Seabridge Gold Inc. (TSX:SEA)(NYSE Amex:SA) announced today the results of an

updated National Instrument 43-101 compliant Preliminary Feasibility Study

("PFS") for its 100% owned KSM project located in northern British Columbia,

Canada. The updated PFS was prepared by Wardrop, A Tetra Tech Company (Wardrop).

The PFS Executive Summary can be found at

www.seabridgegold.net/ksm_exec_sum2011. The complete PFS will be filed at

www.sedar.com within 45 days.

The new PFS includes 2010 drilling results and enhanced engineering work to:

-- Increase estimated mineral reserves by 27% for gold, 42% for copper, 61%

for silver and 22% for molybdenum.

-- Extend mine life to 52 years from 37 (2.2 billion tonnes of reserves at

a throughput of 120,000 tonnes per day).

-- Put in place the potential to expand throughput by 50% in the early

years after start-up.

-- Produce gold at an estimated base case cash operating cost of US$105 per

ounce during first 7 years of mine life.

-- Reduce base case capital payback to 6.6 years or 13% of mine life.

-- Improve base case total net cash flow by US$4.5 billion.

The comparisons noted above are against the KSM March 31, 2010 PFS also prepared

by Wardrop.

Seabridge President and CEO Rudi Fronk stated that "the KSM project represents

an extraordinary opportunity in the current economic environment. Our estimated

operating costs and total costs per ounce of gold produced are well below the

current average of the major gold producers. At current metal prices and

currency exchange rates, estimated life of mine cash operating costs are minus

US$79 per ounce while total costs including all capital and closure costs are

just US$220 per ounce. Projected capital costs are in line with those of

comparable, large-scale undeveloped gold-copper projects and at current metal

prices and currency exchange rates, capital payback takes only to 4.8 years or

9% of mine life. Furthermore, KSM has the advantage of being located in a

low-risk jurisdiction."

The PFS envisages an open-pit mining operation at 120,000 metric tonnes per day

(tpd) of ore fed to a flotation mill which would produce a combined

gold/copper/silver concentrate for transport by truck to the nearby deep-water

sea port at Stewart, B.C. and shipment to a Pacific Rim smelter. Extensive

metallurgical testing confirms that KSM can produce a clean concentrate with an

average copper grade of 25%, making it readily saleable. A separate molybdenum

concentrate and gold-silver dore would be produced at the KSM processing

facility.

The designed throughput of 120,000 tpd is the industry standard start-up

capacity for large tonnage copper and copper-gold projects (even when reserves

are large enough to justify greater rates of production) because it is the

practical limit for developing the necessary working space for sufficient ore

production to feed the plant in the early years of an open pit mine. Examples

include Cerro Verde, Batu Hijau, Boddington, Quebrada Blanca, Las Bambas and

Conga, with start-up throughput varying between 100,000 and 140,000 tpd

depending on ore hardness. Planned expansion comes later as mining capacity

increases, allowing the project economics to be improved with a higher

throughput. Examples of projects that were originally built at 100,000 to

140,000 tpd throughput and have gone through or have planned expansions include

Escondida, Cerro Verde and Batu Hijau. In the new KSM PFS, the project has been

designed to accommodate a 50% expansion in the early years of operation,

essentially removing anticipated bottle-necks in advance. Start-up capital costs

have been increased accordingly.

Reserves

Lerchs-Grossman ("LG") pit shell optimizations were used to define the mine

plans in the updated PFS. Because of the difficulty in predicting relevant metal

prices over such a long project life, the ultimate LG pit limits were set at the

point where an incremental increase in pit size did not significantly increase

the pit resource (an incremental increase in the pit resource results in only

marginal economic return). Waste to ore cut-offs were determined using metal

prices of US$990 per ounce gold, US$2.91 per pound copper, US$15.40 per ounce

silver and US$15.00 per pound molybdenum for net smelter return calculations.

