Filed Pursuant to Rule

424(b)(3)

Registration No. 333-225049

Prospectus Supplement

(to Prospectus dated July 23, 2018)

Jones

Soda Co.

Up to 11,315,000 Shares

of Common Stock

This prospectus supplement

supplements the prospectus, dated July 23, 2018 (the “Prospectus”), which forms a part of our Amendment No. 1 to our

Registration Statement on Form S-3 on Form S-1 (Registration No. 333-225049). This prospectus supplement is being filed to update,

amend and supplement the information included or incorporated by reference in the Prospectus with the information contained in

our current report on Form 8-K, filed with the Securities and Exchange Commission (the “Commission”) on May 9, 2019

(the “Current Report”). Accordingly, we have attached the Current Report (including exhibits) to this prospectus supplement.

The Prospectus

and this prospectus supplement relates to the sale of up to 11,315,000 shares of our common stock which may be resold from time

to time by the selling shareholders identified in the Prospectus. The shares of common stock covered by the Prospectus and this

prospectus supplement

are issuable upon the conversion of a portion or all of the

convertible subordinated promissory notes (the “Convertible Notes”) issued pursuant to that certain Note Purchase Agreement

dated as of March 23, 2018 among the Company and the purchasers of the Convertible Notes

.

We are not selling any common stock under the Prospectus and this prospectus supplement and will not receive any of the proceeds

from the sale or other disposition of shares by the selling shareholders.

This prospectus supplement

should be read in conjunction with the Prospectus. This prospectus supplement updates, amends and supplements the information included

or incorporated by reference in the Prospectus. If there is any inconsistency between the information in the Prospectus and this

prospectus supplement, you should rely on the information in this prospectus supplement.

Our common stock is listed

for quotation on the OTCQB quotation system under the symbol “JSDA.” The last bid price of our common stock on May

8, 2019 was $0.815 per share.

Investing

in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading

“

Risk Factors

” of the Prospectus, and under similar headings in any amendment or

supplements to the Prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus

supplement is May 9, 2019.

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 9, 2019

Jones Soda Co.

(Exact Name of Registrant as Specified in Its Charter)

Washington

(State or Other Jurisdiction of Incorporation)

|

0-28820

|

52-2336602

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

66 South Hanford Street, Suite 150, Seattle, Washington

|

98134

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(206) 624-3357

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not

to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 13(a) of the Exchange Act. [ ]

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

Item 7.01 Regulation FD Disclosure

On May 9, 2019, the shareholders of Jones Soda Co., a Washington

corporation (the “Company”) will have access to the attached slide presentation (the “Slides”) in connection

with the Company’s 2019 Annual Meeting of Shareholders, held at the headquarters of Jones Soda Co. at 66 S. Hanford St.,

Suite 150, Seattle, WA 98134 and via virtual webcast. The Slides are attached hereto as Exhibit 99.1 and incorporated herein by

reference. The Slides may also be used by the Company, in whole or in part, and possibly with modifications, in connection with

presentations to investors, analysts and others commencing May 9, 2019.

By filing this Current Report on Form 8-K and furnishing the

information contained herein, the Company makes no admission as to the materiality of any information in this report that is required

to be disclosed solely by reason of Regulation FD.

The information contained in the Slides is summary information

that is intended to be considered in the context of the Company’s Securities and Exchange Commission filings and other public

announcements. The Company undertakes no duty or obligation to publicly update or revise this information, except as required by

law.

The information in this Current Report on Form 8-K, including

Exhibit 99.1 hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

as amended, or otherwise subject to the liabilities under that section. Furthermore, the information in this Current Report on

Form 8-K, including Exhibit 99.1 hereto, shall not be deemed to be incorporated by reference into the filings of the Company under

the Securities Act of 1933, or the Securities Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

99.1

|

2019 Annual Meeting of Shareholders slide presentation materials made available on May 9, 2019.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

JONES SODA CO.

(Registrant)

|

|

|

|

|

|

|

May 9, 2019

|

|

By:

|

/s/ Jennifer L. Cue

|

|

|

|

|

|

Jennifer L. Cue, President and Chief Executive Officer

|

Exhibit Index

|

Exhibit No.

