U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

May 9, 2014

Inrad Optics, Inc.

(Exact name of registrant as specified in

its charter)

| New Jersey |

|

000-11668 |

|

22-2003247 |

(State or other

jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification

Number) |

| |

|

|

|

|

| 181 Legrand Avenue, Northvale, New Jersey |

|

07647 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (201) 767-1910

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure

The Company will commence

mailing of its 2013 Annual Report together with its Proxy Statement to shareholders, on or about May 9, 2014. A copy of the CEO’s

letter included in the Annual Report is attached hereto as Exhibit 99.1 and furnished herewith.

Item 9.01 Financial Statements and Exhibits

| Exhibit 99.1 | CEO’s letter to Shareholders from its 2013

Annual Report. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Date: May 12, 2014 |

|

|

| |

By: |

/s/ William J. Foote |

|

| |

|

CFO, Secretary and Treasurer |

|

Exhibit 99.1

To Our Valued Shareholders, Customers,

Partners

and Employees

As I pause to reflect

on Inrad Optics’ performance in 2013, I see two distinct but inter-woven views of our business. When I view the financial

performance that characterized 2013, we clearly did not meet our expectations. However, when I view the business from an operational

perspective, I see an organization highly engaged in the process of positive transformational growth. My hope for this communication

is to provide an operational connection to the numbers for our shareholders, as well as our customers, partners and employees.

The 2013 financial

results depict the major internal and external drivers that influenced the business during the year. Revenues remained relatively

flat at $11.2 million versus $11.4 million in 2012. Internally, the expenses associated with the necessary restructuring in New

Jersey in Q2 and Q3, and the accrued expenses related to the Sarasota consolidation effort in Q4 reduced our gross profit. When

combined with a decline in orders for metal optics from the defense sector, the result was an operating loss of $1.5 million, and

a basic and diluted loss per share of $0.14. The Company ended the year with cash of $2.5 million, down from $3.1 million at the

end of 2012.

While our revenue remained

relatively flat against the previous year, our bookings in 2013 were considerably more disappointing. The Company ended 2013 with

bookings of $9.8 million, a decrease from $12.3 million or approximately 20% from 2012. Bookings in the fourth quarter of 2013

were $2.5 million. The Company ended 2013 with a backlog of $4.4 million compared to $5.9 million at the end of 2012.

The single hardest

hit area was metal optical components, a subset of our broad optical components category. This product area has traditionally been

defense centric, and suffered from both the U.S. federal government budget sequestration imposed in March of 2013 and a general

decline in orders from legacy defense prime customers. Bookings for this product subset were off approximately 50% from the previous

year.

Some of the more dramatic

decreases in our bookings for 2013 were offset by higher margin orders from new and existing x-ray monochromator customers which

has been a strong area of our business. This success is part of a focused effort by our sales team to replace long-running legacy

programs that have run their course. I am pleased to report the team is stepping up to that challenge.

Operationally, I would

like to share some significant events that occurred in 2013. The cumulative impact of these initiatives, when coupled with ongoing

efforts in 2014, is intended to recalibrate the business for the current and future photonics marketplace:

· In

April, we commissioned our state of the art 96” plasma assist deposition coating chamber. Designed to handle large substrates,

an Inrad Optics core capability, the investment allows us to serve our current large form factor defense and semiconductor optics,

as well positioning us to serve as the leading next generation vertical manufacturer of wafer inspection tool optics.

· In

June, we received our second $500,000 Phase II funding contract for the growth of stilbene from the Department of Homeland Security’s

Domestic Nuclear Detection Office. Stilbene is proving to be a promising organic crystal for radiation detection, specifically

fast neutron detection of special nuclear materials, a serious security threat. We shipped stilbene components to several customers

in 2013, ahead of our product development schedule.

· October

saw the launch of our online product configurator for quick delivery Interferometer Transmission Flats in a variety of sizes and

configurations. This web-based tool provides customers a much faster and more convenient way to order replacement optics for a

common metrology tool. Early results are promising, and opportunities for custom OEM customers resulting from the initiative have

been validated.