Net smelter return cut-offs for each pit are US$7.48 per tonne of ore for

Mitchell and Iron Cap, US$7.82 for Sulphurets and US$7.56 for Kerr. Mineral

Reserves for the KSM project are stated as follows:

KSM Proven and Probable Reserves

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Average Grades

----------------------------------------

Reserve Tonnes Gold Copper Silver Molybdenum

Zone Category (millions) (gpt) (%) (gpt) (ppm)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Mitchell Proven 617.9 0.64 0.17 3.06 60.2

----------------------------------------------------------------

Probable 848.6 0.59 0.16 3.02 61.8

----------------------------------------------------------------

Total 1,466.5 0.61 0.16 3.04 61.2

----------------------------------------------------------------------------

Iron Cap Probable 334.1 0.42 0.20 5.46 48.4

----------------------------------------------------------------------------

Sulphurets Probable 179.1 0.62 0.26 0.61 59.8

----------------------------------------------------------------------------

Kerr Probable 212.7 0.25 0.46 1.28 Nil

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Totals Proven 617.9 0.64 0.17 3.06 60.2

----------------------------------------------------------------

Probable 1,574.5 0.51 0.22 3.03 50.4

----------------------------------------------------------------

Total 2,192.4 0.55 0.21 3.04 53.2

----------------------------------------------------------------------------

----------------------------------------------------------------------------

KSM Proven and Probable Reserves

------------------------------------------------------------

------------------------------------------------------------

Contained Metal

------------------------------------------------

Gold Copper Silver Moly

(million (million (million (million

Zone ounces) pounds) ounces) pounds)

------------------------------------------------------------

------------------------------------------------------------

Mitchell 12.6 2,279 61 82

------------------------------------------------

16.0 3,040 82 116

------------------------------------------------

28.7 5,320 143 198

------------------------------------------------------------

Iron Cap 4.5 1,490 59 36

------------------------------------------------------------

Sulphurets 3.6 1,021 4 24

------------------------------------------------------------

Kerr 1.7 2,155 9 Nil

------------------------------------------------------------

------------------------------------------------------------

Totals 12.6 2,279 61 82

------------------------------------------------

25.8 7,706 153 175

------------------------------------------------

38.5 9,985 214 257

------------------------------------------------------------

------------------------------------------------------------

Estimated proven and probable reserves of 38.5 million ounces of gold (2.192

billion tonnes at an average grade of 0.55 grams of gold per tonne) are derived

from estimated total measured and indicated resources of 45.3 million ounces of

gold (2.549 billion tonnes at an average grade of 0.55 grams of gold per tonne)

including allowances for mining losses and dilution.

Production

At 120,000 tonnes per day, annual throughput for the mill is estimated at 43.8

million tonnes. With 2.19 billion tonnes of proven and probable reserves, KSM's

mine life is estimated at approximately 52 years. Production is scheduled to

commence at the Mitchell deposit (years 1 to 40), to be augmented by Sulphurets

(years 6 to 13), Kerr (years 14 to 36) and finally Iron Cap (years 38 to 52).

Based on pit availability of ore and operating space, a potentially highly

accretive ramp-up in production to 180,000 tonnes per day could be achieved

prior to year 10 but this anticipated expansion is not included in cash flows.

The economic impact of this expansion will be estimated in the PFS Final Report.

At Mitchell, there is a near-surface higher grade gold zone that would allow for

gold production in the first seven years substantially above the mine life

average. This higher grade gold zone significantly reduces the project's payback

period to approximately 6.6 years for the Base Case or within 13% of mine life.

