UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2012

or

☐ TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _____________________ to ___________________________

Commission

file number 33-18099-NY

QUEST

PATENT RESEARCH CORPORATION

(Exact

name of registrant as specified in its charter)

| Delaware |

|

11-2873662 |

(State

or other jurisdiction of

Incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

| 411

Theodore Fremd Ave., Suite 206S, Rye, NY |

|

10580-1411 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (888) 743-7577

Securities

registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or 15(d) of the Act. ☐

Note - Checking the box above will not relieve any registrant required

to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes ☐ No ☒

Indicate

by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405 of this chapter) is

not contained herein, and will not be contained, to the best registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any amendments to this From 10-K. ☒

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer ☐ |

☐ |

Smaller

reporting company |

☒ |

| (Do not check if a smaller reporting company) |

|

|

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

☒

State the

aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at

which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the

registrant’s most recently completed second fiscal quarter. $1,517,285 as of June 30, 2014.

As of

December 15, 2014, the registrant had 263,038,334 shares of common stock outstanding.

TABLE

OF CONTENTS

EXPLANATORY

NOTE

As

used in this annual report, the terms “we,” “us,” “our,” and words of like import, and the

“Company” refers to Quest Patent Research Corporation and its subsidiaries, unless the context indicates otherwise.

This

annual report of Quest Patent Research Corporation covers periods after June 30, 2003. This report covers the fiscal years ended

December 31, 2012, 2011, 2010, 2009, 2008, 2007, 2006, 2005, 2004, and 2003; in lieu of filing separate reports for each of those

years. Included in this Form 10-K are our audited financial statements for the fiscal years ended December 31, 2012, 2011, 2010,

2009, and 2008; unaudited annual statements for the fiscal years ended December 31, 2007, 2006, 2005, 2004 and 2003 (per Rule

3-11 of Regulation S-X: Financial Statements of an Inactive Registrant); as well as quarterly financial information for interim

periods in 2012 and 2011, none of which have been filed with the SEC. Because of the amount of time that has passed since our

last periodic report was filed with the SEC, the information relating to our business and related matters is focused on our more

recent periods. We do not intend to file the Quarterly Reports on Form 10-Q for any of the quarters ended June 30, 2003 through

September 30, 2010. We believe that the filing of this expanded annual report enables us to provide information to

investors in a more efficient manner than separately filing each of the quarterly reports described above. This annual report

should be read together and in connection with the other reports which have been or will be filed by us with the SEC, for a comprehensive

description of our current financial condition and operating results. In the interest of complete and accurate disclosure, we

have included current information in this annual report for all material events and developments that have taken place through

the date of filing of this annual report with the SEC.

FORWARD

LOOKING STATEMENTS

This

Annual Report on Form 10-K contain “forward-looking statements,” within the meaning of the Private Securities Litigation

Reform Act of 1995, all of which are subject to risks and uncertainties. Forward-looking statements can be identified by the use

of words such as “expects,” “plans,” “will,” “forecasts,” “projects,”

“intends,” “estimates,” and other words of similar meaning. One can identify them by the fact that they

do not relate strictly to historical or current facts. These statements are likely to address our growth strategy, financial results

and product and development programs. One must carefully consider any such statement and should understand that many factors could

cause actual results to differ from our forward looking statements. These factors may include inaccurate assumptions and a broad

variety of other risks and uncertainties, including some that are known and some that are not. No forward looking statement can

be guaranteed and actual future results may vary materially.

These

risks and uncertainties, many of which are beyond our control, include, and are not limited to:

| ●

| Our ability

to generate revenue from our intellectual property rights, including our ability to license our intellectual property

rights and our ability to be successful in any litigation which we may commence in order to seek to monetize our intellectual

property rights; |

| | | |

| ●

| Our

ability to acquire intellectual property rights for innovative technologies for which

there is a significant potential market; |

| | | |

| ●

| Our

ability to recoup any investment which we may make to acquire or generate revenue from

intellectual property rights; |

| | | |

| ●

| Our

ability to identify new intellectual property and obtain rights to that property; |

| | | |

| ●

| The

effect of legislation and court decisions on the ability to generate revenue from patent

and other intellectual property rights; |

| ●

| Our

ability to obtain the funding that we require in order to develop our business; |

| ●

| Our

ability to reduce the cost of litigation through contingent fees with counsel or to obtain

third-party financing to enable us to enforce our intellectual property rights through

litigation or otherwise; |

| | | |

| ●

| The

development of a market for our common stock; and |

| | | |

| ●

| Our

ability to retain our key executive officers and identify, hire and retain additional key employees. |

In

addition, factors that could cause or contribute to such differences include, but are not limited to, those discussed in this

Annual Report on Form 10-K, and in particular, the risks discussed under the caption “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” as well as those discussed in other documents

we file with the SEC. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking

statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance

on such forward-looking statements.

Information

regarding market and industry statistics contained in this Annual Report on Form 10-K is included based on information available

to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes

of securities offerings or economic analysis. We have not reviewed or included data from all sources. Forecasts and other forward-looking

information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any

estimates of future market size, revenue and market acceptance of products and services. We do not assume any obligation to update

any forward-looking statement. As a result, investors should not place undue reliance on these forward-looking statements.

Item

1. Business

Overview

We are an intellectual property asset

management company. Our principal operations include the development, acquisition, licensing and enforcement of intellectual property

rights that are either owned or controlled by us or one of our wholly owned subsidiaries. We currently own, control or manage

five intellectual property portfolios, which principally consist of patent rights. As part of our intellectual property asset

management activities and in the ordinary course of our business, it has been necessary for us or the intellectual property owner

who we represent to initiate, and it is likely to continue to be necessary to initiate, patent infringement lawsuits and engage

in patent infringement litigation. We anticipate that our primary source of revenue will come from the grant of licenses to use

our intellectual property, including licenses granted as part of the settlement of patent infringement lawsuits. We also generate

revenue from management fees from managing intellectual property portfolios.

Intellectual

property monetization includes the generation of revenue and proceeds from the licensing of patents, patented technologies and

other intellectual property rights. Patent litigation is often a necessary element of intellectual property monetization

where a patent owner, or a representative of the patent owner, seeks to protect its patent rights against the unlicensed manufacture,

sale, and use of the owner’s patent rights or products which incorporate the owner’s patent rights. In general, we

seek to monetize the bundle of rights granted by the patents through structured licensing and when necessary enforcement of those

rights through litigation.

We

intend to develop our business by acquiring intellectual property rights, either in the form of ownership or an exclusive license

to the underlying intellectual property. Our goal is to enter into agreements with inventors of innovative technologies for which

there may be a significant market for products which use or incorporate the intellectual property. We seek to purchase all of,

or interests in, intellectual property in exchange for cash, securities of our company, the formation or a joint venture or separate

subsidiary in which the owner has an equity interest, and/or interests in the monetization of those assets. Our revenue from this

aspect of our business can be generated through licensing and, when necessary, litigation efforts as well as intellectual property

management fees. We engage in due diligence and a principled risk underwriting process to evaluate the merits and potential value

of any acquisition, partnership or joint venture. We seek to structure the terms of our acquisitions, partnerships and joint ventures

in a manner that will achieve the highest risk-adjusted returns possible.

