Auryx Receives a Positive PEA for Otjikoto Pre-Tax NPV of USD301 Million and IRR of 42%

September 12 2011 - 6:00AM

Marketwired Canada

Auryx Gold Corp. ("Auryx" or the "Company") (TSX:AYX)(NSX:AYX) is pleased to

announce the results of the Preliminary Economic Assessment ("PEA") on the

Otjikoto gold project (the "Project") in Namibia.

Highlights Include:

-- Pre-tax NPV of USD301 million at a 5% discount rate and an IRR of 42% at

a gold price of USD1,300/oz and an exchange rate of Namibian Dollar

("NAD") 7.50 to the USD;

-- Initial capital costs of USD130 million and ongoing capital of USD15

million (assuming contractor mining);

-- Average annual production of 109,000 ounces of gold over a 10 year life

of mine ("LoM");

-- Average LoM cash operating costs using contractor mining of USD691/oz

before operating contingency (USD725/oz including contingency);

-- Average LoM run of mine ("RoM") head grade of 1.71g/t (1.52g/t including

processing of low grade ore);

The PEA has been prepared by SRK Consulting (South Africa) (Pty) Ltd ("SRK")

with input of a number of independent consultants including Scorpion Mineral

Processing (Pty) Ltd ("SMP"), VBKom Consulting Engineers (Pty) Ltd ("VBKom"),

and Geo Tail. The PEA is preliminary in nature and includes inferred mineral

resources that are considered too speculative geologically to have the economic

considerations applied to them that would enable them to be categorized as

mineral reserves, and there is no certainty that the PEA will be realized.

Using a gold price assumption of USD1,300/oz and an exchange rate of

NAD7.50/USD, the Project's pre-tax NPV is USD301 million and the pre-tax IRR is

42%. The Company views the price assumptions used as conservative and notes that

the base case uses a gold price that is 29% below spot and a currency that is

12.5% above spot. At a gold price of USD1,500/oz and an exchange rate of

NAD8.0/USD, Otjikoto's pre-tax NPV and IRR are USD474 million and 57%

respectively.

The Project's initial CAPEX using contractor mining is estimated at USD130

million and includes a contingency allowance of 19%. Sustaining Capital and

Owners' Costs are USD15 million and USD3.4 million respectively. The LoM cash

operating costs are estimated at USD725/oz (including contingency) which

reflects the Project's modelled strip rate of 7.3:1.

Tim Searcy, CEO of Auryx Gold stated: "We are very pleased with the results of

the PEA. It demonstrates that the Otjikoto gold deposit is a very robust

project, which benefits significantly from the local infrastructure. Road, rail,

and water are accessed at site and grid power is available very close by, all of

which positively impact the initial CAPEX estimate. Furthermore, a number of

additional opportunities exist to improve on these results including new zones

that have been discovered but not yet included into the mine model and the

potential for saleable by-product concentrates of sulfides and iron-oxides."

Mineral Resources

The mineral resource estimate (NI 43-101 compliant) presented in the PEA were

first released on 3 February 2011. The resources have been reported according to

the guidelines of the CIM Standing Committee.

Table 1: Otjikoto Mineral Resources reported above a 0.4g/t cut-off (effective

as of 31 December 2010)(i)

Indicated Mineral Resources Inferred Mineral Resources

----------------------------------------------------------------------------

Contained Contained

COG Tonnes Au Grade Metal Tonnes Au Grade Metal

(g/t) (Mt) (g/t) (Moz) (Mt) (g/t) (Moz)

----------------------------------------------------------------------------

0.4 - 0.8 9.34 0.60 0.18 7.21 0.59 0.14

greater than

0.8 15.78 1.94 0.98 8.37 1.94 0.52

----------------------------------------------------------------------------

Total 25.12 1.44 1.16 15.58 1.31 0.66

----------------------------------------------------------------------------

(i)Mineral resources that are not mineral reserves do not have demonstrated

economic viability.

Mining

A pit optimisation was carried out using the Whittle Four-X(R) software. For a

given block model, cost, recovery and slope data, Whittle Four-X(R) software

calculates a series of incremental pit shells within which each shell is an

optimum for a slightly higher commodity price factor. After selecting the

optimal pit shell, a pit design which incorporates access ramps, bench

configurations and mining constraints was developed in Surpac(R). Lower revenue

factor shells from the pit optimisation exercise were selected to serve as push

backs and assist in scheduling the operation. The material inside the pit design

was then scheduled in XPAC(R) software according to feasible tonnage and grade

targets. A low grade stockpile was introduced to allow the selective processing

of high grade ore. The labour and mobile equipment requirements are based on the

mining schedule developed in XPAC(R). The mining capital and operating

expenditure estimates were derived from first principles.

