Fortuna Silver Mines Inc. (NYSE: FSM)

(TSX: FVI) reports record gold and gold equivalent

production for the third quarter of 2023 from its five operating

mines in West Africa and Latin America. Gold and silver production

for the quarter was 94,821 ounces and 1.7 million ounces,

respectively, or 128,671 gold equivalent ounces1, including lead

and zinc by-products. Gold and silver production for the nine

months totaled 219,260 ounces and 4.5 million ounces, respectively,

or 316,235 gold equivalent ounces1, including lead and zinc

by-products. Fortuna is well positioned to achieve annual

production guidance.

Q3 2023 highlights

- Record gold equivalent production

of 128,671 ounces1; a 38 percent increase compared to Q2 2023

(93,454 Au Eq)2 and a 26 percent increase compared to Q3 2022

(101,840 Au Eq)3

- Record gold production of 94,821

ounces; an increase of 47 percent compared to Q2 2023 (64,348 oz

Au)2 and 43 percent compared to Q3 2022 (66,344 oz Au)

- Increase in gold production was

driven mainly by Séguéla’s first full quarter of production and

steady operating performance across all mines

- Yaramoko’s annual gold production

guidance revised upwards to 110 to 120 thousand ounces, an increase

of approximately 14 percent

- Silver production of 1,680,751

ounces

- Strong safety performance across

the business with Total Recordable Injury Frequency Rate (TRIFR) of

0.86 compared to 2.36 in Q3 2022

|

|

|

|

|

Gold Production (oz) |

Silver Production (oz) |

|

Q3 2023 |

|

Q3 2022 |

|

9 months2023 |

|

Guidance2023 (koz) |

|

Q3 2023 |

|

Q3 2022 |

|

9 months2023 |

|

Guidance2023 (Moz) |

|

|

Lindero, Argentina |

20,933 |

|

30,032 |

|

71,647 |

|

96 - 106 |

|

- |

|

- |

|

- |

|

- |

|

|

Yaramoko, Burkina Faso |

34,036 |

|

27,130 |

|

89,476 |

|

110 - 1205 |

|

- |

|

- |

|

- |

|

- |

|

|

Séguéla, Côte d’Ivoire |

31,498 |

|

- |

|

35,520 |

|

60 - 75 |

|

- |

|

- |

|

- |

|

- |

|

|

San Jose, Mexico |

8,205 |

|

9,091 |

|

22,213 |

|

34 - 37 |

|

1,372,530 |

|

1,545,410 |

|

3,633,107 |

|

5.3 - 5.8 |

|

|

Caylloma, Peru |

149 |

|

91 |

|

404 |

|

- |

|

308,221 |

|

292,096 |

|

896,583 |

|

1.0 - 1.1 |

|

|

Total |

94,821 |

|

66,344 |

|

219,260 |

|

282 - 320 |

|

1,680,751 |

|

1,837,506 |

|

4,529,690 |

|

6.3 - 6.9 |

|

In the third quarter, record gold production was

mainly driven by Séguéla contributing 31,498 ounces during its

first full quarter of production, and Yaramoko contributing 34,036

ounces. Yaramoko’s strong production was a result of higher average

gold grades, leading to an upward revision in the mine’s production

guidance for 2023. Lindero, San Jose, and Caylloma also showed

steady performance in the quarter, positioning Fortuna to achieve

its annual production guidance range of between 282 to 320

thousand ounces of gold, and between 6.3 to 6.9 million ounces of

silver, or between 412 and 463 thousand gold equivalent

ounces, including lead and zinc by-products4 (refer to Fortuna news

release dated January 17, 2023).

