Merger of Npower and SSE's Retail Division Could Cause Issues -UK Competition Authority

April 26 2018 - 3:09AM

Dow Jones News

By Carlo Martuscelli

The U.K.'s Competition and Markets Authority said Thursday that

the proposed merger between SSE PLC's (SSEZY) retail division and

Npower could lead to higher bills for customers.

The two companies have until May 3 to respond to the CMA's

statement. If they do not, the CMA will refer the merger for a

phase 2 investigation, it said.

Rivalry between large energy companies--including SSE and

Npower, which is owned by Innogy SE (IGY.XE)--affects how tariffs

are determined, and a lessening of this competition could lead to

higher prices for customers, the CMA said.

"We know that competition in the energy market does not work as

well as it might. However, competition between energy companies

gives them a reason to keep prices down," Rachel Merelie, senior

director at the CMA, said.

Alistair Phillips-Davies, chief executive of SSE, said he was

confident that the proposed merger would benefit both customers and

the energy market as a whole, and said that the company will

demonstrate this to the CMA.

Write to Carlo Martuscelli at carlo.martuscelli@dowjones.com

(END) Dow Jones Newswires

April 26, 2018 02:54 ET (06:54 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

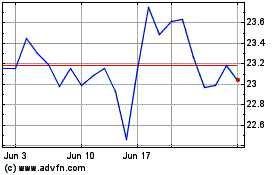

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Oct 2024 to Nov 2024

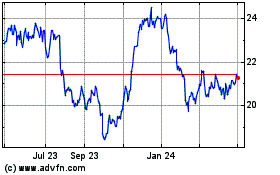

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Nov 2023 to Nov 2024