Fortuna Silver Mines, Inc. (NYSE: FSM)

(TSX: FVI) provides its

updated Mineral Reserve and Mineral Resource estimates as of

December 31, 2023 for its five operating mines in West Africa and

the Americas, and the Arizaro Project located at the Lindero Mine

in Salta, Argentina. All references to dollar amounts in this

news release are expressed in US dollars.

Highlights of Mineral Reserve

and Mineral Resource Update

- Consolidated Proven and Probable Mineral Reserves are reported

containing 3.1 Moz Au Eq1 representing a year-over-year decrease of

11 percent.

- Consolidated Measured and Indicated Resources exclusive of

Mineral Reserves are reported containing 1.1 Moz Au Eq1

representing a year-over-year decrease of 19 percent.

- Consolidated Inferred Mineral Resources are reported containing

1.7 Moz Au Eq1 representing a year-over-year decrease of 22

percent.

- Primary drivers for changes in Mineral Reserves and Mineral

Resources are production related depletion in 2023 of 452 koz Au Eq

and the application of higher cut-off values as a result of

increased operational costs.

- Technical Reports to support the disclosure of Mineral Reserves

and Mineral Resources for the Séguéla, Caylloma, and San Jose mines

will be filed within the next 45 days.

- The Diamba Sud Gold Project JORC historical estimate2 of 625

koz Au of Indicated Resources and 235 koz Au of Inferred Resources

has not been incorporated into this consolidated Mineral Resources

and Mineral Reserves update. Confirmatory drilling to update the

historical resources is ongoing and planned for completion later in

2024.

Notes:1. Gold equivalent

calculated using metal prices of $1,600/oz for Au, $21/oz for Ag,

$2,000/t for Pb, and $2,600/t for Zn.2.

Refer to historical JORC mineral resource estimate tabulation and

cautionary statements regarding historical estimates on page 4.

