0001165320

GB SCIENCES INC

false

Q1

2022

57,322

43,096

272,122

296,504

141,123

154,590

0.0001

0.0001

600,000,000

600,000,000

317,429,078

317,429,078

315,340,411

315,340,411

1

3

3

3

3

3

3

3

3

0.05

3

3

43,096

12,287

296,504

608,580

154,590

0

0.0001

0.0001

600,000,000

600,000,000

315,340,411

315,340,411

275,541,602

275,541,602

3

3

3

3

3

3

3

3

0.05

10

3

3

10

10

33.33

33.33

33.33

3

5

5

3

3

00011653202021-04-012021-06-30

thunderdome:item

iso4217:USD

00011653202021-06-30

00011653202021-03-31

iso4217:USDxbrli:shares

xbrli:shares

00011653202020-04-012020-06-30

00011653202020-03-31

00011653202020-06-30

0001165320us-gaap:CommonStockMember2021-03-31

0001165320us-gaap:AdditionalPaidInCapitalMember2021-03-31

0001165320us-gaap:RetainedEarningsMember2021-03-31

0001165320us-gaap:CommonStockMember2021-04-012021-06-30

0001165320us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-30

0001165320us-gaap:RetainedEarningsMember2021-04-012021-06-30

0001165320us-gaap:CommonStockMember2021-06-30

0001165320us-gaap:AdditionalPaidInCapitalMember2021-06-30

0001165320us-gaap:RetainedEarningsMember2021-06-30

0001165320us-gaap:CommonStockMember2020-03-31

0001165320us-gaap:AdditionalPaidInCapitalMember2020-03-31

0001165320us-gaap:RetainedEarningsMember2020-03-31

0001165320us-gaap:CommonStockMember2020-04-012020-06-30

0001165320us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-30

0001165320us-gaap:RetainedEarningsMember2020-04-012020-06-30

0001165320us-gaap:CommonStockMember2020-06-30

0001165320us-gaap:AdditionalPaidInCapitalMember2020-06-30

0001165320us-gaap:RetainedEarningsMember2020-06-30

xbrli:pure

00011653202020-04-012021-03-31

0001165320us-gaap:SegmentDiscontinuedOperationsMember2021-06-30

0001165320us-gaap:SegmentDiscontinuedOperationsMember2021-03-31

0001165320us-gaap:SegmentDiscontinuedOperationsMember2021-04-012021-06-30

0001165320us-gaap:SegmentDiscontinuedOperationsMember2020-04-012020-06-30

0001165320us-gaap:SegmentContinuingOperationsMember2021-06-30

0001165320gblx:SegmentContinuingAndDiscontinuedOperationsMember2021-06-30

0001165320us-gaap:SegmentContinuingOperationsMember2021-03-31

0001165320gblx:SegmentContinuingAndDiscontinuedOperationsMember2021-03-31

0001165320us-gaap:SegmentContinuingOperationsMember2021-04-012021-06-30

0001165320gblx:SegmentContinuingAndDiscontinuedOperationsMember2021-04-012021-06-30

0001165320us-gaap:SegmentContinuingOperationsMember2020-04-012020-06-30

0001165320gblx:SegmentContinuingAndDiscontinuedOperationsMember2020-04-012020-06-30

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2021-06-30

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2021-03-31

0001165320srt:MaximumMember2021-06-30

0001165320us-gaap:LineOfCreditMember2019-11-27

0001165320us-gaap:LineOfCreditMember2019-11-272021-03-31

0001165320us-gaap:LineOfCreditMember2021-06-30

0001165320gblx:ProductionLicenseMembergblx:NevadaMedicalMarijuanaProductionLicenseAgreementMember2017-10-23

0001165320gblx:CultivationLicenseMembergblx:NevadaMedicalMarijuanaProductionLicenseAgreementMember2017-10-23

0001165320gblx:NevadaMedicalMarijuanaProductionLicenseAgreementMember2017-10-232017-10-23

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2017-10-23

utr:Y

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2017-10-232017-10-23

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2017-10-242021-06-30

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2021-06-30

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:MembershipInterestPurchaseAgreementForSaleOfInterestInGBSciencesNopahLLCMembergblx:PromissoryNoteMember2020-08-10

0001165320us-gaap:RevolvingCreditFacilityMembergblx:TheJuly24NoteMember2020-07-24

0001165320gblx:TheJuly24NoteMembergblx:TecoMember2020-07-24

0001165320gblx:TheJuly24NoteMembergblx:TecoMember2020-12-292020-12-29

0001165320gblx:TheJuly24NoteMembergblx:TecoMember2020-12-29

0001165320gblx:TheJuly24NoteMembergblx:TecoMember2020-04-012021-03-31

0001165320gblx:TheJuly24NoteMembergblx:TecoMember2021-04-012021-06-30

0001165320gblx:TheJuly24NoteMembergblx:TecoMember2021-06-30

0001165320gblx:The0PercentNotePayableDatedOctober232017Memberus-gaap:ConvertibleNotesPayableMember2021-06-30

0001165320gblx:The8PercentLineOfCreditDatedNovember272019Memberus-gaap:LineOfCreditMember2021-06-30

0001165320gblx:The8PercentLineOfCreditDatedJuly242020Memberus-gaap:LineOfCreditMember2021-06-30

0001165320gblx:The6PercentNotePayableDueNovember302018Memberus-gaap:ConvertibleNotesPayableMember2021-06-30

0001165320gblx:TheAmended8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2021-06-30

0001165320gblx:The6PercentNotesPayableDueJanuary182022Memberus-gaap:ConvertibleNotesPayableMember2021-06-30

0001165320gblx:PromissoryNoteMember2021-06-30

0001165320gblx:The6PercentNotePayableDatedSeptember302023Memberus-gaap:ConvertibleDebtMember2021-06-30

0001165320gblx:The6PercentNotePayableDatedDecember312023Memberus-gaap:ConvertibleDebtMember2021-06-30

0001165320gblx:PromissoryNoteMember2021-06-30

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-03-31

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-03-012017-03-31

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-03-31

0001165320gblx:WarrantsIssuedInMarch2017ConvertibleNoteOfferingMember2017-03-012017-03-31

0001165320gblx:WarrantsIssuedInMarch2017ConvertibleNoteOfferingMember2017-03-31

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-05-31

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-03-012017-05-31

0001165320gblx:March2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-03-012017-05-31

0001165320gblx:WarrantsIssuedInMarch2017ConvertibleNoteOfferingMember2017-03-012017-05-31

0001165320gblx:WarrantsIssuedInMarch2017ConvertibleNoteOfferingMember2017-05-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-07-31

0001165320gblx:July2017ConvertibleNoteOfferingMembergblx:PromissoryNoteMember2017-07-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-07-012017-07-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-07-31

0001165320gblx:WarrantsIssuedInMarch2017AndJuly2017ConvertibleNoteOfferingsMember2017-07-012017-07-31

0001165320gblx:WarrantsRelatedToJuly2017ConvertibleNoteOfferingMember2017-07-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-07-012017-07-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-12-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2017-07-012017-12-31

0001165320gblx:July2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2017-07-012017-12-31

0001165320gblx:WarrantsRelatedToJuly2017ConvertibleNoteOfferingMember2017-07-012017-12-31

