UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 28, 2022

VMWARE, INC.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-33622 |

|

94-3292913 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

|

|

|

| 3401 Hillview Avenue

Palo Alto, CA |

|

94304 |

| (Address of principal executive offices) |

|

(Zip Code) |

(650) 427-5000

Registrant’s telephone number, including area code

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A common stock |

|

VMW |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On October 3, 2022, VMware, Inc., a Delaware corporation (the “Company” or “VMware”), filed with the Securities and Exchange

Commission (the “SEC”) a definitive proxy statement/prospectus (the “Definitive Proxy Statement/Prospectus”) with respect to the special meeting of the VMware stockholders scheduled to be held on November 4, 2022 to, among

other things, vote on a proposal to approve the previously announced acquisition of VMware by Broadcom Inc., a Delaware corporation (“Broadcom”), pursuant to that certain Agreement and Plan of Merger, dated as of May 26, 2022 (such

agreement, as it may be amended from time to time, the “Merger Agreement”), by and among VMware, Broadcom, Verona Holdco, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“Holdco”), Verona Merger Sub,

Inc., a Delaware corporation and a wholly owned subsidiary of Holdco (“Merger Sub 1”), Barcelona Merger Sub 2, Inc., a Delaware corporation and a wholly owned subsidiary of Broadcom (“Merger Sub 2”), and Barcelona Merger Sub 3,

LLC, a Delaware limited liability company and a direct wholly owned subsidiary of Broadcom (“Merger Sub 3”), pursuant to which, upon the terms and subject to the conditions of the Merger Agreement, (i) Merger Sub 1 will be merged with

and into the Company (the “First Merger”), with the Company continuing as the surviving corporation in the First Merger (the “Surviving Corporation”) and becoming a wholly owned subsidiary of Holdco; (ii) following the First

Merger, the Surviving Corporation will be converted from a Delaware corporation into a Delaware limited liability company (the “Conversion”); (iii) following the Conversion, Merger Sub 2 will be merged with and into Holdco (the

“Second Merger”), with Holdco continuing as the surviving company (the “Holdco Surviving Company”) and becoming a wholly owned subsidiary of Broadcom; and (iv) following the Second Merger, the Holdco Surviving Company will

be merged with and into Merger Sub 3 (the “Third Merger,” and together with the First Merger, the Conversion and the Second Merger, the “Transactions”), with Merger Sub 3 continuing as the surviving limited liability company and

as a wholly owned subsidiary of Broadcom. The registration statement on Form S-4 filed with the SEC by Broadcom on July 14, 2022, which included a proxy statement/prospectus with respect to the special

meeting of the VMware stockholders, was declared effective by the SEC on October 3, 2022.

As previously disclosed in the Definitive Proxy

Statement/Prospectus, five complaints have been filed as individual actions in the United States District Court for the Southern District of New York and one complaint has been filed as an individual action in the United States District Court for

the Northern District of California. The complaints are captioned as follows: (1) Stein v. VMware, Inc., et al., 22-cv-06307 (filed July 25, 2022); (2)

O’Dell v. VMware, Inc., et al., 22-cv-06352 (filed July 26, 2022); (3) Whitfield v. VMware, Inc., et al., 22-cv-06527 (filed August 1, 2022); (4) Waterman v. VMware, Inc., et al., 22-cv-06533 (filed August 2, 2022);

(5) Laufer v. VMware, Inc., et al., 22-cv-5146 (filed September 9, 2022); and (6) Chapman v. VMware, Inc., et al.,

22-cv-7735 (filed September 11, 2022) (collectively, the “Prior Complaints”). Additionally, on October 6, 2022, a lawsuit entitled Garfield v.

Nicole Anasenes, et al., 22-CIV-04118, was filed in the Superior Court of the State of California in and for the County of San Mateo (the “Garfield

Complaint”), and on October 19, 2022, a lawsuit entitled Scott v. VMware, Inc., et al., 22-cv-01372, was filed in the United States District Court for

the District of Delaware (the “Scott Complaint,” and together with the Garfield Complaint and the Prior Complaints, the “Complaints”). The Complaints generally allege that the proxy statement/prospectus misrepresents and/or omits

certain purportedly material information. The Complaints assert violations of Sections 14(a) and 20(a) of the Exchange Act and Rule 14a-9 promulgated thereunder, or similar statutory and common law claims

under California law, against VMware and the members of the VMware board of directors. The Garfield Complaint also names Broadcom as a defendant. The Complaints seek, among other things: an injunction enjoining the consummation of the transactions;

direction that a registration statement is disseminated, including certain additional information, rescission or rescissory damages in the event the transactions are consummated; declaration that defendants violated Section 14(a) and/or 20(a)

of the Exchange Act, as well as SEC Rule 14a-9 promulgated thereunder; direction that defendants account for all damages suffered as a result of any misconduct; costs of the action, including plaintiffs’

attorneys’ fees and experts’ fees; and other relief the court may deem just and proper. In addition to the Complaints, beginning on July 20, 2022, certain purported stockholders of VMware sent demand letters (the “Demands”,

and together with the Complaints, the “Matters”) alleging similar deficiencies regarding the disclosures made in the Definitive Proxy Statement/Prospectus, and seeking additional disclosures to address those purported deficiencies.

