Pacific's restructuring would mark reversal of fortune for

company that stood at vanguard of continent's oil boom

By Sara Schaefer Muñoz and Anatoly Kurmanaev

BOGOTÁ, Colombia -- Latin America's largest privately owned oil

producer said it was preparing to file for bankruptcy-court

protection after reaching a tentative restructuring deal Monday

that leaves shareholders with cents on the dollar.

The deal would cap a humbling turn of events for Pacific

Exploration & Production Corp., which once stood at the

vanguard of South America's oil boom. At its peak earlier this

decade, Pacific was worth $8 billion, employed 30,000 people and

had so much cash it flew pop star Marc Anthony to a corporate

party.

Pacific has become a major bust from the global commodity

downturn, a slide that current and former directors and employees

say was aggravated by mismanagement, wild overspending and poor

investments.

"Pacific was a big success story, but it didn't make the right

choices," said Nathan Piper, an analyst at RBC Capital Markets. "It

didn't have to be in the situation it's in today."

Pacific spokesman Tom Becker said management made investment

decisions based on the best available information at the time.

The restructuring agreed with Canadian hedge fund The Catalyst

Capital Group Inc. on Monday would inject $500 million and cut $5

billion of the company's debt, at the cost of wiping out equity

holders. The deal now needs to be approved by two-thirds of the

bondholders.

Founded by Venezuelan oil and mining executives who had fled

their country's socialist government, the scrappy startup grew to

become Colombia's second-largest company, after state-controlled

Ecopetrol SA, and helped transform the country into the continent's

third largest producer.

In 2012, Colombian magazine Dinero featured the management team

on its cover, with the headline "The Magic of Pacific."

Pacific's highly visible executives, Serafino Iacono and Ronald

Pantin, flew in private jets and built sprawling country houses.

Pacific sponsored the national soccer team, an annual PGA Golf

Championship and in 2013, congress gave Mr. Iacono the prestigious

Order of Democracy award for his business activities.

Money flowed in, and right out. The firm made nearly a dozen

acquisitions, branching into natural gas and infrastructure, among

them a 35% stake in the ODL oil pipeline and a 41.6% stake in the

city of Cartagena's $600 million new port, which the company said

helped it grow and decrease operating costs.

But analysts and employees say the company's spending spree --

especially the cash acquisition of oil explorer Petrominerales Ltd.

in 2014 for $909 million -- racked up an unsustainable $5 billion

in debt.

"We had huge overhang just as times turned bad," said a former

executive, who said the firm's directors took out more loans to pay

for Petrominerales instead of more prudently paying in shares.

Even then, investors were willing to pile in. Mexican

conglomerate Grupo Industrial Alfa SAB boosted a small stake to 19%

of the company in 2014 for $1 billion.

Analysts also say that Pacific overstated reserves, inflating

demand for its debt and shares long after the price of crude had

fallen and production became less profitable.

Mr. Becker, the Pacific spokesman, said the company hired

independent third-party reserves analysts in accordance with

securities laws.

The company tasked to calculate Pacific's reserves, Canada-based

Petrotech Engineering Ltd., said in 2013 that the company had more

than 30 million barrels of proven reserves in its CPE-6 block in

Colombia's eastern plains, even as the owner of the other half of

the block, Canada's Talisman Energy Inc., said its own reserve

calculations for CPE-6 were zero.

In an interview, Petrotech founder John Yu said he based his

calculations on several factors allowed under Canadian law,

including an estimated future oil price that was higher than what

it turned out to be.

People inside and outside the company said Pacific directors

based their 2015 budget on $80 per barrel oil when the futures

market was already pricing in a further fall. Mr. Becker said

management "immediately began to cut costs and budgets to reflect

the new oil price reality" in late 2014.

As Pacific's woes piled on in early 2015, a group of young

Venezuelans investors saw an opportunity to snatch the company on

the cheap, giving them a vehicle to expand into the massive oil

sector back home. They racked up a nearly 20% stake in the company

for $290 million. Those investors, grouped in investment vehicle

O'Hara Administration Co., are led by electricity contractor

Alejandro Betancourt, whose company Derwick Associates has been

investigated by U.S. authorities for bribery.

A Derwick spokesman said the investigation was suspended after

the Justice Department reviewed its bank accounts. The Justice

Department declined to comment on the status of the

investigation.

Just days after O'Hara upped its stake, Mexico's Alfa and

U.S.-based partner Harbour Energy Ltd. offered to buy Pacific for a

high of 6.50 Canadian dollars (US$5.1) a share -- Pacific is also

listed in Toronto -- to use the company in Mexico's new oil

auctions. But new Venezuelan shareholders blocked the offer, hoping

to gain control of the company themselves.

The Alfa bid for Pacific was "a miracle" amid low world oil

prices, said Ian MacQueen, analyst at Paradigm Capital. "It was

also [unbelievable] that the bid was turned down."

When the deal failed, Pacific's shares plummeted 45% further, to

C$2.85 on the Toronto stock exchange. As prices of crude continued

to sink, so did the share price, and the O'Hara group lost 70% of

their initial investment.

Now O'Hara, and the rest of Pacific's shareholders, could face a

total wipeout if the restructuring deal is approved. Top

management, however, will be able to own up to 10% of the

restructured company's shares under the incentive plan offered by

Catalyst.

Write to Anatoly Kurmanaev at Anatoly.kurmanaev@wsj.com

(END) Dow Jones Newswires

April 20, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

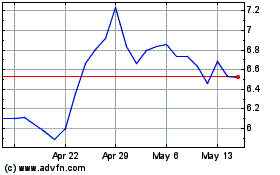

Frontera Energy (PK) (USOTC:FECCF)

Historical Stock Chart

From May 2024 to Jun 2024

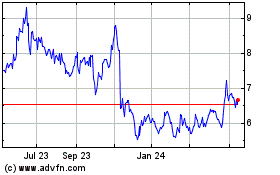

Frontera Energy (PK) (USOTC:FECCF)

Historical Stock Chart

From Jun 2023 to Jun 2024