0001165320gblx:WarrantsRelatedToJuly2017ConvertibleNoteOfferingMember2017-12-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2021-03-31

0001165320gblx:WarrantsIssuedInMarch2017AndJuly2017ConvertibleNoteOfferingsMember2020-04-012021-03-31

0001165320gblx:WarrantsIssuedInSeptember302023ConvertibleNoteOfferingMember2021-03-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleDebtMember2020-04-012021-03-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleDebtMember2021-03-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleDebtMember2021-04-012021-06-30

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleDebtMember2021-06-30

0001165320us-gaap:ConvertibleDebtMember2021-06-30

0001165320us-gaap:ConvertibleDebtMember2021-04-012021-06-30

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-02-28

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2019-02-282019-02-28

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2019-02-28

0001165320us-gaap:CollateralPledgedMembergblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:GBSciencesNevadaLLCMembergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-02-28

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-02-282019-02-28

0001165320gblx:CSWVenturesLPMembergblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-05-282019-05-28

0001165320gblx:CSWVenturesLPMembergblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-05-28

0001165320gblx:CSWVenturesLPMembergblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2019-05-282019-05-28

0001165320gblx:CSWVenturesLPMembergblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2019-05-28

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-07-12

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-07-122019-07-12

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2019-07-12

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-08-012019-08-01

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2019-08-01

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2019-08-012019-08-01

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-08-01

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2019-10-23

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-10-23

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-10-232019-10-23

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-04-012020-03-31

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-11-27

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2019-11-27

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-11-272019-11-27

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-12-162019-12-16

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2019-12-16

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2019-12-162019-12-16

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-12-16

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2021-01-012021-03-31

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2021-03-31

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMemberus-gaap:CommonStockMember2021-01-012021-03-31

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2021-06-30

0001165320gblx:TecoMember2021-06-30

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2019-04-23

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2019-04-232019-04-23

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2019-04-012020-03-31

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2019-10-302019-10-30

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2019-10-30

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2019-11-182019-11-18

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2019-11-18

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2020-04-22

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2020-04-222020-04-22

0001165320gblx:RepaymentOfIliadNoteMemberus-gaap:JudicialRulingMember2020-07-142020-07-14

0001165320gblx:RepaymentOfIliadNoteMemberus-gaap:JudicialRulingMember2020-07-14

0001165320gblx:RepaymentOfIliadNoteMemberus-gaap:JudicialRulingMember2020-11-20

0001165320gblx:RepaymentOfIliadNoteMemberus-gaap:JudicialRulingMember2020-12-09

0001165320gblx:RepaymentOfIliadNoteMemberus-gaap:JudicialRulingMember2020-12-162020-12-16

0001165320gblx:The6PercentConvertibleNotePayableDatedDecember312023Member2020-12-18

0001165320gblx:ThreeInvestorsMembergblx:The6PercentConvertibleNotePayableDatedDecember312023Member2021-03-31

0001165320gblx:ThreeInvestorsMembergblx:The6ConvertibleNotePayableMatureInDecember2021Member2021-03-31

0001165320gblx:ThreeInvestorsMembergblx:The6ConvertibleNotePayableMatureInDecember2023Member2021-03-31

0001165320gblx:The6PercentConvertibleNotePayableIssuedWithInMoneyConversionFeaturesMember2020-04-012021-03-31

0001165320gblx:The6PercentConvertibleNotePayableIssuedWithInMoneyConversionFeaturesMember2021-03-31

0001165320gblx:The6ConvertibleNotePayableMatureInDecember2023Member2021-06-30

0001165320gblx:The6ConvertibleNotePayableMatureInDecember2023Member2021-04-012021-06-30

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMembersrt:MinimumMember2020-04-01

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMembersrt:MaximumMember2020-04-01

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMemberus-gaap:SubsequentEventMember2021-07-18

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMember2021-04-012021-06-30

0001165320gblx:PaymentOfServicesProvidedByContractorMemberus-gaap:PendingLitigationMember2020-04-222020-04-22

0001165320gblx:PaymentOfServicesProvidedByContractorMemberus-gaap:SettledLitigationMember2020-09-172020-09-17

0001165320gblx:OfficersAndDirectorsMember2021-06-30

0001165320gblx:TecoMember2019-11-152019-11-15

0001165320gblx:TecoMember2020-03-242020-03-24

0001165320gblx:TecoMember2020-03-24

utr:M

0001165320us-gaap:SecuredDebtMembergblx:TheJuly24NoteMembergblx:AjeManagementLLCMember2020-07-24

0001165320gblx:July24NoteMembergblx:TecoMember2020-07-24

0001165320us-gaap:SecuredDebtMembergblx:TheJuly24NoteMembergblx:AjeManagementLLCMember2020-07-252021-06-30

0001165320gblx:July24NoteMembergblx:TecoMember2020-12-292020-12-29

0001165320gblx:July24NoteMembergblx:TecoMember2020-12-29

0001165320gblx:TheJuly24NoteMember2020-12-292020-12-29

0001165320gblx:July24NoteMember2020-12-29

0001165320gblx:July24NoteMembergblx:TecoMember2020-12-29

0001165320gblx:July24NoteMembergblx:TecoMember2020-07-242020-07-24

0001165320gblx:TecoMember2021-04-012021-06-30

0001165320gblx:TecoMember2021-05-112021-05-11

0001165320gblx:GBSciencesNopahLLCMember2019-11-272019-11-27

0001165320gblx:GBSciencesNopahLLCMember2020-08-102020-08-10

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMembergblx:GBSciencesNopahLLCMember2020-08-10

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2020-08-10

0001165320gblx:The6ConvertiblePromissoryNoteDueJuly12022Memberus-gaap:SubsequentEventMember2021-07-02

00011653202019-04-012020-03-31

0001165320us-gaap:CommonStockMember2019-03-31

0001165320us-gaap:AdditionalPaidInCapitalMember2019-03-31

0001165320us-gaap:RetainedEarningsMember2019-03-31

0001165320us-gaap:NoncontrollingInterestMember2019-03-31

00011653202019-03-31

0001165320us-gaap:CommonStockMember2019-04-012020-03-31

0001165320us-gaap:AdditionalPaidInCapitalMember2019-04-012020-03-31

0001165320us-gaap:RetainedEarningsMember2019-04-012020-03-31

0001165320us-gaap:NoncontrollingInterestMember2019-04-012020-03-31

0001165320us-gaap:AccountingStandardsUpdate201602Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:CommonStockMember2019-03-31

0001165320us-gaap:AccountingStandardsUpdate201602Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AdditionalPaidInCapitalMember2019-03-31

0001165320us-gaap:AccountingStandardsUpdate201602Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2019-03-31

0001165320us-gaap:AccountingStandardsUpdate201602Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:NoncontrollingInterestMember2019-03-31

0001165320us-gaap:AccountingStandardsUpdate201602Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-03-31

0001165320us-gaap:NoncontrollingInterestMember2020-03-31

0001165320us-gaap:CommonStockMember2020-04-012021-03-31

0001165320us-gaap:AdditionalPaidInCapitalMember2020-04-012021-03-31

0001165320us-gaap:RetainedEarningsMember2020-04-012021-03-31

0001165320us-gaap:NoncontrollingInterestMember2020-04-012021-03-31

0001165320us-gaap:NoncontrollingInterestMember2021-03-31

0001165320us-gaap:ConvertibleNotesPayableMember2020-04-012021-03-31

0001165320us-gaap:ConvertibleNotesPayableMember2019-04-012020-03-31

00011653202018-03-31

00011653202018-04-08

00011653202019-08-15

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCSaleOfEquityMember2019-11-152019-11-15