Processing Facility

Metallurgical testwork conducted over the last 10 years has been used to define

a processing route. The testwork was conducted by various accredited

laboratories, including Mintek in Johannesburg, and indicated average overall

metallurgical recoveries of 88% for the oxide material and 91% for the fresh

sulfide material through a bulk flotation and leach process. The testwork

highlighted a high level of gravity recoverable gold in the ore body.

The plant consists of a conventional flotation and carbon-in-leach ("CIL")

circuit made up of the following unit processes: crushing, milling, gravity gold

recovery, flotation, CIL, electrowinning and smelting. Crushing will be achieved

in two stages with a primary jaw crusher and a closed circuit secondary cone

crusher. The crushed ore is fed into a single stage milling and gravity gold

recovery circuit before feeding the flotation circuit. The flotation circuit

consists of rougher scavenger, and cleaner cells. The flotation concentrate is

thickened and then pumped to the regrind milling circuit. The liberated ore is

then fed to a CIL circuit where the gold is recovered by activated carbon. The

gold is stripped from the activated carbon in an Anglo American Research

Laboratory ("AARL") elution circuit that generates pregnant solution. The

pregnant solution from the gravity circuit and the CIL circuit is then plated in

an electrowinning step, and smelted on site to produce dore bullion bars.

High and low sulfide waste streams will be produced by the plant from the CIL

and flotation circuits respectively. Both streams will be pumped as slurries to

the tailings disposal facility ("TDF"). Paste thickening (on the low sulphide

stream) will be pumped to the TDF as a paste and filtration (on the high sulfide

stream) will produce filter cake that will be deposited on the lined TDF with a

conveyor system. This approach maximises the water recovery.

The proposed mine processing plant production schedule is shown graphically in

Figure 1 below.

Figure 1: http://media3.marketwire.com/docs/AURYX2.jpg.

Tailings Disposal Facility

The slurry pumped from the process plant will pass through the paste thickener

or filtration systems located at the TDF before being fed into the basins of the

storage facilities. Paste will be pumped to the unlined TDF located in a natural

depression with a calcrete surface layer of between 15 and 30 m thickness. Water

recovered from the low sulphide TDF will be pumped to a return water dam. Dry

deposition of the filter cake using a conveyor system will be used for the lined

high sulfide TDF. Water recovered from this facility will drain to a return

water dam.

The benefits of this approach on the design, due to the lower water content in

the tailings stream, are as follows: a) more efficient volumetric storage; b) a

reduced risk of groundwater contamination; c) less make-up water demand; d) a

more stable structure; and e) accelerated rehabilitation potential.

Power

The total installed power requirement for the facility is 11.5 MW and this will

be supplied from the national grid. An application has been submitted to the

relevant authorities for the supply of this power to the facility. During a

technical review with the authorities, a tap off point was identified on the 220

kV main line, which runs on a line 16 km west of the plant, and feeds the

northern Namibia region. This tap off point was recognized as the preferred

supply route.

Capital Costs

The estimated capital requirements for the project are shown in Table 2.

Variable contingencies have been applied by project activity and give an average

contingency allowance of 19% for the project capital. The mine equipment capital

estimate is for a contractor operated mine. If Auryx elects to conduct the

mining itself, the project and sustaining capital for the Otjikoto Project

increases to USD161 million and USD52 million respectively.

Table 2: Summary of the estimated Capital Costs (Contractor Mining)

----------------------------------------------------------------------------

Project Capital Sustaining Capital

Item (USDm) (USDm)

----------------------------------------------------------------------------

Construction Phase capital 0.85 0

Processing 55.70 0

Plant and Administration Infrastructure 2.36 0

Mine and other Infrastructure 6.55 0

Tailings Disposal Facility 21.20 4.02

Power Supply 4.55 0

Laboratory 0.87 0

Miscellaneous Infrastructure 1.17 0

Owner's Cost 3.44 0

Mining Fleet 2.92 1.11

EPCM 10.22 0.52

Contingencies 19.91 0.67

Sustaining Capital 0 8.69

----------------------------------------------------------------------------

Total 129.74 15.00

----------------------------------------------------------------------------

Operating Costs

The total estimated operating costs for the LoM with contractor mining, as

incorporated into the PEA, are set out in the Table 3. The average unit mining

cost over the LoM is USD2.05/t of total material (high grade and low grade ore

plus waste) mined.

