankruptcy

filings), or the value of which is affected by a significant valuation event, are valued at a fair value as determined in

good faith by, or under the direction of, the Board of Trustees and in accordance with the Trust’s valuation procedures. The

value of fair valued securities may be different from the last sale price (or the latest bid price), and there is no guarantee

that a fair valued security will be sold at the price at which a Fund is carrying the security.

(b) Fair Valuation Measurements

Fair value is defined as the price that a

Fund would receive upon selling a security in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment. Various inputs are used in determining the value of a Fund’s investments. A three-tier

hierarchy of inputs is used to classify fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad levels listed below:

|

|

•

|

|

Level 1—Quoted prices (unadjusted) in active markets for an identical security.

|

|

|

•

|

|

Level 2—Prices determined using other significant observable inputs. Observable inputs are inputs that other market participants would use in

pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, and others. In addition, other observable inputs such as foreign exchange rates, benchmark securities indices and foreign

futures contracts may be utilized in the valuation of certain foreign securities when significant events occur between the last sale on the foreign securities exchange and the time the net asset value of the Fund is calculated.

|

|

|

•

|

|

Level 3—Prices determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for

example, when there is little or no market activity for an investment) unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in pricing an investment, and would

be based on the best information available.

|

The inputs or methodology used for valuing an investment are

not necessarily an indication of the risk associated with investing in those securities. For example, money market securities are valued using amortized cost, in accordance with rules under the 1940 Act. Generally, amortized cost approximates the

current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2.

Any transfers between Level 1 and Level 2 are disclosed, effective as of the beginning of the period, in the tables below with the reasons for the transfers disclosed in a note to the tables, if

applicable.

A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities

measured at fair value on a recurring basis are as follows.

Exchange-Traded Securities

Securities traded on a national securities exchange (or reported on the NASDAQ national market), including exchange-traded funds, are

stated at the last reported sales price on the day of valuation. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are stated at the last quoted bid price, except for short

positions, for which the last quoted asked price is used. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Fixed Income Securities

Fixed income securities including corporate, convertible and municipal bonds and notes, U.S. government agencies, U.S. treasury obligations, sovereign issues, bank loans, convertible preferred securities

and non-U.S. bonds are normally valued by pricing service providers that use broker dealer quotations, reported trades or valuation estimates from their internal pricing models. The service providers’ internal models use inputs that are

observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar assets. Securities that use similar valuation techniques and observable inputs as described above

are categorized as Level 2 of the fair value hierarchy.

Asset-Backed Securities

Mortgage-related and asset-backed securities are usually issued as separate tranches, or classes, of securities within each deal. These

securities are also normally valued by pricing service providers that use broker dealer quotations or valuation estimates from their internal pricing models. The pricing models for these securities usually consider tranche-level attributes, current

market data, estimated cash flows and market-based yield spreads for each tranche, and incorporates deal collateral performance, as available. Mortgage-related and asset-backed securities that use similar valuation techniques and inputs as described

above are categorized as Level 2 of the fair value hierarchy.

Short-term Investments

Short-term investments having a maturity of 60 days or less at the time of purchase are generally valued at amortized cost, which

approximates fair market value. These investments are categorized as Level 2 of the fair value hierarchy.

Derivative Instruments

Listed derivatives, such as certain options and Futures contracts, that are actively traded are valued based on

quoted prices from the exchange and are categorized in Level 1 of the fair value hierarchy. Over-the-counter (OTC) derivative contracts include forward foreign currency contracts, swap and option contracts related to interest rates, foreign

currencies, credit standing of reference entities, equity prices, or commodity prices. Depending on the product and the terms of the transaction, the fair value of the OTC derivative products can be modeled taking into account the

counterparties’ creditworthiness and using a series of techniques, including simulation models. Many pricing models do not entail material subjectivity because the methodologies employed do not necessitate significant judgments and the pricing

inputs are observed from actively quoted markets, as is the case of interest rate swaps and option contracts. A substantial majority of OTC derivative products valued by a Fund using pricing models fall into this category and are categorized within

Level 2 of the fair value hierarchy.

CLS Swap Contract

The Swap held by the Subsidiary of CLS is fair valued based on the calculation of the Index by the counterparty, Deutsche Bank. The Swap

is not a listed security nor does it actively trade. The fair value is based on inputs which are not readily observable in the market place, primarily of which are the underlying baskets of commodity pools on which the Swap is derived. The Swap also

includes fees from various parties including the exchanges on which the underlying commodity contracts are traded, management and performance fees from the underlying CTAs and counterparty fees. The Swap is categorized within Level 3 of the fair

value hierarchy.

