false

0001576873

0001576873

2024-04-03

2024-04-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): April 3, 2024

AMERICAN

BATTERY TECHNOLOGY COMPANY

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-41811 |

|

33-1227980 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

Number) |

| 100

Washington Street, Suite 100 Reno, NV |

|

89503 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(775)

473-4744

(Registrant’s

telephone number including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

stock, $0.001 par value |

|

ABAT |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01. Other Events.

On

April 3, 2024, American Battery Technology Company (the “Company”) issued a press release announcing it was selected for

an approximately $20 million tax credit through the Qualifying Advanced Energy Project Credits program (48C) granted by the U.S.

Department of Treasury Internal Revenue Service (the “Program”) to advance the buildout of globally competitive critical

material recycling, processing, and refining infrastructure in the United States.

On

April 4, 2024, the Company issued a press release announcing it was selected for an additional tax credit of $40.5 million through

the Program to support the design and construction of a new, next-generation, commercial battery recycling facility to be located in

the United States.

Copies

of the press releases are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

AMERICAN

BATTERY TECHNOLOGY COMPANY |

| |

|

|

| Date:

April 4, 2024 |

By: |

/s/

Ryan Melsert |

| |

|

Ryan

Melsert |

| |

|

Chief

Executive Officer |

Exhibit

99.1

American

Battery Technology Company Awarded $20 Million Tax Credit through Competitive US DOE Process to Advance its Critical Minerals Battery

Recycling Facility

Award

to support capital expenditures to accelerate deployment of next phase of critical battery minerals manufacturing

Reno,

Nev., April 3, 2024 — American Battery Technology Company (ABTC) (NASDAQ:

ABAT), an integrated critical battery materials company that is commercializing its technologies for both primary battery minerals manufacturing

and secondary minerals lithium-ion battery recycling, was selected for an approximately $20 million award through the Qualifying Advanced

Energy Project Credits program (48C). This award was granted by the U.S. Department of Treasury Internal Revenue Service following

a highly competitive technical and economic review process performed by the U.S. Department of Energy (DOE), which evaluated the feasibility

of applicant facilities to advance America’s buildout of globally competitive critical material recycling, processing, and refining

infrastructure.

“We

are proud to have been selected for this highly competitive award, and humbled to have been chosen within a program where less than one-tenth

of the requested funds were ultimately selected for award,” stated ABTC CEO Ryan Melsert. “These funds will facilitate the

acceleration of the buildout and start of operations of our commercial scale hydrometallurgy-based recycled battery minerals processing

and refinement systems to increase the overall capacity for domestic critical mineral manufacturing.”

ABTC

is commercializing its internally-developed recycling process that utilizes an upfront strategic de-manufacturing process followed by

a targeted chemical extraction train in order to recover battery materials with high yields, low cost, and with a low environmental footprint.

These ABTC recycling technologies have won several competitive corporate awards and government grants and are fundamentally different

than conventional methods of battery recycling, which generally utilize either high temperature smelting operations or non-strategic

shredding systems.

This

$20 million award can be utilized both for the reimbursement of capital expenditures spent to date, and also for equipment and infrastructure

for additional value-add operations at ABTC’s battery recycling facility in the Tahoe-Reno Industrial Center (TRIC) in Storey County,

Nevada. Combined with ABTC’s previously awarded U.S. DOE grants totaling over $70 million, these funds support investment in the

company’s battery recycling and primary battery metals commercialization efforts to buildout a domestically-sourced battery metals

circular supply chain. These efforts simultaneously aim to foster a sustainable and equitable workforce through partnerships that can

propel the new energy transition.

ABTC

is working to foster improved access to jobs for members of the community, including under-represented individuals and those facing barriers

to employment, by leveraging U.S. DOE investments and through partnerships with workforce development and government agencies.

In

collaboration with and support from strategic partners, such as the University of Nevada, Reno, the Nevada Battery Coalition,

the Nevada’s Governor’s Office of Economic Development, the Nevada Department of Employment Training and Rehabilitation,

and the Governor’s Office of Workforce Innovation, ABTC is actively engaged and involved in positioning Nevada as a leading

fulcrum of the battery metals supply chain in North America.

About

American Battery Technology Company

American

Battery Technology Company (ABTC), headquartered in Reno, Nevada, has pioneered first-of-kind technologies to unlock domestically manufactured

and recycled battery metals critically needed to help meet the significant demand from the electric vehicle, stationary storage, and

consumer electronics industries. Committed to a circular supply chain for battery metals, ABTC works to continually innovate and master

new battery metals technologies that power a global transition to electrification and the future of sustainable energy.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are “forward-looking statements.”

Although the American Battery Technology Company’s (the “Company”) management believes that such forward-looking statements

are reasonable, it cannot guarantee that such expectations are, or will be, correct. These forward-looking statements involve a number

of risks and uncertainties, which could cause the Company’s future results to differ materially from those anticipated. Potential

risks and uncertainties include, among others, risks and uncertainties related to the Company’s ability to continue as a going

concern; the inability to obtain permits required for future exploration, development or production, general economic conditions and

conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating

mineral and commodity prices; the failure to satisfy the prevailing wage and apprenticeship requirements of the tax credit; the failure

to notify the U.S. DOE that the prevailing wage and apprenticeship requirements of the tax credit were met; the reduction or revocation

of the tax credit due to the location of the project having materially changed, the occurrence of a significant change in plans from

those submitted in the application to obtain the tax credit, the finding that the property included in the basis of property for the

qualified investment isn’t eligible for the tax credit, an IRS determination that a tax credit has been claimed for the same investment,

the certification requirements aren’t satisfied within two years, the date for placing the project in service was not met, the

failure to notify the U.S. DOE that the project was placed in service, or if there are other violations of Section 48C tax law.. Additional

information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available

in the Company’s filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended

June 30, 2023. The Company assumes no obligation to update any of the information contained or referenced in this press release.

