SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 11-K

ANNUAL

REPORT

☒ ANNUAL

REPORT PURSUANT TO SECTION 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

☐ TRANSITION

REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transaction period from

to

Commission file number 1-36764

A. Full

title of the plan: UBS Financial Services Incorporated of Puerto Rico Savings

Plus Plan

B. Name of issuer of the securities held pursuant to the

plan and the address of its principal executive office:

UBS GROUP AG

Bahnhofstrasse 45

CH-8098, Zurich, Switzerland

UBS

FINANCIAL

SERVICES INCORPORATED OF

PUERTO RICO SAVINGS PLUS PLAN

Financial Statements and

Supplemental Schedule

As of December 31, 2021 and 2020

and

For the Year Ended December 31, 2021

With Report of Independent

Registered Public Accounting Firm

UBS

FINANCIAL SERVICES INCORPORATED OF

PUERTO

RICO SAVINGS PLUS PLAN

Financial Statements and Supplemental Schedule

December 31, 2021 and 2020

and Year Ended December 31, 2021

TABLE OF CONTENTS

Report of Independent

Registered Public Accounting Firm

To the Plan Participants and the Plan Administrator of

UBS Financial Services Incorporated of Puerto Rico Savings Plus Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net

assets available for benefits of UBS Financial Services Incorporated of Puerto

Rico Savings Plus Plan (the Plan) as of December 31, 2021 and 2020, and the

related statement of changes in net assets available for benefits for the year

ended December 31, 2021, and the related notes (collectively referred to as the

“financial statements”). In our opinion, the financial statements present

fairly, in all material respects, the net assets available for benefits of the

Plan at December 31, 2021 and 2020, and the changes in its net assets available

for benefits for the year ended December 31, 2021, in conformity with U.S.

generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of

the Plan’s management. Our responsibility is to express an opinion on the

Plan’s financial statements based on our audits. We are a public accounting

firm registered with the Public Company Accounting Oversight Board (United

States) (PCAOB) and are required to be independent with respect to the Plan in

accordance with the U.S. federal securities laws and the applicable rules and

regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the

standards of the PCAOB. Those standards require that we plan and perform the

audit to obtain reasonable assurance about whether the financial statements are

free of material misstatement, whether due to error or fraud. The Plan is not required

to have, nor were we engaged to perform, an audit of its internal control over

financial reporting. As part of our audits we are required to obtain an

understanding of internal control over financial reporting but not for the

purpose of expressing an opinion on the effectiveness of the Plan’s internal

control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess

the risks of material misstatement of the financial statements, whether due to

error or fraud, and performing procedures that respond to those risks. Such

procedures included examining, on a test basis, evidence regarding the amounts

and disclosures in the financial statements. Our audits also included

evaluating the accounting principles used and significant estimates made by

management, as well as evaluating the overall presentation of the financial statements.

We believe that our audits provide a reasonable basis for our opinion.

Supplemental Schedules Required by ERISA

The accompanying supplemental schedule of assets (held

at end of year) as of December 31, 2021, (referred to as the “supplemental

schedule”), has been subjected to audit procedures performed in conjunction

with the audit of the Plan’s financial statements. The information in the

supplemental schedule is the responsibility of the Plan’s management. Our audit

procedures included determining whether the information reconciles to the

financial statements or the underlying accounting and other records, as

applicable, and performing procedures to test the completeness and accuracy of

the information presented in the supplemental schedule. In forming our opinion

on the information, we evaluated whether such information, including its form

and content, is presented in conformity with the Department of Labor’s Rules

and Regulations for Reporting and Disclosure under the Employee Retirement

Income Security Act of 1974. In our opinion, the information is fairly stated,

in all material respects, in relation to the financial statements as a whole.

We have audited the UBS Financial Services

Incorporated of Puerto Rico Savings Plus Plan since 2000.

New York, New York

June 28, 2022

UBS FINANCIAL SERVICES

INCORPORATED OF

PUERTO

RICO SAVINGS PLUS PLAN

Statements of Net Assets Available for Benefits

As of December 31, 2021

and 2020

|

|

|

2021

|

2020

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

Investments, at fair value

|

|

$ 53,089,240

|

$48,682,308

|

|

Notes receivable from participants

|

|

840,999

|

718,659

|

|

Investment income receivable

|

|

22,958

|

15,709

|

|

Contributions receivable

|

|

|

|

|

Contributions receivable

|

|

17,925

|

18,867

|

|

Company, net of forfeitures

|

|

586,518

|

555,832

|

|

Total assets

|

|

54,557,640

|

49,991,375

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

Accrued expenses

|

|

4,620

|

3,094

|

|

Total liabilities

|

|

4,620

|

3,094

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$54,553,020

|

$49,988,281

|

The

accompanying notes are an integral part of these financial statements.

UBS

FINANCIAL SERVICES INCORPORATED OF

PUERTO

RICO SAVINGS PLUS PLAN

Statement of Changes in Net Assets Available for Benefits

For the Year December

31, 2021

|

|

2021

|

|

|

|

|

ADDITIONS TO NET ASSETS

|

|

|

Investment income

|

|

|

Net appreciation in the fair value of investments

|

$ 4,733,787

|

|

Dividend and interest income

|

1,181,529

|

|

Net investment Income

|

5,915,316

|

|

Interest income on notes receivable from participants

|

28,527

|

|

Contributions

|

|

|

Participants

|

1,399,591

|

|

Company, net of forfeitures

|

1,246,821

|

|

Total contributions

|

2,646,412

|

|

Total additions

|

8,590,255

|

|

|

|

|

DEDUCTIONS FROM NET ASSETS

|

|

|

Distributions to participants

|

4,007,077

|

|

Administrative expenses

|

18,439

|

|

Total deductions from net assets

|

4,025,516

|

|

|

|

|

Net increase in net assets available for benefits

|

4,564,739

|

|

|

|

|

Net assets available for benefits

|

|

|

Beginning of year

|

49,988,281

|

|

End of year

|

$54,553,020

|

The

accompanying notes are an integral part of these financial statements.

UBS

FINANCIAL SERVICES INCORPORATED OF

PUERTO

RICO SAVINGS PLUS PLAN

Notes to Financial Statements

December 31, 2021 and 2020

NOTE 1 DESCRIPTION OF

THE PLAN

The

following description of the UBS Financial Services Incorporated of Puerto Rico

Savings Plus Plan (the Plan) provides only general information. Participants

should refer to the Summary Plan Description for a more complete description of

the Plan’s provisions and detailed definitions of several terms of the Plan.

General

The

following description of the UBS Financial Services Incorporated of Puerto Rico

Saving Plus Plan (the Plan) provides only general information. Participants

should refer to the Summary Plan Description for a more complete description of

the provisions of the Plan and detailed definitions of various Plan terms.

Effective

July 31, 2021 UBS Financial Services Inc (the Company) became the Plan Sponsor

for the Plan when UBS Financial Services Incorporated of Puerto Rico was merged

with the parent company UBS Financial Services Inc. The Plan, a defined-

contribution plan , provides retirement benefits to eligible employees of the

UBS Financial Services and any of its subsidiaries who have adopted the Plan

and are residents of Puerto Rico. Subject to certain exceptions, all full- and

part-time employees on the Company’s U.S. payroll platform and are residents of

Puerto Rico are eligible to participate in the Plan upon completion of one hour

of service. The Plan is subject to the provisions of the Employee Retirement

Income Security Act of 1974 (ERISA), as amended.