We

employ a due diligence process before completing the acquisition of an intellectual property interest. We begin with an investment

thesis supporting the potential transaction and then proceed to test the thesis through an examination of the critical drivers

of the value of the underlying intellectual property asset. Such an examination focuses on areas such as title and inventor issues,

the quality of the drafting and prosecution of the intellectual property assets, legal risks inherent in licensing programs generally,

the applicability of the invention to the relevant marketplace and other issues such as the effects of venue and other procedural

issues. However, our financial position may affect our ability to conduct due diligence with respect to intellectual property

rights.

It is frequently necessary to commence

litigation in order to obtain a recovery for past infringement of, or to license the use of, our intellectual property rights.

Intellectual property litigation is very expensive, with no certainty of any recovery. To the extent possible we seek to engage

counsel on a contingent fee or partial contingent fee basis, which would significantly reduce our litigation cost, but which would

reduce the value of the recovery to us. We do not have the resources for us to fund the cost of litigation. To the extent that

we cannot fund litigation ourselves, we may enter into an agreement with a third party, which may be the patent owner or the former

patent owner who transferred the patent rights to us, or an independent third party. In these cases, if a third party funds the

cost of the litigation, that party would be entitled to participate in the recovery.

Our Organization

We

were incorporated in Delaware on July 17, 1987 under the name Phase Out of America Inc. On September 24, 1997, we changed our

name to Quest Products Corporation and, on June 6, 2007, we changed our name to Quest Patent Research Corporation. During 2003,

2004, 2005, 2006 and 2007 there were no significant operations. We have been engaged in the intellectual property monetization

business since 2008. Our executive principal office is located at 411 Theodore Fremd Ave., Suite 206S, Rye, New York 10580-1411,

telephone number is (888) 743-7577. Our website is www.qprc.com. Information contained on our website does not constitute

a part of this annual report.

Our Intellectual

Property Portfolios

Mobile

Data

The

real-time mobile data portfolio relates to the automatic update of information delivered to a mobile device without the need for

a manual refreshing. The portfolio is comprised of U.S. Patent No. 7,194,468 “Apparatus and Method for Supplying Information”

and all related patents, patent applications, and all continuations, continuations-in-part, divisions, extensions, renewals, reissues

and re-examinations relating to all inventions thereof (the “Mobile Data Portfolio”). We initially entered into an

agreement with the patent owner, Worldlink Information Technology Systems Limited, whereby we received the exclusive license to

license and enforce the Mobile Data Portfolio. Under the agreement we received a monthly management fee and a percentage of licensing

revenues. Subsequently Worldlink transferred its remaining interest in the Mobile Data Portfolio to Allied Standard Limited. In

October 2012, we entered into an agreement with Allied pursuant to which Allied transferred its entire right title and interest

in the Mobile Data Portfolio to Quest Licensing Corporation, which was at the time, a wholly-owned subsidiary. Under the agreement

Allied was entitled to receive a 50% interest in Quest Licensing. Quest Licensing’s only intellectual property is the Mobile

Data Portfolio. Our agreement with Allied provides that we and Allied will each receive 50% of the net licensing revenues, as

defined by the agreement. In June 2013, we entered into an agreement with The Betting Service Limited, an entity controlled by

a former director of Worldlink. Pursuant to the agreement, we granted The Betting Service an interest in licensing proceeds from

the Mobile Data Portfolio in return for The Betting Service’s assistance in developing certain Mobile Data Portfolio assets.

In April 2014, we entered into a further agreement with Allied whereby Allied relinquished certain rights under the October 2012

agreement, including its entitlement to a 50% interest in Quest Licensing, in exchange for our commitment to fund a structured

licensing program for the Mobile Data Portfolio.

Financial

Data

The

invention describes a universal financial data system which allows its holder to use the device to access one or more accounts

stored in the memory of the device as a cash payment substitute as well as to keep track of financial and transaction records

and data, such as transaction receipts, in a highly portable package, such as a cellular device (the “Financial Data Portfolio”).

The inventive universal data system is capable of supporting multiple accounts of various types, including but not limited to

credit card accounts, checking/debit accounts, and loyalty accounts. Our wholly-owned subsidiary, Wynn Technologies Inc., acquired

US Patent No. 5,859,419, from the owner, Sol Wynn. In January 2001, we filed a reissue application for the patent, and the United

States Patent and Trademark Office issued patent RE38,137. This reissued patent, which contains 35 separate claims, replaces the

original patent, which had seven claims. In February 2011, we entered into a new agreement with Sol Li (formerly Sol Wynn), pursuant

to which we issued to Mr. Li a 35% interest in Wynn Technologies and warrants to purchase up to 5,000,000 shares of our common

stock at an exercise price of $0.001 per share. We also agreed that Mr. Li would receive 40% of the net licensing revenues generated

by Wynn Technologies with respect to this patent, which is the only patent owned by Wynn Technologies.

Rich

Media

The rich media portfolio is directed

to methods, systems, and processes that permit typical Internet users to design rich-media production content (i.e., rich-media

applications), such as websites. The portfolio consists of U.S. Patent No. 7,000,180, “Methods, Systems, and Processes for

the Design and Creation of Rich Media Applications via the Internet” and all related patents, patent applications, corresponding

foreign patents and foreign patent applications and foreign counterparts, and all continuations, continuations-in-part, divisions,

extensions, renewals, reissues and re-examinations relating to all inventions thereof (the “Rich Media Portfolio”).

In July 2008, we entered into a consulting and licensing program management agreement with Balthaser Online, Inc., the patent owner,

pursuant to which we performed services related to the establishment and management of a licensing program to evaluate and analyze

the relevant market and to obtain licenses for the Rich Media Portfolio in exchange for management fees as well as an irrevocable

entitlement to a distribution of 15% of all proceeds generated by the Rich Media Portfolio for the remaining life of the portfolio

regardless of whether those proceeds are derived from litigation, settlement, licensing or otherwise. Pursuant to this agreement,

we received $150,000 as an advance payment for our services plus $7,500 per month, up to $250,000. Our 15% distribution right is

subject to reduction to 7.5% in the event that we refuse or are unable to perform the services detailed in the agreement.

Online

Marketing, Sweepstakes, Promotions & Rewards (VonKohorn Portfolio)

The

portfolio consists of eleven United States Patents that include patent claims related to, among other areas, online couponing,

print-at-home boarding passes and tickets, online sweepstakes; including the promotion by television networks of online sweepstakes

(the “Von Kohorn Portfolio”). In December 2009, we entered into an agreement with Intertech Holdings, LLC pursuant

to which our wholly-owned subsidiary, Quest NetTech Corporation, acquired by assignment all right, title, and interest in the

Von Kohorn Portfolio. Under the agreement, we will receive 20% of adjusted gross recoveries, as defined. In August 2013, we and

Intertech Holdings amended the December 2009 agreement to provide that Intertech Holdings will receive 33% of the adjusted gross

recoveries and Quest NetTech will receive 67% of adjusted gross recoveries.

