UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

(Amendment No. )

|

|

|

Check the appropriate box: |

|

|

|

☐ |

|

Preliminary Information Statement |

|

|

|

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

|

|

|

☒ |

|

Definitive Information Statement |

GIGA-TRONICS INCORPORATED

(Name of Registrant As Specified In Its Charter)

|

|

|

|

|

Payment of Filing Fee (Check all boxes that apply): |

|

|

|

|

|

☒ |

|

No fee required. |

|

|

|

|

|

☐ |

|

Fee paid previously with preliminary materials |

|

|

|

|

|

☐ |

|

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A per Item 1 of this Schedule and Exchange Act Rules 14c–5(g) and 0–1 |

GIGA-TRONICS INORPORATED

7272 E. Indian School Road, Suite 540

Scottsdale, AZ 85251

(833) 457-6667

WE ARE NOT ASKING YOU FOR A PROXY OR CONSENT AND

YOU ARE REQUESTED NOT TO SEND US A PROXY OR CONSENT

To our Shareholders:

We are furnishing this notice and the accompanying Information Statement to the holders of shares of common stock, no par value per share, of Giga-tronics Incorporated, a California corporation (the “Company”), for informational purposes only pursuant to Section 14(c) of the Securities Exchange Act of 1934 and the rules and regulations promulgated thereunder.

The purpose of the Information Statement is to notify our shareholders that on October 19, 2023, Ault Alliance, Inc. (“AAI”) the owner of 2,920,085 of the shares of common stock and 514.8 shares of the Series F Convertible Redeemable Preferred Stock which is entitled to vote3,960,043 shares on an as converted basis executed a written consent in lieu of a special meeting of shareholders (the “Majority Shareholder Consent”) which is described below. AAI has a total of 6,880,128 votes of our outstanding voting power of 9,891,645 shares representing approximately 69.6% of the voting power, The Majority Shareholder Consent approved (A) an amendment to our Articles of Incorporation (the “Amendment”) to change the name of the Company from Giga-tronics Incorporated to Gresham Worldwide, Inc. and (B) a proposal to change the state of incorporation of the Company from California to Delaware in each instance subject to the approval of the Financial Industry Regulatory Authority.

PLEASE NOTE THAT THIS IS NOT A NOTICE OF A MEETING OF SHAREHOLDERS AND NO SHAREHOLDERS MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED HEREIN.

|

|

|

|

Sincerely |

|

|

|

/s/ Jonathan Read |

November 6, 2023 |

Name: |

Jonathan Read |

Scottsdale, AZ |

Title: |

Chief Executive Officer |

GIGA-TRONICS INORPORATED

7272 E. Indian School Road, Suite 540

Scottsdale, AZ 85251

(833) 457-6667

__________________________________

INFORMATION STATEMENT PURSUANT TO SECTION 14(c)

OF THE SECURITIES EXCHANGE ACT OF 1934

__________________________________

WE ARE NOT ASKING YOU FOR A

PROXY OR CONSENT AND YOU ARE REQUESTED NOT TO SEND US A PROXY OR CONSENT

GENERAL

This Information Statement is being mailed on or about November 9, 2023 to the holders of record at the close of business on October 27, 2022 (the “Record Date”) for shareholders of Giga-tronics Incorporated, a California corporation, entitled to notice in connection with the adoption of a proposal to change our name to Gresham Worldwide, Inc. ( the “Amendment for the Name Change”) and the approval of our reincorporating in Delaware (the “Delaware Reincorporation”) subject to Financial Industry Regulatory Authority (“FINRA”). On October 19, 2023, Ault Alliance, Inc. (“AAI”), the owner of 2,920,085 of the shares of common stock and 514.8 shares of the Series F Convertible Redeemable Preferred Stock (the “Series F”) which is entitled to vote 3,960,043 shares on an as converted basis executed a written consent in lieu of a special meeting of shareholders (the “Majority Shareholder Consent”) approving the Amendment for the Name Change and the Delaware Reincorporation.

AAI is entitled to 6,880,128 votes out of total voting power of 9,891,645 votes (the “Voting Power”) or approximately 69.6% of the Voting Power. The elimination of the need for a special meeting of shareholders to approve this action is made possible by California Corporations Code Section 603. We refer to the California Corporations Code as the “CGCL” where Section 603 provides that any action to be taken at an annual or special meeting of shareholders may be taken without a meeting, without prior notice, and without a vote, if the action is taken by the holders of outstanding stock of each voting group entitled to vote thereon having not less than the minimum number of votes with respect to each voting group that would be necessary to authorize or take such action at a meeting at which all voting groups and shares entitled to vote thereon were present and voted. The Voting Power held by AAI which is our majority shareholder on the Record Date represents approximately 69.6% of our Voting Power and was sufficient to approve the Amendment for the Name Change and the Delaware Reincorporation. Our Board of Directors (the “Board”) will not solicit any proxies or consents from any other shareholders in connection with this action.

This Information Statement is being distributed pursuant to the requirements of Section 14(c) of the Securities Exchange Act of 1934 (the “Exchange Act”) to our shareholders of record

1

on the Record Date. This Information Statement is being mailed on or about November 9, 2023 to shareholders of record on the Record Date who did not execute the Majority Shareholder Consent. This Information Statement also constitutes notice under Section 603(c) of the CGCL that the corporate actions were taken by the written consent of the majority shareholder.

The entire cost of furnishing this Information Statement will be borne by us. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our common stock held of record by them, and will reimburse such persons for their reasonable charges and expenses in connection therewith.

INTERESTS OF CERTAIN PERSONS

Except for providing some limited liability protection for our officers with respect to the Delaware Reincorporation, our officers and directors do not have any substantial interest in the matters acted upon pursuant to the Majority Shareholder Consent.

2

AMENDMENT TO OUR ARTICLES OF INCORPORATION TO

CHANGE THE NAME OF THE COMPANY

Overview of the Name Change

On September 28, 2023, our Board unanimously approved, subject to shareholder approval, an amendment to our Articles to change the name of the Company from Giga-tronics Incorporated to Gresham Worldwide, Inc. On October 19, 2023, our majority shareholder who owns approximately 69.6% of the Voting Power, executed the Majority Shareholder Consent approving the Amendment for the Name Change. Our Board set the Record Date of October 27, 2023 to determine shareholders of record that are entitled to receive this Information Statement. Pending FINRA approval, our name on Over-The-Counter Markets will remain as Giga-Tronics Incorporated and our trading symbol will remain as GIGA. There can be no assurance as to if and when such FINRA approval will be obtained. In connection with a prior attempt to obtain such FINRA approval, we were unable to obtain such approval as a result of circumstances beyond the Company’s control that did not relate to the business, management and financial condition of the Company.

The timing of the completion of the Name Change will be determined by the Board. In order to reincorporate in Delaware, we will form a Delaware subsidiary and will merge the Company into it with the subsidiary being the surviving corporation.

The text of the proposed amendment to the Articles implementing the Name Change, which we refer to as the “Name Change Amendment” is as follows:

Article I of the Articles of Incorporation is hereby amended to read as follows:

“The name of this corporation is Gresham Worldwide, Inc.”