0001165320gblx:WellcanaNoteMember2020-12-162020-12-16

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:JudicialRulingMemberus-gaap:ConvertibleNotesPayableMember2020-07-142020-07-14

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Membergblx:JudgmentSettlementAgreementMemberus-gaap:ConvertibleNotesPayableMember2020-11-20

0001165320gblx:WellcanaPlusLLCMembergblx:The8PercentConvertiblePromissoryNoteDatedApril232019Membergblx:JudgmentSettlementAgreementMemberus-gaap:ConvertibleNotesPayableMember2020-11-20

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Membergblx:WellcanaPlusLLCMembergblx:JudgmentSettlementAgreementMemberus-gaap:ConvertibleNotesPayableMember2020-11-202020-12-08

0001165320gblx:TecoMember2019-11-152019-11-15

0001165320gblx:TecoMember2019-11-15

0001165320gblx:GBSciencesNopahLLCMember2019-11-272019-11-27

0001165320gblx:GBSciencesNopahLLCMember2020-08-10

0001165320gblx:GBSciencesNopahLLCMembergblx:The0PercentNotePayableDatedOctober232017Member2020-08-10

0001165320us-gaap:SegmentDiscontinuedOperationsMember2020-03-31

0001165320gblx:TecoMember2019-04-012020-03-31

0001165320gblx:ProductionLicenseMember2019-04-012020-03-31

0001165320gblx:ProductionLicenseMember2019-03-31

0001165320gblx:ProductionLicenseMember2020-03-31

0001165320srt:MinimumMember2020-04-012021-03-31

0001165320srt:MaximumMember2020-04-012021-03-31

0001165320gblx:GBSciencesLouisianaLLCMember2021-03-31

0001165320us-gaap:SegmentContinuingOperationsMember2020-03-31

0001165320gblx:SegmentContinuingAndDiscontinuedOperationsMember2020-03-31

0001165320us-gaap:SegmentContinuingOperationsMember2020-04-012021-03-31

0001165320us-gaap:SegmentDiscontinuedOperationsMember2020-04-012021-03-31

0001165320gblx:SegmentContinuingAndDiscontinuedOperationsMember2020-04-012021-03-31

0001165320us-gaap:SegmentContinuingOperationsMember2019-04-012020-03-31

0001165320us-gaap:SegmentDiscontinuedOperationsMember2019-04-012020-03-31

0001165320gblx:SegmentContinuingAndDiscontinuedOperationsMember2019-04-012020-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMembergblx:NevadaSubsidiariesMember2020-04-012021-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMembergblx:GBSciencesLouisianaLLCMember2020-04-012021-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2020-04-012021-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMembergblx:NevadaSubsidiariesMember2019-04-012020-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMembergblx:GBSciencesLouisianaLLCMember2019-04-012020-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2019-04-012020-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2020-03-31

0001165320us-gaap:AccountingStandardsUpdate201602Member2019-04-01

0001165320srt:MinimumMember2021-03-31

0001165320srt:MaximumMember2021-03-31

0001165320us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:SegmentContinuingOperationsMember2020-04-012021-03-31

0001165320us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:SegmentContinuingOperationsMember2019-04-012020-03-31

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2017-10-242021-03-31

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2021-03-31

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2020-04-012021-03-31

0001165320us-gaap:LineOfCreditMember2019-11-282021-03-31

0001165320us-gaap:LineOfCreditMember2021-03-31

0001165320gblx:The8NotePayableDatedMay72020Memberus-gaap:ConvertibleDebtMember2020-05-072020-05-07

0001165320gblx:The8NotePayableDatedMay72020Memberus-gaap:ConvertibleDebtMember2020-05-07

0001165320gblx:RepricedPreexistingWarrantsWithConvertibleDebtIssuanceMember2020-05-07

0001165320gblx:RepricedPreexistingWarrantsWithConvertibleDebtIssuanceMember2020-05-06

0001165320gblx:RepricedPreexistingWarrantsWithConvertibleDebtIssuanceMember2020-05-072020-05-07

0001165320gblx:The8NotePayableDatedMay72020Memberus-gaap:ConvertibleDebtMember2020-04-012021-03-31

0001165320gblx:The8NotePayableDatedMay72020Memberus-gaap:ConvertibleDebtMember2020-10-052020-10-05

0001165320gblx:TheJuly24NoteMember2020-07-24

0001165320gblx:TheJuly24NoteMembergblx:TecoMember2021-03-31

0001165320gblx:The0PercentNotePayableDatedOctober232017Memberus-gaap:ConvertibleNotesPayableMember2021-03-31

0001165320gblx:The8PercentLineOfCreditDatedNovember272019Memberus-gaap:LineOfCreditMember2021-03-31

0001165320gblx:The8PercentLineOfCreditDatedJuly242020Memberus-gaap:LineOfCreditMember2021-03-31

0001165320gblx:The6PercentNotePayableDueNovember302018Memberus-gaap:ConvertibleNotesPayableMember2021-03-31

0001165320gblx:TheAmended8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2021-03-31

0001165320gblx:The6PercentNotesPayableDueJanuary182022Memberus-gaap:ConvertibleNotesPayableMember2021-03-31

0001165320gblx:PromissoryNoteMember2021-03-31

0001165320gblx:The6PercentNotePayableDatedSeptember302023Memberus-gaap:ConvertibleDebtMember2021-03-31

0001165320gblx:The6PercentNotePayableDatedDecember312023Memberus-gaap:ConvertibleDebtMember2021-03-31

0001165320gblx:PromissoryNoteMember2021-03-31

0001165320gblx:The0PercentNotePayableDatedOctober232017Memberus-gaap:ConvertibleNotesPayableMember2020-03-31

0001165320gblx:The8PercentLineOfCreditDatedNovember272019Memberus-gaap:LineOfCreditMember2020-03-31

0001165320gblx:The6PercentNotePayableDueNovember302018Memberus-gaap:ConvertibleNotesPayableMember2020-03-31

0001165320gblx:TheAmended8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2020-03-31

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2020-03-31

0001165320gblx:PromissoryNoteMember2020-03-31

0001165320us-gaap:ConvertibleDebtMember2021-03-31

0001165320us-gaap:ConvertibleDebtMember2020-04-012021-03-31

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2021-03-31

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2020-04-012021-03-31

0001165320gblx:TecoMember2021-03-31

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2020-04-012021-03-31

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:ConvertibleNotesPayableMember2020-11-212021-03-31

0001165320gblx:JudgmentSettlementAgreementMemberus-gaap:JudicialRulingMember2020-04-012021-03-31

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:JudicialRulingMemberus-gaap:ConvertibleNotesPayableMember2020-04-012021-03-31

0001165320gblx:The8PercentConvertiblePromissoryNoteDatedApril232019Memberus-gaap:JudicialRulingMemberus-gaap:ConvertibleNotesPayableMember2021-03-31