Flexible

Packaging - Turtle PakTM

In

March 2008, we entered into an agreement with Emerging Technologies Trust whereby our wholly-owned subsidiary, Quest Packaging

Solutions Corporation, acquired the exclusive license to make, use, sell, offer for sale or sublicense the intellectual property

of Emerging Technologies Trust (the “Turtle Pak™ Portfolio”). The Turtle Pak portfolio relates to a cost effective,

high-protection packaging system recommended for fragile items weighing less than ten pounds. The intellectual property consists

of two U.S. patents, U.S. Patent No. RE36,412 and U.S. Patent No.6,490,844, and the Turtle PakTM trademark. Turtle

Pak™ brand packaging is suited for such uses as electrical and electronic components, medical, dental, and diagnostic equipment,

instrumentation products, and control components. Turtle Pak™ brand packaging materials are 100% curbside recyclable.

Other

Activities

In

August 2008, we were engaged by Juridica Investments Limited, a third-party litigation funding provider, to assist in identifying

and vetting intellectual property claim investment opportunities. We introduced Juridica to Convolve, Inc., a patent holder involved

in asserting its patent rights and desirous of obtaining capital. In consideration for our assistance, we received a fee of $350,000

in 2008.

Monetization

Activities for our Intellectual Property Portfolios

Mobile

Data

In

March 2014, we engaged counsel on a partial contingency fee arrangement and secured funding from a third party to fund legal fees

and litigation expenses in connection with a proposed patent infringement action relating to the Mobile Data Portfolio. Through

December 31, 2013, we did not generate any revenues from the Mobile Data Portfolio.

Universal

Financial Data System

In

August 2010, we entered into a five-year consulting agreement with Alex W. Hart pursuant to which he agreed to serve as a special

consultant to us on the development and commercialization of the Data System Patent. Pursuant to this agreement, we issued Mr.

Hart an option to purchase 5,000,000 shares common stock at a price of $0.001 per share, through December 31, 2015. Through December

31, 2013, we did not generate any revenue from the Data System Patent.

Rich

Media

In

November 2008, Balthaser Online, the patent owner, brought an infringement action in the U.S. District for the Eastern District

of Texas against Network Solutions LLC et al. This action was settled. Through December 31, 2012, we received a total of $400,000

under the agreement with Balthaser Online. We do not anticipate any further payments from the Network Solutions action.

Online

Marketing, Sweepstakes, Promotions & Rewards

In

September 2011, Quest NetTech brought a patent infringement action in the U.S. District Court for the Middle District of Florida

against Valassis Communications, Inc. et al. There were several other defendants in this action, and they settled the action during

2012 and 2013. With respect to each defendant in the action, the parties entered into a mutually agreeable resolution of all claims.

In

September and October 2013, Quest NetTech brought several patent infringement actions against various entities in the U.S. District

for the Eastern District of Texas. These actions have been settled.

In

July 2014, Quest NetTech brought several patent infringement suits against various entities in the U.S. District for the Eastern

District of Texas. These cases are pending. The actions are brought on a partial contingency basis, and Quest NetTech is required

to pay the out-of-pocket disbursements of counsel.

Through December 31, 2011, we generated revenues of approximately $250,000 from

the Von Kohorn Portfolio, and for the year ended December 31, 2012, we generated license fees of approximately $217,500 from this

portfolio. During 2014, we received $295,000.

In

August 2010, Quest NetTech was named as a defendant in a declaratory judgment action filed by Delta Airlines, Inc. in the U.S.

District for the District of Delaware. In September 2011, the parties entered into a mutually agreeable resolution of all claims

in the action, which included the grant of a license to Delta. The license revenues are included in the revenues from the Von

Kohorn Portfolio.

Flexible

Packaging - Turtle PakTM

As

the exclusive licensee and manager of the manufacture and sale of licensed product, we sell products to end users and we outsource

the manufacture and assembly of the product components and coordinate order receipt, fulfillment and invoicing. Revenues from

the TurtlePakTM product sales were approximately $209,000 through December 31, 2011 and approximately $43,000 for the

year ended December 31, 2012. We continue to generate modest revenue from this product.

Competition

We encounter and expect to continue

to encounter competition in the areas of intellectual property acquisitions for the sake of licensure from both private and publicly

traded companies that engage in intellectual property monetization activities. Such competitors and potential competitors include

companies seeking to acquire the same intellectual property assets and intellectual property rights that we may seek to acquire. Entities

such as Acacia Research Corporation, ITUS Corporation, Document Security Systems, Inc., Intellectual Ventures, Wi-LAN, Conversant

IP, VirnetX Holding Corp., Marathon Patent Group, Inc., Network-1 Security Solutions, Round Rock Research LLC, IPvalue Management

Inc., Vringo Inc., Pendrell Corporation and others derive all or a substantial portion of their revenue from patent monetization

activities, and we expect more entities to enter the market. Most of our competitors have longer operating histories and significantly

greater financial resources and personnel than we have.

We

also compete with venture capital firms, strategic corporate buyers and various industry leaders for intellectual property and

technology acquisitions and licensing opportunities. Many of these competitors have more financial and human resources

than our company. In seeking to obtain intellectual property assets or intellectual property rights, we seek to both demonstrate

our understanding of the intellectual property that we are seeking to acquire or license and our ability to monetize their intellectual

property rights. Our weak cash position may impair our ability to negotiate successfully with the intellectual property owners.

Other

companies may develop competing technologies that offer better or less expensive alternatives to intellectual property rights

that we may acquire and/or out-license. Many potential competitors may have significantly greater resources than we

do. The development of technological advances or entirely different approaches could render certain of the technologies

owned or controlled by our operating subsidiaries obsolete and/or uneconomical.