Table 3: Summary of the estimated Operating Costs for the LoM (Contractor Mining)

----------------------------------------------------------------------------

LoM Operating Cost

--------------------------------------

Total Unit Cost

Description (USDm) (USD/t processed)

----------------------------------------------------------------------------

Processing 288.81 11.01

Tailings Disposal 9.31 0.35

Mining 447.05 17.05

Admin 65.57 2.50

----------------------------------------------------------------------------

Total Cash Operating Cost (before

contingency) 808.51 30.83

----------------------------------------------------------------------------

Environmental & Social

Closure Fund Contributions 13.68 0.52

Retrenchment/Downsizing 2.73 0.10

Monitoring 1.20 0.05

Social community support 1.80 0.07

Contingencies 41.40 1.58

Royalties 45.64 1.74

----------------------------------------------------------------------------

Total Working Costs 914.96 34.89

----------------------------------------------------------------------------

Unit Cash Operating costs (USD/oz recovered) (USD/t processed)

Mining 381.97 17.05

Processing & Tailings 254.72 11.37

Admin 54.12 2.42

Cash Operating Cost 690.81 30.83

Environmental & Social 16.58 0.74

Contingency 35.37 1.58

Royalty 39.00 1.74

Total Working Cost 781.77 34.89

----------------------------------------------------------------------------

Financial Analysis

The economics of the project have been evaluated at a gold price of USD1,300/oz

and an exchange rate of NAD7.5/USD based on a 24-month historic average. The

effective date for the PEA is deemed to be 1 September 2011. The PEA

demonstrates the potential for significant positive economic returns from

developing the Otjikoto Gold Project. The variation in NPV with discount factors

is given in Table 4. No formal tax planning was undertaken to optimize the

post-tax scenario.

Table 4: Variation of NPV with discount factor (Contractor Mining)

----------------------------------------------------------------------

NPV (USDm)

Discount Rate Pre-tax Post-tax

----------------------------------------------------------------------

0% 458 286

4% 327 201

5% 301 184

6% 278 169

7% 256 155

8% 236 141

9% 217 129

10% 200 118

12% 170 98

----------------------------------------------------------------------

A summary of key economic results on a pre- and post-tax basis for contractor

and owner operated mining are compared below in Tables 5 and 6.

Table 5: Key economic results (Contractor Mining)

----------------------------------------------------------------------------

Summary Units Pre-Tax Post-Tax

----------------------------------------------------------------------------

NPV @ 5% (USDm) 301 184

IRR 42% 33%

LoM Capital (USDm) 145

Project Capital (USDm) 130

Peak Funding (USDm) 127

Payback years 4.9

Average Au recovered/year (koz) 109

Total Au recovered LoM (koz) 1 170

Unit Cash Operating Cost

(Average LoM) (USD/t ore mined) 30.83

(USD/oz) 690.81

----------------------------------------------------------------------------

Table 6: Key economic results (Owner Operated Mining)

----------------------------------------------------------------------------

Summary Units Pre-Tax Post-Tax

----------------------------------------------------------------------------

NPV @ 5% (USDm) 303 184

IRR 36% 29%

LoM Capital 214

Project Capital (USDm) 161

Peak Funding (USDm) 139

Payback years 4.4

Average Au recovered/year (koz) 109

Total Au recovered LoM (koz) 1 170

Unit Cash Operating Cost

(Average LoM) (USD/t ore mined) 27.87

(USD/oz) 624.43

----------------------------------------------------------------------------

The revenue, operating cost, capital cost and gold price NPV sensitivities are

presented in Table 7 below.

Table 7: NPV Sensitivity (Contractor Mining)

