Current Report Filing (8-k)

December 31 2019 - 1:42PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 24, 2019

|

Bespoke Extracts, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-52759

|

|

20-4743354

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

323 Sunny Isles Boulevard, Suite 700

Sunny Isles Beach, FL 33160

(Address of principal executive offices)

(Zip Code)

Registrant's telephone number, including

area code (855) 633-3738

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 24, 2019, Bespoke Extracts,

Inc. (the “Company”) entered into and closed a securities purchase agreement (the “Purchase Agreement”)

with an accredited investor, pursuant to which, the Company issued and sold to the investor an original issue discount convertible

debenture (the “Debenture”) in the principal amount of $500,000, for a purchase price of $300,000. The Company also

issued to the investor 5,000,000 shares of common stock.

The Debenture matures April 30, 2020 and

is convertible into shares of common stock of the Company at a conversion price of $0.001, except that, if the Company fails to

repay the Debenture upon maturity, the conversion price will be reduced to $0.0004 (subject to adjustment for stock splits, stock

dividends, and similar transactions) and the Debenture will bear interest at the rate of 9% per year. The Debenture may not be

converted to common stock to the extent such conversion would result in the holder beneficially owning more than 4.99% of the Company’s

outstanding common stock.

The Company’s obligation to repay

the Debenture upon maturity is secured by a security interest in the Company’s inventory pursuant to a security agreement

(the “Security Agreement”) between the Company and the investor.

In connection with the foregoing, the Company

relied upon the exemption from registration provided by Section 4(a)(2) under the Securities Act of 1933, as amended, for transactions

not involving a public offering.

On December 24, 2019, the Company entered

into an agreement (the “Repayment Agreement”) with the holder of the amended and restated original issue discount convertible

debenture issued by the Company on November 11, 2019, in the original principal amount of $200,000 (the “November 2019 Debenture”).

Pursuant to the Repayment Agreement, the Company paid the holder $120,000, and transferred certain URLs to the holder, and the

November 2019 Debenture was deemed paid in full.

The foregoing descriptions of the Purchase

Agreement, Debenture, Security Agreement, and Repayment Agreement are qualified by reference to the full text of such documents,

which are filed as exhibits to this report.

Item 2.03 Creation of a Direct Financial

Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information under Item 1.01 is incorporated

by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity

Securities.

The information under Item 1.01 is incorporated

by reference into this Item 3.02.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

Bespoke Extracts, Inc.

|

|

|

|

|

|

Date: December 31, 2019

|

By:

|

/s/ Niquana Noel

|

|

|

|

Niquana Noel

|

|

|

|

Chief Executive Officer

|

2

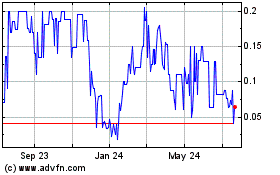

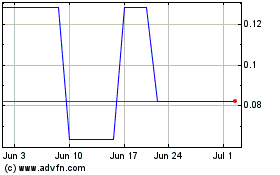

Bespoke Extracts (QB) (USOTC:BSPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bespoke Extracts (QB) (USOTC:BSPK)

Historical Stock Chart

From Apr 2023 to Apr 2024