While VMware believes that the disclosures set forth in the Definitive Proxy Statement/Prospectus comply fully with all applicable law and denies the

allegations in the Matters described above, in order to moot the plaintiffs’ disclosure claims, avoid nuisance and possible expense and business delays, and provide additional information to its stockholders, VMware has determined voluntarily

to supplement certain disclosures in the Definitive Proxy

- 2 -

Statement/Prospectus related to the plaintiffs’ claims with the supplemental disclosures set forth below (the “Supplemental Disclosures”). These Supplemental Disclosures should be

read in conjunction with the rest of the Definitive Proxy Statement/Prospectus, which is available at the SEC’s website, www.sec.gov, and which VMware urges you to read in its entirety. Nothing in the Supplemental Disclosures shall be deemed an

admission of the legal merit, necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary, VMware and the other named defendants specifically deny all allegations in the complaints, including the

allegations that any additional disclosure was or is required or material.

To the extent that the information set forth herein differs from or updates

information contained in the Definitive Proxy Statement/Prospectus, the information set forth herein shall supersede or supplement the information in the Definitive Proxy Statement/Prospectus. All references to sections and subsections herein are

references to the corresponding sections or subsections in the Definitive Proxy Statement/Prospectus, all page references are to pages in the Definitive Proxy Statement/Prospectus, and terms used herein, unless otherwise defined, have the meanings

set forth in the Definitive Proxy Statement/Prospectus. Unless stated otherwise, the new text in the Supplemental Disclosures is in boldface and underlined to highlight the supplemental information being disclosed.

SUPPLEMENT TO THE DEFINITIVE PROXY STATEMENT/PROSPECTUS

| |

1. |

The disclosure under the heading “The Transactions—Background of the Transactions” is

hereby amended and supplemented by including the text below to the final paragraph that begins on page 53 of the Definitive Proxy Statement/Prospectus (with the boldface text below indicating additional language): |

On May 21, 2022, the VMware board of directors met with representatives of VMware management, J.P. Morgan, Goldman Sachs, Gibson Dunn and

Silver Lake. At this meeting, the VMware board of directors was provided with financial information relating to VMware and Broadcom, including a discussion of the VMware fiscal first quarter earnings report which would report revenue of

approximately $3.088 billion as compared to Wall Street consensus estimates of $3.186 billion, earnings before interest and taxes of $771 million as compared to Wall Street consensus estimates of $861 million and earnings per

share of $1.28 as compared to Wall Street consensus estimates of $1.56 and the Broadcom fiscal second quarter earnings report which would report revenue of approximately $8.103 billion as compared to Wall Street consensus estimates of

$7.914 billion, earnings before interest, taxes, depreciation and amortization of $5.111 billion as compared to Wall Street consensus estimates of $4.971 billion and earnings per share of $9.07 as compared to Wall Street consensus

estimates of $8.73. The VMware board of directors was also provided by the representatives of VMware management the VMware management financial projections. Following discussion, the VMware board of directors approved the use of the VMware

management financial projections by J.P. Morgan and Goldman Sachs for purposes of performing their respective financial analyses in connection with their respective fairness opinions to the VMware board of directors (as more fully described in the

sections titled “—Opinion of J.P. Morgan” and “—Opinion of Goldman Sachs”). Representatives of J.P. Morgan and Goldman Sachs also provided an updated summary of the implied metrics of Broadcom’s proposal based on

recent stock price fluctuations and certain preliminary financial matters relating to VMware based on the VMware management financial projections. The VMware board of directors then discussed a potential counterproposal to Broadcom, including

(i) an increase in headline price from $142.50 to $150 per share, (ii) an increase in exchange ratio from 0.242 to 0.2602, (iii) an increase in the cap on the amount of stock consideration to be issued by Broadcom to VMware stockholders in

the proposed transaction from 50% to 60%, (iv) a heightened regulatory-efforts standard, (v) an extended outside date timeline from 15 months to 18 months, (vi) a reverse termination fee payable by Broadcom equal to 2.5% of VMware’s

implied equity value giving effect to the proposed transaction and (vii) an extended go-shop period from 35 days to 40 days, with an additional 15-day window where

the lower termination fee of $500 million would be payable by VMware to Broadcom if VMware accepted a superior proposal, with a termination fee payable by VMware following such extended period equal to 2.5% of VMware’s implied equity

value. The counterproposal also removed as a condition to closing Broadcom’s receipt of a tax opinion with respect to the tax treatment of the transaction and revised Broadcom’s continuing director proposal to provide that

VMware’s designee to the Broadcom board of directors would be a mutually agreed person that need not be a current director on the VMware board of directors. The VMware board of directors authorized Mr. Durban to provide and

negotiate the counterproposal with Mr. Tan.

