Aurora Energy Resources Inc. ("Aurora" or "the Company") (TSX:AXU) reports its

financial and operating results for the nine months ended September 30, 2008.

Details of the Company's financial results are described in the unaudited

financial statements and Management's Discussion and Analysis (MD&A) for the

nine months ended September 30, 2008. Further details on each of the Company's

projects and activities can be found on the Company's website

http://www.aurora-energy.ca and on SEDAR at http://www.sedar.com. All amounts

are in Canadian dollars unless otherwise stated.

Overview

The Corporation was incorporated on June 8, 2005, and operates in the mineral

resource industry. The Corporation has a focus on exploration and development

opportunities globally with current uranium projects in the Central Mineral Belt

("CMB"), Labrador, Canada, one of the most promising uranium districts in the

world, and Baker Lake, Nunavut. Aurora is committed to responsible development,

which includes community consultation, lasting local benefits and the highest

standards of safety, health, and environmental protection.

Aurora's properties in the CMB consist of a total of 223,074 acres in 28

licenses or groups of mineral claims. To date, the Company has identified six

uranium deposits in the region, collectively containing a measured and indicated

resource of 83.9 million pounds of U3O8 and an inferred resource of 49.8 million

pounds of U3O8(i).

Significant events for the nine months ending September 30, 2008 include:

- Key leadership change in August 2008 with the appointment of Mr. Bruce

Dumville as the new President and Chief Executive Officer and the appointment of

Dr. Mark O'Dea to the position of Deputy Chair of the Corporation's Board of

Directors. Mr. Dumville has over twenty-five years of experience in the

international mining industry, including functional responsibility for

pre-feasibility and feasibility studies, project management, operations and the

analysis of new investment opportunities.

- Signing of an option agreement with Pacific Ridge Exploration Ltd. on a

uranium exploration and development opportunity in the Baker Lake Basin of

Nunavut, Canada. The property provides the potential to build value at an

excellent entry cost and in a jurisdiction with clearly defined policies on

exploration and mining. The Baker Lake Basin property covers 96,000 hectares and

boasts attractive near-surface uranium mineralization, including 5 targets with

drill-indicated mineralization, with at least 15 target areas yet to be

drill-tested.

- Completion of the 2008 summer drill program in Labrador, which included an

infill drill campaign of 13,233.49 metres of drilling in 26 holes at the Jacques

Lake and Michelin deposits. Aurora also completed a 2,908 metre geotechnical,

environmental and metallurgical drill program in August 2008 in 25 holes. The

environmental work plan for 2008 was also substantially completed.

- Initiated a tailings management study to identify potential tailings sites for

the Michelin Project. Tailings options will be identified and those that are

acceptable from an environmental, technical and operations standpoint will

create a short list for further consideration in 2009 and 2010.

- Development of an education, training and employment program for residents of

coastal Labrador is underway.

- Recruitment of Mr. Chesley Andersen as Vice President, Labrador Affairs. Mr.

Andersen has over twenty years of experience representing the Labrador Inuit.

Born and raised in the Inuit community of Makkovik in coastal Labrador, he most

recently held the position of Senior Negotiator with the Nunatsiavut Government

and previously served as the Secretary to the Executive Council of the

Nunatsiavut Government.

- Selection of panel members for the Michelin Project Community Panel, announced

in June 2008, is complete.

- Completion of an initial 600 metre drill program to test the Lucky 7 zone at

the Baker Lake Basin property, as well as geological mapping and ground magnetic

surveys, and an airborne magnetic, radiometric and broadband electromagnetic

survey, of which results are pending. This work is designed to cover the

property and aid in the design of the subsequent exploration program.

Operations

Selected Financial Data

This summary of selected unaudited and audited(ii) financial data should be read

in conjunction with the Management Discussion and Analysis ("MD&A") and the

unaudited and audited financial statements of the Corporation and related notes

thereto, for the periods indicated.

--------------------------------------------------------------------------

For the nine months ended

September 30, September 30,

2008 2007

--------------------------------------------------------------------------

Loss and comprehensive loss for the

period $ 2,721,221 $ 7,133,761

Basic and diluted loss per share $ 0.04 $ 0.11

Cash invested in mineral properties $ 23,048,350 $ 18,369,009

Cash generated (used) by financing

activities $ 864,508 $ 2,444,773

--------------------------------------------------------------------------

--------------------------------------------------------------------------

As at

September 30, December 31,

2008 2007

--------------------------------------------------------------------------

Cash $ 106,253,139 $ 131,094,585

Working capital $ 105,091,624 $ 129,898,119

Exploration properties and deferred

exploration expenditures $ 81,441,462 $ 56,710,497

Total assets $ 191,910,177 $ 192,186,937

Shareholder's equity $ 180,511,000 $ 184,879,251

--------------------------------------------------------------------------

(ii) The December 2007 financial data are the only audited financial data

The Company's net loss for the nine months ended September 30, 2008, was

$2,721,221 or a loss per share of $0.04 compared to a net loss of $7,133,761 and

loss per share of $0.11 for the nine months ended September 30, 2007. Increased

interest income offset by a reduction in stock-based compensation are the

primary factors for the improvement in the Corporation's net loss in 2008 vs.

2007.

The net loss for the nine months ended September 30, 2008, consists primarily of

wages and benefits of $2,149,430, stock-based compensation expense of

$1,407,534, office and general expenses of $1,003,117, investor relations,

promotion and advertising expenses of $494,514, consulting fees of $406,807 and

Part XII.6 tax of $261,444 and, offset by interest income of $2,994,365.