----------------------------------------------------------------------------

Sensitivity (NPV

@ 5%) Units -20% -15% -10% -5% 0% 5% 10% 15% 20%

----------------------------------------------------------------------------

Pre-tax

Revenue (USDm) 86 140 194 248 301 355 409 463 517

Operating cost (USDm) 424 393 363 332 301 271 240 210 179

Capital cost (USDm) 328 321 315 308 301 295 288 282 275

----------------------------------------------------------------------------

Post-tax

Revenue (USDm) 48 82 116 150 184 218 252 286 320

Operating cost (USDm) 261 242 223 204 184 165 146 127 107

Capital cost (USDm) 202 198 193 189 184 180 175 171 167

----------------------------------------------------------------------------

Au Price

Sensitivity -15% -12% -8% -4% 0% 4% 8% 12% 15%

----------------------------------------------------------------------------

Actual Au Price 1 100 1 150 1 200 1 250 1 300 1 350 1 400 1 450 1 500

----------------------------------------------------------------------------

NPV @ 5% real

discount

Pre-tax (USDm) 141 181 221 261 301 342 382 422 462

Post-tax (USDm) 83 108 134 159 184 210 235 260 285

----------------------------------------------------------------------------

Within the accuracy of the PEA, it is not possible to confirm whether contractor

or owner operated mining is the more beneficial route to follow. This decision

will be governed by the Company's cost of capital.

Environmental and Social Aspects

All baseline studies have been completed and no fatal flaws have been identified

to date. As planned, the primary source of water supply for the mine will be

from production boreholes located in the marble aquifers found on the property.

Current estimates indicate that four production boreholes will be capable of

supplying the bulk water required by the facility, based on yields from adjacent

well fields.

Closure costs in the PEA are estimated at USD13.6 million based on preliminary

estimates and compared with other operations in Namibia. Currently the project

life is estimated at 12 years, with closure occurring 2 years after final mining

once the low grade stockpile has been processed.

Project Opportunities

Auryx is actively pursuing a number of alternatives for enhancing and increasing

the economics and financial returns relating to the Otjikoto project. These

include delineating additional resources within and outside of the modelled pit

and evaluating the potential for saleable by-products, such as sulfide and

iron-oxide concentrates.

Development Timelines

The Company intends to deliver an updated resource estimate in Q1 2012 and then

use that resource for the basis of a FS. The previous guidance on timing of a FS

was Q2 2013. The Company believes it can materially advance the delivery and

will advise the market on this issue before the end of the 2011.

Qualified Persons

The PEA was prepared by leading independent industry consultants and Qualified

Persons ("QPs") under the National Instrument 43-101.

The QP who assumes overall responsibility for the PEA is Mr Andrew McDonald, a

Principal Engineer with SRK holding a MSc degree in Geophysics (cum laude) from

the University of the Witwatersrand and a MBL from UNISA. He is a registered

Chartered Engineer (Reg. No. 334897) through the Institution of Materials,

Minerals and Mining in London and is a Fellow of the Southern African Institute

of Mining and Metallurgy. He has 37 years of diverse experience in a range of

management, technical and financial activities in mining and light industrial

industries, the past 16 of which have been involved in the fields of feasibility

studies, due-diligence audits, financial evaluation and regulatory reporting for

mining-related projects throughout Africa and other international locations. He

has undertaken numerous mineral asset valuations since 1995. Mr McDonald has

reviewed and approved the content of this press release.

The QP who assumes the responsibility for reporting of the Mineral Resources is

Mr Mark Wanless. Mark is an associate Partner, and Principal Geologist with SRK,

and is registered as a Professional Natural Scientist with the South African

Council for Natural Scientific Professionals Reg: 400178/05 and is also an

associate member of the South African Institute for Mining and Metallurgy. Mark

has over 15 years of experience in Southern Africa and internationally. His

expertise is in due diligence studies, and Mineral Resource estimation. Mark has

experience in a range of commodities including Gold, PGEs, base metals, Iron and

Manganese, and Mineral sands. Mr Wanless has reviewed and approved the content

of this press release.

The QP who assumes the responsibility for the Mining Section of the PEA is Mr

Hermanus J Kriel (Pr. Eng.), the Chief Executive Officer of VBKom Consulting

Engineers holding a B.Eng. (Mining) from the University of Pretoria and a MBL

from UNISA in South Africa. He is a registered Professional Engineer (Reg. No.

20080140) through the Engineering Council of South Africa. He has 16 years of

practical and consulting experience on surface and underground mining projects

throughout the African continent over the whole commodity spectrum. Mr Kriel has

reviewed and approved the content of this press release.

The QP who assumes the responsibility for the Process Plant and the

Infrastructure related to the PEA is Mr Matthys J Wessels (Pr. Eng.), a Project

Engineer with Scorpion Mineral Processing holding a B.Eng. (Mechanical) from the

North-West University in South Africa. He is a registered Professional Engineer

(Reg. No. 20050108) through the Engineering Council of South Africa. He has 12

years of diverse experience in a range of technical activities in mining and

heavy engineering industries throughout Africa and other international

locations. His Engineering experience varies from heavy steel industry to port

facilities and mineral processing. Mr Wessels has reviewed and approved the

content of this press release.