- 3 -

| |

2. |

The disclosure under the heading “The Transactions—Background of the Transactions” is

hereby amended and supplemented by including the text below to the second paragraph that begins on page 55 of the Definitive Proxy Statement/Prospectus (with the boldface text below indicating additional language): |

On May 24, 2022, the VMware board of directors met with representatives of VMware management, J.P. Morgan, Goldman Sachs, Gibson Dunn,

Silver Lake and Axinn, Veltrop & Harkrider LLP (referred to as Axinn), co-counsel to VMware regarding regulatory matters. Representatives of J.P. Morgan and Goldman Sachs reviewed with the VMware

board of directors the potential go-shop process, including potential counterparties to contact, including certain key metrics for each party and the potential strategic rationale for a potential combination

and potential considerations each potential party may have regarding a potential transaction. Mr. Rangarajan (Raghu) Raghuram, Chief Executive Officer of VMware, noted that a senior executive of a large publicly traded corporation (referred to

as Party B) had reached out following the news reports regarding a potential Broadcom transaction and expressed interest in a potential transaction. Mr. Dell noted that he had interacted with another senior executive of Party B in Davos the day

prior and such executive did not mention anything regarding a potential transaction. The VMware board of directors discussed the terms of a revised draft merger agreement to be transmitted to Broadcom, including (i) reinserting the reverse

termination fee payable by Broadcom in the amount of $1.8 billion, which was the same amount as the post-go-shop termination fee payable by VMware,

(ii) revising the go-shop termination fee payable by VMware to $700 million, which was between VMware’s initial $500 million go-shop termination fee

proposal and Broadcom’s $900 million counterproposal and (iii) accepting that Broadcom would not be required to make regulatory divestitures if such divested asset, product or business was not included in the Broadcom Software Group.

Representatives of Gibson Dunn also discussed VMware’s and Broadcom’s representations, warranties and interim operating covenants and other terms, including revising Broadcom’s continuing director proposal to provide that

VMware’s designee to the Broadcom board of directors would be a mutually agreed person that need not be a current director on the VMware board of directors.

| |

3. |

The disclosure under the heading “The Transactions—Background of the Transactions” is

hereby amended and supplemented by including the text below to the final paragraph that begins on page 56 of the Definitive Proxy Statement/Prospectus (with the boldface text below indicating additional language): |

Later on May 26, 2022, in accordance with the go-shop provisions in the merger agreement, at the

direction of the VMware board of directors, representatives of J.P. Morgan and Goldman Sachs began contacting parties about their interest in participating in the go-shop process. During the go-shop period, representatives of J.P. Morgan and Goldman Sachs contacted 10 potential strategic acquirors (including Party A and Party B). Of such contacted parties, two potential strategic acquirors executed

acceptable confidentiality agreements. Neither of such confidentiality agreements contained a standstill provision. During the go-shop period, VMware provided confidential information in

response to due diligence inquiries made by these two potential strategic acquirors. At 11:59 p.m. Pacific time on July 5, 2022, the go-shop period expired without any party submitting a proposal to

acquire VMware.

| |

4. |

The disclosure under the heading “The Transactions—Opinions of VMware’s Financial

Advisors—Opinion of Goldman Sachs” is hereby amended and supplemented by including the text below to the first paragraph under the title “Illustrative Discounted Cash Flow Analysis” on page 68 of the Definitive Proxy

Statement/Prospectus (with the boldface text below indicating additional language and deletions are indicated by strikethrough): |

Using the VMware management financial projections, Goldman Sachs performed an illustrative discounted cash flow analysis on VMware to derive a

range of illustrative present values per share of VMware common stock. Using the mid-year convention for discounting cash flows and discount rates ranging from 7.5% to 8.5%, reflecting estimates of

VMware’s weighted average cost of capital, Goldman Sachs discounted to present value as of April 29, 2022 (i) estimates of unlevered free cash flow for VMware, as arithmetically calculated by Goldman Sachs solely using information provided

in the VMware management financial projections and approved by VMware’s management for use by Goldman Sachs for purposes of its opinion

- 4 -

and financial analyses and referred to as “Unlevered Free Cash Flow (Less Stock-Based Compensation Expenses)” in the section titled “The Merger—Certain Financial Projections

Utilized by the VMware Board of Directors and VMware’s Financial Advisors,” for the nine months ended January 28, 2023 and fiscal years 2024 through 2027 and (ii) a range of illustrative terminal values for VMware, which were

calculated by applying illustrative perpetuity growth rates ranging from 2.0% to 3.0% to a terminal year estimate of the unlevered free cash flow to be generated by VMware of $3.7 billion, as arithmetically

calculated by Goldman Sachs solely using information provided in the VMware management financial projections

| |

5. |

The disclosure under the heading “The Transactions—Opinions of VMware’s Financial

