2nd UPDATE: Repsol Shareholders Hit By YPF Seizure As Impact Widens

April 19 2012 - 12:23PM

Dow Jones News

Collateral damage from Argentina's seizure of oil firm YPF

spread Thursday to key Repsol shareholders Thursday, raising the

stakes for the Spanish government as it battles to protect its

interests in its former colony and dragging Mexico into the

spat.

In yet another worry for Spain's battered economy, Argentina's

move to take over Repsol's unit is hitting companies in two of the

country's already long-suffering sectors: banks and

construction.

Caixabank (CABK.MC), Spain's third-largest bank and Repsol's top

shareholder with a 13% stake, Thursday said it wouldn't writedown

the value of its stake in Repsol yet because such a move might

acknowledge that Argentina was in the right. Chairman Isidro Faine

told reporters in Barcelona that the company would be seeking a

fair price for YPF, but he acknowledged that any settlement would

be a long way off.

The bank faces an even bigger hit to its earnings, after

first-quarter net profit dropped 84% as it set aside most of its

earnings to cover potential losses on its real estate holdings in

line with new requirements set by the government.

Caixabank, along with Repsol's other two major shareholders,

Spanish construction company Sacyr-Vallehermoso SA (SYV.MC) and

Mexican state-owned oil firm Pemex, face immediate problems with

the valuations of their Repsol stakes, even if they don't make

immediate writedowns.

Caixabank currently values its Repsol shares at around EUR21.1

each, while Sacyr, the second-largest shareholder with a 10% stake,

values its Repsol shares at around EUR26, according to the

estimates of Borja Castro, an analyst with Cheuvreux. That compares

with Repsol's current share price of EUR14.66, the result of a 35%

slide so far this year amid rising YPF nationalization threats.

Argentina's government took control of YPF's operations earlier

this week, and an Argentine Senate committee approved Wednesday a

bill to re-nationalize the firm, originally a state-owned company

that was bought by Repsol in 1999. The committee approval sets the

stage for a vote next week by the full Senate on President Cristina

Kirchner's proposal to take over 51% of YPF. The plan, likely to be

passed, would leave the Argentine federal and provincial

governments in control of the company and reduce Repsol's stake to

just 6% from 57% currently.

Both Repsol and Spain's government have denounced the Argentine

takeover as illegal, and Repsol has vowed to take the dispute to

court.

The problem could be most acute for Sacyr, which has waged a

six-year long struggle to gain control of Repsol. The construction

company, like peers, took out loans in the boom years to diversify.

It has since seen revenues collapse due to the problems in Spain's

property sector and now depends heavily on Repsol's earnings and

dividends. In the first nine months of 2011, Sacyr reported sales

of just 877 homes, a fraction of the sales seen in the pre-crisis

years.

However, creditor banks can force Sacyr to add collateral to

back outstanding loans when Repsol shares drop below EUR10, said

Javier Barrio, a BPI analyst.

Sacyr is struggling to service some EUR2.5 billion worth of debt

it took on to buy the Repsol shares, and with its own shares

trading at levels last seen in 1993, it is now worth only EUR700

million, or just over a third of the value of its Repsol stake.

Sacyr declined to comment.

Sacyr's plight comes as other Spanish construction firms see

forays into the energy sector unravel. Peer Actividades de

Construccion y Servicios SA (ACS.MC) took a stake in Spanish power

utility Iberdrola SA (IBE.MC) and then tried to wrest control of

the company. However, the now cash-strapped company Wednesday sold

a 3.7% stake in Iberdrola for EUR798 million, booking a EUR540

million loss on the asset.

Mexico's Pemex, which owns 10% stake of Repsol, is seeing its

strategic bet on Spain lose value quickly as Repsol's shares slide

due to the loss of YPF, which represents just under half of

Repsol's total oil reserves.

The company declined to comment Thursday, but Mexico's Finance

Minister Jose Antonio Meade Wednesday warned during the World

Economic Forum against a "return to protectionism and the

expropriation of companies by countries."

Spain's government, meanwhile, Thursday continued a high-profile

diplomatic campaign against the move that has placed the

traditionally close ties between the two countries at their worst

level in decades. Spain's Foreign Affairs minister Jose Manuel

Garcia-Margallo called Argentina's move "an isolationist step" and

welcomed the supportive stance of the U.S. on the issue.

Sacyr shares closed Thursday down 4.4% to EUR1.62 and

CaixaBank's down 2.2% at EUR2.55. Repsol's shares were down 4.8% at

EUR14.66.

-By David Roman and Anna Perez; Dow Jones Newswires;

+34913958127; christopher.bjork@dowjones.com

(Pablo Dominguez en Barcelona contributed to this story.)

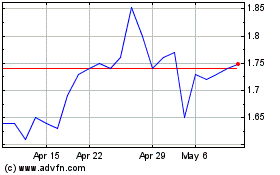

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Jul 2023 to Jul 2024