UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Date: March 11, 2021

UBS Group AG

Commission File Number: 1-36764

UBS AG

Commission File Number: 1-15060

(Registrants' Name)

Bahnhofstrasse 45, Zurich, Switzerland and

Aeschenvorstadt 1, Basel, Switzerland

(Address of principal executive offices)

Indicate by check mark whether the registrants file or will

file annual reports under cover of Form 20‑F or Form 40-F.

This Form 6-K consists of UBS Group AG and UBS AG's

Sustainability Report 2020, which appears immediately following this page.

Sustainability

Report 2020

Based on GRI Standards

Why

sustainability is important to UBS

Our Chairman and CEO

explain why UBS strives to extend its

leadership in sustainability and how we will achieve it.

Sustainability has become a catch-all phrase, covering everything

from carbon emissions to human rights.

As leaders of UBS, what does it mean to you?

AAW: Sustainability means thinking and acting with the long term in

mind. We have an obligation to our clients, shareholders and employees to apply

a long-term lens – and we also have a responsibility to society at large.

RH: When we consider our own practices, investments, services or day-to-day

operations, it should always be through the lens of, “will this support a long-term

vision of a sound future? What are the consequences tomorrow and many years

down the road?” Sustainable thinking that weighs long-term opportunities and

risks creates a more stable firm, ensures that we can continuously serve our

clients well and drives our ambition to lead the financial sector in attaining

commercial, environmental, and social change that benefits both economies and

societies.

How high does sustainability rank in terms of our

firm’s priorities?

RH: Sustainability must be part of our DNA (core); it’s not something

we do sporadically. We continuously challenge ourselves to do better and to

focus on the long term. This is why I put in place a strategic workstream on

sustainability that is focused on our future approach to this important area.

AAW: The COVID-19 crisis brought the vulnerability and interconnected

nature of the environment, societies and economies to the forefront of all our

minds and demonstrated that sustainability considerations must be firmly

pursued. The crisis has demonstrated how years of sustainable thinking and

acting delivered value for our firm, employees and clients. For example,

technology investments that long preceded the COVID-19 outbreak allowed us to

transition from the workplace to home office with ease.

What do our shareholders expect from UBS in terms of sustainability?

AAW: Sustainability is increasingly becoming the main theme in the

conversations with our shareholders. The quality and depth of discussions has

increased materially. Shareholders are very well prepared these days on these

issues, and invest a lot of time and resources to understand ESG

(environmental, social, governance) issues for their investee companies.

Despite a strong focus on sustainable finance and climate, other themes also

come up more often, such as diversity. Additionally, governance and corporate

culture questions have always been and remain topics of interest to

shareholders.

Where is UBS in terms of achieving its sustainable

finance ambitions?

RH: For over two decades, UBS has been at the forefront of sustainable

finance – and we aim to extend our leadership. We aspire to do more to help

clients transition to sustainable ways of doing business, to ensure their

long-term success and to support them in fulfilling the commitments they've

made to people and planet.

We became the first major global financial

institution to make sustainable investments the preferred solution for private

clients investing globally and attracted significant growth into our 100%

sustainable portfolios. So, it’s fair to say we’ve again made significant

progress on our ambitious goals. A key indicator is the development of our core

sustainable investing assets, which – at USD 793 billion at the end of 2020 –

have again risen substantially.

What about UBS’s leading role in philanthropy, driving funds into

successful projects that support the most vulnerable and needy?

RH: We are committed to addressing racial and economic inequality through

our considerable activities in client philanthropy and community investment. We

support the most marginalized members of society in some of the world’s poorest

countries. Last year, our firm, together with clients, increased commitments to

the UBS Optimus Foundation, growing donations by 74% to USD 168 million.

One of the greatest aggravating factors in

the pandemic has been inequality, which impedes testing and treatment while

also worsening underlying health factors. UBS committed USD 30 million to

various COVID-19-related initiatives around the globe. We matched client and

employee donations for COVID-19-related programs and raised an additional USD

15 million for the UBS Optimus Foundation’s COVID-19 Response Fund, which

supports various organizations, including those in the healthcare industry that

facilitate testing and increase capacity for emergency treatment.

You’ve long emphasized the importance of addressing climate change.

What do you think will be the greatest obstacles to achieving a less

carbon-intense economy?

AAW:

The COVID-19 crisis has shown that we must better

prepare for global systemic risks, among them climate change. If we delay any

longer, the eventual costs will only increase. It’s therefore critical to take

action now. The financial sector has a central role to play, in particular, by

converting savings into investments, since the transition to a low-carbon

global economy requires huge investments.

One of the major challenges, both for

financial institutions and the world as a whole, remains the disclosure of

social and environmental factors. Many companies have made significant progress

with voluntary reporting and setting energy transition targets, but comparing

one company’s ambitions with those of another remains a challenge. Asset owners

in particular want actual strategy changes, including quantifiable net zero

targets and compensation tied to outcomes. We therefore engage on climate

topics with the companies in which we invest.

Axel A. Weber

Chairman of the Board of Directors

What other steps are you taking at UBS to address

this challenge?

AAW: Our climate strategy supports an orderly transition to a low-carbon

economy, as defined by the Paris Agreement. We support clients to align their

investment and environmental goals. An excellent example in this regard is the

broadening of our Asset Management’s Climate Aware suite of strategies based on

its Climate Aware framework, which helps investors reduce the carbon footprint

of their investments.

Our firm is committed to aligning its climate

disclosure within the five-year pathway outlined by the Task Force on

Climate-related Financial Disclosures. In 2020, we again strengthened

transparency on our climate actions by further refining the disclosure of

climate metrics. We developed a novel transition risk heatmap methodology and

improved the granularity and accuracy of our disclosure of climate-sensitive

sectors and carbon-related assets. Our exposure to carbon-related assets on our

banking balance sheet went down to 1.9%, or USD 5.4 billion, at the end of

2020, compared with 2.3% in 2019.

When we talk about sustainability goals a little closer to home, how

are you practicing what you believe in?

RH: We’ve taken steps to strengthen even further our sustainability

disclosures to demonstrate measurably what we have achieved in 2020 as well as our

future commitments. For instance, we have achieved ambitious goals in reducing

our own carbon footprint. Beginning in 2020, our firm sourced 100% of its

electricity from renewable sources. And we consider environmental factors

throughout the lifetimes of all our buildings. Being a bank, these are

especially important steps because they demonstrate that we are taking

sustainability seriously across all our operations. And it’s also critical to

our employees, present and future.

As a result of our actions, UBS regularly

wins recognition from the most reputable organizations charged with measuring

and ranking corporate sustainability achievements. For the sixth consecutive

year, we were ranked a global industry leader in the Dow Jones Sustainability

Index (DJSI), and we secured a place on the CDP’s prestigious “A List” for

tackling climate change. That’s independent, external proof that we are indeed

practicing what we believe in.

Ralph A. J. G. Hamers

Group Chief Executive Officer

Where do you see UBS’s focus and ambitions

going forward?

