Innogy Cuts Outlook For 2017, 2018

December 13 2017 - 9:39AM

Dow Jones News

By Euan Conley

Innogy SE (IGY.XE) said Wednesday that it had cut its 2017 and

2018 forecasts, citing the difficult retail environment and the

agreement with SSE PLC (SSE.LN) to create an independent British

energy retail company that will be listed.

Adjusted earnings before interest, taxes, depreciation and

amortization, or Ebitda, for 2017 is now expected to be 4.3 billion

euros ($5.1 billion), down from EUR4.4 billion, the company

said.

Adjusted Ebit is anticipated to be EUR2.8 billion, down from

EUR2.9 billion.

The company attributed the lowered guidance to the difficult

market environment in the U.K. retail business, and said its

restructuring programme wasn't enough to offset negative market

effects.

Innogy also said it expects 2018 adjusted Ebit of EUR2.7

billion.

Part of the reason for the decline from 2017 is because its U.K.

retail business will be classified as a discontinued operation once

the SSE deal is complete. Adjusted net income is also expected to

be lower than in 2017, with the company anticipating a figure of

above EUR1.1 billion.

In November, the company reached an agreement to merge its U.K.

retail business npower with SSE's household energy and energy

services business. If the deal completes, Innogy will hold a 34.4%

stake in the combined business.

The deal is expected to be completed by the last quarter of 2018

or the first quarter of 2019, subject to regulatory and shareholder

approval.

Write to Euan Conley at euan.conley@dowjones.com

(END) Dow Jones Newswires

December 13, 2017 09:24 ET (14:24 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

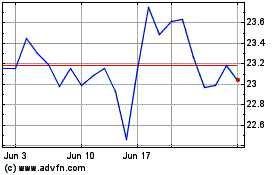

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Oct 2024 to Nov 2024

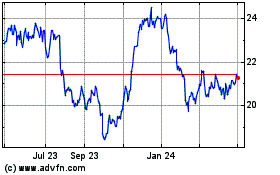

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Nov 2023 to Nov 2024