Seabridge Gold (TSX:SEA)(NYSE:SA) announced today the results of its first

Preliminary Feasibility Study ("PFS") for its 100%-owned Courageous Lake project

located in Canada's Northwest Territories. The study demonstrates that

Courageous Lake is an economic project at the current gold price while also

offering substantial leverage to higher gold prices. The PFS was prepared by

Tetra Tech Wardrop ("Tetra Tech"). The PFS Executive Summary can be found at

www.seabridgegold.net/CL_ExecSum_2012.pdf. The complete PFS will be filed at

www.sedar.com within 45 days.

Commenting on the study, Seabridge Chairman and CEO Rudi Fronk said: "Our

business plan from inception has been to grow gold resources and reserves while

minimizing equity dilution. With an estimated 6.5 million ounces of newly

defined proven and probable reserves at Courageous Lake, combined with the 38.2

million ounces of gold reserves estimated at our KSM project, we now report

total proven and probable gold reserves of 44.7 million ounces. Not only does

this rank Seabridge among the top ten companies in the world with respect to

gold reserves, but with only 43.4 million common shares outstanding, we provide

our shareholders with more than one ounce of gold reserves per common share

outstanding. Furthermore, this entire reserve base is located in Canada, one of

the safest and most mining-friendly jurisdictions in the world." Proven and

probable reserves at KSM are estimated at 2.2 billion tonnes grading 0.55 grams

per tonne gold, 0.21% copper and 2.74 grams per tonne silver.

Mr. Fronk noted that Seabridge will continue to optimize the Courageous Lake

project. "We believe the most cost effective way to improve project economics is

to add to reserves. We are now drilling some highly prospective targets which

could be accessed easily by the operation proposed in the PFS."

The Courageous Lake PFS is based on a single open-pit mining operation with

on-site processing. A base case scenario was developed for the project

incorporating an estimated 91.1 million tonnes of proven and probable reserves

at an estimated average grade of 2.20 grams of gold per tonne feeding a 17,500

tonnes per day operation (6.1 million tonnes per year annual average

throughput). This yields a projected 15 year operation with average estimated

annual production of 385,000 ounces of gold at a projected life of mine average

cash operating cost of US$780 per ounce recovered (US$674 in years one to five).

Start-up capital costs for the project are estimated at US$1.52 billion,

including a contingency of US$187 million.

At a gold price of US$1,384 per ounce (the 3 year trailing average gold price at

July 3, 2012), the base case has an estimated US$1.5 billion pre-tax net cash

flow, a US$303 million net present value at a 5% discount rate and an internal

rate of return of 7.3%. This base case is consistent with the requirements of

securities regulators. At a gold price of US$1,618 (the spot price on July 3,

2012), the estimated total pre-tax net cash flow nearly doubles that of the base

case to US$2.8 billion, the net present value at a 5% discount rate more than

triples to US$1.1 billion and the internal rate of return increases to 12.5%. To

demonstrate the leverage to gold price, an alternative case was run using last

year's gold price high of $1,925 per ounce which yielded a pre-tax net cash flow

of $4.5 billion, a net present value at a 5% discount rate of $2.1 billion and

an internal rate of return of 18.7%.

The PFS also identifies several opportunities that could significantly improve

the overall project economics. First, the current design incorporates a

combination of diesel and wind generated power resulting in a projected power

generation cost of Cdn$0.184 per kilowatt hour which is nearly 40% lower than

power generation by diesel fuel alone. Seabridge is evaluating nearby potential

hydro-electric sources which would also provide reliable, sustainable and

lower-cost clean energy source and significantly reduce the requirement for

diesel fuel at the site. Secondly, access to the project under the current

design is by winter road which is limited to less than three months per year. It

is during this period that almost all of the project's supplies are transported

to site. The Tibbitt to Contwoyto Winter Road Joint Venture proposes extending

the winter road seasonal use by at least another month with a 150 km extension

from the permanent road access at Tibbitt Lake to Lockhart camp. While this

would result in some reduction in both operating and capital costs for

Courageous Lake, an all-season access road from the Bathurst Inlet would provide

considerably more benefit to Courageous Lake economics. Seabridge will continue

to investigate these options as the project moves forward.