AAW: Sustainable finance is undoubtedly a growth area that sticks out

for us, given our long-standing leadership and engagement on the topic as well

as our competitive positioning. Our unique approach to sustainable and impact

investing leverages all parts of UBS, from working with our corporate clients

on their transition, through engaging with clients via our investment

stewardship processes, to providing our individual clients with the options

they need to effect the changes they want to see in the world. We must and will

be even more strategic in this area, increasing our offerings around environmental,

social and governance (ESG) factors so that clients’ investments are protected

on more fronts. UBS is already strong in this area and we must continue to develop

our position of strength.

RH: Acting with sustainability in mind is something we already firmly

believe in across our firm. We know the entire area of sustainability is

dynamic and continues to evolve. I will ensure that our firm remains focused on

helping to tackle the growing environmental and social challenges people and

planet face. These are clearly delineated in the UN Sustainable Development

Goals (SDGs), and we will put even greater emphasis on shaping our efforts

around this important framework. We are committed to the investments required

in sustainability to ensure that UBS remains at the forefront of delivering

against our objectives on behalf of all our stakeholders.

Axel A. Weber Ralph A. J. G.

Hamers

Chairman of the Group Chief Executive

Officer

Board of Directors

UBS was among the 43 companies that first signed the UN Global

Compact in 2000 and is also a member of the UN Global Compact Network

Switzerland, meaning we are committed to its principles on human rights, labor

standards, the environment and anti-corruption. As reflected in detail in this report,

we have a comprehensive set of goals and activities in place pertaining to the

principles of the UN Global Compact

|

|

Why

|

|

Why we drive

sustainability

|

|

10

|

Why we

focus on sustainability

|

|

10

|

Why we

focus on sustainable finance

|

|

10

|

Why we

focus on client philanthropy and

community

investment

|

|

10

|

Why we

focus on sustainable business practices

|

|

10

|

Why we

focus on our people

|

|

11

|

Our

sustainability ambitions and goals

|

|

The changes

we face

|

|

12

|

Sustainable

Development Goals

|

|

13

|

Climate

change as a (financial) risk

|

|

13

|

Weighing

results – when addressing the

changes

we face

|

Sustainability

Report 2020 | Why

Why we drive sustainability

We have a long-standing strategy to play a

leading role in sustainability in our industry. We focus on driving positive

change for our clients, our employees and society at large. Find out why we

want to help attain change – for the benefit of people and planet.

Why we focus on sustainability

Our sustainability strategy is guided

by our goal to be the financial provider of choice for clients who wish to

mobilize capital toward the achievement of the 17 United Nations (UN)

Sustainable Development Goals (SDGs) and the orderly transition to a low-carbon

economy. This demonstrates our focus on making UBS a

force for driving positive, long-term change for people and planet.

Why we focus

on sustainable finance

We are conscious that the activities

and decisions of our clients can have substantial impacts on society. That is

the reason we strive to incorporate environmental, social and governance (ESG)

impacts into the products and services we provide to clients and partner with

them.

We believe that by considering sustainability

factors, we, together with our clients, can enhance portfolios’ resilience

without compromising risk-adjusted returns. We share our insights to help

clients navigate some of the risks and opportunities ahead and to help mobilize

capital toward achieving both the SDGs and the orderly transition to a

low-carbon economy.

Why we focus on client philanthropy and

community investment

We offer clients expert advice,

carefully selected programs from UBS Optimus Foundation, and innovative social

financing mechanisms, such as development impact bonds. In this way, we believe

our clients can make a meaningful, and measurable, differences for their chosen

causes.

We recognize that our firm’s long-term

success depends on the health and prosperity of the communities we are part of.

We therefore seek to address inequality and create opportunity through

long-term investments in education and entrepreneurship.

We are focused on supporting the needs of the

most marginalized in society in some of the poorest countries and in the

countries where UBS operates. Last year, when we saw social inequalities grow

even greater, we and our clients increased our commitment to this cause.

Why we focus on sustainable business

practices

We view the proper firm-wide

management of our environmental footprint and supply chain as important proof

of how we do business in a sustainable manner for the benefit of society. This

is equally true of our broad and wide-ranging environmental and social risk

framework that governs client and vendor relationships and is applied firmwide.

And we regard meaningful transparency of our firm’s sustainability activities

as supporting a sustainable economy.

Why we focus on our people

We are committed to being a

world-class employer and a great place to build a career. Our employees are key

to delivering our business strategy. We therefore seek to attract, develop and

retain employees who have the diverse backgrounds and capabilities to advise

our clients, develop innovative and sustainable solutions, manage risk and

adapt to evolving situations.

Our aim is to create long-term value for

our stakeholders. To make this value creation measurable and tangible, we have

established four sustainability ambitions, each with clear goals and clear

timelines.

Our

sustainability ambitions and goals (goals are cumulative figures, to be

achieved by the end of 2025)

Ambition to be a

leader in sustainable finance across all client segments, with the key goal of

–

adding USD 70 billion of invested assets

classified as impact investing1 or with sustainability focus.2

Ambition to be a recognized innovator and thought leader in

philanthropy, with the key goals of

–

raising USD 1 billion donations to UBS’s client

philanthropy foundations and funds3 and reaching 25 million

beneficiaries, and

–

supporting one million beneficiaries to learn

and develop skills for employment, decent jobs and entrepreneurship through our

community investment activities.

Ambition to be an industry leader in

sustainable business practices, with the key goals of

–

achieving net zero for scope 1 and 2 greenhouse

gas (GHG) emissions,4

–

retaining favorable positions in key environmental,

social and governance (ESG) ratings,

–

implementing the Task Force on Climate-related

Financial Disclosures (TCFD) recommendations by the end of 2022, and

–

implementing the Principles for Responsible

Banking (PRB) by September 2023.

Ambition to be an employer of choice, with

the key goals of

–

maintaining our recognition as one of the

world’s most attractive employers in key ratings and rankings,5 and

–

increasing the percentage of Director level and

above positions filled by women (aspiration to reach 30%).

› Refer

to “How we measure our progress” in the “How” section of this report for more

information about our progress on previously set goals

› Refer

to Appendix 8 for our sustainability objectives and achievements 2020 and

sustainability objectives 2021

1 Strategies where the intention is to generate measurable

environmental and social impact alongside financial return

2 Strategies where

sustainability is an explicit part of the investment guidelines, universe,

selection, and / or investment process

3 This includes the UBS

Optimus Foundations, UBS UK Donor-Advised Foundation and UBS Philanthropy

Foundation in Switzerland.

4 Scope 1 accounts for

direct GHG emissions by UBS. Scope 2 accounts for indirect GHG emissions

associated with the generation of imported / purchased electricity (grid

average emission factor), heat or steam.

5 Indicators such as

global and country-specific Universum rankings, peer-leading positions in human

resources elements of the Dow Jones Sustainability Index, recognition by

Bloomberg Gender Equality Index, market recognition in various new and

established benchmarks / rankings

Sustainability

Report 2020 | Why

The changes

we face

Sustainable Development Goals

Our role in the world

We are advancing toward 2030, the

designated deadline to reach the United Nations (UN) Sustainable Development

Goals (SDGs). The SDGs focus on issues like climate change, equality and

healthcare – major challenges for our world now and over the coming years.