The

Plan is administered by the Company’s Plan administrator (Head of Benefits

Americas Region). Northern Trust (the Custodian) is the custodian of the assets

and the UBS Trust Company of Puerto Rico (the Trustee) is the trustee.

Alight

(formerly Aon Hewitt) is the Plan’s record-keeper and Mercer serves as the

Plan’s investment advisor. An employee is eligible to participate in the Plan

on the first day of service performed for the Company.

The

Plan is established under the laws of Puerto Rico and is subject to Puerto

Rico’s contribution limits. All other features of the Plan are similar to those

of the UBS 401(k) Plan.

The

Plan invests in mutual funds, common collective trust funds, money market

funds, the UBS Company Stock Fund (UBS Stock Fund) and short-term investments.

In addition to these investment options, the Plan allows participants to

maintain Self-Directed Brokerage Accounts.

Plan Amendments

Effective January 1, 2021 (amendment July 1, 2021) the

UBS Financial Services Incorporated of Puerto Rico Savings Plus Plan (the

“Plan”) is amended as follows:

1. The definition of “Required Beginning Date” in Section

2.1 is amended to read as follows:

“Required Beginning Date” means

(i) with respect to each Participant who is a Five-Percent Owner, the April 1st

of the calendar year following the year in which the Participant attains age

seventy and one-half (age seventy-two, with respect to a Participant who

attains age seventy and one-half after December 31, 2019), and (ii) for each

other Participant, April 1st following the end of the calendar year in which

the later of the following occurs: (A) the Participant’s date of retirement or

other termination of employment and (B) the Participant attains age seventy and

one half (age seventy-two, with respect to a Participant who attains age

seventy and one-half after December 31, 2019).

2. Section 8.6 “Minimum Required Distributions” is

amended in its entirety to read as follows:

Notwithstanding any other provision of

the Plan, distributions under the Plan shall be made in accordance with the

amount and timing requirements of Section 401(a)(9) of the US Code.

Furthermore, a Participant who (i) is not a Five-Percent Owner, (ii) attains

age seventy and one-half on or after January 1, 1999 (age seventy-two, with

respect to a Participant who attains age seventy and one-half after December

31, 2019), and (iii) is an Employee on April 1 of the year following the year

in which the Participant attains age seventy and one-half (age seventy-two,

with respect to a Participant who attains age seventy and one-half after December

31, 2019), shall not receive a distribution of his Vested Account Balance until

the Participant’s Severance Date, but in no event later than April 1st

following the year in which such Severance Date occurs. Distributions shall

comply with the final regulations issued under Section 401(a)(9) of the US Code

in 2002. The requirements of Section 401(a)(9) of the US Code, including U.S.

Treasury Regulation Section 1.401(a)(9)-2 through and including 1.401(a)(9)-9

and the incidental death benefit requirement included in Section 401(a)(9)(G)

of the US Code, to the extent not otherwise expressly reflected in this Plan,

are hereby incorporated by reference. To the extent any provision of the Plan

is inconsistent with such Section of the US Code and regulations, the Plan

provisions shall be disregarded. Notwithstanding any other provisions in this

Section 8.6 or any other section of the Plan to the contrary, effective January

1, 2020, the Company will suspend distribution from the Plan required under

this Section 8.6 and Section 8.7 to the extent such distribution would

otherwise have to be paid in the 2020 calendar year (or paid in 2021 for the

2020 calendar year for a Participant with a required beginning date of April 1,

2021), provided that a Participant or Beneficiary may elect not to have such

distributions suspended. Such election shall be made in the manner prescribed

by the Plan Administrator.

NOTE 1

DESCRIPTION OF THE PLAN (continued)

In no event shall the Company suspend

a distribution from the Plan under this Section 8.6 or Section 8.7 to the

extent such distribution would otherwise have to be paid in any year other than

the 2020 calendar year (or paid in 2021 for the 2020 calendar year for a

Participant with a required beginning date of April 1, 2021).

3. Section 8.7 “Death of a Participant” is amended

in its entirety to read as follows:

(a) Death Before

Distributions Commence. Except as provided in the following sentence, if a

Participant’s Service with the UBS Financial Services ends by reason of the

Participant’s death, the Participant’s Beneficiary shall receive a distribution

of his Vested Account Balance in a lump sum as soon as practicable after the

date of death of the Participant. However, if the Vested Account Balance equals

or exceeds the Cash-Out Amount and the Participant dies prior to the

Participant’s Required Beginning Date, distribution of the Participant’s Vested

Account Balance in a lump sum shall (i) be completed by the December 31 of the

year which includes the fifth anniversary of the Participant’s death or, (ii)

commence by the December 31 of the year including the first anniversary of the

Participant’s death. Notwithstanding the foregoing, if the sole designated

beneficiary is the Participant’s surviving spouse, distribution of the

Participant’s Vested Account Balance must commence by the later of (i) the

December 31 of the year including the first anniversary of the Participant’s

death or (ii) the December 31 of the calendar year in which the Participant

would have attained age 70 ½ (age 72, with respect to a Participant who attains

age 70 ½ after December 31, 2019). Unless distribution of the Participant’s

Vested Account Balance is completely distributed by December 31 of the year

including the fifth anniversary of the Participant’s death, the minimum amount

of each installment for each distribution year shall be determined in

accordance with Section 401(a)(9) of the US Code and the final regulations

issued thereunder in 2002. If a portion of the Vested Account Balance is

invested in the Common Stock Fund, the Beneficiary may elect to receive shares

of Common Stock in connection with such lump-sum distribution in the manner

contemplated by Section 8.3(c) as if, solely for such purpose, the Beneficiary

were the electing Participant. (b) Death After Distributions Commence. If a

Participant who is currently receiving an installment distribution pursuant to

Section 8.3(b) dies before his entire Vested Account Balance is distributed to

him, then the remaining portion of his Vested Account Balance, if any, shall be

distributed at least as rapidly as under the method of distributions being used

prior to the date of the Participant’s death; provided, however, that,

if a Beneficiary so elects, the Participant’s remaining Vested Account Balance

may be paid to the Beneficiary in a lump sum. If a Participant who has incurred

a Severance Date dies before such payment is made to the Participant, the

provisions of Section 8.7(a) shall apply as if the Participant had died in

Service. Notwithstanding the foregoing, in the case of a Participant who is

currently receiving an installment distribution pursuant to Section 8.3(b) who

dies after December 31, 2019 and before his entire Vested Account Balance is

distributed to him, the remaining portion of his Vested Account Balance, if

any, shall be distributed to a Beneficiary who is not an “eligible designated

beneficiary” by the end of the tenth calendar year following the year of the

Participant’s death. “Eligible designated beneficiary” means, with respect to a

Participant who dies after December 31, 2019, any designated beneficiary who

is: (1) the surviving spouse of the Participant; (2) a child of the Participant

who has not reached majority; (3) disabled within the meaning of US Code

Section 72(m)(7); (4) a chronically ill individual as defined in US Code

Section 401(a)(9)(E)(ii)(IV); and (5) any other individual who is not more than

ten years younger than the Participant. If such Participant’s eligible

designated beneficiary is a minor child, distribution of the Participant’s

entire interest will be completed by December 31 of the calendar year

containing the tenth anniversary of the minor child’s age of majority.