Mine Planning

Lerchs-Grossman ("LG") pit shell optimizations were used to define the mine

plans in the PFS. The pit optimizations incorporated estimated costs for mining,

processing, tailings management, general and administrative and gold recovery

rates. Waste to ore cut-offs were determined using a gold price of US$1,244 per

ounce. Estimated in-pit diluted proven and probable reserves, including mining

dilution within the ultimate pit limit based on a Cdn$20.10 per tonne cut-off,

are as follows:

Courageous Lake Reserves

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Diluted Contained

Tonnes Grade Gold

Reserve Category (000's) (g/t) (000 ounces)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Proven 12,300 2.41 960

Probable 78,800 2.17 5,500

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total 91,100 2.20 6,460

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Proven and probable reserves are derived from estimated total undiluted measured

and indicated resources of 8.0 million ounces of gold (107 million tonnes at an

average grade of 2.31 grams of gold per tonne).

Mineral Processing

Seabridge has conducted five major metallurgical testing programs since 2003.

The comminution proposed for Courageous Lake uses an energy efficient process

including: (i) primary crushing by gyratory crusher; (ii) secondary crushing by

cone crusher; (iii) tertiary crushing by high pressure grinding rolls; and (iv)

final grinding by ball mills. The recovery process includes conventional

flotation, flotation concentrate pressure oxidation, cyanidation and gold

refining circuits. Overall gold recovery is projected at 89.4%.

Capital Costs

Start-up capital costs (including contingencies of US$187 million) are estimated

at US$1.52 billion and are summarized as follows:

Start-up Capital Costs

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Description US$'000

---------------

Overall Site 59,745

Open Pit Mining 96,701

Crushing and Stockpiles 83,238

Grinding and Flotation 135,039

Pressure Oxidation 88,660

Thickening, Neutralization & Cyanide Leaching 38,940

Gold ADR Circuit, Cyanide Handling & Electrowinning 14,833

Reagents and Consumables 23,536

Tailings Management Facility 53,422

Water Treatment Plant 8,774

Site Services and Utilities 34,352

Ancillary Buildings 66,839

Airstrip & Loading/Unloading Facilities 12,203

Plant Mobile Equipment 3,058

Temporary Services 49,085

Electrical Power Supply 179,838

Yellowknife & Edmonton Facilities 17,227

----------------------------------------------------------------------------

Sub-total 965,490

Project Indirects 315,187

Owner's Costs 55,059

Contingencies 186,703

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total 1,522,439

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Operating Costs

Average mine, process and G&A operating costs over the project's life (including

waste mining) are estimated at US$47.35 per tonne milled. A breakdown of

estimated unit operating costs is as follows:

Unit Operating Costs

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cost Category US$ (Per Tonne Milled)

----------------------------------------------------------------------------

Mining Costs 26.24

Milling Costs 15.72

Site Services 1.90

G&A 3.49

----------------------------------------------------------------------------

Total 47.35

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Economic Analysis

A base case economic evaluation was undertaken incorporating historical

three-year trailing averages for gold prices and currency exchange rates as of

July 3, 2012. This approach is consistent with the guidance of the United States

Securities and Exchange Commission, adheres to National Instrument 43-101 and is

consistent with industry practice. A spot price case was prepared using the July

3, 2012 spot gold price and currency exchange rates. To demonstrate the leverage

to gold price, a third case was prepared using last year's gold price high of

$1,925 per ounce. Pre-tax economic results for all three cases are as follows:

Projected Economic Results (US$)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Spot Alternate Gold

Base Case Price Case Price Case

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Gold Price Per Ounce $ 1,384 $ 1,618 $ 1,925