As of July 31, 2013, the hierarchical input levels of securities

in each Portfolio, segregated by security class, are as follows:

|

Investments

in Securities

|

|

Macro

Allocation

|

|

|

Commodity

Strategy

Long/Short

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Level 1—Quoted Prices

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

$

|

1,034,387

|

|

|

|

—

|

|

|

Exchange-Traded Funds

|

|

|

136,321,165

|

|

|

|

—

|

|

|

Purchased Options

|

|

|

1,954,883

|

|

|

|

—

|

|

|

Level 2—Other Significant Observable Inputs

|

|

|

|

|

|

|

|

|

|

Government Securities

|

|

|

18,884,092

|

|

|

|

10,434,058

|

|

|

Asset-Backed Securities

|

|

|

—

|

|

|

|

1,229,770

|

|

|

Corporate Obligations

|

|

|

—

|

|

|

|

1,772,980

|

|

|

Short-term Investments

|

|

|

26,929,338

|

|

|

|

1,859,612

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Level 1—Quoted Prices

|

|

|

|

|

|

|

|

|

|

Exchange-Traded Funds

|

|

|

(11,623,440

|

)

|

|

|

—

|

|

|

Total Investments in Securities

|

|

$

|

173,500,425

|

|

|

$

|

15,296,420

|

|

|

Other Financial Instruments

|

|

Macro

Allocation

|

|

|

Commodity

Strategy

Long/Short

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Level 1—Quoted Prices

|

|

|

|

|

|

|

|

|

|

Futures Contracts

|

|

$

|

2,677,381

|

|

|

|

|

|

|

Level 2—Other Significant Observable Inputs

|

|

|

|

|

|

|

|

|

|

Futures Contracts

|

|

|

1,283,983

|

|

|

|

—

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Level 2—Other Significant Observable Inputs

|

|

|

|

|

|

|

|

|

|

Forward Foreign Currency Contracts

|

|

|

(1,205,929

|

)

|

|

|

—

|

|

|

Swaps

|

|

|

(598,424

|

)

|

|

|

—

|

|

|

Level 3—Significant Unobservable Inputs

|

|

|

|

|

|

|

|

|

|

Total Return Swap

|

|

|

—

|

|

|

|

(507,330

|

)

|

|

Total Other Financial Instruments

|

|

$

|

2,157,011

|

|

|

$

|

(507,330

|

)

|

The

following is a reconciliation of Level 3 securities in the Commodity Strategy Long/Short Fund for which significant unobservable

inputs were used to determine fair value:

|

|

|

|

Market

Value

10/31/2012

|

|

|

|

Notional

Increase

|

|

|

|

Notional

Decrease

|

|

|

|

Change

in

Unrealized

Depreciation

|

|

|

|

Market

Value

7/31/2013

|

|

|

Total Return Swap

|

|

$

|

(215,187

|

)

|

|

$

|

12,432,343

|

|

|

$

|

(3,142,491

|

)

|

|

$

|

(292,143

|

)

|

|

$

|

(507,330

|

)

|

Significant unobservable inputs for

the Swap consist primarily of the performance of the underlying CTAs. For the period ending July 31, 2013, the underlying

CTA performance ranged from -9.03% for the lowest performing CTA and 23.21% for the highest performing CTA. The swap value

will increase or decrease generally in proportion to the weighted average performance of the CTAs.

(4) Short Sales

A Fund

may sell a security it does not own in anticipation of a decline in the fair value of that security. When the Fund sells a security short, it must borrow the security sold short and deliver it to the broker-dealer through which it made the short

sale. A gain, limited to the price at which the Fund sold the security short, or a loss unlimited in size, will be recognized upon the termination of the short sale. The Fund is also subject to the risk that it may be unable to reacquire a security

to terminate a short position except at a price substantially in excess of the price it sold the security short.

(5) Financial Derivative

Instruments

The Funds may use derivative instruments to obtain investment exposures, to maintain liquidity, to provide

hedging, or in anticipation of changes in the composition of its portfolio holdings or as otherwise provided in each Fund’s prospectus.

Derivative

transactions carry counterparty risk as they are based on contracts between

the Fund and the applicable counterparty. For exchange-traded or cleared

derivative contracts, such counterparty risk is limited due to the role of

the exchange or clearinghouse. OTC derivative contracts, however, are exposed

to counterparty risk in the amount of unrealized gains, net of collateral

held, for the duration of the contract. The Funds seek to reduce counterparty

risk in respect of OTC derivatives contracts by only transacting with high

credit-standing counterparties and by regularly monitoring its exposure to

counterparties.

Futures Contracts

A futures contract provides for the future sale

by one party and purchase by another party of a specified amount of a specific financial instrument for a specified price at a designated date, time and place. An index futures contract is an agreement pursuant to which the parties agree to take or

make delivery of an amount of cash equal to the difference between the value of the index at the close of the last trading day of the contract and the price at which the index futures contract was originally written. If the offsetting purchase price

is less than the original sale price, a Fund realizes a gain; if it is more, a Fund realizes a loss. Conversely, if the offsetting sale price is more than the original purchase price, a Fund realizes a gain; if it is less, a Fund realizes a loss.