Intellectual

Property Rights

We

have five intellectual property portfolios: mobile data, financial data, rich media, Von Kohorn and Turtle Pak. The following

table sets forth information concerning our patents and other intellectual property. Each

patent or other intellectual property right listed in the table below that has been granted is publicly accessible on the Internet

website of the U.S. Patent and Trademark Office at www.uspto.gov.

| Segment | |

Type | |

Number | |

Title | |

File

Date | |

Issue

/ Publication Date | |

Expiration |

Financial

Data | |

US Patent | |

RE38,137 | |

Programmable Multiple Company Credit Card System | |

01/11/2001 | |

06/10/2003 | |

09/28/2015 |

Mobile

Data | |

US Patent | |

7,194,468 | |

Apparatus and Method for Supplying Information | |

02/09/2001 | |

03/20/2007 | |

02/09/2021 |

Mobile

Data | |

US Application | |

12/617,373 | |

Apparatus and Method for Supplying Information | |

11/12/2009 | |

05/20/2010 | |

N/A |

Mobile

Data | |

US Application | |

13/832,012 | |

Apparatus and Method for Supplying Information | |

03/15/2013 | |

09/05/2013 | |

N/A |

| Von Kohorn | |

US Patent | |

5,128,752 | |

System and method for generating and redeeming tokens | |

10/25/1990 | |

07/07/1992 | |

07/17/2009 |

| Von Kohorn | |

US Patent | |

5,227,874 | |

Method for measuring the effectiveness of stimuli on decisions

of shoppers | |

10/15/1991 | |

07/13/1993 | |

07/13/2010 |

| Von Kohorn | |

US Patent | |

5,249,044 | |

Product information storage, display, and coupon dispensing system | |

07/11/1991 | |

05/11/1993 | |

07/07/2009 |

| Von Kohorn | |

US Patent | |

5,283,734 | |

System and method of communication with authenticated wagering

participation | |

09/19/1991 | |

02/01/1994 | |

09/19/2011 |

| Von Kohorn | |

US Patent | |

5,368,129 | |

Retail facility with couponing | |

07/23/1992 | |

11/29/1994 | |

07/23/2012 |

| Von Kohorn | |

US Patent | |

5,508,731 | |

Generation of enlarged participatory broadcast audience | |

02/25/1993 | |

04/16/1996 | |

04/16/2013 |

| Von Kohorn | |

US Patent | |

5,697,844 | |

System and method for generating and redeeming tokens | |

10/25/1990 | |

07/07/1992 | |

07/17/2009 |

| Von Kohorn | |

US Patent | |

5,713,795 | |

System and method for generating and redeeming tokens | |

10/25/1990 | |

07/07/1992 | |

07/17/2009 |

| Von Kohorn | |

US Patent | |

5,759,101 | |

System and method for generating and redeeming tokens | |

10/25/1990 | |

07/07/1992 | |

07/17/2009 |

| Von Kohorn | |

US Patent | |

5,916,024 | |

System and method of playing games and rewarding successful players | |

12/08/1997 | |

06/29/1999 | |

03/10/2006 |

| Von Kohorn | |

US Patent | |

6,443,840 | |

Evaluation of responses of participatory broadcast audience with

prediction of winning contestants; monitoring, checking and controlling of wagering, and automatic crediting and couponing | |

06/01/1998 | |

09/03/2002 | |

03/10/2006 |

| Turtle Pak | |

US Patent | |

RE36,412 | |

Article Packaging Kit, System, and Method | |

06/18/1996 | |

11/30/1999 | |

06/24/2013 |

| Turtle Pak | |

US Patent | |

6,490,844 | |

Film Wrap Packaging Apparatus and Method | |

06/21/2001 | |

12/10/2002 | |

07/10/2021 |

| Turtle Pak | |

US Trademark | |

74709827 | |

Turtle Pak - design plus words, letters, and/or numbers | |

08/01/1995 | |

06/04/1996 | |

N/A |

| Rich Media | |

Patent Proceeds Interest | |

7,000,180 | |

Methods, Systems, And Processes For The Design And Creation Of

Rich Media Applications Via The Internet | |

02/09/2001 | |

02/14/2006 | |

10/16/2023 |

| Rich Media | |

US Application Proceeds Interest | |

13/314977 | |

Methods, Systems, And Processes For The Design And Creation Of

Rich Media Applications Via The Internet | |

12/08/2011 | |

04/12/2012 | |

N/A |

Research

and Development

Research

and development expense are incurred by us in connection with the evaluation of patents and in the development of a marketing

program. We did not incur research and development expenses during 2012 or 2011. Our research and development expenses, which

related primarily to the marketing program, were $1,000 for 2010, $14,172 for 2009 and $24,747 for 2008.

Employees

As

of October 31, 2014, we have no employees other than our two officers, only one of whom, Mr. Scahill, our chief executive officer

and president, is full time. Our employees are not represented by a labor union, and we consider our employee relations to be

good.

ITEM

1A. RISK FACTORS

An

investment in our common stock involves a high degree of risk. You should carefully consider the risks described below,

together with all of the other information included in this report, before making an investment decision, and you should only

consider an investment in our common stock if you can afford to sustain the loss of your entire investment. If any of the following

risks occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our

common stock could decline, and you may lose all or part of your investment.

Risks

Relating to our Financial Conditions and Operations

We

have a history of losses and are continuing to incur losses. During the period from 2008, when we changed our business to

become an intellectual property management company, through 2012, we generated a cumulative loss of approximately $3,700,000 on

cumulative revenues of approximately $1,463,000. Our total assets were approximately $24,000 at December 31, 2012. At December

31, 2012, we had a working capital deficiency of more than $3,500,000. We had negative working capital from our operations for

both 2012 and 2011, and our continuing losses are generating an increase in our negative working capital. We used approximately

$24,000 in our operations for the year ended 2012. We are continuing to generate losses and negative cash flows, and we cannot

give assurance that we can or will ever operate profitably.

We

require significant funding in order to develop our business. Our business requires substantial funding to evaluate and acquire

intellectual property rights and to develop and implement programs to monetize our intellectual property rights. Our failure to

develop and implement these programs could both jeopardize our relationships under our existing agreements and could inhibit our

ability to generate new business, either through the acquisition of intellectual property rights or through exclusive management

agreements. We cannot be profitable unless we are able to obtain the funding necessary to develop our business. We cannot assure

you that we will be able to obtain necessary funding or to develop our business.

Because

of our lack of funds, we may not be able to conduct adequate due diligence on any new intellectual property which we may seek

to acquire. We currently have nominal current assets and are operating at a loss. In order to evaluate any intellectual property

rights which we may seek to acquire, we need to conduct due diligence on the intellectual property and underlying technology.

To the extent that we are unable to perform the necessary due diligence, we will not be able to value any asset which we acquire,

which may impair our ability to generate revenue from the intellectual property rights. If any conditions occur, such as defects

in the ownership of the intellectual property, infringement on intellectual property rights of others, the existence of better

technology which does not require our intellectual property, or other conditions that affect the value of the patents or marketability

of the underlying intellectual property rights, we may not be able to monetize the patents and we may be subject to liability

to a third party who has rights in the intellectual property.

Any

funding we obtain may result in significant dilution to our shareholders. Because of our financial position, our continuing

losses and our negative working capital from operations, we do not expect that we will be able to obtain any debt financing for

our operations. Our stock price has generally been trading at a price which is less than $0.01 per share for more than the past

two years. As a result, it will be very difficult for us to raise funds in the equity markets. However, in the event that we are

able to raise funds in the equity market, the sale of shares would result in significant dilution to the present shareholders,

and even a modest equity investment could result in the issuance of a very significant number of shares.

