Current Report Filing (8-k)

October 13 2021 - 4:13PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 6, 2021

PUREBASE

CORPORATION

(Exact

name of registrant as specified in charter)

|

Nevada

|

|

000-55517

|

|

27-2060863

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

8625

State Hwy, 124

Ione,

CA 95640

(Address

of principal executive offices)

(855)

743-6478

(Registrant’s

telephone number, including area code)

|

N/A

|

|

(Former

name or former address, if changed since last report)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

None

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

October 6, 2021, Purebase Corporation, a Nevada corporation (the “Company”), entered into an amendment (the “Amendment”)

to its Materials Extraction Agreement, dated May 27, 2021 (the “Agreement”), with US Mine, LLC (“US Mine”), which

Agreement was previously disclosed by the Company in the Current Report on Form 8-K filed with the Securities and Exchange Commission

(“SEC”) on June 3, 2021. Pursuant to the terms of the Agreement, the rights acquired by the Company to extract up to 100,000,000

tons of metakaolin supplementary cementitious materials from property owned by US Mine were paid for by the issuance to US Mine

of a convertible promissory note in the principal amount of $50,000,000 (the “Note”). In accordance with the terms of the

Amendment, the Note was cancelled and the consideration for the mining rights granted to the Company was replaced with an option

entitling US Mine to purchase shares of common stock of the Company.

Pursuant to the terms of the Common Stock Purchase

Option (the “Stock Option”), issued on October 6. 2021, US Mine has the option to purchase up to 116,000,000

shares of common stock of the Company, at an exercise price of $0.38 per share, such exercise price being the closing price of a share

of the Company’s on the OTC Markets on October 6, 2021. The Stock Option vests as to (i) the first 58,000,000 shares

on April 6, 2022, (ii) an additional 29,000,000 shares on October 6, 2022, and (iii) the remaining 29,000,000 shares

on April 6, 2023. US Mine’s right to exercise the Stock Option expires on April 6, 2028.

A.

Scott Dockter, the principal executive officer, and a director and shareholder of the Company, and John Bremer, a director and shareholder

of the Company, are also manager-members of US Mine. The Company’s board of directors approved the transaction described in this

Current Report on Form 8-K (“Report”), with Mr. Dockter and Mr. Bremer abstaining from providing consent due to their interest

in the transaction.

The

foregoing descriptions of the Amendment and Option Agreement do not purport to be complete and are qualified in their entirety by reference

to the complete text of the Amendment and Option Agreement, copies of which are filed with this Report as Exhibits 10.17 and 10.18, respectively,

and incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

Reference

is made to the disclosure set forth under Item 1.01 above, which disclosure is incorporated herein by reference.

The

issuance of the Stock Option was and, upon exercise of the of Stock Option, the issuance of the shares of common stock underlying the

Stock Option will be, exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended, as transactions by an

issuer not involving any public offering.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

Date:

October 13, 2021

|

PUREBASE

CORPORATION

|

|

|

|

|

|

|

By:

|

/s/

A. Scott Dockter

|

|

|

|

A.

Scott Dockter

|

|

|

|

Chief

Executive Officer

|

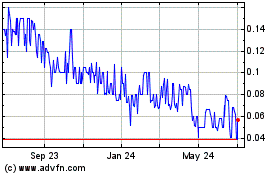

PureBase (PK) (USOTC:PUBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

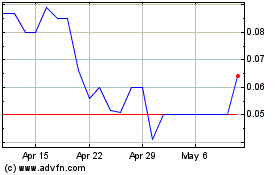

PureBase (PK) (USOTC:PUBC)

Historical Stock Chart

From Apr 2023 to Apr 2024