Effective July 31,

2021, the UBS Financial Services Incorporated of Puerto Rico Savings Plus Plan

(the “Plan”) was amended for the definition of “Company” in Section 2.1 of

the Plan as follows:

“ ‘Company’

means (i) on and after July 31, 2021, UBS Financial Services Inc. or any

corporation or entity which may succeed to all or substantially all of its

business; (ii) from June 9, 2003 to July 30, 2021, UBS Financial Services

Incorporated of Puerto Rico, a Puerto Rico corporation; and (iii) prior to June

9, 2003, any predecessor to UBS Financial Services Incorporated of Puerto

Rico.”

Effective May 4, 2020, Article IX

of the Amended and Restated Plan document effective January 1, 2017 was amended

by adding a new Section 9.11 as follows:

NOTE 1

DESCRIPTION OF THE PLAN (continued)

9.11 Withdrawals pursuant to Puerto Rico Treasury

Department Circular Letters No.20-09 and 20-23. The provisions of this Plan

regarding in-service withdrawals shall be deemed to be modified by, and shall

incorporate by reference, the provisions of Circular Letter No. 20-09 issued on

February 20, 2020 on account of the disaster relief declared by the Governor of

Puerto Rico due to the January 7, 2020 earthquake and subsequent aftershocks

and of Circular Letter No. 20-23 issued on March 29, 2020 on account of the

disaster relied declared by the Governor of Puerto Rico due to the COVID-19

emergency (hereinafter collectively the “Circular Letters”) both allowing for

“special disaster withdrawals” (as defined by the Circular Letters). The Plan

shall be administered in accordance with the Circular Letter unless the Plan

Administrator determines otherwise. The Plan Administrator may require a Participant

to provide such information and make such attestations, as the Plan

Administrator determines in its discretion to be necessary or appropriate to

administer the Plan in accordance with the Circular Letters. The Plan

Administrator shall be entitled to rely on the information provided by the

Participant to the extent permissible under the Circular Letters.

Effective September 20, 2017, the UBS Financial

Services Incorporated of Puerto Rico Savings Plus Plan (the “Plan”) is amended

as follows (signed Effective 11-2-18):

1. Article IX of the Plan is amended

by adding a new Section

9.10 to read as follows:

9.10 Withdrawals pursuant to Puerto Rico Treasury

Administrative Determination Letter No. 17-29 The provisions of this Plan

regarding in-service withdrawals shall be deemed to be modified by, and shall

incorporate by reference, the provisions of Administrative Determination Letter

No. 17-29 (as modified by Administrative Determination Letters nos. 18-02 and

18-13) issued by the Puerto Rico Treasury Department that provides relief under

the PR Code for Participants affected by a hurricane Maria ( the “Determination

Letter”). The Plan shall be administered in accordance with such Determination

Letter unless the Plan Administrator determines otherwise.

The Plan Administrator may require a Participant to

provide such information and make such attestations, as the Plan Administrator

determines in its discretion to be necessary or appropriate to administer the

Plan in accordance with the Determination Letter. The Plan Administrator shall

be entitled to rely on the information provided by the Participant to the

extent permissible under the Determination Letter.

The Plan was amended with respect to

Before-Tax Contributions and After-Tax Contributions made on or after January

1, 2018, Matching Contributions will be limited as follows (regardless of the

level of Company or Affiliated Employer profit in the applicable Plan Year) for

any Participant who is eligible for Matching Contributions in the applicable

Plan Year: (i) for the Plan Year ending December 31, 2018, Matching

Contributions will be limited to $4,500; (ii) for the Plan Year ending December

31, 2019, Matching Contributions will be limited to $5,850; and (iii) for the

Plan Year ending December 31, 2020, and each Plan Year thereafter, Matching

Contributions will be limited to $8,000. In addition, Matching Contributions

for any such Participant with respect to a Plan Year shall not exceed 100% of

such Participant’s Before-Tax Contributions and After-Tax Contributions up to

6% of Compensation.”

In addition, effective with respect to

Compensation paid in Plan Years beginning on or after January 1, 2018, each

individual who is eligible for a Retirement Contribution under Section 5.4 for

a Plan Year shall receive a Retirement Contribution for each applicable Plan

Year in accordance with the following applicable schedule, based upon the

individual’s Compensation paid solely during the portion of the Plan Year in

which such individual was an Eligible Employee (both for purposes of

determining whether the Eligible Employee has Compensation greater than

$200,000 in the Plan Year, and the percentage of Compensation to be contributed

on his behalf) and the individual’s attained Period of Service as of the first day

of the applicable Plan Year:

|

SCHEDULE

A: ELIGIBLE PARTICIPANTS WITH COMPENSATION NO MORE THAN $200,000 IN PLAN YEAR

|

|

Number of Years in

the Period of Service As of the First Day of the Plan Year

|

Percentage of

Compensation to be Contributed as Retirement Contribution

|

|

less than 10

|

2.0

|

|

10, but less than 15

|

3.0

|

|

15 or more

|

3.5

|

NOTE 1

DESCRIPTION OF THE PLAN (continued)

|

SCHEDULE

B: ELIGIBLE PARTICIPANTS WITH COMPENSATION GREATER THAN $200,000 IN PLAN YEAR

|

|

Number of Years in

the Period of Service As of the First Day of the Plan Year

|

Percentage of

Compensation to be Contributed as Retirement Contribution in 2018 Plan Year

|

Percentage of

Compensation to be Contributed as Retirement Contribution in 2019 Plan Year

|

Percentage of

Compensation to be Contributed as Retirement Contribution in 2020 Plan Year

and thereafter

|

|

less than 10

|

2.0

|

2.0

|

2.0

|

|

10 or more

|

3.0

|

2.5

|

2.0

|

Effective February 8, 2017, the UBS Financial Services

Incorporated of Puerto Rico Savings Plus Plan (the “Plan”) is amended as

follows: The definition of “Highly Compensated Employee” in Section 2.1 is

amended to read as follows: “Highly Compensated Employee” means, effective

February 8, 2017, any Employee who (A) is more than a five percent owner of the

voting shares or the total value of all classes of stock of the Employer, as

defined in the PR Code and the regulations promulgated there under; or (B) for

the preceding Plan Year received Compensation in excess of $150,000 or such

other amount in effect pursuant to Section 1081.01(d)(3)(E)(iii) of the PR Code.

The Plan was amended effective January 1, 2017 to

include auto enrollment of 3% of eligible compensation. Participants have up to

90 days (from date of employment) to enroll in the plan or opt out and not

contribute. If the participant does not opt out or enroll within 90 days of

employment they will be automatically set up to contribute 3% of their eligible

compensation via payroll deductions. The funds will be invested in the age

appropriate Target Retirement Fund (the Plans Qualified Default Investment Alternative).