|

Description

|

|

99.1

|

2019 Annual Meeting of Shareholders slide presentation materials made available on May 9, 2019.

|

Exhibit 99.1

ANNUAL MEETING MAY 9, 2019 66 S. HANFORD ST., STE. 150, SEATTLE, WA 98134

This presentation contains a number of “forward - looking statements” within the meaning of the of the Private Securities Litigati on Reform Act of 1995 that reflect management’s current views and expectations with respect to our business, strategies, products, future results and events, an d f inancial performance. All statements made in this presentation other than statements of historical fact, including statements that address operating performance, the e con omy, events or developments that management expects or anticipates will or may occur in the future, including statements related to case sales, revenues, prof ita bility, distributor channels, new products, adequacy of funds from operations, cash flows and financing, our ability to continue as a going concern, potential strategic tra nsactions, statements regarding future operating results and non - historical information, are forward - looking statements. In particular, the words such as “believe,” “e xpect,” “intend,” “anticipate,” “estimate,” “may,” “will,” “can,” “plan,” “predict,” “could,” “future,” "continue," variations of such words, and similar expressions ide nti fy forward - looking statements, but are not the exclusive means of identifying such statements and their absence does not mean that the statement is not forward - looking. You sh ould not place undue reliance on these forward - looking statements, which are based on management’s current expectations and projections about future events, are not gu arantees of future performance, are subject to risks, uncertainties and assumptions and apply only as of the date of this presentation. Our actual results, perfo rma nce or achievements could differ materially from historical results as well as from the results expressed in, anticipated or implied by these forward - looking statements. Ex cept as required by law, we undertake no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. In particular, our business, including our financial condition and results of operations and our ability to continue as a going concern may be impacted by a number of factors, including, but not limited to, the factors listed in “Item 1A. Risk Factors” in our Annual Report on Form 10 - K for the year ended December 31, 2018 filed w ith the Securities and Exchange Commission (the “SEC”) on March 22, 2019. You are also urged to carefully review and consider the various financial and other disclosures, discussion and analysis made by us in our other reports we file with the Securities and Exchange Commission, including our periodic reports on Forms 10 - Q and current repo rts on Form 8 - K, and those described from time to time in our press releases and other communications, which attempt to advise interested parties of the risks and fa ctors that may affect our business, prospects and results of operations. This presentation may contain discussion of certain non - GAAP financial measures. The most d irectly comparable GAAP measures and reconciliations for non - GAAP measures are available in the earnings release and other documents posted on our website at www.jon essodea.com under “Investor Relations.” SAFE HARBOR LANGUAGE 2

WHO WE ARE • Founded in 1996 as the original national craft soda • We stand for premium craft beverages (no high - fructose corn syrup, made with cane sugar) • Compete in a unique & growing segment of the beverage industry • Asset - light, co - pack model • Strategic initiatives underway – well - positioned to execute our growth plan 3

~$470M ~$490M ~$540M ~$730M 2014 2015 2016 2025E CRAFT SODA MARKET SALES¹ ¹Grand View Research. Craft Soda Market Analysis by Product Type, Target Consumer, Distribution Channel & Segment Forecasts. Nov, 2017. CRAFT SODA – A GROWTH MARKET • Consumer behavior is changing • “Better for you” ingredients pervading food & beverage industries • Traditional consumer soft drinks in decline • Rejecting traditional marketing, look for authenticity • Parallels to craft beer market 4

GLASS BOTTLES STRATEGIC PARTNERS FOUNTAIN LEMONCOCCO OUR BEVERAGE PORTFOLIO 5

GLASS BOTTLES • Cane sugar, premium product • 22 - year legacy • Classic flavors & exclusive Jones offerings (11 Flavors) • 20 - 25% gross margins • Provides cash flow to help fund growth/higher margin initiatives 6

GLASS BOTTLES – NEW FLAVORS • Introduced Jones Ginger Beer and two sugar - free flavors , Strawberry Lime and Cream Soda, in January 2019 • Switching to all natural flavors and colors in core lineup when possible 7

NEW CHAIN ACCOUNTS IN 2019 • Walmart • Safeway/Albertsons • Circle K • QuikTrip 8

FOUNTAIN • Leverage Jones ’ brand recognition & consumer acceptance to offer differentiated fountain experience • Launched in 2015 • Competitive pricing with better ingredients • Target margins >50% • Q1 - 19 sales up 52% year - over - year 9

FOUNTAIN – EARLY ADOPTERS 10 The ~2,000 early adapters (# of locations) (5) (6) (6) (6) (1,500) (20, converting to 140) (2) (6) (15) • Some 2019 Fountain adopters : • Zeeks Pizza (16 locations) • Yesway (150 locations) • Corporate, restaurant, convenience, grocery

LEMONCOCCO • Non - carbonated all - natural blend of Sicilian lemons and coconut, 90 calories total • Launched in 2016 • 1 SKU • Retail chain locations up 400+% since end of 2016 • 40% gross margin target • ~3% of our total revenue in Q1 - 19 • Q1 - 19 revenue up 13% from Q1 - 18 11

LEMONCOCCO – ENHANCEMENTS 12

CHANNEL 2017 2018 Grocery 1,580 1,662 Food Service 93 232 Total 1 1,673 1,894 GROCERY & RETAIL FOOD SERVICE ¹ Strong reorders and consumer traction from existing customers. Total does not include independent accounts. LEMONCOCCO CHAIN LISTINGS 13

STRATEGIC PARTNERS • Launched partnership with 7 - Eleven in 2016, “7 - Select crafted by Jones Soda” • Available in majority of U.S. stores (8,000 total 7 - Eleven locations) • Minimal inventory risk • Target 20% gross margin • Premium shelf & cooler placement without slotting spend • Minimal below - the - line costs, high flow through margins • Unique co - branding and flavor concepts 14

