-- H&R to become Canada's largest REIT by enterprise value

-- Combines two unique REITs consisting of high quality, low risk

properties, to form a fully diversified commercial portfolio emulating

the real estate investment model adopted by large Canadian pension plans

-- Provides Primaris unitholders a tax-deferred rollover for substantially

all of the unit portion of the consideration

-- Offers Primaris unitholders the ability to continue to participate in

the future growth and value creation of the combined REIT

-- Retains the valuable platform created by Primaris over the last 10 years

to acquire, develop, and manage premium enclosed shopping centres in

Canada

-- Has unanimous approval by the Boards of Trustees of both H&R and

Primaris

Investor conference call scheduled for January 17 at 8:00 am

Eastern - see below for details. A detailed presentation regarding

the transaction will be available at www.primarisreit.com and

www.hr-reit.com.

H&R Real Estate Investment Trust and H&R Finance Trust

(collectively "H&R") (TSX:HR.UN) and Primaris Retail Real

Estate Investment Trust ("Primaris") (TSX:PMZ.UN) are pleased to

announce that they, together with PRR Investments Inc., have

entered into an arrangement agreement whereby H&R will acquire

100 per cent of the issued and outstanding units of Primaris.

Unitholders of Primaris will be entitled to elect to receive

1.13 stapled units of H&R or $28.00 cash per unit, subject to a

maximum cash amount of $700 million.

The Boards of Trustees of Primaris and H&R have unanimously

agreed to both vote their units in favour of the transaction and to

recommend that unitholders vote in favour of the transaction.

Benefits to H&R:

-- A unique opportunity to acquire a professional retail platform, with an

irreplaceable Canadian enclosed shopping centre portfolio

-- This transaction will create the largest REIT in Canada by enterprise

value

-- Increased market capitalization will result in substantially enhanced

liquidity for unitholders

-- Broader portfolio diversification geographically, by asset class, and by

tenant base

-- A deleveraging of the balance sheet to 51.9 per cent Debt/FV (assuming

full take-up of the cash consideration)

-- Combines two businesses having similar philosophies with respect to

asset and tenant qualities and their disciplined approach to real estate

investing

-- With expected savings from synergies of up to $10 million over the next

two years, the transaction will be accretive to FFO

Benefits to Primaris:

-- The transaction offers superior value to the hostile bid currently in

the market

-- Provides Primaris unitholders the option to retain ownership in the

enclosed shopping centre asset class or to elect to receive immediate

cash payment, subject to proration

-- Offers Primaris unitholders the opportunity for a tax-deferred rollover

for substantially all of the unit portion of the consideration

-- Improves Primaris distributions by 20 per cent from the current

annualized rate of $1.27 to $1.53 pro forma ($1.35 H&R distributions x

1.13 exchange ratio) for those Primaris unitholders who elect to receive

unit consideration

-- Preserves the substantial value of the asset and employee platform

developed over the last 10 years

-- H&R is a credible and reputable real estate investor with the financial

capability and operational expertise to complete the transaction and

successfully integrate the businesses

"This is a unique opportunity to acquire an irreplaceable and

much sought-after enclosed shopping centre portfolio. It permits us

to expand into a new and exciting asset class in Canada with an

existing infrastructure having an experienced and dedicated

professional team," said Tom Hofstedter, CEO of H&R. "This

acquisition will solidify H&R's position as Canada's leading

diversified real estate investment trust and is complementary to

our existing low risk, high quality and conservative

philosophy."

"We are excited to be able to participate in the U.S. retail

expansion into Canada, with Target set to open in 10 Primaris

shopping centres within the next few months. This will undoubtedly

lead to increased traffic and sales within the Primaris portfolio

and ultimately result in an increase in value to our combined

unitholders," Mr. Hofstedter added.

"This transaction is compelling from a number of perspectives,"

said John Morrison, CEO of Primaris. "It enhances H&R's

objective of providing unitholders with stable and growing cash

distributions from a diversified portfolio. It also provides

H&R with the unique opportunity to own a significant portfolio

of high quality regional shopping centres and management

platform."

"We have succeeded in our mandate to attract a financially

superior alternative to the hostile offer currently in the market,"

said Bill Biggar, Chair of the Independent Committee at Primaris.

"This transaction delivers greater value to our unitholders while

allowing them to remain invested in the enclosed shopping centre

asset class, and provides our employees with the opportunity to be

a part of the largest consolidated REIT in Canada, with excellent

growth prospects."