Notes:

- Au Eq includes gold, silver, lead and

zinc and is calculated using the following metal prices: $1,924/oz

Au, $23.70/oz Ag, $2,136/t Pb and $2,428/t Zn or Au:Ag =

1:81.19, Au:Pb = 1:0.90, Au:Zn = 0.79

- Refer to Fortuna news release dated

July 12, 2023, “Fortuna reports production of 93,454 gold

equivalent ounces for the second quarter of 2023”

- Refer to Fortuna news release dated

October 6, 2022, “Fortuna reports production of 101,840 gold

equivalent ounces for the third quarter of 2022”

- Au Eq includes gold, silver, lead and

zinc and is calculated using the following metal prices: $1,700/oz

Au, $21/oz Ag, $2,000/t Pb and $3,200/t Zn or Au:Ag = 1:81.00,

Au:Pb = 1:0.85, Au:Zn = 1:0.53

- Reflects the Yaramoko Mine’s updated

production guidance for 2023

- Figures may not add due to

rounding

West Africa Region

Séguéla Mine, Côte d’Ivoire: Solid first

full production quarter; exceeding nameplate capacity

|

|

Q3 2023 |

|

Q2 2023 |

|

|

Tonnes milled |

310,387 |

|

109,605 |

|

|

Average tpd milled |

3,695 |

|

1,611 |

|

|

Gold grade (g/t) |

3.83 |

|

1.56 |

|

|

Gold recovery (%) |

93.4 |

|

89.6 |

|

|

Gold production1 (oz) |

31,498 |

|

4,023 |

|

|

Note: |

|

|

|

|

|

1. Production includes doré only |

|

|

|

|

|

|

From Séguéla’s first gold pour on May 24th to

the successful completion of the processing plant performance test

in August, the operation is now exceeding nameplate capacity (refer

to Fortuna news releases dated May 25, 2023 and September 7, 2023).

Séguéla is well positioned to achieve the mid-point of its gold

production guidance of 60 to 75 thousand ounces for the second half

of 2023 (refer to Fortuna news release dated January 17, 2023).

Mining

In the third quarter of 2023, mine production

totaled 502,326 tonnes of ore, averaging 3.48 g/t Au, and

containing an estimated 56,136 ounces of gold from the Antenna

Pit. Movement of waste during the quarter totaled 1,156,540 tonnes,

for a strip ratio of 2.3:1.

The first stage of grade control drilling was

completed at the Ancien deposit during the third quarter, with

results currently being processed. Construction of the access road

continued as planned, with stripping and initial mining of oxide

material scheduled to begin in the fourth quarter.

At the Koula deposit, initial grade control

drilling started and should be completed early in the fourth

quarter.

Mine reconciliation to reserve model

Reconciliation of tonnes, grade, and gold ounces

mined for the third quarter show a positive correlation when

compared to the long-term reserve model with 6 percent lower ore

tonnes mined but at 29 percent higher grades resulting in 22

percent more gold ounces extracted than predicted in the model.

Management considers the result to be encouraging based on the

available data density used for estimating the reserve model and

the operations’ careful management when defining ore-waste

boundaries. Variations between the model and production will

continue to be closely monitored as mining progresses further into

fresh rock and additional geological data is collected.

Processing

At the processing plant, 310,387 tonnes of ore

were treated at an average grade of 3.83 g/t Au producing 31,498

ounces of gold.

Throughput at the processing plant was gradually

increased throughout the quarter, achieving 174 t/hr in September,

13 percent higher than nameplate capacity. In the fourth quarter,

Séguéla expects to benefit from this consistent higher throughput.

The operation will continue optimization activities with the aim of

further increasing mill throughput capacity.

Third quarter production breakdown:

|

Month |

Processed Ore(t) |

Throughput (dry t/hr) |

Gold Grade(g/t) |

Recovery(%) |

Gold Poured(oz) |

|

July |

68,919 |

133.6 |

2.95 |

93.4 |

6,008 |

|

August |

119,311 |

172.3 |

3.98 |

91.1 |

11,685 |

|

September |

122,157 |

174.0 |

4.18 |

95.5 |

13,805 |

|

Total |

|

31,498 |

Yaramoko Mine, Burkina Faso: revised

guidance upward to 110 to 120 thousand ounces; approximately 14

percent higher

|

|

Q3 2023 |

|

Q3 2022 |

|

|

Tonnes milled |

137,281 |

|

137,202 |

|

|

Average tpd milled |

1,492 |

|

1,491 |

|

|

Gold grade (g/t) |

7.72 |

|

6.21 |

|

|

Gold recovery (%) |

98.5 |

|

97.4 |

|

|

Gold production (oz) |

34,036 |

|

27,130 |

|

|

Note: |

|

|

|

|

|

1. Production includes doré only |

|

|

|

|

|

|

In the third quarter of 2023, Yaramoko produced

34,036 ounces of gold at an average head grade of 7.72 g/t Au,

a 25 and 24 percent increase, respectively, compared to the same

period in 2022. Increased production resulted from higher average

grades and greater widths of mineralization encountered in

development headings, which contributed 42 percent of total mill

feed.

As a result of the aforementioned higher grades

in development and production zones within the mine plan, the

Company has revised Yaramoko’s annual gold production guidance

upwards to 110 to 120 thousand ounces from the original guidance of

92 to 102 thousand ounces, an increase of approximately 14 percent.

Gold production for the first nine months of 2023 totaled 89,476

ounces.

Drilling focused on infill grade control and

exploring for extensions beyond the mineralized resource envelope

in the deeper eastern portion of Zone 55. During the fourth

quarter, drilling will continue on the western portion of Zone 55,

testing for up and down-dip continuity of the recently discovered

extensions to the resource boundary.

Latin America Region

Lindero Mine,

Argentina: gold production on-track to meet annual guidance; leach

pad expansion project underway

|

|

Q3 2023 |

|

Q3 2022 |

|

|

Ore placed on pad (t) |

1,467,578 |

|

1,365,726 |

|

|

Gold grade (g/t) |

0.62 |

|

0.83 |

|

|

Gold production (oz)1 |

20,933 |

|

30,032 |

|

|

Note: |

|

|

|

|

|

1. Q3 2023 production includes doré, gold in carbon, and gold in

copper concentrate; Q3 2022 includes doré only |

|

|

During the third quarter of 2023, ore mined was

1.9 million tonnes, with a stripping ratio of 1.1:1. The stripping

ratio in the third quarter is 59 percent lower than the second

quarter and is expected to continue declining through to the end of

the year. A total of 1.5 million tonnes of ore were placed on the

leach pad at an average gold grade of 0.62 g/t, containing an

estimated 29,068 ounces.

Lindero’s gold production in the quarter was

20,933 ounces, 30 percent lower when compared to the third quarter

in 2022, explained by the lower head grade of ore placed on the

leach pad, in accordance with the mining sequence and the Mineral

Reserves.

Higher stripping of waste in the first nine

months of the year will allow improved access to higher grade

material scheduled in the mine plan for the fourth quarter. As a

result, Lindero anticipates placing approximately 1.6 million

tonnes of ore on the leach pad at a higher average grade of 0.67

g/t Au.

Gold production for the first nine months of

2023 totaled 71,647 ounces.

As of September 30, 2023, the leach pad

expansion project (Project) is approximately 13 percent complete.

The procurement construction and management (PCM) service has been

awarded to Knight Piésold, the accommodation camp expansion and PCM

offices for the Project have been finalized, and PCM personnel are

already onsite. Mobilization of the contractor’s personnel and

equipment has commenced. The first shipments of geomembrane and

geosynthetic clay liner are in transit, and the Project remains on

schedule for completion during the second half of 2024.

San Jose Mine, Mexico: Yessi vein, high

grade silver-gold discovery

|

|

Q3 2023 |

|

Q3 2022 |

|

|

Tonnes milled |

247,542 |

|

267,198 |

|

|

Average tpd milled |

2,845 |

|

3,071 |

|

|

Silver grade (g/t) |

189 |

|

196 |

|

|

Silver recovery (%) |

91.31 |

|

91.92 |

|

|

Silver production (oz) |

1,372,530 |

|

1,545,410 |

|

|

Gold grade (g/t) |

1.14 |

|

1.16 |

|

|

Gold recovery (%) |

90.71 |

|

90.97 |

|

|

Gold production (oz) |

8,205 |

|

9,091 |

|

|

|

The San Jose Mine produced 1,372,530 ounces of

silver at an average head grade of 189 g/t Ag and 8,205 ounces of

gold at an average head grade of 1.14 g/t Au. Gold production is

expected to fall slightly below the annual guidance range of 34 to

37 thousand ounces, resulting from lost production days in the

second quarter due to the illegal union blockade, and gold head

grade reconciliation to reserves in the low end of range.