In addition, the match formula was changed to $1 for $1 up to 6% of eligible

contributions with an annual caps of $3,000 per participant

Administrative Expenses

The Plan’s administrative

expenses are paid by the Plan or the Company, as provided by the Plan’s

provisions. Administrative expenses that may be paid by the Plan include

recordkeeping, trustee, legal, audit, and investment consulting. Administrative

fees (recordkeeping fees) associated with Self-directed mutual fund window are

paid by the plan participants that invest in the Self- directed window.

Expenses relating to the Plan’s investments (investment management fees and

commissions) are charged to the specific investment fund to which the expense

relates. For the years ended December 31, 2021 and 2020 the Plan administration

fees (including fees associated with the self-directed window) were charged to

participants’ accounts after one full calendar year of being a terminated

employee, beneficiaries or alternate payees.

NOTE 1

DESCRIPTION OF THE PLAN (continued)

Participant Contributions

A participant’s contributions can consist of “pre-tax

contributions,” which reduce the participant’s taxable compensation and “after-

tax contributions,” which do not reduce a participant’s taxable compensation,

and “rollovers,” which are transfers from other Puerto Rico tax-qualified

retirement plans.

For each plan year, a participant is eligible to make

pre-tax contributions through payroll deductions, up to 85% of his/her eligible

compensation. The dollar amount of a participant’s contributions cannot exceed

certain Plan limits and those imposed under the Internal Revenue Code for a New

Puerto Rico (the Code). Eligible compensation is defined as 499-R-2/W-2 Puerto

Rico earnings (subject to certain adjustments), not to exceed $285,000 for 2020

and $290,000 for 2021. Pre-tax contributions are limited by the Code to $15,000

for 2020 and 2021. Participants who have attained age 50 on or before December

31, 2020, were limited to pre-tax contributions of $16,500 for 2020 and 2021.

These limits are subject to change in future years to be consistent with

limitations imposed by the Code.

Participants are also permitted to make after-tax

contributions of up to 10% of their eligible compensation provided that the

maximum combined rate of a participant’s pre- and after-tax contributions does

not exceed 85% of his/her eligible compensation for 2020 and 2021. After-tax

contributions may be considered in determining the Company’s matching

contribution.

Additionally, participants may make rollover

contributions to the Plan, which are transfers from another Puerto Rico

tax-qualified retirement plan. The amount rolled over will be credited to a

participant’s account and will be treated similar to appreciation on pre- tax

contributions for Plan accounting and Puerto Rico income tax purposes.

Company Contributions

Each year, the Company uses pre- and after-tax

contributions in determining the amount of the Company’s matching contribution

for each participant. For Plan Year beginning January 1, 2017 the Company Match

is calculated by multiplying each participant's pre-tax, and after-tax

contributions (up to 6% of eligible compensation) by 100% and, is limited on an

annual basis, to $3,000 for 2017; $ 4500 for 2018 and $5850 for 2019 and $8,000

for 2020. Company Match contributions are contributed on a payroll basis based

on the participants contributions and year to date annual eligible retirement

earnings.

Company match contributions and earnings are invested

according to the participant’s investment elections in effect for Company

contributions, which can be different or similar to their pre-tax and after-tax

contribution elections. For plan year 2018, all participants regardless of

their earnings were eligible to receive the Company match.

The Company also provides a retirement contribution

(basic profit-sharing contribution) equal to a percentage of the participant’s

eligible compensation and based on the participant’s years of service with the

Company as of the beginning of the plan year and eligible compensation. The

retirement contribution is invested according to the participant’s investment

elections in effect for Company contributions, which can be different or

similar to their pre- and after-tax contributions.

The Qualified Deferred Payment (QDP) feature is a supplemental

profit-sharing contribution provided to participants who satisfy certain

eligibility requirements. The contribution amount is based on a participant’s

age at the beginning of the plan year. QDP contributions and earnings are

invested according to the participant’s investment elections in effect for

Company contributions, which can be different or similar to their pre- and

after-tax contribution elections.

If a participant has not selected his or her

investment elections, the Company Contributions are invested in the

age-appropriate Vanguard Target Date Retirement Fund, the default investment

option. The determination of the Target Date Fund is based on the participant’s

year of birth.

NOTE 1

DESCRIPTION OF THE PLAN (continued)

Participant Accounts

Under the Plan, each

participant has two accounts—an employee account (Employee Account) and a

company account (Company Account). The Company Account is funded; per payroll

for the Company Match, annually for the Company Retirement Contribution and,

per specific payrolls for the QDP. The participant can change their investment

elections for Company Contributions (Company Match, Company Retirement

Contribution, and QDP) as well as their own contributions (pre-tax and

After-tax) at any time. In addition, they can make different investment

elections for their Company Contributions, before-tax contributions, and

after-tax contribution. The participant’s Employee Account reflects all of the

participant’s contributions in addition to income, gains, losses, withdrawals,

distributions, loans, and expenses attributable to these contributions. The

participant’s Company Account reflects his/her share of the Company’s

contributions from the Company match, the Company retirement contribution, and

the QDP for each plan year and income, gains, losses, withdrawals, distributions,

and expenses attributable to these Company contributions.

Vesting

Participants are immediately vested in their Employee

Account. A participant is fully vested in the Company match, retirement and QDP

contributions and earnings thereon after attaining either three years of

service, reaching age 65, becoming totally and permanently disabled, or upon

death.

Forfeited Accounts

Forfeited balances of terminated participants’

unvested Company Accounts are used to reduce the Company’s contributions to the

Plan. For the year ended December 31, 2021, total forfeitures of $11,622 were

used to reduce the Company contributions. Unallocated forfeited balances as of

December 31, 2021 and 2020 were $(17,302) and $7,327 respectively.

Distributions and Withdrawals

After-tax contributions, including any income and loss

thereon, may be withdrawn by participants at any time in accordance with the

Plan’s provisions. Withdrawals of pre-tax contributions or vested Company

contributions are permitted, subject to certain limitations as set forth in the

Code. All withdrawals or a portion thereof are subject to taxation as set forth

in the Code.

Upon termination of service, a participant may elect

to receive a distribution of the vested portion of his/her account in a lump-sum

amount or in installments over a period of up to 10 years. Distributions

consist of common stock or cash from the UBS Stock Fund and cash from all other

funds.

Notes Receivable from Participants

Notes receivable from participants represent participant

loans which are permitted under the Plan. The minimum amount that may be

borrowed is $1,000 and the maximum amount is limited to the lesser of 50% of

the value of a participant’s vested account balance, or $50,000, reduced by the

participant’s highest outstanding loan balance over the previous 12 months. The

interest rates ranged from 5.25% to 7.50% for the year ended December 31, 2021

and 5.25% to 10.25% for the year ended December 31, 2020.

Loans are payable in equal installments, representing

a combination of interest and principal by withholding from the participant’s

paychecks. The outstanding principal amount of any loan can be repaid on any

business day. In the event a participant has a loan outstanding under the Plan,

various limitations exist on such participant’s right to receive additional

loans under the Plan. If a loan is not repaid within 90 days, it will

automatically be treated as a distribution to the participant.

Plan Termination

While the Company has not expressed any intent to

terminate the Plan, it is free to do so at any time subject to the provisions

of ERISA. In the event the Plan is wholly or partially terminated, or upon the

complete discontinuance of contributions under the Plan by any entity of the

Company, each participant affected shall become fully vested in his/her Company

Account. Any unallocated assets of the Plan then held by the Custodian shall be

allocated among the appropriate Company Accounts and Employee Accounts of the

participants and will be distributed in a manner determined by the Company.