2023 Mineral Reserves and

Mineral Resources

|

Mineral Reserves – Proven and Probable |

Contained Metal |

|

Property |

Classification |

Tonnes (000) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag (Moz) |

Au (koz) |

|

SilverMines |

Caylloma, Peru |

Proven |

20 |

261 |

0.94 |

2.23 |

2.62 |

0.2 |

1 |

|

Probable |

2,269 |

81 |

0.13 |

2.79 |

4.06 |

5.9 |

9 |

|

Proven + Probable |

2,288 |

83 |

0.13 |

2.78 |

4.04 |

6.1 |

10 |

|

San Jose, Mexico |

Proven |

37 |

172 |

1.23 |

N/A |

N/A |

0.2 |

2 |

|

Probable |

695 |

155 |

0.97 |

N/A |

N/A |

3.5 |

22 |

|

Proven + Probable |

733 |

156 |

0.98 |

N/A |

N/A |

3.7 |

23 |

|

Total |

Proven + Probable |

3,021 |

101 |

0.34 |

N/A |

N/A |

9.8 |

33 |

|

GoldMines |

Lindero, Argentina |

Proven |

24,295 |

N/A |

0.60 |

N/A |

N/A |

0.0 |

468 |

|

Probable |

47,210 |

N/A |

0.54 |

N/A |

N/A |

0.0 |

816 |

|

Proven + Probable |

71,505 |

N/A |

0.56 |

N/A |

N/A |

0.0 |

1,284 |

|

Yaramoko, Burkina Faso |

Proven |

21 |

N/A |

5.44 |

N/A |

N/A |

0.0 |

4 |

|

Probable |

842 |

N/A |

7.96 |

N/A |

N/A |

0.0 |

216 |

|

Proven + Probable |

863 |

N/A |

7.90 |

N/A |

N/A |

0.0 |

219 |

|

Séguéla, Côte d’Ivoire |

Proven |

436 |

N/A |

2.06 |

N/A |

N/A |

0.0 |

29 |

|

Probable |

11,327 |

N/A |

3.09 |

N/A |

N/A |

0.0 |

1,125 |

|

Proven + Probable |

11,763 |

N/A |

3.05 |

N/A |

N/A |

0.0 |

1,154 |

|

Total |

Proven + Probable |

84,131 |

N/A |

0.98 |

N/A |

N/A |

0.0 |

2,658 |

|

Total |

Proven + Probable |

9.8 |

2,691 |

|

Mineral Resources – Measured and Indicated |

Contained Metal |

|

Property |

Classification |

Tonnes (000) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag (Moz) |

Au (koz) |

|

SilverMines |

Caylloma, Peru |

Measured |

524 |

98 |

0.30 |

2.09 |

3.16 |

1.6 |

5 |

|

Indicated |

1,262 |

82 |

0.21 |

1.47 |

2.54 |

3.3 |

9 |

|

Measured + Indicated |

1,786 |

87 |

0.24 |

1.65 |

2.72 |

5.0 |

14 |

|

San Jose, Mexico |

Measured |

45 |

141 |

1.09 |

N/A |

N/A |

0.2 |

2 |

|

Indicated |

1,001 |

148 |

1.11 |

N/A |

N/A |

4.7 |

35 |

|

Measured + Indicated |

1,046 |

147 |

1.11 |

N/A |

N/A |

5.0 |

37 |

|

Total |

Measured + Indicated |

2,832 |

109 |

0.56 |

N/A |

N/A |

9.9 |

51 |

|

GoldMines |

Lindero, Argentina |

Measured |

1,981 |

N/A |

0.48 |

N/A |

N/A |

0.0 |

30 |

|

Indicated |

28,482 |

N/A |

0.42 |

N/A |

N/A |

0.0 |

382 |

|

Measured + Indicated |

30,464 |

N/A |

0.42 |

N/A |

N/A |

0.0 |

412 |

|

Yaramoko, Burkina Faso |

Measured |

18 |

N/A |

4.33 |

N/A |

N/A |

0.0 |

2 |

|

Indicated |

452 |

N/A |

2.82 |

N/A |

N/A |

0.0 |

41 |

|

Measured + Indicated |

469 |

N/A |

2.87 |

N/A |

N/A |

0.0 |

43 |

|

Séguéla, Côte d’Ivoire |

Measured |

0 |

N/A |

- |

N/A |

N/A |

0.0 |

0 |

|

Indicated |

4,659 |

N/A |

2.54 |

N/A |

N/A |

0.0 |

381 |

|

Measured + Indicated |

4,659 |

N/A |

2.54 |

N/A |

N/A |

0.0 |

381 |

|

Total |

Measured + Indicated |

35,592 |

N/A |

0.73 |

N/A |

N/A |

0.0 |

837 |

|

Total |

Measured + Indicated |

9.9 |

888 |

|

Mineral Resources – Inferred |

Contained Metal |

|

Property |

Classification |

Tonnes (000) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag (Moz) |

Au (koz) |

|

SilverMines |

Caylloma, Peru |

Inferred |

4,505 |

99 |

0.43 |

2.43 |

3.70 |

14.4 |

63 |

|

San Jose, Mexico |

Inferred |

1,029 |

147 |

1.04 |

N/A |

N/A |

4.9 |

35 |

|

Total |

Inferred |

5,534 |

108 |

0.55 |

N/A |

N/A |

19.3 |

97 |

|

GoldMines |

Lindero, Argentina |

Inferred |

25,325 |

N/A |

0.47 |

N/A |

N/A |

0.0 |

386 |

|

Yaramoko, Burkina Faso |

Inferred |

159 |

N/A |

3.52 |

N/A |

N/A |

0.0 |

18 |

|

Séguéla, Côte d’Ivoire |

Inferred |

3,059 |

N/A |

2.50 |

N/A |

N/A |

0.0 |

245 |

|

Total |

Inferred |

28,543 |

N/A |

0.71 |

N/A |

N/A |

0.0 |

649 |

|

Gold Project |

Arizaro, Argentina |

Inferred |

24,131 |

N/A |

0.40 |

N/A |

N/A |

0.0 |

310 |

|

Total |

Inferred |

19.3 |

1,056 |

Notes:

- Mineral Reserves and Mineral Resources are as defined by the

2014 CIM Definition Standards for Mineral Resources and Mineral

Reserves.

- Mineral Resources are exclusive of Mineral Reserves.

- Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability.

- Factors that could materially affect the reported Mineral

Resources or Mineral Reserves include changes in metal price and

exchange rate assumptions; changes in local interpretations of

mineralization; changes to assumed metallurgical recoveries, mining

dilution and recovery; and assumptions as to the continued ability

to access the site, retain mineral and surface rights titles,

maintain environmental and other regulatory permits, and maintain

the social license to operate.

- Mineral Resources and Mineral Reserves are reported as of

December 31, 2023.

- Mineral Reserves for the Caylloma Mine are reported above NSR

breakeven cut-off values based on underground mining methods

including: mechanized (breasting) that represents 91 % of Mineral

Reserves planned for mining at $89.78/t, mechanized (uppers) at

$79.70/t, semi-mechanized at $93.27/t, sub-level stoping at

$88.81/t, and a conventional method at $170/t; using assumed metal

prices of $21/oz Ag, $1,600/oz Au, $2,000/t Pb, and $2,600/t Zn;

metallurgical recovery rates of 82 or 85 % for Ag, 22 or 55 % for

Au, 87 or 89 % for Pb and 89 % for Zn. Mining, processing, and

administrative costs used to determine NSR cut-off values were

estimated based on actual operating costs incurred from July 2022

through June 2023. Mining recovery is estimated to average 94 %

with average mining dilution of 17 % depending on the mining

methodology. Mineral Resources are reported at an NSR cut-off grade

of $75/t for veins classified as wide (Animas, Animas NE, Nancy,

and San Cristobal) and $135/t for veins classified as narrow (all

other veins) based on the same parameters used for Mineral

Reserves, and a 15 % upside in metal prices.