The San Jose Mine remains positioned to deliver

annual silver production within the guidance range of between 5.3

to 5.8 million ounces. Silver and gold production for the first

nine months totaled 3,633,107 ounces, and 22,213 ounces,

respectively.

The decrease in silver and gold production for

the third quarter of 2023, when compared to the third quarter of

2022, is explained by the declining grade profile of Mineral

Reserves in the mine plan. The processing plant milled 247,542

tonnes at an average of 2,845 tonnes per day during the third

quarter, in line with the plan for the period.

Infill drilling at the San Jose Mine during the

quarter led to the discovery of the Yessi vein, a blind structure,

located 200 horizontal meters from existing underground

infrastructure. The discovery hole SJOM-1387 intersected 1,299 g/t

Ag Eq over 9.9 meters, and drill hole SJOM-1391 intersected 621 g/t

Ag Eq over 5 meters (refer to Fortuna news release dated September

5, 2023). Additional drilling is currently underway from both

surface and underground to define the extent and geometry of this

discovery. Mineralization remains open along strike to the north

and south, and at depth.

Caylloma Mine, Peru: steady performer;

on track to achieve upper end of guidance

|

|

Q3 2023 |

|

Q3 2022 |

|

|

Tonnes milled |

140,077 |

|

139,143 |

|

|

Average tpd milled |

1,556 |

|

1,546 |

|

|

Silver grade (g/t) |

83 |

|

79 |

|

|

Silver recovery (%) |

82.05 |

|

82.25 |

|

|

Silver production (oz) |

308,221 |

|

292,096 |

|

|

Lead grade (%) |

3.66 |

|

3.33 |

|

|

Lead recovery (%) |

91.53 |

|

88.97 |

|

|

Lead production (lbs) |

10,337,475 |

|

9,085,250 |

|

|

Zinc grade (%) |

5.07 |

|

4.37 |

|

|

Zinc recovery (%) |

89.67 |

|

88.63 |

|

|

Zinc production (lbs) |

14,036,832 |

|

11,885,121 |

|

|

Note: |

|

|

|

|

|

1. Metallurgical recovery for silver is calculated based on

silver content in lead concentrate |

|

|

In the third quarter, the Caylloma Mine produced

308,221 ounces of silver, a 6 percent increase from the same period

in 2022, at an average head grade of 83 g/t Ag and is well

positioned to achieve the upper end of annual guidance. Silver

production for the first nine months totaled 896,582 ounces.

Zinc and lead production was 14.0 and 10.3

million pounds, which represents an 18 and 14 percent increase in

production from the same period in 2022. Increased production is

the result of positive grade reconciliation to the reserve model in

levels 16 and 18 of the Animas vein. Zinc and lead average head

grades were 5.07 % and 3.66 %, 16 and 10 percent higher,

respectively, against the comparable period of 2022. Increased

recoveries for zinc and lead were driven by the higher grades. Zinc

and lead production for the first nine months totaled 41.1 and 30.1

million pounds, respectively.

Qualified Person

Eric Chapman, Senior Vice President of Technical

Services of Fortuna, is a Professional Geoscientist registered with

Engineers and Geoscientists British Columbia (Registration Number

36328) and a Qualified Person as defined by National Instrument

43-101 Standards of Disclosure for Mineral Projects. Mr. Chapman

has reviewed and approved the scientific and technical information

contained in this news release and has verified the underlying

data.

About Fortuna Silver Mines

Inc.