NOTE 2 SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Basis of Accounting

The accompanying financial statements are prepared on

the accrual basis of accounting in conformity with U.S. generally accepted

accounting principles (U.S. GAAP).

Payments of Benefits

Benefits to participants are recorded when paid.

Notes Receivable from Participants

Notes receivable from participants represent

participant loans that are recorded at their unpaid principal balance plus any

accrued but unpaid interest. Interest income on loans receivable from

participants is recorded when it is earned. Related fees are recorded as

administrative expenses and are expensed when they are incurred. No allowance

for credit losses has been recorded as of December 31, 2020 or 2019. If a

participant does not make loan repayments for more than 90 days, the Plan

administrator will deem the participant loan to be a distribution and the

participant loan balance is reduced and a benefit payment is recorded.

Investment Valuation and Income

Recognition

Purchases and sales of securities are recorded on a

trade-date basis. Interest income is recorded on the accrual basis and

dividends are recorded on the ex-dividend date. Net appreciation/depreciation

includes the Plan’s gains and losses on investments bought, sold and held

during the year.

Investments held by the Trust are stated at fair

value. Fair value is the price that would be received to sell an asset or paid

to transfer a liability in an orderly transaction between market participants

at the measurement date. (See Note 3 for a discussion of fair value

measurement).

Use of Estimates

The preparation of financial statements in conformity

with U.S. GAAP requires management to make estimates and assumptions that

affect the amounts reported in the financial statements and accompanying notes

and supplemental schedule. Actual results could differ from those estimates.

New Accounting Pronouncement

In July 2018, the Financial Accounting Standard Board

issued Accounting Standards Update 2018-14 Compensation—Retirement

Benefits—Defined Benefit Plans—General (Subtopic 715-20). The Accounting

Standard Update 2018-14 contains several amendments to the disclosure

requirements for employers that sponsor defined benefit pension and other

post-retirement plans. The objective of the amendments is to improve the

effectiveness of disclosures in the notes to financial statements. Several

disclosure requirements that are no longer considered cost beneficial are

removed, specific disclosure requirements are clarified, and certain

disclosures are added. ASU 2018-14 was effective for year end 2020 and it

relates primarily to the reporting by a defined benefit plan and is not

applicable for the Plan.

On August 28, 2018, the FASB issued Accounting

Standards Update (ASU) 2018-13, Fair Value Measurement (Topic 820) Disclosure

Framework—Changes to the Disclosure Requirements for Fair Value Measurement.

The amendments on changes in unrealized gains and losses, the range and

weighted average of significant unobservable inputs used to develop Level 3

fair value measurements, and the narrative description of measurement

uncertainty should be applied prospectively for only the most recent interim or

annual period presented in the initial fiscal year of adoption. All other

amendments should be applied retrospectively to all periods presented upon

their effective date. The amendments in ASU 2018-13 are effective for all

entities for fiscal years, and interim periods within those fiscal years,

beginning after December 15, 2019. Early adoption is permitted upon issuance of

ASU 2018-13. The plan adopted the standard on its mandatory effective date on

January 1, 2020. As these amendments relate to disclosures, the adoption did

not have an impact on the plan’s financial statements.

NOTE 3 FAIR VALUE MEASUREMENT

Fair value is defined as the price that would be

received to sell an asset or paid to transfer a liability in an orderly

transaction (i.e., exit price).

The fair value hierarchy prioritizes the inputs to

valuation techniques used to measure fair value into three broad levels. The

fair value hierarchy gives the highest priority to quoted prices (unadjusted)

in active markets for identical financial instruments (Level 1) and the lowest

priority to unobservable inputs (Level 3). In some cases, the inputs used to

measure fair value might fall in different levels of the fair value hierarchy.

The level in the fair value hierarchy within which the fair value measurement

in its entirety falls is determined based on the lowest level input that is

significant to the fair value measurement in its entirety. Assessing the

significance of a particular input to the fair value measurement in its

entirety requires considerable judgment and involves considering a number of

factors specific to the financial instrument.

Level 1: Inputs are quoted prices

(unadjusted) in active markets for identical financial instruments that the

reporting entity has the ability to access at the measurement date. An active

market for the financial instrument is a market in which transactions for the

financial instrument occur with sufficient frequency and volume to provide

pricing information on an ongoing basis.

Level 2: Inputs other than quoted

prices included within Level 1 that are observable for the financial

instrument, either directly or indirectly.

Level 3: Unobservable inputs for the financial instrument

The following is a description of the valuation

methodologies used for assets measured at fair value. There have been no

changes in the methodologies used at December 31, 2021 and 2020.

Mutual funds: Funds that are actively traded on

an exchange are priced at the net asset value (NAV) of shares held by the Plan

at year end. Funds that are not actively traded on an exchange are priced at

NAV using inputs that corroborate the NAV with observable (i.e., ongoing

redemption and/or subscription activity) market-based data.

Common and collective trust funds: Funds that

are actively traded on an exchange are priced at the NAV of shares held by the

Plan at year end. Funds that are not actively traded on an exchange are priced

at NAV using inputs that corroborate the NAV with observable (i.e., ongoing

redemption and/or subscription activity) market-based data.

Money market funds: Records its corresponding

value at $1 NAV. Investments are valued at amortized cost unless this would not

represent fair value.

UBS Stock Fund: Actively traded securities are

valued at the closing price reported on the active market on which the

individual securities are traded.

Common Stock: Actively traded securities are

valued at the closing price reported on the active market on which the

individual securities are traded.

Self-Directed Brokerage Accounts: Mutual funds

and money market funds valued at the list price at NAV of shares held by the

Plan at the valuation date.

The methods described above may produce a fair value

calculation that may not indicate net realizable value or reflect future fair

values. Furthermore, while the Plan believes its valuation methods are

appropriate and consistent with other market participants, the use of different

methodologies or assumptions to determine the fair value of certain financial

instruments could result in a different fair value measurement at the reporting

date.

There were no transfers between levels in 2021 and

2020.