The transaction costs must also be included in these calculations. There can be no assurance, however,

that a Fund will be able to enter into an offsetting transaction with respect to a particular futures contract at a particular time. If a Fund is not able to enter into an offsetting transaction,

a Fund will continue to be required to maintain the margin deposits on the futures contract.

Upon entering into a futures

contract, a Fund is required to pledge to the broker an amount of cash, U.S. government securities, or other liquid assets equal to a certain percentage of the contract amount (initial margin deposit). Futures contracts are marked to market daily

and an appropriate payable or receivable for the change in value (“variation margin”) is recorded by the Fund. Gains or losses are recognized but not considered realized until the contracts expire or are closed.

Options

The

purchase or sale of an option by the Funds involves the payment or receipt of a premium by the investor and the corresponding right or obligation, as the case may be, either to purchase or sell the underlying security, commodity, or other instrument

for a specific price at a certain time or during a certain period. Purchasing options involves the risk that the underlying instrument will not change price in the manner expected, so the investor loses its premium. Selling options involves

potentially greater risk because the investor is exposed to the extent of the actual price movement in the underlying security rather than only the amount of the premium paid (which could result in a potentially unlimited loss). OTC options also

involve counterparty credit risk.

Forward Foreign Currency Contracts

The Funds may enter into forward foreign currency exchange contracts. When entering into a forward currency contract, the Funds agree to

receive or deliver a fixed quantity of foreign currency for an agreed-upon price on an agreed future date. The Funds’ net equity therein, representing unrealized gain or loss on the contracts as measured by the difference between the forward

foreign exchange rates at the dates of entry into the contracts and the forward rates at the reporting date. These instruments may involve market risk, credit risk, or both kinds of risks in excess of the amount recognized in the Statements of

Assets and Liabilities. Risks arise from the possible inability of counterparties to meet the terms of their contracts and from movement in currency.

Swap Contracts

Swap agreements may include total return, interest

rate, securities index, commodity, security and currency exchange rate swaps. Swap agreements are two-party contracts entered into primarily by institutional investors for periods ranging from a few weeks to several years. In a standard

“swap” transaction, two parties agree to exchange the returns (or differentials in rates of return) earned or realized on particular predetermined investments or instruments. The gross returns to be exchanged or “swapped” between

the parties are calculated with respect to a “notional amount” (i.e., the change in the value of a particular dollar amount invested at a particular interest rate, in a particular foreign currency, or in a “basket” of securities

representing a particular index). Swap agreements are subject to the risk that the counterparty to the swap will default on its obligation to pay the Fund and the risk that the Fund will not be able to meet its obligations to pay the counterparty to

the swap. Swap agreements may also involve fees, commissions or other costs that may reduce the Fund’s gains from a swap agreement or may cause the Fund to lose money.

CLS will gain exposure to the commodities market by investing in a total return swap with Deutsche Bank. The Fund’s returns will be reduced or its losses will be increased by the costs associated

with the Swap, which are the fees deducted by the counterparty in the calculation of the Index. In addition, there is the risk that the Swap may be terminated by the Fund or the counterparty in accordance with its terms or as a result of regulatory

changes. If the Swap were to terminate, the Fund may be unable to implement its investment strategies with respect to commodities investments and the Fund may not be able to seek to achieve its investment objective.

For the CLS Swap no price is paid upon entering into the arrangement nor is any initial margin required to be posted. In the event of

depreciation, the Fund is required to deposit in a segregated account with its custodian an amount equal to the unrealized losses.

Item 2. Controls and Procedures

|

|

(a)

|

The Registrant’s Principal Executive Officer and Principal Financial Officer have concluded that the Registrant’s disclosure controls and procedures are

effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures.

|

|

|

(b)

|

There was no change in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that

occurred during the Registrant’s last fiscal quarter that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

|

Item 3. Exhibits

Separate

certifications for the Registrant’s Principal Executive Officer and Principal Financial Officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached as exhibit

EX-99.CERT.

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

WILLIAM BLAIR FUNDS

|

|

|

|

|

By:

|

|

/s/ Michelle R. Seitz

|

|

|

|

Michelle R. Seitz

President

|

Date: September 25,

2013

Pursuant to the requirements of the Securities and Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and

in the capacities and on the dates indicated.

|

|

|

|

|

By:

|

|

/s/ Michelle R. Seitz

|

|

|

|

Michelle R. Seitz

President

(Principal Executive Officer)

|

Date: September 25, 2013

|

|

|

|

|

By:

|

|

/s/ Colette M. Garavalia

|

|

|

|

Colette M. Garavalia

|

|

|

|

Treasurer (Principal Financial Officer)

|

Date: September 25, 2013

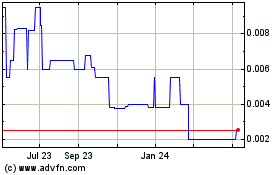

Suggestion Box (PK) (USOTC:SGTB)

Historical Stock Chart

From Apr 2024 to May 2024

Suggestion Box (PK) (USOTC:SGTB)

Historical Stock Chart

From May 2023 to May 2024