Advisors—Opinion of Goldman Sachs” is hereby amended and supplemented by including the text below to the last paragraph under the title “Illustrative Discounted Cash Flow Analysis” on page 68 of the Definitive Proxy

Statement/Prospectus (with the boldface text below indicating additional language and deletions are indicated by strikethrough): |

Goldman Sachs derived a range of illustrative enterprise values for VMware by adding the ranges of present values it derived as described

above. Goldman Sachs then subtracted from the range of illustrative enterprise values it derived for VMware the amount of VMware’s total debt of $12.0 billion and added the amount of VMware’s

cash and cash equivalents of $3.7 billion and strategic investments of $0.2 billion as of April 29, 2022, as provided by VMware management and

approved for Goldman Sachs’ use by VMware management, to derive a range of illustrative equity values for VMware. Goldman Sachs then divided the range of illustrative equity values it derived by the numbers a

range of 441.8 million to 441.9 million fully diluted outstanding shares of VMware as of the Undisturbed Date, as provided by VMware management and approved for

Goldman Sachs’ use by VMware management, to derive a range of illustrative present values per share of VMware common stock, rounded to the nearest $0.10, of $100.80 to $148.90.

| |

6. |

The disclosure under the heading “The Transactions—Opinions of VMware’s Financial

Advisors—Opinion of Goldman Sachs” is hereby amended and supplemented by including the text below to the first sentence of the last paragraph under the title “Illustrative Present Value of Future Share Price Analysis”

on page 69 of the Definitive Proxy Statement/Prospectus (with the boldface text below indicating additional language and deletions are indicated by strikethrough): |

Goldman Sachs then subtracted the amount of VMware’s net debt (calculated as total debt and added the amount of

VMware’s less cash and cash equivalents and strategic investments) of $5.5 billion, $1.9 billion and $(1.9) billion as of January 31,

2023, 2024 and 2025, respectively, each as provided by management of VMware and approved for Goldman Sachs’ use by VMware management, to the range of implied enterprise values to derive a range of illustrative equity values as of

January 31, 2023, 2024 and 2025. Goldman Sachs then divided these implied equity values by the ranges of 445.5 million to 445.6 million,

446.2 million to 446.2 million and 447.2 million to 447.2 million projected fully diluted outstanding shares

of VMware, as provided by VMware management and approved for Goldman Sachs’ use by VMware management, as of January 31, 2023, 2024 and 2025, respectively, to derive a range of implied future equity values per share of VMware

common stock.

| |

7. |

The disclosure under the heading “The Transactions—Opinions of VMware’s Financial

Advisors—Opinion of Goldman Sachs” is hereby amended and supplemented by including the text below to the last two sentences of the last paragraph under the title “Selected Precedent Transactions Analysis” on page 70 of

the Definitive Proxy Statement/Prospectus (with the boldface text below indicating additional language and deletions are indicated by strikethrough): |

Goldman Sachs then subtracted from the range of implied enterprise values the amount of VMware’s total debt of

$12.0 billion and added the amount of VMware’s cash and cash equivalents of $3.7 billion and strategic investments of

$0.2 billion as of April 29, 2022, as provided by VMware management and approved for Goldman Sachs’ use by VMware management, to derive a range of illustrative equity values for VMware.

- 5 -

Goldman Sachs divided the range of illustrative equity values by the number a range of 441.8 million to

441.9 million fully diluted outstanding shares of VMware as of the Undisturbed Date, as provided by management of VMware and approved for Goldman Sachs’ use by management of VMware, to derive a range of

implied values per share of VMware common stock, rounded to the nearest $0.10, of $99.10 to $132.90.

| |

8. |

The disclosure under the heading “The Transactions—Opinions of VMware’s Financial

Advisors—Opinion of J.P. Morgan—VMware Analysis” is hereby amended by replacing last sentence of the paragraph and the table immediately following the paragraph that begins on page 75 of the Definitive Proxy Statement/Prospectus

under the heading “Public Trading Multiples Analysis” with the following: |

With respect to the selected

companies, J.P. Morgan calculated the ratio of firm value to unlevered free cash flow for the calendar year 2023 for each company based on publicly available financial information and Wall Street estimates per FactSet Research Systems as of

May 24, 2022 (referred to as FV / uFCF CY23E). For VMware, the companies selected by J.P. Morgan were The results of this analysis are indicated in the following table:

|

|

|

| Selected Company |

|

FV / uFCF CY23E |

| Cisco Systems, Inc. |

|

10.5x |

| International Business Machines Corporation |

|

12.2x |

| Microsoft Corporation |

|

22.9x |

| Oracle Corporation |

|

17.0x |

| SAP SE |

|

18.0x |

| VMware, Inc.(1) |

|

10.8x |

| (1) |

Based on unaffected closing share price as of the Undisturbed Date. |

| |

9. |

The disclosure under the heading “The Transactions—Opinions of VMware’s Financial