NOTE 3

FAIR VALUE MEASUREMENT (Continued)

At December 31, 2021, the investments held by the Plan

within the fair value hierarchy are as follows:

|

|

|

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

|

|

Significant

Other

Observable

Inputs (Level 2)

|

|

Significant

Unobservable

Inputs (Level 3)

|

|

Total

|

|

Mutual funds

|

|

$21,158,648

|

|

—

|

|

—

|

|

$21,158,648

|

|

Self-directed brokerage accounts

|

|

13,462,976

|

|

—

|

|

—

|

|

13,462,976

|

|

UBS Stock Fund

|

|

2,032,552

|

|

—

|

|

—

|

|

2,032,552

|

|

Common Stock

|

|

1,893,754

|

|

—

|

|

—

|

|

1,893,754

|

|

|

|

$38,547,930

|

|

$ —

|

|

$ —

|

|

$38,547,930

|

|

Investments measured at NAV:

|

|

|

|

|

|

|

|

|

|

Money market funds(a)

|

|

|

|

|

|

|

|

$5,118,741

|

|

U.S. equity funds(b)

|

|

|

|

|

|

|

|

$6,743,803

|

|

Non-U.S. equity funds(c)

|

|

|

|

|

|

|

|

$568,701

|

|

U.S. bond funds(d)

|

|

|

|

|

|

|

|

$2,110,065

|

|

Total investments at fair value

|

|

|

|

|

|

|

|

$53,089,240

|

At December 31, 2020, the investments held by the Plan

within the fair value hierarchy are as follows:

|

|

|

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

|

|

Significant

Other

Observable

Inputs

(Level 2)

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

Total

|

|

Mutual funds

|

|

$17,630,923

|

|

—

|

|

—

|

|

$17,630,923

|

|

Self-directed brokerage accounts

|

|

14,715,818

|

|

—

|

|

—

|

|

14,715,818

|

|

UBS Stock Fund

|

|

1,661,391

|

|

—

|

|

—

|

|

1,661,391

|

|

Common Stock

|

|

1,166,407

|

|

—

|

|

—

|

|

1,166,407

|

|

|

|

$35,174,540

|

|

$ —

|

|

$ —

|

|

$35,174,540

|

|

Investments measured at NAV:

|

|

|

|

|

|

|

|

|

|

Money market funds(a)

|

|

|

|

|

|

|

|

$5,382,958

|

|

U.S. equity funds(b)

|

|

|

|

|

|

|

|

$5,222,464

|

|

Non-U.S. equity funds(c)

|

|

|

|

|

|

|

|

$662,141

|

|

U.S. bond funds(d)

|

|

|

|

|

|

|

|

$2,240,205

|

|

Total investments at fair

value

|

|

|

|

|

|

|

|

$48,682,308

|

NOTE 3 FAIR VALUE MEASUREMENT

(Continued)

(a) Money market funds are designed

to protect capital with low-risk investments and include cash, bank notes,

corporate notes, government bills, and various short-term debt instruments.

(b) Equity common/collective trust

funds seek to maintain portfolio diversification and approximate the risk and

return characterized by certain equity indices. Under normal circumstances,

redemptions for participant activity may be made daily with no notice period

required. Plan sponsor-initiated activity may require prior written notice of 3

to 15 days.

(c) U.S. bond common/collective trust

funds seek to maintain an overall diversified portfolio whose investment return

matches the performance of certain bond indices. Under normal circumstances,

redemptions for participant activity may be made daily with no notice period

required. Plan sponsor-initiated activity may require prior written notice of

15 days.

(d) Non-U.S. bond common/collective

trust funds seek to provide investment returns of a diversified portfolio of

international government bonds and match the performance of an index. Under

normal circumstances, redemptions for participant activity may be made daily

with no notice period required. Plan sponsor-initiated activity may require

prior written notice of 15 days.

(e) Target date common/collective

trust funds are pre-mixed portfolios of diversified assets (stocks, bonds and

other investments). They are designed for participants who expect to retire in

or close to the target year stated in each option’s name. With the exception of

the Target Retirement Income Fund, over time, the portfolio mix of each fund

will gradually shift to more fixed income securities as the target year

approaches. Upon reaching the target year, the fund will be blended into the

Target Retirement Income Fund, which is designed to provide those participants

who are withdrawing money from the Plan with an appropriate blend of growth,

income and inflation protection. Under normal circumstances, redemptions for

participant activity may be made daily with no notice period required. Plan

sponsor-initiated activity may require prior written notice of 3 days.

The above provides a general description of the

investments. Participants should refer to the Investment Options Guide for

information on the investment objectives and strategy of each investment option.

NOTE 4 RISKS AND

UNCERTAINTIES

The Plan invests in various investment instruments

that are exposed to various risks such as interest rate, market, and credit

risks. Due to the level of risk associated with certain investment securities,

it is at least reasonably possible that changes in the values of investment securities

will occur in the near term and that such changes could materially affect

participants’ account balances and the amounts reported in the statements of

net assets available for benefits.

NOTE 5 RELATED-PARTY TRANSACTIONS

The Plan invests in the common stock of UBS Group AG.

In addition, certain Plan investments are shares/units of mutual funds and

short-term investments managed by the Custodian. These transactions qualify as

party-in-interest transactions; however, they are exempt from the prohibited

transactions rules under ERISA. The Plan received a common stock dividend

payment of $ 42,083 from UBS Group AG for 2021.

Certain officers and employees of the Plan’s sponsor

(who may also be participants in the Plan) perform administrative services related

to the Plan’s operation, record keeping and financial reporting. The Plan’s

sponsor pays these individuals’ salaries and also pays certain other

administrative expenses on the Plan’s behalf. The foregoing transactions are

not deemed prohibited party-in- interest transactions, because they are covered

by statutory and administrative exemptions from the Code and ERISA’s rules on

prohibited transactions.

The UBS mutual funds’ investment advisor,

administrator, and distributor is UBS Asset Management (Americas) LP, a wholly

owned subsidiary of UBS Americas Inc. UBS AM earns management fees from the UBS

AM Funds offered in the self-directed window which is offered in one of the

core funds. These fees were paid by the participants.

The Plan has received a favorable determination letter

from the Commonwealth of Puerto Rico Department of Treasury (the Treasury)

dated August 25, 2015, stating that the Plan is qualified under Sections

1165(a) and 1165(e) of the Puerto Rico Internal Revenue Code of 1994 (PRIRC-94)

and, therefore, the related trust is exempt from taxation. Subsequent to

receiving the determination letter, the Plan was amended. Puerto Rico Treasury

confirmed in a letter dated February 26, 2018 that amendments to the plan do

not adversely affect the plan’s qualified status.

Pursuant to the determination letter dated February

26, 2018 Puerto Rico Treasury confirmed

In a letter dated February

19, 2019 that Amendment 1 dated October 20, 2017 does not adversely affect the

plan's qualified status.

And in a letter dated July 29, 2021 that Amendment 6

dated July 31, 2021 regarding the merger of UBS Financial Services Incorporated

of Puerto Rico with UBS Financial Service Inc. – does not adversely affect the

plan’s qualified status.

Once qualified, the Plan is required to operate in

conformity with the Puerto Rico Code to maintain its qualification. The Plan

administrator has indicated that they will take the necessary steps to bring

the Plan into compliance with the Puerto Rico Code. The Plan has not been

qualified nor is intended to be qualified under Sections 401(a) or 401(k) of

the U.S. Internal Revenue Code.

Accounting principles generally accepted in the United

States require plan management to evaluate uncertain tax positions taken by the

Plan. The financial statement effects of a tax position are recognized when the

position is more-likely-than-not, based on the technical merits, to be

sustained upon examination by the IRS. The Plan administrator has analyzed the

tax positions taken by the Plan, and has concluded that as of December 31,

2018, there are no uncertain positions taken or expected to be taken. The Plan

has recognized no interest or penalties related to uncertain tax positions. The

Plan is subject to routine audits by taxing jurisdictions; however, there are

currently no audits for any tax periods in progress. The plan administrator has

indicated that it will take the necessary steps, if any, to bring the Plan’s

operations into compliance with the Code.

Management has evaluated its subsequent event

disclosure through the date the Plan's financial statements are available to be

issued and notes at there are not subsequent events.