The QP who assumes responsibility for the PEA for the Tailings Storage

Facilities is Mr Guillaume Louw de Swardt, a Director with Geo Tail holding an

MSc degree in Civil Engineering from the University of the Witwatersrand. He is

a registered Professional Engineer (Reg. No. 950429) through the Engineering

Council of South Africa. He has 20 years of diverse experience in geotechnical

and tailings engineering. He has been involved in numerous major mining projects

on the African continent and his experience in tailings management encompasses

the full range of disposal options for different types of tailings. Mr de Swardt

has reviewed and approved the content of this press release.

About Auryx Gold Corp.

Auryx Gold Corp. (TSX:AYX)(NSX:AYX) is a Canadian, growth-focused resource

company engaged in the acquisition and exploration of gold projects in Namibia.

The Company is currently advancing the Otjikoto gold project, located 300km

north of Namibia's capital city, Windhoek. By virtue of its location, the

project benefits significantly from Namibia's well established infrastructure

with paved highways, a railway, power grids, and water grid all close by.

Located in the western part of southern Africa, Namibia is lauded as one of the

continent's most politically and socially stable jurisdictions.

On behalf of the Board of Directors,

Tim Searcy, P.Geo., Chief Executive Officer

Cautionary Notes

Cautionary Note Concerning Forward Looking Statements

Certain information set forth in this press release contains "forward-looking

information" under applicable securities laws. Except for statements of

historical fact, certain information contained herein constitutes

forward-looking information which include management's assessment of Auryx's

future plans and operations and are based on Auryx's current internal

expectations, estimates, projections, assumptions and beliefs, which may prove

to be incorrect. These risks and uncertainties include, but are not limited to:

successful completion of the proposed FS and exploration and development

programs referred to herein; the actual results of current and future

exploration and development activities, liabilities inherent in exploration,

mine development and production; geological, mining and processing technical

problems; Auryx's inability to obtain required licenses, permits and regulatory

approvals required in connection with exploration, mining and mineral processing

operations; competition for, among other things, capital, acquisitions of

resources, reserves, undeveloped lands and skilled personnel; incorrect

assessments of the value of acquisitions; changes in commodity prices and

exchange rates; currency and interest rate fluctuations; various events which

could disrupt operations and/or the transportation of mineral products,

including labour stoppages and severe weather conditions; the demand for and

availability of rail, port and other transportation services; the availability

of financing, and management's ability to anticipate and manage the foregoing

factors and risks. There can be no assurance that forward-looking information

will prove to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Auryx undertakes no

obligation to update forward-looking information if circumstances or

management's estimates or opinions should change except as required by

applicable securities laws. The reader is cautioned not to place undue reliance

on forward-looking information.

Cautionary Note Concerning Resource Estimates

The mineral resource figures referred to in this press release are estimates and

no assurances can be given that the indicated levels of gold will be produced.

Such estimates are expressions of judgment based on knowledge, mining

experience, analysis of drilling results and industry practices. Valid estimates

made at a given time may significantly change when new information becomes

available. While the Company believes that the resource estimates included in

this press release are well established, by their nature resource estimates are

imprecise and depend, to a certain extent, upon statistical inferences which may

ultimately prove unreliable. If such estimates are inaccurate or are reduced in

the future, this could have a material adverse impact on the Company. There is

no certainty that mineral resources can be upgraded to mineral reserves through

continued exploration.

Due to the uncertainty that may be attached to inferred mineral resources, it

cannot be assumed that all or any part of an inferred mineral resource will be

upgraded to an indicated or measured mineral resource as a result of continued

exploration. Confidence in the estimate is insufficient to allow meaningful

application of the technical and economic parameters to enable an evaluation of

economic viability worthy of public disclosure, except in the case of the

Preliminary Assessment. Inferred mineral resources are excluded from estimates

forming the basis of a feasibility study.

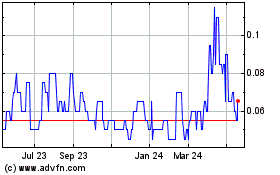

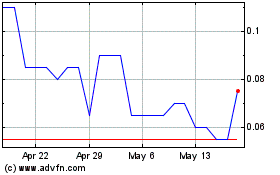

Southern Empire Resources (TSXV:SMP)

Historical Stock Chart

From May 2024 to Jun 2024

Southern Empire Resources (TSXV:SMP)

Historical Stock Chart

From Jun 2023 to Jun 2024