The Reasons for the Name Change

We are proposing to change our name in order to more closely align our corporate name with our brand. As noted above, pending reincorporation in Delaware, the Company has complied with the fictitious name laws of Arizona and California and has been doing business as Gresham Worldwide. The vast majority of our revenues come from our Gresham Holdings, Inc. subsidiary and its subsidiaries. The Board believes that the new Company name is in the best interest of shareholders since it can provide the Company with a more appropriate identification which will benefit the Company’s future business development. The Board believes that it would be advantageous to complete the name change as soon as possible so as to clearly establish and grow its brand to its customers and potential strategic partners.

Effect on our Outstanding Stock

You will receive one share of common stock of Gresham Worldwide, Inc. in exchange for each existing share of common stock. However, you need not exchange your certificate(s) at any

3

particular time. We will record the change on our records and will contact you if exchanging certificates becomes required for any reason. A new CUSIP number will be assigned to the outstanding shares of common stock following the effectiveness of the Name Change. Stock certificates bearing the Giga-tronics Incorporated name and the old CUSIP number of the outstanding common stock will continue to be honored. You do not have dissenters or appraisal rights, or the right to receive cash instead of stock if you oppose the Name Change.

The trading symbol for our common stock will remain “GIGA” until the OTCQB and FINRA each approve a change. Our common stock will continue to be listed on the OTCQB. We expect no interruption in trading.

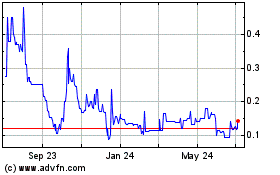

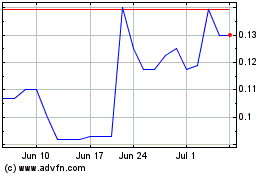

We cannot predict whether the stock price for our common stock will increase, remain the same or decrease if and when the Name Change is completed. We do not expect the Name Change to have any direct effect on the market price of our stock.

DELAWARE REINCORPORATION

Overview of the Proposed Reincorporation

On September 28, 2023, our Board unanimously approved, subject to shareholder approval, a proposal to change the state of incorporation of the Company from California to Delaware (the “Delaware Reincorporation”). On October 19, 2023, our majority shareholder who owns approximately 69.6% of the Voting Power, executed the Majority Shareholder Consent approving the Delaware Reincorporation. Our Board set the Record Date of October 27, 2023 to determine shareholders of record that are entitled to receive this Information Statement.

The Delaware Reincorporation will be implemented through the merger of the Company with and into a wholly-owned subsidiary corporation incorporated in the State of Delaware which will be named Gresham Worldwide, Inc. (the “Merger”). Subject to approval by FINRA , our name following the Delaware Reincorporation will be Gresham Worldwide, Inc. There can be no assurance as to if and when such FINRA approval will be obtained. In connection with a prior attempt to obtain such FINRA approval, we were unable to obtain such approval as a result of circumstances beyond the Company’s control that did not relate to the business, management and financial condition of the Company. Assuming we obtain FINRA approval, we will file the appropriate Merger documents with the Secretary of State of California and Delaware.

Pending reincorporation in Delaware, the Company has complied with the fictitious name laws of Arizona and California and has been doing business as Gresham Worldwide.

For purposes of the discussion below, the Company as it currently exists as a corporation organized under the laws of the State of California is sometimes referred to as “Giga-tronics — California.”

The Board considered several factors in reaching this decision to approve the Delaware Reincorporation such as corporate governance, our ability to attract and retain board members,

4

certain differences between California and Delaware state corporate laws, and other advantages and disadvantages of the Delaware Reincorporation.

The Board believes that the choice of state domicile is important because state corporate law governs the internal affairs of a corporation. Management and boards of directors of corporations look to state corporate law and judicial interpretations of state law to guide their decision-making on many key issues, including appropriate governance policies and procedures, satisfaction of fiduciary obligations to shareholders, compliance with financial and legal requirements in the corporation’s business operations, and consideration of key strategic transactions for the corporation, including financings, mergers, acquisitions and divestitures. The Company is in preliminary discussions exploring such a potential strategic transaction and believes that it would be advantageous to complete the Delaware Reincorporation as soon as possible.

The Board believes that it is important for the Company to be able to draw upon the well-established principles of corporate governance of Delaware law in making legal and business decisions while helping to preserve the shareholder rights that our shareholders are accustomed to, in the interest of maximizing long-term shareholder value. The prominence, breadth, depth and predictability of Delaware corporate law, including its extensive body of case law, provide a reliable foundation on which governance decisions can be based, and the Board believes that our shareholders will benefit from the responsiveness of Delaware corporate law to their needs. After careful consideration, the Board believes that it is in the best interests of the Company and its shareholders to complete the Delaware Reincorporation.

The timing of the completion of the Delaware Reincorporation and the related Name Change will be determined by the Board. In order to reincorporate in Delaware, we will form a Delaware subsidiary and will merge the Company into it with the subsidiary being the surviving corporation.

Shareholders are urged to read this proposal carefully, including all of the related appendices attached to this Schedule 14C. The following discussion summarizes material provisions of the Delaware Reincorporation and is subject to and qualified in its entirety by the Merger Agreement in substantially the form attached hereto as Annex A (the “Reincorporation Agreement”), the Delaware Certificate of Incorporation in substantially the form attached hereto as Annex B; and the Delaware Bylaws in substantially the form attached hereto as Annex C. Prior to the consummation of the Delaware Reincorporation, the Company will file the Delaware Certificate of Incorporation and the Delaware Certificate of Designation, Preference and Rights (the “Certificate of Designation”) of the Series A Convertible Preferred Stock (the “Series A”) with the Secretary of State of the State of Delaware, substantially in the form attached as Annex D. The Certificate of Designation for the Series A will be substantially similar to the Certificate of Determination with respect to the Series F other than changes to conform the comparable provisions under California law to the applicable provisions under Delaware law. Copies of our current California Articles and California Bylaws have been filed with the SEC as exhibits to our periodic or current reports and will be sent to shareholders free of charge upon written request to:

5

Giga-tronics Incorporated

7272 E. Indian School Road, Suite 540

Scottsdale, AZ 85251

Attention: Investor Relations

Phone Number; (833) 457-6667

E-mail Address: lhenckels@gigatronics.com

Structure of the Delaware Reincorporation

To accomplish the Delaware Reincorporation, we will incorporate a subsidiary as a Delaware corporation under Delaware law. We refer to this new subsidiary that will be named Gresham Worldwide, Inc. as Giga-tronics-Delaware in this Schedule 14C. Giga-tronics-California will then merge with and into Giga-tronics-Delaware under the terms of an Agreement and Plan of Merger between Giga-tronics-California and Giga-tronics-Delaware, which we refer to as the “Reincorporation Agreement.” Giga-tronics-Delaware will be the survivor in the Merger, and shares of Giga-tronics-California common stock will convert to Giga-tronics-Delaware common stock on a one-for-one basis.

The proposed Reincorporation Agreement is included as Annex A. Forms of the Giga-tronics-Delaware’s Delaware Certificate of Incorporation and Delaware Bylaws are included as Annex B and Annex C of this Schedule 14C. The form of Certificate of Designation is included as Annex D. Please read these documents in full rather than relying on any summary or description of their terms.