A payback period representing less than 20% of mine life is considered highly

favorable. Metal production for the first seven years compared to life of mine

average production is estimated as follows:

Average Annual Metal Production

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Years 1-7 Average Life of Mine Average

----------------------------------------------------------------------------

Average Grades:

Gold (grams per tonne) 0.83 0.55

Copper (%) 0.21 0.21

Silver (grams per tonne) 3.32 3.04

Molybdenum (parts per million) 42.5 53.2

----------------------------------------------------------------------------

Annual Production:

Gold (ounces) 854,000 546,000

Copper (pounds) 166 million 157 million

Silver (ounces) 2.9 million 2.7 million

Molybdenum (pounds) 1.1 million 1.7 million

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Capital Costs

Start-up capital costs (including contingencies of US$576 million) are estimated

at US$4.68 billion, approximately US$1.3 billion above the start-up capital cost

estimate from the 2010 PFS. Start-up capital costs are higher due to: (i) the

increase in reserves which requires additional mine waste rock placement and

storage as well as associated water diversions, storage dams and water treatment

facilities; (ii) building into the design the flexibility to be able to increase

production by 50% early in the project's life (essentially removing anticipated

bottle-necks in advance); (iii) a more conservative estimated productivity rate

during construction; (iv) higher labor rates compared to last year; and (v)

equipment cost inflation. The design also includes five on-site small energy

recovery plants which would provide green power to the site and to the B.C.

power grid.

Start-up Capital Costs

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Description US$'000

Overall Site 121,485

Open Pit Mining 257,518

Crushing, Stockpiles and Grinding 491,363

Tunneling 323,200

Mitchell Teigen Tunnel Transfer System 180,364

Plantsite Grinding and Flotation 327,330

Tailings Management Facility 116,468

Water Treatment 267,372

Environmental 15,887

Avalanche Control 78,855

Site Services and Utilities 81,583

Ancillary Buildings 82,943

Plant Mobile Equipment 11,393

Temporary Services 217,450

Permanent Electrical Power Supply 169,410

Mini Hydro Plants 47,642

Energy Recovery Plants 10,954

Permanent Access Roads 64,986

Temporary Winter Access Roads 15,763

Offsite Infrastructure and facilities 62,210

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Sub-total 2,994,176

Project Indirects 1,070,615

Owner's Costs 94,428

Contingencies 575,753

Total 4,684,972

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Operating Costs

Average mine, process and G&A operating costs over the project's life (including

waste mining and on-site power credits) are estimated at US$13.29 per tonne

milled (before base metal credits). Estimated unit operating costs are up

approximately 14% from the 2010 PFS due primarily to increased labor,

consumables and diesel costs. A breakdown of estimated unit operating costs is

as follows:

Unit Operating Costs

----------------------------------------------------------------------------

----------------------------------------------------------------------------

US$s

(Per Tonne

Cost Category Milled)

----------------------------------------------------------------------------

Mining Costs 5.37

Milling Costs:

Staff and Supplies 5.03

Power (Process only) 1.07

G&A 0.97

Site Services 0.26

Tailings 0.39

Water Treatment 0.36

On-Site Power Credit (0.16)

----------------------------------------------------------------------------

Total 13.29

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Economic Analysis

A Base Case economic evaluation was undertaken incorporating historical

three-year trailing averages for metal prices as of April 15, 2011. This

approach is consistent with the guidance of the United States Securities and

Exchange Commission, is accepted by the Ontario Securities Commission and is

industry standard. An Alternate Case was also constructed using a more

conservative copper price approximately 40% below current market (assumes a

significant worldwide recession) and gold and silver prices about 20% below

current levels. Finally, a Spot Price Case was prepared using April 15, 2011

spot metal prices and currency exchange rates. The pre-tax economic results in

U.S. dollars for all three cases are as follows:

Projected Economic Results

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Alternate Spot Price

Base Case Case Case

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Metal Prices:

Gold ($/ounce) 1,069 1,200 1,477

Copper ($/pound) 3.04 2.60 4.27

Silver ($/ounce) 18.12 36.00 42.57

Molybdenum ($/pound) 17.35 17.35 17.00

----------------------------------------------------------------------------

Net Cash Flow $16.2 billion $18.8 $35.7 billion

----------------------------------------------------------------------------

NPV @ 5% Discount Rate $2.6 billion $3.3 $7.8 billion

----------------------------------------------------------------------------

IRR (%) 9.2 10.2 14.9

----------------------------------------------------------------------------

Payback Period (years) 6.6 5.9 4.8

----------------------------------------------------------------------------

Operating Costs Per Ounce of Gold

Produced During Years 1 to 7 105 134 -110

----------------------------------------------------------------------------

Operating Costs Per Ounce of Gold

Produced (life of mine) 231 272 -79

----------------------------------------------------------------------------

Total Costs Per Ounce of Gold

Produced (includes all capital) 498 539 220

----------------------------------------------------------------------------

US$/Cdn$ Exchange Rate 0.93 0.93 1.04

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Note: Operating and total costs per ounce of gold are after base metal credits.

