Amended Statement of Beneficial Ownership (sc 13d/a)

March 23 2018 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934*

(Amendment No. 1)

WESTLAKE

CHEMICAL PARTNERS LP

(Name of Issuer)

Common Units Representing Limited Partner Interests

(Title of Class of Securities)

960417103

(CUSIP Number)

Anthony Merhige

Harvest Fund Advisors LLC

100 West Lancaster Avenue, Suite 200

Wayne, Pennsylvania 19087

Tel:

(610) 341-9700

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 19, 2018

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

§§240.13d-1(e),

240.13d-1(f)

or

240.13d-1(g),

check the following box: ☐

NOTE

: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule

240.13d-7

for other parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Harvest Fund Advisors LLC

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

2,899,223

|

|

|

8

|

|

SHARED VOTING POWER

0

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

2,899,223

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,899,223

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

9.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

IA

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Harvest Fund Holdco L.P.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

2,899,223

|

|

|

8

|

|

SHARED VOTING POWER

0

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

2,899,223

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,899,223

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

9.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

PN

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Blackstone Harvest Holdco L.L.C.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

2,899,223

|

|

|

8

|

|

SHARED VOTING POWER

0

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

2,899,223

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,899,223

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

9.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

OO

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Blackstone Intermediary Holdco L.L.C.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

2,899,223

|

|

|

8

|

|

SHARED VOTING POWER

0

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

2,899,223

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,899,223

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

9.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

OO

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Blackstone Advisory Partners L.P.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

2,899,223

|

|

|

8

|

|

SHARED VOTING POWER

0

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

2,899,223

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,899,223

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

9.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

PN

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Blackstone Advisory Services L.L.C.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

2,899,223

|

|

|

8

|

|

SHARED VOTING POWER

0

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

2,899,223

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,899,223

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

9.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

OO

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Blackstone Holdings I L.P.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

2,899,223

|

|

|

8

|

|

SHARED VOTING POWER

0

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

2,899,223

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,899,223

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

9.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

PN

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Blackstone Holdings I/II GP Inc.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

2,899,223

|

|

|

8

|

|

SHARED VOTING POWER

0

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

2,899,223

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,899,223

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

9.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

CO

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

The Blackstone Group L.P.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

2,899,223

|

|

|

8

|

|

SHARED VOTING POWER

0

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

2,899,223

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,899,223

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

9.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

PN

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Blackstone Group Management L.L.C.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

2,899,223

|

|

|

8

|

|

SHARED VOTING POWER

0

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

2,899,223

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,899,223

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

9.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

OO

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS

Stephen A. Schwarzman

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

United States of America

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

2,899,223

|

|

|

8

|

|

SHARED VOTING POWER

0

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

2,899,223

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,899,223

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

9.0%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

IN

|

Explanatory Note

This Amendment No. 1 (“

Amendment No.

1

”) to Schedule 13D relates to common units representing limited partner

interests (the “

Common Units

”) of Westlake Chemical Partners LP, a Delaware limited partnership (the “

Issuer

”), and amends the initial statement on Schedule 13D filed on October 26, 2017 (the “

Original

Schedule 13D

”, and as amended, the “

Schedule 13D

”). Capitalized terms used but not defined in this Amendment No. 1 shall have the same meanings ascribed to them in the Schedule 13D.

Item 3. Source and Amount of Funds or Other Consideration

Item 3 of the Schedule 13D is hereby supplemented by adding the following:

As of March 20, 2018, the funds and accounts managed by Harvest Fund Advisors LLC (“

HFA

”) acquired the securities reported herein for

aggregate consideration of approximately $66.4 million, using cash available in such funds and accounts.

Item 5. Interest in Securities of

the Issuer.

Items 5(a)-(b) of the Schedule 13D are hereby amended and restated as follows:

(a) and (b). Calculations of the percentage of Common Units beneficially owned assumes that there are a total of 32,237,266 Common Units outstanding as of

February 22, 2018, as reported in the Issuer’s Annual Report on Form

10-K

filed with the Securities and Exchange Commission on March 1, 2018.

The aggregate number and percentage of Common Units beneficially owned by each Reporting Person and, for each Reporting Person, the number of Common Units as

to which there is sole power to vote or to direct the vote, shared power to vote or to direct the vote, sole power to dispose or to direct the disposition, or shared power to dispose or to direct the disposition are set forth on rows 7 through 11

and row 13 of the cover pages of this Schedule 13D and are incorporated herein by reference.