Impact on Our Business

Giga-tronics-Delaware will carry on our business as before, with all of the same directors, officers, employees and properties. We will not move any employees or operations to Delaware. In general the Delaware Reincorporation itself is not expected to change our business, management, fiscal year, assets or liabilities or location of our facilities, which we expect will be the same immediately after the Delaware Reincorporation is completed as immediately before it is completed.

Other Aspects of the Delaware Reincorporation

In connection with the Delaware Reincorporation proposal, the Merger has three key components:

|

|

|

|

|

• |

|

the Delaware Certificate of Incorporation, Certificate of Designation and the Bylaws of Giga-tronics-Delaware; |

|

|

|

|

|

• |

|

the Reincorporation Agreement between Giga-tronics-California and Giga-tronics-Delaware; and |

|

|

|

|

|

• |

|

Giga-tronics-Delaware’s assumption of Giga-tronics’ benefit plans and equity incentive plans under which grants of equity securities including rights and options may be made. |

6

No Tax or Accounting Effects

Giga-tronics-Delaware will inherit Giga-tronics-California’s tax and financial history and attributes. We believe you will not recognize any gain or loss on your shares because of the Delaware Reincorporation.

Effect on our Outstanding Stock

You will receive one share of common stock of Giga-tronics-Delaware in exchange for each existing share of common stock. However, you need not exchange your certificate(s) at any particular time. We will record the change on our records and will contact you if exchanging certificates becomes required for any reason. You do not have dissenters or appraisal rights, or the right to receive cash instead of stock if you oppose the reincorporation.

The trading symbol for our common stock will remain “GIGA” until we receive FINRA approval of the Delaware Reincorporation and the OTCQB approves a change. Our common stock will continue to be listed on the OTCQB. We expect no interruption in trading.

We cannot predict whether the stock price for our common stock will increase, remain the same or decrease if and when the Delaware Reincorporation is completed. We do not expect the reincorporation to have any direct effect on the market price of our stock.

The Reasons for Reincorporating in Delaware

The Board considered many factors in deciding to approve and recommend the reincorporation. Its principal reasons were:

|

|

|

|

|

• |

|

Delaware has a modern and flexible corporation law. |

|

|

|

|

|

• |

|

Delaware’s legislature is responsive to business needs and often adopts amendments to the law to address newly perceived problems promptly. |

|

|

|

|

|

• |

|

Delaware has courts devoted exclusively to corporate law issues. As a result, the corporate legal system tends to be more efficient and predictable than other states. |

|

|

|

|

|

• |

|

More large corporations are incorporated in Delaware than in any other state, and Delaware has the most extensive case law on corporate issues. This body of case law provides corporations, their boards of directors and advisers greater certainty about the application of law to particular facts and circumstances (e.g., enforceability of a shareholder rights plan and the obligations of directors in responding to an acquisition proposal). We would like to have the benefit of this greater certainty. |

|

|

|

|

|

• |

|

Delaware law on elimination of director and officer liability and indemnification of corporate agents provides more assurance for persons acting in these roles than does the law of other states. As a result, qualified persons may be more willing to serve in those |

7

|

|

|

|

|

|

|

roles for a Delaware corporation than for a corporation incorporated in California or another state. |

We believe that the factors listed above will improve the Board’s ability to manage the Company for the benefit of all shareholders. We previously sought FINRA approval but did not obtain such approval. That prior attempt also included a proposed reverse stock split which we are not again seeking to effectuate. We do not know if the proposed reverse split had any impact on FINRA’s position.

Impacts on Rights of Shareholders

As a California corporation, the rights of shareholders and the duties of the Board are governed by the CGCL, our Articles and our Bylaws. After the Delaware Reincorporation, the rights of shareholders and the duties of the Board will instead be governed by the Delaware General Corporation Law, or DGCL, the Delaware Certificate of Incorporation and the Delaware Bylaws. California corporate law and Delaware corporate law are similar in many respects with respect to the rights of shareholders but have some differences. In addition, the proposed Delaware Certificate of Incorporation and Bylaws of Giga-tronics — Delaware varies in certain respects from the existing Articles and Bylaws of Giga-tronics — California. See the questions and answers below for a discussion of some of the differences. The changes in your rights are described in more detail in the sections below entitled “Significant Differences the Charters and Bylaws of Giga-tronics — California and Giga-tronics — Delaware and Between the Corporation Laws of California and Delaware.”

Opt Out of Delaware General Corporation Law Section 203

Section 203 of the DGCL restricts certain “business combinations” with certain “interested shareholders” for three years following the date that a person becomes an interested shareholder, unless the Board and two-thirds of the remaining shareholders approve the business combination. For purposes of Section 203, an interested shareholder is one that acquires 15% or more of a corporation’s outstanding voting shares. A Delaware corporation may elect not to be governed by this law.

In the Delaware Reincorporation, Giga-tronics — Delaware would elect to not apply to Giga-tronics Section 203 of the DGLC, so Section 203’s restrictions would not apply to us after the Delaware Reincorporation.

At present, other than AAI we have no 15% shareholders because of beneficial ownership limitations in convertible notes and warrants.

How Does the Proposed Delaware Certificate of Incorporation of the Giga-tronics — Delaware Differ from the Existing California Articles of Incorporation?

Under the CGCL the California Articles and the California Bylaws, holders of our common stock have the right to cumulate votes in the election of directors. The proposed Delaware Certificate of Incorporation does not authorize holders of Giga-tronics Delaware to cumulate votes

8

in the election of directors. As a result, while holders of our common stock currently have the ability to cumulate votes in the election of directors, following the completion of the Delaware Reincorporation, holders of our common stock will not have the right to cumulate votes in the election of directors.

The proposed Delaware Certificate of Incorporation provides that litigation concerning the internal affairs of the Giga-tronics — Delaware, including shareholder derivative actions but excluding claims under the Exchange Act, shall be brought exclusively in state courts located in Delaware. The proposed Delaware Certificate of Incorporation further provides that unless Giga-tronics — Delaware consents in writing to an alternative forum, the federal district courts of the United States shall have exclusive jurisdiction over claims brought under the Securities Act of 1933, as amended (the “Securities Act”) , and that the United States District Court for the State of Delaware shall be the exclusive venue with respect to any cause of action brought under the Securities Act or the Exchange Act. Neither the California Articles nor the California Bylaws have a similar forum selection provision.

Other differences between the existing and proposed charters are described below in the section titled “Significant Differences Between the Charters and Bylaws of Giga-tronics — California and Giga-tronics — Delaware and Between the Corporate Laws of California and Delaware.”

How Does Delaware Corporate Law Differ From California Corporate Law?