0001165320gblx:The6PercentConvertibleNotePayableDatedDecember312023Member2021-03-31

0001165320gblx:The6PercentConvertibleNotePayableDatedDecember312023Member2020-04-012021-03-31

0001165320us-gaap:FurnitureAndFixturesMember2021-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMemberus-gaap:FurnitureAndFixturesMember2021-03-31

0001165320us-gaap:ComputerEquipmentMember2021-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMemberus-gaap:ComputerEquipmentMember2021-03-31

0001165320us-gaap:MachineryAndEquipmentMember2021-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMemberus-gaap:MachineryAndEquipmentMember2021-03-31

0001165320us-gaap:LeaseholdsAndLeaseholdImprovementsMember2021-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMemberus-gaap:LeaseholdsAndLeaseholdImprovementsMember2021-03-31

0001165320us-gaap:ConstructionInProgressMember2021-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMemberus-gaap:ConstructionInProgressMember2021-03-31

0001165320gblx:FinanceLeaseRightOfUseAssetMember2021-03-31

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMembergblx:FinanceLeaseRightOfUseAssetMember2021-03-31

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMember2020-04-012021-03-31

0001165320gblx:ScientistAndResearcherMember2020-04-012021-03-31

0001165320us-gaap:EmployeeStockOptionMembergblx:ScientistAndResearcherMember2020-04-012021-03-31

0001165320gblx:ConvertibleWarrantMember2020-04-012021-03-31

0001165320gblx:MarchAndJuly2017ConvertibleNoteOfferingMemberus-gaap:ConvertibleNotesPayableMember2020-04-012021-03-31

0001165320gblx:ConvertibleWarrantMember2021-03-31

0001165320gblx:FormerDirectorMember2020-11-16

0001165320gblx:FormerDirectorMember2020-11-162020-11-16

0001165320gblx:EmployeesAndDirectorWarrantsMembergblx:EmployeesAndDirectorsMember2020-12-07

0001165320gblx:EmployeesAndDirectorWarrantsMembergblx:EmployeesAndDirectorsMember2020-12-072020-12-07

0001165320gblx:EmployeesAndDirectorsMember2020-12-152020-12-15

0001165320us-gaap:EmployeeStockOptionMembergblx:EmployeesAndDirectorsMember2020-12-152020-12-15

0001165320us-gaap:EmployeeStockOptionMembergblx:EmployeesAndDirectorsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2020-12-152020-12-15

0001165320us-gaap:EmployeeStockOptionMembergblx:EmployeesAndDirectorsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2020-12-152020-12-15

0001165320us-gaap:EmployeeStockOptionMembergblx:EmployeesAndDirectorsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2020-12-152020-12-15

0001165320gblx:EmployeesAndDirectorsMember2020-04-012021-03-31

0001165320gblx:EmployeesAndDirectorsMember2021-03-31

0001165320gblx:CurrentEmployeesMember2020-12-15

0001165320gblx:CurrentEmployeesMember2020-12-152020-12-15

0001165320us-gaap:EmployeeStockOptionMember2020-12-152020-12-15

0001165320gblx:CompensationWarrantsIssuedToBrokersMember2021-01-02

0001165320gblx:CompensationWarrantsIssuedToBrokersMembersrt:MinimumMember2021-01-01

0001165320gblx:CompensationWarrantsIssuedToBrokersMembersrt:MaximumMember2021-01-01

0001165320gblx:CompensationWarrantsIssuedToBrokersMember2021-01-01

0001165320gblx:CompensationWarrantsIssuedToBrokersMember2021-01-022021-01-02

0001165320gblx:ReplacementWarrantsMember2021-02-08

0001165320gblx:WarrantsMember2021-03-31

0001165320gblx:WarrantsMembersrt:MinimumMember2021-03-31

0001165320gblx:WarrantsMembersrt:MaximumMember2021-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2021-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2021-03-31

0001165320gblx:The8PercentSeniorSecuredConvertiblePromissoryNoteDatedFebruary282019Membergblx:SeniorSecuredConvertiblePromissoryNoteMember2019-12-31

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMember2019-07-11

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMembersrt:MinimumMember2019-07-11

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMembersrt:MaximumMember2019-07-11

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMember2019-04-012019-07-11

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMember2019-07-122019-07-12

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMember2019-07-12

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMembersrt:MinimumMember2019-12-31

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMembersrt:MaximumMember2019-12-31

0001165320gblx:WarrantsIssuedToInvestorsInPrivatePlacementsMember2019-12-012019-12-31

0001165320srt:MinimumMember2019-04-012020-03-31

0001165320srt:MaximumMember2019-04-012020-03-31

0001165320us-gaap:RestrictedStockMembergblx:GBSciencesInc2007AmendedStockOptionPlanMember2008-02-06

0001165320us-gaap:EmployeeStockOptionMembergblx:The2014EquityCompensationPlanMember2015-06-30

0001165320gblx:GbSciencesInc2018StockPlanMember2018-10-25

0001165320us-gaap:EmployeeStockOptionMember2020-04-012021-03-31

0001165320us-gaap:EmployeeStockOptionMember2019-04-012020-03-31

0001165320us-gaap:RestrictedStockMember2020-04-012021-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2019-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2018-04-012019-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2019-04-012020-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2020-03-31

0001165320us-gaap:ShareBasedPaymentArrangementEmployeeMember2020-04-012021-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2019-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2018-04-012019-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2019-04-012020-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2020-03-31

0001165320us-gaap:ShareBasedPaymentArrangementNonemployeeMember2020-04-012021-03-31

0001165320gblx:AgreementWithLouisianaStateUniversityAgCenterMember2017-09-182017-09-18

0001165320gblx:AgreementWithLouisianaStateUniversityAgCenterMember2017-09-18

0001165320gblx:AgreementWithLouisianaStateUniversityAgCenterMember2020-04-012021-03-31

0001165320gblx:AgreementWithLouisianaStateUniversityAgCenterMember2017-09-182021-03-31

0001165320gblx:AgreementWithLouisianaStateUniversityAgCenterMember2020-08-242020-08-24

0001165320gblx:UnpaidSeveranceCompensationMembergblx:KseniaGriswoldMember2020-11-162020-11-16

0001165320gblx:UnpaidSeveranceCompensationMembergblx:KseniaGriswoldMember2021-01-022021-01-02

0001165320gblx:UnpaidSeveranceCompensationMembergblx:KseniaGriswoldMember2021-01-02

0001165320gblx:UnpaidSeveranceCompensationMembergblx:LeslieBocskorMember2020-11-162020-11-16

0001165320gblx:LeslieBocskorMember2020-11-16

0001165320gblx:LeslieBocskorMember2020-11-162020-11-16

0001165320gblx:LeslieBocskorMember2020-04-012021-03-31

0001165320gblx:LeslieBocskorMember2019-04-012020-03-31

0001165320gblx:JohnDavisMember2021-03-31

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2019-11-152019-11-15

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2019-11-15

0001165320gblx:WellcanaNoteMember2021-03-31

0001165320gblx:WellcanaNoteMember2020-04-012021-03-31

0001165320gblx:WellcanaNoteMember2019-11-15

00011653202019-11-15

0001165320gblx:GBSciencesLouisianaLLCMember2019-11-152019-11-15

0001165320gblx:GBSciencesLouisianaLLCMember2019-11-15

00011653202019-11-152019-11-15

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2020-08-242020-10-15

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2020-08-23

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2020-08-24

0001165320gblx:WellcanaNoteMember2020-06-012020-10-15

0001165320gblx:WellcanaNoteMember2020-03-31

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2020-08-012020-08-31

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2020-09-012020-09-30

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2020-12-31

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2020-10-15

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2020-12-08

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2020-10-292020-10-29

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2020-12-082020-12-08

0001165320gblx:WellcanaGroupLLCMembergblx:GBSciencesLouisianaLLCMember2020-12-162020-12-16