Traditional financing mechanisms, such as grants and overseas development aid,

are insufficient to tackle these growing challenges. The UN estimates the funding

gap to achieve the SDGs by 2030 at USD 2.5–3 trillion annually1 – with some experts putting the number even

higher.

Financial institutions have a big part to

play, notably when it comes to educating clients about the importance of the

SDGs and mobilizing their assets toward achieving them. In doing so, we must

ensure longevity and achievement of desired results. That is why we made a commitment

to raise USD 5 billion of clients’ assets for impact investments related to the

SDGs. We are proud to say that we have surpassed our goal one year early. This

is a key achievement but, of course, our support for the SDGs extends well

beyond this particular goal.

A growing number of our activities have an

explicit or implicit SDG angle. Take, for instance, green, social and other

sustainability bonds. As of 31 December 2020, we held green, social and

pandemic bonds in the amount of USD 1.8 billion in our high-quality liquid

assets portfolios under the management of Group Treasury. Year over year, Group

Treasury effectively doubled its investments in securities that have a direct

link to sustainable projects.

While our firm has touchpoints with all SDGs

across its manifold sustainability activities, our firm-wide focus is on five

SDGs. This is why:

1 un.org/sustainabledevelopment/sg-finance-strategy/

Climate change as a (financial) risk

Big-picture thinking

Recent developments, in particular the COVID-19

pandemic, have underscored the importance of addressing global challenges

quickly. Often, these challenges go much deeper than their surface-level impact,

which makes it even more important to take steps to manage the risks we know

exist. Climate change is one such risk. By acting now, we can avert potentially

catastrophic consequences in the future. If we delay any longer, the consequences

will only become greater. It is why we have developed a multi-layered approach

to addressing climate change, focusing not only on our own practices but also

working to safeguard our clients’ investments and the interests of the

communities we live in.

Weighing results – when addressing the changes

we face

Measuring and analyzing impact has

become a major focus of companies, investors, governments and regulators.

Investors want to know how well investments align to their preferences, whether

they are capturing significant long-term opportunities and whether they are aimed

at addressing the challenges framed by the SDGs. A clear focus on

sustainability outcomes and tangible impact is what will define and

differentiate sustainable practices, in finance as well as in our own

operations, in the coming years.

At UBS, we have been focusing on impact for

years, both in the context of the investment space and of our own activities.

We were among the very first banks to shine a light on the importance of the

SDGs – and specifically on what it takes to make them investable. And we were one

of the founding signatories of both the International Finance Corporation (IFC)-launched

Operating Principles for Impact Management (Impact Principles2) and the UN-backed Principles for

Responsible Banking (PRB3) in 2019. In

late 2020, we also joined the Banking for Impact Working Group.

2 The Impact Principles are a framework for

investors that ensures impact considerations are purposefully integrated

throughout the investment life cycle.

3 The PRB are a framework for banks that

supports integration of society’s goals into business strategy while also

incorporating both the SDGs and the Paris Agreement.

|

|

What

|

|

Our sustainability track record

|

|

What we do for our clients

|

|

18

|

Our clients’ changing needs

|

|

18

|

Addressing new needs

|

|

19

|

Broadening opportunities in sustainable

finance

|

|

21

|

What sustainable finance means for

clients

|

|

21

|

Transitioning to a low-carbon future

|

|

22

|

Reimagining client philanthropy

|

|

24

|

Key achievements in 2020

|

|

What we do for our employees

|

|

26

|

Helping

employees navigate through an uncertain year

|

|

26

|

Our

culture is the foundation for our sustainable success

|

|

28

|

Diversity,

equity and inclusion

|

|

29

|

The

future of work and the workforce of the future

|

|

30

|

Benefits

that count

|

|

30

|

Environmental,

social and governance considerations in performance, reward and compensation

|

|

What we do to act on a low-carbon future

|

|

32

|

Climate

governance

|

|

32

|

Climate

strategy

|

|

32

|

Climate

risk management

|

|

39

|

Climate-related

opportunities

|

|

41

|

Climate-related

metrics

|

|

What we do for societies and the environment

|

|

43

|

Environment

and human rights

|

|

44

|

Reducing

our environmental footprint

|

|

45

|

Managing

our supply chain responsibly

|

|

46

|

UBS's

charitable contributions

|

Sustainability

Report 2020 | What

Our

sustainability track record

Sustainability is not new to

us: our first steps date

back decades, and our journey includes many important

milestones to date.

Sustainability

Report 2020 | What

What we do

for our clients

The world is becoming more and more focused

on sustainability, and there is no sign of this trend halting soon. This focus

is reflected in consumer demand, public policy and industry regulation. Our

client offering, direct lending exposure and our business model in general have

been geared toward this trend for years. These developments play to our

strengths, which benefits all stakeholders, including our shareholders.

Our clients’ changing needs

Society’s understanding of the world’s

challenges is constantly evolving. Among our client groups, awareness of

sustainability is rapidly growing. Sustainability is also helping to define our

role in society, our corporate strategy and how we think about financial

solutions overall.

Over the past years, clients have been making

a shift in favor of investments that focus on, or more actively take into account,

material environmental, social and governance (ESG) factors. And this shift is

not isolated to individual institutional investors and private clients –

corporate clients are transforming their operations to aim for ESG best

practice and aligning their business models to the UN Sustainable Development

Goals (SDGs). The COVID-19 crisis has both accelerated and solidified this

trend by highlighting the consequences of not addressing challenges we are well

aware of (such as climate change or social inequalities) as well as the

interconnectedness of our world.

Our own research provides evidence of this

shift. A global UBS Asset Management survey of 600 institutional investors

found that European asset owner respondents predict that systemic environmental

factors (i.e., climate crisis, biodiversity loss, etc.) will, in the next five

years, be more material to their investments than financial factors.1

Another survey showed that, among Swiss institutional investors, 49% of

respondents have already invested sustainably, and out of these, two-thirds

plan to increase their share of sustainable investing (SI).2 In a

UBS Investment Bank survey, 68% of corporate clients are considering or

currently revising their sustainability strategy. And 70% stated they are

considering including ESG targets as part of their compensation framework.3

In our Personal & Corporate Banking business, the newly introduced

sustainability-linked loans are experiencing strong demand. And in the private

wealth space, the majority of our clients believe SI will become the norm in

the next decade.4

In terms of actual market movements, as of December

2020, global assets in sustainable funds had risen from around USD 600

billion at the end of 2018 to more than USD 1.65 trillion.5 If

current growth rates persist, ESG mutual fund assets in the US alone are

projected to grow from just over USD 150 billion at the end of 2019 to

more than USD 300 billion at the end of 2021.6 In Europe, ESG

assets under management are predicted to triple between 2019 and 2025, to reach

EUR 5.5 trillion.7

Addressing new needs

Client surveys are

not just about gathering evidence to support trends. They also tell us what is

most important to our clients, which, in turn, helps us make sure we are

supporting them in the right way. From this information, we have identified

three areas where we should focus our efforts. These are:

–

understanding trends,

–

managing 21st-century risks and

–

taking advantage of new opportunities.