- Mineral Reserves for the San Jose Mine are based on underground

mining within optimized stope designs using an estimated NSR

break-even cut-off grade of $96.54/t to $85.02/t equivalent to 154

to 132 g/t Ag Eq based on assumed metal prices of $23.90/oz

Ag and $1,880/oz Au; estimated metallurgical recovery rates of 91 %

for Ag and 90 % for Au and mining costs of $49.83/t (C&F) -

$38.31/t (SLS); processing costs of $20.79/t; and other costs

including distribution, general service costs of $25.92/t based on

actual operating costs. Average mining recovery is estimated to 94

% (C&F) and 92 % (SLS) and average mining dilution 10 %

(C&F) and 14 % (SLS). Mineral Resources are reported at a 130

g/t Ag Eq cut-off grade based on the same parameters used for

Mineral Reserves.

- Mineral Reserves for the Lindero Mine are reported based on

open pit mining within a designed pit shell based on variable gold

cut-off grades and gold recoveries by metallurgical type: Met type

1 cut-off 0.28 g/t Au, recovery 75.4 %; Met type 2 cut-off 0.27 g/t

Au, recovery 78.2 %; Met type 3 cut-off 0.27 g/t Au, recovery 78.5

%; and Met type 4 cut-off 0.31 g/t Au, recovery 68.5 %. Mining

recovery and mining dilution have been accounted for during block

regularization to 10-meter x 10-meter x 8-meter size. The cut-off

grades and pit designs are considered appropriate for long term

gold prices of $1,600/oz, estimated base mining costs of $1.36 per

tonne of material, total processing and G&A costs of $9.78 per

tonne of ore, and refinery costs net of pay factor of $12.20 per

ounce gold. Reported Proven Reserves include 8.3 Mt averaging

0.44 g/t Au of stockpiled material. Mineral Resources are reported

within a conceptual pit shell above a 0.24 g/t Au cut-off

grade based on the same parameters used for Mineral Reserves and a

15 % upside in metal prices. Mineral Resources for Arizaro are

reported within a conceptual pit shell above a 0.26 g/t Au cut-off

grade using the same gold price and costs as Lindero with an

additional $0.52 per tonne of ore to account for haulage costs

between the deposit and plant. A slope angle of 47° was used for

defining the pit.

- Mineral Reserves for the Yaramoko Mine are reported on a 100 %

ownership basis at a cut-off grade of 1.57 g/t Au for the Zone 55

open pit, 0.86 g/t Au for the Zone 109 open pit, 4.5 g/t Au for

Zone 55 underground, 3.8 g/t Au for Bagassi South QV Prime and

Bagassi South underground based on an assumed gold price of

$1,600/oz, metallurgical recovery rates of 96.8 %, underground

mining costs of $154/t, processing cost of $28/t and G&A costs

of $27/t, surface mining costs of $4.95/t, processing cost of

$27/t, and G&A costs of $33/t. Underground average mining

recovery is estimated at 90 % for Bagassi South QV Prime and

Bagassi South underground, 93 % for Zone 55 SLS stopes, and 86 %

for sill drift stopes. A mining dilution factor of 10 % has been

applied for sill drift stopes, 0.7-meter and 0.4-meter dilution

skin has been applied for sub-level stopes and shrinkage mining

respectively. Surface mining recovery and mining dilution have been

accounted for during block regularization to 5-meter x 5-meter x

5-meter size within an optimized pit shell and only Proven and

Probable categories reported within the final pit designs. Yaramoko

Mineral Resources are reported at a gold grade cut-off grade of 0.9

g/t Au for the Zone 55 open pit, 0.5 g/t Au for the Zone 109 open

pit, and 2.7 g/t Au and 2.5 g/t Au for underground Zone 55 and

Bagassi South respectively, based on an assumed gold price of

$1,840/oz and the same costs, metallurgical recovery and

constrained within an optimized pit shell. The Yaramoko Mine is

subject to a 10 % carried interest held by the State of Burkina

Faso.

