Mortgage Rates Continue to Rise, Freddie Mac Says

February 17 2022 - 10:29AM

Dow Jones News

By Will Feuer

Mortgage rates climbed in the latest week, according to

government-backed housing-finance agency Freddie Mac.

In the week ending Thursday, the average rate on a 30-year

fixed-rate mortgage increased to 3.92% from 3.69% last week. A year

ago this week, the average rate was 2.81%.

Average 15-year rates were 3.15%, up from 2.93% a week ago and

2.21% a year ago.

The average rate on a five-year Treasury-indexed hybrid

adjustable-rate mortgage, or ARM, was 2.98%, up from 2.8% a week

ago and from 2.77% in the same period last year.

"Mortgage rates jumped again due to high inflation and stronger

than expected consumer spending," Freddie Mac Chief Economist Sam

Khater said.

"The 30-year fixed-rate mortgage is nearing 4%, reaching highs

we have not seen since May 2019. As rates and house prices rise,

affordability has become a substantial hurdle for potential

homebuyers, especially as inflation threatens to place a strain on

consumer budgets," he said.

Expectations that the Federal Reserve will raise interest rates

multiple times this year have also been driving increases in

mortgage rates, which are closely tied to the 10-year U.S.

Treasury.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

February 17, 2022 10:14 ET (15:14 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

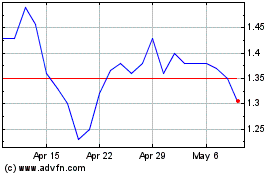

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Apr 2023 to Apr 2024