To help in understanding

trends, we share our knowledge

and shed light on challenges that resonate strongly with our clients. For

example, in 2020, our global Chief Investment Office (CIO) launched a thematic

investment research series entitled the “Future of ….” The series highlights

longer-term investment themes and opportunities for private investors, and some

examples thus far have been the Future of humans (September 2020), Future

of the tech economy (June 2020) and Future of waste (February 2020).

In addition, we publish regular white papers on challenges and opportunities

within SI, including a monthly review of key sustainability developments titled

“Sustainable Investing Perspectives,” and provide associated investment

solutions across public and private markets. Our research and insights have a

strong sustainable component, but venture beyond pure sustainability

considerations.

› Refer

to our “Sustainable Finance, Trends for 2021” white paper available at ubs.com/davos-agenda-2021

1 Survey conducted in June 2019 among 600 institutional clients (ESG:

Do you or Don’t you, UBS Asset Management and Responsible Investor)

2 Survey conducted in

August 2020 among 110 Swiss institutional investors

3 Survey conducted in October 2020 among 160 Investment Bank clients

4 UBS Investor Watch on the Year Ahead, November 2019.

5 Morningstar: Global Sustainable Fund Flows: Q4 2020 in Review

6 “ESG: Transforming asset management and fund distribution.”

Broadridge, September 2020

7 “2022 The growth

opportunity of the century. Are you ready for the ESG change?,” PwC, October

2020

In general terms, we

believe the purpose of sell-side research is to support our clients in their

investment decision-making by doing our best to help them understand how

information and markets connect, through our research offering. This core

purpose also drives Global ESG Research, which works in conjunction with over

250 macro, sector and company analysts to provide coverage focused on listed

entities and thematic research.

Real world ESG-related impacts, when present,

can potentially connect to the nuts and bolts of financial analysis: namely,

ESG risk and opportunity, impact, likelihood, timing, connecting mechanisms and

catalysts, competitive landscapes, and financial models. In 2020, we launched

the UBS ESG Risk Radar, an important ESG integration project to understand how

ESG factors and markets connect, and how markets can be leveraged to move

capital with a clear purpose, in the direction of a more sustainable, equitable

world.

To help our clients to the best of our

ability, we need to stay current in research. We regularly publish a list of

ESG definitions and SI strategies. Each SI strategy encapsulates a different

approach to sustainable investing, based on a different set of ethical beliefs

and market theories. This list is inevitably only a rough guide, because it is

also important to recognize that the field of ESG and SI is constantly evolving

and redefining itself.

In addition to the research and insights we

produce within our firm, we have also teamed up with more than 50 Nobel

laureates in economic sciences who share their answers to some of the toughest

challenges, such as technological change, global warming and the future of

work. This information is made publicly available through virtual events and

podcasts.

When it comes to helping clients in managing 21th-century risks, we have long held the view that integration of

ESG factors and active engagement can help identify risks that traditional

fundamental analysis alone may not uncover. As the awareness of

consumers and investors on sustainability issues increases, so does the

pressure on companies to become better at managing their ESG risks, be it by

addressing their carbon footprint and exposure to carbon taxation, by

protecting human rights within their operations and supply chains, or by

ensuring strong and transparent corporate governance.

Ample and strong academic and empirical

evidence points out that ESG risks affect companies’ reputation and financial

performance. More broadly, from the 1970s to the mid-2010s, over 2,200

empirical studies on the relationship between ESG criteria and corporate

financial performance and valuation were published. According to a single

meta-analysis of those reports, more than half reported positive findings,

compared to just 7.5% that pointed to a possible negative correlation.1

On balance, ESG integration within our investment processes and recommendations

for clients need not be negative for financial performance, while also aligning

clients' investments to their values.

And lastly, to support our clients in taking advantage of new opportunities, we are

continuously developing our offering. Our intent is to help our clients

generate measurable environmental and / or social impact as well as financial

returns. In the following section, we have highlighted opportunities with high growth

potential.

Broadening opportunities

in sustainable finance

Sustainable finance refers to any

form of financial service that integrates ESG

criteria into business or investment decisions, including sustainable investing and sustainable financing.

Sustainable finance has been a firm-wide priority at UBS for years and the COVID-19

pandemic is sharpening the market’s understanding of its importance. Our aim is

to continue to help all our clients meet their investment and financing objectives

through sustainable finance.

Sustainable investing

As implied by the name, sustainable

investing (SI) focuses on investment decisions. SI strategies seek to better

risk manage portfolios in alignment with 21st-century challenges and / or align

investments with investor’s values regarding ESG topics, while also aiming to

improve portfolio risk and return characteristics.

We identify three overarching SI approaches:

exclusion (when individual companies or entire industries are excluded from

portfolios because their activities conflict with an investor’s values); ESG

integration (which combines ESG factors with traditional financial

considerations); and impact investing.

Impact investments are made with the

intention of generating positive, measurable social and / or environmental

impact alongside a financial return. They are made in emerging and developed

markets as well as across asset classes. Shareholder engagement can also

contribute to positive impact, as investors may use their ownership stake in a

company to drive measurable environmental and / or social change.

In 2020, SI strategies demonstrated

comparable or better financial performance than conventional equivalents at the

index, fund and instrument levels.

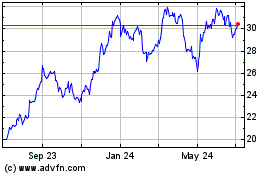

Core SI assets grew strongly in 2020 to reach

18.9% (USD 793 billion) of client-invested assets, up from 13.5% (USD 488

billion) in 2019. In addition to generally supportive markets, the growth was

driven by client demand and our focus on advancing sustainable solutions.

Norms-based screening assets, i.e., assets

that fall under the application of a UBS policy2 and do not

otherwise qualify as a core SI, amounted to USD 797.9 billion as of 31

December 2020. Total SI, including norms-based screening assets, accounted for USD 1,591

billion (2019: USD 1,306 billion), or 38.0% (2019: 36.2%), of our total

invested assets.

1 Gunnar

Friede, Timo Busch & Alexander Bassen. “ESG and financial performance: aggregated evidence from more than

2,000 empirical studies,” Journal of Sustainable Finance & Investment,

2015

2 The assets in discretionary mandates, in UBS’s actively managed

retail and institutional funds, as well as in our firm’s proprietary trading

book, are subject to our firm’s policy on the prohibition of investment in and

indirect financing of companies involved in the development, production or

purchase of anti-personnel mines and cluster munitions.