Fortuna Silver Mines Inc. is a Canadian precious

metals mining company with five operating mines in Argentina,

Burkina Faso, Côte d'Ivoire, Mexico, and Peru. Sustainability is

integral to all our operations and relationships. We produce gold

and silver and generate shared value over the long-term for our

stakeholders through efficient production, environmental

protection, and social responsibility. For more information, please

visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza President, CEO,

and DirectorFortuna Silver Mines Inc.

Investor Relations:

Carlos Baca |

info@fortunasilver.com | www.fortunasilver.com |

Twitter | LinkedIn |

YouTube

Forward-looking Statements

This news release contains forward-looking

statements which constitute “forward-looking information” within

the meaning of applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995 (collectively, “Forward-looking Statements”). All

statements included herein, other than statements of historical

fact, are Forward-looking Statements and are subject to a variety

of known and unknown risks and uncertainties which could cause

actual events or results to differ materially from those reflected

in the Forward-looking Statements. The Forward-looking Statements

in this news release may include, without limitation, statements

about the Company’s plans for its mines and mineral properties;

changes in general economic conditions and financial markets; the

impact of inflationary pressures on the Company’s business and

operations; statements regarding the likelihood of the Company

achieving 2023 annual production guidance, that guidance for the

Yaramoko Mine has been revised upward to 110 to 120 thousand

ounces, that the Séguéla Mine is well positioned to achieve

mid-point of gold production guidance, that gold production at the

Lindero Mine is on-track to meet annual guidance, that annual gold

production at the San Jose Mine is expected to be 8 percent below

the annual guidance range and is positioned to deliver annual

silver production within guidance range, and that the Caylloma Mine

is well positioned to achieve the upper end of annual guidance;

timing for mining at the Ancien deposit and the commencement of

stripping and initial mining of oxide material; expected timing for

completion of initial grade control drilling at the Koula deposit;

statements that the Séguéla Mine expects to benefit from consistent

higher throughput compared to the third quarter; expectations for

drilling on the western portion of Zone 55 during the fourth

quarter; expectations regarding a decline of the stripping ratio at

the Lindero Mine through the end of the year; statements regarding

the quantity of ore expected to be placed on the leach pad at the

Lindero Mine at a higher average grade and the expected timing for

completion of the leach pad expansion project; the Company’s

business strategy, plans and outlook; the merit of the Company’s

mines and mineral properties; the future financial or operating

performance of the Company; the Company’s ability to comply with

contractual and permitting or other regulatory requirements;

approvals and other matters. Often, but not always, these

Forward-looking Statements can be identified by the use of words

such as “estimated”, “potential”, “open”, “future”, “assumed”,

“projected”, “used”, “detailed”, “has been”, “gain”, “planned”,

“reflecting”, “will”, “anticipated”, “estimated” “containing”,

“remaining”, “to be”, or statements that events, “could” or

“should” occur or be achieved and similar expressions, including

negative variations.

Forward-looking Statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any results, performance or achievements

expressed or implied by the Forward-looking Statements. Such

uncertainties and factors include, among others, operational risks

associated with mining and mineral processing; uncertainty relating

to Mineral Resource and Mineral Reserve estimates; uncertainty

relating to capital and operating costs, production schedules and

economic returns; uncertainties related to new mining operations

such as the Séguéla Mine; risks relating to the Company’s ability

to replace its Mineral Reserves; risks associated with mineral

exploration and project development; uncertainty relating to the

repatriation of funds as a result of currency controls;

environmental matters including obtaining or renewing environmental

permits and potential liability claims; uncertainty relating to

nature and climate conditions; risks associated with political

instability and changes to the regulations governing the Company’s

business operations; changes in national and local government

legislation, taxation, controls, regulations and political or

economic developments in countries in which the Company does or may

carry on business; risks associated with war, hostilities or other

conflicts, such as the Ukrainian – Russian conflict, and the impact

it may have on global economic activity; risks relating to the

termination of the Company’s mining concessions in certain

circumstances; developing and maintaining relationships with local

communities and stakeholders; risks associated with losing control

of public perception as a result of social media and other

web-based applications; potential opposition to the Company’s

exploration, development and operational activities; risks related

to the Company’s ability to obtain adequate financing for planned

exploration and development activities; property title matters;