- Mineral Reserves for the Séguéla Mine are reported on a 100 %

ownership basis at an incremental gold grade cut-off of 0.65 g/t Au

for Antenna, 0.72 g/t Au for Agouti, 0.69 g/t Au for Boulder,

0.66 g/t Au for Koula, 0.73 g/t Au for Ancien, and 0.66 g/t Au for

Sunbird deposits based on a gold price of $1,600/ounce,

metallurgical recovery rates of 94.5 %, surface mining costs of

$3.12/t, processing cost of $15.42/t and G&A cost of $8.83/t,

and only Proven and Probable categories reported within the final

pit designs. The Mineral Reserves pit designs were completed based

on overall slope angle recommendations of between 37° and 57° for

Antenna, Koula, and Agouti deposits from oxide to fresh weathering

profiles, between 34° and 56° for Ancien deposit from oxide to

fresh weathering profiles, 37° and 60° for Boulder deposit from

oxide to fresh weathering profiles and 37° and 58° for Sunbird

deposit from oxide to fresh weathering profiles. The Mineral

Reserves are reported with modifying factors of mining dilution and

mining recovery represented by regularizing the block models to an

appropriate selective mining unit block size. Mineral Resources for

Séguéla are reported at a cut-off grade of 0.55 g/t Au for Antenna,

0.55 g/t Au for Sunbird, 0.60 g/t Au for Koula and Boulder, and

0.65 g/t Au for Ancien and Agouti deposits, based on an assumed

gold price of $1,840/oz and constrained within preliminary pit

shells. The Séguéla Mine is subject to a 10 % carried interest held

by the State of Côte d’Ivoire.

- Eric Chapman, P. Geo. (EGBC #36328), is the Qualified Person

responsible for Mineral Resources; Raul Espinoza (FAUSIMM (CP)

#309581) is the Qualified Person responsible for Mineral Reserves;

both being employees of Fortuna Silver Mines Inc.

- N/A = Not applicable.

- Totals may not add due to rounding.

Historical Mineral

Resources

|

Property |

Classification (JORC) |

Tonnes (Mt) |

Au (g/t) |

Au (koz) |

|

GoldProject |

Diamba Sud, Senegal |

Indicated |

10.0 |

1.9 |

625 |

|

Inferred |

4.7 |

0.42 |

235 |

This estimate was prepared in accordance with

the JORC Code; refer to the Scoping Study Report entitled “Diamba

Sud Project, Senegal, prepared by Chesser Resources Limited

("Chesser") and published on March 15, 2022 and subsequently

amended on October 27, 2022, and December 12, 2022.

Disclosure of the historical estimate in this

news release is derived from the Diamba Sud Scoping Study completed

in March 2022 by Chesser Resourced Ltd and updated in October and

December 2022 and has been judged to be relevant and therefore

suitable for disclosure, however, it should not be relied upon.

Mineral Resources were reported within a $1,800/oz gold price pit

shell and at a cut-off grade of 0.5 g/t Au. In the Company's view,

there are no material differences between the confidence categories

assigned under the 2012 Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves prepared by

the Australasian Institute of Mining and Metallurgy, Australian

Institute of Geoscientists and Minerals Counsel of Australia, as

amended (the “JORC Code”) and the equivalent confidence categories

in the Canadian Institute of Mining 2014 Definition Standards for

Mineral Resources and Reserves. NI 43-101, defined below, reporting

requirements do not allow for "Inferred Mineral Resources" to be

added to other Mineral Resource categories and must be reported

separately. The Inferred Resource category estimates above under

the JORC Code were reported separately in each instance. There are

numerous uncertainties inherent in the historical estimate, which

is subject to all of the assumptions, parameters, and methods used

to prepare such historical estimates. The historical estimate has

been prepared in accordance with the requirements of the Joint Ore

Reserves Committee of The Australasian Institute of Mining and

Metallurgy, Australian Institute of Geoscientists and Minerals

Council of Australia and does not comply with or fulfill the CIM

Definition Standards on Mineral Resources and Mineral Reserves, as

amended, adopted by the Canadian Institute of Mining, Metallurgy

and Petroleum (the “CIM Definition Standards”) as required by

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects of the Canadian Securities Administrators (“NI 43-101”),

and may vary significantly from actual amounts, grade, and quality

of minerals recovered from the property. There are no other more

recent estimates. Fortuna has completed 101 diamond drillholes

totaling 13,102 meters and 166 reverse circulation drillholes

totaling 19,448 meters as part of an ongoing program to confirm the

historical estimate with no material discrepancies identified to

date. A detailed study of the drill results, technical data and

economic parameters relating to the property, together with the

preparation of an updated development plan, is required to be

conducted in order to update these historical estimates, as a

current Mineral Resource or Mineral Reserve. A qualified person has

not done sufficient work to classify the historical estimates as

current Mineral Resources or current Mineral Reserves and Fortuna

is not treating the historical estimate as current Mineral

Resources. Investors are cautioned not to place undue reliance on

the historical estimates contained in this news release.

Diamba Sud Gold Project,

Senegal

Fortuna plans to prepare a Mineral Resource

estimate in accordance with the disclosure requirements of Canadian

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects upon the completion of the current Brownfields exploration

program that includes 42,700 meters of drilling, including

extension and resource development, in addition to the testing and

advancement of previously identified geochemistry anomalies (refer

to Fortuna news release dated January 18, 2024). The program is

expected to finish by the end of August 2024 with the updated

evaluation planned for completion by the end of 2024.