Sustainability

Report 2020 | What

|

Core sustainable investments1,2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended

|

|

% change from

|

|

USD billion, except

where indicated

|

|

GRI

|

|

31.12.20

|

31.12.19

|

31.12.18

|

|

31.12.19

|

|

Core SI products and

mandates

|

|

|

|

|

|

|

|

|

|

Integration – sustainability focus3

|

|

FS11

|

|

127.7

|

46.4

|

20.0

|

|

175.0

|

|

Integration – ESG integration4

|

|

FS11

|

|

512.8

|

372.3

|

224.5

|

|

37.7

|

|

Impact investing5

|

|

FS11

|

|

13.1

|

9.1

|

4.7

|

|

44.1

|

|

Exclusions6

|

|

FS11

|

|

132.2

|

52.2

|

50.3

|

|

153.4

|

|

Third-party7

|

|

FS11

|

|

7.4

|

8.5

|

13.4

|

|

(11.8)

|

|

Total core sustainable

investments

|

|

FS11

|

|

793.2

|

488.5

|

312.9

|

|

62.4

|

|

UBS total invested assets

|

|

|

|

4,187.0

|

3,607.0

|

3,101.0

|

|

16.1

|

|

Core SI proportion of total invested assets (%)

|

|

FS11

|

|

18.9

|

13.5

|

10.1

|

|

|

|

1 In 2020, Asset

Management refined its reporting methodology by carving out funds with high

SI categories from funds of funds or mandates that are classified with a

lower or no SI category. The impact of this methodology change is an

additional USD 109 billion in core SI (USD 2 billion in integration

– sustainability focus and impact investing, USD 28 billion in

integration – ESG integration and USD 79 billion in exclusions) and a

decrease of USD 29 billion in norms-based screening assets. 2 FS

represents the performance indicators defined in the Financial Services

Sector Supplement of the Global Reporting Initiative reporting framework. 3 Strategies

where sustainability is an explicit part of the investment guidelines,

universe, selection, and / or investment process. 4 Strategies

that integrate environmental, social and governance (ESG) factors into

fundamental financial analysis to improve risk / return. 5 Strategies

where the intention is to generate measurable environmental and social impact

alongside financial return. 6 Strategies that exclude companies from portfolios where

they are not aligned to an investor’s values. Includes customized screening

services (single or multiple exclusion criteria). 7 SI

products from third-party providers applying a strict and diligent asset

selection process; the selection criteria have been reviewed for the end of

the 2020 reporting cycle, following a stricter approach from the provider of

sustainability ratings. Excludes third-party products that went through a

systematic Global Wealth Management onboarding process, now included under

Integration – sustainability

focus.

|

Sustainable

financing

Sustainable financing refers to the

process of raising, underwriting and lending capital in one of two ways – (1)

for defined green or sustainable use or (2) under the condition that a company

will meet or demonstrate sustainability characteristics. Additionally,

sustainable financing encompasses the act of providing financial or

non-financial advice relating to ESG aspects of investment and sustainable

finance activities.

We offer products and solutions, including

access to equity and debt markets, to clients looking to finance projects that

demonstrate sustainability characteristics. Financing activities can be on

balance sheet (such as loans and mortgages) or off-balance sheet (such as

access to debt and equity markets). We also provide additional advice on

related ESG aspects (both financial and non-financial), such as integrated

disclosure requirements.

› Refer

to the “Our focus on sustainability” section of the UBS Annual Report 2020 for

more information on sustainable investing

› Refer

to “Sustainable finance products” in Appendix 2 of

this report

What sustainable finance means for clients

Our Global Wealth Management

(GWM) clients benefit from fully diversified sustainable portfolios as well

as advisory options that offer investors choice on how to implement SI. In

2020, we became the first major global financial institution to make SI the

preferred solution for private clients investing globally. Our differentiated 100%

sustainable multi-asset portfolio, based on our Chief Investment Office’s

dedicated SI strategic asset allocation, surpassed USD 17 billion under

management in 2020, having grown from just over USD 1 billion roughly two

years ago.

Our institutional clients benefit from

the holistic integration of ESG factors into the investment decision-making

process across UBS’s entire suite of investment funds and strategies.

Underpinning our ESG integration activities is a robust stewardship program,

comprising engagement and proxy voting. To that end, we are also an active

participant1 in key investor coalitions, such as Climate Action

100+, where we actively engage with the world’s largest corporate greenhouse

gas emitters to drive progress on climate change.

Our retail clients in Switzerland benefit from access

to appropriate and relevant SI products from Asset Management (AM) and GWM that

follow our Group-wide approach to SI. This includes the UBS SI Strategy Fund as well as the UBS Manage SI

mandate solution. As part of our sustainability

roadmap, we are substantially expanding our offering. In 2020, our retirement

savings funds were turned sustainable: all funds of the UBS Vitainvest family

covering pillar 2 (occupational pension) and pillar 3 (private retirement

savings) investments have undergone further development to follow ESG criteria

defined by UBS. The repositioning of the funds gives clients an opportunity to

combine the advantages of the well-known UBS Vitainvest retirement savings

funds with the advantages of SI.

Client interest in SI solutions continued to be strong in 2020, with almost 70%

of Personal Banking’s mandate sales being UBS Manage SI. In addition, 29% of

total custody assets in Personal Banking are being invested sustainably.

Our corporate clients benefit from a

range of financing and advisory solutions. It is our aim to meet clients

wherever they are in their sustainability journey, with advice, support,

products, expertise and execution. To this end, we support the issuance of

green, social and sustainability bonds – and the raising of capital in

international capital markets – in line with recognized market guidelines such

as the Principles.2 We also extend sustainability-linked loans in

line with the Loan Market Association (LMA). All transactions are vetted in adherence to our (continuously updated)

ESR policy framework. For our Swiss corporate and institutional clients,

supplier and producer transactions in Commodity Trade Finance are also

monitored according to UBS ESR standards. Furthermore, our sustainable finance

advisory extends to strategic positioning of business models, disclosure

practices and benchmarking.

SI Advisory is an integral part of dialogue

with our institutional clients, and our sustainability analytics offering

enables institutional clients to achieve full transparency by screening their

portfolio for industry exposure. Many of the institutional investor

conversations taking place under the ESG and sustainable finance banner tend to

be focused around equities and bonds, such as structured equity products with

ESG overlays. However, the commodities asset class is attracting attention as

well, including carbon markets. Emissions futures are increasingly topical,

both as an investment asset as well as a carbon-hedging tool. The UBS

commodities trading desk is now actively offering emissions futures for a

variety of applications.

Transitioning to a low-carbon future

Climate change is one of the greatest

challenges of our modern world. While corporate and institutional clients

are increasingly transitioning to a lower-carbon future, much remains to be

done. The developments we have made in finding new ways to finance the

transition to a less carbon-intense future are spurred by two realities. First,

there is still a significant finance gap in the climate sphere – the

Organisation for Economic Co-operation and Development (OECD) estimates more

than USD 90 trillion is needed in infrastructure investment alone if we

are to meet the goals of the Paris Climate Agreement.3 Second, clients want to be able to align

their investment goals with their environmental objectives while also

mitigating climate-related risks in their portfolios.

We aim to give clients the actionable tools

and techniques they need in order to act now in allocating their capital to

help drive the low-carbon transition. One way we are doing this is through the Climate

Aware framework, developed by AM. With the framework, we seek to help institutional

clients reduce the carbon footprint of their portfolios and align their

portfolios to their chosen climate glidepath. Based on the framework, we have

created a suite of dedicated products across asset classes to provide the ideal

solution for any climate investment need.

In 2020, we launched a suite of new

strategies to build on our existing award-winning passive equity Climate Aware

strategy. It includes equity and fixed income, and both active and passive

approaches. Over the past twelve months, Climate Aware assets have increased

almost five-fold to reach USD 15.3 billion.