Advisors—Opinion of J.P. Morgan—VMware Analysis” is hereby amended by replacing the table immediately following the paragraph that begins on page 76 of the Definitive Proxy Statement/Prospectus under the heading “Selected

Transaction Multiples Analysis” with the following: |

|

|

|

|

|

|

|

| Announcement Date |

|

Acquiror |

|

Target |

|

FV / NTM EBITDA |

| January 2022 |

|

Elliott Investment Management L.P. and Vista Equity Partners Management, LLC |

|

Citrix Systems, Inc. |

|

14.1x |

|

|

|

|

| December 2021 |

|

Oracle Corporation |

|

Cerner Corporation |

|

14.3x |

|

|

|

|

| March 2021 |

|

Symphony Technology Group, LLC |

|

McAfee Corp. (Enterprise Segment) |

|

11.9x |

|

|

|

|

| August 2019 |

|

Broadcom Inc. |

|

Symantec Corporation (Enterprise Security Segment) |

|

8.2x |

|

|

|

|

| July 2018 |

|

Broadcom Inc. |

|

CA, Inc. |

|

11.1x |

|

|

|

|

| October 2015 |

|

Silver Lake Group, L.L.C. and Thoma Bravo, LLC |

|

SolarWinds, Inc. |

|

16.1x |

- 6 -

|

|

|

|

|

|

|

| April 2015 |

|

Canada Pension Plan Investment Board and Permira Advisers LLC |

|

Informatica Corporation |

|

17.9x |

|

|

|

|

| December 2014 |

|

Ontario Teachers’ Pension Plan and Thoma Bravo, LLC |

|

Riverbed Technology, Inc |

|

11.2x |

|

|

|

|

| September 2014 |

|

Thoma Bravo, LLC |

|

Compuware Corporation |

|

10.3x |

| |

10. |

The disclosure under the heading “The Transactions—Opinions of VMware’s Financial

Advisors—Opinion of J.P. Morgan—VMware Analysis” is hereby amended and supplemented by revising the second paragraph under the title “Discounted Cash Flow Analysis” on page 77 of the Definitive Proxy

Statement/Prospectus as follows (with the boldface text below indicating additional language): |

J.P. Morgan calculated

the unlevered free cash flows that VMware is expected to generate during the remainder of fiscal year 2023 through fiscal year 2027 based upon the VMware management financial projections. Based on VMware management’s estimates of a 2.5%

terminal value growth rate in the industry in which VMware operates, J.P. Morgan also calculated a range of terminal values for VMware by applying terminal growth rates ranging from 2.0% to 3.0% to the unlevered free cash flows of VMware at the end

of fiscal year 2027. The unlevered free cash flows and the range of terminal values were then discounted to present values using a range of discount rates from 7.5% to 8.5%, which were chosen by J.P. Morgan based upon an analysis of the weighted

average cost of capital of VMware, taking into account macro-economic assumptions, estimates of risk, VMware’s capital structure and other appropriate factors. The present value of the unlevered free cash flows and the range of

terminal values were then adjusted for the net debt balance of VMware (approximately $8 billion) and divided by VMware’s fully diluted shares outstanding (calculated using the treasury stock method). Based on the results of this

analysis, J.P. Morgan arrived at a range of implied equity values per share of VMware common stock, rounded to the nearest $0.25, of $109.00 to $159.25, which was compared to the unaffected closing price per share of VMware common stock of $95.71 on

the Undisturbed Date and the Blended Offer Price.

| |

11. |

The disclosure under the heading “The Transactions—Opinions of VMware’s Financial

Advisors—Opinion of J.P. Morgan—Broadcom Analysis” is hereby amended by replacing the last sentence of the paragraph and the table immediately following the paragraph that begins on page 78 of the Definitive Proxy

Statement/Prospectus under the heading “Public Trading Multiples Analysis” with the following: |

With

respect to the selected companies, J.P. Morgan calculated the ratio of closing share price to earnings per share for the calendar year 2023 for each company based on publicly available financial information and Wall Street estimates per FactSet

Research Systems as of May 24, 2022, which is referred to as P/E CY23E. For Broadcom, the companies selected by J.P. Morgan were The results of this analysis are indicated in the following table:

|

|

|

| Selected Company |

|

P/E CY23E |

| Broadcom Inc. (1) |

|

13.8x |

|

|

| Semiconductor |

|

|

|

|

| Analog Devices, Inc. |

|

15.8x |

|

|

| Marvell Technology, Inc. |

|

18.4x |

|

|

| NXP Semiconductors NV |

|

12.4x |

|

|

| Texas Instruments Incorporated |

|

18.7x |

|

|

| Qualcomm, Inc. |

|

9.6x |

|

|

| Software |

|

|

|

|

| Check Point Software Technologies Ltd. |

|

15.5x |

- 7 -

|

|

|

|

|

| Cisco Systems, Inc. |

|

11.9x |

|

|

| F5, Inc. |

|

13.1x |

|

|

| International Business Machines Corporation |

|

12.9x |

|

|

| Oracle Corporation |

|

12.6x |

| (1) |

Based on unaffected closing share price as of the Undisturbed Date. |

| |

12. |

The disclosure under the heading “The Transactions—Opinions of VMware’s Financial