###

American

Battery Technology Company

Media

Contact:

Tiffiany

Moehring

tmoehring@batterymetals.com

720-254-1556

Exhibit

99.2

American

Battery Technology Company Awarded Additional $40 Million Competitive Tax Credit to Accelerate Construction of Next Battery Recycling

Facility

Award

to supplement capital expenditures to accelerate construction and commissioning of next-generation lithium-ion battery recycling facility

to enable expanded North American closed-loop battery metals supply chain

Reno,

Nev., April 4, 2024 — American Battery Technology Company (ABTC) (NASDAQ:

ABAT), an integrated critical battery materials company that is commercializing its technologies for both primary battery minerals manufacturing

and secondary minerals lithium-ion battery recycling, has been selected for an additional award of $40.5 million through the Qualifying

Advanced Energy Project Credits program (48C) to support the design and construction of a new, next-generation, commercial battery

recycling facility to be located in the United States. As with ABTC’s initial $20 million tax credit award under the 48C

program supporting the construction and buildout of its battery recycling facility in Nevada, this additional award was granted by the

U.S. Department of Treasury Internal Revenue Service following a highly competitive technical and economic review process performed by

the U.S. Department of Energy (DOE), which evaluated the feasibility of applicant facilities to advance America’s buildout of globally

competitive critical material recycling, processing, and refining infrastructure.

“ABTC

and our partners have been engaging with nearly every major automotive OEM and battery cell manufacturer in the world to present the

services we offer of domestic, low-cost, and low environmental impact recycling of lithium-ion batteries, the manufacturing of precursor

materials, and the synthesis of refined materials such as high-recycled metal content high energy density cathode active material (CAM),”

stated American Battery Technology Company CEO Ryan Melsert. “We are now at the point where we have more feedstock battery material

for recycling under negotiations than can be processed in our current Nevada facility, and as a result, we have been conducting preliminary

design and site selection processes for our next commercial-scale recycling facility.

Melsert

continued, “This next facility will be strategically aligned with our partner facilities in location and throughput, and we are

excited to have received this support from the U.S. Government to apply these $40.5 million in credits towards the accelerated construction

and start of operations of this pivotal facility intended to significantly increase the Nation’s capacity to manufacture domestic

critical battery minerals.”

ABTC

is commercializing its internally-developed recycling process that utilizes an upfront strategic de-manufacturing process followed by

a targeted chemical extraction train in order to recover battery materials with high yields, low cost, and a low environmental footprint.

These ABTC recycling technologies have won several competitive corporate awards and government grants and are fundamentally different

than conventional methods of battery recycling, which generally utilize either high temperature smelting operations or non-strategic

shredding systems.

ABTC

has been awarded over $60 million through the 48C program and over $70 million in U.S. DOE grants to support investment in the company’s

battery recycling and primary battery metals commercialization efforts to buildout a domestic battery metals circular supply chain.

ABTC

is working to foster improved access to jobs for members of the community, including under-represented individuals and those facing barriers

to employment, by leveraging U.S. DOE investments and through partnerships with workforce development and government agencies.

About

American Battery Technology Company

American

Battery Technology Company (ABTC), headquartered in Reno, Nevada, has pioneered first-of-kind technologies to unlock domestically manufactured

and recycled battery metals critically needed to help meet the significant demand from the electric vehicle, stationary storage, and

consumer electronics industries. Committed to a circular supply chain for battery metals, ABTC works to continually innovate and master

new battery metals technologies that power a global transition to electrification and the future of sustainable energy.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are “forward-looking statements.”

Although the American Battery Technology Company’s (the “Company”) management believes that such forward-looking statements

are reasonable, it cannot guarantee that such expectations are, or will be, correct. These forward-looking statements involve a number

of risks and uncertainties, which could cause the Company’s future results to differ materially from those anticipated. Potential

risks and uncertainties include, among others, risks and uncertainties related to the Company’s ability to continue as a going

concern; the inability to obtain permits required for future exploration, development or production, general economic conditions and

conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating

mineral and commodity prices; the failure to satisfy the prevailing wage and apprenticeship requirements of the tax credit; the failure

to notify the U.S. DOE that the prevailing wage and apprenticeship requirements of the tax credit were met; the reduction or revocation

of the tax credit due to the location of the project having materially changed, the occurrence of a significant change in plans from

those submitted in the application to obtain the tax credit, the finding that the property included in the basis of property for the

qualified investment isn’t eligible for the tax credit, an IRS determination that a tax credit has been claimed for the same investment,

the certification requirements aren’t satisfied within two years, the date for placing the project in service was not met, the

failure to notify the U.S. DOE that the project was placed in service, or if there are other violations of Section 48C tax law.. Additional

information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available

in the Company’s filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended

June 30, 2023. The Company assumes no obligation to update any of the information contained or referenced in this press release.

###

American

Battery Technology Company

Media

Contact:

Tiffiany

Moehring

tmoehring@batterymetals.com

720-254-1556

v3.24.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

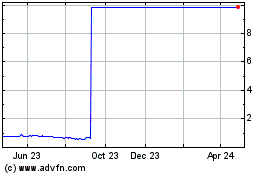

American Battery Technol... (QX) (USOTC:ABML)

Historical Stock Chart

From Apr 2024 to May 2024

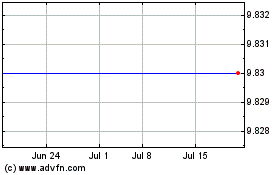

American Battery Technol... (QX) (USOTC:ABML)

Historical Stock Chart

From May 2023 to May 2024