----------------------------------------------------------------------------

Net Cash Flow $ 1,507 million $ 2,785 million $ 4,519 million

----------------------------------------------------------------------------

NPV @ 5% Discount Rate $ 303 million $ 1,054 million $ 2,080 million

----------------------------------------------------------------------------

IRR 7.3% 12.5% 18.7%

----------------------------------------------------------------------------

Payback Period 11.2 years 7.4 years 4.0 years

----------------------------------------------------------------------------

Operating Costs Per Ounce

of Gold Produced (years

1 to 5) $ 674 $ 683 $ 689

----------------------------------------------------------------------------

Operating Costs Per Ounce

of Gold Produced (life

of mine) $ 780 $ 789 $ 796

----------------------------------------------------------------------------

Total Costs Per Ounce of

Gold Produced (includes

all capital) $ 1,123 $ 1,134 $ 1,141

----------------------------------------------------------------------------

US$/Cdn$ Exchange Rate 0.9803 0.9877 0.9877

----------------------------------------------------------------------------

----------------------------------------------------------------------------

National Instrument 43-101 Disclosure

The PFS for Courageous Lake was prepared by Tetra Tech, and incorporates the

work of a number of industry-leading consulting firms. These firms and their

Qualified Persons (as defined under National Instrument 43-101) are independent

of Seabridge and have reviewed and approved this news release. The consultants

and their QPs are listed below with their responsibilities:

-- Tetra Tech, under the direction of Dr. John Huang (overall report

preparation, metallurgical testing review, mineral processing,

infrastructures (excluding power supply and airstrip), operating costs

(excluding mining operating costs), capital cost estimate and project

development plan) and Dr. Sabry Abdel Hafez (financial evaluation)

-- Moose Mountain Technical Services under the direction of Jim Gray

(mining, mine capital and mine operating costs)

-- W.N. Brazier Associates Inc. under the direction of W.N. Brazier (power

generation)

-- Rescan Environmental Services Ltd. under the direction of Pierre

Pelletier (environmental matters)

-- Golder Associates Ltd. under the direction of Cameron Clayton (open pit

slope stability)

-- EBA, a Tetra Tech Company, under the direction of Nigel Goldup

(tailings, surface water management and waste rock storage facilities,

and surficial geology) and Kevin Jones (airstrip upgrade)

-- SRK Consulting (Canada) Inc., under the direction of Stephen Day (metal

leaching and acid rock drainage)

-- Resource Modeling Inc. under the direction of Michael Lechner (mineral

resources)

Seabridge holds a 100% interest in several North American gold resource

projects. The Company's principal assets are the KSM property located near

Stewart, British Columbia, Canada and the Courageous Lake gold project located

in Canada's Northwest Territories. For a breakdown of Seabridge's mineral

reserves and resources by project and category please visit the Company's

website at http://www.seabridgegold.net/resources.php.

All reserve and resource estimates reported by the Corporation were calculated

in accordance with the Canadian National Instrument 43-101 and the Canadian

Institute of Mining and Metallurgy Classification system. These standards differ

significantly from the requirements of the U.S. Securities and Exchange

Commission. Mineral resources which are not mineral reserves do not have

demonstrated economic viability.

This document contains "forward-looking information" within the meaning of

Canadian securities legislation and "forward-looking statements" within the

meaning of the United States Private Securities Litigation Reform Act of 1995.

This information and these statements, referred to herein as "forward-looking

statements" are made as of the date of this document. Forward-looking statements

relate to future events or future performance and reflect current estimates,

predictions, expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to: (i) the estimated amount and

grade of mineral reserves and mineral resources; (ii) estimates of the capital

costs of constructing mine facilities and bringing a mine into production,

including financing payback periods; (iii) the amount of future production; (iv)

estimates of operating costs, net cash flow and economic returns from an

operating mine; (v) completion of and submission of an Environmental Impact

Statement and permit applications; and (vi) the prospect of obtaining necessary

permits and proceeding with the construction and operation of a mine and the

value of such a venture to Seabridge Gold shareholders. Any statements that

express or involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives or future events or performance (often,

but not always, using words or phrases such as "expects", "anticipates",

"plans", "projects", "estimates", "envisages", "assumes", "intends", "strategy",

"goals", "objectives" or variations thereof or stating that certain actions,

events or results "may", "could", "would", "might" or "will" be taken, occur or

be achieved, or the negative of any of these terms and similar expressions) are

not statements of historical fact and may be forward-looking statements.