Generally, Delaware law places more authority in the hands of the directors and provides directors greater protection from liability. Some of the specific differences are:

|

|

|

|

|

• |

|

Delaware law provides that shareholders only have the right to cumulate votes in the election of directors if specifically authorized by the Delaware corporation’s Certificate of Incorporation. California law provides that shareholders of a California corporation have the right to cumulative votes in the election of directors, but a California corporation with outstanding shares listed on a major U.S. stock exchange, may eliminate cumulative voting by amended to its articles of incorporation or bylaws eliminate cumulative voting. |

|

|

|

|

|

• |

|

Both California and Delaware law allow a corporation to eliminate directors’ personal liability for actions they take in their role as directors, but the ability to do so under Delaware law is broader. |

|

|

|

|

|

• |

|

Both California and Delaware law allow a corporation to indemnify its directors, officers and other corporate agents if they are sued or incur liability in the course of performing their duties for the corporation. To “indemnify” means to reimburse for personal liability and personal expenses, or to advance funds for expenses as incurred. Each state also restricts or prohibits indemnification of these persons in certain circumstances. If a director or officer displays a “reckless disregard” for duty or an “unexcused pattern of inattention to duty,” California expressly prohibits indemnification. Delaware does not have an express prohibition in such cases and might permit indemnification. |

9

|

|

|

|

|

• |

|

California law may prevent a merger between a corporation and a person or entity that owns a majority of the common stock unless you as a shareholder receive common stock, and not cash or other securities, in the merger. |

|

|

|

|

|

• |

|

Both California and Delaware permit shareholders to inspect the corporation’s shareholder list for appropriate purposes under certain circumstances. Inspection rights under California law are broader: a 5% shareholder can inspect the list for any purpose and not just for a proper purpose. |

|

|

|

|

|

• |

|

California requires shareholder approval by a majority of the voting power where there is a change of control. Delaware generally does not, though Nasdaq Listing Rules, which would apply to us if our common stock is listed on Nasdaq, would require shareholder approval if shares of common stock are issued in a change of control transaction. |

Further Discussion of the Reasons for Reincorporating in Delaware

The Board recommends the Delaware Reincorporation for several reasons. Generally, we believe that incorporation in Delaware will improve our ability to manage the Company for the benefit of shareholders.

Predictability of Delaware Law. Delaware has a modern statutory corporation law and well-developed case law. It has courts specializing in corporate law. These courts have developed expertise in dealing with corporate issues. Delaware case law on corporate issues is the most comprehensive of any state. These factors all provide the Board and management with greater certainty in discharging their duties. The predictability of Delaware corporate law provides a reliable foundation on which governance decisions can be based. For example, Delaware courts have addressed shareholder rights plans or poison pills on many occasions. Delaware court decisions have generally upheld these plans but have invalidated certain provisions that make it impossible for new directors appointed by a shareholder to redeem the plan or take other actions within a board’s normal authority. California has little case law on these plans.

Flexibility of Delaware Law. For many years, Delaware has followed a policy of encouraging corporations to incorporate in that state. It has done so by adopting and administering comprehensive and flexible corporate laws responsive to the legal and business needs of corporations. Historically, Delaware’s legislature and courts have acted quickly and effectively to meet changing business needs. The expertise of Delaware courts in dealing with new corporate law issues and a changing business climate contributes to the orderly development of Delaware corporate law.

Prominence of Delaware Law. Among large companies, such as those listed on the New York Stock Exchange, Delaware is the most common state of incorporation. Many large companies have reincorporated in Delaware as we propose to do. Delaware has the most well-developed corporation law of any state. The legislatures and courts of other states often look to Delaware law for guidance on corporate law issues.

10

Increased Ability to Attract and Retain Qualified Directors. The Board believes that a Delaware corporation has certain advantages in attracting qualified candidates to act as directors and officers.

Both California and Delaware law permit a corporation to adopt charter provisions that reduce or limit the monetary liability of directors for breaches of their fiduciary duty in certain circumstances and provide for indemnification of directors and officers. The frequency of claims and litigation directed against directors and officers may discourage qualified persons from taking on these positions. The Company believes that, in general, Delaware law provides greater protection to directors and officers than California law and that Delaware case law regarding a corporation’s ability to limit director liability, and in some instances, officer liability, and provide indemnification is more developed and provides more guidance than California law.

With clearer corporation laws, directors and officers should be able to carry out their duties with more assurance that they are acting properly. A more developed and clearer corporation law should reduce the risk of liability and claims. Potential directors and officers can accept roles with the Company with less concern for their own financial risk.

To date, no persons invited to become a director or officer of the Company have declined because it was a California corporation.

Anti-Takeover Provisions and Possible Effect on Takeover Offers

Some provisions of Delaware law or the proposed Delaware Certificate of Incorporation may deter another person or entity from making a hostile acquisition proposal for part or all of the Company, because they make it harder for the acquirer to acquire control of us without our cooperation. We believe that these provisions are in your best interests. However, they may also discourage a third party from proposing a transaction you would approve if given the opportunity to vote on it.

Existing Defensive Measures

In the discharge of its fiduciary obligations to our shareholders, the Board has considered or may consider in the future certain defensive strategies designed to enhance our ability to negotiate with an unsolicited bidder. We do not currently have in place and defensive measures such as a rights plan other than under normal California law.

Proposed Defense Measures in the Delaware Certificate of Incorporation and Delaware Bylaws

Like many other states, Delaware permits a corporation to adopt measures designed to reduce its vulnerability to unsolicited takeover attempts. We are not proposing the reincorporation to prevent an unsolicited takeover attempt and are not aware of any present effort by any person to acquire control of the company, obtain representation on the Board or take any action that would materially affect the governance of the company.

11

Our proposed Delaware Certificate of Incorporation and Delaware Bylaws contain provisions which could operate to delay, defer or prevent a change of control of the Company or an extraordinary corporate transaction such as a merger, reorganization, tender offer or sale of all or substantially all of our assets. These provisions and certain provisions of the proposed Delaware Certificate of Incorporation and proposed Delaware Bylaws could make it more difficult to acquire us by means of a tender offer, a proxy contest or otherwise, or to remove incumbent officers and directors. Specifically, the following provisions may have anti-takeover effects:

|

|

|

|

|

• |

|

The Delaware Bylaws will contain advance notice requirements for shareholder proposals wherein shareholders seeking to propose a matter for consideration at an annual meeting must deliver detailed notice to us no earlier than the 120th calendar day, nor later than the 90th calendar day, prior to the anniversary date of the immediately preceding annual meeting, or if the current year’s meeting is called for a date that is not within 30 days of the anniversary of the previous year’s annual meeting, such notice must be received no later than 10 calendar days following the day on which public announcement of the date of the annual meeting is first made; |

|

|

|

|

|

• |

|

The DGCL and the Delaware Bylaws will require the affirmative vote of at least a majority of the voting power of the issued and outstanding stock of the Company entitled to vote in order to remove an incumbent director; |

|

|

|

|

|

• |

|

Our Delaware Certificate of Incorporation will authorize “blank check” preferred stock which may have such rights and preferences, including super voting rights, as the Board may determine, which could be issued to affiliates or other persons whose interests align with incumbent control persons of the Company; |

|

|

|

|

|

• |

|

Our Delaware Certificate of Incorporation will provide that lawsuits involving the Company and its internal affairs, including derivative actions brought on behalf of the Company by its shareholders under state corporate law, be governed by the laws of Delaware and providing that resulting proceedings be heard exclusively in state courts located within Delaware, which may make actions against or on behalf of the Company more difficult to litigate by shareholders; and |

|

|

|

|

|

• |

|

Similarly, our Delaware Certificate of Incorporation will provide that actions brought under the Securities Act or the Exchange Act be brought exclusively in federal court in Delaware, and that federal courts have exclusive jurisdiction over Securities Act litigation relating to the Company. |

These provisions, together with provisions of the DGCL, could have the effect of delaying, deferring or preventing an attempted takeover or change of control of the Company, or making such an attempt more difficult. Additionally, in most jurisdictions it remains unclear how a court would interpret and whether it would enforce some of these provisions, resulting in added uncertainty. Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. Investors cannot waive compliance with the federal securities

12

laws and the rules and regulations thereunder, and that there is uncertainty as to whether a state or federal court would enforce these charter provisions.

