Fortuna Silver Mines Inc. (NYSE: FSM) (TSX: FVI)

is pleased to report that the Company has paid down an additional

$41 million of its revolving credit facility at the end of the

fourth quarter of 2023, using cash on hand.

After the payment of $41 million, the Company

expects to bring down the leverage ratio1 below 0.5 times total net

debt2 to adjusted EBITDA3 (which was reported for the third quarter

of 2023). At December 31, 2023, it is expected that Fortuna’s

total outstanding debt balance will stand at approximately $165

million on its credit facility (excluding letters of credit), and

approximately $46 million of convertible notes, for an estimated

total net debt, after cash and cash equivalents, of

$83 million as at December 31, 2023. This represents a

reduction of approximately $50 million in total net debt in

the period, reflecting cash flow contributions from the Séguéla

Mine in its second full quarter of production.

The estimated total net debt and liquidity for

Fortuna as at the end of the fourth quarter of 2023 is preliminary

financial information and has been prepared by management and

remains subject to final review by the Company’s audit committee

and approval by the Company’s board of directors. Such preliminary

financial information for the fourth quarter of 2023 is subject to

the finalization and closing of Fortuna´s accounting books and

records for the period and should not be viewed as a substitute for

the Company’s annual financial statements prepared in accordance

with accounting principles generally accepted under International

Financial Reporting Standards (IFRS). The Company’s auditor has not

audited the preliminary financial information contained in this

news release, nor have they expressed any opinion or any other form

of assurance on the preliminary financial information contained

herein. Refer to the “Cautionary Statements” section at the end of

this news release.

It is expected that Fortuna will release its

financial statements and management’s discussion and analysis as at

and for the three and twelve months ended December 31, 2023, as

approved by its audit committee and board of directors, by

mid-March, 2024.

Notes:

- Total net debt to adjusted EBITDA

is a non-IFRS ratio; refer to the “Non-IFRS Measures” section at

the end of this news release for a description of this non-IFRS

ratio and the reconciliation from debt, the most comparable IFRS

measure

- Total net debt is a non-IFRS

measure; refer to the “Non-IFRS Measures” section at the end of

this news release for a description of this non-IFRS measure and a

reconciliation to debt, the most comparable IFRS measure

- Adjusted EBITDA is a non-IFRS

measure; refer to the “Non-IFRS Financial Measures” section in the

Company’s management discussion and analysis for the three and nine

months ended September 30, 2023 (“Q3 2023 MD&A”), for a

description of the measure on page 28 and for a reconciliation to

net income the most directly comparable IFRS measure on page 37,

and which aforementioned sections are incorporated by reference

herein. The Q3 2023 MD&A may be accessed on SEDAR+ at

www.sedarplus.ca under the Company’s profile

About Fortuna Silver Mines

Inc.

Fortuna Silver Mines Inc. is a Canadian precious

metals mining company with five operating mines in Argentina,

Burkina Faso, Côte d'Ivoire, Mexico, and Peru. Sustainability is

integral to all our operations and relationships. We produce gold

and silver and generate shared value over the long-term for our

stakeholders through efficient production, environmental

protection, and social responsibility. For more information, please

visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza President, CEO, and

DirectorFortuna Silver Mines Inc.

Investor Relations:

Carlos Baca | info@fortunasilver.com |

www.fortunasilver.com | X |

LinkedIn | YouTube

Cautionary Statements

The estimated total net debt and liquidity for

the Company as at the end of the fourth quarter of 2023, is

preliminary financial information and has been prepared by

management and remains subject to final review by the Company’s

audit committee and approval by the Company’s board of directors.

Such preliminary financial information for the fourth quarter of

2023 is subject to the finalization and closing of our accounting

books and records for the period and should not be viewed as a

substitute for the annual financial statements prepared in

accordance with accounting principles generally accepted under

International Financial Reporting Standards (IFRS). The Company’s

auditor has not audited the preliminary financial information

contained in this news release, nor have they expressed any opinion

or any other form of assurance on the preliminary financial

information contained herein.

Forward-looking Statements

This news release contains forward looking

statements which constitute "forward-looking information" within

the meaning of applicable Canadian securities legislation and

"forward-looking statements" within the meaning of the "safe

harbor" provisions of the Private Securities Litigation Reform Act

of 1995 (collectively, "Forward-looking Statements"). All

statements included herein, other than statements of historical

fact, are Forward-looking Statements and are subject to a variety

of known and unknown risks and uncertainties which could cause

actual events or results to differ materially from those reflected

in the Forward-looking Statements. The Forward-looking Statements

in this news release include, without limitation, the Company’s

anticipated financial and operational performance in 2023;