The amounts reported herein reflect the number of Common

Units held by funds and accounts managed by HFA as of March 20, 2018. None of the Blackstone Persons directly owns any Common Units.

Harvest Fund

Holdco L.P. is the sole member of HFA. Blackstone Harvest Holdco L.L.C. is the general partner of Harvest Fund Holdco L.P. Blackstone Intermediary Holdco L.L.C. is the sole member of Blackstone Harvest Holdco L.L.C. Blackstone Advisory Partners L.P.

is the sole member of Blackstone Intermediary Holdco L.L.C. Blackstone Advisory Services L.L.C. is the general partner of Blackstone Advisory Partners L.P. Blackstone Holdings I L.P. is the sole member of Blackstone Advisory Services L.L.C.

Blackstone Holdings I/II GP Inc. is the general partner of Blackstone Holdings I L.P. The Blackstone Group L.P. is the controlling shareholder of Blackstone Holdings I/II GP Inc. The general partner of The Blackstone Group L.P. is Blackstone Group

Management L.L.C. Blackstone Group Management L.L.C. is wholly-owned by Blackstone’s senior managing directors and controlled by its founder, Stephen A. Schwarzman.

HFA, an investment adviser registered under the Investment Advisers Act of 1940, as amended, advises funds and accounts. In such capacity, HFA has voting

authority and dispositive discretion over the securities of the Issuer described in this Schedule 13D that are owned by the funds and accounts advised by it. Except for the purpose of determining beneficial ownership under Section 13(d) of the

Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), HFA and the other Reporting Persons each disclaims beneficial ownership of all securities reported as beneficially owned by HFA in this Schedule 13D. None of the

Reporting Persons has any pecuniary interest in the securities reported as beneficially owned by HFA in this Schedule 13D, as such term is used for purposes of Section 16 of the Exchange Act. Neither the filing of this Schedule 13D nor any of

its contents shall be deemed to constitute an admission that any of the Reporting Persons is the beneficial owner of the securities referred to herein for purposes of Section 13(d) or Section 16 of the Exchange Act or for any other

purpose.

Item 5(c) of the Schedule 13D is hereby amended and restated as follows:

(c) Except as set forth in Schedule 1 of this Amendment No. 1, none of the Reporting Persons has effected any transaction in Common Units in the 60 days

prior to this filing.

Item 6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is hereby amended and restated as follows:

As of March 20, 2018, an account managed by HFA has entered into notional principal amount derivative agreements (the “

Derivative

Agreements

”) in the form of cash settled swaps with respect to 409,995 Common Units (representing economic exposure to approximately 1.3% of the Common Units). The Derivative Agreements provide such holder with economic results that are

comparable to the economic results of ownership but do not provide it with the power to vote or direct the voting or dispose of or direct the disposition of the Common Units that are the subject of the Derivative Agreements (such units, the

“

Subject Units

”). The Reporting Persons disclaim beneficial ownership in the Subject Units. The counterparties to the Derivative Agreements are unaffiliated third party financial institutions.

SIGNATURES

After reasonable inquiry and to the best of its or his knowledge and belief, each of the undersigned certifies that the information set forth in this

statement is true, complete and correct.

Dated: March 23, 2018

|

|

|

|

|

|

|

|

|

|

|

HARVEST FUND ADVISORS LLC

|

|

|

|

|

|

|

|

|

|

By:

/s/ Anthony Merhige

|

|

|

|

|

|

Name: Anthony Merhige

|

|

|

|

|

|

Title: Senior Managing Director

|

|

|

|

|

|

|

|

|

|

HARVEST FUND HOLDCO L.P.

|

|

|

|

|

|

By: Blackstone Harvest Holdco L.L.C., its General Partner

|

|

|

|

|

|

|

|

|

|

By:

/s/ Marisa Beeney

|

|

|

|

|

|

Name: Marisa Beeney

|

|

|

|

|

|

Title: Authorized Person

|

|

|

|

|

|

|

|

|

|

BLACKSTONE HARVEST HOLDCO L.L.C.

|

|

|

|

|

|

By: Blackstone Intermediary Holdco L.L.C., its Sole Member

|

|

|

|

|

|

By: Blackstone Advisory Partners L.P., its Sole Member

|

|

|

|

|

|

By: Blackstone Advisory Services L.L.C., its General Partner

|

|

|

|

|

|

By: Blackstone Holdings I L.P., its Sole Member

|

|

|

|

|

|

By: Blackstone Holdings I/II GP Inc., its General Partner

|

|

|

|

|

|

|

|

|

|

By:

/s/ John G. Finley

|

|

|

|

|

|

Name: John G. Finley

|

|

|

|

|

|

Title: Chief Legal Officer

|

|

|

|

|

|

|

|

|

|

BLACKSTONE INTERMEDIARY HOLDCO L.L.C.

|

|

|

|

|

|

By: Blackstone Advisory Partners L.P., its Sole Member

|

|

|

|

|

|

By: Blackstone Advisory Services L.L.C., its General Partner

|

|

|

|

|

|

By: Blackstone Holdings I L.P., its Sole Member

|

|

|

|

|

|

By: Blackstone Holdings I/II GP Inc., its General Partner

|

|

|

|

|

|

|

|

|

|

By:

/s/ John G. Finley

|

|

|

|

|

|

Name: John G. Finley

|

|

|

|

|

|

Title: Chief Legal Officer

|

|

|

|

|

|

|

|

|

|

BLACKSTONE ADVISORY PARTNERS L.P.

|

|

|

|

|

|

By: Blackstone Advisory Services L.L.C., its General Partner

|

|

|

|

|

|

By: Blackstone Holdings I L.P., its Sole Member

|

|

|

|

|

|

By: Blackstone Holdings I/II GP Inc., its General Partner

|

|

|

|

|

|

|

|

|

|

By:

/s/ John G. Finley

|

|

|

|

|

|

Name: John G. Finley

|

|

|

|

|

|

Title: Chief Legal Officer

|

[Westlake Chemical Partners LP – Schedule 13D/A]

|

|

|

|

|

|

|

|

|

|

|

BLACKSTONE ADVISORY SERVICES L.L.C.

|

|

|

|

|

|

By: Blackstone Holdings I L.P., its Sole Member

|

|

|

|

|

|

By: Blackstone Holdings I/II GP Inc., its General Partner

|

|

|

|

|

|

|

|

|

|

By:

/s/ John G. Finley

|

|

|

|

|

|

Name: John G. Finley

|

|

|

|

|

|

Title: Chief Legal Officer

|

|

|

|

|

|

|

|

|

|

BLACKSTONE HOLDINGS I L.P.

|

|

|

|

|

|

By: Blackstone Holdings I/II GP Inc., its General Partner

|

|

|

|

|

|

|

|

|

|

By:

/s/ John G.

Finley

|

|

|

|

|

|

Name: John G. Finley

|

|

|

|

|

|

Title: Chief Legal Officer

|

|

|

|

|

|

|

|

|

|

BLACKSTONE HOLDINGS I/II GP INC.

|

|

|

|

|

|

|

|

|

|

By:

/s/ John G.

Finley

|

|

|

|

|

|

Name: John G. Finley

|

|

|

|

|

|

Title: Chief Legal Officer

|

|

|

|

|

|

|

|

|

|

THE BLACKSTONE GROUP L.P.

|

|

|

|

|

|

By: Blackstone Group Management L.L.C., its General Partner

|

|

|

|

|

|

|

|

|

|

By:

/s/ John G.

Finley

|

|

|

|

|

|

Name: John G. Finley

|

|

|

|

|

|

Title: Chief Legal Officer

|

|

|

|

|

|

|

|

|

|

BLACKSTONE GROUP MANAGEMENT L.L.C.

|

|

|

|

|

|

|

|

|

|

By:

/s/ John G.

Finley

|

|

|

|

|

|

Name: John G. Finley

|

|

|

|

|

|

Title: Chief Legal Officer

|

|

|

|

|

|

|

|

|

|

/s/ Stephen A. Schwarzman

|

|

|

|

|

|

Stephen A. Schwarzman

|

[Westlake Chemical Partners LP – Schedule 13D/A]