Caylloma Mine,

Peru

As of December 31, 2023, the Caylloma Mine has

Proven and Probable Mineral Reserves of 2.3 Mt containing 6.1 Moz

Ag, 10 koz Au, 64 kt Pb, and 93 kt Zn in addition to Inferred

Resources of 4.5 Mt containing 14.4 Moz Ag, 63 koz Au, 110 kt

Pb, and 162 kt Zn.

Year-over-year, Mineral Reserve tonnes decreased

by 28 percent, while silver grade increased 2 percent to 83

g/t, lead grade increased 5 percent to 2.78 %, and zinc grade

increased 4 percent to 4.04 %. Changes are due to mining related

depletion of 544,000 tonnes, a decrease by 51,000 tonnes due to

higher cut-off values related to increases in operating costs, a

decrease of 188,000 tonnes as a result of changes in commercial

terms and metal price, a decrease of 218,000 tonnes due to

adjustments in the estimation parameters and geologic

interpretation, and conversion of 23,000 tonnes of Inferred

Resources to Mineral Reserves.

Measured and Indicated Resource tonnes,

exclusive of Mineral Reserves, decreased by 37 percent

year-over-year to 1.8 Mt with silver and lead grades increasing

slightly by 9 and 1 percent, respectively, and zinc grades

decreasing by 12 percent, due to an increase in cut-off value as a

result of higher operating costs and the application of operational

dilution based on mineable shape optimizer evaluation to remove

isolated and narrow mineralized structures from the inventory.

Inferred Resource tonnes decreased by 10 percent

year-over-year. Silver grades decreased 6 percent, whereas

lead and zinc grades increased by 9 and 8 percent, respectively.

The decrease in Inferred Mineral Resources is a result of an

increase in cut-off values used for reporting Mineral Resources

from $65/t to $75/t resulting in a decrease of 416,000 tonnes and

adjustments in the geologic interpretation, changes in commercial

terms, and sterilization of material associated with isolated or

narrow mineralization resulting in a decrease of 929,000 tonnes,

offset by the discovery of 900,000 tonnes through exploration

drilling of the Animas and Animas NE veins.

The Brownfields exploration program budget for

2024 at Caylloma is $2.0 million, supporting field exploration,

regional geophysics, and ongoing studies of the structural controls

to mineralization on the Animas vein (refer to Fortuna news release

dated January 18,

2024).

San Jose Mine,

Mexico

As of December 31, 2023, the San Jose Mine has

Proven and Probable Mineral Reserves of 0.7 Mt containing 3.7 Moz

Ag and 23 koz Au, in addition to Inferred Resources of 1.0 Mt

containing a further 4.9 Moz Ag and 35 koz Au.

Year-over-year, Mineral Reserves decreased 66

percent in terms of tonnes, while silver grade decreased 9 percent

and gold grade decreased 16 percent after net changes of minus 1 Mt

resulting from production-related depletion, and a further decrease

of 0.4 Mt due to the application of higher cut-off grades as a

result of significant cost increments related to the appreciation

of the Mexican Peso, higher contractor costs for transportation,

distribution, shotcrete, maintenance, and mining services, higher

labor costs and new labor reform mandates, change from owner’s

mining fleet to contractor fleet for mine development, and higher

costs in fuel, energy, materials, and consumables related to 2023

inflation.

Measured and Indicated Resource tonnes exclusive

of Mineral Reserves increased by 15 percent year-over-year,

while silver and gold grades increased 35 and 54 percent,

respectively. The change is due to an increase in cut-off grade

from 110 g/t to 130 g/t Ag Eq due to cost increases as detailed

above combined with the upgrading of Inferred Resources to

Indicated Resources in the Victoria mineralized zone. An evaluation

is ongoing as to whether sufficient tonnage at a high enough grade

is located in localized areas of the Victoria mineralized zone to

cover development and infrastructure costs allowing conversion of

Inferred Resources to Mineral Reserves and inclusion in the mine

plan.

Year-over-year, Inferred Resources decreased 59

percent in terms of tonnes, with grades increasing for silver and

gold by 25 percent. The net variation is due primarily to the

increase in cut-off grade used for reporting, as described above,

the upgrading of Inferred Resources to Indicated Resources through

infill drilling of the Victoria mineralized zone and changes in the

geologic interpretation and removal of isolated mineralization

through the application of a mineable stope optimizer.

The Brownfields exploration program budget for

2024 at San Jose is $4.9 million, which includes 13,900 meters of

diamond drilling, focused on testing and extending the Yessi vein

as well as exploring additional targets within the mine area (refer

to Fortuna news release dated January 18,

2024).