0001165320us-gaap:LineOfCreditMembergblx:TecoNoteMember2019-11-15

0001165320us-gaap:SecuredDebtMembergblx:TheJuly24NoteMembergblx:AjeManagementLLCMember2020-07-252021-03-31

0001165320gblx:TheJuly24NoteMember2020-12-29

0001165320gblx:TecoMember2021-03-31

0001165320gblx:TecoMember2020-04-012021-03-31

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMembergblx:GBSciencesNopahLLCMember2019-11-27

0001165320gblx:The0PercentNotePayableDatedOctober232017Membergblx:PromissoryNoteMember2019-11-27

0001165320us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-04-012021-03-31

0001165320us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembergblx:CustomerOneMember2020-04-012021-03-31

0001165320us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembergblx:CustomerTwoMember2020-04-012021-03-31

0001165320us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembergblx:CustomerThreeMember2020-04-012021-03-31

0001165320us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-04-012020-03-31

0001165320us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembergblx:CustomerOneMember2019-04-012020-03-31

0001165320us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembergblx:CustomerTwoMember2019-04-012020-03-31

0001165320stpr:NV2019-04-012020-03-31

0001165320us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMemberstpr:NV2019-04-012020-03-31

0001165320stpr:LA2019-04-012020-03-31

0001165320us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMemberstpr:LA2019-04-012020-03-31

0001165320gblx:TecoMemberus-gaap:SubsequentEventMember2021-05-112021-05-11

0001165320us-gaap:SubsequentEventMember2021-06-142021-06-14

0001165320us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2021-04-012021-06-30

0001165320gblx:NevadaSubsidiariesMember2021-04-012021-06-30

0001165320gblx:GBSciencesLouisianaLLCSaleOfEquityMember2020-04-012021-03-31

0001165320gblx:NevadaSubsidiariesMember2020-04-012021-03-31

This prospectus relates to the resale, by the Selling Security Holders identified in this prospectus, of up to an aggregate of 119,899,091 shares of our common stock, par value $0.0001 per share (“Common Stock”), issuable upon the conversion of convertible debt issued in private placements and issuable upon the exercise of warrants and options issued in private placements and to employees and consultants in exchange for services rendered to the Company.

The Selling Security Holders may sell all or a portion of the shares of Common Stock from time to time in market transactions through any market on which our shares of Common Stock are then traded, in negotiated transactions or otherwise, and at prices and on terms that will be determined by the then prevailing market price or at negotiated prices directly or through a broker or brokers, who may act as agent or as principal or by a combination of such methods of sale. See “Plan of Distribution.”

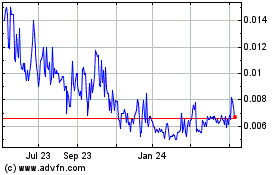

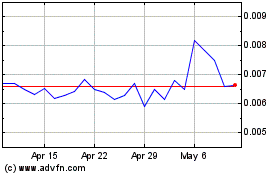

Our Common Stock is listed on The OTC Markets under the symbol “GBLX.” On September 7, 2021, the last reported sale price of our Common Stock was $0.037 per share.

The date of this prospectus is ___, 2021.

RISK FACTORS

This offering involves a high degree of risk. You should carefully consider the risks and uncertainties described below in addition to the other information contained in this prospectus before deciding whether to invest in shares of our common stock. If any of the following risks actually occur, our business, financial condition or operating results could be harmed. In that case, the trading price of our common stock could decline and you may lose part or all of your investment. In the opinion of management, the risks discussed below represent the material risks known to the Company. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also impair our business operations and adversely affect the market price of our common stock.

RISKS RELATING TO OUR BUSINESS AND INDUSTRY

We have a limited operating history, which may make it difficult for investors to predict future performance based on current operations.

We have a limited operating history upon which investors may base an evaluation of our potential future performance. In particular, we have not proven that we can supply growing equipment in a manner that enables us to be profitable and meet customer requirements, develop intellectual property to enhance our product lines, obtain the necessary permits to develop medical grade cannabis, develop and maintain relationships with key manufacturers and strategic partners to extract value from our intellectual property, raise sufficient capital in the public and/or private markets, or respond effectively to competitive pressures. As a result, there can be no assurance that we will be able to develop or maintain consistent revenue sources, or that our operations will be profitable and/or generate positive cash flows.

Any forecasts we make about our operations may prove to be inaccurate. We must, among other things, determine appropriate risks, rewards, and level of investment in our product lines, respond to economic and market variables outside of our control, respond to competitive developments and continue to attract, retain and motivate qualified employees. There can be no assurance that we will be successful in meeting these challenges and addressing such risks and the failure to do so could have a materially adverse effect on our business, results of operations and financial condition. Our prospects must be considered in light of the risks, expenses, and difficulties frequently encountered by companies in the early stage of development. As a result of these risks, challenges and uncertainties, the value of your investment could be significantly reduced or completely lost.

Our independent auditors’ report for the fiscal years ended March 31, 2021 and 2020 have expressed doubts about our ability to continue as a going concern;

Due to the uncertainty of our ability to meet our current operating and capital expenses, in our audited annual financial statements as of and for the years ended March 31, 2021 and 2020 our independent auditors included a note to our financial statements regarding concerns about our ability to continue as a going concern. The Company has incurred recurring losses and has generated limited revenue since inception. These factors and the need for additional financing in order for the Company to meet its business plan, raise substantial doubt about the ability to continue as a going concern. The presence of the going concern note to our financial statements may have an adverse impact on the relationships we are developing and plan to develop with third parties as we continue the commercialization of our products and could make it challenging and difficult for us to raise additional financing, all of which could have a material adverse impact on our business and prospects and result in a significant or complete loss of your investment.

We have incurred significant losses in prior periods, and losses in the future could cause the quoted price of our Common Stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due and on our cash flows.

We have incurred significant losses in prior periods. For the years ended March 31, 2021 and 2020, we incurred net losses of $3,725,027 and $12,373,579 respectively, and we had an accumulated deficit of $103,886,232 and $97,387,205 respectively. Any losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due, and on our cash flows.

We will need additional capital to sustain our operations and will need to seek further financing, which we may not be able to obtain on acceptable terms or at all. If we fail to raise additional capital, as needed, our ability to implement our business plan could be compromised.

We have limited capital resources and operations. To date, our operations have been funded primarily from the proceeds of debt and equity financings. We expect to require substantial additional capital in the near future to implement our strategies, develop our intellectual property base, and establish our targeted levels of commercial production. There is no assurance that we will be able to raise the amount of capital needed for future growth plans.