preliminary estimated financial information for the fourth quarter

of 2023; a preliminary estimate of the Company’s liquidity and

outstanding debt balance and total net debt as at December 31,

2023; a preliminary estimate of the reduction in total net debt

compared to the third quarter ended September 30, 2023; the

economics for the mine at Séguéla; statements about the Company's

plans for its mines and mineral properties; the Company's business

strategy, plans and outlook; the merit of the Company's mines and

mineral properties; the future financial or operating performance

of the Company; the anticipated timing for release of the Company’s

financial statements and management’s discussion and analysis as at

and for the three and twelve months ended December 31, 2023. Often,

but not always, these Forward looking Statements can be identified

by the use of words such as "estimated", “expected”, “anticipated”,

"potential", "open", "future", "assumed", "projected", "used",

"detailed", "has been", "gain", "planned", "reflecting", "will",

"containing", "remaining", "to be", or statements that events,

"could" or "should" occur or be achieved and similar expressions,

including negative variations.

Forward-looking Statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance, or achievements of the Company to be

materially different from any results, performance or achievements

expressed or implied by the Forward-looking Statements. Such

uncertainties and factors include, among others, the preliminary

estimated financial information, liquidity and outstanding total

debt may not be consistent with the final quarterly results and

statement of liquidity and debt subsequently approved by the Board;

operational risks associated with mining and mineral processing;

uncertainty relating to Mineral Resource and Mineral Reserve

estimates; uncertainty relating to capital and operating costs,

production schedules and economic returns; uncertainties related to

new mining operations such as the Séguéla Mine; risks relating to

the Company’s ability to replace its Mineral Reserves; risks

associated with mineral exploration and project development;

uncertainty relating to the repatriation of funds as a result of

currency controls; environmental matters including obtaining or

renewing environmental permits and potential liability claims;

uncertainty relating to nature and climate conditions; risks

associated with political instability and changes to the

regulations governing the Company’s business operations; changes in

national and local government legislation, taxation, controls,

regulations and political or economic developments in countries in

which the Company does or may carry on business; risks associated

with war, hostilities or other conflicts, such as the

Ukrainian - Russian conflict, and the impact it may have

on global economic activity; risks relating to the termination of

the Company’s mining concessions in certain circumstances;

developing and maintaining relationships with local communities and

stakeholders; risks associated with losing control of public

perception as a result of social media and other web-based

applications; potential opposition to the Company’s exploration,

development and operational activities; risks related to the

Company’s ability to obtain adequate financing for planned

exploration and development activities; property title matters;

risks relating to the integration of businesses and assets acquired

by the Company; impairments; risks associated with climate change

legislation; reliance on key personnel; adequacy of insurance

coverage; operational safety and security risks; legal proceedings

and potential legal proceedings; the possibility that the Court

ruling in favor of Compañia Minera Cuzcatlan S.A. de C.V. to

reinstate the environmental impact authorization at the San Jose

Mine will be successfully appealed; temporary restrictions imposed

by the Company’s lenders on the Company’s abilities under the

Credit Facility; our ability to access the capital markets;

uncertainties relating to general economic conditions; risks

relating to a global pandemic, which could impact the Company’s

business, operations, financial condition and share price;

competition; fluctuations in metal prices; risks associated with

entering into commodity forward and option contracts for base

metals production; fluctuations in currency exchange rates and

interest rates; tax audits and reassessments; risks related to

hedging; uncertainty relating to concentrate treatment charges and

transportation costs; sufficiency of monies allotted by the Company

for land reclamation; risks associated with dependence upon

information technology systems, which are subject to disruption,

damage, failure and risks with implementation and integration;

risks associated with climate change legislation; labor relations

issues; as well as those factors discussed under “Risk Factors” in

the Company's Annual Information Form. Although the Company has

attempted to identify important factors that could cause actual

actions, events, or results to differ materially from those

described in Forward-looking Statements, there may be other factors

that cause actions, events, or results to differ from those

anticipated, estimated or intended.

Forward-looking Statements contained herein are

based on the assumptions, beliefs, expectations and opinions of

management, including but not limited to expectations regarding the

Company’s financial performance for the fourth quarter of 2023;

that management’s preliminary financial information for the fourth

quarter of 2023 will be consistent with the final full quarterly

and annual financial results; that the Company’s activities will be

conducted in accordance with the Company’s public statements and

stated goals; that there will be no material adverse change

affecting the Company, its properties or its production estimates

(which assume accuracy of projected head grade, mining rates,

recovery timing, and recovery rate estimates and may be impacted by

unscheduled maintenance, labor and contractor availability and

other operating or technical difficulties); the duration and effect

of global and local inflation; geo-political uncertainties on the

Company’s production, workforce, business, operations and financial

condition; the expected trends in mineral prices, inflation and

currency exchange rates; that all required approvals and permits

will be obtained for the Company’s business and operations on

acceptable terms; that there will be no significant disruptions

affecting the Company's operations; the Company’s ability to access

the capital markets; the ability to meet current and future

obligations and such other assumptions as set out herein.