Our private clients in Personal &

Corporate Banking benefit from our renovation mortgage “eco,” which provides

incentives to invest into sustainability measures around one’s home. Furthermore,

we support Swiss small and medium-sized enterprises (SMEs) in their

energy-saving efforts and transitions to a low-carbon economy. SMEs benefit

from initiatives such as energy check-ups or leasing bonuses (financial

contributions toward enhancing environmental performance) for production

machines. In addition, we support Swiss start-ups in developing innovative

circular economy solutions.

› Refer

to “What we do to act on a low-carbon future – our climate strategy” in the

“What” section of this report for more information on our climate strategy and

activities

› Refer

to the Core Sustainable Investment table on the

previous page

1 Refer to Appendix 7

“External commitments and memberships” for more information on UBS's

commitments and memberships.

2 Green Bond Principles, Social Bond Principles, Sustainability Bond

Guidelines, Sustainability-linked Bond Principles

3 OECD

/ IEA / NEA / ITF (2015), “Aligning Policies for a Low-carbon Economy,”

available at http://dx.doi.org/10.1787/9789264233294-en

Sustainability

Report 2020 | What

Reimagining client philanthropy

With more than 60 philanthropy

experts in eight countries, we support clients in maximizing their impact

locally, nationally and globally, wherever their objectives lead. By partnering

with clients and their families, we employ an investment-based approach that

maximizes their impact and connects them to an international network of expertise

and support.

Our award-winning1 philanthropy

offering began over two decades ago and we have come a long way since. Our

approach is based on three core pillars: Advice

– such as advising clients who are considering establishing their first

charitable fund and guiding them on how to ensure their giving is

tax-efficient, thereby maximizing the value of charitable funds. Insights – connecting our clients to a global

network of experts, both within and outside UBS. This could be in the form of an

insights trip to visit impactful programs on the ground, a report on the latest

charitable-giving tax rules or an invitation to a networking event with fellow

philanthropists. Execution – providing

clients with flexible options on how to manage their philanthropic giving,

including structures like our Donor-Advised Fund (DAF) or the UBS Optimus

Foundation that make it easier and more cost effective to put their strategy

into practice.

1 Best Global Bank for

Philanthropy Advice, Euromoney Private Banking Survey 2017–2020

Donor-Advised Fund

A Donor-Advised Fund (DAF) offers

clients an easy, flexible and efficient alternative to setting up their own foundation.

Quick to set up and simple in structure, a DAF can be managed in line with

clients’ usual investment approach. Their charitable donations are invested

within the parameters they select, such as capital, growth or income, so they

can grow their fund to make grants at a later date. UBS has offered DAF

services in the US for some time, and in 2014, we established a DAF in the UK,

which has seen more than USD 400 million in donations. In 2020, the UBS

Philanthropy Foundation was launched in Switzerland as well.

UBS Optimus Foundation

The UBS Optimus Foundation connects

clients with inspiring entrepreneurs, new technologies and proven models that seek

to make a measurable, long-term difference to the most serious and enduring

social and environmental problems. The Foundation has a 20-year track record

and is recognized globally as both a philanthropic thought leader and a pioneer

in the social finance space, through which we leverage solutions to mobilize

private capital in new and more efficient ways.

What started in 1999 with a small Swiss

foundation in Zurich, has evolved into a global network

with seven locations. In 2020, the UBS Optimus Foundation raised almost CHF 150

million and surpassed its

CHF 100 million goal (including UBS contributions). Since its inception, UBS

clients and employees have donated more than CHF 600 million – totaling more

than CHF 700 million including UBS contributions.

This impacted the lives of more than 18 million people in the last seven years.

The UBS

Optimus Foundation takes an evidence-based approach and focuses on programs

that have the potential to be transformative, scalable and sustainable. We

conduct extensive due diligence and only recommend what we consider to be the

most innovative programs that have the capacity to achieve long-term,

measurable impact. UBS aims to give clients the reassurance that they are

funding innovative projects that have a strong chance of achieving systemic

change. In some cases, UBS also makes matching contributions to the Foundation,

to help our clients’ donations go even further.

An evidence-based approach to

philanthropy

–

The world’s largest education development impact

bond (DIB), improving literacy and numeracy outcomes for more than 200,000

children in India, is showing exceptional results, with children learning twice

as fast as others who are not part of this DIB.

–

The first equity investment was made to Rising

Academies, a chain of low-fee private schools in West Africa with a track

record of improving learning twice as much as their peers in other schools.

–

UBS Collectives brings together philanthropists

to pool their funds, share their expertise and achieve more sustainable

long-term impact. These collectives will also take philanthropists on a

three-year learning journey with a tailor-made curriculum wherein they network

with peers and funding programs toward the common goals of preventing family

separation, mitigating climate change or funding programs linked to measurable

results.

Expanding the scope toward climate and

the environment

Since its establishment, the UBS

Optimus Foundation has focused on children’s health, education and protection. In

2020, to ring in the Foundation’s 20-year anniversary and in light of the growing

threat of climate change, we expanded our offering.

To make sure clients maximize their

environmental impact with their philanthropy, we, together with experts,

conducted an extensive landscape analysis. The outcome is a systematic approach

for clients to assess where to invest philanthropically, and how to best

contribute to accelerate environmental and climate action. Clients interested

in this space can now get involved in:

–

sustainable land use, by contributing to land

restoration, conservation, climate-resilient agriculture, and agroforestry; as

well as

–

coastal and marine ecosystems, by contributing to

wetland restoration and conservation, sustainable fisheries, as well as

reduction of ocean waste and pollution.

UBS Optimus Foundation COVID-19 Response Fund

When the COVID-19 pandemic struck,

we knew we needed a collaborative effort to protect the most vulnerable

globally. That is why we launched the UBS Optimus Foundation COVID-19

Response Fund. Our clients and employees acted fast, and UBS matched their

contributions. Thanks to the generous help, USD 30 million was raised

and 48 partners, working in 35 countries, were enabled to respond swiftly and

effectively, while protecting previous gains in development.

The COVID-19 Response Fund is

centered around three main pillars:

–

Prevent the spread of

the virus: by educating communities regarding signs, symptoms, transmission,

and preventative measures like hand hygiene and social distancing – including

supporting livelihoods to make social distancing possible

–

Detect cases as they

emerge: by supporting frontline health organizations to identify symptoms,

and also helping to facilitate testing

–

Respond as the

situation unfolds: by increasing capacity for emergency treatment among health

organizations and making sure primary health services remain functional

› For more information visit ubs.com/optimus-covid19

With the remaining

funds to be allocated and client donations, we launched a UBS Optimus

Foundation COVID Prize of USD 1 million to support promising approaches

to improve social outcomes in our strategic areas of focus: improved

education, skills for employment, improved maternal and child health,

prevention of child trafficking, prevention of family separation and

increased local food production.

|

Sustainability

Report 2020 | What

What we do

for our employees

UBS is a place where individuals with

a wide variety of skills, interests, experiences and backgrounds can unlock

their potential. With nearly 73,000 employees working in around 50 countries

and a workforce that represents 141 nationalities and a broad range of

ethnicities, we have the size, global presence, experience and range of

business activities to make a difference for our employees, clients,

shareholders and society.