Lindero Mine,

Argentina

As of December 31, 2023, the Lindero Mine has

Proven and Probable Mineral Reserves of 71.5 Mt containing 1.3 Moz

Au, in addition to Measured and Indicated Resources, exclusive of

Mineral Reserves, of 30.5 Mt containing 412 koz Au, and

Inferred Resources of 25.3 Mt containing 386 koz Au.

Since December 31, 2022, Mineral Reserve tonnes

decreased by 10 percent, while gold grade remained relatively

unchanged at 0.56 g/t Au. Changes are primarily due to mining

related depletion and sterilization of 6.5 Mt of material

containing 122 koz Au delivered to the heap leach pad in 2023 and

an increase in the reporting cut-off grade due to higher operating

costs resulting in a decrease of 2.3 Mt containing 21 koz Au.

Measured and Indicated Resource gold ounces,

exclusive of Mineral Reserves, remained relatively unchanged

year-over-year.

Inferred Resource tonnes increased by 1.1 Mt or

5 percent, to 25.3 Mt since December 31, 2022 with the gold grade

remaining unchanged at 0.47 g/t. The slight increase in Inferred

Resources is due to minor adjustments in the optimization of the

pit shell.

Yaramoko Mine, Burkina

Faso

As of December 31, 2023, the Yaramoko Mine has

Proven and Probable Mineral Reserves of 0.9 Mt containing 219 koz

Au, in addition to Measured and Indicated Resources, exclusive of

Mineral Reserves, of 0.5 Mt containing 43 koz Au, and Inferred

Resources of 0.16 Mt containing 18 koz Au.

Year over year, Mineral Reserve tonnes decreased

26 percent, while gold grades increased 34 percent to 7.90 g/t Au.

The changes are due to mining related depletion in 2023 of 0.5 Mt

of material containing 118 koz Au offset by successful

underground exploration and delineation drilling of the Zone 55 and

Bagassi South QV Prime veins that, after the application of

modifying factors, resulted in an increase of 0.3 Mt containing 124

koz Au of new Probable Reserves.

Measured and Indicated Resource gold ounces,

exclusive of Mineral Reserves, decreased by 46 koz and Inferred

Resources by 7 koz as a result of the application of updated

cut-off grades and operational dilution based on mineable stope

optimizer evaluation to remove isolated non-economic

mineralization. The Brownfields exploration program budget for 2024

at Yaramoko is $6.1 million, which includes 41,450 meters of

exploration drilling, with underground drilling testing western and

depth extensions to the Zone 55 deposit, surface drilling testing

several anomalies along the Boni Shear, Bagassi South surface

extensions, and other surface targets (refer to Fortuna news

release dated January 18, 2024).

Séguéla Mine, Côte

d’Ivoire

As of December 31, 2023, the Séguéla Mine has

Proven and Probable Mineral Reserves of 11.8 Mt containing 1.2

Moz Au, in addition to Indicated Resources of 4.7 Mt containing 381

koz Au and Inferred Resources of 3.1 Mt containing 245 koz Au.

Since December 31, 2022, Mineral Reserve tonnes

decreased by 3 percent, while gold grade increased by 9 percent to

3.05 g/t Au. Changes are primarily due to mining related depletion

of 0.8 Mt of material containing 79 koz Au since operations

commenced in May 2023, an increase in the reporting cut-off grade

due to higher processing and service costs resulting in a decrease

of 1.6 Mt containing 53 koz Au offset by the reclassification of

2.1 Mt containing 206 koz from Indicated Resources to Probable

Reserves related to delineation drilling and definition of the

updated pit shell at the Sunbird deposit.

Measured and Indicated Resource gold ounces,

exclusive of Mineral Reserves, decreased 34 percent, by 142 koz,

year-over-year, in relation to the reclassification of the Sunbird

deposit open pit resources from Indicated Resources to Probable

Reserves and a reduction in pit size based on updated contractor

costs and geologic interpretation, a decrease of 339 koz Au. This

reduction was offset by the inclusion of underground Indicated

Resources for the Koula, Ancien and Sunbird deposits totaling 233

koz Au. The application of higher cut-off grades in relation to an

increase in processing and service costs accounted for a further

decrease of 36 koz Au.

Inferred Resources decreased 2.6 Mt or 365 koz

Au in relation to the reduction in the size of the Sunbird pit

shell due to the results of the infill drilling and increased costs

as described above resulting in a decrease of 203 koz, and

upgrading to Indicated Resources of underground mineralization,

previously planned for open pit mining of 233 koz Au. These

decreases were offset by the inclusion of underground Inferred

Resources for the Koula, Ancien and Sunbird deposits totaling 98

koz Au. Adjustments to the estimation parameters and pit

optimization for the other deposits resulted in a further decrease

of 27 koz Au.