Total costs per ounce include all start-up capital, sustaining capital and

reclamation/closure costs.

It is important to note that even with the increased capital and operating

costs, the base case net cash flow and payback periods have improved when

compared to the 2010 PFS.

National Instrument 43-101 Disclosure

The updated KSM PFS was prepared by Wardrop, and incorporates the work of a

number of industry-leading consulting firms. These firms and their Qualified

Persons (as defined under National Instrument 43-101) are independent of

Seabridge and have reviewed and approved this news release. The consultants and

their QPs are listed below with their responsibilities:

-- Wardrop, under the direction of John Huang (overall report preparation,

metallurgical testing review, mineral processing and process operating

cost) and Hassan Ghaffari (infrastructure capital cost estimate,

financial analysis and process related infrastructure)

-- Moose Mountain Technical Services under the direction of Jim Gray

(mining, mine capital and mine operating costs)

-- W.N. Brazier Associates Inc. under the direction of W.N. Brazier (power

supply, energy recovery plants and associated costs)

-- Rescan Environmental Services Ltd. under the direction of Greg McKillop

(environment and permitting)

-- Bosche Ventures Ltd. under the direction of Harold Bosche (rope

conveying, slurry pipeline system, tailings delivery, reclaim pumping

and piping systems and associated capital costs)

-- Klohn Crippen Berger Ltd. under the direction of Graham Parkinson (water

diversion and seepage collection ponds, tailings dam, water treatment

dam and related capital, operating and closure costs)

-- Allnorth Consultants Ltd. Under the direction of Mr. Darby Kreitz

(storage dam and tailings starter dam construction cost estimates)

-- Resource Modeling Inc. under the direction of Michael Lechner (mineral

resources)

-- McElhanney Consulting Services Ltd. under the direction of Robert

Parolin (main and temporary access roads and associated costs)

-- BGC Engineering Inc. under the direction of Warren Newcomen (rock

mechanics and mining pit slopes)

-- EBA Engineering Consultants Ltd. (EBA) under the direction of Kevin

Jones (winter access roads and associated costs)

-- Thyssen Mining Construction of Canada Ltd. under the direction of Adrian

Bodolan (tunnel design and costs).

Seabridge holds a 100% interest in several North American gold resource

projects. The Company's principal assets are the KSM property located near

Stewart, British Columbia, Canada and the Courageous Lake gold project located

in Canada's Northwest Territories. For a breakdown of Seabridge's mineral

reserves and resources by project and category please visit the Company's

website at http://www.seabridgegold.net/resources.php.

All reserve and resource estimates reported by the Corporation were calculated

in accordance with the Canadian National Instrument 43-101 and the Canadian

Institute of Mining and Metallurgy Classification system. These standards differ

significantly from the requirements of the U.S. Securities and Exchange

Commission. Mineral resources which are not mineral reserves do not have

demonstrated economic viability.

This document contains "forward-looking information" within the meaning of

Canadian securities legislation and "forward-looking statements" within the

meaning of the United States Private Securities Litigation Reform Act of 1995.