Advisors—Opinion of J.P. Morgan—Broadcom Analysis” is hereby amended and supplemented by revising the second paragraph under the title “Discounted Cash Flow Analysis” beginning on page 78 of the Definitive Proxy

Statement/Prospectus as follows (with the boldface text below indicating additional language): |

J.P. Morgan calculated

the unlevered free cash flows that Broadcom is expected to generate during the remainder of fiscal year 2022 through fiscal year 2026 based upon the VMware approved Broadcom financial projections. Based on VMware management’s estimates of a

2.5% terminal value growth rate in the industry in which Broadcom operates, J.P. Morgan also calculated a range of terminal values for Broadcom by applying terminal growth rates ranging from 2.0% to 3.0% to the unlevered free cash flows of Broadcom

at the end of fiscal year 2026. The unlevered free cash flows and the range of terminal values were then discounted to present values using a range of discount rates from 8.0% to 9.0%, which were chosen by J.P. Morgan based upon an analysis of the

weighted average cost of capital of Broadcom, taking into account macro-economic assumptions, estimates of risk, Broadcom’s capital structure and other appropriate factors. The present value of the unlevered free cash flows and

the range of terminal values were then adjusted for the net debt balance of Broadcom (approximately $32 billion) and divided by Broadcom’s fully diluted shares outstanding (calculated using the treasury stock method). Based on the

results of this analysis, J.P. Morgan arrived at a range of implied equity values per share of Broadcom common stock, rounded to the nearest $0.25, of $532.00 to $747.00, which was compared to the unaffected closing price per share of Broadcom

common stock of $543.19 on the Undisturbed Date (the last trading day prior to public rumors of a potential sale of VMware to Broadcom).

| |

13. |

The disclosure under the heading “The Transactions—Interests of VMware’s Directors and

Executive Officers in the Transactions—Treatment of VMware Equity Awards” is hereby amended and supplemented by including the text and tables below after the last paragraph on page 82 of the Definitive Proxy Statement/Prospectus (with

the boldface text below indicating additional language and deletions are indicated by strikethrough): |

Unvested VMware

restricted stock units (“RSUs”). The table below shows the number of unvested VMware restricted stock units (“Unvested RSUs”) held by each non-employee director as of October 17,

2022, the cash and Broadcom common stock consideration each non-employee director will receive with respect to such Unvested RSUs, and the estimated total value of such consideration based on the closing price

of Broadcom’s common stock on October 21, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Number of

Unvested

RSUs (#) |

|

|

Total Cash for

Unvested RSUs ($) |

|

|

Total Shares of

Broadcom Common

Stock for Unvested

RSUs (#)(1) |

|

|

Estimated Total

Value of

Consideration for

Unvested RSUs ($) |

|

| Nicole Anasenes |

|

|

1,707 |

|

|

$ |

121,623.75 |

|

|

|

215.082 |

|

|

$ |

218,352.58 |

|

| Anthony Bates |

|

|

1,707 |

|

|

$ |

121,623.75 |

|

|

|

215.082 |

|

|

$ |

218,352.58 |

|

| Marianne Brown |

|

|

1,707 |

|

|

$ |

121,623.75 |

|

|

|

215.082 |

|

|

$ |

218,352.58 |

|

| Michael Brown |

|

|

1,707 |

|

|

$ |

121,623.75 |

|

|

|

215.082 |

|

|

$ |

218,352.58 |

|

| Michael Dell |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Kenneth Denman |

|

|

1,707 |

|

|

$ |

121,623.75 |

|

|

|

215.082 |

|

|

$ |

218,352.58 |

|

| Egon Durban |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Karen Dykstra |

|

|

1,707 |

|

|

$ |

121,623.75 |

|

|

|

215.082 |

|

|

$ |

218,352.58 |

|

| Paul Sagan |

|

|

1,707 |

|

|

$ |

121,623.75 |

|

|

|

215.082 |

|

|

$ |

218,352.58 |

|

| (1) |

Fractional shares will be cashed out based on the closing price of Broadcom’s common stock on the last

trading day prior to the effective time. |

- 8 -

Deferred VMware RSUs and Shares Held. The table below shows the number of vested but

deferred VMware RSUs (“Deferred RSUs”) held by each non-employee director as of October 21, 2022, the number of shares of VMware common stock held by each

non-employee director as of October 21, 2022 (“VMware Shares”), the cash and Broadcom common stock consideration each non-employee director will receive

with respect to such Deferred RSUs and VMware Shares (assuming each non-employee director elects, with respect to each VMware Share, to receive 50% of their consideration in cash and 50% in shares of Broadcom

common stock), and the estimated total value of such consideration based on the closing price of Broadcom’s common stock on October 21, 2022. The settlement of Deferred RSUs (including any consideration received therefor) has been deferred