We believe that unsolicited takeover attempts may be unfair or disadvantageous to us and our shareholders because, among other reasons:

|

|

|

|

|

• |

|

an uninvited acquirer may time its takeover bid to take advantage of temporarily depressed stock prices; |

|

|

|

|

|

• |

|

an uninvited acquirer may design its bid to preclude or minimize the possibility of more favorable competing bids or alternative transactions; |

|

|

|

|

|

• |

|

an uninvited acquirer may acquire only a controlling interest in the corporation’s stock, without affording all shareholders the opportunity to receive the same economic benefits; and |

|

|

|

|

|

• |

|

a non-negotiated acquisition of a controlling interest may put us in default under certain contractual arrangements that prohibit a “change of control” without the prior written consent of the other contracting party. |

Defensive measures encourage a potential bidder to negotiate with the Board. Despite our belief in its benefits to shareholders, the Delaware Reincorporation may be disadvantageous to our existing shareholders. For example, we might not approve of a takeover attempt that a majority of shareholders may deem to be in their best interests or in which shareholders may receive a substantial premium over the then current market value for their shares. The Delaware Reincorporation could discourage such an offer. As a result, an existing shareholder might wish to participate in an unsolicited tender offer but not have an opportunity to do so. In addition, to the extent that provisions of Delaware law enable us to resist a takeover or a change in control, certain features of the Delaware Reincorporation will make it more difficult for shareholders to change the existing Board and management.

Certain Significant Differences Between the Corporation Laws of California and Delaware

Shareholder Derivative Suits

A derivative suit is a legal action brought by one or more shareholders in the name of, and for the benefit of, the corporation, after the corporation has failed to pursue the claim. California law provides that a shareholder bringing a derivative action on behalf of a corporation need not have been a shareholder at the time the claim arose, provided certain tests are met. Under Delaware law, a shareholder may bring a derivative action only if the shareholder was a shareholder of the corporation at the time the claim arose or he or she later acquired the stock by operation of law. Under California law, the plaintiff shareholder may be required to furnish a security bond. Delaware does not have a similar bonding requirement.

13

Ability to Have the Federal District Courts of the United States in the District of Delaware and Delaware Courts Serve as the Exclusive Forum for the Adjudication of Certain Legal Matters

To ensure that we get the full benefits of Delaware’s corporate legal framework, the proposed Delaware Certificate of Incorporation provide that the internal affairs of the Company, including shareholder derivative actions but excluding claims under the Exchange Act, shall be brought exclusively in state courts located in Delaware. The proposed Delaware Certificate of Incorporation also provides that unless the Company consents in writing to an alternative forum, the federal district courts of the United States shall have exclusive jurisdiction over claims brought under the Securities Act, and that the United States District Court for the District of Delaware shall be the exclusive venue with respect to any cause of action brought under the Securities Act or the Exchange Act.

Under the exclusive forum provision contained in the Delaware Certificate of Incorporation, (i) the federal district courts of the United States in the District of Delaware shall serve as the exclusive jurisdiction for any litigation arising under the Securities Act unless we consent to an alternative forum, and (ii) the Court of Chancery in the State of Delaware will be the exclusive forum for certain actions involving the Company unless we consent to an alternative forum. Based on the proposed language in the Delaware Certificate of Incorporation, the Court of Chancery would be the exclusive forum for (a) derivative actions brought on our behalf, and (b) any action asserting a claim of breach of a fiduciary duty owed by, or other wrongdoing by, any director, officer, shareholder, employee or agent of the Company to us or our shareholders; (c) any action asserting a claim against the Company arising pursuant to any provision of the DGCL, the Delaware Certificate of Incorporation or as to which the DGCL confers jurisdiction on the Court of Chancery of the State of Delaware; (d) any action to interpret, apply, enforce or determine the validity of the Delaware Certificate of Incorporation and Delaware Bylaws; or (e) any action asserting a claim against the Company governed by the internal affairs doctrine.

We believe that the exclusive forum provision in the Delaware Certificate of Incorporation will reduce the risk that we could become subject to duplicative litigation in multiple forums, as well as the risk that the outcome of cases in multiple forums could be inconsistent, even though each forum purports to follow Delaware law or federal securities law. Any of these could expose the Company to increased expenses or losses.

Although the Board believes that the designation of the Delaware Court of Chancery as the exclusive forum for intra-corporate disputes and the federal district courts of the United States in the District of Delaware for Securities Act claims serves our best interests and our shareholders as a whole, the Delaware Certificate of Incorporation allows us to consent to an alternative forum on a case-by-case basis. Specifically, where the Board determines that our interests and those of our shareholders are best served by permitting a dispute to proceed in a forum other than the Delaware Court of Chancery or the federal district courts of the United States in the District of Delaware, the exclusive forum provision in the Delaware Certificate of Incorporation permits us to consent to the selection of such alternative forum. Neither of these choice of forum provisions would affect suits brought to enforce any liability or duty created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction, except for mandating venue in Delaware.

14

Possible Negative Consequences of Reincorporation

Although the Board believes the Delaware Reincorporation will benefit our shareholders, you should be aware that Delaware law has been criticized by some commentators on the grounds that it does not afford minority shareholders the same substantive rights and protections as are available in a number of other states, including California. In addition, franchise taxes payable by us in Delaware may be greater than the equivalent or other similar taxes currently payable by us in California. The Board has considered the possible disadvantages of the Delaware Reincorporation and has concluded that the potential benefits outweigh the possible disadvantages.

California in contrast to Delaware requires a majority of a California corporation’s voting power to approve any change of control. For example, when AAI acquired control of the Company on September 8, 2022, the Company had to first obtain shareholder approval. While this resulted in considerable expense and delay, our shareholders had to pass upon the share exchange, Delaware has no comparable provision. Thus, if the Delaware Reincorporation is approved, the Company may enter into a future transaction involving a change of control without allowing our shareholders to have any rights to approve it. We do not know if the preliminary discussion referred to earlier in this Information Statement will, if consummated, result in a change of control. It should also be noted that the interests of our directors and executive officers in voting on the Delaware Reincorporation proposal may be different from, or in addition to, those of shareholders generally because, for example, some substantive provisions of California and Delaware law apply only to directors and officers. See “Interest of Our Directors and Executive Officers in the Delaware Reincorporation” below. For a comparison of shareholders’ rights and the material substantive provisions that apply to the Board and executive officers under Delaware and California law, see “Significant Differences Between the Charters and Bylaws of Giga-tronics — California and Giga-tronics — Delaware and Between the Corporate Laws of California and Delaware” below. The Board has considered these interests, among other matters, in reaching its decision to approve the Delaware Reincorporation and to recommend that our shareholders vote in favor of this proposal.