The Brownfields exploration program budget for

2024 at Séguéla is $7.8 million, which includes 41,750 meters of

exploration drilling, focused on testing and extending underground

targets associated with the Sunbird, Ancien, and Koula deposits, as

well as advancing emerging prospects such as Barana, Badior, and

Kestral, and continuing to explore for additional prospects (refer

to Fortuna news release dated January 18,

2024).

Arizaro Gold Project, Lindero

Property, Argentina

As of December 31, 2023, the Arizaro Gold

Project has Inferred Mineral Resources of 24.1 Mt averaging

0.40 g/t Au containing 310 koz Au, remaining

relatively unchanged from last year other than minor adjustments in

the pit shell. Mineralization remains open at depth and along the

trend of the northeast to southwest striking

porphyry.

Qualified

Person

Eric Chapman, Fortuna´s Senior Vice-President of

Technical Services, is a Professional Geoscientist of the Engineers

and Geoscientists of British Columbia (Registration Number 36328)

and a Qualified Person as defined by National Instrument 43-101 -

Standards of Disclosure for Mineral Projects. Mr. Chapman has

reviewed and approved the scientific and technical information

contained in this news release and has verified the underlying

data.

About Fortuna Silver Mines

Inc.

Fortuna Silver Mines Inc. is a Canadian precious

metals mining company with five operating mines in Argentina,

Burkina Faso, Côte d'Ivoire, Mexico, and Peru. Sustainability is

integral to all our operations and relationships. We produce gold

and silver and generate shared value over the long-term for our

stakeholders through efficient production, environmental

protection, and social responsibility. For more information, please

visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza President, CEO,

and DirectorFortuna Silver Mines Inc.

Investor Relations:

Carlos Baca |

info@fortunasilver.com | www.fortunasilver.com | X

| LinkedIn | YouTube

Forward looking Statements

This news release contains forward-looking

statements which constitute “forward-looking information” within

the meaning of applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995 (collectively, “Forward-looking Statements”). All

statements included herein, other than statements of historical

fact, are Forward-looking Statements and are subject to a variety

of known and unknown risks and uncertainties which could cause

actual events or results to differ materially from those reflected

in the Forward-looking Statements. The Forward-looking

Statements in this news release may include, without limitation,

mineral resource and mineral reserve estimates; the ability to

expand and prove a mineral resource and reserve at the Diamba Sud

Project; statements about the Company’s plans for its mines and

mineral properties , including statements that confirmatory

drilling at the Diamba Sud Project is planned for completion in

2024 and statements regarding the preparation of an updated

development plan at the Diamba Sud Project; changes in general

economic conditions and financial markets; the impact of

inflationary pressures on the Company’s business and operations;

estimated Brownfields expenditures in 2024; exploration

plans; the future results of exploration activities; the timing of

the implementation and completion of sustaining capital investment

projects at the Company’s mines; expectations with respect to metal

grade estimates and the impact of any variations relative to metals

grades experienced; metal prices, currency exchange rates and

interest rates in 2024; timing of the filing of Technical Reports;

plans to prepare a mineral resource estimate for the Diamba Sud

Project; timing of and possible outcome of litigation; life

of mine estimates; the Company’s business strategy, plans and

outlook; the merit of the Company’s mines and mineral properties;

and the future financial or operating performance of the

Company. Often, but not always, these Forward-looking

Statements can be identified by the use of words such as

“estimated”, “potential”, “open”, “future”, “assumed”, “projected”,

“used”, “detailed”, “has been”, “gain”, “planned”, “reflecting”,

“will”, “anticipated”, “estimated” “containing”,

“remaining”, “to be”, or statements that events, “could” or

“should” occur or be achieved and similar expressions, including

negative variations.

Forward-looking Statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance, or achievements of the Company to be

materially different from any results, performance or achievements

expressed or implied by the Forward-looking Statements. Such

uncertainties and factors include, among others, operational risks

associated with mining and mineral processing; uncertainty relating

to Mineral Resource and Mineral Reserve estimates; uncertainty

relating to capital and operating costs, production schedules and

economic returns; uncertainties related to new mining operations,

including the possibility that actual capital and operating costs

and economic returns will differ significantly from those estimated

for such projects prior to production; risks relating to the

Company’s ability to replace its Mineral Reserves; risks associated

with mineral exploration and project development; uncertainty

relating to the repatriation of funds as a result of currency

controls; environmental matters including obtaining or renewing

environmental permits and potential liability claims; uncertainty

relating to nature and climate conditions; risks associated with

political instability and changes to the regulations governing the

Company’s business operations; changes in national and local

government legislation, taxation, controls, regulations and

political or economic developments in countries in which the

Company does or may carry on business, including relating to the

newly elected government in Argentina; risks associated with war,

hostilities or other conflicts, such as the Ukrainian – Russian

conflict, and the impact it may have on global economic activity;

