Excelsior Energy Limited (TSX VENTURE:ELE) ("Excelsior" or the "Company")

announces it has filed financial statements and management's discussion and

analysis for the three and nine month periods ended September 30, 2009 and 2008.

These materials can be found online at www.sedar.com and on the Company's

website www.excelsior-energy.com.

"During the third quarter the Company achieved a further milestone by filing a

patent application for its combustion overhead gravity drainage proprietary

process." said Dr. David Winter, Excelsior's President and Chief Executive

Officer. "We are now focused on funding the COGD experimental project and the

engagement with CIBC World Markets Inc., to secure a joint venture partner, will

greatly assist in this effort."

Third Quarter 2009 Highlights

-- Excelsior filed a patent application with the Canadian Intellectual

Property Office for its combustion overhead gravity drainage ("COGD")

proprietary process (the "Process"). The Process is designed to prepare

a viscous oil reservoir for exploitation using COGD. The Process uses

cyclic steam and steam flood techniques to predispose the viscous oil

reservoir to form a combustion chamber similar in geometry to the steam

chamber in steam assisted gravity drainage.

-- Excelsior's in situ combustion experimental project application ("COGD

Project Application") to the Alberta Energy Resources Conservation Board

("ERCB") and Alberta Environment ("AENV") has been administratively

accepted and deemed complete and is moving through the approval process.

The COGD Project Application is seeking approval to operate three COGD

well arrays with a production target of up to 1,000 barrels of bitumen

per day. Regulatory approval is on track and approval is anticipated in

approximately nine to twelve months.

-- Excelsior's proprietary COGD technology is supported by a recently

completed computer reservoir simulation model. The work was contracted

to Computer Modeling Group Inc. and used their steam thermal advanced

reservoir simulation (STARS) technology. Excelsior's geological

reservoir characterization model, which integrated all core, log, and

seismic data formed the geological framework for the simulation model. A

number of runs were made to test sensitivities to different reservoir

and operating parameters. The modelling results were positive and

supported Excelsior's pre-ignition process and indicated that a COGD

horizontal well has the potential to produce in excess of 800 barrels of

bitumen per day and attain potential recovery factors in excess of 64%.

-- The Company had working capital of $1.9 million at September 30, 2009,

which is sufficient for general and administrative expenses for the next

four quarters. The Company has no debt. Further operations and

implementation of the COGD experimental pilot project will require

additional funding.

Outlook

-- The Company has commenced a process to find a joint venture partner for

the COGD pilot project. Excelsior engaged CIBC World Markets Inc.

("CIBC") as its strategic advisor to identify and secure a major joint

venture partner for the development of its experimental in situ COGD

pilot project at the Company's Hangingstone property.

-- Excelsior resubmitted an application to the Alberta Government's

Innovative Energy Technology Program ("IETP") in support of the COGD

experimental program. IETP provides for royalty credits to be awarded

for capital spent on new technology. Confirmation is expected by March

31, 2010. The Company cannot guarantee that it will be successful in

securing the IETP funding as it is a competitive process.

-- The Company, through its subsidiary Excelsior Energy North Sea Limited

("EENS"), completed seismic reprocessing and interpretation on licence

P1500 in the UK North Sea. A drilling location has been identified to

test one of the prospects which is a step-out from an existing oil

discovery drilled in 1996. EENS is required to commit to drill on the

block by November 30, 2009, and demonstrate it has the financial

capacity for drilling operations, or relinquish the licence at no

further cost. EENS has requested an extension to February 28, 2009, to

provide additional time to obtain financing for an exploratory well.

EENS is currently conducting a farm-out process to seek an industry

partner for the well.

Selected Information

----------------------------------------------------------------------------

($'s except weighted Three Months Ended Nine Months Ended

average shares) September 30, September 30,

----------------------------------------------------------------------------

2009 2008 2009 2008

----------------------------------------------------------------------------

Gas sales 1,937 15,408 12,552 97,520

----------------------------------------------------------------------------

Royalties (20) (3,070) (349) (15,531)

----------------------------------------------------------------------------

Operating expenses (3,544) (8,159) (12,383) (26,225)

----------------------------------------------------------------------------

Net gas revenue (1,627) 4,179 (180) 55,764

----------------------------------------------------------------------------

Interest income 1,842 51,388 32,326 243,335

----------------------------------------------------------------------------

General and

administrative expense 293,074 407,453 829,338 1,111,375

----------------------------------------------------------------------------

Net loss and

comprehensive loss (313,029) (666,845) (1,061,559) (2,078,999)

----------------------------------------------------------------------------

Loss per share (basic and

diluted) - (0.01) (0.01) (0.01)

----------------------------------------------------------------------------

Capital expenditures

----------------------------------------------------------------------------

Petroleum and

natural gas properties 215,547 403,090 8,779,187 11,659,794

----------------------------------------------------------------------------

Cash flows

----------------------------------------------------------------------------

Cash flows from (used

in) operations (286,781) (396,652) (719,832) (686,336)

