Disney, Tyson and CVS Among Those Reporting Earnings This Week

May 03 2020 - 7:29AM

Dow Jones News

By Allison Prang

The weakest earnings season in more than a decade continues,

with nearly 150 companies in the S&P 500 expected to report

quarterly results this week, including big names in media and

food.

More than half of the S&P have already logged their results

for the first three months of 2020, according to FactSet, and

earnings are projected to fall 13.7%, year over year, as companies

detail the impact of the coronavirus pandemic on their operations.

The estimate, based on those companies that have already reported

and forecasts for those to come, would mark the largest such

quarterly decline in earnings since the third quarter of 2009,

FactSet said.

Revenue growth is holding up better, projected to grow 0.7% year

over year, said FactSet, which forecasts 148 companies in the

S&P 500 giving quarterly updates this week.

Among the big names expected to report this week are Walt Disney

Co., General Motors Co., Tyson Foods Inc. and CVS Health Corp.

Disney reports its financial results after the market closes

Tuesday. Nearly every corner of Disney has been rocked by the

pandemic, and its profitable parks division was effectively shut

down in the midst of calls for people to practice social

distancing.

The pandemic is seen benefiting the company's streaming

platform, Disney+, because consumers were trapped indoors. Several

of the biggest releases headed to the platform, however, have had

production halted during the new coronavirus outbreak. As a result,

Disney has moved some theatrical releases to the streaming service

ahead of schedule.

ViacomCBS Inc., which has its own streaming services, reports on

Thursday. The question for video-streaming services is whether

consumers will keep paying for those offerings after the pandemic

subsides, said John Janedis, managing director at Wolfe

Research.

Netflix Inc. Chief Executive Reed Hastings said last month that

his company's surge in streaming-video subscribers in the first

quarter may mean smaller growth later in the year, but he couldn't

say for sure.

"Our guess is that subs will be light in [the second half]

relative to prior years because of that," Mr. Hastings said. "But

we don't use the words guess and guesswork lightly. We use them

because it's a bunch of us feeling the wind."

Tyson Foods, which is among meat processors that have closed

plants because of the pandemic, reports results Monday. The plant

closures sparked an oversupply of pigs, which has spurred the

industry to consider euthanizing the animals. President Trump

signed an executive order to let meat companies operate during the

pandemic.

Beyond Meat Inc., known for its alternative meat products,

reports results Tuesday. The stock has been on a strong run over

the past month, up 58%, in the midst of concern about meat supply

in the U.S. and the company's recent expansion into China.

The coronavirus pandemic has curtailed car sales and halted

vehicle production around the country. Detroit auto makers are

looking at starting production again May 18, and General Motors

gives its quarterly update Wednesday.

Health-care companies are on track to report the highest

year-over-year growth in revenue among the 11 S&P 500 sectors

and are tied with consumer staples on earnings growth, FactSet

said. CVS Health will detail the pandemic's impact on its

operations Wednesday.

The company's stores suffered product shortages like other

retailers, Chief Executive Larry Merlo said in March, and he said

that it was too soon then to tell how the pandemic would affect the

company's insurance operations. The pharmacy company acquired

health insurer Aetna Inc. for nearly $70 billion in 2018, and it

owns Caremark, one of the country's largest pharmacy-benefits

managers.

Energy is among the sectors reporting a year-over-year decline

in earnings, and more energy companies are scheduled to report this

week, including Marathon Petroleum Corp., Marathon Oil Corp. and

Occidental Petroleum Corp.

Those results follow Exxon Mobil Corp., which reported its first

loss in decades last week, and Chevron Corp., which on Friday

announced more cuts to its capital-spending plans this year. The

companies painted a dismal picture of the oil industry, signaling

that the impact of the coronavirus pandemic may hang over their

businesses for much of 2020.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

May 03, 2020 07:14 ET (11:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

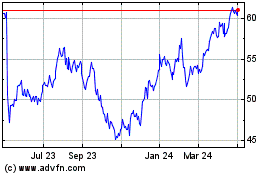

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

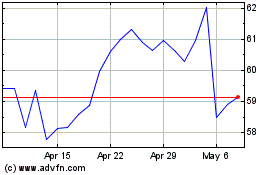

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Apr 2023 to Apr 2024