Pembina Pipeline, KKR Form C$11.4 Billion Joint Venture

March 01 2022 - 8:44AM

Dow Jones News

By Adriano Marchese

Pembina Pipeline Corp. said Tuesday that it is creating a joint

venture with U.S. investment company KKR & Co. in which they

would combine their western Canadian natural gas processing

assets.

The Canadian oil and gas transportation and storage

infrastructure company said it would own 60% of the new JV and

would act as operator and manager, while the remaining 40% would be

owned by KKR's global infrastructure funds.

The assets included are Pembina's field-based natural gas

processing assets, the Veresen Midstream business which funds

managed by KKR own 55% and Pembina 45%, as well as the business

currently carried on by Energy Transfer Canada, which KKR-managed

funds own 49%.

The company said the ascribed value of all the transactions

amount to 11.4 billion Canadian dollars, or US$8.99 billion.

"The formation of this new joint venture is a natural extension

of our relationship, unlocks value for Pembina and creates another

growth platform," Pembina President and Chief Executive Officer

Scott Burrows.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

March 01, 2022 08:29 ET (13:29 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

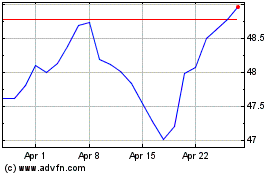

Pembina Pipeline (TSX:PPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pembina Pipeline (TSX:PPL)

Historical Stock Chart

From Apr 2023 to Apr 2024