Perseus Extends Life of Yaoure Gold Mine to 2035

September 17 2023 - 6:40PM

PERSEUS EXTENDS LIFE OF

YAOURÉ GOLD MINE TO 2035

Perth, Western Australia/September 18,

2023/Perseus Mining Limited (ASX/TSX: PRU) is pleased to

announce an updated Life of Mine Plan (“LOMP”) for

its Yaouré Gold Mine in Côte d’Ivoire, West Africa

(“Yaouré”).

HIGHLIGHTS

-

Perseus has extended Yaouré’s operational life to 12+

years (to at least 2035), with potential

for further extension through additional discoveries adjacent to

existing infrastructure and further resource definition drilling of

known deposits, including the Yaouré open pit and CMA underground

(“CMA UG”) structure.

-

Yaouré’s updated LOMP incorporates for the first time an

UG mining operation below the CMA

Open Pit, as well as the existing CMA Open Pit and an expanded

Yaouré Open Pit.

-

Yaouré Gold Mine Ore Reserves1,2 now total 37.2

million tonnes of ore grading 1.73 g/t gold, containing

2.07 million ounces of gold from open pits and

underground.

-

Updated Measured and Indicated Mineral

Resources1 are estimated at 54.7 million tonnes grading

1.59 g/t gold, containing 2.80

million ounces of gold.

Inferred Resources1 are estimated

at 11.3 million tonnes, grading 1.9 g/t gold, containing

0.70 million

ounces of gold.

-

CMA UG Ore Reserves are based on drilling to 185m below the base of

the CMA open pit, with Inferred Mineral Resources extending to 350m

below the base of the pit and remaining

open down plunge and at

depth.

-

Key parameters arising from the revised LOMP for Yaouré Gold Mine

are as follows:

|

Key Parameters |

Units |

Annual Average FY24 – FY29 |

Annual Average FY30 – FY35 |

September 2023LOMP

1,2 |

|

Total Ore + waste mined |

Mt |

28.6 |

1.04 |

176.4 |

|

Strip ratio |

t:t |

4.7 : 1 |

0.2 : 14 |

3.8 : 1 |

|

Ore processed |

Mt |

3.5 |

3.4 |

41.9 |

|

Head grade |

g/t gold |

2.0 |

1.1 |

1.58 |

|

Gold recovery rate |

% |

91.6 |

89.8 |

90.8 |

|

Gold production |

Moz |

0.210 |

0.110 |

1.93 |

|

Production costs |

US$/oz |

949 |

1,002 |

969 |

|

Royalty 3 |

US$/oz |

87 |

85 |

86 |

|

Sustaining capital |

US$/oz |

68 |

47 |

61 |

|

Average All-in site costs |

US$/oz |

1,104 |

1,134 |

1,116 |

|

CMA UG pre-production & ongoing mine development 5 |

US$M |

98.8 |

5.3 |

104.1 |

|

CMA UG infrastructure |

US$M |

27.6 |

- |

27.6 |

|

CMA UG Development Capital |

US$M |

126.34 |

5.3 |

131.7 |

Notes:

-

For detailed disclosures on updated Mineral Resources and Ore

Reserves estimates refer to ASX Release “Perseus Mining Announces

Open Pit and Underground Ore Reserve Growth at Yaouré”, dated 23

August 2023. Mineral Resources are inclusive of Ore Reserves.

- Assumes gold price of US$1,500 /oz

for Reserve calculation in September 2023 LOMP.

- Assumes a flat gold price of

US$1,700 /oz for royalty calculation in September 2023 LOMP.

- CMA UG Mining in September 2023

LOMP ends in FY34 hence average is calculated over 5 years FY30 to

FY34.

-

All CMA UG Mining costs are capitalised in accordance with IFRS up

to declaration of Commercial Production in H2 FY27.

Perseus’s Managing Director and CEO Jeff Quartermaine

said:

“Our increase to the life of Yaouré Gold Mine to

12+ years announced today ensures Yaouré will continue to be an

important part of Perseus’s geopolitically diverse asset portfolio

for many years to come and will enable us to continue delivering on

our Corporate Mission of generating material benefits for all of

our stakeholders, including our host governments and

communities.