UBS FINANCIAL SERVICES INCORPORATED OF

PUERTO RICO SAVINGS PLUS PLAN

EIN: 13-3074649

Plan #: 003

Schedule

H,

Line 4(i)—Schedule of Assets (Held at End of Year)

As of December 31,

2021

|

Security Description / Asset ID

|

Share / Par Value

|

Historical Cost

|

Current Value

|

|

Non-Interest Bearing Cash - USD

|

|

|

|

|

USD - United States dollar

|

-26,554.470

|

-26,554.47

|

-26,554.47

|

|

Total - all currencies

|

|

-26,554.47

|

-26,554.47

|

|

Total Non-Interest Bearing Cash - USD

|

|

-26,554.47

|

-26,554.47

|

|

|

|

|

|

|

Corporate Stock - Common

|

|

|

|

|

China - USD

|

|

|

|

|

ADR PROSUS N.V. ADR NASPERS NEWCO-ADR CUSIP: 74365P108

|

1,082.000

|

19,185.59

|

17,972.02

|

|

Total China - USD

|

|

19,185.59

|

17,972.02

|

|

France - USD

|

|

|

|

|

ADR SAFRAN ADR CUSIP: 786584102

|

893.000

|

28,802.53

|

27,316.87

|

|

Total France - USD

|

|

28,802.53

|

27,316.87

|

|

Netherlands - USD

|

|

|

|

|

AERCAP HOLDINGS N.V. EUR0.01 CUSIP: N00985106

|

354.000

|

16,752.63

|

23,158.68

|

|

Total Netherlands - USD

|

|

16,752.63

|

23,158.68

|

|

South Africa - USD

|

|

|

|

|

NASPERS SPON ADR EACH REP 0.2 ORD SHS (P/S)CL N CUSIP: 631512209

|

214.000

|

8,157.26

|

6,634.00

|

|

Total South Africa - USD

|

|

8,157.26

|

6,634.00

|

|

Sweden - USD

|

|

|

|

|

ADR EVOLUTION AB ADR UNSP ADR EACH REPR 1 ORD CUSIP: 30051E104

|

76.000

|

10,473.81

|

10,864.96

|

|

Total Sweden - USD

|

|

10,473.81

|

10,864.96

|

|

Switzerland - USD

|

|

|

|

|

UBS GROUP AG COMMON STOCK CUSIP: H42097107

|

113,741.000

|

1,856,656.47

|

2,032,551.67

|

|

Total Switzerland - USD

|

|

1,856,656.47

|

2,032,551.67

|

|

United States - USD

|

|

|

|

|

ALPHABET INC CAP STK USD0.001 CL C CUSIP: 02079K107

|

63.000

|

93,960.88

|

182,296.17

|

|

AMAZON COM INC COM CUSIP: 023135106

|

37.000

|

90,356.00

|

123,370.58

|

|

ANTHEM INC COM CUSIP: 036752103

|

134.000

|

42,202.58

|

62,114.36

|

|

AON PLC CUSIP: G0403H108

|

250.000

|

48,156.46

|

75,140.00

|

|

CAPITAL ONE FINL CORP COM CUSIP: 14040H105

|

199.000

|

18,387.22

|

28,872.91

|

|

CHARTER COMMUNICATIONS INC NEW CL A CL CUSIP: 16119P108

|

17.000

|

6,417.43

|

11,083.49

|

|

CITIGROUP INC COM NEW COM NEW CUSIP: 172967424

|

1,186.000

|

70,740.92

|

71,622.54

|

|

COMCAST CORP NEW-CL A CUSIP: 20030N101

|

1,536.000

|

65,413.71

|

77,306.88

|

|

DISH NETWORK CORP CL A COM STK CUSIP: 25470M109

|

1,002.000

|

34,526.60

|

32,504.88

|

|

GEN MTRS CO COM CUSIP: 37045V100

|

624.000

|

24,169.02

|

36,585.12

|

|

GENERAL ELECTRIC CO COM USD0.01(POST REV SPLIT) CUSIP: 369604301

|

766.000

|

56,880.72

|

72,364.02

|

|

GOLDMAN SACHS GROUP INC COM CUSIP: 38141G104

|

206.000

|

52,136.04

|

78,805.30

|

|

HILTON WORLDWIDE HLDGS INC COM NEW COM NEW CUSIP: 43300A203

|

399.000

|

36,536.76

|

62,240.01

|

|

IAC/INTERACTIVECORP NEW COM NEW COM NEW CUSIP: 44891N208

|

111.000

|

14,105.83

|

14,508.81

|

|

LIBERTY BROADBAND CORP COM SER A COM SERA CUSIP: 530307107

|

162.000

|

18,291.37

|

26,065.80

|

|

LIBERTY BROADBAND CORP COM SER C COM SERC CUSIP: 530307305

|

358.000

|

46,183.58

|

57,673.80

|

|

LYONDELLBASELL IND N V COM USD0.01 CL 'A' CUSIP: N53745100

|

158.000

|

9,857.14

|

14,572.34

|

|

MARRIOTT INTL INC NEW COM STK CL A CUSIP: 571903202

|

506.000

|

54,726.24

|

83,611.44

|

|

META PLATFORMS INC CUSIP: 30303M102

|

386.000

|

96,820.08

|

129,831.10

|

|

MICROSOFT CORP COM CUSIP: 594918104

|

535.000

|

91,924.53

|

179,931.20

|

|

MORGAN STANLEY COM STK USD0.01 CUSIP: 617446448

|

781.000

|

53,406.18

|

76,662.96

|

|

NETFLIX INC COM STK CUSIP: 64110L106

|

145.000

|

69,167.77

|

87,353.80

|

|

UNITEDHEALTH GROUP INC COM CUSIP: 91324P102

|

163.000

|

46,591.91

|

81,848.82

|

|

VISA INC COM CL A STK CUSIP: 92826C839

|

101.000

|

20,482.63

|

21,887.71

|

|

WALT DISNEY CO CUSIP: 254687106

|

197.000

|

23,585.45

|

30,513.33

|

|

WELLS FARGO & CO NEW COM STK CUSIP: 949746101

|

1,090.000

|

40,207.39

|

52,298.20

|

|

WILLIS TOWERS WATSON PLC COM USD0.000115 CUSIP: G96629103

|

110.000

|

24,703.52

|

26,123.90

|

|

WOODWARD INC COM CUSIP: 980745103

|

97.000

|

9,496.64

|

10,617.62

|

|

Total United States - USD

|

|

1,259,434.60

|

1,807,807.09

|

|

Total Corporate Stock - Common

|

|

3,199,462.89

|

3,926,305.29

|

|

|

|

|

|

|

Security Description / Asset ID

|

Share / Par Value

|

Historical Cost

|

Current Value

|

|

Value of Interest in

Common/Collective Trusts

|

|

|

|

|

United States - USD

|

|

|

|

|

MFO INVESCO OPPENHEIMER EMERGING MARKETS EQUITY CL A - 504

CUSIP: 67084Y723

|

8,014.390

|

532,141.18

|

568,701.11

|

|

MFO PRUDENTIAL CORE PLUS BOND FUND CLASS 5 032884 74443R100

CUSIP: 74443R100

|

4,654.240

|

888,486.21

|

907,995.68

|

|

MFO SSGA GLOBAL ALL CAP EQUITY EX-US INDEX NL SERIES FD - CL K

CUSIP: 85744W531

|

20,711.360

|

258,381.66

|

319,058.50

|

|

MFO SSGA RUSSELL SMALL/MID CAP INDEX NL CLASS C CUSIP: 85744L741

|

17,592.320

|

913,896.34

|

1,201,045.28

|

|

MFO SSGA S&P 500 INDEX NON-LENDING SERIES FUND CLASS K

CUSIP: 85744W705

|

144,410.150

|

3,808,389.96

|

6,318,232.88

|

|

MFO SSGA US BOND INDEX NL SERIES CLASS C CUSIP: 85744L725

|

63.420

|

1,000.00

|

1,024.17

|

|

MFO SSGA US BOND INDEX NON-LENDING SERIES FUND CLASS K CUSIP:

85744W259

|

8,811.410

|

105,725.95

|

106,512.32

|

|

NTGI COLLECTIVE GOVERNMENT STIF REG CUSIP: 195998B99

|

5,118,740.540

|

5,118,740.54

|

5,118,740.54

|

|

Total United States - USD

|

|

11,626,761.84

|

14,541,310.48

|

|

Total Value of Interest in Common/Collective Trusts

|

|

11,626,761.84

|

14,541,310.48

|

|

|

|

|

|

|

Value of Interest in

Registered Investment Companies

|

|

|

|

|

Global Region - USD

|

|

|

|

|

MFO NATIXIS FUNDS TRUST I MIROVA GLOBAL SUSTAINABLE EQUITY Y

CUSIP: 63872R533

|

7,056.650

|

153,980.06

|

146,143.22

|

|

Total Global Region - USD

|

|

153,980.06

|

146,143.22

|

|

International Region - USD

|

|

|

|

|

MFO ARTISAN FDS INC INTL FD INSTL SHS CUSIP: 04314H402

|

9,833.940

|

312,686.68

|

301,410.26

|

|

Total International Region - USD

|

|

312,686.68

|

301,410.26

|

|

United States - USD

|

|

|

|

|

MFO GALLERY TR MONDRIAN INTL EQUITY FD CUSIP: 36381Y108

|

14,527.910

|

203,371.61

|

211,381.09

|

|

MFO LOOMIS SAYLES INVT TR FORMERLY LOOMIS S CUSIP: 543495691

|

7,894.760

|

142,126.60

|

132,710.92

|

|

MFO T ROWE PRICE INSTITUTIONAL EQUITY FDS LARGE-CAP GROWTH FD

CUSIP: 45775L408

|

29,969.260

|

1,477,589.44

|

2,203,340.00

|

|

MFO VANGUARD CHESTER FDS INSTL TARGET RETIREMENT 2025 FD CUSIP:

92202E789

|

99,806.000

|

2,333,075.05

|

2,930,304.16

|

|

MFO VANGUARD CHESTER FDS INSTL TARGET RETIREMENT 2030 FD CUSIP:

92202E771

|

183,483.190

|

4,083,298.33

|

5,625,594.61

|

|

MFO VANGUARD CHESTER FDS INSTL TARGET RETIREMENT 2035 FD CUSIP:

92202E763

|

38,833.400

|

897,501.21

|

1,234,513.79

|

|

MFO VANGUARD CHESTER FDS INSTL TARGET RET 2050 FD VANGUARD INST

T/R 2050-INST CUSIP: 92202E730

|

17,629.550

|

413,209.80

|

603,988.38

|

|

MFO VANGUARD CHESTER FDS INSTL TARGET RETIREMENT 2015 FD CUSIP:

92202E813

|

7,202.340

|

162,100.76

|

177,609.70

|

|

MFO VANGUARD CHESTER FDS INSTL TARGET RETIREMENT 2020 FD CUSIP:

92202E797

|

101,008.120

|

2,175,985.71

|

2,758,531.76

|

|

MFO VANGUARD CHESTER FUNDS INSTITUTIONAL TARGET RETIREMENT

INCOME CUSIP: 92202E698

|

30,650.630

|

660,574.09

|

757,683.57

|

|

MFO VANGUARD CHESTER FUNDS INSTITUTIONAL TARGET RETIREMENT 2040 CUSIP:

92202E755

|

57,792.220

|

1,325,179.39

|

1,906,565.34

|

|

MFO VANGUARD CHESTER FUNDS INSTITUTIONAL TARGET RETIREMENT 2045

CUSIP: 92202E748

|

35,472.400

|

918,112.30

|

1,208,544.67

|

|

MFO VANGUARD CHESTER FUNDS INSTITUTIONAL TARGET RETIREMENT 2055

CUSIP: 92202E722

|

6,944.170

|

185,900.26

|

238,532.24

|

|

MFO VANGUARD CHESTER FUNDS INSTITUTIONAL TARGET RETIREMENT 2060

CUSIP: 92202E714

|

16,499.480

|

409,262.18

|

569,067.07

|

|

MFO VANGUARD TARGET RETIREMENT 2065 FUNDINSTL CUSIP: 92202E672

|

5,669.890

|

131,278.75

|

179,281.92

|

|

Total United States - USD

|

|

15,518,565.48

|

20,737,649.22

|

|

Total Value of Interest in Registered Investment Com

|

|

15,985,232.22

|

21,185,202.70

|

|

|

|

|

|

|

Other

|

|

|

|

|

United States - USD

|

|

|

|

|

&&&UBS PR LOAN ASSET CUSIP: 000810283

|

840,998.970

|

840,998.97

|

840,998.97

|

|

&&&UBS PUERTO RICO SDA ASSET CUSIP: 000810457

|

1.000

|

13,143,619.39

|

13,462,976.40

|

|

REBATE ACCRUALS CUSIP: 999927312

|

0.000

|

0.00

|

0.00

|

|

Total United States - USD

|

|

13,984,618.36

|

14,303,975.37

|

|

Total Other

|

|

13,984,618.36

|

14,303,975.37

|

|

|

|

|

|

|

Payable Other

|

|

|

|

|

United States - USD

|

|

|

|

|

INVESTMENT MANAGEMENT EXPENSE ACCRUAL CUSIP: 999899537

|

0.000

|

0.00

|

0.00

|

|

Total United States - USD

|

|

0.00

|

0.00

|

|

Total Payable Other

|

|

0.00

|

0.00

|

|

|

|

|

|

|

Total

|

|

44,769,520.84

|

53,930,239.37

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the Plan Administrator of the UBS Financial Services Incorporated of

Puerto Rico Savings Plus Plan has duly caused this annual report to be signed

on its behalf by the undersigned thereunto duly authorized.

UBS Financial Services Incorporated of Puerto Rico Savings Plus

Plan

By: _/s/ Michael O’Connor______________

Name: Michael O’Connor

Title: Plan Administrator

Date: June 28, 2022

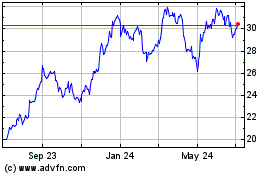

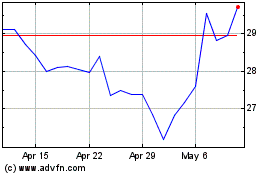

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024