Forward-looking Statements are made as of the date hereof and the

Company disclaims any obligation to update any Forward-looking

Statements, whether as a result of new information, future events,

or results or otherwise, except as required by law. There can be no

assurance that these Forward-looking Statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

investors should not place undue reliance on Forward-looking

Statements.

The purpose of disclosing the Company's

estimated total outstanding debt balance and estimated total net

debt, after cash and cash equivalents is to assist readers in

understanding the impact of cash flows from the contribution of the

Company's Séguéla Mine on its outstanding indebtedness. This

information may not be appropriate for other purposes.

Non-IFRS Financial Measures

The Company has disclosed certain financial

measures and ratios in this news release which are not defined

under IFRS, as issued by the International Accounting Standards

Board, and are not disclosed in the Company's financial statements,

including but not limited to total net debt and total net debt to

adjusted EBITDA ratio. These non-IFRS financial measures and

non-IFRS ratios are widely reported in the mining industry as

benchmarks for performance and are used by management to monitor

and evaluate the Company's operating performance and ability to

generate cash. The Company believes that, in addition to financial

measures and ratios prepared in accordance with IFRS, certain

investors use these non-IFRS financial measures and ratios to

evaluate the Company’s performance. However, the measures do not

have a standardized meaning under IFRS and may not be comparable to

similar financial measures disclosed by other companies.

Accordingly, non-IFRS financial measures and non-IFRS ratios should

not be considered in isolation or as a substitute for measures and

ratios of the Company’s performance prepared in accordance with

IFRS. Except as otherwise described below, the Company has

calculated these non-IFRS financial measures and non-IFRS ratios

consistently for all periods presented. To facilitate a

better understanding of these measures as calculated by the

Company, descriptions are provided below.

Total net debt is a non-IFRS measure which is

calculated as debt consisting of credit facilities and convertible

debentures less cash and cash equivalents.

Management believes that total net debt provides

valuable information as an indicator of the Company’s liquidity and

ability to fund working capital needs fund capital expenditures.

Total net debt is also a common metric that provides additional

information used by investors and analysts for valuation purposes

based on an observed or inferred relationship between total net

debt and enterprise value. Total net debt is not meant to be a

substitute for other subtotals or totals presented in accordance

with IFRS measures, but that rather should be evaluated in

conjunction with IFRS measures.

The following table presents a reconciliation of

Total net debt from Debt1, the most directly comparable IFRS

measure, as of the date of this news release:

|

As at |

December 31, 2023 |

|

Debt |

$210,700,000 |

|

Less: cash and cash equivalents |

$(127,800,000) |

|

Total net debt |

$82,900,000 |

Note:

- The debt, cash and cash

equivalents, and total net debt figures for the Company presented

in the table above, represent preliminary financial information

estimated by management which remains subject to final review by

the Company’s Auditors, audit committee and approval by the

Company’s board of directors.

Total Net Debt to Adjusted EBITDA Ratio

Total net debt to adjusted EBITDA ratio is a

non-IFRS ratio which is calculated as total net debt divided by

adjusted EBITDA. Management believes that total net debt to

adjusted EBITDA provides valuable information as an indicator of

the Company’s solvency and ability to fund working capital needs

and fund capital expenditures. Total net debt to adjusted EBITDA

ratio is also a common metric that provides additional information

used by investors and analysts for valuation purposes based on an

observed or inferred relationship between total net debt to

adjusted EBITDA ratio and enterprise value. Total net debt to

adjusted EBITDA ratio is not meant to be a substitute for other

subtotals or totals presented in accordance with IFRS measures, but

rather should be evaluated in conjunction with IFRS measures.

The following table presents a reconciliation of

total net debt to adjusted EBITDA ratio from debt, the most

directly comparable IFRS measure, as of September 30, 2023:

|

As at |

September 30, 2023 |

|

Debt |

$251,200,000 |

|

Less: cash and cash equivalents |

$(117,800,000) |

|

Total net debt |

$133,400,000 |

|

Adjusted EBITDA (last four quarters) |

$270,100,000 |

|

Total net debt to adjusted EBITDA ratio |

0.5 |

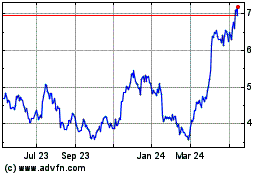

Fortuna Mining (TSX:FVI)

Historical Stock Chart

From Nov 2024 to Dec 2024

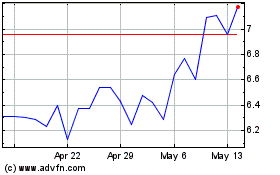

Fortuna Mining (TSX:FVI)

Historical Stock Chart

From Dec 2023 to Dec 2024