Effectiveness of Delaware Reincorporation

We anticipate that we will cause the Delaware Reincorporation to become effective as soon as reasonably practicable following FINRA approval, subject to the completion of certain legal formalities, including obtaining certain consents and approvals by third parties with respect to certain contracts to which we a party and providing certain notices to regulatory authorities. The Reincorporation Agreement also provides that the Reincorporation Agreement may be terminated and the Reincorporation may be abandoned at any time before it is completed and for any reason by the Board of either the Company or Giga-tronics—Delaware or both, notwithstanding the approval, if obtained, of the principal terms of the Reincorporation Agreement by our shareholders, or the adoption of the Reincorporation Agreement by the sole shareholder of Giga-tronics—Delaware, or both. Therefore, the Board could determine to delay or not to proceed with the Delaware Reincorporation even if FINRA approval is obtained. Furthermore, the Reincorporation Agreement may be amended at any time prior to the date Delaware Reincorporation is completed, either before or after the shareholders have voted to adopt this proposal, subject to applicable law.

15

Significant Differences Between the Charters and Bylaws of Giga-tronics—California and Giga-tronics—Delaware and Between the Corporate Laws of California and Delaware

The following summarizes a comparison of certain key provisions between the California Incorporation Documents and proposed Delaware Certificate of Incorporation and Delaware Bylaws, as well as certain provisions of California and Delaware corporate laws. The comparison highlights important differences, but is not intended to list all differences, and is qualified in its entirety by reference to such documents and to the respective General Corporation Laws of the States of California and Delaware. Shareholders are encouraged to read the Delaware Certificate of Incorporation, the Delaware Bylaws, the California Articles and the California Bylaws in their entirety. The proposed Delaware Certificate of Incorporation and Delaware Bylaws are attached to this Information Statement. Our current Articles, which we refer to as the “California Articles,” and our current Bylaws, which we refer to as the “California Bylaws,” are filed publicly as exhibits to our periodic reports with the SEC.

|

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

Authorized Shares |

|

100,000,000 shares of our common stock, and 1,000,000 shares of preferred stock, all with no par value. |

|

The total number of shares of stock of all classes of capital stock that the Corporation shall be authorized to issue is 101,000,000, of which 100,000,000 shares shall be shares of common stock, $0.001 par value and 1,000,000 shares shall be shares of preferred stock, $0.001 par value. |

|

|

|

|

|

|

|

|

Annual Election of Directors |

|

Under California law, at each annual meeting of shareholders, directors shall be elected to hold office until the next annual meeting and until a successor has been elected and qualified, unless the corporation permits staggered terms in the Articles of Incorporation or Bylaws. We have not opted for staggered director terms, so its directors are subject to election at each annual meeting of directors. |

|

No change. Although Delaware law permits the staggered election of directors, the default rule is that directors are elected annually at each meeting of its shareholders. The Delaware Bylaws provide for the annual election of all directors. |

16

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

|

|

|

Number of Directors |

|

California law requires that board size be specified in the Bylaws and that the maximum number of directors may be no more than two times minus one the stated minimum number of directors. The California Bylaws provide that the number of directors will be between five and seven, with the exact number of directors to be fixed by the Board or shareholders. |

|

Under Delaware law, the number of directors is fixed by or in the manner provided in the Bylaws, unless the Certificate of Incorporation fixes the number of directors. The Delaware Certificate does not fix a number of directors. The Delaware Bylaws provide for a range of three to nine directors, with the exact number of directors to be fixed by the board. |

|

|

|

|

|

Vote Required to Elect Directors |

|

California law provides that directors of a California corporation are elected by a plurality of the shares represented at a meeting, unless the vote of a greater number is required by the Articles of Incorporation, or by unanimous written consent if elected by written consent without a meeting. California law provides that a public company may amend its Articles of Incorporation or Bylaws to provide that, in an uncontested election, approval of the shareholders shall be required to elect a director. Neither the California Articles nor the California Bylaws provide for a majority voting standard. “Approved by (or approval of) the shareholders” means approved or ratified by the affirmative note of a majority of the shares represented and voting at a duly |

|

The default voting standard for the election of directors under Delaware law is a plurality vote; however, the Delaware Certificate of Incorporation or Delaware Bylaws may specify a different standard for the election of directors, such as a majority of the votes cast. Delaware law also provides that upon application of any shareholder or director, or any officer whose title to office is contested, the Court of Chancery may hear and determine the validity of any election, and if it should be determined that no valid election has been held, the Court of Chancery may order an election to be held in which the voting standard is also a plurality unless otherwise specified in the Delaware Certificate of Incorporation or Delaware Bylaws. |

17

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

held meeting at which a quorum is present (which shares voting affirmatively also constitute at least a majority of the required quorum) or by the written consent of shareholders or by the affirmative vote or written consent of such greater proportion (including all) of the shares of any class or series as may be provided in the Articles of Incorporation or in this division for all or any specified shareholder action. |

|

|

|

|

|

|

|

Cumulative Voting |

|

Under California law, cumulative voting for election of directors is permitted if the shareholder provides advance notice of the intent to exercise cumulative voting. California law also permits companies with common stock traded on a national securities exchange to eliminate cumulative voting by the approval of shareholders. Neither the California Articles nor the California Bylaws eliminate the right shareholders to cumulative votes in the election of directors. |

|

The Delaware Bylaws maintain the plurality voting standard. Under Delaware law, cumulative voting is not permitted unless the corporation provides for cumulative voting rights in its Delaware Certificate of Incorporation. The Delaware Certificate of Incorporation does not allow for cumulative voting in director elections. |

|

|

|

|

|

Removal of Directors |

|

Under California law, directors may be removed by the Board if they are of unsound mind or convicted of a felony. A majority of shareholders may remove directors without cause, provided that the removal of less than all of the directors on the Board requires calculating the votes against removal cumulatively. |

|

Under Delaware law, any director, or the entire board, may be removed, with or without cause, with the approval of a majority of the outstanding shares entitled to vote at an election of directors. The Delaware Bylaws conform to Delaware law, permitting an unclassified director to be |

18

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

The California Bylaws allow directors to be removed by the Board if they are of unsound mind or have been convicted of a felony, and allow a majority of shareholders to remove directors without cause. The California Bylaws further provide that removal of less than all of the directors on the Board requires calculating the votes against removal cumulatively. |

|

removed at any time with or without cause at a meeting of shareholders called expressly for that purpose (and not by written consent). The Delaware Bylaws do not provide for cumulative voting, which is not required under Delaware law and will not be utilized in voting on director removal. |

|

|

|

Filling a Vacancy on the Board |

|

Consistent with California law, vacancies on the Board may be filled by the majority of remaining directors, other than vacancies created by the removal of a director by the vote of the shareholders, which may only be filled by the consent of all shareholders entitled to vote on the election of directors. |

|

Consistent with Delaware law, vacancies on the Board be filled by the majority of the remaining directors. |

|

|

|

|

|

Advance Notice of Shareholder Proposals and Director Nominations |

|

Under California law, corporations may set the time period required for shareholders to provide advance notice to the corporation of director nominees and business to be put to vote at the annual meeting of shareholders. The California Bylaws do not require shareholders to provide advance notice to the corporation of either director nominees or business to be put to vote at the annual meeting of shareholders. |

|

Delaware law also permits corporations to set the advance notice time period in the corporation’s bylaws for shareholder director nominations and proposals of business at shareholder meetings. The Delaware Bylaws require a shareholder intending to nominate a candidate for election as a director at or to bring other proposals before a meeting of shareholders to notify the corporate secretary in advance. The notice must |