for up to 10 years from the date of grant (or an earlier “separation from service”) pursuant to deferral elections previously made by each such non-employee director.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Number

of

Deferred

RSUs (#) |

|

|

Number of

VMware

Shares (#) |

|

|

Total Cash for

Deferred RSUs and

VMware Shares ($) |

|

|

Total Shares of

Broadcom

Common Stock

for Deferred RSUs

and VMware

Shares

(#)(1) |

|

|

Estimated Total

Value of

Consideration for

Deferred RSUs and

VMware Shares ($) |

|

| Nicole Anasenes |

|

|

1,005 |

|

|

|

— |

|

|

$ |

71,606.25 |

|

|

|

126.630 |

|

|

$ |

128,555.56 |

|

| Anthony Bates |

|

|

— |

|

|

|

16,835 |

|

|

$ |

1,199,493.75 |

|

|

|

2,121.210 |

|

|

$ |

2,153,465.52 |

|

| Marianne Brown |

|

|

6,197 |

|

|

|

— |

|

|

$ |

441,536.25 |

|

|

|

780.822 |

|

|

$ |

792,695.33 |

|

| Michael Brown |

|

|

— |

|

|

|

22,837 |

|

|

$ |

1,627,136.25 |

|

|

|

2,877.462 |

|

|

$ |

2,921,217.24 |

|

| Michael Dell(2) |

|

|

— |

|

|

|

169,278,015 |

|

|

$ |

12,061,058,568.75 |

|

|

|

21,329,029.890 |

|

|

$ |

21,653,363,181.18 |

|

| Kenneth Denman |

|

|

3,732 |

|

|

|

— |

|

|

$ |

265,905.00 |

|

|

|

470.232 |

|

|

$ |

477,382.44 |

|

| Egon Durban(3) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Karen Dykstra |

|

|

4,177 |

|

|

|

13,705 |

|

|

$ |

1,274,092.50 |

|

|

|

2,253.132 |

|

|

$ |

2,287,393.55 |

|

| Paul Sagan |

|

|

— |

|

|

|

20,710 |

|

|

$ |

1,475,587.50 |

|

|

|

2,609.460 |

|

|

$ |

2,649,139.95 |

|

| (1) |

Fractional shares will be converted to cash based on the closing price of Broadcom’s common stock on the

last trading day prior to the effective time. |

| (2) |

Includes 155,005,746 shares of VMware common stock held by Mr. Dell and 14,272,269 shares of VMware common

stock beneficially owned by the Susan Lieberman Dell Separate Property Trust, as to which Mr. Dell disclaims beneficial ownership. |

| (3) |

Excludes shares held by Silver Lake Partners IV, L.P., Silver Lake Technology Investors IV, L.P., Silver Lake

Partners V DE (AIV), L.P., Silver Lake Technology Investors V, L.P., SL SPV-2, L.P. and Silver Lake Group, L.L.C. |

| |

14. |

The disclosure under the heading “The Transactions—Interests of VMware’s Directors and

Executive Officers in the Transactions—Board Seat on the Broadcom Board of Directors” is hereby amended and supplemented by including the text below to the paragraph on page 82 of the Definitive Proxy Statement/Prospectus (with the

boldface text below indicating additional language): |

Pursuant to the merger agreement, one member of the VMware board of

directors, to be mutually agreed by VMware and Broadcom, will be added to Broadcom’s board of directors. As of the date hereof, there is no agreement between VMware and Broadcom or among the VMware board of directors regarding who the

designee to the Broadcom board of directors will be or whether the Broadcom board seat will be filled by one of the members of the Transaction Committee, and there have not been any discussions related to the compensation that would be payable to

such director. However, VMware anticipates that such director will receive compensation equivalent to other non-employee directors on the Broadcom board of directors. In addition, other than discussions during

the negotiation of the Transaction Agreement, during which the VMware board of directors requested that VMware’s designee to the Broadcom board of directors would be a mutually agreed person that need not be a current director on the VMware

board of directors, there have been no discussions between VMware

- 9 -

and Broadcom or among the VMware board of directors regarding who the designee to the Broadcom board of directors will be or whether the Broadcom board seat will be filled by one of the

members of the Transaction Committee.

| |

15. |

The disclosure under the heading “The Transactions—Interests of VMware’s Directors and

Executive Officers in the Transactions—Potential Employment Arrangements with Broadcom” is hereby amended and supplemented by including the text below to the last sentence of the paragraph on page 83 of the Definitive Proxy

Statement/Prospectus (with the boldface text below indicating additional language): |

As of the date of this proxy

statement/prospectus, no new individualized compensation arrangements between VMware’s executive officers and Broadcom or Broadcom Merger Subs have been established, and no post-closing employment arrangements for members of VMware senior

management have been negotiated with, or secured by, Broadcom.

Cautionary Note Regarding Forward-Looking Statements

This communication relates to a proposed business combination transaction between Broadcom Inc. (“Broadcom”) and VMware, Inc.