Transaction Details

Under the terms of the Agreement, H&R will acquire all of

the issued and outstanding units of Primaris for a combination of

cash and H&R stapled units. For each Primaris unit held,

Primaris unitholders may elect to receive either $28.00 in cash,

subject to a maximum amount of $700 million, or 1.13 stapled units

of H&R, substantially all of which would be received on a

tax-deferred basis. If the maximum cash is elected, it will

represent approximately 25 per cent of the total consideration. In

the event that Primaris unitholders elect more cash than is

available, the cash consideration will be prorated among those

unitholders electing cash, with the balance of the consideration

being settled in H&R stapled units on the basis of the 1.13

exchange ratio. Based on H&R's 20-day VWAP ended January 15,

2013 of $23.99, the value of each Primaris unit under the

transaction at full proration will be $27.33, consisting of $6.89

in cash, and 0.8518 H&R units (valued at $20.44). The

transaction has been structured so holders of Primaris units will

receive their H&R stapled units on a substantially tax-deferred

rollover (the receipt of H&R Finance Trust units, expected to

be less than 4% of the total unit consideration, will be

taxable).

The cash price of $28.00 for each Primaris unit represents a

22.0 per cent premium over the $22.95 volume weighted average price

of Primaris units for the 20 trading days up to and including

December 4, 2012, the day before KingSett Capital announced its

hostile bid for Primaris. The full proration price of $27.33

represents a 19.1 per cent premium over the same reference price.

If the maximum cash is elected, Primaris unitholders will own

approximately 30 per cent of the combined REIT.

The proposed transaction will be structured as a plan of

arrangement. The transaction is subject to the approval of 66 2/3

per cent of Primaris units voted at a special meeting of Primaris

unitholders and a 50.1 per cent majority of H&R units voted at

a special meeting of H&R unitholders.

It is expected that each of H&R and Primaris will prepare

and mail meeting circulars to their respective investors within the

next few weeks and that the special unitholder meetings will be

held in March. The transaction is also subject to regulatory

approvals (including under the Competition Act (Canada)), court

approvals, required consents and other customary closing

conditions. Assuming the requisite approvals and consents are

received and other conditions are met or waived, the plan of

arrangement is expected to be completed by late March.

Under the arrangement agreement, H&R is entitled to an

effective $106.6 million break fee in certain circumstances,

including the acceptance by Primaris of an unsolicited superior

proposal from a third party. The break fee is structured as a cash

payment of $70 million and an option to acquire Dufferin Mall and

certain Yonge Street properties owned by Primaris, priced at an

aggregate $36.6 million discount to the appraised values of the

properties. H&R has also been granted other typical deal

protection provisions including a right to match any superior

proposal that is received by Primaris on an unsolicited basis.

Prior to closing, holders of Primaris convertible debentures

will be entitled to convert their debentures in accordance with

their terms and participate in the arrangement on the same basis as

other unitholders. In accordance with the terms of these

debentures, holders may also require that their convertible

debentures be purchased at a price equal to 101% of the principal

amount plus accrued and unpaid interest following closing.

Following closing, holders of the convertible debentures will be

entitled to receive stapled units of H&R upon conversion based

on the exchange ratio contemplated by the transaction.

The Board of Trustees of Primaris appointed an Independent

Committee in response to the hostile bid from the group led by

KingSett Capital. The Independent Committee, together with

management of Primaris and its financial and legal advisors, has

undertaken a rigorous process designed to achieve a result that is

financially superior to the hostile offer and delivers greater

value for Primaris unitholders. Through the process, parties from

across the globe were contacted, consisting of both potential

strategic investors within the real estate industry and financial

investors. Primaris signed confidentiality and standstill

agreements with a number of those parties who were granted access

to the confidential data room of Primaris in order to facilitate

offers reflecting the fair value of Primaris and several of those

parties submitted proposals. The terms of the arrangement agreement

with H&R require Primaris to terminate those discussions and

close its data room.

Canaccord Genuity, a financial advisor to the Independent

Committee, has provided the Board of Trustees of Primaris with an

opinion to the effect that, as of the date of the opinion and based

upon and subject to the limitations and qualifications therein, the

consideration to be received is fair, from a financial point of

view, to Primaris unitholders other than KingSett Capital. The

Independent Committee carefully considered a number of factors,

including the terms of the transaction, the assets and business of

H&R, the outcome of the process described above, including the

Independent Committee's belief that it is very unlikely that a

superior offer will emerge for all the outstanding units of

Primaris, and the opinion of Canaccord Genuity in recommending the

transaction to the Board of Trustees of Primaris. Based in part on

the recommendation of the Independent Committee and the other

factors noted herein, the Board of Trustees of Primaris determined

that the consideration to be received by Primaris unitholders is

fair, from a financial point of view, and it would be in the best

interests of Primaris to enter into the arrangement agreement. The

Board of Trustees of Primaris has unanimously agreed to recommend

that unitholders of Primaris vote in favour of the transaction.

Each of the Trustees and senior executive management of Primaris

have agreed to support the transaction by voting their units in

favour of the transaction.