Even if financing is available, it may not be on terms that are acceptable. If unable to raise the necessary capital at the times required, the Company may have to materially change the business plan, including delaying implementation of aspects of the business plan or curtailing or abandoning the business plan. Even if we obtain financing for our near-term operations, we expect that we will require additional capital thereafter, especially if we are to develop our Science division and start to conduct, individually or with joint venture partners, pre-clinical and clinical trials for potential pharmaceutical, or nutraceutical products derived from cannabis. Our capital needs will depend on numerous factors including: (i) our profitability; (ii) the release of competitive products by our competition; (iii) the level of our investment requirements for research and development; and (iv) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership held by our existing stockholders will be reduced and our stockholders may experience significant dilution. In addition, new securities may contain rights, preferences or privileges that are senior to those of our common stock. If we raise additional capital by incurring debt, this will result in increased interest expense. If we raise additional funds through the issuance of securities, market fluctuations in the price of our shares of common stock could limit our ability to obtain equity financing.

We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us. If we are unable to raise capital when needed, our business, financial condition, and results of operations would be materially adversely affected, and we could be forced to reduce or discontinue our operations.

Drug research and development programs typically involves huge expenditures, long periods to obtain FDA approvals and the potential that such prospective pharmaceutical products will not prove to be safe and effective.

The production of FDA-approved pharmaceutical products and related drug is typically a highly expensive a long and drawn out process, typically involving hundreds of millions of dollars and a decade or more to achieve. Although we believe that some, if not all, of our planned cannabinoid based pharmaceutical protocols can qualify for “orphan drug” status and be accelerated through the FDA approval process, there can be no assurance that this will be the case.

In addition, we do not now have, and do not expect in the foreseeable future to have, the capital resources to fund our drug discovery programs, nor do we have the infrastructure to conduct such program alone. For that reason, we intend to engage in joint ventures with third parties, including hospitals, clinics, foundations and other qualified sources. Although we are in preliminary discussions with various potential partners, to date, we have not entered into any definitive drug development joint venture or partnership agreement. Our failure or inability to enter into one or more drug development agreements will materially and adversely affect our ability to develop our Science division. Even if we are able to obtain such joint drug development agreements there can be no assurance that it will be on terms and conditions that will be favorable to us.

There is the further risk that the anticipated costs of producing an FDA approved drug will not escalate to the point that will cause us and any of our prospective development partners to abandon such efforts.

Even if we do develop an FDA-approved pharmaceutical product, there is the risk that it will not be saleable to a major pharmaceutical company (either before or after completion of the FDA approval process), or that other competing drugs will not be produced providing the same medical benefits.

Accordingly, there is a significant risk that we will never be able to generate a return on our investment, and we could lose our entire investment in GBS Global Biopharma, Inc. Either of such events, would have a material adverse effect on our business prospects and equity value.

There has been limited study on the effects of cannabinoids and future clinical research studies may lead to conclusions that dispute or conflict with our understanding and belief regarding the medical benefits, viability, safety, efficacy, dosing and social acceptance of cannabinoid-based active ingredients.

Research regarding the medical benefits, viability, safety, efficacy and dosing of cannabinoids (such as CBD) remains in relatively early stages. There have been few clinical trials on the benefits of cannabinoids conducted by us or by others, but the number of trials is growing.

Future research and clinical trials may draw opposing conclusions to statements contained in the articles, reports and studies we have relied on or could reach different or negative conclusions regarding the medical benefits, viability, safety, efficacy, dosing or other facts and perceptions related to cannabinoid-containing prescription medicines. However, our proprietary formulations will have been through the rigorous premarket approval process of the US FDA prior to marketing.

Federal law prohibits the use of cannabis for the purposes in which the Company expects to engage.

Under the federal Controlled Substances Act (“CSA”), cannabis is deemed to be a Schedule One narcotic that has no medical benefit. Therefore, a range of activities including cultivation and the personal use of cannabis is prohibited and is a criminal offense. Unless and until Congress amends the CSA with respect to medical cannabis, as to the timing or scope of any which amendments there can be no assurance, there is a risk that federal authorities may enforce current federal law. The risk of strict enforcement of the CSA in light of Congressional activity, judicial holdings, and stated federal policy remains uncertain.

The current policy and regulations of the Federal government and its agencies, including the U.S. Drug Enforcement Agency and the FDA, are that cannabis has no medical benefit and a range of activities including cultivation and use of cannabis for personal use is prohibited on the basis of Federal law. Although thirty-three states and District of Columbia have passed legislation permitting the cultivation and dispensing of medical cannabis, these laws are, in many jurisdictions, subject to strict regulation and limitations and are still being developed. Active enforcement of the current federal regulatory position on cannabis on a regional or national basis may directly and adversely affect the ability of the Company to develop its business plan even though it is allowed by state regulation in the various states in which the Company intends to operate. Although research and development in the growing and processing of cannabis products for medicinal purposes and in seeking to obtain state permits for the cultivation and sale of cannabis products are not in violation of Federal law, our business plan to conduct our Solutions and Products divisions, even if conducted within the parameters of any state licenses or permits we are able to obtain, will violate federal laws, as currently in effect. Accordingly, although the Company was successful in obtaining a cultivation and production license in Nevada or other states and operates pursuant to such licenses, if federal law does not change, we believe the Company will at that time be in violation of federal law. If existing federal laws are enforced by the United States Department of Justice or the FDA, it is likely that our proposed business will be significantly and materially adversely affected.

Because the Company's sales are subject to IRC 280E, we may owe federal income taxes even though we are incurring losses.

Under the federal Controlled Substances Act (“CSA”), cannabis is deemed to be a Schedule One narcotic that has no medical benefit. The production and distribution of Schedule One narcotics is subject to Internal Revenue Code Section 280E, which prohibits the Company from deducting any ordinary and necessary business expenses from taxable gross profit related to the sale of cannabis products. Without the deduction of business expenses, it is possible that the Company will owe income taxes while generating losses. If we are unable to pay those taxes we may be subject to penalties and IRS enforcement action.

FDA regulation of marijuana and the possible registration of facilities where medical marijuana is grown could negatively affect the cannabis industry which would directly affect our financial condition.

Should the federal government legalize marijuana for medical use, it is possible that the U.S. Food and Drug Administration (FDA) would seek to regulate it under the Food, Drug and Cosmetics Act of 1938. Additionally, the FDA may issue rules and regulations including cGMPs (current good manufacturing practices) related to the growth, cultivation, harvesting and processing of medical marijuana. Clinical trials may be needed to verify efficacy and safety. It is also possible that the FDA would require that facilities where medical marijuana is grown be registered with the FDA and comply with certain federally prescribed regulations. In the event that some or all of these regulations are imposed, we do not know what the impact would be on the medical marijuana industry, what costs, requirements and possible prohibitions may be enforced.

If no additional states allow the medicinal use of cannabis, or if one or more states that currently allow it reverse their position, we may not be able to continue our growth, or the market for our products and services may decline.

Currently, thirty-three states and the District of Columbia allow the use of medicinal cannabis. While we believe that the number of states that allow the use of medicinal cannabis will grow, there can be no assurance that it will, and if it does not, there can be no assurance that the thirty-three existing states and/or the District of Columbia won’t reverse their position and disallow it. If either of these things happens, then not only will the growth of our business be materially impacted, we may experience declining revenue as the market for our products and services declines.