19

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

|

|

provide the information specified in the Delaware Bylaws, including information about the shareholder making the proposal and information about the proposal or proposed nominee, within the time periods specified in the Delaware Bylaws. In addition, a shareholder’s proposed nominee for election as a director must provide the information and make the undertakings specified in the Delaware Bylaws. If any required information or undertakings are not provided as and within the times specified in the Delaware Bylaws, the chairman of the meeting may declare the nomination or proposal invalid, in which case it would not be presented for shareholder action at the meeting and shareholders would not vote on the matter. |

|

|

|

Ability of Shareholders to Call Special Meetings |

|

Under California law, a special meeting of shareholders may be called by the board, the board chair, the president, or the holders of shares entitled to cast not less than 10% of the votes at such meeting and such persons as are authorized by the Articles of Incorporation or Bylaws. The California Bylaws allow a special meeting to be called by the board chair, a President, the Board or by shareholders |

|

Under Delaware law, a special meeting of shareholders may be called by the Board or by any person authorized in the Certificate of Incorporation or the Bylaws. The Delaware Bylaws allow a special meeting to be called by the board chair, the board or by shareholders holding at least 20% of the outstanding voting power. The Delaware Bylaws require a shareholder requesting a special meeting to provide the certain information |

20

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

holding at least 10% of the outstanding stock. |

|

and documentation to the Board concerning the shareholder and the purpose of the special meeting, as specified in the Delaware Bylaws. If the Board determines that the shareholder’s request for a special meeting is valid, the Board will determine the timing of the meeting, which shall be not less than 90 nor more than 120 days after the receipt of the request. |

|

|

|

Shareholder Action by Written Consent |

|

California law provides that shareholder action by written consent is available unless otherwise provided in a company’s Articles of Incorporation. We have not opted out of this default rule, and therefore the California Articles permit shareholders may act by written consent without a meeting. Pursuant to the California Bylaws and California law, the election of directors must be by unanimous shareholder consent; provided that the shareholders may elect a director to fill a vacancy, other than a vacancy created by removal, by the consent of a majority of the outstanding shares entitled to vote. |

|

Under Delaware law the right of shareholders to take action by consent without a meeting and by written consent is available unless otherwise provided in a company’s certificate of incorporation. The Delaware Certificate retains the right of shareholders to take action through consent on any action that may be taken at any meeting of the shareholders. However, the California law requirement that directors be elected by unanimous consent if action is taken without a meeting is not contained in the Delaware Bylaws. |

|

|

|

Dividends, Repurchases and Redemption |

|

Under California law, a corporation may not make any distribution (including dividends, whether in cash or other property, and including repurchases of its shares) unless either (i) the corporation’s retained earnings immediately |

|

Delaware law is generally more flexible than California law with respect to payment of dividends and implementing share repurchase programs. Delaware law permits a corporation, unless otherwise restricted by its Certificate of |

21

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

prior to the proposed distribution equal or exceed the amount of the proposed distribution plus the preferential dividends arrears amount; or (ii) immediately after giving effect to such distribution, the corporation’s assets would equal or exceed the sum of its total liabilities plus the preferential rights amount. Such tests are applied to California corporations on a consolidated basis. Under California law, there are certain exceptions to the foregoing rules for repurchases of shares in connection with certain rescission actions and certain repurchases pursuant to employee stock plans. |

|

Incorporation, to declare and pay dividends out of surplus or, if there is no surplus, out of net profits for the fiscal year in which the dividend is declared and/or for the preceding fiscal year as long as the amount of capital of the corporation is not less than the aggregate amount of the capital represented by the issued and outstanding stock of all classes having preference upon the distribution of assets. In addition, Delaware law generally provides that a corporation may redeem or repurchase its shares only if such redemption or repurchase would not impair the capital of the corporation. In determining the amount of surplus of a Delaware corporation, the assets of the corporation, including stock of subsidiaries owned by the corporation, must be valued at their fair market value as determined by the board, regardless of their historical book value. |

|

|

|

Amendment of Bylaws |

|

Under California law, the board may amend the California Bylaws by default. The California Bylaws specify that they may be adopted, amended, or repealed by the board or by majority shareholder vote. |

|

Under Delaware law, the power of the board to amend the Delaware Bylaws must be expressly contained in the Certificate of Incorporation. Therefore, the Delaware Certificate of Incorporation provides that the board may amend the Delaware Bylaws, and the Delaware Bylaws provide that the right of the board to amend the Delaware Bylaws is concurrent with the shareholders’ right. The |

22

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

|

|

Delaware Bylaws maintain that they may be adopted, amended, or repealed by majority shareholder vote. |

|

|

|

|

|

Restrictions on Transactions with Interested Shareholders |

|

Section 1203 of the California Corporations Code, which applies to mergers or corporate acquisition transactions with interested shareholders or their affiliates, makes it a condition to the consummation of a merger or other acquisition transaction with an interested shareholder that an affirmative opinion be obtained in writing as to the fairness of the consideration be received by the shareholders of the corporation being acquired. |

|

Under DGCL Section 203, a Delaware corporation is prohibited from engaging in a “business combination” with an “interested shareholder” (generally as a person with 15% or more of the corporation’s outstanding voting stock) for three years, unless certain conditions are met. Delaware corporations may opt out of DGCL Section 203 only by express provision in a Certificate of Incorporation. The Delaware Certificate of Incorporation includes a provision opting out from DGCL Section 203. |

|

|

|

|

|

Shareholder Vote Required to Approve Merger or Sale of Company |

|

Except in limited circumstances, California law requires the affirmative vote of a majority of the outstanding shares entitled to vote in order to approve a merger of the corporation or a sale of all or substantially all the assets of the corporation, including, in the case of a merger, the affirmative vote of each class of outstanding stock. |

|

Delaware law requires the affirmative vote of a majority in voting power of the outstanding shares entitled to vote to approve a merger of the corporation or a sale of all or substantially all the assets of the corporation, except in limited circumstances. |

|

|

|

|

|

Restrictions on Cash Mergers |

|

Under California law, a merger may not be consummated for cash if the purchaser owns more than 50% but less than 90% of the then outstanding shares unless either: (i) all of the shareholders consent, or (ii) the |

|

Delaware law does not have a provision similar to this California rule. |

23

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

California Commissioner of Financial Protection and Innovation approves the merger. |

|

|

|

|

|

|

|

Exclusive Forum Provisions |

|

Under California law, a corporation may designate certain jurisdictions as the exclusive forum for certain claims. Neither the California Articles nor the California Bylaws make any exclusive forum designation. |

|

Under Delaware law, a corporation may designate certain jurisdictions as the exclusive forum for certain claims. The proposed Delaware Certificate of Incorporation provide that the internal affairs of the Company, including shareholder derivative actions but excluding claims under the Exchange Act, shall be brought exclusively in state courts located in Delaware. The proposed Delaware Certificate of Incorporation also provides that unless we consent in writing to an alternative forum, the federal district courts of the United States shall have exclusive jurisdiction over claims brought under the Securities Act, and that the United States District Court for the District of Delaware shall be the exclusive venue with respect to any cause of action brought under the Securities Act or the Exchange Act. |

|

|

|

|

|

Indemnification and Advancement of Expenses |

|

Indemnification of corporate officers and directors is permitted by California law, provided the requisite standard of conduct is met. California law requires indemnification when the indemnitee has |

|

Substantially similar. Delaware law permits corporations to indemnify its directors, officers, employees and agents from expenses and losses arising out of litigation arising by reason of the person’s |

