TXO Partners, L.P. Announces Pricing of Upsized Public Offering

June 26 2024 - 6:27PM

Business Wire

TXO Partners, L.P. (NYSE: TXO) (“TXO”) today announced the

pricing of its public offering of 6,500,000 common units

representing limited partner interests in TXO (the “common units”)

at price to the public of $20.00 per common unit. The offering size

was increased from the previously announced offering size of

5,000,000 common units. TXO has granted the underwriters an option

to purchase up to an additional 975,000 common units at the public

offering price, less underwriting discounts and commissions. The

offering is expected to close on June 28, 2024, subject to

customary closing conditions.

TXO expects to receive net proceeds of approximately $122.5

million, after deducting underwriting discounts and commissions and

estimated offering expenses and excluding any exercise of the

underwriters’ option to purchase additional common units. TXO

intends to use the net proceeds from this offering, if consummated,

to fund a portion of the cash consideration for the previously

announced asset acquisitions from Eagle Mountain Energy Partners

and a private company (the “Acquisitions”). The offering is not

conditioned on the consummation of either of the Acquisitions.

Pending the closing of the Acquisitions, and in the event that

either of the Acquisitions are not completed, the proceeds from the

offering will be used to repay the outstanding borrowings under

TXO’s revolving credit facility and for general partnership

purposes.

Raymond James is acting as the sole book-running manager for the

offering. The offering is being made pursuant to an effective shelf

registration statement, including a base prospectus, filed by TXO

with the Securities and Exchange Commission (“SEC”). The offering

of these securities may be made only by means of the prospectus

supplement and the accompanying base prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended. When available, a copy of the prospectus supplement may be

obtained from any of the following sources:

Raymond James & Associates, Inc.

Attention: Syndicate

880 Carillon Parkway

St. Petersburg, Florida 33716

Telephone: (800) 248-8863

Email: prospectus@raymondjames.com

You may also obtain these documents for free when they are

available by visiting EDGAR on the SEC website at www.sec.gov.

Important Information

This press release does not constitute an offer to sell or the

solicitation of an offer to buy securities, and shall not

constitute an offer, solicitation or sale in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of that

jurisdiction.

About TXO Partners, L.P.

TXO Partners, L.P. is a master limited partnership focused on

the acquisition, development, optimization and exploitation of

conventional oil, natural gas, and natural gas liquid reserves in

North America. TXO’s current acreage positions are concentrated in

the Permian Basin of West Texas and New Mexico and the San Juan

Basin of New Mexico and Colorado.

Cautionary Statement Concerning Forward-Looking

Statements

Certain statements contained in this press release constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include the words such as “possible,” “if,” “will” and

“expect” and contain statements regarding the size, timing or

results of the offering and the proposed Acquisitions. These

forward-looking statements represent TXO’s expectations or beliefs

concerning future events, and it is possible that the results

described in this press release will not be achieved, and they are

subject to risks, uncertainties and other factors, many of which

are outside of TXO’s control, that could cause actual results to

differ materially from the results discussed in the forward-looking

statements.

Any forward-looking statement speaks only as of the date on

which it is made, and, except as required by law, TXO does not

undertake any obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise. New factors emerge from time to time, and it is not

possible for TXO to predict all such factors. When considering

these forward-looking statements, you should keep in mind the risk

factors and other cautionary statements discussed in "Risk Factors"

in our prospectus supplement, the Registration Statement on Form

S-3, our Annual Report on Form 10-K for the year ended December 31,

2023, our Quarterly Reports on Forms 10-Q filed with the U.S.

Securities and Exchange Commission and our other filings with the

SEC. These risks include, but are not limited to, our ability to

consummate the proposed Acquisitions on the terms currently

contemplated, the anticipated future performance of the combined

company, risks and uncertainties related to economic, market or

business conditions, and satisfaction of customary closing

conditions related to the proposed offering and the proposed

Acquisitions. The risk factors and other factors noted above could

cause its actual results to differ materially from those contained

in any forward-looking statement. You are cautioned not to place

undue reliance on these forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240626707365/en/

TXO Partners Brent W. Clum President, Business Operations &

CFO 817.334.7800 ir@txopartners.com

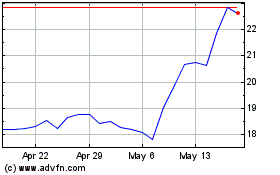

TXO Partners (NYSE:TXO)

Historical Stock Chart

From May 2024 to Jun 2024

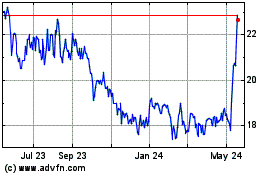

TXO Partners (NYSE:TXO)

Historical Stock Chart

From Jun 2023 to Jun 2024