Our employees are key to delivering our

business strategy. We therefore seek to attract, develop and retain employees

who have the diverse backgrounds and capabilities to advise our clients,

develop innovative and sustainable solutions, manage risk and adapt to evolving

situations. For our part, we’re committed to being a world-class employer and a

great place to build a career. Our identity, management processes and

businesses are all built on a strong cultural foundation. Sustainability and

good corporate citizenship principles are embedded into our practices as an

employer, for example, in how we market the firm to candidates, in our learning

and development activities as well as in our philanthropy and volunteering

activities.

› Refer

to "Workforce by the numbers" in Appendix 3 of this report for

supplementary information to this sub-section

Sustainability

Report 2020 | What

Helping employees navigate through an uncertain year

The

global COVID-19 pandemic introduced an unprecedented situation for us, and for

our employees. A key priority throughout 2020 was safeguarding the health and well-being

of our employees and their families, and providing them additional support. We

enabled 95% of employees to work remotely and enhanced procedures to protect

employees whose roles required them to work on site.

Recognizing the additional pressure placed on

employees by shuttered workplaces and schools, restricted activities and

near-continuous change, we introduced a variety of measures throughout 2020 to

help them adapt. For example, we offered extra flexibility to care for children

and address other needs and implemented a variety of tools and resources to

support employees’ physical, mental, financial and social well-being. We also entered

into a partnership to offer an app-based solution for guided mindfulness

techniques, sleep, nutrition and physical activity to all employees globally.

Health and well-being, including resilience and positivity, were and will

continue to be important focus areas to help our employees manage the pandemic

situation, which is both professionally and personally demanding. Results from

our employee and pulse surveys underline the positive impact of our well-being

initiatives.

For their part, our employees consistently

rose to the challenges of 2020, demonstrating resilience and dedication while

ensuring excellent client service. In November, as a sign of appreciation for

their contributions throughout the year and acknowledging that the pandemic may

have had unexpected financial impact, employees at less senior ranks were

awarded a one-time cash payment equivalent to one week’s salary.

Finally, following the pandemic’s ascent in

early 2020, we did not pursue restructuring activities that would have led to

redundancies in order to provide our employees and their families the necessary

safety and stability and protect society from negative consequences, e.g., due

to higher unemployment.

Our culture is

the foundation for our sustainable success

Our three keys to success – Pillars,

Principles and Behaviors – embody the foundation of our strategy and culture.

They define what we stand for as a firm and individually, and help drive

performance. The three keys have long been embedded in all of our people

management processes; for example, hiring, onboarding, performance management,

compensation, promotion, talent development, training and succession planning

are all founded on three-keys values. Specific expectations are part of every

management process to ensure we’re incentivizing and rewarding the excellent

work and behavior that we expect from all employees.

In late 2020, we launched an initiative to

define the company’s purpose, outlining why we do things the way we do. Once

established, our purpose will guide all our actions. It will be a key element

to success in the future and will continue to inspire and empower our

employees.

We support culture building through

divisional, regional and Group-wide initiatives, among which is the successful

Group Franchise Awards (GFA) program that rewards employees for

cross-divisional collaboration and operational effectiveness improvements. An

interactive idea-sharing site lets employees collaborate on solutions and

submit ideas for improvement. A peer-to-peer appreciation program that

originated as a GFA idea was launched in late 2020 to empower employees to

acknowledge colleagues’ collaboration, commitment and behavior. In addition to

increasing collaboration across teams, peer appreciation reinforces our culture

and improves retention of highly motivated employees. We also encourage

continuous feedback among colleagues and with line managers to foster

development and ongoing improvement and have seen a lot of engagement, with

44,000 recognitions in the first month.

› Refer

to the foldout pages of the UBS Annual Report 2020 for more information about our Pillars, Principles and Behaviors

› Refer

to "UBS's charitable contributions" in this section and “Charitable contributions”

in Appendix 5 of this report for a discussion of our community affairs and

employee volunteering activities

The importance of leadership

Leadership drives culture, and

culture drives performance. It also plays a key role in increasing an

organization’s agility and sustainability, which is why great leaders are

game-changers for UBS. They are the key to growing our people, client

relationships and results so that we can thrive and build the future of our

business.

Our House View on Leadership defines the

behavior that we expect from every leader toward employees, clients and

business activities. Our House View is embedded in all of our leadership

development programs, line manager training and performance management

initiatives; firm-wide culture metrics promote accountability and ensure that

we continually improve.

Our leadership development programs are

oriented toward agility, transformation, growth and digitization, and they seek

to address organizational challenges at multiple levels. For example, our

Senior Leadership Program enables leaders to drive digital transformation and

accelerate sustainable profitable growth in today’s complex and ever-changing

environment.

In addition to training, our talent

management processes include structured talent and succession reviews to help

us identify future leaders, ensure business continuity for critical roles and

proactively manage employee development.

Our employees

have a voice

Our employees are engaged in shaping

the firm’s identity, future direction and daily management, and we provide

numerous opportunities for them to share their views. For example, we regularly

solicit feedback on various topics, including engagement, enablement, workplace

conditions, health, well-being and diversity.

Our anonymous survey of all permanent

employees, conducted by an external, independent provider, measures views on

key strategic and cultural measures, with several questions added this year to

solicit feedback on remote working and employee well-being during the pandemic.

A record 86% of employees participated in the survey and among respondents, 84%

indicated high levels of engagement. In addition, 86% indicated they are proud

to work at UBS, 83% agreed that their line manager(s) are effective, 83%

recognized our positive work environment and 70% consider our talent management

practices to be state of the art. All of these scores were above the norms for

both financial services and high-performing companies.

Employees are informed of Group-wide survey

scores, as well as divisional, regional and business area results, as

applicable. Each year’s data is leveraged in future culture-building

initiatives, as it is our ongoing ambition to have a highly motivated workforce

that models integrity, collaboration and challenge in its daily work. We strive

to be the clear employer of choice in the financial services industry and to

maintain overall engagement ratings in the top quartile; both ambitions were

achieved in 2020.

› Refer

to Appendix 7 of this report for more information about our employer ratings

and recognitions

Engaging with our employees

We engage with employees through

channels such as our intranet news and information sites, UBS Connections (our

internal social network), UBS TV and directly, via individual and team meetings,

emails, town halls and feedback tools. In 2020, employees in all businesses and

regions attended numerous virtual town halls and small group meetings to

discuss relevant issues directly with senior management. Regular “Ask the CEO”

events allowed employees to learn about (and ask questions on) topics such as

the firm’s strategy and direction. These events are broadcast live (and

available via replay) on UBS TV.

Sustainability

Report 2020 | What

Employee

networks

Our employee networks are another avenue

to listen to employees and influence the firm’s future. Sponsored by business

leaders, these groups help employees build cross-business relationships and

support an open and inclusive workplace. In 2020, we supported 46 employee

networks globally, including ones focused on culture, gender, ethnicity,

family, mental health, Pride / LGBTQ+, disability and veterans. Each of our

networks plays an important role in helping UBS evolve its approach and

provides valuable mentoring and development experiences for members through

networking, connections and education.