Because the business activities of some of our customers are illegal under Federal law, we may be deemed to be aiding and abetting illegal activities through the services that we provide to those customers. As a result, we may be subject to actions by law enforcement authorities which would materially and adversely affect our business.

We provide services to customers that are engaged in businesses involving the possession, use, cultivation, and transfer of cannabis. As a result, law enforcement authorities may seek to bring an action or actions against us, including, but not limited, to a claim of aiding and abetting another’s criminal activities. Such an action would have a material effect on our business and operations.

In the states where medicinal cannabis is permitted, local laws and regulations could adversely affect our clients, including causing some of them to close, which would materially and adversely affect our business.

Even in areas where the medicinal use of cannabis is legal under state law, there are also local laws and regulations that affect our clients. These local laws and regulations may cause some of our customers to close and having a material effect on our business and operations. In addition, the enforcement of identical rules or regulations as it pertains to medicinal cannabis may vary from municipality to municipality, or city to city.

Variations in state and local regulation and enforcement in states that have legalized medical cannabis that may restrict cannabis-related activities, including activities related to medical cannabis may negatively impact our revenues and profits.

Individual state laws do not always conform to the federal standard or to other states laws. A number of states have decriminalized cannabis to varying degrees, other states have created exemptions specifically for medical cannabis, and several have both decriminalization and medical laws. Variations exist among states that have legalized, decriminalized, or created medical cannabis exemptions. For example, Colorado has limits on the number of cannabis plants that can be homegrown. In most states, the cultivation of cannabis for personal use continues to be prohibited except for those states that allow small-scale cultivation by the individual in possession of medical cannabis needing care or that person’s caregiver. Active enforcement of state laws that prohibit personal cultivation of cannabis may indirectly and adversely affect our business and our revenue and profits.

It is possible that federal or state legislation could be enacted in the future that would prohibit us from selling our products or any resulting cannabis products, and if such legislation were enacted, it could prevent us from generating revenue, leading to a loss in your investment.

We are not aware of any federal or state regulation that regulates the sale of indoor cultivation equipment to medical or recreational cannabis growers. The extent to which the regulation of drug paraphernalia under the CSA is applicable to our business and the sale of our products is found in the definition of “drug paraphernalia.” Drug paraphernalia means any equipment, product, or material of any kind that is primarily intended or designed for use in manufacturing, compounding, converting, concealing, producing processing, preparing, injecting, ingesting, inhaling, or otherwise introducing into the human body a controlled substance, possession of which is unlawful.

If federal and/or state legislation is enacted which prohibits the sale of our growing equipment to medical cannabis growers, our revenues would decline, leading to a loss of a material portion of your investment.

Prospective customers may be deterred from doing business with a company with a significant nationwide online presence because of fears of federal or state enforcement of laws prohibiting possession and sale of medical or recreational cannabis.

Internet websites are visible by people everywhere, not just in jurisdictions where the medical or recreational use of cannabis is considered legal. Our website is visible in jurisdictions where medicinal and/or recreational use of cannabis is not permitted and, as a result, we may be found to be violating the laws of those jurisdictions. We could lose potential customers as they could fear federal prosecution. In most states in which the production and sale of cannabis have been legalized, there are additional laws or licenses required and some states altogether prohibit home cultivation, all of which could make the loss of potential customers more likely.

We may not obtain the necessary permits and authorizations to operate the cannabis business.

We may not be able to obtain or maintain the necessary licenses, permits, authorizations, or accreditations, or may only be able to do so at great cost, to operate its medical cannabis business. In addition, we may not be able to comply fully with the wide variety of laws and regulations applicable to the medical cannabis industry. Failure to comply with or to obtain the necessary licenses, permits, authorizations, or accreditations could result in restrictions on our ability to operate the medical cannabis business, which could have a material adverse effect on our business.

Any failure on our part to comply with applicable regulations could prevent us from being able to carry on our business.

Nevada Department of Taxation inspectors routinely assess the Teco Facility for compliance with applicable regulatory requirements. Any failure by us to comply with the applicable regulatory requirements could require extensive changes to our operations; result in regulatory or agency proceedings or investigations, increased compliance costs, damage awards, civil or criminal fines or penalties or restrictions on our operations; and harm our reputation or give rise to material liabilities or a revocation of our licenses and other permits. There can be no assurance that any pending or future regulatory or agency proceedings, investigations or audits will not result in substantial costs, a diversion of management’s attention and resources or other adverse consequences to us and our business.

If we incur substantial liability from litigation, complaints, or enforcement actions, our financial condition could suffer.

Our participation in the medical cannabis industry may lead to litigation, formal or informal complaints, enforcement actions, and inquiries by various federal, state, or local governmental authorities against these subsidiaries. Litigation, complaints, and enforcement actions involving these subsidiaries could consume considerable amounts of financial and other corporate resources, which could have a negative impact on our sales, revenue, profitability, and growth prospects.

We are subject to risks inherent in an agricultural business, including the risk of crop failure.

We grow cannabis, which is an agricultural process. As such, our business is subject to the risks inherent in the agricultural business, including risks of crop failure presented by weather, insects, plant diseases and similar agricultural risks.

We have difficulty accessing the service of banks, which may make it difficult for us to operate.

Since the use of cannabis is illegal under Federal law, there is an argument that banks should not accept for deposit funds from businesses involved with the cannabis industry. Consequently, such businesses often have difficulty finding a bank willing to accept their business.

On February 14, 2014, the U.S. government issued rules allowing banks to legally provide financial services to state licensed marijuana businesses. A memorandum issued by the Justice Department to federal prosecutors re-iterated guidance previously given, this time to the financial industry that banks can do business with legal marijuana businesses and “may not” be prosecuted. The Treasury Department's Financial Crimes Enforcement Network (FinCEN) issued guidelines to banks that “it is possible to provide financial services" to state-licensed marijuana businesses and still be in compliance with federal anti-money laundering laws.

Notwithstanding the above federal guidelines and in addition to potential federal sanctions, regulators in the states in which we are able to conduct business may make it difficult for local banks to do business with companies considered to be engaged in cultivating and dispensing cannabis. Failure to establish a permanent banking relationship could have a material and adverse effect on our future business operations.

We face intense competition and many of our competitors have greater resources that may enable them to compete more effectively.

The industry in which we operate is subject to intense and increasing competition. Some of our competitors have greater capital resources, facilities and diversity of product lines, which may enable them to compete more effectively in this market. Our competitors may devote their resources to developing and marketing products that will directly compete with our product lines. Due to this competition, there is no assurance that we will not encounter difficulties in obtaining revenues and market share or in the positioning of our products. There are no assurances that competition in our respective industries will not lead to reduced prices for our products. If we are unable to successfully compete with existing companies and new entrants to the market this will have a negative impact on our business and financial condition.

If we fail to protect or develop our intellectual property, our business could be adversely affected.

Our viability will depend, in part, on our ability to develop and maintain the proprietary aspects of our technology to distinguish our products from our competitors’ products. We will rely on patents, copyrights, trademarks, trade secrets, and confidentiality provisions to establish and protect our intellectual property.

Any infringement or misappropriation of our intellectual property could damage its value and limit our ability to compete. We may have to engage in litigation to protect the rights to our intellectual property, which could result in significant litigation costs and require a significant amount of our time. In addition, our ability to enforce and protect our intellectual property rights may be limited in certain countries outside the United States, which could make it easier for competitors to capture market position in such countries by utilizing technologies that are similar to those developed or licensed by us.

