Canadian General Investments: Investment Update-Unaudited

April 03 2014 - 3:38PM

Marketwired Canada

Canadian General Investments, Limited (CGI)

(TSX:CGI)(TSX:CGI.PR.C)(TSX:CGI.PR.D)(LSE:CGI) reports on an unaudited basis

that its net asset value per share (NAV) at March 31, 2014 was $26.62, resulting

in year-to-date and 12-month NAV returns, with dividends reinvested, of 4.3% and

20.1%, respectively. These compare with the 6.1% and 16.0% returns of the

benchmark S&P/TSX Composite Index on a total return basis for the same periods.

The closing price for CGI's common shares at March 31, 2014 was $18.00,

resulting in year-to-date and 12-month share price returns, with dividends

reinvested, of -1.5% and 17.7%, respectively.

The sector weightings of CGI's investment portfolio at market as of March 31,

2014 were as follows:

Financials 22.0%

Energy 20.9%

Consumer Discretionary 16.6%

Industrials 12.9%

Materials 12.5%

Information Technology 6.0%

Telecommunication Services 3.6%

Health Care 2.5%

Consumer Staples 1.3%

Utilities 1.1%

Cash & Cash Equivalents 0.5%

The top ten investments which comprised 29.6% of the investment portfolio at

market as of March 31, 2014 were as follows:

Dollarama Inc. 4.4%

Enbridge Inc. 3.6%

Canadian Pacific Railway Limited 3.1%

Element Financial Corporation 3.0%

Bank of Montreal 2.9%

Methanex Corporation 2.8%

Royal Bank of Canada 2.5%

Catamaran Corporation 2.5%

Brookfield Canada Office Properties 2.4%

Stantec Inc. 2.4%

FOR FURTHER INFORMATION PLEASE CONTACT:

Canadian General Investments, Limited

Jonathan A. Morgan

President and CEO

(416) 366-2931

(416) 366-2729 (FAX)

cgifund@mmainvestments.com

www.canadiangeneralinvestments.ca

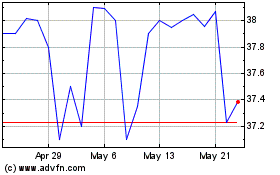

Canadian General Investm... (TSX:CGI)

Historical Stock Chart

From Apr 2024 to May 2024

Canadian General Investm... (TSX:CGI)

Historical Stock Chart

From May 2023 to May 2024