All forward-looking statements are based on Seabridge's or its consultants'

current beliefs as well as various assumptions made by them and information

currently available to them. These assumptions include: (i) the presence of and

continuity of metals at the Project at modeled grades; (ii) the capacities of

various machinery and equipment; (iii) the availability of personnel, machinery

and equipment at estimated prices; (iv) exchange rates; (v) metals sales prices;

(vi) appropriate discount rates; (vii) tax rates and royalty rates applicable to

the proposed mining operation; (viii) financing structure and costs; (ix)

anticipated mining losses and dilution; (x) metallurgical performance; (xi)

reasonable contingency requirements; (xii) success in realizing proposed

operations; (xiii) receipt of regulatory approvals on acceptable terms; and

(xiv) the negotiation of satisfactory terms with impacted Treaty and First

Nations groups. Although management considers these assumptions to be reasonable

based on information currently available to it, they may prove to be incorrect.

Many forward-looking statements are made assuming the correctness of other

forward looking statements, such as statements of net present value and internal

rates of return, which are based on most of the other forward-looking statements

and assumptions herein. The cost information is also prepared using current

values, but the time for incurring the costs will be in the future and it is

assumed costs will remain stable over the relevant period.

By their very nature, forward-looking statements involve inherent risks and

uncertainties, both general and specific, and risks exist that estimates,

forecasts, projections and other forward-looking statements will not be achieved

or that assumptions do not reflect future experience. We caution readers not to

place undue reliance on these forward-looking statements as a number of

important factors could cause the actual outcomes to differ materially from the

beliefs, plans, objectives, expectations, anticipations, estimates assumptions

and intentions expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and estimates expressed

above do not occur, but specifically include, without limitation: risks relating

to variations in the mineral content within the material identified as mineral

reserves or mineral resources from that predicted; variations in rates of

recovery and extraction; developments in world metals markets; risks relating to

fluctuations in the Canadian dollar relative to the US dollar; increases in the

estimated capital and operating costs or unanticipated costs; difficulties

attracting the necessary work force; increases in financing costs or adverse

changes to the terms of available financing, if any; tax rates or royalties

being greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in project parameters

as plans continue to be refined; risks relating to receipt of regulatory

approvals or settlement of an agreement with impacted First Nations groups; the

effects of competition in the markets in which Seabridge operates; operational

and infrastructure risks and the additional risks described in Seabridge's

Annual Information Form filed with SEDAR in Canada (available at www.sedar.com)

for the year ended December 31, 2011 and in the Corporation's Annual Report Form

40-F filed with the U.S. Securities and Exchange Commission on EDGAR (available

at www.sec.gov/edgar.shtml). Seabridge cautions that the foregoing list of

factors that may affect future results is not exhaustive.

When relying on our forward-looking statements to make decisions with respect to

Seabridge, investors and others should carefully consider the foregoing factors

and other uncertainties and potential events. Seabridge does not undertake to

update any forward-looking statement, whether written or oral, that may be made

from time to time by Seabridge or on our behalf, except as required by law.

ON BEHALF OF THE BOARD

Rudi Fronk, Chairman & C.E.O.

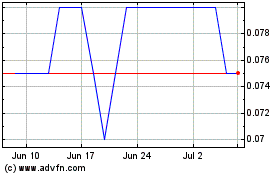

Lahontan Gold (TSXV:LG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lahontan Gold (TSXV:LG)

Historical Stock Chart

From Jul 2023 to Jul 2024