SCHEDULE 1

As of March 20, 2018, the below reflects the transactions in Common Units effected by the Reporting Persons during the past 60 days. All transactions

occurred in the open market.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date

|

|

Common Units

Purchased/(Sold)

|

|

|

Weighted Average

Trading Price per

Common Unit

|

|

|

Seller/Purchaser

|

|

1/19/2018

|

|

|

(2,500.00

|

)

|

|

$

|

24.4250

|

|

|

Harvest Fund Advisors LLC*

|

|

1/22/2018

|

|

|

(8,700.00

|

)

|

|

$

|

24.6506

|

|

|

Harvest Fund Advisors LLC*

|

|

1/23/2018

|

|

|

2,545.00

|

|

|

$

|

24.6250

|

|

|

Harvest Fund Advisors LLC*

|

|

1/23/2018

|

|

|

5,833.00

|

|

|

$

|

24.6500

|

|

|

Harvest Fund Advisors LLC*

|

|

1/23/2018

|

|

|

(2,545.00

|

)

|

|

$

|

24.6250

|

|

|

Harvest Fund Advisors LLC*

|

|

1/23/2018

|

|

|

(5,833.00

|

)

|

|

$

|

24.6500

|

|

|

Harvest Fund Advisors LLC*

|

|

1/24/2018

|

|

|

(200.00

|

)

|

|

$

|

24.6500

|

|

|

Harvest Fund Advisors LLC*

|

|

1/25/2018

|

|

|

(6,600.00

|

)

|

|

$

|

24.6061

|

|

|

Harvest Fund Advisors LLC*

|

|

1/30/2018

|

|

|

(15,459.00

|

)

|

|

$

|

24.0023

|

|

|

Harvest Fund Advisors LLC*

|

|

2/1/2018

|

|

|

(10,700.00

|

)

|

|

$

|

24.3000

|

|

|

Harvest Fund Advisors LLC*

|

|

2/15/2018

|

|

|

(827.00

|

)

|

|

$

|

23.5060

|

|

|

Harvest Fund Advisors LLC*

|

|

2/26/2018

|

|

|

2,814.00

|

|

|

$

|

23.5500

|

|

|

Harvest Fund Advisors LLC*

|

|

2/26/2018

|

|

|

(2,814.00

|

)

|

|

$

|

23.5500

|

|

|

Harvest Fund Advisors LLC*

|

|

2/27/2018

|

|

|

8,210.00

|

|

|

$

|

23.9000

|

|

|

Harvest Fund Advisors LLC*

|

|

2/27/2018

|

|

|

(8,210.00

|

)

|

|

$

|

23.9000

|

|

|

Harvest Fund Advisors LLC*

|

|

3/2/2018

|

|

|

(3,025.00

|

)

|

|

$

|

22.9215

|

|

|

Harvest Fund Advisors LLC*

|

|

3/5/2018

|

|

|

(28,815.00

|

)

|

|

$

|

23.0643

|

|

|

Harvest Fund Advisors LLC*

|

|

3/6/2018

|

|

|

(29,180.00

|

)

|

|

$

|

23.2077

|

|

|

Harvest Fund Advisors LLC*

|

|

3/7/2018

|

|

|

(900.00

|

)

|

|

$

|

23.2556

|

|

|

Harvest Fund Advisors LLC*

|

|

3/12/2018

|

|

|

(1,200.00

|

)

|

|

$

|

23.1354

|

|

|

Harvest Fund Advisors LLC*

|

|

3/13/2018

|

|

|

(13,500.00

|

)

|

|

$

|

22.9500

|

|

|

Harvest Fund Advisors LLC*

|

|

3/14/2018

|

|

|

(2,665.00

|

)

|

|

$

|

23.1137

|

|

|

Harvest Fund Advisors LLC*

|

|

3/16/2018

|

|

|

128.00

|

|

|

$

|

22.8750

|

|

|

Harvest Fund Advisors LLC*

|

|

3/16/2018

|

|

|

(128.00

|

)

|

|

$

|

22.8750

|

|

|

Harvest Fund Advisors LLC*

|

|

3/19/2018

|

|

|

(13,000.00

|

)

|

|

$

|

23.2000

|

|

|

Harvest Fund Advisors LLC*

|

|

*

|

Reflects transactions in the Common Units effected by Harvest Fund Advisors LLC on behalf of the funds and accounts it manages.

|

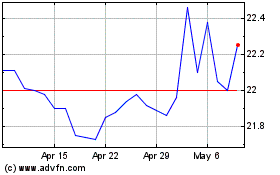

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Oct 2024 to Nov 2024

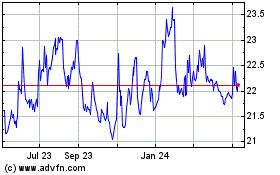

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Nov 2023 to Nov 2024