risks relating to the integration of businesses and assets acquired

by the Company; impairments; risks associated with climate change

legislation; reliance on key personnel; adequacy of insurance

coverage; operational safety and security risks; legal proceedings

and potential legal proceedings; the ability of the Company to

successfully contest and revoke the resolution issued by SEMARNAT

which annuls the extension of the environmental impact

authorization for the San Jose Mine; uncertainties relating to

general economic conditions; risks relating to a global pandemic,

which could impact the Company’s business, operations, financial

condition and share price; competition; fluctuations in metal

prices; risks associated with entering into commodity forward and

option contracts for base metals production; fluctuations in

currency exchange rates and interest rates; tax audits and

reassessments; risks related to hedging; uncertainty relating to

concentrate treatment charges and transportation costs; sufficiency

of monies allotted by the Company for land reclamation; risks

associated with dependence upon information technology systems,

which are subject to disruption, damage, failure and risks with

implementation and integration; risks associated with climate

change legislation; labour relations issues; as well as those

factors discussed under “Risk Factors” in the Company's Annual

Information Form. Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

Forward-looking Statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended.

Forward-looking Statements contained herein are

based on the assumptions, beliefs, expectations and opinions of

management, including but not limited to the accuracy of the

Company’s current Mineral Resource and Mineral Reserve estimates;

that the Company’s activities will be conducted in accordance with

the Company’s public statements and stated goals; that there will

be no material adverse change affecting the Company, its properties

or its production estimates (which assume accuracy of projected

head grade, mining rates, recovery timing, and recovery rate

estimates and may be impacted by unscheduled maintenance, labour

and contractor availability and other operating or technical

difficulties); the duration and effect of global and local

inflation; geo-political uncertainties on the Company’s production,

workforce, business, operations and financial condition; the

expected trends in mineral prices, inflation and currency exchange

rates; that the Company will be successful in challenging the

annulment of the extension to the San Jose environmental impact

authorization; that all required approvals and permits will be

obtained for the Company’s business and operations on acceptable

terms; that there will be no significant disruptions affecting the

Company's operations and such other assumptions as set out herein.

Forward-looking Statements are made as of the date hereof and the

Company disclaims any obligation to update any Forward-looking

Statements, whether as a result of new information, future events

or results or otherwise, except as required by law. There can be no

assurance that these Forward-looking Statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

investors should not place undue reliance on Forward-looking

Statements.

Cautionary Note to United States Investors

Concerning Estimates of Reserves and Resources

Reserve and resource estimates included in this

news release have been prepared in accordance with National

Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI

43-101") and the Canadian Institute of Mining, Metallurgy, and

Petroleum Definition Standards on Mineral Resources and Mineral

Reserves. NI 43-101 is a rule developed by the Canadian Securities

Administrators that establishes standards for public disclosure by

a Canadian company of scientific and technical information

concerning mineral projects. Unless otherwise indicated, all

Mineral Reserve and Mineral Resource estimates contained in the

technical disclosure have been prepared in accordance with NI

43-101 and the Canadian Institute of Mining, Metallurgy and

Petroleum Definition Standards on Mineral Resources and

Reserves.

Canadian standards, including NI 43-101, differ

significantly from the requirements of the Securities and Exchange

Commission, and Mineral Reserve and Mineral Resource information

included in this news release may not be comparable to similar

information disclosed by U.S. companies.

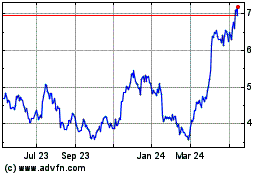

Fortuna Mining (TSX:FVI)

Historical Stock Chart

From Nov 2024 to Dec 2024

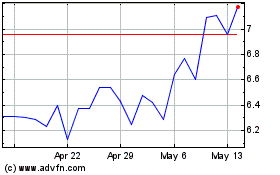

Fortuna Mining (TSX:FVI)

Historical Stock Chart

From Dec 2023 to Dec 2024