Canaccord Genuity and Evercore Partners were engaged by the

Independent Committee as its financial advisors. McCarthy Tetrault

LLP was engaged as counsel to the Independent Committee and to

Primaris, and Cassels Brock & Blackwell LLP was retained as

counsel to Primaris.

The Board of Trustees of H&R has unanimously agreed to

recommend that unitholders of H&R vote in favour of the

transaction.

H&R has retained Blake, Cassels & Graydon LLP to act as

its legal counsel in this matter.

Conference call:

H&R and Primaris will host an investor conference call on

Thursday January 17, 2013 at 8am EST to discuss the transaction.

Senior management of both H&R and Primaris will speak to the

transaction and be available for questions.

Toronto: (647) 427-7450

North America (toll free): (888) 231-8191

Audio replays of the conference call will be available

immediately following its completion and will remain available

until March 15.

Phone: (855) 859-2056 Password: 90616174

The audio replay will also be available for download at

www.primarisreit.com and at www.hr-reit.com.

About H&R

H&R is an open-ended real estate investment trust, which

owns a North American portfolio of 42 office, 115 industrial and

138 retail properties comprising over 45 million square feet and 2

development projects, with a fair value of approximately $10

billion. The foundation of H&R's success since inception in

1996 has been a disciplined strategy that leads to consistent and

profitable growth. H&R leases its properties long term to

creditworthy tenants and strives to match those leases with

primarily long-term, fixed-rate financing.

H&R Finance Trust is an unincorporated investment trust,

which primarily invests in notes issued by a U.S. corporation which

is a subsidiary of H&R. The current note receivable is U.S.

$162.5 million. In 2008, H&R completed an internal

reorganization which resulted in each issued and outstanding

H&R unit trading together with a unit of H&R Finance Trust

as a "Stapled Unit" on the Toronto Stock Exchange.

About Primaris

Primaris is a TSX listed real estate investment trust that

specializes in owning and operating Canadian enclosed shopping

centres that are dominant in their local trade areas. Merchandising

for each property is dynamic in order to meet the unique needs of

its local customers and the community. Primaris maintains a high

occupancy rate at its shopping centres and has retail tenants that

offer new and exciting brands. Primaris owns 35 income-producing

properties comprising approximately 14.7 million square feet

located in Canada. As of December 31, 2012, Primaris had

100,346,768 units issued and outstanding (including exchangeable

units for which units have yet to be issued).

INFORMATION

Primaris unitholders who have already tendered their units to

the hostile KingSett bid can withdraw them. Unitholders should

contact their broker, who will withdraw the units on their behalf.

If you require assistance in withdrawing your Primaris units,

please contact Kingsdale Shareholder Services Inc. at

1-866-581-1571 toll-free in North America, or 416-867-2272 outside

North America (collect calls accepted), or by email at

contactus@kingsdaleshareholder.com.

FORWARD LOOKING INFORMATION

This press release contains forward looking statements that

reflect current expectations of each of Primaris and H&R about

their future results, performance, prospects and opportunities,

including with respect to the closing, costs and benefits of the

proposed transaction and all other statements that are not

historical facts. The timing and completion of the proposed

transaction is subject to customary closing conditions, termination

rights and other risks and uncertainties including, without

limitation, required regulatory, court, and unitholder approvals.

Accordingly, there can be no assurance that the proposed

transaction will occur, or that it will occur on the timetable or

on the terms and conditions contemplated in this news release. The

proposed transaction could be modified, restructured or terminated.

Readers are cautioned not to place undue reliance on forward

looking information. Each of Primaris and H&R has tried to

identify these forward looking statements by using words such as

"may", "will", "should" "expect", "anticipate", "believe",

"intend", "plan", "estimate", "potentially" and similar

expressions. By its nature, such forward looking information

necessarily involves known and unknown risks and uncertainties that

may cause actual results, performance, prospects and opportunities

in future periods of Primaris or H&R to differ materially from

those expressed or implied by such forward looking statements.

Contacts: H&R Tom Hofstedter President & Chief Executive

Officer (416) 635-7520 H&R Larry Froom Chief Financial Officer

(416) 635-7520 www.hr-reit.com Primaris John Morrison President

& Chief Executive Officer (416) 642-7860 Primaris Louis Forbes

Executive Vice President & Chief Financial Officer (416)

642-7810 www.primarisreit.com MEDIA CONTACT NATIONAL Public

Relations Peter Block (416) 848-1431 NATIONAL Public Relations

Jennifer Lee (416) 848-1383

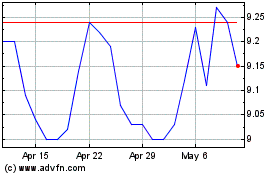

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jun 2024 to Jul 2024

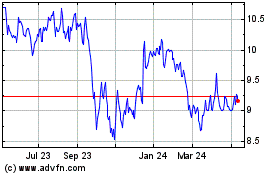

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jul 2023 to Jul 2024