We are dependent upon our chief executive

officer. We are dependent upon Jon Scahill, our chief executive officer and president and sole full-time employee, for all

aspects of our business including locating, evaluating and negotiating for intellectual property rights from the owners, managing

our intellectual property portfolios, engaging in licensing activities and monetizing the rights through licensing and managing

and monitoring any litigation with respect to our intellectual property as well as defending any actions by potential licensees

seeking a declaratory judgment that they do not infringe. The loss of Mr. Scahill would materially impair our ability to conduct

our business. Although we have an employment agreement with Mr. Scahill, the employment agreement does not insure that Mr. Scahill

will remain with us.

Risks

Relating to Monetizing our Intellectual Property Rights

We

may not be able to monetize our intellectual property portfolios. Although our business plan is to generate revenue from our

intellectual property portfolios, we have not been successful in generating any significant revenue from our portfolios and we

have not generated any revenues from two of our intellectual property portfolios. We cannot assure you that we will be able to

generate any significant revenue from our existing portfolios or that we will be able to acquire new intellectual property rights

that will generate significant revenue.

If we are not successful in monetizing

our portfolios, we may not be able to continue in business. Although we have ownership of some of our intellectual property,

we also license the rights pursuant to agreements with the owners of the intellectual property. If we are not successful in generating

revenue for those parties who have an interest in the results of our efforts, those parties may seek to renegotiate the terms of

our agreements with them, which could both impair our ability to generate revenue from our intellectual property and make it more

difficult for us to obtain rights to new intellectual property rights. If we continue to be unable to generate revenue from our

existing intellectual property portfolios and any new portfolios we may acquire, we may be unable to continue in business.

Our inability to acquire intellectual property

portfolios will impair our ability to generate revenue and develop our business. We do not have the personnel to develop patentable

technology by ourselves. Thus, we need to depend on acquiring rights to intellectual property and intellectual property portfolios

from third parties. In acquiring intellectual property rights, there are delays in (i) identifying the intellectual property which

we may want to acquire, (ii) negotiating an agreement with the owner or holder of the intellectual property rights, and (iii)

generating revenue from those intellectual property rights which we acquire. During these periods, we will continue to incur expenses

with no assurance that we will generate revenue. We currently hold intellectual property portfolios from which we have not generated

any revenue to date, and we cannot assure you that we will generate revenue from our existing intellectual property portfolios

or any additional intellectual properties which we may acquire.

Because

of our financial condition and our failure to have generated revenues from our existing portfolios, we may not be able to obtain

intellectual property rights to the most advanced technologies. In order to generate meaningful revenues from intellectual

property rights, we need to be able to identify, negotiate rights to and offer technologies for which there is a developing market.

Because of our financial condition and our lack of the generation of any significant revenue from our existing intellectual property

portfolios, we may have difficult in negotiating rights to technology for which there which will be a strong developing market,

or, if we are able to negotiate agreements for such intellectual property, the terms of our purchase or license may not be favorable

to us. Accordingly, we cannot assure you that we will be able to acquire intellectual property rights to the technology for which

there is a strong market demand.

Potential

acquisitions may present risks, and we may be unable to achieve the financial or other goals intended at the time of any potential

acquisition. Our ability to grow depends, in large part, on our ability to acquire interests in intellectual property, including

patented technologies, patent portfolios, or companies holding such patented technologies and patent portfolios. Accordingly,

we intend to engage in acquisitions to expand our intellectual property portfolios and we intend to continue to explore such acquisitions.

Such acquisitions are subject to numerous risks, including the following:

| |

● |

our failure to have sufficient funding to enable us to make the acquisition; |

| |

|

|

| |

● |

our failure to have sufficient personal to satisfy the seller that we have the personnel to monetize the assets we propose to acquire; |

| ●

| dilution

to our stockholders to the extent that we use equity in connection with any acquisition; |

| | | |

| ●

| our

inability to enter into a definitive agreement with respect to any potential acquisition,

or if we are able to enter into such agreement, our inability to consummate the potential

acquisition; |

| ●

| difficulty

integrating the operations, technology and personnel of the acquired entity; |

| | | |

| ● | our

inability to achieve the anticipated financial and other benefits of the specific acquisition; |

| | | |

| | |

| ●

| difficulty

in maintaining controls, procedures and policies during the transition and monetization

process; |

| | | |

| ●

| diversion

of our management’s attention from other business concerns, especially considering

that we have only one full-time employee/officer; and |

| | | |

| ●

| failure

of our due diligence process to identify significant issues, including issues with respect

to patented technologies and intellectual property portfolios, and other legal and financial

contingencies. |

If

we are unable to manage these risks effectively as part of any acquisition, our business could be adversely affected.

Our

acquisition of intellectual property rights may be time consuming, complex and costly, which could adversely affect our operating

results. Acquisitions of patent or other intellectual property assets, which are and will be critical to the development of

our business, are often time consuming, complex and costly to consummate. We may utilize many different transaction structures

in our acquisitions and the terms of such acquisition agreements tend to be heavily negotiated. As a result, we expect to incur

significant operating expenses and may be required to raise capital during the negotiations even if the acquisition is ultimately

not consummated. Even if we are able to acquire particular intellectual property assets, there is no guarantee that we will generate

sufficient revenue related to those intellectual property assets to offset the acquisition costs. We may also identify intellectual

property assets that cost more than we are prepared to spend with our own capital resources. We may incur significant costs to

organize and negotiate a structured acquisition that does not ultimately result in an acquisition of any intellectual property

assets or, if consummated, proves to be unprofitable for us. These higher costs could adversely affect our operating results.

If we acquire technologies that are

in the early stages of market development, we may be unable to monetize the rights we acquire. We may acquire patents, technologies

and other intellectual property rights that are in the early stages of adoption in the commercial, industrial and consumer markets.

Demand for some of these technologies will likely be untested and may be subject to fluctuation based upon the rate at which companies

may adopt our intellectual property in their products and services. As a result, there can be no assurance as to whether technologies

we acquire or develop will have value that we can monetize. It may also be necessary for us to develop additional intellectual

property and file new patent applications as the underlying commercial market evolves, as a result of which we may incur substantial

costs with no assurance that we will ever be able to monetize our intellectual property.

Our

intellectual property monetization cycle is lengthy and costly, and our marketing, legal and sales efforts may be unsuccessful.

We expect to incur significant marketing, legal and sales expenses prior to entering into monetization events that generate revenue

for us. We will also spend considerable resources educating potential licensees on the benefits of entering into an

agreement with us that may include a non-exclusive license for future use of our intellectual property rights. Thus,

we may incur significant losses in any particular period before any associated revenue stream begins. If our efforts to convince

potential licensees of the benefits of a settlement arrangement are unsuccessful, we may need to continue with the litigation

process or other enforcement action to protect our intellectual property rights and to realize revenue from those rights. We

may also need to litigate to enforce the terms of existing agreements, protect our trade secrets, or determine the validity and

scope of the proprietary rights of others. Enforcement proceedings are typically protracted and complex. The costs are typically

substantial, and the outcomes are unpredictable. Enforcement actions will divert our managerial, technical, legal and financial

resources from business operations.