Employee

representation

As a responsible employer, we

maintain an open dialogue with our formal employee representation groups. We

have two pan-European forums – the UBS Employee Forum (which is our European

Works Council) and the UBS Europe SE Works Council. These groups represent 17

countries and discuss issues that may affect our performance, operations or

prospects. Local and regional work councils, like the Employee Representation

Committee in Switzerland, consider topics such as business transfers, pensions,

workplace conditions, health and safety, and redundancies. Collectively, these

groups represent approximately 49% of our global workforce.

Grievances and

whistleblowing protection, policies and procedures

We strive to maintain high ethical

standards, and we have long-standing procedures in every region to help us

resolve grievances of any kind. Employees are strongly encouraged to speak with

their line manager or HR about any workplace concerns and immediately report

any potential violations of our Code of Conduct and Ethics (the Code) to their

line manager or local compliance officer.

Our global whistleblowing procedures offer

multiple channels (including a whistleblowing and sexual misconduct hotline)

for staff to raise concerns about any suspected breaches of laws, regulations,

rules or other legal requirements, policies or professional standards, sexual

misconduct or harassment, or any violation of the Code. UBS prohibits

retaliation against any employee who reports a concern that they reasonably

believe is a breach or violation.

We are committed to ensuring a workplace

where employees are fairly treated, with equitable employment and advancement

opportunities for all. We do not tolerate harassment of any kind, including

sexual harassment, and we take measures to prevent all forms of harassment,

bullying, victimization and retaliation. Our policies, procedures, employee

education and awareness materials specifically encourage employees to raise

concerns, openly or anonymously. An internal anti-harassment officer appointed

by the Group Head Human Resources provides an independent view of the firm’s various

processes and procedures to prevent harassment and sexual misconduct.

› Refer to “Risk management and control” in the “Risk, capital, liquidity

and funding, and balance sheet“ section of the UBS Annual Report 2020 for more

information

Diversity, equity and inclusion

Continually increasing the diversity

of our workforce and building an inclusive workplace is vital to our business

success. Our strategy is to continue to shape a diverse and inclusive

organization that is innovative, provides outstanding service to our clients,

offers equitable opportunities and is a great place to work for everyone. We

take a broad approach, focusing on gender, race and ethnicity, LGBTQ+,

disability, veterans, mental health and other aspects. Awareness-raising,

training and improved accountability for inclusive leadership have been clear

focus areas for the past several years.

Raising the bar on gender diversity

Gender diversity has long been a

strategic diversity, equity and inclusion priority for us. We want to enable

women to build long and satisfying careers here, and we’re especially working

to increase the representation of women at senior management levels. In this

effort, we take a multi-pronged approach, analyzing and refining the various

elements that support hiring, developing and retaining women at all levels

across the firm. For example, our interview slates for open roles are expected

to include qualified diverse candidates, along with questions to gauge

inclusive leadership competencies for executive roles.

We also hold ourselves accountable for

progress. In early 2020, for example, we stated an aspiration to increase the

percentage of women in our Director level and above population to 30% by 2025,

and our global gender diversity strategy and initiatives are designed to

support that goal. In 2020, 26% of all employees in roles at Director level and

above were women, up from 25.2% in 2019 and we are on track to achieve our

target. In addition, 27% of senior managers who reported to GEB members in 2020

were female.

Our award-winning UBS Career Comeback program is a recruitment and retention initiative for female

leaders. Professionals looking to return to corporate jobs after a career break

are hired for permanent roles and supported with targeted onboarding, coaching

and mentoring. We manage this global program out of hubs in the US, UK, Switzerland,

India and Poland and since 2016, Career Comeback has helped 169 women and 14 men relaunch their careers.

Increasing

ethnic diversity is a priority

In addition to gender diversity,

increasing the ethnic diversity of our workforce and a commitment to

underrepresented talent and communities is a key strategic diversity, equity and

inclusion priority. We focus on four areas: accountability and transparency,

investing in our talent, improving our culture and leveraging our business

strengths in underrepresented communities. We are taking a country-by-country

approach to these topics in close collaboration with relevant business and

jurisdictional entities, as legislation, legal requirements and progress toward

racial and ethnic equality vary significantly across the locations in which we

do business.

Due to our significant presence in

Switzerland, the US and UK and their complex individual histories, we are

primarily focusing on initiatives in these countries in the short term. In these

locations, we have been actively implementing strategies to increase

representation of underrepresented ethnicities. In mid-2020, we set aspirations

to have a 26% representation of underrepresented ethnicities at the Director

level and above by 2025 in the US and to increase our ethnic minority senior

management (Directors and above) headcount by 40% in the UK in the same time frame.

Actions in 2020 to support these aims included refining our recruitment

processes, designing new professional development programs and updating our

training and mentoring programs. As of the end of 2020, we had achieved 20.7%

of our aspiration and are on track to realize our ambition for ethnic diversity

in the UK. In the US, representation of ethnic minorities at the Director level

and above was 19.5% and we are likewise on track.

Our employee networks are strong partners and

facilitators of our ethnic diversity strategy. In the spring of 2020, our MOSAIC ethnicity networks led a series of virtual

conversations to enable colleagues from diverse racial and ethnic backgrounds to

share their personal experiences – more than 6,000 UBS employees tuned into at

least one of the conversations. One outcome has been the formation of a new

global network of more than 140 Diversity & Inclusion Ambassadors who act

as a resource for employee advice and coaching on conversations about various

diversity- and inclusion-related topics.

› Refer

to our Americas Diversity & Inclusion Impact Report at ubs.com/diversity,

for more details

› Refer

to our UK Gender Pay Gap Report at ubs.com/uk/en/gender-pay-report, for more

details

Ensuring fair and inclusive workplaces

Fair and effective people management

processes are key to our long-term success. Our global performance management

process evaluates both performance and behavior. This dual emphasis helps us

progress our culture by assessing how well integrity, collaboration and

challenge (the firm’s expected behaviors) are demonstrated in daily business

activities. For 2020, 99% of eligible employees received a performance review.

Pay equity is taken very seriously at UBS.

Pay fairness principles are embedded in our compensation policies, and we

conduct regular reviews with the aim of ensuring that we appropriately evaluate

and reward employees. From a pay equity perspective, if we uncover any gaps

that cannot be explained by business factors such as experience, role,

responsibility, performance, or location, we explore the root causes of those

gaps and address them.

In April 2020, UBS was one of the first banks

to be certified by the EQUAL-SALARY Foundation for its equal pay practices in

Switzerland. This review included an independent audit across our HR policies

and practices and a statistical review of our pay levels. In late 2020, the US,

UK, Hong Kong and Singapore received the same certification. These

certifications are testament to our well-established equal opportunity

environment and underline the strengths of our reward practices.

UBS is a strong supporter of the UN Standards

of Conduct for Business anti-discrimination guidelines, and a signatory to the

UN-backed Women’s Empowerment Principles, the UK government’s Women in Finance

Charter, as well as the Race at Work Charter.