When Perseus acquired Yaouré as a development

project in 2016, the possibility of extending the life of the mine

through development of an underground operation was not part of the

plan. However, our discovery, and subsequent engineering and

planning, that has led to today’s announcement, bears testament to

Perseus’s in-house ability to create significant value through

organic growth.

An underground mine planned for Yaouré, will be

Perseus’s first foray into underground mining, with all previous

operations having been open cut operations. While the underground

mine represents a new style of mining and a new challenge for us as

a company, it is certainly not new to many of our technical team

members, who are very keen to demonstrate their skills in an

underground mining setting.

With the prospect of further extending the mine

life through further exploration success, we expect that the Yaouré

Mine will live up to its reputation as one of the leading mines in

Côte d’Ivoire, if not in all of West Africa.”

Competent Person Statement:

All production targets referred to in this

report are underpinned by estimated Ore Reserves which have been

prepared by competent persons in accordance with the requirements

of the JORC Code.

The current Mineral Resources and Ore Reserves

for the Yaouré Gold Mine have most recently been reported by the

Company in a market announcement released on 23 August 2023. The

Company confirms that all material assumptions underpinning those

estimates and the production targets, or the forecast financial

information derived therefrom, in that market release continue to

apply and have not materially changed. The Company further confirms

that material assumptions underpinning the estimates of Ore

Reserves described in “Technical Report — Yaouré Gold Project, Côte

d’Ivoire” dated 18 December 2017 continue to apply.

Caution Regarding Forward Looking

Information:

This report contains forward-looking information

which is based on the assumptions, estimates, analysis and opinions

of management made in light of its experience and its perception of

trends, current conditions and expected developments, as well as

other factors that management of the Company believes to be

relevant and reasonable in the circumstances at the date that such

statements are made, but which may prove to be incorrect.

Assumptions have been made by the Company regarding, among other

things: the price of gold, continuing commercial production at the

Yaouré Gold Mine, the Edikan Gold Mine and the Sissingué Gold Mine

without any major disruption, the receipt of required governmental

approvals, the accuracy of capital and operating cost estimates,

the ability of the Company to operate in a safe, efficient and

effective manner and the ability of the Company to obtain financing

as and when required and on reasonable terms. Readers are cautioned

that the foregoing list is not exhaustive of all factors and

assumptions which may have been used by the Company. Although

management believes that the assumptions made by the Company and

the expectations represented by such information are reasonable,

there can be no assurance that the forward-looking information will

prove to be accurate. Forward-looking information involves known

and unknown risks, uncertainties, and other factors which may cause

the actual results, performance or achievements of the Company to

be materially different from any anticipated future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

the actual market price of gold, the actual results of current

exploration, the actual results of future exploration, changes in

project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's publicly filed documents.

The Company believes that the assumptions and expectations

reflected in the forward-looking information are reasonable.

Assumptions have been made regarding, among other things, the

Company’s ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of

gold, the ability of the Company to operate in a safe, efficient

and effective manner and the ability of the Company to obtain

financing as and when required and on reasonable terms. Readers

should not place undue reliance on forward-looking information.

Perseus does not undertake to update any forward-looking

information, except in accordance with applicable securities

laws.

|

REGISTERED OFFICE:Level 2437 Roberts RoadSubiaco

WA 6008Telephone: +61 8 6144 1700Email:

IR@perseusmining.comWWW.PERSEUSMINING.COM |

|

CONTACTS:Jeff

QuartermaineManaging Director &

CEOjeff.quartermaine@perseusmining.comNathan

RyanMedia Relations+61 4 20 582

887nathan.ryan@nwrcommunications.com.au |

- 180923 TSX Yaoure Updated LOMP - Final

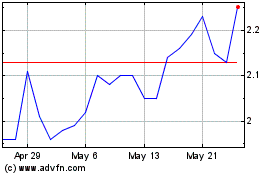

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Jan 2024 to Jan 2025