Exploration Projects

The Company incurred cash expenditures of $23,048,350 for the nine months ended

September 30, 2008, on the development and exploration of its CMB uranium assets

(net of stock-based compensation of $857,936, amortization of $358,318 and

future income taxes of $466,361).

Liquidity

At September 30, 2008, the Company had cash on its balance sheet of $106,253,139

and working capital of $105,091,624, as compared to cash of $131,094,585 and

working capital of $129,898,119 at December 31, 2007. The changes in cash and

working capital of $24,841,446 and $24,806,495, respectively, are primarily

related to the use of funds for deferred exploration and development

expenditures of $14,404,011 and $8,644,339, and net equipment purchase of

$286,002 offset by interest income of $2,994,365 and receipt of $550,800 upon

the exercise of stock options.

The Company currently has no operating revenues other than interest income and

relies primarily on existing cash balance to fund its exploration, development

and administrative costs.

ABOUT AURORA

Aurora is a uranium exploration and development company active in the Central

Mineral Belt of coastal Labrador - one of the world's most promising uranium

districts - and in Nunavut, Canada, where it has acquired an interest in the

Baker Lake Basin property through a deal with Pacific Ridge Exploration Ltd.

Aurora has no debt and approximately C$102 million in cash that is fully liquid

and held with a large Canadian commercial bank.

Aurora is committed to responsible development, which includes community

consultation, lasting local benefits and the highest standards of safety,

health, and environmental protection.

(i) The Michelin deposit contains a measured resource of 1.289 million tonnes of

resource grading 0.12% U3O8 (underground) and 5.795 million tonnes of resource

grading 0.08% U3O8 (open pit), an indicated resource of 16.170 million tonnes of

resource grading 0.13% (underground) and 7.146 million tonnes of resource

grading 0.06% U3O8 (open pit), and an inferred resource of 12.577 million tonnes

of resource grading 0.12% U3O8 (underground) and 1.564 million tonnes of

resource grading 0.05% U3O8 (open pit). The Jacques Lake deposit contains a

measured resource of 0.415 million tonnes of resource grading 0.09% U3O8

(underground) and 0.401 million tonnes of resource grading 0.09% U3O8 (open

pit), an indicated resource of 3.357 million tonnes of resource grading 0.08%

(underground) and 1.909 million tonnes of resource grading 0.07% U3O8 (open

pit), and an inferred resource of 2.778 million tonnes of resource grading 0.08%

U3O8 (underground) and 2.210 million tonnes of resource grading 0.05% U3O8 (open

pit). The Rainbow deposit contains an indicated resource of 1.088 million tonnes

of resource grading 0.09% U3O8 and an inferred resource of 0.931 million tonnes

of resource grading 0.08% U3O8 (both open pit). The Nash deposit contains an

indicated resource of 0.757 million tonnes of resource grading 0.08% U3O8 and an

inferred resource of 0.613 million tonnes of resource grading 0.07% U3O8 (both

open pit). The Inda deposit contains an indicated resource of 1.460 million

tonnes of resource grading 0.06% U3O8 and an inferred resource of 3.042 million

tonnes of resource grading 0.07% U3O8 (both open pit). The Gear deposit contains

an indicated resource of 0.520 million tonnes of resource grading 0.06% U3O8 and

an inferred resource of 0.210 million tonnes of resource grading 0.06% U3O8

(both open pit). Aurora's CMB Mineral Resources are reported at cut-off grades

that contemplate underground (0.05% U3O8) and open pit (0.03% U3O8) mining

scenarios, based on preliminary economic assumptions, and may be refined with

more in-depth economic analyses. For further details of the property interests

of Aurora, please refer to the National Instrument 43-101 compliant technical

report dated April 7, 2008 and amended August 28, 2008 entitled "An Update on

the Exploration Activities of Aurora Energy Resources Inc. on the CMB Uranium

Property, Labrador, Canada, during the period January 1, 2007 to December 31,

2007, Part II - CMB Mineral Resources" prepared by Ian Cunningham-Dunlop, P.

Eng. and Christopher Lee, P. Geo., and available on SEDAR at www.sedar.com.

Except for the statements of historical fact contained herein, certain

information presented constitutes "forward-looking statements". Such

forward-looking statements, including but not limited to the timing and level of

exploration activities, including drilling activities, the timing of completion

of a pre-feasibility study and anticipated results of the 2008 work program;

involve known and unknown risks, uncertainties and other factors which may cause

the actual results, performance or achievement of Aurora to be materially

different from any future results, performance or achievements expressed or

implied by such forward-looking statements. Such factors include, among others,

risks related to the actual results of current exploration activities,

conclusions of economic evaluations, uncertainty in the estimation of mineral

resources, changes in project parameters as plans continue to be refined, future

prices of uranium, economic and political stability in Canada, environmental

risks and hazards, increased infrastructure and/or operating costs, labor and

employment matters, and government regulation as well as those factors discussed

in the section entitled "Risk Factors" in Aurora's Annual Information Form on

file with the Canadian Securities Commissions. Although Aurora has attempted to

identify important factors that could cause actual results to differ materially,

there may be other factors that cause results not to be as anticipated,

estimated or intended. There can be no assurance that such statements will prove

to be accurate as actual results and future events could differ materially from

those anticipated in such statements. Aurora disclaims any intention or

obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. Accordingly, readers

should not place undue reliance on forward-looking statements.

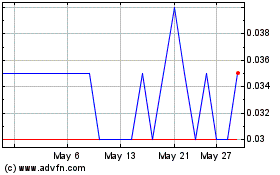

CMC Metals (TSXV:CMB)

Historical Stock Chart

From May 2024 to Jun 2024

CMC Metals (TSXV:CMB)

Historical Stock Chart

From Jun 2023 to Jun 2024