A.I.S. Resources Limited (TSX.V: AIS, OTCQB: AISSF) (the “Company”

or “AIS”) an innovative and advanced stage lithium and gold

exploration company provides an update on the development of its

projects. With the large number of activities AIS is currently

participating in, the Company is providing this summary for

shareholders.

“Our company focus is on discovering and adding

value to exploration projects in the lithium and gold mining

sectors,” stated Martyn Element, Chairman of AIS.

Phil Thomas, President of AIS also commented,

“With our current exploration activities at the Bright Gold Project

and ongoing development of our three lithium projects in Argentina

and three additional Australian gold projects we expect to make

several positive announcements over the next six months.”

Fig. 1 – A NI43-101 has been completed based on the

2021 drilling progress at Incahuasi Salar in

Argentina.https://www.globenewswire.com/NewsRoom/AttachmentNg/bd7f8276-cfd3-453b-bf56-ce750991424d

LITHIUM PROJECTS IN

ARGENTINAAIS is the lead partner driving the exploration

and development in three lithium projects in the world-renowned

Lithium Triangle in Argentina. With the current very active lithium

market the Company is looking forward the developing these

projects.

Cauchari Salar Lithium

ProjectAIS has completed a 43 page environmental impact

statement for Yareta XIII, which is located on the

southern tip of Cauchari Salar where Allkem Limited (AKE - market

cap 6.41B AUD) and Exar Inc have their large lithium project. AIS

is inviting joint venture proposals to develop the project.

Pocitos Salar Lithium ProjectIn

2018 AIS explored Pocitos 7 and Pocitos 9, completing a VES

geophysics survey, and 20 x 5m trenches that were sampled for

lithium. There are a number of other explorers drilling nearby,

including Chengxin Lithium Group Co., Ltd. a large lithium producer

(market cap 51.28B CNY). The Company is actively seeking joint

ventures proposals on both these properties.

Pocitos One Lithium

ProjectRecharge Resources optioned Pocitos One from Spey

Resources, which originally optioned the property from AIS

Resources. In 2018 significant brine flows were recorded and with

lithium assays up to 125 ppm. The brine flow rate before it was

choked was in excess of 50,000 litres a minute (investors should

note that this brine release value is not NI43-101 compliant). In

2018 the magnesium to lithium ratio was too high to process using

technologies available at the time. The new Ekosolve™ Direct

Lithium Extraction system has shown it can manage up to 50:1 or

even higher Mg:Li ratios and it recovers more than 95% of the

lithium from low concentration brines. Recharge Resources will be

drilling a production well in August, and if they exercise their

option, AIS will receive a 15% royalty and proceeds from the sale

of the 800 hectares.

Incahuasi Salar Lithium Project – 20%

InterestAIS has a 20% interest in the Incahuasi project.

The Company sold an 80% interest in Incahuasi to Tech One Lithium a

subsidiary of Spey Resources (Spey) for a payment USD$1 million

received in March 2022 and exploration expenditures totalling

USD$500,000 completed by Tech One. Spey has completed a NI43-101

written by Montgomery and Associates regarding drilling in 2021 on

Incahuasi. When Spey Resources resumes trading, the company will

drill two production wells and three exploration wells with the

view to producing a NI43-101 mineral resource estimate. Spey has an

option to acquire AIS Resources’ 20% interest for USD$6M by March

23, 2023. Spey Resources has signed a licence agreement with

Ekosolve™ .

GOLD PROJECTS IN AUSTRALIAAIS

has four significant advanced stage exploration projects in

Australia’s two major gold-rich regions including Victoria near the

Fosterville Gold Mine and in the Lachlan fold belt in New South

Wales.

Bright Gold ProjectThis month,

AIS Resources started drilling the Bright property at the Reliance

reef/mine site. The program includes 7 drill holes in a fan pattern

from one point above the Reliance adit to intersect the reef. AIS

has contracted with the driller to drill a minimum of 1500 m and

each hole will be 50-100 m in depth depending on lithology.

The next drill program will be in the Golden Bar

area. Further work is being done on the Rose, Thistle &

Shamrock mine for drill pad locations and best approach to drill

from Landtax reef area. A detailed community engagement program is

being put in place concurrent with our exploration work.

The Bright Gold Project and

surrounds comprises many major historical workings and recorded

production of over 730,0001 oz from both alluvial and rock mining.

The largest producers on the Project were the Rose, Thistle and

Shamrock mine @ 22.2g/t Au for 140,000 oz and the Oriental Mine @

28g/t for 6,194 oz. The Bright Project is in a premium location and

only 6km from E79’s Happy Valley Project. The EL006194 contains

more than 250 historical gold mines, reefs (quartz veins) and gold

occurrences dating back to the 1890’s. Historically the EL006194

yielded 341,000 oz gold at grades ranging between 7-992 3g/t,

averaging 22 g/t Au.

Fig. 2 – A.I.S. Resources preparing to commence the

July 2022 drill program on Bright Gold

Project.https://www.globenewswire.com/NewsRoom/AttachmentNg/dd9a7160-43c5-4594-b11a-f1c37125ff87

Toolleen Fosterville Gold

ProjectFor the Toolleen Fosterville project, AIS has

engaged with the landowners to walk the drill hole locations in the

next few weeks. A 10-hole program is planned when the ground

becomes sufficiently dry to bring in a drill rig.