GLASS BOTTLES • Add new chain business as craft segment gains traction • Gradually reduce calories • Enhance portfolio FOUNTAIN • Focus in select geographic regions • Land increasingly larger QSRs and convenience chains • Currently in talks testing with several regional restaurant chains • Grow independent business in N. America LEMONCOCCO • Focus in select markets (NY, Bay Area, Seattle, Montreal) • Gain shelf - space through multipack • Pursue national listings STRATEGIC PARTNERS • Expand existing relationships • Develop new partners OUR GROWTH STRATEGY 15

JENNIFER CUE - CEO & DIRECTOR • July 2012 to present; oversaw complete turnaround of the company • Was COO/CFO from 1995 - 2006 at JSDA • Single largest shareholder in the company STEVE GRESS – EVP SALES • Previously President/CEO of Exclusive Distribution from 2006 - 2015; built Vita Coco in 5 boroughs of NYC before brand moved to Dr. Pepper Snapple Group • Formerly at Big Geyser, was instrumental in building Vitamin Water as well as several other brands ERIC CHASTAIN - CHIEF OPERATING OFFICER • Various operational roles at JSDA since 2001, becoming COO in 2013 • Responsible for buildout of 7 - Eleven piece of business as well as overall Fountain business for JSDA • Directs the operational aspects of contract manufacturing, purchasing, logistics, and product development EXECUTIVE TEAM 16

1. Source: Capital IQ 2. TTM = trailing twelve months as of 3/31/19 3. MRQ = most recent quarter as of 3/31/19 Stock Price $0.79 $0.22/$0.98 52 WEEK LOW/HIGH 270,668 AVG. DAILY VOL. (3 MO.) 41.6M SHARES OUTSTANDING 82.2% PUBLIC FLOAT TRADING DATA @ (5/7/19 ) ¹ Market Cap $33.0M VALUATION MEASURES @ (5/7/19) ¹ Revenue (TTM) 2 $12.5M $(1.8)M ADJ. EBITDA ( TTM ) 2* $(2.4)M NET LOSS ( TTM ) 2 $35.9M ENTERPRISE VALUE 2.9x EV/TTM 2 REVENUE FINANCIAL OVERVIEW @ (3/31/19) STOCK TREND Cash (MRQ) 3 $0.5M $4.5M ASSETS (MRQ) 3 $5.8M LIABILITIES (MRQ) 3 BALANCE SHEET HIGHLIGHTS KEY STATS 17 0 .5M 1.0M 1.5M 2.0M $0.10 $0.30 $0.50 $0.70 $0.90 *The difference between Adjusted EBITDA (a non - GAAP measure) and Net Loss (the most comparable GAAP financial measure) is the ex clusion of interest expense, income tax expense, depreciation & amortization expense and stock - based comp.

• Stabilization and growth of Jones bottle business • Growth of new portfolio initiatives • Prudently managing expenses – executive team on low - salary, equity - driven compensation package STRATEGY HIGHLIGHTS RECENT FINANCIAL HIGHLIGHTS • Fountain revenue grew 52% year - over - year in Q1 - 19 • Lemoncocco revenue grew 13% year - over - year in Q1 - 19 • ~$3.2 million of loan facility available for working capital needs *The difference between Adjusted EBITDA (a non - GAAP measure) and Net Loss (the most comparable GAAP financial measure) is the ex clusion of interest expense, income tax expense, depreciation & amortization expense and stock - based comp. KEY INITIATIVES 18 YTD RESULTS 12/31/2018 Sales $12.6M Gross Profit $2.7M Gross Margin 21.8% Operating Expenses $4.6M Operating (Loss)/Income $(1.8)M Net (Loss)/Income $(2.1)M Adjusted EBITDA* $(1.6)M

KEY TAKEAWAYS • The original national craft soda, broad consumer acceptance • Changing consumer tastes & behavior setup strong market dynamics • Leverage Jones’ national recognition to drive high - margin fountain and bottle growth • Lemoncocco is a completely new, “white space” category • Strategic initiatives underway 19

INDEPENDENT, AUTHENTIC & ALTERNATIVE CRAFT BEVERAGES JONES SODA 66 S. Hanford St., Ste. 150 Seattle, WA 98134 206 - 624 - 3357 www.jonessoda.com INVESTOR RELATIONS Cody Slach 949 - 574 - 3860 JSDA@gatewayir.com 20

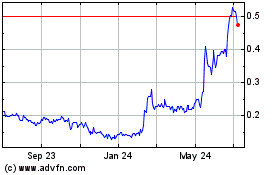

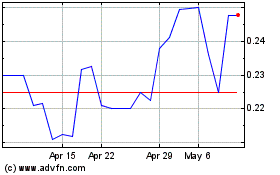

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Apr 2023 to Apr 2024