(“VMware”). This communication includes forward-looking statements. These forward-looking statements include but are not limited to statements that relate to the expected future business and financial performance, the anticipated benefits

of the proposed transaction, the anticipated impact of the proposed transaction on the combined business, the expected amount and timing of the synergies from the proposed transaction, and the anticipated closing date of the proposed

transaction. These forward-looking statements are identified by words such as “will,” “expect,” “believe,” “anticipate,” “estimate,” “should,” “intend,” “plan,”

“potential,” “predict,” “project,” “aim,” and similar words or phrases. These forward-looking statements are based on current expectations and beliefs of Broadcom management and current market trends and

conditions.

These forward-looking statements involve risks and uncertainties that are outside Broadcom’s control and may cause actual

results to differ materially from those contained in forward-looking statements, including but not limited to: the effect of the proposed transaction on our ability to maintain relationships with customers, suppliers and other business partners or

operating results and business; the ability to implement plans, achieve forecasts and meet other expectations with respect to the business after the completion of the proposed transaction and realize expected synergies; business disruption following

the proposed transaction; difficulties in retaining and hiring key personnel and employees due to the proposed transaction and business combination; the diversion of management time on transaction-related issues; the satisfaction of the conditions

precedent to consummation of the proposed transaction, including the ability to secure regulatory approvals on the terms expected, at all or in a timely manner; significant indebtedness, including indebtedness incurred in connection with the

proposed transaction, and the need to generate sufficient cash flows to service and repay such debt; the disruption of current plans and operations; the outcome of legal proceedings related to the transaction; the ability to consummate the proposed

transaction on a timely basis or at all; the ability to successfully integrate VMware’s operations; the impact of public health crises, such as pandemics (including COVID-19) and epidemics and any related

company or government policies and actions to protect the health and safety of individuals or government policies or actions to maintain the functioning of national or global economies and markets; cyber-attacks, information security and data

privacy; global political and economic conditions, including rising interest rates, the impact of inflation and challenges in manufacturing and the global supply chain; and events and trends on a national, regional and global scale, including the

cyclicality in the semiconductor industry and other target markets and those of a political, economic, business, competitive and regulatory nature.

These risks, as well as other risks related to the proposed transaction, are included in the registration statement on Form S-4 and proxy statement/prospectus that has been filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. While the list of factors presented here is, and the

list of factors presented in the registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. For

additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to Broadcom’s and VMware’s respective periodic reports and other filings

with the SEC, including the risk factors identified in Broadcom’s and VMware’s most recent Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K.

The forward-looking statements included in this communication are made only as of the date hereof. Neither Broadcom nor VMware undertakes any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except

as required by law.

- 10 -

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any

securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction and Where to Find It

In connection with the proposed transaction, VMware has filed with SEC a definitive proxy statement and Broadcom has filed with the SEC a

registration statement on Form S-4 that includes a proxy statement of VMware and that also constitutes a prospectus of Broadcom. Each of Broadcom and VMware may also file other relevant documents with the SEC

regarding the proposed transaction. This document is not a substitute for the proxy statement/prospectus or registration statement or any other document that Broadcom or VMware may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ

THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the registration statement and proxy statement/prospectus and other documents containing important information about Broadcom, VMware and

the proposed transaction, through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Broadcom may be obtained free of charge on Broadcom’s website at https://investors.broadcom.com. Copies of

the documents filed with the SEC by VMware may be obtained free of charge on VMware’s website at ir.vmware.com.

Participants in

the Solicitation

Broadcom, VMware and certain of their respective directors and executive officers may be deemed to be participants in

the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Broadcom, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in

Broadcom’s proxy statement for its 2022 Annual Meeting of Stockholders, which was filed with the SEC on February 18, 2022, and Broadcom’s Annual Report on Form 10-K for the fiscal year ended

October 31, 2021, which was filed with the SEC on December 17, 2021. Information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, is

contained in VMware’s proxy statement for the special meeting regarding the proposed transaction filed on October 3, 2022. Investors should read the proxy statement/prospectus carefully before making any voting or investment decisions. You

may obtain free copies of these documents from Broadcom or VMware using the sources indicated above.

- 11 -

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Dated: October 28, 2022

|

|

|

| VMware, Inc. |

|

|

| By: |

|

/s/ Craig Norris |

|

|

Craig Norris |

|

|

Vice President, Deputy General Counsel and Assistant Secretary |

- 12 -

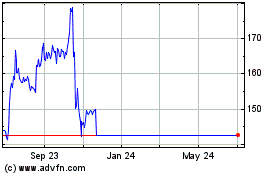

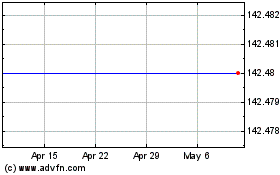

Vmware (NYSE:VMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vmware (NYSE:VMW)

Historical Stock Chart

From Apr 2023 to Apr 2024