We

may not be successful in obtaining judgments in our favor. We have commenced litigation seeking to monetize our intellectual

property portfolios and it may be necessary for us to commence ligation in the future. All litigation is uncertain, and we cannot

assure you that any litigation will be decided in our favor or that, if damages are awarded or a license is negotiated, that we

will generate any significant revenue from the litigation.

Our

financial condition may cause both intellectual property rights owners and potential licensees to believe that we do not have

the financial resources to commence and prosecute litigation for infringement. Because of our financial condition, both intellectual

property rights owners and potential licensees may believe that we do not have the ability to commence and prosecute sustained

and expensive litigation to protect our intellection rights with the effect that (i) intellectual property rights owners may be

reluctant to grant us rights to their intellectual property and (ii) potential licensees may be less inclined to pay for license

rights from us.

Any patents which may be issued to

us pursuant to patent applications which we filed or may file may fail to give us necessary protection. We cannot be certain

that patents will be issued as a result of any pending or future patent applications, or that any of our patents, once issued,

will provide us with adequate protection from competing products. For example, issued patents may be circumvented or challenged,

declared invalid or unenforceable, or narrowed in scope. In addition, since publication of discoveries in scientific or patent

literature often lags behind actual discoveries, we cannot be certain that we will be the first to make additional new inventions

or to file patent applications covering those inventions. It is also possible that others may have or may obtain issued patents

that could prevent us from commercializing our products or require us to obtain licenses requiring the payment of significant fees

or royalties in order to enable us to conduct our business. As to those patents that we may acquire, our continued rights will

depend on meeting any obligations to the seller and we may be unable to do so. Our failure to obtain or maintain intellectual property

rights for our inventions would lead to the loss of our investments in such activities, which would have a material adverse effect

on us.

The

provisions of Federal Declaratory Judgment Act may affect our ability to monetize our intellectual property. Under the Federal

Declaratory Judgment Act, it is possible for a party who we consider to be infringing upon our intellectual property to commence

an action against us seeking a declaratory judgment that such party is not infringing upon our intellectual property rights. In

such a case, the plaintiff could choose the court in which to bring the action and we would be the defendant in the action. Common

claims for declaratory judgment in patent cases are claims of non-infringement, patent invalidity and unenforceability. Although

the commencement of an action requires a claim or controversy, a court may find a letter from us to the alleged infringer seeking

a royalty for the use of our intellectual property rights to form the basis of a controversy. In such a case, the plaintiff, rather

than we, would choose the court in which to bring the action and the timing of the action. In addition, when we commence an action

as plaintiff, we may be able to enter into a contingent fee arrangement with counsel, it is possible that counsel may be less

willing to accept such an arrangement if we are the defendant. Further, we would not have the opportunity of choosing against

which party to bring the action. An adverse decision in a declaratory judgment action could significantly impair our ability to

monetize the intellectual property rights which are the subject of the litigation. We have been a defendant in one declaratory

judgment action, which resulted in a settlement. We cannot assure you that potential infringers will not be able to use the Declaratory

Judgment Act to reduce our ability to monetize the patents that are the subject of the action.

A

recent Supreme Court decision could significantly impair business method and software patents. In June 2014, the United States

Supreme Court, in Alice v. CLS Bank, struck down patents covering a computer-implemented scheme for mitigating “settlement

risk” by using a third party intermediary, holding the patent claims to be ineligible as being drawn to a patent-ineligible

abstract idea. The courts have been dealing for many years over what business methods are patentable. We cannot predict the extent

to which the decision in Alice as well as prior Supreme Court decisions dealing with patents, will be interpreted by courts.

To the extent that the Supreme Court decision in Alice gives businesses reason to believe that business model and software

patents are not enforceable, it may become more difficult for us to monetize patents which are held to be within the ambit of

the patents before the Supreme Court in Alice and for us to obtain counsel willing to represent us on a contingency basis.

As a result, the decision in Alice could materially impair our ability to obtain patent rights and monetize those which

we do obtain.

Legislation,

regulations or rules related to obtaining patents or enforcing patents could significantly increase our operating costs and decrease

our revenue. We may apply for patents and may spend a significant amount of resources to enforce those patents. If legislation,

regulations or rules are implemented either by Congress, the United States Patent and Trademark Office, or the courts that impact

the patent application process, the patent enforcement process or the rights of patent holders, these changes could negatively

affect our expenses and revenue. For example, new rules regarding the burden of proof in patent enforcement actions could significantly

both increase the cost of our enforcement actions and make it more difficult to sign licenses without litigation, changes in standards

or limitations on liability for patent infringement could negatively impact our revenue derived from such enforcement actions,

and any rules requiring that the losing party pay legal fees of the prevailing party could also significantly increase the cost

of our enforcement actions. United States patent laws were recently amended with the enactment of the Leahy-Smith America Invents

Act, or the America Invents Act, which took effect on March 16, 2013. The America Invents Act includes a number of significant

changes to U.S. patent law. In general, the legislation attempts to address issues surrounding the enforceability of patents and

the increase in patent litigation by, among other things, establishing new procedures for patent litigation. For example, the

America Invents Act changes the way that parties may be joined in patent infringement actions, increasing the likelihood that

such actions will need to be brought against individual parties allegedly infringing by their respective individual actions or

activities. The America Invents Act and its implementation increases the uncertainties and costs surrounding the enforcement of

our patented technologies, which could have a material adverse effect on our business and financial condition. In addition, the

U.S. Department of Justice has conducted reviews of the patent system to evaluate the impact of patent assertion entities on industries

in which those patents relate. It is possible that the findings and recommendations of the Department of Justice could impact

the ability to effectively license and enforce standards-essential patents and could increase the uncertainties and costs surrounding

the enforcement of any such patented technologies.

Proposed

legislation may affect our ability to conduct our business. There are presently pending or proposed a number of laws which,

if enacted, may affect the ability of companies such as us to generate revenue from our intellectual property rights. Typically,

these proposed laws cover legal actions brought by companies which do not manufacture products or supply services but seek to

collect licensing fees based on their intellectual property rights and, if they are not able to enter into a license, to commence

litigation. Although a number of such bills have been proposed in Congress, we do not know which, if any, bills will be enacted

into law or what the provisions will be and, therefore, we cannot predict the effect, if any, that such laws, if passed by Congress

and signed by the president, would provide. However, we cannot assure you that legislation will not be enacted which would impair

our ability to operate by making it more difficult for us to commence litigation against a potential licensee or infringer. To

the extent that an alleged infringer believes that we will not prevail in litigation, it would be more difficult to negotiate

a license agreement without litigation.

