ACS Is In Advanced Talks To Sell Abertis Stake To Abertis, Others

April 25 2012 - 4:10AM

Dow Jones News

Spanish construction company Actividades de Construccion y

Servicios SA (ACS.MC) said Wednesday it is in advanced talks to

sell its stake in Spanish toll-road concessionaire Abertis

Infraestructuras SA (ABE.MC) to the toll-road company and others as

it seeks to shore up its balance sheet.

ACS owns a 10.3% in Abertis according to FactSet and is facing a

liquidity crunch that has led it to sell off stakes in several

companies to strengthen its balance sheet.

Abertis said in a separate statement that it is authorized to

buy up to 5.3% of its own shares, and that it would consider

purchasing this stake from ACS if the company decides to sell

it.

Abertis said late Tuesday it has signed a letter of intent with

its smaller peer Obrascon Huarte Lain SA (OHL.MC) in which they

agreed that Abertis will integrate OHL's Brazilian unit, Obrascon

Huarte Lain Brasil, while OHL will become one of Abertis's core

shareholders, with a 10% stake.

Following the operation, which includes a separate deal to buy

OHL's toll-road concessions in Chile, Abertis will become the world

leader in the toll-road concession sector, operating over 7,500

kilometers. The assets Abertis will incorporate are nine toll-road

concessions in Brazil, totaling 3,227 kilometers, and three

concessions in Chile, totaling 342 kilometers.

ACS and Abertis shares are leading the Madrid stock market

higher. ACS shares are up 7.1% at EUR14.52, while Abertis is up

6.1% at EUR11.82.

-By Alex MacDonald, Dow Jones Newswires; +44 (0)7776 200 924;

alex.macdonald@dowjones.com

(Enza Tedesco in Buenos Aires and Art Patnaude in Madrid

contributed to this article.)

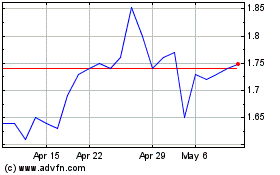

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Jul 2023 to Jul 2024