The Fosterville Toolleen Gold Project is located

12 km east of Kirkland Lake’s Fosterville gold mine – currently one

of the richest gold mines in Australia.

Kingston Gold ProjectIntensive

soil sampling has been completed as well as a detailed structural

geology review. This has changed the modelled mineralization to a

more northerly direction. Connor Coote that have a prospector’s

licence within the AIS Exploration licence area, have sunk a 50m

shaft and are preparing to start mining the lode. Any gold won

outside their prospector’s licence on our EL will result in a 15%

royalty share for AIS.

From 1900 to 1903, hard rock gold mining

occurred at the Old Kingston Mine with production estimated by the

then Mining Surveyor to be 2,762ozs of gold from 11,764 tonnes of

ore, at an average grade of 7.3g Au/t.

In January 2012 Navarre Minerals Limited which

held the concession at the time announced diamond drill results of

16.9m at 5.5g Au/t from a depth of 65.7m down-hole, including

3.1m at 29.5g Au/t. Visible gold was identified

between 65.7m and 65.9m down-hole within a quartz breccia on the

hanging wall side of a quartz lode structure.

HQ Diamond Drilling was undertaken in four holes

in March 2019 near the Old Kingston Mine site. Holes SWK001 to 4

were drilled by Starwest Drilling contractors to a depth of 70 to

80m. There was a range of results up to 24.27g/t Au.

Yalgogrin Gold ProjectThe

landowner sold the property where our EL was located, and the new

owners are pro-mining. During the fall 2021 drilling program an

intercept of 83m at 1.5gm/tonne of gold was measured. AIS currently

holds a 40% interest in Yalgogrin. AIS is evaluating its options to

JV or sell its 40% interest or acquire a 100% interest.

The Yalgogrin Gold Project is located in the

historic West Wyalong gold corridor of central NSW, Australia which

produced 445,700 oz gold mined between 1894-1921. The project had

Auger results of 12.5 gm/t and 32.3 gm/t, and 14 DDH’s with

intercepts ranging from 1.9 gm/t to 1m at 21.5 gm/t.

Technical information in this news release has

been reviewed and approved by Phillip Thomas, BSc Geol, MBM,

FAusIMM MAIG MAIMVA(CMV) who is a Qualified Person under the

definitions established by the National Instrument 43-101 and is

President, CEO of A.I.S. Resources Ltd.

About A.I.S. Resources

LimitedA.I.S. Resources Limited is a publicly traded

investment issuer listed on the TSX Venture Exchange focused on

lithium, gold, precious and base metals exploration. AIS’ value add

strategy is to acquire prospective exploration projects and enhance

their value by better defining the mineral resource with a view to

attracting joint venture partners and enhancing the value of our

portfolio. The Company is managed by a team of experienced

geologists and investment bankers, with a track-record of

successful capital markets achievements.

AIS owns 100% of the 28 sq km

Fosterville-Toolleen Gold Project located 9.9 km from Kirkland

Lake’s Fosterville gold mine, a 60% interest in the 57 sq km Bright

Gold project (with the right to acquire 100%), a 40% interest in

the 58 sq km New South Wales Yalgogrin Gold Project, and 100%

interest in the 167 sq km Kingston Gold Project in Victoria

Australia near Stawell and Navarre. AIS has further options to

acquire three lithium concessions in the Pocitos and Cauchari

Salars in Argentina and also has 20% joint venture interest with

Spey Resources Corp. in the Incahuasi lithium brine project in

Argentina and Pocitos Salars.

On Behalf of the Board of Directors,A.I.S.

Resources Ltd.Phillip Thomas, President & CEO

Corporate ContactFor further information, please

contact:Phillip Thomas, Chief Executive OfficerT: +1-323 5155

164E:pthomas@aisresources.comOrMartyn Element ChairmanT:

+1-604-220-6266E:melement@aisresources.comWebsite:www.aisresources.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

ADVISORY: This press release contains

forward-looking statements. Although the Company believes that the

expectations reflected in these forward-looking statements are

reasonable, undue reliance should not be placed on them because the

Company can give no assurance that they will prove to be correct.

Since forward-looking statements address future events and

conditions, by their very nature they involve inherent risks and

uncertainties. The forward-looking statements contained in this

press release are made as of the date hereof and the Company

undertakes no obligations to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws. Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release._____________________

1 “Victorian gold deposits”. Philps N and Hughes

M. AGSO Journal of Australian Geology & Geophysics, 17(4),

1996. pp.2152 Ibid3 Recorded from mines of greater than 1,000

oz of production.

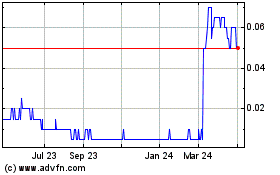

AIS Resources (TSXV:AIS)

Historical Stock Chart

From Oct 2024 to Nov 2024

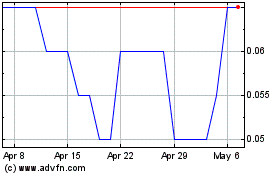

AIS Resources (TSXV:AIS)

Historical Stock Chart

From Nov 2023 to Nov 2024