risks relating to the termination of the Company’s mining

concessions in certain circumstances; developing and maintaining

relationships with local communities and stakeholders; risks

associated with losing control of public perception as a result of

social media and other web-based applications; potential opposition

to the Company’s exploration, development and operational

activities; risks related to the Company’s ability to obtain

adequate financing for planned exploration and development

activities; property title matters; risks relating to the

integration of businesses and assets acquired by the Company;

impairments; risks associated with climate change legislation;

reliance on key personnel; adequacy of insurance coverage;

operational safety and security risks; legal proceedings and

potential legal proceedings; the possibility that the ruling in

favor of Compania Minera Cuzcatlan S.A. de C.V. (“Minera

Cuzcatlan”) to reinstate the environmental impact authorization at

the San Jose mine (the “EIA”) will be successfully appealed;

uncertainties relating to general economic conditions; risks

relating to a global pandemic, which could impact the Company’s

business, operations, financial condition and share price;

competition; fluctuations in metal prices; risks associated with

entering into commodity forward and option contracts for base

metals production; fluctuations in currency exchange rates and

interest rates; tax audits and reassessments; risks related to

hedging; uncertainty relating to concentrate treatment charges and

transportation costs; sufficiency of monies allotted by the Company

for land reclamation; risks associated with dependence upon

information technology systems, which are subject to disruption,

damage, failure and risks with implementation and integration;

risks associated with climate change legislation; labor relations

issues; as well as those factors discussed under “Risk Factors” in

the Company's Annual Information Form for the fiscal year ended

December 31, 2022. Although the Company has attempted to identify

important factors that could cause actual actions, events, or

results to differ materially from those described in

Forward-looking Statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended.

Forward-looking Statements contained herein are

based on the assumptions, beliefs, expectations and opinions of

management, including, but not limited to, the accuracy of the

Company’s current mineral resource and reserve estimates; that the

Company’s activities will be conducted in accordance with the

Company’s public statements and stated goals; that there will be no

material adverse change affecting the Company, its properties or

its production estimates (which assume accuracy of projected ore

grade, mining rates, recovery timing, and recovery rate estimates

and may be impacted by unscheduled maintenance, labor and

contractor availability and other operating or technical

difficulties); the duration and effect of global and local

inflation; the duration and impacts of geo-political uncertainties

on the Company’s production, workforce, business, operations and

financial condition; the expected trends in mineral prices,

inflation and currency exchange rates; that any appeal in respect

of the ruling in favor of Minera Cuzcatlan to reinstate the EIA

will not be successful; that all required approvals and permits

will be obtained for the Company’s business and operations on

acceptable terms; that there will be no significant disruptions

affecting the Company's operations and such other assumptions as

set out herein. Forward-looking Statements are made as of the date

hereof and the Company disclaims any obligation to update any

Forward-looking Statements, whether as a result of new information,

future events, or results or otherwise, except as required by law.

There can be no assurance that these Forward-looking Statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements.

Accordingly, investors should not place undue reliance on

Forward-looking Statements.

Cautionary Note to United States Investors

Concerning Estimates of Reserves and Resources

Unless otherwise indicated, reserve and resource

estimates included in this news release have been prepared in

accordance with National Instrument 43-101 Standards of Disclosure

for Mineral Projects ("NI 43-101") and the Canadian Institute of

Mining, Metallurgy, and Petroleum Definition Standards on Mineral

Resources and Mineral Reserves. NI 43-101 is a rule developed by

the Canadian Securities Administrators that establishes standards

for public disclosure by a Canadian company of scientific and

technical information concerning mineral projects. Unless otherwise

indicated, all mineral reserve and mineral resource estimates

contained in the technical disclosure have been prepared in

accordance with NI 43-101 and the Canadian Institute of Mining,

Metallurgy and Petroleum Definition Standards on Mineral Resources

and Reserves. The historical resource estimates in respect of the

Diamba Sud Project included in this news release have been prepared

in accordance with the requirements of the Joint Ore Reserves

Committee of The Australasian Institute of Mining and Metallurgy,

Australian Institute of Geoscientists and Minerals Council of

Australia.

Canadian standards, including NI 43-101, and

Australian standards, including the JORC Code, each differ

significantly from the requirements of the Securities and Exchange

Commission, and mineral reserve and resource information included

in this news release may not be comparable to similar information

disclosed by U.S. companies.

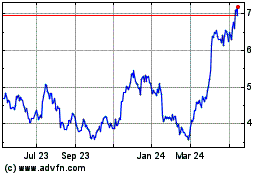

Fortuna Mining (TSX:FVI)

Historical Stock Chart

From Nov 2024 to Dec 2024

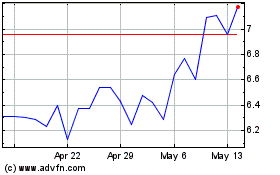

Fortuna Mining (TSX:FVI)

Historical Stock Chart

From Dec 2023 to Dec 2024