24

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

defended the action successfully on the merits. Indemnification is permitted under California law only for acts taken in good faith and believed to be in the best interests of the company and its shareholders. Expenses incurred by an officer or director in defending an action may be paid in advance if the director or officer undertakes to repay such amounts if it is ultimately determined that he or she is not entitled to indemnification. California law authorizes a corporation to purchase indemnity insurance for the benefit of its officers, directors, employees and agents whether or not the corporation would have the power to indemnify against the liability covered by the policy. California law permits a corporation to provide rights to indemnification beyond those provided therein to the extent such additional indemnification is authorized in the corporation’s Articles of Incorporation. Thus, if so authorized, rights to indemnification may be provided pursuant to agreements or bylaw provisions which make mandatory the permissive indemnification provided by California law. |

|

service to the corporation or to another entity at its request, including, in certain circumstances, litigation by or in the right of the corporation so long as the person acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests of the corporation and, in the case of criminal proceedings, had no reasonable cause to believe that his or her conduct was unlawful. A corporation must indemnify a person “to the extent” the person is successful on the merits or otherwise in defense of an action, suit or proceeding. Unless judicially authorized, corporations may not indemnify a person in connection with a proceeding by or in the right of the corporation in which the person was adjudged liable to the corporation. Expenses incurred by a director, officer, employee or agent in defending an action may be paid in advance, if the person undertakes to repay such amounts if it is ultimately determined that he or she is not entitled to indemnification. Delaware law authorizes a corporation to purchase indemnity insurance for the benefit of its directors, officers, employees and agents whether or not the corporation would have the power to indemnify against the liability covered by the policy. |

25

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

The California Articles and California Bylaws authorize indemnification to the fullest extent permissible under California law. The California Bylaws also specify that any expenses reasonably incurred by an agent defending a claim resulting from such person serving at our request as a director or officer of another corporation shall be paid by us. |

|

Delaware law permits a Delaware corporation to provide indemnification in excess of that provided by statute. The Delaware Certificate of Incorporation authorizes indemnification to the fullest extent permissible under Delaware law. Notwithstanding the indemnification provided for by in the Delaware Certificate of Incorporation, the Delaware Bylaws or any written agreement, such indemnity shall not include any advancement of expenses incurred by any officer or director relating to or arising from any proceeding in which the Company asserts a direct claim against an officer or director, or an officer or director asserts a direct claim against the Company, whether such claim is termed a complaint, counterclaim, crossclaim, third-party complaint or otherwise. |

|

|

|

Elimination of Director Personal Liability for Monetary Damages |

|

California law permits a corporation to eliminate the personal liability of directors for monetary damages, except where such liability is based on: (i) Intentional misconduct or knowing and culpable violation of law; |

|

Substantially similar. Delaware law permits a corporation to eliminate the personal liability of directors for monetary damages, except where such liability is based on: (i) Breaches of the director’s duty of loyalty to the corporation or its shareholders; |

26

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

(ii) Acts or omissions that a director believes to be contrary to the best interests of the corporation or its shareholders or that involve the absence of good faith on the part of the director; (iii) Any transaction from which a director derived an improper personal benefit; (iv) Acts or omissions that show reckless disregard for the director’s duty to the corporation or its shareholders, where the director in the ordinary course of performing a director’s duties is, or should be, aware of a risk of serious injury to the corporation or its shareholders; (v) Acts or omissions that constitute an unexcused pattern of inattention that amounts to an abdication of the director’s duty to the corporation and its shareholders; (vi) Transactions between the corporation and a director who has a material financial interest in such transaction; or (vii) Liability for improper distributions, loans or guarantees. The California Articles eliminate the liability of directors for monetary damages to the fullest extent permissible under California law. |

|

(ii) Acts or omissions not in good faith or involving intentional misconduct or knowing violations of law; (iii) The payment of unlawful dividends or unlawful stock repurchases or redemption; or (iv) Transactions in which the director received an improper personal benefit. Such a limitation of liability provision also may not limit a director’s liability for violation of, or otherwise relieve the company or directors from the necessity of complying with, federal or state securities laws, or affect the availability of non-monetary remedies such as injunctive relief or rescission. To the fullest extent permitted by Delaware statutory or decisional law, the Delaware Certificate of Incorporation eliminates the liability of directors to the Company or its shareholders for monetary damages for breach of duty as a director. |

|

|

|

27

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

Exculpation of Certain Officers |

|

Under Section 309(a) of the California Corporations Code, California effectively requires that in making every major decision for the company, the officers and directors are held to a test of inquiry to determine whether the director or officer has satisfied the requirement to inquire. While California law provides for exculpation, California Corporation Code Section 204(a)(10) excludes from exculpation any acts by directors demonstrating reckless disregard of duty or a persistent lack of attention (when the act poses a risk of major harm to the company or shareholders). California also hold officers and directors to a standard of ordinary negligence rather than gross negligence. |

|

Delaware law permits Delaware corporations to eliminate the liability of certain senior officers for the breach of the duty of care if the Certificate of Incorporation permits it. Section 102(b)(7) of the DGCL does not provide comparable exclusions from exculpation that exist under the CGCL. The proposed Delaware Certificate of Incorporation permits such exculpation. |

Inspection of Shareholders’ List |

|

California law allows any shareholder to inspect the shareholders’ list for a purpose reasonably related to such person’s interest as a shareholder. California law provides, in addition, for an absolute right to inspect and copy the corporation’s shareholders’ list by a person or persons holding 5% or more of a corporation’s voting shares, or any shareholder or shareholders holding 1% or more of such shares who have contested the election of directors. |

|

Delaware law allow any shareholder to inspect the shareholders’ list and make copies for a purpose reasonably related to such person’s interest as a shareholder. |

28

|

|

|

|

|

Provision |

|

Current California Provision |

|

Proposed Change for Reincorporation |

|

|

|

Approval of Certain Corporate Transactions |

|

Under California law, with certain exceptions, any merger, consolidation or sale of all or substantially all assets must be approved by the Board and by a majority of the outstanding shares entitled to vote. Under California law, similar board and shareholder approval is also required in connection with certain additional acquisition transactions. |

|

Under Delaware law, with certain exceptions, any merger, consolidation or sale of all or substantially all assets must be approved by the Board and by a majority of the outstanding shares entitled to vote. |

|

|

|

|

|

Class Voting in Certain Corporate Transactions |

|

Under California law, with certain exceptions, any merger, certain sales of all or substantially all of the assets of a corporation and certain other transactions must be approved by a majority of the outstanding shares of each class of stock (without regard to limitations on voting rights). |

|

Delaware law does not generally require class voting, except in connection with certain amendments to the Certificate of Incorporation that, among other things, adversely affect a class of stock. |

|

|

|

Appraisal Rights |

|

Under California law, a shareholder of a corporation participating in certain major corporate transactions may, under varying circumstances, be entitled to appraisal rights, pursuant to which such shareholder may receive cash in the amount of the fair market value of the shares held by such shareholder (as determined by agreement of the corporation and the shareholder or by a court) in lieu of the consideration such shareholder would otherwise receive in the transaction. |

|