The

unpredictability of our revenues may harm our financial condition. Due to the nature of the licensing business and uncertainties

regarding the amount and timing of the receipt of license and other fees from potential infringers, stemming primarily from uncertainties

regarding the outcome of enforcement actions, rates of adoption of our patented technologies, the growth rates of potential licensees

and certain other factors, our revenues, if any, may vary significantly from quarter to quarter, which could make our business

difficult to manage, adversely affect our business and operating results, cause our quarterly results to fall below market expectations

and adversely affect the market price of our common stock.

Our

success depends in part upon our ability to retain the qualified legal counsel to represent us in patent enforcement litigation.

The success of our licensing business may depend upon our ability to retain the qualified legal counsel to prosecute patent infringement

litigation. As our patent enforcement actions increase, it will become more difficult to find the preferred choice for legal counsel

to handle all of our cases because many of these firms may have a conflict of interest that prevents their representation of us

or because they are not willing to represent us on a contingent or partial contingent fee basis.

Our

reliance on representations, warranties and opinions of third parties may expose us to certain material liabilities. From

time to time, we may rely upon the representations and warranties of third parties, including persons claiming ownership of intellectual

property rights, and opinions of purported experts. In certain instances, we may not have the opportunity to independently

investigate and verify the facts upon which such representations, warranties and opinions are made. By relying on these representation,

warranties and opinions, we may be exposed to liability in connection with the licensing and enforcement of intellectual property

and intellectual property rights which could have a material adverse effect on our operating results and financial condition.

In connection

with patent enforcement actions, counterclaims may be brought against us and a court may rule unfavorably in counterclaims which

may expose us and our operating subsidiaries to certain material liabilities. In connection with patent enforcement actions,

it is possible that a defendant may file counterclaims against us or a court may rule that we have violated statutory authority,

regulatory authority, federal rules, local court rules, or governing standards relating to the substantive or procedural aspects

of such enforcement actions. In such event, a court may issue monetary sanctions against us or our operating subsidiaries

or award attorney’s fees and/or expenses to the counterclaiming defendant, which could be material, and if we or our operating

subsidiaries are required to pay such monetary sanctions, attorneys’ fees and/or expenses, such payment could materially

harm our operating results, our financial position and our ability to continue in business.

Trial

judges and juries may find it difficult to understand complex patent enforcement litigation, and as a result, we may need to appeal

adverse decisions by lower courts in order to successfully enforce our patents. It is difficult to predict the outcome of

patent enforcement litigation at the trial level. It is often difficult for juries and trial judges to understand complex, patented

technologies, and, as a result, there is a higher rate of successful appeals in patent enforcement litigation than more standard

business litigation. Regardless of whether we prevail in the trial court, appeals are expensive and time consuming, resulting

in increased costs and delayed revenue, and attorneys may be less likely to represent us in an appeal on a contingency basis especially

if we are seeking to appeal an adverse decision. Although we may diligently pursue enforcement litigation, we cannot predict the

decisions made by juries and trial courts.

More

patent applications are filed each year resulting in longer delays in getting patents issued by the United States Patent and Trademark

Office. We hold a number of pending patents and may file or acquire rights to additional patent applications. We have identified

a trend of increasing patent applications each year, which we believe is resulting in longer delays in obtaining approval of pending

patent applications. The application delays could cause delays in recognizing revenue, if any, from these patents and could cause

us to miss opportunities to license patents before other competing technologies are developed or introduced into the market.

U.S.

Federal courts are becoming more crowded, and as a result, patent enforcement litigation is taking longer. Patent enforcement

actions are almost exclusively prosecuted in federal district courts. Federal trial courts that hear patent enforcement actions

also hear criminal and other civil cases. Criminal cases always take priority over patent enforcement actions. As a result, it

is difficult to predict the length of time it will take to complete an enforcement action. Moreover, we believe there is a trend

in increasing numbers of civil lawsuits and criminal proceedings, and, as a result, we believe that the risk of delays in patent

enforcement actions will have a significant effect on our business in the future unless this trend changes.

Any

reductions in the funding of the United States Patent and Trademark Office could have an adverse impact on the cost of processing

pending patent applications and the value of those pending patent applications. Our primary assets are our patent portfolios,

including pending patent applications before the United States Patent and Trademark Office. The value of our patent portfolios

is dependent upon the issuance of patents in a timely manner, and any reductions in the funding of the United States Patent and

Trademark Office could negatively impact the value of our assets. Further, reductions in funding from Congress could result in

higher patent application filing and maintenance fees charged by the United States Patent and Trademark Office, causing an unexpected

increase in our expenses.

The

rapid development of technology may impair our ability to monetize intellectual property that we own. In order for us to generate

revenue from our intellectual property, we need to offer intellectual property that is used in the manufacture or development

of products. Rapid technological developments have reduced the market for products using less advanced technology. To the extent

that technology develops in a manner in which our intellectual property is not a necessary element or to the extent that others

design around our intellectual property, our ability to license our intellectual property portfolios or successfully prosecute

litigation will be impaired. We cannot assure you that we will have rights to intellectual property for most advanced technology

or that there will be a market for products which require our technology.

The

intellectual property management business is highly competitive. A large number of other companies seek to obtain rights to

new intellectual property and to market existing intellectual property. Most of these companies have significantly both greater

resources that we have and industry contacts which place them in a better position to generate new business. Further, our financial

position, our lack of executive personnel and our inability to generate revenue from our portfolio can be used against us by our

competitors. We cannot assure you that we will be successful in obtaining intellectual property rights to new developing technologies.

As

intellectual property enforcement litigation becomes more prevalent, it may become more difficult for us to voluntarily license

our intellectual property. We believe that the more prevalent intellectual property enforcement actions become, the

more difficult it will be for us to voluntarily license our intellectual property rights. As a result, we may need to increase

the number of our intellectual property enforcement actions to cause infringing companies to license the intellectual property

or pay damages for lost royalties.

Weak

global economic conditions may cause potential licensees to delay entering into licensing agreements, which could prolong our

litigation and adversely affect our financial condition and operating results. Our business depends significantly on strong

economic conditions that would encourage potential licensees to enter into license agreements for our intellectual property

rights. The United States and world economies have recently experienced weak economic conditions. Uncertainty about global economic

conditions poses a risk as businesses may postpone spending in response to tighter credit, negative financial news and declines

in income or asset values. This response could have a material adverse effect on the willingness of parties infringing on our

assets to enter into settlements or other revenue generating agreements voluntarily.

If

we are unable to adequately protect our intellectual property, we may not be able to compete effectively. Our ability

to compete depends in part upon the strength of the intellectual property and intellectual property rights that we own or may

hereafter acquire in our technologies, brands and content and our ability to protect such intellectual property rights. We rely

on a combination of patent and intellectual property laws and agreements to establish and protect our patent, intellectual property

and other proprietary rights. The efforts we take to protect our patents, intellectual property and other proprietary rights may

not be sufficient or effective at stopping unauthorized use of our patents, intellectual property and other proprietary rights.