· In

November, we announced the plan to consolidate our Sarasota, FL metal optics production facility into our Northvale, NJ facility.

The consolidation is part of a larger strategic effort to improve the company's value proposition to its customers, as well as

improve its financial results. The move will centralize the company's optical problem solving skills, allowing for beneficial cross-pollination

of expertise, including leveraging the Florida metal optics facility's single point diamond turning capability over a broader range

of optical materials. Overall, annual reductions in operational costs are expected to be in the range of $800,000 to $1,000,000

per year starting in the second quarter of 2014.

Our transformational

change efforts continue in earnest in 2014. In 2013, we added to our operational firepower by hiring a highly qualified and determined

VP of Operations and welcoming back a former employee who was previously a successful operations manager in our crystal fabrication

area. We are continuing the trend in 2014 with the hiring of a skilled set of resources for the new metal optics production area,

as well as adding an experienced outside sales manager.

The consolidation of

the Sarasota operation continues in New Jersey, on time and on budget. The team consisting of former Sarasota employees and new

employees is demonstrating ownership of their project, and the energy of the entire Inrad Optics team is a pleasure to see.

Our work with stilbene

and other organic scintillator crystals has provided a clear roadmap for entry into the important radiation detection market. Technical

results continue to be very positive, we are partnered with highly funded research facilities, and the U.S. Department of Homeland

Security continues to advocate for efforts to grow larger forms of stilbene.

Positive transformational

change and growth is never easy, but our marketplace demands it. The challenge ahead is significant. We are executing on this necessary

change, while continuing to work hard at serving our long time customers exceptionally well, and earning the trust and respect

of new ones. We are building a leaner and smarter business, maintaining processes that serve us well and implementing new processes

to replace those that do not. My team and I are energized by the challenge, and I continue to welcome your support on the journey

ahead.

Amy Eskilson

May 9, 2014

About Inrad Optics

Inrad Optics, Inc. was incorporated in

New Jersey in 1973. The Company develops, manufactures and markets products and services for use in photonics industry sectors

via three distinct but complimentary product areas - “Crystals and Devices”, “Custom Optics” and “Metal

Optics.”

The Company is a vertically integrated

organization specializing in crystal-based optical components and devices, custom optical components from both glass and metal,

and precision optical and opto-mechanical assemblies. Manufacturing capabilities include solution and high temperature crystal

growth, extensive optical fabrication capabilities, including precision diamond turning and the ability to handle large substrates,

optical coatings and in-process metrology expertise. Inrad Optics’ customers include leading corporations in the defense,

aerospace, laser systems, process control and metrology sectors of the photonics industry, as well as the U.S. Government, National

Laboratories and Universities worldwide.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995

The statements contained in this press

release that are not purely historical are forward looking statements within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Act of 1934. These statements may be identified by their use of forward-looking terminology

such as "believes", "expects", “should”, "will", "plan", “anticipate”,

“probably”, “targeting” or similar words. Such forward-looking statements, such as our expectation for

revenues, new orders, and improved results involve risks and uncertainties that could cause actual results to differ materially

from those projected. Risks and uncertainties that could cause actual results to differ materially from such forward looking statements

are, but are not limited to, uncertainties in market demand for the company's products or the products of its customers, future

actions by competitors, inability to deliver product on time, inability to develop new business, inability to retain key employees

or hire new employees, and other factors discussed from time to time in the Company's filings with the Securities and Exchange

Commission including our Annual Report on Form 10-K for the year ended December 31, 2011. The forward looking statements made in

this news release are made as of the date hereof and Inrad Optics, Inc. does not assume any obligation to update publicly any forward

looking statement.

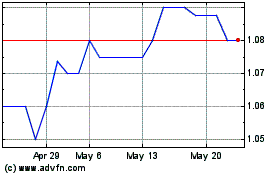

Inrad Optics (PK) (USOTC:INRD)

Historical Stock Chart

From May 2024 to Jun 2024

Inrad Optics (PK) (USOTC:INRD)

Historical Stock Chart

From Jun 2023 to Jun 2024