This information and these statements, referred to herein as "forward-looking

statements", are made as of the date of this document. Forward-looking

statements relate to future events or future performance and reflect current

estimates, predictions, expectations or beliefs regarding future events and

include, but are not limited to, statements with respect to: (i) the amount of

mineral reserves and mineral resources; (ii) any potential for the increase of

mineral reserves and mineral resources, whether in existing zones or new zones;

(iii) the amount of future production; (iv) further optimization of the PFS

including capacity expansion; (v) completion of, and submission of, the

Environmental Assessment Application; and (vi) potential for engineering

improvements. Any statements that express or involve discussions with respect to

predictions, expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, using words or phrases

such as "expects", "anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or variations thereof or

stating that certain actions, events or results "may", "could", "would", "might"

or "will" be taken, occur or be achieved, or the negative of any of these terms

and similar expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on Seabridge's or its consultants'

current beliefs as well as various assumptions made by them and information

currently available to them. These assumptions include: (i) the presence of and

continuity of metals at the Project at modeled grades; (ii) the capacities of

various machinery and equipment; (iii) the availability of personnel, machinery

and equipment at estimated prices; (iv) exchange rates; (v) metals sales prices;

(vi) appropriate discount rates; (vii) tax rates and royalty rates applicable to

the proposed mining operation; (viii) financing structure and costs; (ix)

anticipated mining losses and dilution; (x) metallurgical performance; (xi)

reasonable contingency requirements; (xii) success in realizing further

optimizations and potential in exploration programs and proposed operations;

(xiii) receipt of regulatory approvals on acceptable terms, including the

necessary right of way for the proposed tunnels; and (xiv) the negotiation of

satisfactory terms with impacted First Nations groups. Although management

considers these assumptions to be reasonable based on information currently

available to it, they may prove to be incorrect. Many forward-looking statements

are made assuming the correctness of other forward looking statements, such as

statements of net present value and internal rates of return, which are based on

most of the other forward-looking statements and assumptions herein. The cost

information is also prepared using current values, but the time for incurring

the costs will be in the future and it is assumed costs will remain stable over

the relevant period.

By their very nature, forward-looking statements involve inherent risks and

uncertainties, both general and specific, and risks exist that estimates,

forecasts, projections and other forward-looking statements will not be achieved

or that assumptions do not reflect future experience. We caution readers not to

place undue reliance on these forward-looking statements as a number of

important factors could cause the actual outcomes to differ materially from the

beliefs, plans, objectives, expectations, anticipations, estimates assumptions

and intentions expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and estimates expressed

above do not occur, but specifically include, without limitation: risks relating

to variations in the mineral content within the material identified as mineral

reserves or mineral resources from that predicted; variations in rates of

recovery and extraction; developments in world metals markets; risks relating to

fluctuations in the Canadian dollar relative to the US dollar; increases in the

estimated capital and operating costs or unanticipated costs; difficulties

attracting the necessary work force; increases in financing costs or adverse

changes to the terms of available financing, if any; tax rates or royalties

being greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in project parameters

as plans continue to be refined; risks relating to receipt of regulatory

approvals or settlement of an agreement with impacted First Nations groups; the

effects of competition in the markets in which Seabridge operates; operational

and infrastructure risks and the additional risks described in Seabridge's

Annual Information Form filed with SEDAR in Canada (available at www.sedar.com)

for the year ended December 31, 2010 and in the Corporation's Annual Report Form

40-F filed with the U.S. Securities and Exchange Commission on EDGAR (available

at www.sec.gov/edgar.shtml). Seabridge cautions that the foregoing list of

factors that may affect future results is not exhaustive.

When relying on our forward-looking statements to make decisions with respect to

Seabridge, investors and others should carefully consider the foregoing factors

and other uncertainties and potential events. Seabridge does not undertake to

update any forward-looking statement, whether written or oral, that may be made

from time to time by Seabridge or on our behalf, except as required by law.

ON BEHALF OF THE BOARD

Rudi Fronk, President & C.E.O.

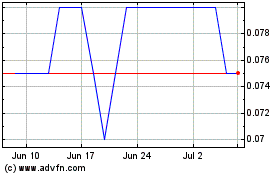

Lahontan Gold (TSXV:LG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lahontan Gold (TSXV:LG)

Historical Stock Chart

From Jul 2023 to Jul 2024