In addition, effective trademark, patent, copyright and trade secret protection may not be available or cost-effective in every

country in which we have rights. There may be instances where we are not able to protect or utilize our patent and other intellectual

property in a manner that maximizes competitive advantage. If we are unable to protect our patent assets and intellectual property

and other proprietary rights from unauthorized use, the value of those assets may be reduced, which could negatively impact our

business. Our inability to obtain appropriate protections for our intellectual property may also allow competitors to enter our

markets and produce or sell the same or similar products as those covered by our intellectual property rights. In addition, protecting

our intellectual property and intellectual property rights is expensive and diverts our critical and limited managerial resources.

If any of the foregoing were to occur, or if we are otherwise unable to protect our intellectual property and proprietary rights,

our business and financial results could be impaired. If it becomes necessary for us to commence legal proceedings to enforce

our intellectual property rights, the proceedings could be burdensome and expensive. In addition, our intellectual property rights

could be at risk if we are unsuccessful in, or cannot afford to pursue, those proceedings. We also rely on trade secrets and contract

law to protect some of our intellectual property rights. We will enter into confidentiality and invention agreements with our

employees and consultants. Nevertheless, these agreements may not be honored and they may not effectively protect our right to

our un-patented trade secrets and know-how. Moreover, others may independently develop substantially equivalent proprietary information

and techniques or otherwise gain access to our trade secrets and know-how.

Risks

Concerning our Common Stock

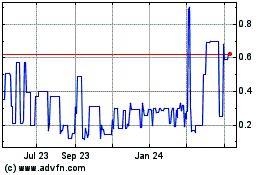

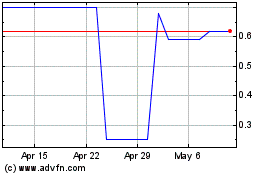

There is a limited market for our

common stock, which may make it difficult for you to sell your stock. Our common stock trades on the Pink OTC Markets, Inc.

under the symbol “QPRC.” There is a limited trading market for our common stock and there are frequently days on which

there is no trading in our common stock. As of December 12, 2014, the last reported sale price was less than $0.01, and, with few

exceptions, the price per share has been less than $0.01 for more than the past two years. Accordingly, there can be no assurance

as to the liquidity of any markets that may develop for our common stock, the ability of holders of our common stock to sell our

common stock, or the prices at which holders may be able to sell our common stock.

Because

our common stock is a penny stock, you may have difficulty selling our common stock in the secondary trading market. Our common

stock fits the definition of a penny stock and therefore is subject to the rules adopted by the SEC regulating broker-dealer practices

in connection with transactions in penny stocks. The SEC rules may have the effect of reducing trading activity in our common

stock making it more difficult for investors to purchase and sell their shares. The SEC’s rules require a broker or

dealer proposing to effect a transaction in a penny stock to deliver the customer a risk disclosure document that provides certain

information prescribed by the SEC, including, but not limited to, the nature and level of risks in the penny stock market.

The broker or dealer must also disclose the aggregate amount of any compensation received or receivable by him in connection with

such transaction prior to consummating the transaction. In addition, the SEC’s rules also require a broker or dealer

to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s

written agreement to the transaction before completion of the transaction. The existence of the SEC’s rules may result

in a lower trading volume of our common stock and lower trading prices. Further, some broker-dealers will not process transactions

in penny stocks.

Our

lack on internal controls over financial reporting may affect the market for and price of our common stock. Our disclosure

controls and our internal controls over financial reporting are not effective. Since we became engaged in the intellectual property

management business in 2008 we have not had the financial resources to develop or implement systems that would provide us with

the necessary information on a timely basis so as to be able to implement financial controls. Our continued financial condition

together with the fact that we have one full time employee makes it difficult for us to implement a system of internal controls

over financial reporting, and we cannot assure you that we will be able to develop and implement the necessary controls. The absence

of internal controls over financial reporting may inhibit investors from purchasing our shares and may make it more difficult

for us to raise debt or equity financing.

Our

lack of a full-time chief financial officer could affect our ability to develop financial controls, which could affect the market

price for our common stock. We do not have a full-time chief financial officer. At present, our chief executive officer, who

does not have an accounting background, is also acting as our chief financial officer. We do not anticipate that we will be able

to hire a qualified chief financial officer until our financial condition has improved significantly. The lack of an experienced

chief financial officer, together with our lack of internal controls, may impair our ability to raise money through a debt or

equity financing, the market for our common stock and our ability to enter into agreements with owners of intellectual property

rights.

Our stock price may be volatile and

your investment in our common stock could suffer a decline in value. As of December 12, 2014, there has only been limited trading

activity in our common stock. There can be no assurance that any significant market will ever develop in our common

stock in the future. The price may fluctuate significantly in response to a number of factors, many of which are beyond

our control. These factors include, but are not limited to, the following, in addition to general market and economic conditions:

| ●

| our

low stock price, which may result in a modest dollar purchase or sale of our common stock

having a disproportionately large effect on the stock price; |

| | | |

| ●

| the

market’s perception as to our ability to generate positive cash flow or earnings

from our intellectual property portfolios; |

| | | |

| ●

| changes

in our or securities analysts’ estimate of our financial performance; |

| | | |

| ●

| our

ability or perceived ability to obtain necessary funding for operations; |

| | | |

| ●

| the

market’s perception of the effects of legislation or court decisions on our business; |

| | | |

| ●

| the

anticipated or actual results of our operations; |

| | | |

| ●

| the

results or anticipated results of litigation by or against us; |

| | | |

| ●

| changes

in market valuations of other intellectual property marketing companies; |

| | | |

| ●

| any

discrepancy between anticipated or projected results and actual results of our operations; |

| ●

| the

market’s perception or our ability to continue to make our filings with the SEC

in a timely manner; |

| ●

| events

or conditions relating to the enforcement of intellectual property rights; |

| ●

| actions

by third parties to either sell or purchase stock in quantities which would have a significant

effect on our stock price; and |

| | | |

| ●

| other

matters not within our control. |

Legislation,

court decisions and other factors affecting enforcement of intellectual property rights may affect the price of our stock.

Court rulings in intellectual property enforcement actions and new legislation or proposed legislation are often difficult to

understand, even when favorable or neutral to the value of our intellectual property rights and our overall business. Investors

and market analysts may react without a full understanding of these matters, causing fluctuations in our stock prices that may

not accurately reflect the impact of court rulings, legislation, proposed legislation or other developments on our business operations

and assets.

Raising

funds by issuing equity or debt securities could dilute the value of the common stock and impose restrictions on our working capital.

If we were to raise additional capital by issuing equity securities, the value of the then outstanding common stock could decline.

If the additional equity securities were issued at a per share price less than the per share value of the outstanding shares,

which is customary in the private placement of equity securities, the holders of the outstanding shares would suffer a dilution

in value with the issuance of such additional shares. Because of the low price of our stock and our working capital deficiency,

the dilution to our stockholders could be significant. We may have difficulty in raising funds through the sale of debt securities