----------------------------------------------------------------------------

Cash flows used in

investing (454,013) (601,375) (11,142,390) (12,942,898)

----------------------------------------------------------------------------

Cash flows from

financing - 10,477,701 - 12,589,426

----------------------------------------------------------------------------

Change in cash and

cash equivalents (740,794) 9,479,674 (11,862,222) (1,039,808)

----------------------------------------------------------------------------

Cash and cash

equivalents, beginning

of period 2,626,629 5,329,166 13,748,057 15,848,648

----------------------------------------------------------------------------

Cash and cash

equivalents, end of

period 1,885,835 14,808,840 1,885,835 14,808,840

----------------------------------------------------------------------------

Basic and diluted

weighted average number

of shares outstanding 143,060,590 112,251,793 143,060,590 119,244,452

----------------------------------------------------------------------------

About Excelsior

Excelsior is an early stage, oil sands company with 58 operated sections on two

contiguous blocks in the Hangingstone and West Surmont areas of the Athabasca

Oil Sands Region near Fort McMurray, Alberta. The Company has developed a

proprietary in situ combustion technology ("Combustion Overhead Gravity

Drainage" or "COGD") which has game-changing potential in the development and

recovery of heavy oil and bitumen. An application for an experimental pilot

project to field demonstrate the COGD technology was submitted in at the end of

the second quarter of 2009 with a targeted start up in early 2011. In addition

the Company indirectly holds a 100% working interest in UK North Sea Licences

P1500 and P1691 covering four part-blocks through its 75% owned subsidiary ENS

Energy Ltd. Excelsior's strategy is to capture oil and gas appraisal and

development opportunities where we can leverage Management's diverse

international operating, heavy oil and field development expertise with

developing technologies to produce oil and gas.

Forward Looking Information

This press release contains forward-looking statements and forward-looking

information within the meaning of applicable securities laws. The use of any of

the words "expect", "anticipate", "continue", "estimate", "objective",

"ongoing", "may", "will", "project", "should", "believe", "plans", "intends" and

similar expressions are intended to identify forward-looking statements or

information. More particularly and without limitation, this press release

contains forward-looking statements and information concerning: anticipated

regulatory approvals, anticipated production and recovery results using the

Company's COGD process, the sufficiency of its current funding to meet planned

expenditure requirements, the plans of its subsidiary companies in meeting their

contractual commitments, joint venture opportunities and financing arrangements.

The forward-looking statements and information in this press release are based

on certain key expectations and assumptions made by Excelsior, including

expectations and assumptions concerning: prevailing commodity prices and

exchange rates; applicable royalty rates and tax laws; future drilling results

and production rates; reserve and resource volumes; the success obtained in

drilling new wells; the anticipated production rates and recoverability factors

based on certain modelling results conducted by third parties; the success of

the process conducted by CIBC on terms acceptable to the Company; the

sufficiency of budgeted capital expenditures in carrying out planned activities;

the availability and cost of labour and services; and the receipt, in a timely

manner, of regulatory approvals. Although Excelsior believes that the

expectations and assumptions on which such forward-looking statements and

information are based are reasonable, undue reliance should not be placed on the

forward-looking statements and information because Excelsior can give no

assurance that they will prove to be correct.

Since forward-looking statements and information address future events and

conditions, by their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently anticipated due to a

number of factors and risks. These include, but are not limited to the risks

associated with the oil and gas industry in general such as: operational risks

in development, exploration and production; delays or changes in plans with

respect to exploration or development projects or capital expenditures; the

uncertainty of reserve and resource estimates; the uncertainty of estimates

relating to production, costs and expenses; health, safety and environmental

risks; commodity price and exchange rate fluctuations; marketing and

transportation or petroleum and natural gas and loss of markets; environmental

risks; competition; incorrect assessment of the value of acquisitions; failure

to realize the anticipated benefits of acquisitions; ability to access

sufficient capital from internal and external sources; failure to obtain

required regulatory approvals; inaccuracies in modelling results conducted by

third parties; the ability of the Company to identify and enter into a binding

agreement with a joint venture partner on terms acceptable to the Company; and

changes in legislation, including but not limited to tax laws, royalty rates and

environmental regulations.

Readers are cautioned that the foregoing list of factors is not exhaustive.

Additional information on these and other factors that could affect the

operations or financial results of Excelsior are included in reports on file

with applicable securities regulatory authorities and may be accessed through

the SEDAR website (www.sedar.com).

The forward-looking statements and information contained in this press release

are made as of the date hereof and Excelsior undertakes no obligation to update

publicly or revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise, unless so required by

applicable securities laws.

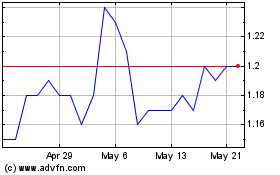

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From May 2024 to Jun 2024

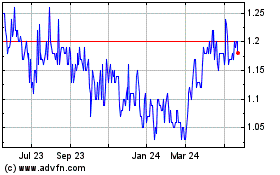

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jun 2023 to Jun 2024