UPDATE: Repsol Shareholders Hit By YPF Seizure As Impact Widens

April 19 2012 - 9:28AM

Dow Jones News

Collateral damage from Argentina's seizure of oil firm YPF

spread Thursday in Spain to key Repsol shareholders, as CaixaBank

SA (CABK.MC)--one of the country's largest banks and Repsol YPF

SA's (REP.MC)'s largest shareholder--said it doesn't yet plan to

write down its controlling stake on the Spanish oil company.

In what could become yet another worry for Spain's battered

economy, Argentina's move to seize Repsol's unit could hit

companies in two of the country's already long-suffering sectors -

banks and construction.

Speaking in Barcelona, where CaixaBank Thursday presented

first-quarter earnings, Chairman Isidro Faine said Spain's

third-largest bank by market value doesn't see an urgent need to

write down its 13% stake in Repsol. Caixabank has a EUR3.34 billion

valuation of the Repsol stake, according to its 2012 annual report.

The market value of the stake Thursday was EUR2.41 billion.

Faine said that Argentina must pay a "fair price" for the stake

it is claiming in YPF, backing up Repsol's official stance on the

matter. However, he acknowledged the issue would take time to be

resolved. A potential writedown of the Repsol stake could further

erode Caixabank's results, after first-quarter net profit dropped

84% as it set aside most of its earnings to cover potential losses

on its real estate holdings in line with new requirements set by

the government.

The problem is especially acute for Sacyr-Vallhermoso SA

(SYV.MC), a construction company that took on debt to buy a large

Repsol stake in 2006 and has struggled to service that debt ever

since. Analysts believe Sacyr, which was already forced by

creditors to sell half of its Repsol stake earlier this year, may

find it hard to keep the banks at bay.

As shares of Repsol tumbled Thursday for a third consecutive

day, those of Caixabank and Sacyr also headed lower amid fears that

the loss of YPF would lower Repsol's contribution to their

earnings, and that accounting rules may eventually force them to

write down the value of their stakes in the oil firm.

Borja Castro, an analyst with Cheuvreux in Madrid, said that

Sacyr has valued Repsol at EUR26 per share in its books, compared

with the current market value of EUR15.10. However, he added that

Sacyr and other shareholders may delay a writedown of their Repsol

stakes until Repsol itself formalizes the loss of YPF. This will

likely follow a potentially lengthy legal battle.

At the same time, creditor banks can force Sacyr to add

collateral to back outstanding loans when Repsol shares drop below

EUR10, said Javier Barrio, a BPI analyst. But Sacyr's construction

and real estate business is in bad shape, and the whole company is

now valued at EUR700 million--little more than one third of the

value of its stake in Repsol.

A Sacyr spokesman declined to comment.

The problems for Sacyr come as other Spanish construction

companies struggle with assets that they bought using bank loans

during the boom years. In an attempt to diversify, the companies

bought assets including stakes in energy companies.

Wedensday, Actividades de Construccion y Servicios SA (ACS.MC)

sold a 3.7% stake in Iberdrola for EUR798 million, booking a EUR540

million loss on the asset. It is also set to announce further asset

sales.

Argentina's government took control of YPF's operations earlier

this week, and an Argentine Senate committee approved Wednesday a

bill to re-nationalize the firm, originally a state-owned company

that was bought by Repsol in 1999.

The committee approval sets the stage for a vote next week by

the full Senate on President Cristina Kirchner's proposal to take

over 51% of YPF. The plan, likely to be passed, would leave the

Argentine federal and provincial governments in control of the

company and reduce Repsol's stake to 6% from just 57%

currently.

Repsol shares had already fallen in recent weeks as speculation

about a nationalization of YPF intensified. The stock has lost

about a third of its value since the beginning of 2012.

At 1253 GMT, Sacyr was trading down 3.6% to EUR1.64, its lowest

level since 1993, and CaixaBank was down 3.8% at EUR2.51. Repsol's

shares were down 2% at EUR15.10.

-By David Roman and Anna Perez; Dow Jones Newswires;

+34913958127; christopher.bjork@dowjones.com

(Pablo Dominguez en Barcelona contributed to this story.)

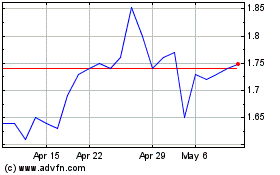

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Jul 2023 to Jul 2024