Competitors may also harm our sales by designing products that mirror the capabilities of our products or technology without infringing on our intellectual property rights. If we do not obtain sufficient protection for our intellectual property, or if we are unable to effectively enforce our intellectual property rights, our competitiveness could be impaired, which would limit our growth and future revenue.

We may also find it necessary to bring infringement or other actions against third parties to seek to protect our intellectual property rights. Litigation of this nature, even if successful, is often expensive and time-consuming to prosecute and there can be no assurance that we will have the financial or other resources to enforce our rights or be able to enforce our rights or prevent other parties from developing similar technology or designing around our intellectual property.

Although we believe that our intellectual property does not and will not infringe upon the patents or violate the proprietary rights of others, it is possible such infringement or violation has occurred or may occur, which could have a material adverse effect on our business.

We are not aware of any infringement by us of any person’s or entity’s intellectual property rights. In the event that products we sell are deemed to infringe upon the patents or proprietary rights of others, we could be required to modify our products or obtain a license for the manufacture and/or sale of such products or cease selling such products. In such event, there can be no assurance that we would be able to do so in a timely manner, upon acceptable terms and conditions, or at all, and the failure to do any of the foregoing could have a material adverse effect upon our business.

There can be no assurance that we will have the financial or other resources necessary to enforce or defend a patent infringement or proprietary rights violation action. If our products or proposed products are deemed to infringe or likely to infringe upon the patents or proprietary rights of others, we could be subject to injunctive relief and, under certain circumstances, become liable for damages, which could also have a material adverse effect on our business and our financial condition.

Our trade secrets may be difficult to protect.

Our success depends upon the skills, knowledge, and experience of our scientific and technical personnel, our consultants and advisors, as well as our licensors and contractors. Because we operate in several highly competitive industries, we rely in part on trade secrets to protect our proprietary technology and processes. However, trade secrets are difficult to protect. We enter into confidentiality or non-disclosure agreements with our corporate partners, employees, consultants, outside scientific collaborators, developers, and other advisors. These agreements generally require that the receiving party keep confidential and not disclose confidential information developed by the receiving party or made known to the receiving party by us during the course of the receiving party’s relationship with us. These agreements also generally provide that inventions conceived by the receiving party in the course of rendering services to us will be our exclusive property, and we enter into assignment agreements to perfect our rights.

These confidentiality, inventions and assignment agreements may be breached and may not effectively assign intellectual property rights to us. Our trade secrets also could be independently discovered by competitors, in which case we would not be able to prevent the use of such trade secrets by our competitors. The enforcement of a claim alleging that a party illegally obtained and was using our trade secrets could be difficult, expensive and time consuming and the outcome would be unpredictable. In addition, courts outside the United States may be less willing to protect trade secrets. The failure to obtain or maintain meaningful trade secret protection could adversely affect our competitive position.

Our future success depends on our key executive officers and our ability to attract, retain, and motivate qualified personnel.

Our future success largely depends upon the continued services of our executive officers and management team. If one or more of our executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Additionally, we may incur additional expenses to recruit and retain new executive officers. If any of our executive officers joins a competitor or forms a competing company, we may lose some of our potential customers. Finally, we do not maintain “key person” life insurance on any of our executive officers. Because of these factors, the loss of the services of any of these key persons could adversely affect our business, financial condition, and results of operations, and thereby an investment in our stock.

Our continuing ability to attract and retain highly qualified personnel will also be critical to our success because we will need to hire and retain additional personnel as our business grows. There can be no assurance that we will be able to attract or retain highly qualified personnel. We face significant competition for skilled personnel in our industry. This competition may make it more difficult and expensive to attract, hire, and retain qualified managers and employees. Because of these factors, we may not be able to effectively manage or grow our business, which could adversely affect our financial condition or business. As a result, the value of your investment could be significantly reduced or completely lost.

We may not be able to effectively manage our growth or improve our operational, financial, and management information systems, which would impair our results of operations.

In the near term, we intend to expand the scope of our operations activities significantly. If we are successful in executing our business plan, we will experience growth in our business that could place a significant strain on our business operations, finances, management and other resources. The factors that may place strain on our resources include, but are not limited to, the following:

|

|

●

|

The need for continued development of our financial and information management systems;

|

|

|

●

|

The need to manage strategic relationships and agreements with manufacturers, customers and partners; and

|

|

|

●

|

Difficulties in hiring and retaining skilled management, technical, and other personnel necessary to support and manage our business.

|

Additionally, our strategy could produce a period of rapid growth that may impose a significant burden on our administrative and operational resources. Our ability to effectively manage growth will require us to substantially expand the capabilities of our administrative and operational resources and to attract, train, manage, and retain qualified management and other personnel. There can be no assurance that we will be successful in recruiting and retaining new employees or retaining existing employees.

We cannot provide assurances that our management will be able to manage this growth effectively. Our failure to successfully manage growth could result in our sales not increasing commensurately with capital investments or otherwise materially adversely affecting our business, financial condition, or results of operations.

If we are unable to continually innovate and increase efficiencies, our ability to attract new customers may be adversely affected.

In the area of innovation, we must be able to develop new technologies and products that appeal to our customers. This depends, in part, on the technological and creative skills of our personnel and on our ability to protect our intellectual property rights. We may not be successful in the development, introduction, marketing, and sourcing of new technologies or innovations, that satisfy customer needs, achieve market acceptance, or generate satisfactory financial returns.

Litigation may adversely affect our business, financial condition, and results of operations.

From time to time in the normal course of our business operations, we may become subject to litigation that may result in liability material to our financial statements as a whole or may negatively affect our operating results if changes to our business operations are required. The cost to defend such litigation may be significant and may require a diversion of our resources. There also may be adverse publicity associated with litigation that could negatively affect customer perception of our business, regardless of whether the allegations are valid or whether we are ultimately found liable. Insurance may not be available at all or in sufficient amounts to cover any liabilities with respect to these or other matters. A judgment or other liability in excess of our insurance coverage for any claims could adversely affect our business and the results of our operations.

If we fail to implement and maintain proper and effective internal controls and disclosure controls and procedures pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, our ability to produce accurate and timely financial statements and public reports could be impaired, which could adversely affect our operating results, our ability to operate our business, and investors’ views of us.

As of March 31, 2021, management assessed the effectiveness of our internal controls over financial reporting. Management concluded, as of the fiscal year ended March 31, 2021, that our internal controls and procedures were not effective to detect the inappropriate application of U.S. GAAP rules. Management concluded that our internal controls were adversely affected by deficiencies in the design or operation of our internal controls, which management considered to be material weakness; specifically, no member of our board of directors qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act.

The failure to implement and maintain proper and effective internal controls and disclosure controls could result in material weaknesses in our financial reporting such as errors in our financial statements and in the accompanying footnote disclosures that could require restatements. Investors may lose confidence in our reported financial information and disclosure, which could negatively impact our stock price.

We do not expect that our internal controls over financial reporting will prevent all errors and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the controls. Over time, controls may become inadequate because changes in conditions or deterioration in the degree of compliance with policies or procedures may occur. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.